The First Tycoon

by

T.J. Stiles

Published 14 Aug 2009

Cornelius Vanderbilt and Daniel Drew, May 4, 1854, file LJ-1854-V-131, Supreme Court Law Judgments Cornelius Vanderbilt v. William C Moon, June 7, 1854, file L J-1854-M-398, Supreme Court Judgments Cornelius Vanderbilt v. Reuben C. Stone, September 12, 1854, file L J-1854-S-19, Supreme Court Judgments Cornelius Vanderbilt v. John C Thompson and Minthorne Tompkins, September 26, 1854, file J L-1854-T-172, Supreme Court Judgments James H Quimby v. Cornelius Vanderbilt, November 13, 1854, file 1854-#1242, Court of Common Pleas Cornelius Vanderbilt v. Spring Valley Shot & Lead Manufacturing Company, April 21, 1855, file L J-1855-S-206, Supreme Court Judgments Cornelius Vanderbilt v. Spring Valley Shot & Lead Manufacturing Company, July 26, 1855, file L J-1855-S-208 Cornelius Vanderbilt v.

…

Naval Officers, March 1778–July 1908, Record Group 45 Records of the Office of the Judge Advocate General (Army), Record Group 153 National Archives, New York, New York New York Tax Assessment Lists, 1867–1873, Record Group 58 Old Records Division, New York County Clerk's Office, New York, New York John De Forest and Cornelius Vanderbilt Jr. vs. Daniel Morgan, April 5, 1817, file 1817-#337, Court of Common Pleas Cornelius Vanderbilt and Cornelius Vanderbilt Jr. vs. Phineas Carman and Cornelius P. Wyckoff, May 26, 1817, file 1817-#1201, Court of Common Pleas Aaron Ogden v. Thomas Gibbons, December 4, 1819, file O-109, Court of Chancery Fitz G. Halleck v. Daniel Drew, March 15, 1820, file 1820-#479, Court of Common Pleas John R. Livingston v. Cornelius Vanderbilt, December 28, 1822, file L J-1822-V-18, Supreme Court Judgments John Adams, Treasurer of New York Hospital, v. Cornelius Vanderbilt, June 27, 1826, file 1820-#20, Court of Common Pleas Cornelius Vanderbilt v.

…

John's Park Freight Depot The Vanderbilt statue Stock watering (cartoon) Racing Fisk (cartoon) Grand Central Depot under construction Grand Central Depot Grand Central Depot car house, exterior view Grand Central Depot car house, interior view Fast train to Chicago New York Central & Hudson River Railroad Fast trotters on Harlem Lane Mountain Boy Congress Hall veranda, Saratoga Springs Cornelius Vanderbilt Tennessee Claflin Victoria Woodhull Horace Greeley Frank Crawford Vanderbilt Ethelinda Vanderbilt Allen Sophia Vanderbilt Torrance Mary Vanderbilt La Bau Going to the Opera The run on the Union Trust Vanderbilt at rest Death of Cornelius Vanderbilt Funeral of Cornelius Vanderbilt Burial of Cornelius Vanderbilt Dr. Jared Linsly at the will trial New York, 1880 Maps New York Bay Southern New England New York Gold Rush Steamship Lines Nicaragua The Trunk Lines Chapter One THE ISLANDER They came to learn his secrets.

In Pursuit of Privilege: A History of New York City's Upper Class and the Making of a Metropolis

by

Clifton Hood

Published 1 Nov 2016

Now popular magazines like McClure’s and Outlook ran fawning portraits of industrialists like Cornelius Vanderbilt and Philip Armour, and Harper’s Bazaar and Century published reverential descriptions of the New York Produce Exchange, the Chamber of Commerce, and the New York Stock Exchange. This journalism echoed the famous defense of great wealth and business competition as a source of social progress that Andrew Carnegie made in his 1889 essay The Gospel of Wealth.20 In 1899, for instance, Outlook informed its readers that Cornelius Vanderbilt II was not just a millionaire railroad king: no, he was “a Christian philanthropist who gave liberally of his wealth and of what was more valuable, his time and energy, to a great variety of philanthropic and Christian enterprises.”21 Outlook extolled Vanderbilt as “a man of great simplicity of character, easily approached, but strong, even to sternness, when necessary, and yet withal as gentle as a woman.”22 The magazine emphasized that Vanderbilt possessed his money not for himself but for others: he regarded his wealth “not simply as something personal, but as a great and sacred trust, which it was his duty to administer…with a wise and discriminating conscientiousness, for the benefit of his fellow-man.”23 Now the Wall Street Journal could respect even the reptilian Jay Gould for having built railroads, telegraphs, and elevated railways that had improved the country, even as it acknowledged his unethical business conduct and indifference to charity.24 New York City exemplified (and drove) many of the changes in economic productivity and the status hierarchy that James Bryce spoke of in his article.

…

It was largely built by craftsmen brought over from Europe and was decorated with stone and wood carvings, stained glass, and embroidered textiles imported from the Continent. This mansion featured a ballroom that could hold more than 1,200 people, while the 130-room palace of Cornelius Vanderbilt II at Fifth Avenue and West Fifty-Ninth Street (figure 6.2) was the largest single-family private home ever built in New York City.15 One scholar has remarked that these “aristocratic houses were more than just large; they were presentation stages for the spectacular trappings of the ruling class.”16 FIGURE 6.2 A postcard of the residence of Cornelius Vanderbilt II and Alice Claypoole Gwynne Vanderbilt, at Fifth Avenue and West Fifty-Ninth Street, postmarked 1912. (Author’s collection.)

…

Their prevalent theme of family deterioration is encapsulated by one book title–Dead End Gene Pool (2010).69 Its author is Wendy Burden, the great-great-great-great granddaughter of Cornelius Vanderbilt. Rather than celebrating a privileged lifestyle, Burden exposes ugly truths that she believes lay concealed beneath the elegant and refined surface of the upper class. In particular, she describes episodes of “rich people behaving badly” because they had the money and influence to indulge their vices without having to worry about the consequences.70 Ultimately, their extravagance did have costs: the death of Cornelius Vanderbilt from syphilis and the nervous breakdown and premature demise of her great-great-grandfather.

Great American Railroad Journeys

by

Michael Portillo

Published 26 Jan 2017

As a consequence, the members of this elite group were branded ‘robber barons’, a term that put their public conduct on a par with detested feudal lords from the medieval era who likewise knew no boundaries when it came to achieving their goals. Even railroad bosses who weren’t tainted by allegations of corruption operated in ways that would not be tolerated today. CORNELIUS VANDERBILT One of the first to be elevated to the ranks of the super-rich was Cornelius Vanderbilt. Although initially poor and ill-educated, he refused to allow these two issues to define him and, following his success, he came to characterize the self-made man so beloved by American folk lore. During an extraordinarily long and busy life Vanderbilt displayed fruitful acumen that underpinned his golden touch.

…

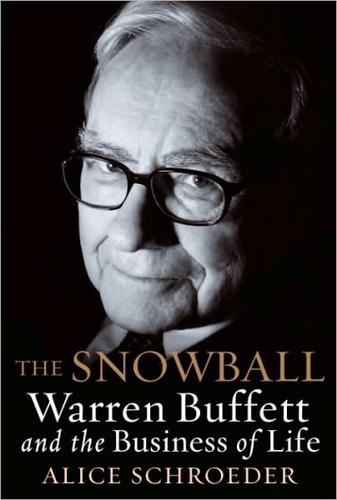

Opponents were crushed, often with a brinkmanship more appropriate to a game of poker than a nationally significant industry. For anyone who crossed him, he had these sinister words: ‘I won’t sue you, for the law is too slow. I’ll ruin you.’ In 1854, when this portrait was commissioned, Cornelius Vanderbilt’s business activities were restricted to steamships. STEAMSHIP KING At his death, Cornelius Vanderbilt (1794–1877) was worth $100 million. One estimate says that by then he possessed one-ninth of all US currency in circulation. His name is indelibly associated with railroads, and he was the first to be dubbed a ‘robber baron’ for his unsavoury business practices.

…

CONTENTS FOREWORD BY MICHAEL PORTILLO INTRODUCTION SECTION ONE THE EARLY YEARS Dreams & reality The pioneers Marvels & machinations in the mid-century SECTION TWO THE AMERICAN CIVIL WAR Modern warfare Railroads in the south Railroads in the north Engine exploits Abraham Lincoln SECTION THREE ROBBER BARONS Cornelius Vanderbilt Jay Gould A rogues’ gallery Credit Mobilier SECTION FOUR RECONSTRUCTION & THE GILDED AGE The Transcontinental Railroad Regulation & railroads The Pennsylvania Railroad empire Comfort & safety Bridges & tunnels TIMELINE CONCLUSION PICTURE CREDITS INDEX FOREWORD Throughout the years of making rail journeys for BBC television, first in the United Kingdom and then on the continent of Europe, I had dreamed of carrying the programme’s concept to the United States.

Grand Central: How a Train Station Transformed America

by

Sam Roberts

Published 22 Jan 2013

No railroad officials were charged, however. Wisker was indicted for second-degree manslaughter because he “unmistakably violated the well-known rule which, under the conditions surrounding him, required him to stop his train.” THE CRASH OCCURRED AT 56TH STREET, not far from the Vanderbilt mansion on Fifth Avenue. Cornelius Vanderbilt III and Alfred Vanderbilt, great-grandsons of the Commodore, rushed to the scene in time to learn that Wisker had been arrested by the New York City police pending a coroner’s inquest. Almost on the spot, they joined other railroad officials, including William J. Wilgus, the New York Central’s chief engineer, in a decision that would change the face of New York.

…

“It was not enough that the New York Central Railroad had been maintaining for many years a defective signal system and that any day a serious accident might happen as a result of the maintenance of such a system,” said William Travers Jerome, the district attorney (he was a nephew of Leonard Jerome, who had been Cornelius Vanderbilt’s stockbroker), “but it must have been found affirmatively, and beyond reasonable doubt, that this particular accident, with the ensuing deaths, occurred as the direct result of its defective system.” The next time, a grand jury might do just that. Even with the recent renovations, Grand Central Station, which was already outmoded the day it opened a generation earlier, would have to be razed.

…

After all, when the 9,000-pound, 13-foot-long DeWitt Clinton was cast at the West Point Foundry in Cold Spring, New York, and fitted at the foot of Beach Street in lower Manhattan, it was only the third or fourth steam locomotive built in the United States. But the railroad men weren’t completely crazy. They were shrewd enough to engage in a subterfuge sufficient to forestall a veto of railroad franchises by the state legislature, which the boatmen, including Cornelius Vanderbilt, all but owned. Following experiments by the inventor Peter Cooper of New York on the Baltimore & Ohio and service on the Charleston & Hamburg line in South Carolina, John B. Jervis commissioned the DeWitt Clinton for the newly chartered Mohawk & Hudson Railroad, the first leg of what two decades later would become the New York Central.

Flight of the WASP

by

Michael Gross

Kahn Jr., “Profiles: Man of Means,” New Yorker, August 11, 1951. 52 Lisa Gubernick and Alexander Parker, “The Outsider,” Forbes, October 26, 1987. 53 Geoffrey T. Hellman, “Profiles: The Man Who Is Not His Cousin,” New Yorker, June 21, 1941. 54 “Business Mogul Cornelius Vanderbilt Whitney Dies,” Washington Post, December 14, 1992. 55 Ted Ramsay, “Cornelius Vanderbilt Whitney Biographical Sketch,” unpublished manuscript, June 2, 1941. 56 “Whitney Picks Hardest Way to Congress Seat,” New York Herald Tribune, September 16, 1932. 57 Author interview with Whitney Tower Jr., February 24, 2020. 58 Whitney Tower Jr., “Personal History: I Can’t Get No Satisfaction,” Town and Country, August 2012. 59 Author interview with Penelope Tree, October 21, 2019. 60 Author interview with Penelope Tree, October 21, 2019. 61 Holly Brubach, “Running Around in High Circles,” New York Times, November 9, 1997. 62 Caroline Seebohm, No Regrets: The Life of Marietta Tree (New York: Simon & Schuster, 1997), 156. 63 Seebohm, No Regrets, 227–230. 64 Seebohm, No Regrets, 277. 65 David Bailey, Look Again (London: Macmillan, 2020), 213–215. 66 Louise Frank, “People Thought I Was a Freak.

…

Steel, 251 US Treasury, 184 Utes tribe, 200 van Brughe Livingston, Sarah (Sarah Jay), 252 Van Buren, Martin, 135, 176, 177, 182–183, 189, 191, 193, 195 Vanderbilt, Alva Erskine Smith, 269–270 Vanderbilt, Consuelo, 269–271 Vanderbilt, Cornelius, 3, 233, 250 Vanderbilt, Cornelius, II, 260 Vanderbilt, Gertrude, 279, 384 Vanderbilt, Gloria, 345 Vanderbilt, William Henry, 251, 258, 269 Vanderbilt, William Kissam “Willie,” 259, 269–270, 281 Vermont, 35, 142 Vidal, Gore, 230, 346 Vietnam War, 399–400 Virginia, 25, 72, 101–103, 107–108 Virginia and Kentucky Resolutions, 113 Virginia Company of London, 20, 25, 30, 102 Virginia Constitutional Convention, 136 voting, 72, 80, 81 Wade-Davis Bill, 214 Wampanoag tribe, 43 wampum, 33 Warburg, Felix, 312, 317 War Department, 178, 180 Ward Howe, Julia, 239, 252 Warhol, Andy, 345 War of 1812, 125–126, 127, 166, 168, 176 Washington, George, 71, 73, 79–80, 87–88, 143, 150, 165 WASPs advancement of, 253–255 attention increase of, 264 background of, 11 backlash from, 328 challenges of, 375 characteristics of, 9 clanishness of, 293 confidence of, 88 decline of, 10, 13–14, 416–417 diversity resistance by, 7–8 duties of, 329–330 engagement of, 375 escape of, 375 immigration concerns of, 290–291 immigration of, 255 incorporation into, 13 introduction of, 3–7 irrelevance of, 417 justification of, 262 obituaries of, 9–10 population of, 201 as presidents, 4 as rebels, 345 resorts of, 256 as role models, 9 schools for, 241–242, 255 self-indulgence of, 374 social changes of, 327–328 traits of, 80 values of, 418 wealth sources of, 283 writings regarding, 8–9 Wealth Tax, 328 weapons, purchase of, 210–211 Weber, Max, 49 Webster, Daniel, 177, 184, 192 Webster, Noah, 19 Weed, Thurlow, 206 Wenner-Gren, Axel, 349 West, Francis, 111, 137 West Jersey, 146 Weston, Thomas, 25, 31–32 Wheelock, Alice, 413–414 Whig Party, 186, 203–204 Whiskey Rebellion, 175 Whitehouse, Sheldon, 10 Whitney, Barbara, 384 Whitney, Charlotte Anita, 49 Whitney, Cornelius Vanderbilt “C. V.,” 384 Whitney, Cornelius Vanderbilt “Sonny,” 286 Whitney, Courtney, 49 Whitney, Eli, 49 Whitney, Flora, 275–276, 277–278, 279, 336, 387 Whitney, Gertrude, 285–287 Whitney, Henry “Harry” Payne, 46, 48, 279 284–287, 384 Whitney, James Scollay, 45–46 Whitney, John, 44–45 Whitney, John Hay “Jock,” 384–385 Whitney, Josiah, 45, 49 Whitney, Mary Watson, 49 Whitney, Pauline Payne, 336 Whitney, Payne, 282, 283–284 Whitney, Sonny, 384, 386–387 Whitney, Stephen, 45–46 Whitney, Wheelock, Jr., 414 Whitney, William Collins, 46–49, 275–283, 304 Whitney, Willis Rodney, 49 Whitney Museum, 285–286 Whitney Payson, Joan, 384, 385–386 Whitney Straight, Dorothy, 287–289 Wilkinson, James, 142 William & Mary, 36 Williams, Roger, 34 Wilmot Proviso, 194 Winn Butler, Pauline, 336 Winslow, Edward, 29, 37, 39 Winthrop, John, 34, 38, 59 Winthrop, John “the Younger,” 60 Women’s Wear Daily, 364 World War II, 289, 292, 378–381, 403–404 XYZ affair, 112 Yale University, 44 Yazoo land fraud, 112, 115–116, 179 Zenger, John Peter, 64 zoos, 303

…

The buyers of the first American slaves at Port Comfort near Jamestown in 1619 were WASPs, as was George Washington, and every president until 1961. Many of the brave men and women who supported the abolition of slavery before the Civil War were members of the northern WASP elite. The industrialists and financiers who built and ran America, men like Cornelius Vanderbilt, J. Pierpont Morgan, and Henry Ford, and the lawyers who protected them? WASPs. Until the third decade of the twentieth century, just about every person with power and influence in the United States was a WASP—or else a convert. Into the 1980s, the upwardly mobile wanted to wear the same clothes, go to the same schools, join their clubs, and move on up to their exclusive neighborhoods.

How Capitalism Saved America: The Untold History of Our Country, From the Pilgrims to the Present

by

Thomas J. Dilorenzo

Published 9 Aug 2004

Indeed, from the mid-nineteenth century onward, this sort of battle marked the development of much of American industry—the steamship industry, the steel industry, and the auto industry, to name just a few. For example, the great steamship entrepreneur Cornelius Vanderbilt competed with government-subsidized political entrepreneurs for much of his career. In fact, he got his start in business by competing—illegally—against a state-sanctioned steamship monopoly operated by Robert Fulton. In 1807, the New York state legislature had granted Fulton a legal, thirty-year monopoly on steamboat traffic in New York—a classic example of mercantilism.37 In 1817, however, a young Cornelius Vanderbilt was hired by New Jersey businessman Thomas Gibbons to defy the monopoly and run steamboats in New York.

…

State capitalism consists of one or more groups making use of the coercive apparatus of the government . . . for themselves by expropriating the production of others by force and violence. —Murray N. Rothbard, The Logic of Action (1997) THE LATE nineteenth and early twentieth centuries are often referred to as the time of the “robber barons.” It is a staple of history books to attach this derogatory phrase to such figures as John D. Rockefeller, Cornelius Vanderbilt, and the great nineteenth-century railroad operators—Grenville Dodge, Leland Stanford, Henry Villard, James J. Hill, and others. To most historians writing on this period, these entrepreneurs committed thinly veiled acts of larceny to enrich themselves at the expense of their customers. Once again we see the image of the greedy, exploitative capitalist, but in many cases this is a distortion of the truth.

…

This is a common, ordinary business practice—offering volume discounts to one’s largest customers in order to keep them—but Rockefeller’s less efficient competitors complained bitterly. Nothing was stopping them from cutting their costs and prices and winning similar railroad rebates other than their own inabilities or laziness, but they apparently decided that it was easier to complain about Rockefeller’s “unfair advantage” instead. Cornelius Vanderbilt publicly offered railroad rebates to any oil refiner who could give him the same volume of business that Rockefeller did, but since no one was as efficient as Rockefeller, no one could take him up on his offer.29 All of Rockefeller’s savings benefited the consumer, as his low prices made kerosene readily available to Americans.

The Dawn of Innovation: The First American Industrial Revolution

by

Charles R. Morris

Published 1 Jan 2012

I understand that three hundred were navigating the great western rivers some time ago: and the number is probably much increased.25 The eastern seaboard was blessed with a more or less continuous system of tidal waterways linking almost all the major cities. Rivers like the Hudson and the Connecticut were broad, deep, and relatively straight. For a skilled captain with a good boat, sailing upstream was almost as easy as sailing down. As a teenager, Cornelius Vanderbilt ran a Staten Island–to-Manhattan ferry service with a small sailing sloop. By his early twenties he owned a string of twenty- to thirty-ton fast sailing vessels running freight traffic up and down the East Coast. He could sail up the Delaware during shad season, picking up fishermen’s catches to sell in New York City.

…

The bill of fare was preserved for posterity: “Chowder, a yoke of oxen barbecued whole, 10 sheep roasted whole, beef a la mode, boiled ham, corned beef, buffalo tongues, bologna sausage, beef tongues (smoked and pickled), 100 roast fowls, hot coffee, etc.” 60 The broad outline of the modern railroad network east of the Mississippi was more or less in place by 1860. There were four large east-west networks. Two originated in New York: the Erie and Cornelius Vanderbilt’s New York Central, an 1850s consolidation often connecting roads. Both the Pennsylvania and the B&O offered through service to Pittsburgh and beyond from Philadelphia and the Chesapeake region respectively. The outline of a rail network emanating from Chicago was in place, with multiple connections both with the four east-west lines and to Cincinnati, St.

…

By the 1830s and 1840s, the boats were of oceanic proportions, roughly twice the size of Fulton’s Clermont/Steamboat and far heavier and faster. Competing lines raced, and occasionally jostled, each other on the water, rather like NASCAR racers. There was no dominant owner, but the active presence of Cornelius Vanderbilt kept all the lines at a knife-sharp point of tension. His strategy was to move into and out of the trade opportunistically—launching price wars against complacent operators to gain control of their routes, then selling out at a profit. Vanderbilt had become by far the richest of the operators and the only one who could order and pay for major steamboats from his own resources—rich enough even to shrug off the loss of a major new boat, The Atlantic, a 321-foot behemoth.

The Great Railroad Revolution

by

Christian Wolmar

Published 9 Jun 2014

Despite these many positive developments for the railroads, services remained basic on many lines, adding to the unpopularity of the railroads with some members of the public. The postbellum period was also the age of “bare knuckles,” as the major companies began to slug it out for increased market share. Powerful and unscrupulous railroad magnates—men like Cornelius Vanderbilt, Daniel Drew, and banker Jay Gould— became a feature of the industrial landscape of America’s “Gilded Age,” and they exacerbated the railroads’ unpopularity, as did their response to the increasing labor unrest. The resentment engendered by several railroad strikes would be a significant factor in the birth of labor unions in the United States.

…

To give a scale of the enterprise, which was probably around the same size as the Erie, the New York Central could lay claim to 542 miles of line and owned 150 wood-burning locomotives, 1,700 freight cars, and just under 200 passenger coaches. Indeed, it fared so well, easily surviving the panic of 1857, that it attracted the attention of a rapacious shipping magnate, one Cornelius Vanderbilt (see Chapter 8). In the 1850s, the consolidation of smaller lines to create a larger railroad was a new idea in America, but would be adopted widely across the United States, particularly after the Civil War as the Hamiltonian ethos prevailed. Big companies like the Erie, the Pennsylvania, and the New York Central were still, in the antebellum period, the exception.

…

A train traveling from South Amboy was derailed at Hightstown, New Jersey, when an axle broke, injuring all but one of the twenty-four passengers and killing two. The train was carrying a remarkable contingent of famous people, suggesting perhaps that early travelers were largely the better off. The infamous entrepreneur Cornelius Vanderbilt, who broke a leg in the accident, vowed never to travel by rail again, a promise he failed to keep when he gained control of numerous railroads a quarter of a century later (see Chapter 8). The former president and now congressman John Quincy Adams was the sole passenger to escape unscathed, while Irish actor Tyrone Power, who suffered only minor injuries, later wrote a detailed account of the crash, describing it as “the most dreadful catastrophe that ever my eyes beheld” and recalling how he helped a fellow passenger, a surgeon, tend to the injured.36 As rail lines extended, journeys lasting more than the daylight hours became necessary.

Company: A Short History of a Revolutionary Idea

by

John Micklethwait

and

Adrian Wooldridge

Published 4 Mar 2003

In 1913, there was $11.2 billion worth of railroad bonds, versus $7.2 billion of common stock, and that ignores both the railroads’ enormous bank debts and the fact that half of the common stock was corporate cross-holdings.11 Preference shares were also enormously popular—particularly after they were used to launch the Pennsylvania Railroad in 1871. Such a narrow equity base made bankruptcy a common threat, spurring consolidation. Many of the earliest railway lines did not yet connect to each other. Bullies like Cornelius Vanderbilt and then J. P. Morgan tidied up this fragmented system. Even without their prompting, many railroad tycoons decided that collusion was the only way to ensure a regular flow of traffic and avert ruinous price wars. This consolidation meant that by the 1890s, the railways were bigger than the utility companies that brought light, heat, and water to Chicago and New York, and bigger by far than the armies that defended the United States.

…

Duke’s story was repeated in several other industries. George Eastman invented not only a cheap camera but also the idea of the amateur photographer to find a market for his photographic film. But the most distinctive feature of all the integrated firms was a desire to grow as big as possible. That inevitably led to mergers. Cornelius Vanderbilt had already shown the benefits of consolidation in the railway industry. Between 1890 and 1904, huge waves of consolidation left most of the country’s industrial base in the hands of around fifty organizations—usually (if sometimes unfairly) referred to as trusts. The merger era produced some of the most powerful companies of their time, including U.S.

…

The robber barons may have kept the big strategic decisions in their own hands, but they couldn’t personally oversee every detail of their gigantic business empires. And they couldn’t find the management skills that they needed among their immediate families, who anyway found more amusing things to do: Digby Baltzell writes acidly about “the divorcing John Jacob Astor III (three wives), Cornelius Vanderbilt, Jr. (five wives), Tommy Manville (nine wives) or the Topping brothers (ten wives between them).”2 So the company founders turned to a new class of professional managers. The likes of King Gillette, William Wrigley, H. J. Heinz, and John D. Rockefeller hired hordes of black-coated managers to bring order to their chaotic empires.

The Race Underground: Boston, New York, and the Incredible Rivalry That Built America's First Subway

by

Doug Most

Published 4 Feb 2014

Whitney ignored it all and watched as McKinley, a former Republican governor from Ohio, defeated Nebraskan Democrat William Jennings Bryan. * * * THE FOLLOWING SUMMER, WILLIAM’S SON, Harry Payne Whitney, traded vows with young Gertrude Vanderbilt, the twenty-one-year-old daughter of Cornelius Vanderbilt II, putting in motion a blending of two of the most important families of the late nineteenth century. Over the years, William Whitney and Cornelius Vanderbilt had been more than neighbors. They had vacationed together in Newport, Rhode Island, at the Vanderbilt mansion, the Breakers; in Bar Harbor, Maine; and upstate New York. They had shared a love of the opera, attending hundreds of performances together.

…

She covered the floors with rich oriental rugs and the walls with bright tapestries and works by the French painter François Boucher, whom Whitney had a special affection for. The Whitneys may have left behind the neighborhood of the Morgans, but in their new home, they were trading up to live across the street from Cornelius Vanderbilt II, whose daughter Gertrude would in a few years marry Will Whitney’s oldest son, Harry. It was that marriage that assured the Whitney family’s legacy would thrive into the twentieth century and beyond. Gertrude Vanderbilt Whitney became a prominent sculptor and art collector, and after she established the Whitney Studio in Greenwich Village in 1914 and accumulated more than five hundred works of art, she offered them with an endowment to the Metropolitan Museum of Art.

…

His son tried college but wasn’t interested, and he dropped out to partner with his father in work. He quickly showed himself to be skilled as both a laborer and a manager. One of his first assignments, which he landed through his father, was a low-level timekeeping job at the Croton Dam. His first railroad job was rebuilding Cornelius Vanderbilt’s New York Central Railroad’s Fourth Avenue tracks up around Ninety-sixth Street. It was a job that gained him notoriety and led him on a busy path around North America, from New Jersey to Canada to Western Massachusetts to Buffalo to Philadelphia to Wisconsin to Illinois to West Virginia. He settled for a while in Baltimore to work on a long and complicated tunnel for the Baltimore & Ohio Railroad, and by the time he returned to New York with his wife, son, and daughter, he was no longer a run-of-the-mill contractor.

The Billionaire Raj: A Journey Through India's New Gilded Age

by

James Crabtree

Published 2 Jul 2018

What had been a nation of isolated farmers turned into a giant continental economy and the world’s leading industrial power. Just as in India, this growth gave birth to a new generation of plutocrats, from oil magnate John Rockefeller and banker John Pierpont Morgan to railroad tycoons Jay Gould and Cornelius Vanderbilt. These men sat atop a new “millionaire class” known for its extravagant houses and vulgar displays of wealth. Then they acquired another name: the “robber barons,” for the speed at which they built their fortunes and the lack of conscience they displayed while doing so. From the cliff-top mansions of Newport, Rhode Island, to the splendor of New York’s newly minted millionaires’ row on Fifth Avenue, it was the wealth these tycoons accumulated that defined their era.

…

They were also the great philanthropists of the city and are now remembered as city fathers. Mr. Ambani’s efforts are simply the latest example.” Antilia’s excess also carried echoes of an earlier era in America, and another celebrated business dynasty: the Vanderbilts. Like Dhirubhai Ambani, Cornelius Vanderbilt grew up modestly. The son of poor Dutch immigrants, he was born in a wooden house on Staten Island in 1794, working on his father’s boat as a boy and learning to take goods over the bay to New York. In his teens he pestered his mother to lend him $100 to buy a vessel of his own, earning the nickname “Commodore” for his fearlessness on the water.24 He went on to build a small fleet, only to find his expansion plans blocked by local rivals whose businesses were protected by exclusive government licenses and charters, which were controlled in turn by pliant politicians.

…

These problems then focus attention on one final critical barrier India faces: government itself. The crony capitalism of America’s Gilded Age ended when rampant nineteenth-century clientelism was curbed by impartial, meritocratic twentieth-century public administration. The kind of concentrated power built up by tycoons like Cornelius Vanderbilt was undone through the introduction of new antitrust law and competition policy. Improvements in basic public services gradually broke the grip of political patronage, a process that developed over many decades after the Gilded Age itself, culminating only with the New Deal of the 1930s. In India’s case, similar breakthroughs will require a focus on what is often called “state capacity.”15 Ending corruption is part of this battle, but it also involves the more complex objective of building a state machinery able to create and implement wise public policies, while remaining impartial between different social groups.

The Myth of Capitalism: Monopolies and the Death of Competition

by

Jonathan Tepper

Published 20 Nov 2018

,” NBER Working Paper No. 24085, November 2017,http://www.nber.org/papers/w24085. Chapter 7: What Trusts and Nazis Had in Common 1. https://www.theatlantic.com/magazine/archive/1881/03/the-story-of-a-great-monopoly/306019/. 2. Edward J. Renehan Jr., Commodore: The Life of Cornelius Vanderbilt (Basic Books, 2019). Kindle Edition. 3. T. J. Stiles, The First Tycoon: The Epic Life of Cornelius Vanderbilt (Alfred A. Knopf, 2009). 4. https://www.theatlantic.com/magazine/archive/1881/03/the-story-of-a-great-monopoly/306019/. 5. Ron Chernow, Titan (Vintage Books, 1998). 6. