Bob Litterman

description: an American economist, notable for his work in risk management, particularly the development of the Black-Litterman asset allocation model

14 results

Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis

by

Scott Patterson

Published 5 Jun 2023

“Nassim Taleb is a vulgar bombastic windbag” http://noahpinionblog.blogspot.com/2014/01/of-brains-and-balls-nassim-talebs-macro.html. “Without any precise models, we can still reason” https://necsi.edu/climate-models-and-precautionary-measures. CHAPTER 19: IT’S WAY PAST TIME This chapter is based on multiple interviews with Robert Litterman, as well as an account of his career at the Minneapolis Federal Reserve. https://www.minneapolisfed.org/article/2019/interview-with-robert-litterman. “Today, my testimony will focus on The Green Swan” https://www.democrats.senate.gov/climate/hearings/climate-crisis-committee-to-hold-hearing-on-economic-risks-of-climate-change. “Bad news is costly,” they wrote https://www.pnas.org/content/116/42/20886.

…

One person dying of an infectious disease does increase the risk that his neighbor will get sick and die. When such risks become systemic, posing potential ruin to society as a whole, extreme precaution is required. * * * Taleb wasn’t the only expert in systemic risk applying lessons learned on Wall Street to the increased threats facing the world. In the 2010s, Bob Litterman, who once managed one of the largest stock portfolios in the world for New York investment giant Goldman Sachs, turned his decades of risk management skills to one of the worst threats of all: global warming. Unlike Taleb, who shunned models and argued that it was the uncertainty in forecasts for climate change that required extreme precaution, Litterman would go on to construct a model that prescribed the same precautionary approach practiced by chaos kings: When the risk is existential, you’ve got to panic early.

…

Unlike Taleb, who shunned models and argued that it was the uncertainty in forecasts for climate change that required extreme precaution, Litterman would go on to construct a model that prescribed the same precautionary approach practiced by chaos kings: When the risk is existential, you’ve got to panic early. CHAPTER 19 IT’S WAY PAST TIME Heavy rain splashed the windshield of Bob Litterman’s Tesla as he maneuvered through light traffic on the New Jersey Turnpike. It was December 6, 2014, a Saturday. Litterman and his wife, Mary, were looking forward to a fun evening in New York City. Dinner and drinks with friends. A Broadway show. He set the Tesla’s cruise control to seventy-two miles an hour.

Capital Ideas Evolving

by

Peter L. Bernstein

Published 3 May 2007

Indeed, Black soon became an enthusiastic guide to the development of quantitative modeling for a wide range of profitable strategies, in fixed-income as well as in equities, while the Goldman staff gradually learned how to take advantage of Black’s quirky methods and personality. One day in 1986, Black interviewed a man named Bob Litterman for a position in fixed-income research. Litterman was a Ph.D. from the University of Minnesota who also had had a stint of teaching at MIT, but his F 214 bern_c15.qxd 3/23/07 9:11 AM Page 215 Goldman Sachs Asset Management 215 primary interest was in econometrics—the application of statistical methods to economic and financial forecasting.

…

Blake Grossman at BGI says, “The markets are very efficient, very dynamic, constantly reaching greater levels of efficiency that makes them more and more difficult to beat. The half-lives of our strategies [are] shrinking.” David Swensen at Yale acknowledges his “huge respect for efficient markets.” Bob Litterman at Goldman Sachs asserts that “I am not worried that markets are fully efficient— yet. But they are becoming more efficient all the time, and fast. The world is going quant, and there are no secrets! Alpha is in limited supply and hard to find.” Myron Sholes has a similar view: “We are one group among myriad teams making markets more efficient by compressing time.”

