Carl Icahn

description: an American businessman known for his activities as an activist shareholder

118 results

King Icahn: The Biography of a Renegade Capitalist

by

Mark Stevens

Published 31 May 1993

In retrospect, Phillips was a watershed deal, for both the evolution of Carl Icahn and the M&A craze that defined the decade. “Before Phillips, Carl Icahn was just Carl Icahn—a successful takeover guy with brass balls and a pretty good record for getting things done,” said the former Drexel managing director. “But after Phillips, Carl became the Carl Icahn. The deal firmly established his image as the best intimidator, the best takeover practitioner around. “Think about it this way. For Pickens, a creature of the oil patch, to launch an assault on Phillips was audacious. But for Carl Icahn, this Wall Street operative who’d never even seen an oil well and who had no ties to the business establishment, to attack Phillips, that was unholy, incredible, awesome.

…

The man, who for all outward appearances and statements didn’t care a whit what others thought of him, was genuinely interested in having a biography of his life produced by an independent writer and read by the world. I believe this rush of vanity surprised no one more than Carl Icahn himself. A final note: there are many qualities about this germaphobic, detached, relatively loveless man but he is by far the smartest person I have ever had the pleasure of knowing in my life. This book chronicles it all. THE BILLION DOLLAR EPIPHANY “I was once the rich uncle. Now he’s the rich nephew.” —Elliot Schnall In the summer of 1979, Carl Icahn, then a relatively obscure Wall Street figure with a hole-in-the-wall brokerage firm and a knack for making money in the options business, traveled to Miami to visit his mother Bella and his uncle, Elliot Schnall.

…

Icahn had detected a weak link in the capitalist system, and he would exploit it with enormous success over the course of a tumultuous decade in American business. FIRST STRIKES: CONTROLLING THE DESTINY OF COMPANIES “In a fight, I go over a certain line and I become very tough. I even surprise myself. I reach a certain point in a fight where there is no turning back.” —Carl Icahn By 1977, Carl Icahn was ready to move out of the shadows and onto Wall Street’s center stage. Two decades of thinking and observing had come together in a cohesive vision. He would make his mark, and his fortune, by controlling “the destinies of companies”—a feat he would accomplish not with brute force or financial might (neither of which he possessed at the time), but instead by putting a new spin on a time-tested Wall Street battle tactic, the proxy contest.

Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism

by

Jeff Gramm

Published 23 Feb 2016

WARREN BUFFETT AND AMERICAN EXPRESS Warren Buffett letter to President and CEO Howard Clark, June 16, 1964 The Great Salad Oil Swindle nearly topples American Express and sparks a minor revolt among its shareholders. Warren Buffett’s investment in the company marks a turning point in his career. CARL ICAHN AND PHILLIPS PETROLEUM Carl Icahn letter to Chairman and CEO William Douce, February 4, 1985 After a brief interlude covering Jim Ling, Harold Simmons, and Saul Steinberg, we enter the corporate raider era to watch Carl Icahn’s Milken-funded frontal assault on hapless Phillips Petroleum. ROSS PEROT AND GENERAL MOTORS Ross Perot letter to Chairman and CEO Roger Smith, October 23, 1985 Pushed to the brink by poison pills and greenmail, institutional investors finally lose their cool when General Motors pays its largest shareholder, and one of the world’s greatest businessmen, to quit the board of directors.

…

With help from the efficient market hypothesis and the free market movement of the 1970s, raiders were viewed less as a scourge and threat to industry and more as a disciplinary force. In the ’80s, the hostile raiders rode strong economic growth and Michael Milken’s blank checkbook to fame and riches. 4 Carl Icahn versus Phillips Petroleum: The Rise and Fall of the Corporate Raiders “However, what I strenuously oppose is the Board not allowing the shareholders to receive a fair price for all their shares.” —CARL ICAHN, 1985 ON FEBRUARY 4, 1985, Carl Icahn sent a letter to William Douce, chairman and CEO of Phillips Petroleum, offering to buy the company. He wrote that if Phillips did not accept his bid, he would launch a hostile tender offer for control.

…

More than any of the other raiders’, Carl Icahn’s career in the 1980s exemplified the decade. He had an unlikely ascent followed by a crash that almost left him ruined. Yet today he is the best known of the corporate raiders. And, to use the metric that probably matters most to him, he is also the richest. Early in his career, Icahn was dismissed as a simple “greenmailer,” someone who would agitate at a company only to win a preferential buyout of his shares. But his tussle with Phillips showed him at his instinctive and gunslinging best. As a former Drexel managing director described it, “Carl Icahn became the Carl Icahn.”12 The deal also showcased the awesome power of Milken and Drexel, and by doing so, numbered the days for both.

When the Wolves Bite: Two Billionaires, One Company, and an Epic Wall Street Battle

by

Scott Wapner

Published 23 Apr 2018

James Sterngold, “The Pawns Differ: Icahn Still Winning,” New York Times, February 6, 1985. 10. Tobias Carlisle, “How Carl Icahn Became a Corporate Raider,” Investment News, December 7, 2014. 11. Tobias Carlisle, “The Insight That Enabled Carl Icahn to Become a Corporate Raider,” Crain’s Wealth, December 8, 2014. 12. Carlisle, “How Carl Icahn Became a Corporate Raider.” 13. Paul Richter, “Carl Icahn Relishes His Raider Role,” Los Angeles Times, June 9, 1985. 14. Slater, The Titans of Takeover. 15. Ibid. 16. Ibid. 17. Ibid. 18. Ibid. 19. Carlisle, “How Carl Icahn Became a Corporate Raider.” 20. Robert Cole, “Icahn Makes Dual Offer for Dan River,” New York Times, October 26, 1982. 21.

…

Kevin McCoy and Nathan Bomey, “Herbalife Agrees to $200M FTC Settlement,” USA Today, July 15, 2016. 27. Carl Icahn, “Carl Icahn Issues Statement in Response to Herbalife’s Settlement with the FTC,” carlicahn.com, July 15, 2016. 28. Lindsay Rittenhouse, “Herbalife Settlement Is Profound Victory,” The Street, July 15, 2016. Chapter 15: Finale or Fakeout? 1. Michelle Celarier, “Inside Wall Street’s Greatest Feud,” Fortune, September 19, 2016. 2. Ibid. 3. Ibid. 4. David Benoit, “Carl Icahn Mulled Selling Herbalife Stake to Group That Included Bill Ackman,” Wall Street Journal, August 26, 2016. 5. CNBC, Squawk Box, August 26, 2016. 6. Carl Icahn, “Carl Icahn Issues Statement Regarding Herbalife,” carlicahn.com, August 26, 2016. 7.

…

Slater, The Titans of Takeover. 22. Richter, “Carl Icahn Relishes His Raider Role.” 23. Robert Cole, “ACF, Icahn Target, Prepares Next Step,” New York Times, September 20, 1983. 24. Ibid. 25. Linette Lopez, “Carl Icahn Told an Amazing 8-Minute Story That Explains His Entire Philosphy About Activist Investing,” Business Insider, November 4, 2015. 26. Times Wire Services, “Chesebrough Will Buy Stauffer for $1.2 Billion,” Los Angeles Times, February 20, 1985. 27. Robert J. Cole, “Icahn Bids $8.1 Billion for Phillips,” New York Times, February 6, 1985. 28. Ibid. 29. William Gruber, “Raider Carl Icahn—A Pirate or Patriot?”

Deep Value

by

Tobias E. Carlisle

Published 19 Aug 2014

Available at http://dealbook.nytimes.com/2010/06/03/ another-view-can-biotech-survive-icahn/?ref=business. Bertoni, March 9, 2011. Carl Icahn, Schedule 14A Filing, February 23, 2010: http://www.sec.gov/ Archives/edgar/data/732485/000091062710000037/dfan14a022210.txt. Icahn Capital LP SEC Form 13F March 31, 2010 Available at http://www.sec. gov/Archives/edgar/data/1412093/000114036110021805/form13fhr.txt. Ibid. Howard Anderson. “Carl Icahn’s Battle to Take Down Genzyme.” The Boston Globe, June 2, 2010. Available at http://www.boston.com/bostonglobe/ editorial_opinion/oped/articles/2010/06/02/carl_icahns_battle_to_take_ down_genzyme. Icahn Capital LP SEC Schedule 14A Filing Available at http://www.sec.gov/ Archives/edgar/data/732485/000091062710000101/genzdfan14a060110.txt.

…

“iPrefs: Unlocking Value.” Greenlight Capital, 2013. Available at https://www.greenlightcapital.com/905284.pdf. 17. Ibid. 18. Ibid. 19. Carl Icahn, “Letter to Tim Cook.” Icahn Enterprises, October 8, 2013. Available at http://www.scribd.com/doc/178753981/Carl-Icahn-s-Letter-To-Apple-s-Tim-Cook. 20. Einhorn, 2013. 21. David Benoit. “Icahn Ends Apple Push With Hefty Paper Profit.” The Wall Street Journal, February 10, 2014. Applied Deep Value 215 22. Steven Russolillo. “Carl Icahn: ‘Agree Completely’ With Apple’s Bigger Buyback.” The Wall Street Journal, April 23, 2014. 23. Benoit, 2014. 24. Benjamin Graham and David Dodd.

…

Each chapter tells a different story about a characteristic of deep value investing, seeking to illustrate a genuinely counterintuitive insight. Through these stories, it explores several ideas demonstrating that deeply undervalued stocks provide an enormous tail wind to investors, generating outsized returns whether they are subject to activist attention or not. We begin with former arbitrageur and option trader Carl Icahn. An avowed Graham-and-Dodd investor, Icahn understood early the advantage of owning equities as apparently appetizing as poison. He took Benjamin Graham’s investment philosophy and used it to pursue deeply undervalued positions offering asymmetric returns where he could control his own destiny.

The Predators' Ball: The Inside Story of Drexel Burnham and the Rise of the JunkBond Raiders

by

Connie Bruck

Published 1 Jun 1989

The junk-bond-financed takeover had not sprung, fully functioning, from the minds of Milken and his Drexel colleagues; it had needed crafting and fine-tuning. T. Boone Pickens Jr.’s peanut-sized Mesa Petroleum had made a run at mammoth Gulf Oil in early 1984. Pickens had ultimately driven Gulf into the arms of its white knight, Standard Oil of California. Then Steinberg’s Reliance had mounted its raid against Disney. Carl Icahn had launched his bid for Phillips Petroleum, after Pickens’ Mesa had taken its turn and been bought out. These raids—all financed by Drexel junk bonds, except for Pickens’ run at Phillips—had thrown off hundreds of millions of dollars to the raiders and to Drexel. But not one had acquired its target.

…

It must have not only excited but tickled the fancy of Milken, an amateur magician who occasionally does tricks for his friends, to be able to wave this particular wand. The honored guests of this conference, therefore, were the takeover artists and their biggest backers—men like T. Boone Pickens, Carl Icahn, Irwin Jacobs, Sir James Goldsmith, Oscar Wyatt, Saul Steinberg, Ivan Boesky, Carl Lindner, the Belzbergs—and lesser lights about to shine, such as Nelson Peltz, Ronald Perelman, William Farley. The names tend to meld into a kind of raiders’ litany, but they are not all the same. For Milken, they would have separate roles during the coming months, performing discrete functions in a vast, interlocking machine of which he alone would know all the parts.

…

It was a glorified road show for the buyers and for the scores of companies that made presentations, many of whom would soon be doing junk-bond offerings. It was a reunion for Milken’s high-rollers, whose camaraderie, if not collusion, he encouraged. One Drexel lawyer later recalled having seen Ivan Boesky, Carl Icahn, Carl Lindner and Irwin Jacobs huddled in a corner. “Anything could have been happening there,” he remarked with a laugh. It was a good time. Bungalow 8 would not soon be forgotten, and client loyalty gets forged in sundry ways. And it launched Milken’s now full-blown tour de force. Within the first two weeks of April 1985, hard on the heels of the Predators’ Ball, five more Drexel clients—in addition to Triangle Industries—would make bids for companies, all backed by Milken’s junk bonds.

The Acquirer's Multiple: How the Billionaire Contrarians of Deep Value Beat the Market

by

Tobias E. Carlisle

Published 13 Oct 2017

Available at https://www.sec.gov/Archives/edgar/data/1040273/000089914000000393/0000899140-00-000393-0003.txt 59 David Einhorn. “iPrefs: Unlocking Value.” Greenlight Capital, 2013. Available at https://www.greenlightcapital.com/905284.pdf. 60 David Einhorn. “iPrefs: Unlocking Value.” Greenlight Capital, 2013. Available at https://www.greenlightcapital.com/905284.pdf. 61 Carl Icahn, Letter to Tim Cook. Available at https://www.cnbc.com/2013/10/24/carl-icahns-letter-to-tim-cook.html 62 Carl C Icahn, Tweet, 11:21 AM, August 14, 2013. Available at https://twitter.com/Carl_C_Icahn/statuses/367350206993399808 63 David Einhorn. “iPrefs: Unlocking Value.” Greenlight Capital, 2013. Available at https://www.greenlightcapital.com/905284.pdf. 64 Carl C Icahn, Tweet, 11:12 AM, 11:13 AM, August 19, 2014.

…

Buffett wrote in 1984, “It is extraordinary to me that the idea of buying dollar bills for 40 cents takes immediately to people or it doesn’t take at all”:1 A fellow…who had no formal education in business, understands immediately the value approach to investing and he’s applying it five minutes later. In the book, I set out the data and my reasoning. We’ll look at the details of actual stock picks by billionaire deep-value investors: •Warren Buffett •Carl Icahn •Daniel Loeb •David Einhorn We’ll see the strategies of Buffett and his teacher, Benjamin Graham, and other contrarians, including: •billionaire trader Paul Tudor-Jones •venture capitalist billionaire Peter Thiele •global macroinvestor billionaire Michael Steinhardt •billionaire tail-risk hedger Mark Spitznagel I wrote this book so you can read it in a couple of hours.

…

But they only do it when the stock is deeply undervalued. Billionaire value-investor Warren Buffett famously says he tries to be “fearful when others are greedy, and greedy when others are fearful.” Said in other words, Buffett zigs when the crowd zags. Like Buffett, billionaire corporate-raider Carl Icahn is also a value investor. He has been called the “the contrarian to end all contrarians.”2 Ken Moelis, former chief of investment banking at UBS, said of Icahn, “He’ll buy at the worst possible moment, when there’s no reason to see a sunny side and no one agrees with him.”3 Icahn explains why:4 The consensus thinking is generally wrong.

The System: Who Rigged It, How We Fix It

by

Robert B. Reich

Published 24 Mar 2020

Their successes earned them billions of dollars and laid the groundwork for the next round of exploitation. In order to unravel the nexus of wealth and power at the top, these systemic changes must be reversed. CHAPTER 8 From Stakeholder to Shareholder Capitalism JAMIE DIMON wanted to be President Trump’s Treasury secretary, according to several sources. But billionaire investor Carl Icahn preferred Steven Mnuchin for the job. Mnuchin got it. How did Icahn get his pick? Icahn endorsed Trump for president in September 2015, barely three months after Trump announced his candidacy and long before he was considered a serious contender. “He’s the only candidate that speaks out about the country’s problems,” Icahn explained at the time.

…

In 1980, under pressure from financial entrepreneurs like Weill, Congress lifted that ban, and Weill quickly got to work merging banks. A related Depression-era rule erected a strict wall between commercial banking (collecting deposits and making loans) and investment banking (making bets), called the Glass-Steagall Act. By the mid-1980s, as the stock market took off courtesy of Carl Icahn and the other raiders, people like Weill and Dimon noted that huge money could be made by taking down that wall. In early 1985, three of the Street’s biggest banks—JPMorgan, Citicorp, and Bankers Trust—asked the Federal Reserve Board to remove a few bricks. As a member of JPMorgan’s board at the time, Alan Greenspan endorsed the company’s application.

…

The three systemic changes I have outlined—from stakeholder to shareholder capitalism, from unionized workers to corporate monopolies, and from regulation of Wall Street to letting the Street run wild—profoundly altered the American system. It created a jaw-droppingly wealthy and powerful oligarchy. It shafted just about everyone else. CHAPTER 11 The Triumph of the Oligarchy DIG UNDER THE SURFACE of the system and you see individuals making deals that generated billions for themselves—such as Carl Icahn’s corporate raids, Jack Welch’s attacks on GE’s workers and unions, Warren Buffet’s investments in corporations with moats, and Sandy Weill’s and Jamie Dimon’s unfettered financial supermarkets and betting parlors. Dig deeper and you see how these deals depended on seemingly small changes in laws and regulations, such as preventing companies from defending themselves from raiders, neutering antitrust enforcement, imposing small fines on corporations for firing union organizers, refusing to regulate derivatives, and dismantling Glass-Steagall.

MONEY Master the Game: 7 Simple Steps to Financial Freedom

by

Tony Robbins

Published 18 Nov 2014

You’ll gain insight into how they became the titleholders in the field of finance, and how you too have to stay alert and be ready for anything that happens. You’ll learn investment strategies that will prepare you for all seasons, for times of inflation and deflation, of war and peace, and, as Jack Bogle puts it, “times of sorrow and joy.” CHAPTER 6.1 CARL ICAHN: MASTER OF THE UNIVERSE * * * The Most Feared Man on Wall Street Question: When is a single tweet worth $17 billion? Answer: When Carl Icahn says Apple is undervalued and announces he’s buying the stock. Within an hour of Icahn’s tweet in the summer of 2013, Apple stock had jumped 19 points. The market got the message: whenever the billionaire businessman takes an interest in a company, it’s time to buy.

…

Icahn’s business skills have made him one of the richest men in the world—at last check of the Forbes list, he was 27th, with a net worth of more than $23 billion—and he’s made billions more for ordinary shareholders who invest in his diversified holding company, Icahn Enterprises LP (NASDAQ: IEP), or own stock in the companies he targets. The secret to his success? Even his critics will tell you Carl Icahn doesn’t just look for opportunities in business—he makes them. But most outsiders still think of him as a Wall Street caricature, a ruthless vulture capitalist who pillages companies for personal gain. When you Google the term corporate raider, Icahn’s name autofills in the search bar. But Carl Icahn is challenging that creaky old stereotype. Icahn thinks of himself as a “shareholder activist.” What does that mean? “We go in and shine a light on public companies that are not giving shareholders the value they deserve,” he told me.

…

Buffett responded that he had abstained from the vote but was opposed to the plan, and that he had been quietly talking to management about reducing its excessive pay proposal—but he didn’t want to “go to war” with Coke over the issue. In contrast, Carl Icahn is always ready for war. He’s been in the trenches many times before, making runs on companies as diverse as US Steel, Clorox, eBay, Dell, and Yahoo. But this time was different: instead of Icahn, a younger fund manager named David Winters was buying stock and leading the charge against Coke’s management. To the dismay of overpaid CEOs everywhere, a new generation of “activist investors” is taking up the fight Icahn started decades ago. Naturally, Carl Icahn has ticked off a lot of corporate dynamos, enemies with big clout in the media.

The Founders: The Story of Paypal and the Entrepreneurs Who Shaped Silicon Valley

by

Jimmy Soni

Published 22 Feb 2022

“Regarding Mr. Icahn’s”: “eBay Inc.’s Statement on Carl Icahn’s Investment and Related Proposals,” January 22, 2014, https://www.ebayinc.com/stories/news/ebay-incs-statement-carl-icahns-investment-and-related-proposals/. “The complete disregard”: Maureen Farrell, “Carl Icahn Charges eBay’s Board with ‘Complete Disregard for Accountability,’ ” Wall Street Journal, February 24, 2014, https://blogs.wsj.com/moneybeat/2014/02/24/carl-icahn-charges-ebays-board-with-complete-disregard-for-accountability/. “dead wrong”: “Stick to the Facts, Carl: eBay Inc. Responds to Carl Icahn,” February 26, 2014, https://www.ebayinc.com/stories/news/stick-facts-carl-ebay-inc-responds-carl-icahn/.

…

Responds to Carl Icahn,” February 26, 2014, https://www.ebayinc.com/stories/news/stick-facts-carl-ebay-inc-responds-carl-icahn/. “PayPal is a jewel”… “in the world”: Steven Bertoni, “Carl Icahn Attacks eBay, Marc Andreessen and Scott Cook in Shareholder Letter,” Forbes, accessed July 29, 2021, https://www.forbes.com/sites/stevenbertoni/2014/02/24/carl-icahn-attacks-ebay-marc-andreessen-and-scott-cook-in-shareholder-letter/. “A thorough strategic”: “eBay Inc. to Separate eBay and PayPal Into Independent Publicly Traded Companies in 2015,” September 30, 2014, https://www.businesswire.com/news/home/20140930005527/en/eBay-Inc.-to-Separate-eBay-and-PayPal-Into-Independent-Publicly-Traded-Companies-in-2015.

…

In a 2002 talk at Stanford, a questioner asked Thiel what advice he had for PayPal. “The larger market is off eBay,” he said, “and they should develop a lot of product features and functionalities that enable point-to-point payments in a non-eBay context.” The PayPal independence movement picked up steam, thanks to activist investor Carl Icahn. In 2013, Icahn took a significant stake in eBay and began to push it to spin off PayPal. In its January 2014 quarterly report, eBay responded: “Regarding Mr. Icahn’s separation proposal, eBay’s Board of Directors… does not believe that breaking up the company is the best way to maximize shareholder value.”

Netflixed: The Epic Battle for America's Eyeballs

by

Gina Keating

Published 10 Oct 2012

Craft Blockbuster Online, vice president of strategic planning Rick Ellis Blockbuster Online, operations consultant Shane Evangelist Blockbuster Online, senior vice president and general manager Gary Fernandes Board member Bill Fields Chairman/chief executive before Antioco Sarah Gustafson Blockbuster Online, senior director, customer analytics Jules Haimovitz Board member Lillian Hessel Blockbuster Online, vice president, customer marketing Jim Keyes Chairman/chief executive Karen Raskopf Corporate Communications, senior vice president, Nick Shepherd Chief operating officer Michael Siftar Blockbuster Online, director, applications development Nigel Travis President Strauss Zelnick Board member Larry Zine Chief financial officer COSTARS (ALPHABETICAL) Robert Bell AT&T Laboratory, Statistics Division, researcher Jeff Bezos Amazon.com founder/chief executive Martin Chabbert Netflix Prize winner, French-Canadian programmer Tom Dooley Viacom, senior vice president Roger Enrico PepsiCo, chairman John Fleming Walmart, chief executive Brett Icahn Carl Icahn’s son Carl Icahn Blockbuster investor/board member Michael Jahrer Netflix Prize winner, Big Chaos team, machine learning researcher Mike Kaltschnee HackingNetflix, founder/blogger Gregg Kaplan Redbox, chief executive Mel Karmazin Viacom, chief operating officer Yehuda Koren Netflix Prize winner, AT&T Laboratory, scientist Warren Lieberfarb Warner Home Video, president Joe Malugen Movie Gallery, chairman/chief executive Dave Novak Yum!

…

Wattles, however, would not turn over the information to Antioco unless his rival agreed not to tender an offer directly to Hollywood Video’s shareholders. Wattles said publicly that he welcomed the offer, but he privately expressed doubts to the Blockbuster executives that U.S. antitrust regulators would approve the deal. The proposal had drawn the attention of billionaire investor Carl Icahn, a former corporate raider and self-styled shareholder activist, who then planned to profit on both ends of the Blockbuster–Hollywood Video merger. Icahn sank $150 million into Blockbuster shares and about $60 million into Hollywood Video. In a securities filing Icahn said he might seek to participate in, and influence the outcome of, any proxy solicitation and the bidding process involving the owner of the Hollywood Video stores.

…

“They are still pretty small, so in the background, but have good significant potential over the next three years, mostly to negatively impact stores, which of course has a positive effect for us,” Hastings said. That summer, everyone at Netflix was exhausted and becoming demoralized. Hastings carried himself like a depleted man, and it was clear that Kilgore was very, very worried. CHAPTER THIRTEEN THE GREAT ESCAPE (2007–2009) LATER, CARL ICAHN WOULD REFLECT that John Antioco had, in fact, done a good job in setting up Total Access, and that if Antioco had not left the company in a huff over his bonus, things might have turned out differently. But in the summer of 2007, Icahn could hardly wait to get rid of Antioco. In his view, Antioco never cared as much about Blockbuster as he did about making money and escaping to his ranch to drink tequila.

All the Money in the World

by

Peter W. Bernstein

Published 17 Dec 2008

Then, in 1984, Milken began using: Burrough and Helyar, Barbarians at the Gate, p. 141. 21. Black famously conceived: Jerry Useem, “20 That Made History,” Fortune, June 27, 2005, as well as interview with Black. 22. Carl Icahn, for example: Information about Marshall Field’s comes from Charles Geisst, Wall Street: A History (New York: Oxford University Press, 1997), p. 339; information about Carl Icahn and Texaco is from Roy C. Smith, The Wealth Creators: The Rise of Today’s Rich and Super-Rich (New York: St. Martin’s Press, 2001), p. 107. 23. Not all of his deals: Geisst, Wall Street, p. 340. By 2006, Icahn’s fortune had ballooned to $9.7 billion. 24.

…

Much of the 1980s bull market is attributed to the Milken machine that bought and sold junk bonds for corporate takeovers. Without the hundreds of billions of dollars in these low-grade bonds that he and Drexel raised, the takeover boom might have been far smaller, and his raider clients such as Ronald Perelman, T. Boone Pickens, and Carl Icahn might never have landed on the Forbes 400. “There was fear everywhere,” remembers Leon Black, cohead of corporate finance at Drexel in the 1980s and now head of a major New York private equity firm (and number 160 on the Forbes 400 in 2006). “Every CEO was worried. They’d read the Wall Street Journal in the morning and learn that their company was under attack by some guy we’d financed for $10 billion that morning.

…

They’d read the Wall Street Journal in the morning and learn that their company was under attack by some guy we’d financed for $10 billion that morning. Nobody felt safe.” Black famously conceived21 the “highly confident” letter that Drexel gave raiders, essentially a pirate flag that told takeover targets the fearsome bank was backing them. Carl Icahn, for example22, a secretive former Wall Street stock arbitrageur and fiendish poker player, came out of nowhere to earn over $100 million from hostile purchases of stock in companies like Marshall Field’s and over $500 million from Texaco, whose corporate boards paid him to go away—the greenmailing strategy.

Makers and Takers: The Rise of Finance and the Fall of American Business

by

Rana Foroohar

Published 16 May 2016

Six out of the top ten fastest-growing job categories pay $15 an hour and workforce participation is as low as it’s been since the late 1970s.4 It used to be that as the fortunes of American companies improved, the fortunes of the average American rose, too. But now something has broken that relationship. That something is Wall Street. Just consider that only weeks after Apple announced it would pay off investors with the $17 billion, more sharks began circling. Corporate raider Carl Icahn, one of the original barbarians at the gate who attacked companies from TWA to RJR Nabisco in the 1980s and 1990s, promptly began buying up Apple stock, all the while tweeting demands that Cook spend billions and billions more on buybacks. With each tweet, Apple’s share price jumped. By May 2015, Icahn’s stake in Apple had soared 330 percent, to more than $6.5 billion, and Apple had pledged to spend a total of $200 billion on dividends and buybacks through March 2017.

…

Chapter 3 will delve deeply into the history of US business education and examine how and why it came to focus on balance sheet manipulation to the exclusion of real managerial skills. Chapter 4 will deconstruct our conventional wisdom around shareholder value by looking at how activist investors like Carl Icahn now call the shots at the country’s largest and most successful firms—such as Apple—at the expense of innovation and job creation. Chapter 5 will show how much of corporate America has come to emulate banking—how we’re all glorified bankers now—by tracking the history of General Electric, which is one of the great American innovators, but which became the country’s fifth-largest bank before trying to reclaim its roots in industry.

…

Indeed, “shareholder value” has become the rallying cry of many a financially oriented manager making decisions that boost a company’s share price at the expense of longer-term growth. And it has also become the justification for “activist” investors who, in a clever semantic trick, have today been rebranded from their previous incarnation as “corporate raiders”—people like Carl Icahn, Bill Ackman, and Daniel Loeb, who have pushed American companies to pay back their record $2 trillion cash hoard in the form of dividends and share buybacks, rather than pay higher wages or make investments in factories, infrastructure, or worker training.17 And they’ve been quite successful at forcing companies to do just that.

100 Baggers: Stocks That Return 100-To-1 and How to Find Them

by

Christopher W Mayer

Published 21 May 2018

And you can see that. There are so many articles out there right now about how companies are hoarding cash at such a high level. The owner-operators are nothing if not opportunistic. We talked about a few examples, such as Carl Icahn, the famous dealmaker. There are a variety of Icahn-led companies in the index. American Railcar, CVR Energy and Chesapeake are three. “When you study somebody like Carl Icahn,” Matt said, “it becomes very clear that he’s using these companies like chess pieces.” Let’s just look at American Railcar and CVR Energy, for instance. In the oil-rich Bakken, there was a shortage of pipeline capacity to get it to the refineries, such as CVR.

…

— Martin Sosnoff, Silent Investor, Silent Loser OWNER-OPERATORS: SKIN IN THE GAME 87 “When my mother asked me what I was doing these days, I explained it to her this way,” Matt Houk told me. “I said, ‘OK, Mom, what if Warren Buffett approached you and said he’d manage your money [for a small fee]—would you let him?’ “‘Of course.’ “‘What about Carl Icahn?’ “‘Yes.’ “‘What about Bill Ackman, David Einhorn or the Tisch family at Loews? Would you let them do it for that fee?’ “‘Yes, absolutely.’ “And that’s what this fund is. People manage your money for a very reasonable fee and you get access to private equity-type talent. “Odd that there wasn’t a product like this before,” Matt explained.

…

OWNER-OPERATORS: SKIN IN THE GAME 91 “For the average person,” Matt summed up, “getting access to investors of that quality is not easy. You can get it only if you go through a hedge fund or a private equity partnership. And you need to be at a high standard of living to qualify. But this is an indirect way to access that talent. And you can have Nelson Peltz invest your money. You can have Carl Icahn and Warren Buffett.” Wealth begets wealth “Most wealth remains hidden in private financial arrangements undetected by curious onlookers,” write Professors Joel Shulman and Erik Noyes. “The public will probably never know the secrets behind this money.” But not all such wealth lies hidden. As we saw with Matt Houk, some of the world’s wealthiest own and operate public companies.

Palace Coup: The Billionaire Brawl Over the Bankrupt Caesars Gaming Empire

by

Sujeet Indap

and

Max Frumes

Published 16 Mar 2021

“TPG Capital, Apollo sell remaining stake in Caesars,” Las Vegas Review-Journal, March 12, 2019. Caesars Entertainment Corporation, Robert Morse resignation, 8-K, Nov 26, 2018. Vardi, Nathan. “How Carl Icahn Made $1.4 Billion Playing The Booms And Busts Of Las Vegas.” Forbes, August 30, 2017. Indap, Sujeet. “US casinos unlock the value in their real estate.” Financial Times, July 18, 2019. Lombardo, Cara. “Carl Icahn All But Exits Casinos With Tropicana Entertainment Sale.” Wall Street Journal, April 16, 2018. CNBC Power Lunch. “Caesars Entertainment CEO on plummeting stock price.” Mark Frissora on CNBC, August 1, 2018.

…

The party made news highlights and Loveman, wounded by Bonderman’s decision, would be asked for years about why exactly the TPG founder did not choose the casino he owned. A PARTY AT THE MUSEUM of Modern Art proved more problematic for Leon Black and Apollo. On the evening of May 15, 2007, the crowd included New York heavyweights such as Mayor Mike Bloomberg, Henry and Marie-Josée Kravis, Caroline Kennedy, Carl Icahn, Barry Diller and his wife Diane Von Furstenberg, and Vera Wang. The MoMA was hosting its annual black-tie “Party in the Garden” fundraiser, and the evening’s honorees were Leon and Debra Black and Martin Scorsese. The entertainment would be provided by Jay-Z, who, like Black, was a native New Yorker.

…

Apollo was having a difficult time finding candidates for the top spot, and Frissora would have had a hard time finding any job at any other public company. In September 2014, he had left as CEO at Hertz Global citing “personal reasons.” In fact, Hertz was in the middle of a massive accounting scandal where the rental car and equipment company was facing accusations of inflating profits. Carl Icahn had taken a near 10 percent stake and was making noise. Another hedge fund said Frissora had “lost all credibility.” To his surprise, Frissora got a call from an executive search firm just two weeks after leaving Hertz. They asked if he had interest in the Caesars job. He met with Rowan, Sambur, and Bonderman.

Dead Companies Walking

by

Scott Fearon

Published 10 Nov 2014

All kidding aside, it’s hard to believe that in the age of mobile communication and content delivery that the company’s management believed something as old-fashioned as home phones would reverse its slide. Candy sales almost seemed more promising by comparison. Even though I shorted the stocks of three other public video rental chains that wound up going bankrupt, I never shorted Blockbuster. You could say I got “cahned.” A few years before my visit with Angelika, renowned investor Carl Icahn had become the biggest shareholder in Blockbuster and had won a proxy war to control its board of directors. I respected Icahn’s acumen, or at least his clout, enough to stay away from shorting Blockbuster while he was so deeply involved. Even if the new retail scheme was as doomed as I thought, I didn’t want to be on the wrong side of such a powerful figure.

…

But without late fees and per-movie charges, it was never going to be profitable for the company—not with the burden of thousands of store leases and tens of thousands of employee salaries to pay. But instead of closing as many stores as they could to cut costs and putting everything they could into its online presence, Blockbuster’s leadership went backward and decided to turn its stores into glorified candy racks. I am definitely not trying to bash Carl Icahn. I have a lot of respect for him. But as he has admitted, he blew it big time at Blockbuster. The only way it was going to survive was by adapting to the fact that people weren’t going to get in their cars and drive several miles to a store just so they could overpay to rent movies anymore. Instead, he wagered that people would continue to drive several miles to overpay for movie rentals if they could also buy candy and magazines and video games—or maybe a cheap flat-screen TV—at the same time.

…

There’s no other way to put it: the man was imposing. Leaning back in his leather chair with the skyline of Houston spread out behind him, he looked like the perfect embodiment of the 1980s corporate raider—which, in many ways, he was. A few years after our meeting, he waged a storied takeover battle for Eastern Airlines with none other than Carl Icahn. Several scale models of DC-10s were displayed around his office. One of these was painted in Continental’s colors, another had the now-defunct Texas International Air brand on the side of it, and a third had been decorated with the name and logo of Jet Capital, the holding company Lorenzo and a fellow Harvard MBA had started in the late 1960s.

Den of Thieves

by

James B. Stewart

Published 14 Oct 1991

Tomilson Hill III, co-head of M&A Steve Waters, co-head of M&A Peter Solomon, investment banker At Bank Leu, Nassau, the Bahamas Bernhard Meier, banker Bruno Pletscher, banker Cast of Characters U At Merrill Lynch & Co., New York Stephen Hammerman, general counsel Richard Drew, vice president, compliance Major investors Carl Icahn, corporate raider and future chairman of TWA John Mulheren, head of Jamie Securities Henry Kravis, principal, Kohlberg Kravis Roberts Inc. At Wachtell, Lipton, Rosen & Katz, New York (counsel for Goldman, Sachs) Martin Lipton, partner Ilan Reich, partner Lawrence Pedowitz, partner At Paul, Weiss, Rifkind, Wharton & Garrison, New York (counsel for Michael Milken and Dennis Levine) Arthur Liman, partner Martin Flumenbaum, partner At Williams & Connolly, Washington, D.C.

…

Boesky claimed he had no interest in the unsavory practice of "greenmail," in which a large, hostile stake is accumulated in a company hoping to scare management into buying out the raider at a premium price. Conway signed on; he was intrigued at the thought of working for someone who might turn into the next Boone Pickens or Carl Icahn. His colleagues at Drexel were pleased: Conway could be counted on to steer business to his former employer. Indeed, to put his ambitious plans into eflFect, Boesky needed much more capital—and Drexel seemed the perfect source for it. The capital base in his arbitrage operation, always smaller than he had hoped for, had been decimated by the Cities Service crisis; he wasn't even financing his routine arbitrage activity on the scale he had wanted.

…

Considine frantically tried to put together his own financing for a leveraged buyout, but it was really no contest. Milken simply shopped National Can to his other loyal clients, oflFering them the chance to seize the company in Posner's stead, sure that they would top any bid Considine could muster. Carl Icahn eyed National Can seriously, even taking a large position, but eventually demurred. Ultimately another Milken protege, Nelson Peltz, bought the company. Drexel, raising a total of $595 million for Peltz, made even more in financing and investment banking fees than it would have had Posner carried through with the original plan.

Hiding in Plain Sight: The Invention of Donald Trump and the Erosion of America

by

Sarah Kendzior

Published 6 Apr 2020

When John Carpenter filmed his 1981 postapocalyptic thriller Escape from New York—a commentary on Manhattan’s shattered state—he chose to do it in St. Louis because he did not need to build a set. St. Louis’s natural end-times look filled in just fine. New York and St. Louis were brothers in blight—until they weren’t. The rapacious greed of the Reagan 1980s marked the rise of New York corporate raiders like Carl Icahn, who bought out St. Louis companies like Trans World Airlines (TWA), draining St. Louis of its money and resources and pride. TWA was “a broken-winged bird helpless before the pounce of the ultimate corporate predator,” wrote St. Louis magazine, describing the shock of Missourians that an out-of-state tycoon had bought something as essential as an airline purely to destroy it and pocket the profits.8 By the late 1980s, New York and St.

…

In the late 1970s, as Ford told New York to drop dead, Cohn and Trump picked at the city’s corpse like vultures. Manhattan was ready to be torn down and bludgeoned and remade with blood money in concrete: Trump Tower, the Plaza, the many, many casinos. Corporate raiders who would later aid the Trump administration—Carl Icahn, Wilbur Ross, Rupert Murdoch—commenced a national shakedown disguised as economic revival. Scams stretched from Atlantic City to Gary, Indiana, to St. Louis and beyond, to international waters where moguls parked their stolen assets.29 Critical regulations were tossed—the fairness doctrine that had protected media; the labor laws that had protected unions.

…

“What we were seeing with Russia was the fruition of a long-term strategy to try and compromise Treasury by cultivating civil servants. That’s why we sounded the alarm and reported it.”39 This internal threat to national security has only grown since 2015. The Treasury is now run by Steven Mnuchin, a lackey of Trump and fellow protégé of Trump’s old adviser Carl Icahn. Mnuchin has gone out of his way to ease sanctions on Russian oligarchs—in particular, Manafort’s former employer Oleg Deripaska—despite protest from Congress.40 Again, basic vetting by state officials—particularly during Trump’s “I have nothing to do with Russia” campaign phase—would have highlighted shady connections between the Trumps and Russia that were already in the public domain.

The Frackers: The Outrageous Inside Story of the New Billionaire Wildcatters

by

Gregory Zuckerman

Published 5 Nov 2013

Now they, too, were nearly broke and the banks were making noises about calling in the loans. The U.S. economy was on a roll, so bankers gave McClendon and Ward some time to meet their payments. McClendon and Marc Rowland, the chief financial officer, flew to New York to ask some big-name investors, like Carl Icahn, to buy Chesapeake. After an hour’s discussion at Icahn’s office, he came to a decision. “Your bonds aren’t cheap enough,” Icahn said. His point: Chesapeake wasn’t yet enough of a bargain, even at seventy-five cents a share, because its debt wasn’t trading at the dirt-cheap prices that usually got Icahn excited.

…

Ward renamed his company SandRidge Energy to signal that he was going after sandstone and other types of rock that had been drilled for decades. Let McClendon and Chesapeake spend all that money on shale, I’m going to find enough energy in old-fashioned rock, Ward was saying. Several months later, Ward approached Carl Icahn, the billionaire New York investor, who had cobbled a collection of energy companies into an entity called National Energy Group. Ward asked if Icahn was interested in merging his operation with Ward’s new company. Icahn was hesitant. He liked Ward on a personal level and thought he was bright, but Icahn was wary of all the money Ward and McClendon had spent at Chesapeake.

…

“Mark Ruffalo got an Academy Award nomination and was in the Avengers movie after” becoming involved in the antifracking movement. Either way, the publicity helped pressure New York State officials to maintain the moratorium on fracking in the state and it helped focus national attention on the drilling, dealing a public relations blow to those in the business. • • • In late 2010, billionaire investor Carl Icahn disclosed that he had purchased nearly 6 percent of Chesapeake’s shares. Icahn is a so-called activist investor, or someone who buys big chunks of a company and then levies pressure on its management to enact changes aimed at getting shares higher. Weeks later, Icahn reached out to McClendon to let him know the company had piled on too much debt.

No Is Not Enough: Resisting Trump’s Shock Politics and Winning the World We Need

by

Naomi Klein

Published 12 Jun 2017

NBC News: Trump’s cabinet appointments combined net worth of $14.5 billion Ben Popken, “Trump’s Cabinet Picks Have a Combined Wealth of $14.5B. How Did They All Make Their Money?” NBCNews.com, December 7, 2016, http://www.nbcnews.com/business/economy/trump-s-cabinet-picks-have-combined-wealth-11b-how-did-n692681. Carl Icahn: worth more than $15 billion “Carl Icahn Profile,” Forbes.com, last modified April 12, 2017, https://www.forbes.com/profile/carl-icahn/. Steve Mnuchin and foreclosures Sean Coffey, California Reinvestment Coalition, personal correspondence with author or her research assistants, April 24, 2017: “tens of thousands of people were foreclosed on (or kicked out of their homes), with more than 15,000 of those foreclosures happening due to a reverse mortgage, a type of loan that can only be originated to seniors.”

…

Not a Transition, but a Corporate Coup What Donald Trump’s cabinet of billionaires and multimillionaires represents is a simple fact: the people who already possess an absolutely obscene share of the planet’s wealth, and whose share grows greater year after year—the latest figure from Oxfam shows eight men are worth as much as half the world—are determined to grab still more. According to NBC News in December 2016, Trump’s picks for cabinet appointments had a staggering combined net worth of $14.5 billion (not including “special adviser” Carl Icahn, who’s worth more than $15 billion on his own). Moreover, the key figures who populate Trump’s cabinet are more than just a representative sample of the ultrarich. To an alarming extent, he has collected a team of individuals who made their personal fortunes by knowingly causing harm to some of the most vulnerable people on the planet, and to the planet itself, often in the midst of crisis.

Skygods: The Fall of Pan Am

by

Robert Gandt

Published 1 Mar 1995

Another group based in Iowa and headed by a Pan Am pilot named Neil Sapp launched a quixotic effort of its own to take over the shuttle. One of the most persistent shoppers—and most irritating—was TWA owner Carl Icahn. Icahn was like a horsefly around Tom Plaskett’s head. Icahn had bought out TWA and was managing it in much the same enervating fashion as Frank Lorenzo had run Continental and Eastern. Like Lorenzo, Carl Icahn was a predatory creature, an animal of the roaring, deregulated eighties. What he lacked in hard cash he made up for in hubris. Although TWA was in scarcely better health than Pan Am, and even though Icahn was about to sell TWA’s own London gates to American Airlines, Icahn was talking about building a merged TWA-Pan Am airline into a new American megacarrier.

…

The notion caused head-shakes among those who remembered Juan Trippe’s own frustrated merger talks with TWA when it was controlled by Howard Hughes. Virtually every CEO since Trippe had fantasized about such a merger. It was a tantalizing prospect—a single American flag carrier that would span virtually the entire planet. The trouble was, it was too late. It would be a marriage of the enfeebled. And no one in the industry was taking Carl Icahn seriously as a builder of such an enterprise. Icahn’s style was to buy on the cheap, in a highly leveraged takeover, and then sell off assets to fund his huge indebtedness. These days Tom Plaskett was ignoring Icahn’s phone calls. And that was making Icahn furious. “Plaskett will go down in history,” Icahn told the Wall Street Journal, “as the General Custer of the airlines.”

…

On the morning of August 12, 1991, in the court of New York bankruptcy judge Cornelius Blackshear, Tom Plaskett unloaded most of Pan Am’s remaining assets to Delta Airlines for $416 million in cash and the assumption of $389 million worth of liabilities. To some, it still seemed like too good a deal for Delta. Several unsuccessful bidders, notably Carl Icahn, screamed that their own bids were being ignored. But Icahn’s bids were backed mostly by paper and pledges, with little hard cash. Delta was not only waving real money, it was immediately advancing $80 million of debtor-in-possession funding to keep Pan Am in operation. Even better, Delta was agreeing to invest in what was now being called the “restructured” Pan Am, the remaining sliver of the airline that would be based in Miami and fly to Latin America.

Confidence Game: How a Hedge Fund Manager Called Wall Street's Bluff

by

Christine S. Richard

Published 26 Apr 2010

Berkowitz agreed to accept a Gibson acoustic guitar, which originally cost about $1,000, in exchange for his stake in the management company. “He got a bargain,” Ackman remembers. And he didn’t have to deal with Carl Icahn. On April 16, 2004, Hallwood Realty Partners announced that it would be merging with another company and that the shareholders would be bought out for $137.91 a share, a substantial premium to the $80 per share Carl Icahn had paid Ackman. It looked to Ackman like the “schmuck insurance” was going to pay off. Ackman called Icahn to congratulate him on the deal and to find out when Icahn would wire him $5 million, the amount Ackman believed his investors were entitled to under the schmuck insurance contract.

…

IN EARLY 2003, in addition to preparing for upcoming testimony at the attorney general’s office and at the Securities and Exchange Commission, Ackman was working to liquidate Gotham’s holdings. He negotiated the sale of Gotham’s stake in Hallwood Realty Partners to renowned shareholder activist and corporate raider Carl Icahn for $80 a share. As part of the agreement, Ackman and Icahn worked out a “schmuck insurance” arrangement under which Ackman would get half of the profits if Icahn sold his Hallwood stake within 18 months. When Icahn asked Ackman if he had any other interesting investment ideas, Ackman launched into his argument for shorting MBIA and gave Icahn a copy of the Gotham report Is MBIA Triple-A?

…

(Morgan Stanley) Government Accountability Office (GAO) Farmer Mac and Gotham Partners / Ackman and Grady County (Oklahoma) bonds, MBIA and Graham, Benjamin Graham Fisher & Company Great Depression Greenberg, Maurice “Hank,” Greenlight Capital Greenspan, Alan Gross, Bill comments on rescue proposals for bond insurers Grossman, Hy Grossman, Michael Grubman, Jack guaranteed-investment contracts (GICs) defined FSA and MBIA and Moody’s and Haines, Robert Hallwood Realty Partners LP Hamline University JB Hannauer & Company Harbus News Harrisburg International Airport (Pennsylvania) bonds Harvard Club Harvard University Ackman and Business School Law School “Havenrock II,” Hearst, Patty Heitmeyer, Richard Hempel, George Herskovitz, Marilyn Hilal, Paul background of Hilal, Phil Hobson, Cal Hottensen, Robert housing market, mortgage crisis and Credit Suisse projections Deutsche Bank projections Hovde Capital Advisors “How to Save the Bond Insurers” (Pershing Square / Ackman) Hubbard, Edward Hunt, Heather MBIA downgraded by Hurricane Katrina, MBIA and IBM Icahn, Carl Icahn Partners IKB Deutsche Industriebank AG ING Groep NV Initiative for a Competitive Inner City Institutional Investor “Insurance Charade, The” (Bloomberg News) Intelligent Investor (Graham) Is MBIA Triple-A? A Detailed Analysis of SPVs, CDOs, and Accounting and Reserving Policies at MBIA Inc.

Barbarians at the Gate: The Fall of RJR Nabisco

by

Bryan Burrough

and

John Helyar

Published 1 Jan 1990

As stock prices plummeted in the crash of October 1987, Kravis and Roberts made their move, swooping in and secretly buying vast chunks of several major U.S. corporations. In 1988 they brought the LBO idea to one of those companies—its identity still secret—and were rejected. At the end of March, Kravis unveiled a 4.9 percent stake in Texaco, then under pressure from its largest shareholder, investor Carl Icahn. For two months Kravis and Roberts attempted to talk the oil company’s officials into a buyout or major restructuring. “We tried everything in the world to get them to do something with us,” Raether recalled, “and they wouldn’t.” The firm eventually sold its stock at a profit. The problem, it soon became clear, was that Kohlberg Kravis was all bite and no bark.

…

“Peter knew what he read in the magazines, but he had about as much experience in investment banking as my father,” who had advised Bershad to stay away from Wall Street. Bershad’s replacement, hired in June 1986, was a controversial figure named Daniel Good, who as merger chief at E. F. Hutton had built a thriving business backing corporate raiders. Good, so boundlessly optimistic he was sometimes called “Dan Quixote,” didn’t back four-star investors like Carl Icahn or Boone Pickens. His clients were little-known “wanna-be” raiders, third-tier greenmailers such as Asher Edelman, a Fifth Avenue arbitrager, and Herbert Haft, the pompadoured scourge of the retail industry. Instead of LBOs, Cohen chose to funnel Shearson’s money into bridge loans for Good’s raiders.

…

This would give Salomon bargaining leverage, Strong argued. It had the added advantage that, even if Salomon failed to ultimately gain control of the company, the firm would almost certainly realize a massive gain on its stock holdings. What Strong described was exactly the strategy that corporate raiders such as Boone Pickens and Carl Icahn had been using for years. For a major investment bank to try the same approach was unheard of, an order of magnitude beyond what Tom Hill and Shearson had sprung on Koppers that spring. But unusual deals, Strong argued, required unusual tactics. With Gutfreund’s approval, Strong wanted to begin acquiring RJR Nabisco stock on Monday morning and keep buying until they had spent $1 billion.

What They Do With Your Money: How the Financial System Fails Us, and How to Fix It

by

Stephen Davis

,

Jon Lukomnik

and

David Pitt-Watson

Published 30 Apr 2016

The authors are founders (Stephen Davis, Jon Lukomnik) and a director (David Pitt-Watson) of the ICGN. 38. Institutional Investor Responsibilities (2013), https://www.icgn.org/policy/guidance. 39. www.youtube.com/watch?v=5YGc4zOqozo. 40. David Benoit, “Carl Icahn Wants to Create Twitter Movement,” Wall Street Journal, September 9, 2013, http://blogs.wsj.com/moneybeat/2013/09/09/carl-icahn-wants-to-create-twitter-movement/. 41. http://navalny.livejournal.com/. 42. “Access Blocked to Major Opposition Sites and Navalny’s Blog,” Moscow Times, March 14, 2014, www.themoscowtimes.com/news/article/access-blocked-to-major-opposition-sites-and-navalnys-blog/496148.html. 43.

…

A passenger took a run-of-the-mill complaint about a musical instrument damaged in a baggage transfer and turned it into a YouTube video called “United Breaks Guitars.”39 The company was caught flat-footed when the video went viral, exacting a nasty reputation hit. Investors have joined in too, though less often. Yahoo! saw perhaps the best-known example in 2007 when Eric Jackson, a retail investor with a handful of shares, stirred a large-scale shareowner revolt through his Breakout Performance social media campaign. The activist investor Carl Icahn started using Twitter in June 2013 as part of a battle over the Dell buyout and quickly gained 76,000 followers.40 Then there is retail shareholder David Webb, in Hong Kong, who writes a blog from his home flat. People feed him tips about insider corporate wrongdoing that could never appear in Hong Kong’s mainstream media, because they are controlled by either the state or major families.

Triumph of the Yuppies: America, the Eighties, and the Creation of an Unequal Nation

by

Tom McGrath

Published 3 Jun 2024

In the months that followed, Pickens and other Milken clients continued looking for companies that were appealing takeover targets. Dealmaker Saul Steinberg made a hostile run at Disney, and while he didn’t acquire it, he walked away with tens of millions in profit. The same was true of arbitrageur Carl Icahn and his failed, but lucrative, raid on Phillips Petroleum. Finally, in the spring of 1985, around the time of that year’s Predators’ Ball, a Milken-backed client actually succeeded in a hostile takeover. Triangle Industries, a relatively small vending machine outfit run by an entrepreneur named Nelson Peltz, acquired National Can, a company that was nearly ten times larger.

…

Of course, the truth was that while Drexel had turbocharged the M&A activity, it hadn’t created it, and it was hardly the only Wall Street firm involved. If 1984 had been the Year of the Yuppie, then 1985 was the Year of the Merger. By the end of the year, there would be twenty-four mergers worth $1 billion or more. After losing out in his pursuit of Phillips Petroleum, Carl Icahn successfully took over legendary airline TWA. Wall Street firm KKR acquired Beatrice, the mammoth food processing company. R. J. Reynolds bought Nabisco. Philip Morris took over General Foods. Capital Cities bought ABC. In many cases, Wall Street’s investment firms were both the instigators and the beneficiaries of the deals.

…

In the months that followed, Milken—who never did interviews—began talking a little more to the press, including a story with writer Edward Jay Epstein in Manhattan, inc. magazine. What junk bonds had done, Milken explained to Epstein, was to democratize finance and business. As for his alliances with raiders like T. Boone Pickens and Carl Icahn and their attacks on big corporations, well, they were simply holding corporate managers accountable to shareholders and rooting out inefficiency. Ultimately, Epstein concluded, where you stood on Michael Milken probably depended on what your view of a corporation was. Did a corporation exist merely to serve its legal owners, its shareholders?

Big Mistakes: The Best Investors and Their Worst Investments

by

Michael Batnick

Published 21 May 2018

Loeb wrote a letter to his investors saying that the majority of his stake was purchased “during the panicked selling that followed the short seller's dramatic claims.”18 In the five days since Loeb's filing, Herbalife's stock rose 20%. Then a week later, the Wall Street Journal reported that billionaire activist investor Carl Icahn took a stake in Herbalife, and a month later, disclosures showed he owned 12.98% of the company. Carl Icahn and Dan Loeb against Bill Ackman – a face‐off raging all because Ackman got on his soapbox. It's impossible to know for sure whether Loeb and Icahn actually thought Herbalife was a good business and its stock was undervalued. In fact, that part was sort of irrelevant.

After Steve: How Apple Became a Trillion-Dollar Company and Lost Its Soul

by

Tripp Mickle

Published 2 May 2022

Slate pilloried it: Seth Stevenson, “Designed by Doofuses in California,” Slate, August 26, 2013, https://slate.com/business/2013/08/designed-by-apple-in-california-ad-campaign-why-its-so-terrible.html. One of the original corporate raiders: Cara Lombardo, “Carl Icahn Is Nearing Another Landmark Deal. This Time It’s with His Son,” Wall Street Journal, October 19, 2019, https://www.wsj.com/articles/carl-icahn-is-nearing-another-landmark-deal-this-time-its-with-his-son-11571457602; interview with Carl Icahn. Ahrendts had tripled: Jeff Chu, “Can Apple’s Angela Ahrendts Spark a Retail Revolution?,” Fast Company, January 6, 2014, https://www.fastcompany.com/3023591/angela-ahrendts-a-new-season-at-apple.

…

The commercial would be a great spot for other companies; for Apple, it was a B. THE SENATE’S SPOTLIGHT on Apple’s growing cash hoard attracted Wall Street’s sharks. Apple’s share price was languishing as Samsung stole smartphone market share. Investors wanted the company to pay dividends. In August 2013, Carl Icahn trumpeted on Twitter that he had bought a large stake in Apple and spoken by phone with Cook. Icahn made his message clear: Apple needed to return capital to increase the price of its depressed shares. One of the original corporate raiders, Icahn had made a name for himself in the 1980s by amassing stakes in mismanaged companies such as TWA and pushing them to cut costs and sell assets.

Fire and Fury: Inside the Trump White House

by

Michael Wolff

Published 5 Jan 2018

And Murdoch, finally arriving at the party he was in more than one way sorely late to, was as subdued and thrown as everyone else, and struggling to adjust his view of a man who, for more than a generation, had been at best a clown prince among the rich and famous. * * * Murdoch was hardly the only billionaire who had been dismissive of Trump. In the years before the election, Carl Icahn, whose friendship Trump often cited, and who Trump had suggested he’d appoint to high office, openly ridiculed his fellow billionaire (whom he said was not remotely a billionaire). Few people who knew Trump had illusions about him. That was almost his appeal: he was what he was. Twinkle in his eye, larceny in his soul.

…

But Trump had grown up and built his business in New York, the world’s largest Jewish city. He had made his reputation in the media, that most Jewish of industries, with some keen understanding of media tribal dynamics. His mentor, Roy Cohn, was a demimonde, semiunderworld, tough-guy Jew. He courted other figures he considered “tough-guy Jews” (one of his accolades): Carl Icahn, the billionaire hedge funder; Ike Perlmutter, the billionaire investor who had bought and sold Marvel Comics; Ronald Perelman, the billionaire Revlon chairman; Steven Roth, the New York billionaire real estate tycoon; and Sheldon Adelson, the billionaire casino magnate. Trump had adopted a sort of 1950s Jewish uncle (tough-guy variety) delivery, with assorted Yiddishisms—Hillary Clinton, he declared, had been “shlonged” in the 2008 primary—helping to give an inarticulate man an unexpected expressiveness.

…

This ritual was, everyone understood, more a pretext to a discussion of the power he held than it was, strictly, about personnel decisions. Still, in Trump’s poison-the-well fashion, the should-I-fire-so-and-so question, and any consideration of it by any of the billionaires, was translated into agreement, as in: Carl Icahn thinks I should fire Comey (or Bannon, or Priebus, or McMaster, or Tillerson). His daughter and son-in-law, their urgency compounded by Charlie Kushner’s concern, encouraged him, arguing that the once possibly charmable Comey was now a dangerous and uncontrollable player whose profit would inevitably be their loss.

The Taking of Getty Oil: Pennzoil, Texaco, and the Takeover Battle That Made History

by

Steve Coll

Published 12 Jun 2017

Lipton, for example, now expressed doubts about the effects of merger mania on the long-term health of the country’s economy, this despite the personal fortune he had made during its halcyon days. He even drafted legislation and testified before Congress, urging that restrictions be imposed on corporate raiders such as Boone Pickens, Carl Icahn, and Irwin “The Liquidator” Jacobs. Lipton’s critics, and there were plenty of them, decried the hypocrisy of his sudden moralizing about takeovers. At a more personal level, merger maestros such as Lipton, Boisi, and even the ambitious Siegel, had by the fall of 1983 settled into a steady, quiet professional routine.

…

They had come to Icahn’s office to cut a deal: Jamail, Pennzoil chairman J. Hugh Liedtke, and a handful of the other lawyers involved in the case. After wallowing in Texaco’s Dickensian bankruptcy proceedings since the previous April, Pennzoil v. Texaco had again come to life, and once more the puckish Jamail was at the center of things. Carl Icahn, an enormously successful corporate raider who had gained control of TWA Inc. in a hostile takeover, had decided there was potential for profit in Texaco’s travails. After the stock market collapse in October 1987, he had purchased about 15 percent of Texaco’s stock at fire sale prices from Australian investor Robert Holmes a Court.

…

I’m just bored.” “Where are you going?” “I’m going to get a cold beer.” “It’s only eleven o’clock in the morning,” Icahn observed. “Now, look, you can’t be my guardian,” Jamail answered, his voice animated with a playful malice. “I’m going to get a cold beer. And you’re invited.” “All right,” Carl Icahn said. “Let’s go.” They found a tavern, threw back a few beers, and began to talk. Jamail sketched out a scenario for Icahn: he suggested that the lawsuit could probably be settled for less than $3.5 billion. He urged Icahn to visit Texaco and press for a deal. “You’re the big, bad bogeyman now, not me,” Jamail told Icahn, whose reputation for launching hostile takeovers had indeed seemed to spook Texaco in recent weeks.

The War Below: Lithium, Copper, and the Global Battle to Power Our Lives

by

Ernest Scheyder

Published 30 Jan 2024

Author’s interview with Richard Adkerson, December 2, 2022. 43. Stewart, “Freeport-McMoRan Battles the Oil Slump.” 44. Antoine Gara, “Freeport-McMoRan Exits Disastrous Foray into Gulf of Mexico Amid Pressure from Carl Icahn,” Forbes, September 13, 2016, www.forbes.com/sites/antoinegara/2016/09/13/freeport-mcmoran-exits-disastrous-foray-into-gulf-of-mexico-oil-amid-pressure-from-carl-icahn/?sh=2c24532419f1. 45. Ben Miller and Olivia Pulsinelli, “Freeport-McMoRan to Sell California Oil and Gas Assets for $742M,” Houston Business Journal, October 17, 2016, www.bizjournals.com/houston/news/2016/10/17/freeport-mcmoran-to-sell-california-oil-and-gas.html. 46.

…

Grasberg alone could be worth $16.2 billion if sold, Freeport estimated.41 One other mine that Freeport controlled was also highly sought after, especially by rivals in China. “We were really in dire straits,” Adkerson recalled. “It was a very scary time.”42 Freeport was, in the words of a business columnist, a desperate seller.43 * * * UNDER PRESSURE FROM the corporate raider Carl Icahn, Freeport sold parts of its oil business in September 2016 for $2 billion.44 Not long after, it sold more oil assets—this time in California—for $742 million.45 The company had already that year sold a 13 percent stake in the Morenci mine to Japan’s Sumitomo Metal Mining Co. for $1 billion in cash, a deal that boosted the Japanese company’s stake in the largest North American mine to 28 percent based on its previous holdings.46 But those sales were sideshows to the main event.

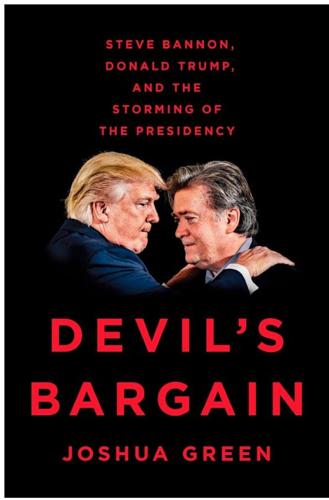

Devil's Bargain: Steve Bannon, Donald Trump, and the Storming of the Presidency

by

Joshua Green

Published 17 Jul 2017

Milken and Drexel would fund these hostile takeovers by pledging the assets of the target corporation as collateral, in the same way that a home buyer obtains a mortgage by pledging the collateral of the home against the loan. This practice gave rise to an army of corporate raiders, men such as Ron Perelman, Carl Icahn, T. Boone Pickens, and Nelson Peltz, who became rich selling junk bonds through Drexel Burnham to finance predatory raids on such Fortune 100 companies as TWA, Disney, Revlon, and Phillips Petroleum. So fearsome did Milken’s reputation become that sometimes the mere rumor that a company might come under siege was enough to send it scrambling toward a defensive merger.

…

— Trump thought being president was about asserting dominance. Just after he’d locked up the GOP nomination, Trump said something to me that crystallized his view of politics and explains, to my mind, much of his subsequent difficulties. “I deal with people that are very extraordinarily talented people,” he told me. “I deal with Steve Wynn. I deal with Carl Icahn. I deal with killers that blow these [politicians] away. It’s not even the same category. This”—he meant politics—“is a category that’s like nineteen levels lower. You understand what I’m saying? Brilliant killers.” Trump was equating politics with business and the presidency with the job of being a big-shot CEO, a “killer.”

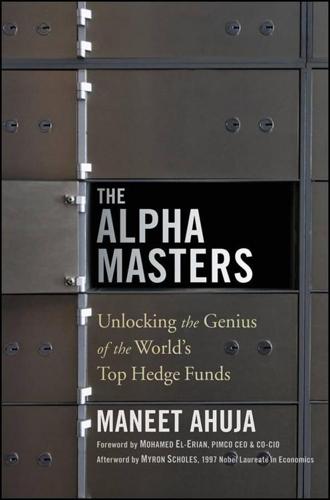

The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds

by

Maneet Ahuja

,

Myron Scholes

and

Mohamed El-Erian

Published 29 May 2012

As I was ushered up to the forty-second floor and led into a conference room with sweeping views of all of midtown Manhattan in the far distance, I knew I’d landed somewhere where people were having a real impact on the world in a big way and felt fortunate to be there. I was fascinated hearing about how the team identified credit risk and mitigated losses for thousands of clients and outside parties. Hearing about how the bank would work closely with companies advising on potential mergers and takeover targets seemed exciting—this must be what Carl Icahn does, I thought. Citigroup had “the big balance sheet” that dwarfed many of the more prestigious investment banking teams on the Street, and so we were always allowed into the consortium for deals—even as the deal arranger. I left the building with an offer for a semester internship in hand, convinced I had found my calling with the good guys—good guys with nice shoes.

…

Once the managers realized I was truly interested in things like portfolio construction and alpha generation—a return in excess of a benchmark adjusted for risk and country analysis—I started to get more access and even some complimentary comments on Squawk Box from Julian Robertson, Michael Steinhardt, and Carl Icahn. Beyond that, I continued to speak to investors and get a pulse for what they were seeing, hearing, and concerned about within hedge funds. As I continued to study the leaders of this new age of hedge funds, I realized that the investors who had consistently outperformed the broader market for a significant period of time, these alpha masters, were bound together under the hedge fund umbrella, yet were wildly unique.

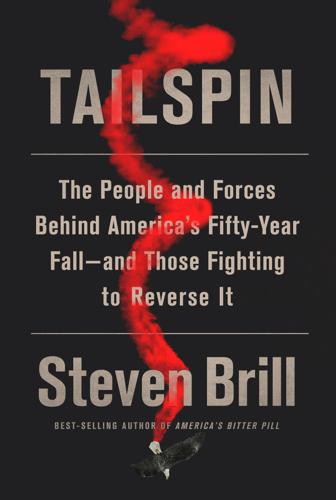

Tailspin: The People and Forces Behind America's Fifty-Year Fall--And Those Fighting to Reverse It

by

Steven Brill

Published 28 May 2018

Working at Drexel Burnham Lambert, a second-tier brokerage and investment bank, Milken—who would go to prison in 1991 for securities law violations—figured out that if companies had sufficient earnings or potential earnings, he could help what would become a group of buccaneer raiders, including Carl Icahn, Victor Posner, and Boone Pickens, borrow the money to buy them. The interest rates on what came to be called “junk bonds,” which Milken specialized in, would be high because the risk would seem high. However, if the raider took over and made the right expense cuts and sold off the right pieces, and then cashed out, the result would be a home run.

…

When the company yields by purchasing huge amounts of its stock, the hedge funder usually sells his stake at the now increased price and goes away. Even Apple yielded, beginning in 2013, when it borrowed billions of dollars (rather than tap profits it was shielding overseas from U.S. taxes) to finance a massive buyback that was being pushed by, among others, raider Carl Icahn. Whether Icahn’s assault on Apple produced a positive or negative result for the company is beside the general point, which is that these kinds of drive-by shareholders have no accountability for the long-term damage that those who run the corporations they briefly own might do to please them.

…

As The Washington Post put it, the company was “swept away by the wave of corporate takeovers and buyouts that have come to dominate American business in the 1980’s.” The raiders’ victory didn’t last. As of 2016, the larger textile maker that had purchased the bulk of the Stevens operations in 1988 had gone through a 2003 bankruptcy stemming from foreign competition. It was then bought by corporate raider Carl Icahn. Most of its manufacturing is now done overseas, and what remains has been highly automated. The industry as a whole shared the same fate. In 1973, there were 1,024,000 textile workers in the United States. In 2016, there were 112,000, and the average hourly wage for those left in American textile factories was 30 percent lower than it would have been if the low, non-union wages prevailing in 1975 (the year closest to 1973 for which there is wage data) had only kept up with inflation.

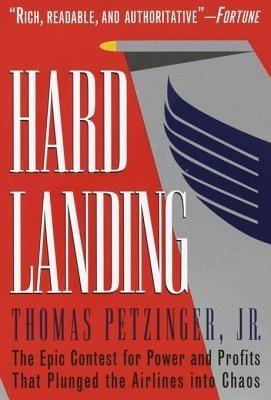

Hard Landing

by

Thomas Petzinger

and

Thomas Petzinger Jr.

Published 1 Jan 1995

One of the least welcome effects of the strike was its depressing influence on United’s stock. This was the precise midpoint of the 1980s, when the takeover epidemic was intensifying. A low stock price on even the biggest corporations was like a blue light twirling in the ceiling of a dime store, an advertisement to the likes of Carl Icahn or Boone Pickens or Sir James Goldsmith or Ivan Boesky or Donald Trump or for that matter, Frank Lorenzo. United was an inviting target in another respect. Unlike Pan Am, which had been raiding its pension plans to keep afloat, United had been overfunding its pension accounts—or so Dick Ferris was told by his advisors on Wall Street.

…

Lorenzo, they could see, had an additional and probably greater motive: to lay his hands on TWA’s computer reservation system, the same system that Bob Crandall had helped to create in the early 1970s, before joining American Airlines. In the end, Lorenzo’s reputation would cost him TWA. The company’s unions were so mortified at the idea of having him on the property that they maneuvered the takeover artist Carl Icahn into a position to take control, failing to appreciate that he was no picnic either. There was something vague and off-center about Icahn; whereas Lorenzo was accused of forever backing out of his deals, Icahn would never quite come to closure on one. Lorenzo and Icahn tussled over TWA for weeks, the battle growing increasingly personal.

…

Plaskett remained unaware that Wolf had already made up his mind to the contrary. Crandall was apoplectic that Wolf had stolen the march into Heathrow, but he made a quick recovery. There was a second American company with precious landing rights at Heathrow. It was TWA, and TWA was in nearly as sorry a condition as Pan Am. In the rarefied atmosphere of the race to London, Carl Icahn of TWA could force Crandall to pay top dollar. For six routes to Heathrow Crandall forked over $445 million; Wolf had paid less for more from Pan Am. Icahn, for additional millions, agreed to throw in 40 slots at O’Hare. With this purchase Crandall scored a double, because many of those slots had been on lease from TWA to United.

The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism

by

Arun Sundararajan

Published 12 May 2016

A high point of the visit was the opportunity I got to try on a Lyft employee’s Halloween costume. He had dressed up as a Lyft car, using a skillfully constructed cardboard contraption. Three years later, Lyft had raised over a billion dollars in venture capital (including $100 million from the legendary investor Carl Icahn) and was in 60 cities around the United States. Although often in the news because of the bruising battles it has waged with Uber for market share, Lyft projects a decidedly kinder and gentler feel than their larger competitor, even as they have graduated from the giant pink mustaches to a more subtle branding strategy.

…

These executives are present in growing numbers at events like OuiShare Fest (something my friend Charly Strum had pointed out to me earlier in the day with a sardonic remark about there being “more high heels than Birkenstocks this year”). Active investors range from New York’s Union Square Ventures and Silicon Valley’s Andreessen Horowitz to the hedge funds Black Rock and Tiger Global Management, the investment banking firm Goldman Sachs, the business magnate Carl Icahn, General Motors, and the Indian media company Bennett and Coleman. Of particular interest is the Collaborative Fund, founded by Craig Shapiro in 2011, which invests almost exclusively in the sharing economy. The infusion of venture capital and the emergence of platforms with large corporate investors lead many to believe that any ideals associated with a pre-2010 sharing economy cannot be sustained.

The Impulse Society: America in the Age of Instant Gratification

by

Paul Roberts

Published 1 Sep 2014

The raiders’ m.o. was simple: they looked for struggling companies whose sagging share price made them a bargain, quietly bought up a controlling stake (usually with high-interest loans, known as “junk bonds”), and then began what was euphemistically referred to as “restructuring.” In some cases, the raiders—epitomized by flashy characters such as bond trader Carl Icahn and real estate mogul Victor Posner—would go on a downsizing tear. They shut down underperforming divisions and laid off hundreds and even thousands of employees before selling the restructured firm at a substantial profit. In other cases, the target would simply be liquidated: broken up into separate entities and sold off piecemeal.

…

In a truly efficient market, such short-termism would be recognized and punished. But in the self-centered economy, the market is in on the scam. Thus, shareholders cheer when Microsoft or Apple or Intel spends tens of billions of dollars on share buybacks. Consider the following: in August 2013, Carl Icahn, the corporate-raider-turned-activist-investor, announced (on Twitter, naturally) that he had acquired a $1 billion stake in Apple, and was demanding that the company spend $150 billion to buy back its own shares. Such a move, Icahn insisted, would lift Apple’s share price from $487 to $625 (and, others noted, net the raider a $280 million capital gain48).

One Up on Wall Street

by

Peter Lynch

Published 11 May 2012

For instance, the SEC says a mutual fund such as mine cannot own more than ten percent of the shares in any given company, nor can we invest more than five percent of the fund’s assets in any given stock. The various restrictions are well-intentioned, and they protect against a fund’s putting all its eggs in one basket (more on this later) and also against a fund’s taking over a company à la Carl Icahn (more on that later, too). The secondary result is that the bigger funds are forced to limit themselves to the top 90 to 100 companies, out of the 10,000 or so that are publicly traded. Let’s say you manage a $1-billion pension fund, and to guard against diverse performance, you’re required to choose from a list of 40 approved stocks, via the Inspected by 4 method.

…