…

Gabaix, Xavier, Arvind Krishnamurthy, and Olivier Vigneron, 2005. “Limits of Arbitrage: Theory and Evidence from the Mortgage-Backed Securities Market,” National Bureau of Economic Research, Working Paper No. 11851. Gottlieb, Jason, 2003. “Risk Management and Risk Budgeting at the Total Fund Level,” in Bob Litterman and the Quantitative Resources Group of Goldman Sachs Asset Management, Modern Investment Management: An Equilibrium Approach, Hoboken, NJ: John Wiley & Sons, pp. 211–228. bern_z02bbiblio.qxd 254 3/23/07 9:13 AM Page 254 BIBLIOGRAPHY Goyal, Amit, and Sumil Warhal, 2005. “The Selection and Termination of Investment Management Firms by Plan Sponsors,” American Finance Association Annual Meeting, Boston.

Mathematics of the Financial Markets: Financial Instruments and Derivatives Modelling, Valuation and Risk Issues

by

Alain Ruttiens

Published 24 Apr 2013

The author published in 2000, also with Prentice Hall, two “clones” of this book: Modern Investment Theory – United States Edition and Modern Investment Theory – International Edition. E. JURCZENKO, B. MAILLET (eds), Multi-Moment Asset Allocation and Pricing Models, John Wiley & Sons, Ltd, Chichester, 2006, 233 p. Bob LITTERMAN, Modern Investment Management – An Equilibrium Approach, John Wiley & Sons, Inc., Hoboken, 2003, 624 p. William F. SHARPE, Investors and Markets – Portfolio Choices, Asset Prices, and Investment Advice, Princeton University Press, 2006, 232 p. 1. A detailed presentation of the market efficiency and its various forms (weak, semi-strong, strong) is beyond the scope of this book.

…

Donna KLINE, Fundamentals of the Futures Market, McGraw-Hill, 2000, 256 p. Tze Leung LAI, Haipeng XING, Statistical Models and Methods for Financial Markets, Springer, 2008, 374 p. Raymond M. LEUTHOLD, Joan C. JUNKUS, Jean E. CORDIER, The Theory and Practice of Futures Markets, Stipes Publishing, 1999, 410 p. Bob LITTERMAN, Modern Investment Management – An Equilibrium Approach, John Wiley & Sons, Inc., Hoboken, 2003, 624 p. T. LYNCH, J. APPLEBY, Large Fluctuation of Stochastic Differential Equations: Regime Switching and Applications to Simulation and Finance, LAP LAMBERT Academic Publishing, 2010, 240 p. A.G.

How I Became a Quant: Insights From 25 of Wall Street's Elite

by

Richard R. Lindsey

and

Barry Schachter

Published 30 Jun 2007

The technicians thought the PhDs were hopeless geeks who wouldn’t know a good trade if they sat next to it on a bus. Stocks Are Stories, Bonds Are Mathematics This split was never more apparent than it was on the one day I actually met Fischer Black. I’d been invited over by a group of Goldman equity traders, technicians all. Previously, I’d met Bob Litterman, Fischer’s collaborator, at a Berkeley finance seminar, and called to let him know I was coming to his building. He decided to have his crowd join the group of equity traders for my show-and-tell. First, I got to meet Fischer himself. He graciously showed me some analytic software they were developing.

…

In the middle of discussing the portfolio model, Fischer interjected, “Banks don’t need to diversify their portfolios; their portfolio risks can be diversified by equity investors.” This is, of course, a fundamental proposition in finance, and, while it has an answer on several different levels, involves a complex discussion. There was silence around the table. The Goldman bankers were clearly not interested in getting into that discussion. Their eyes came to rest on Bob Litterman, the one who worked most closely with Fischer. “Well, Fischer, that’s right. But the banks want to diversify.” “Oh, well, if they want to diversify, then that’s Okay.” The discussion resumed with looks of relief around the table. We had not been sure when we started the business whether we were selling models, or data, or a service, or some combination.

Portfolio Design: A Modern Approach to Asset Allocation

by

R. Marston

Published 29 Mar 2011

Basu, Sanjoy, 1977, “Investment Performance of Common Stocks in Relation to Their Price-Earnings Ratios: A Test of the Efficient Market Hypothesis,” Journal of Finance (June), pp. 663–682. Bernstein Wealth Management Research, 2006, Hedge Funds: Too Much of a Good Thing?, Bernstein Global Wealth Management (June). Black, Fischer, and Robert Litterman, 1992, “Global Portfolio Optimization,” Financial Analysts Journal (September-October), pp. 28–43. Bodnar, Gordon, Bernard Dumas, and Richard Marston, 2004, “Cross-Border Valuation: The International Cost of Equity Capital,” in Hubert Gatignon and John Kimberly, eds., Globalizing: Drivers, Consequences and Implications, INSEADWharton Alliance.

…

Keim, 1993, “Risk and Return in Real Estate: Evidence from a Real Estate Stock Index,” Financial Analyst Journal (September/ October), pp. 39–46. Gyourko, Joseph, Christopher Mayer, and Todd Sinai, 2006, “Superstar Cities,” working paper. Harvard Management Company Endowment Report, 2009, “Message from the CEO”, September. He, Guangliang, and Robert Litterman, 1999, “The Intuition Behind BlackLitterman Model Portfolios,” Goldman Sachs Investment Management Division. Hennessee Group LLC, 2007, “Sources of Hedge Fund Capital,” The 2007 Manager Survey. Himmelgerg, Charles, Christopher Mayer, and Todd Sinai, 2005, “Assessing High House Prices: Bubbles, Fundamentals and Misperceptions,” Journal of Economic Perspectives (Fall), 67–92.

The Crisis of Crowding: Quant Copycats, Ugly Models, and the New Crash Normal

by

Ludwig B. Chincarini

Published 29 Jul 2012

It contains, for example, a comprehensive inventory of the types of trades LTCM had entered into and an inventory of lessons learned. This book is not only a useful history of recent financial crises, but a treasure trove of insightful quotations from interviews with many luminaries among modern financial practitioners and academics.” —Robert Litterman, Former Partner and Head of Risk Management at Goldman Sachs; co-inventor of the Black-Litterman Model “Chincarini returns to the proverbial crime scene of a decade earlier to find the origins of the crisis of 2008. Based on new interviews with key players and his own analysis, the book argues that the LTCM collapse of 1998 should have been the early warning signal of fragility in the financial system rooted in the fact that holders of sophisticated financial products so often just end up copying each other’s behavior.

…

Whether it is possible to set risk controls around the many examples of crowdedness may be debatable, but what is not arguable is that the market did and probably will continue to present surprises for which the crowd of investors is not prepared. This is an excellent exploration of many of the most interesting events in the financial markets of the past several decades, with insights from many of the former academics turned participants, as well as a very useful compilation of lessons learned. Robert Litterman Former Partner and Head of Risk Management, Goldman Sachs; co-inventor of the Black-Litterman Model Preface My initial motivation for writing this book was to clarify many of the misunderstandings surrounding financial failures and crises. After a collapse, we are often given incorrect versions of what happened, and this leads us to make mistakes again in the future.

Beyond Diversification: What Every Investor Needs to Know About Asset Allocation

by

Sebastien Page

Published 4 Nov 2020

“Earnings Growth: The Two Percent Dilution,” Financial Analysts Journal, vol. 59, no. 5, pp. 47–55. Bhansali, Vineer. 2010. Bond Portfolio Investing and Risk Management. New York: McGraw-Hill. Billio, Monica, Mila Getmansky, and Loriana Pelizzon. 2012. “Crises and Hedge Fund Risk,” Yale ICF Working Paper, vol. 7, no. 14. Retrieved from ssrn.com/abstract=1130742. Black, Fischer, and Robert Litterman. 1992. “Global Portfolio Optimization,” Financial Analysts Journal, vol. 48, no. 5, pp. 28–43. Blitz, David C., and Pim Van Vliet. 2008. “Global Tactical Cross-Asset Allocation: Applying Value and Momentum Across Asset Classes,” Journal of Portfolio Management, vol. 35, no. 1, pp. 23–38. Bodie, Zvi, Robert C.

Nerds on Wall Street: Math, Machines and Wired Markets

by

David J. Leinweber

Published 31 Dec 2008

The technicians thought the Ph.D.’s were hopeless geeks who wouldn’t know a good trade if they sat next to it on a bus. Stocks Are Stories, Bonds Are Mathematics This split was never more apparent than it was on the one day I actually met Fischer Black. I’d been invited over by a group of Goldman equity traders, technicians all. Previously, I’d met Bob Litterman, Fischer’s collaborator, at a Berkeley finance seminar, and called to let him know I was coming to his building. He decided to have his crowd join the group of equity traders for my show-and-tell. First, I got to meet Fischer himself. He graciously showed me some analytic software they were developing—sort of a spreadsheet on steroids that calculated more about bonds and derivatives than I knew existed.

What Happened to Goldman Sachs: An Insider's Story of Organizational Drift and Its Unintended Consequences

by

Steven G. Mandis

Published 9 Sep 2013

Silverstein 0.475% 1,258,841 66,718,552 88,597,201 Joseph D. Gatto 0.475% 1,258,841 66,718,552 88,597,201 Joseph Della Rosa 0.475% 1,258,841 66,718,552 88,597,201 Lawton W. Fitt 0.475% 1,258,841 66,718,552 88,597,201 Peter G.C. Mallinson 0.475% 1,258,841 66,718,552 88,597,201 Richard G. Sherlund 0.475% 1,258,841 66,718,552 88,597,201 Robert Litterman 0.475% 1,258,841 66,718,552 88,597,201 Robert V. Delaney 0.475% 1,258,841 66,718,552 88,597,201 Tracy R. Wolstencroft 0.475% 1,258,841 66,718,552 88,597,201 Connie K. Duckworth 0.425% 1,126,331 59,695,546 79,271,180 Danny O. Yee 0.425% 1,126,331 59,695,546 79,271,180 David L. Henle 0.425% 1,126,331 59,695,546 79,271,180 Esta E.

Investing Amid Low Expected Returns: Making the Most When Markets Offer the Least

by

Antti Ilmanen

Published 24 Feb 2022

Geert Rouwenhorst (2019), “The commodity futures risk premium: 1871–2018,” SSRN working paper. Black, Fischer (1972), “Capital Market Equilibrium with Restricted Borrowing,” Journal of Business 45(3), 444–455. Black, Fischer (1993), “Beta and return,” Journal of Portfolio Management 20(1), 8–18. Black, Fischer; and Robert Litterman (1992), “Global portfolio optimization.” Financial Analysts Journal 48(5), 28–43. Black, Fischer; Michael Jensen; and Myron Scholes (1972), “The capital asset pricing model: some empirical tests,” in Studies in the Theory of Capital Markets. Praeger, Jensen, Michael (ed.): 79–121. Blake, David; Alberto G.

Adaptive Markets: Financial Evolution at the Speed of Thought

by

Andrew W. Lo

Published 3 Apr 2017

Amir and I had no inside knowledge about the workings of the many hedge funds that were affected in August 2007, nor did we have any proprietary access to brokerage records or trading histories. So, please take this narrative with caution and a healthy dose of skepticism. However, the Unwind Hypothesis is consistent with the rumors, reports, and accounts told to the public during and since the crisis (an illuminating example is the public lecture on the Quant Meltdown given by Bob Litterman, who sat on the Goldman Sachs risk committee during that time).31 Various participants in the events of August 2007 have looked at our simulation, and they haven’t said it’s wrong. From a scientific viewpoint, no one has come up with a stronger hypothesis in the years since we first proposed it.

Expected Returns: An Investor's Guide to Harvesting Market Rewards

by

Antti Ilmanen

Published 4 Apr 2011

Thus, active management is a zero-sum game before costs and fees, and a negative-sum game after they are included. Any gains one active investor makes must come at the expense of a losing active investor. The average active investor must deliver a lower net return than the average passive investor who benefits from much lower costs and fees. In jargon, the net alpha is negative. • Robert Litterman’s “active risk puzzle” notes that only a small share of institutional risk budgets is allocated to active management. (Even when capital is allocated to long-only active managers, tracking error targets tend to be much lower than the volatility of underlying assets.) Given that equity market risk takes up 90% of many risk budgets, and the related SR is about 0.3, the small share of active risk must imply a much lower expected SR for active management.

Trading and Exchanges: Market Microstructure for Practitioners

by

Larry Harris

Published 2 Jan 2003

I particularly appreciate the generosity and encouragement that the following individuals have extended to me: Stanley Abel Howard Baker Frank Baxter Brandon Becker Gil Beebower Jeff Benton Dale Berman Charles Black David Booth Harold Bradley Kurt Bradshaw Pearce Bunting Richard Cangelosi Jim Cochrane David Colker Cromwell Coulson Larry Cuneo David Cushing Harry Davidow Pina DeSantis Mike Edleson Jim Farrell Tom Fay Gene Finn Ed Fleischman Russ Fogler Gifford Fong Stuart Fraser Dean Furbush Jim Gallagher Gary Gastineau Brian Geary Steven Giacoma Jim Gilmore Phil Ginsberg Gary Ginter Keith Goggin Wendy Gramm Dick Grasso Bob Greber Leo Guzman Spence Hilton Dave Hirschfeld Blair Hull Billy Johnson Rick Ketchum Rick Kilcollin Ray Killian Howard Kramer Ken Kramer Arthur Leavitt Charlie Lebens Marty Leibowitz Dave Leinweber Rich Lindsey Evelyn Liszka Bob Litterman Bill Lupien Bernie Madoff Peter Madoff Steven Malin David Malmquist Tim McCormick Dick McDonald Seth Merrin Dick Michaud Mark Minister Nate Most Annette Nazareth Gene Noser Bill Pratt Eddie Rabin Murali Ramaswami Bill Ryan Henry Sasser Evan Schulman Andy Schwarz Christina Sciotto Jim Scott Jim Shapiro David Shaw Katy Sherrerd Fred Siesel Deborah Soesbee George Sofianos Eric Sorensen Olof Stenhammar Rob Telsar Artie Tolendini Jack Treynor Wayne Wagner Jeffery Wecker Genie Williams Steve Wallman Steve Wunsch Steve Youngren Dorit Zeevi Four people particularly influenced the development of this book.

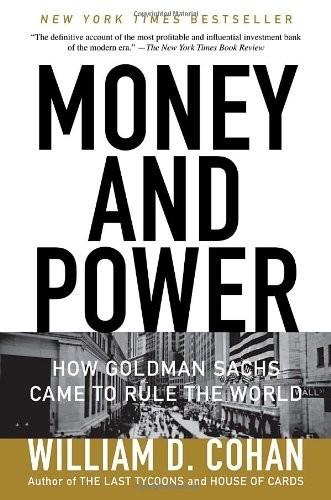

Money and Power: How Goldman Sachs Came to Rule the World

by

William D. Cohan

Published 11 Apr 2011

.… Corzine was able to convey the culture in a really profound way.” Another cultural change that Paulson and Corzine instituted after they took over and that seemed to ignite the troops was the new system of risk controls, accountability, internal police, and open lines of communication. Around that time, Goldman partner Robert Litterman, a former professor at MIT who had joined Goldman in 1985, created the “value-at-risk” model, which attempts to quantify how much Goldman could lose trading on any given day. (Many Wall Street firms still use a version of Litterman’s model, including Goldman, although the model’s ability to gauge genuine risk remains controversial.)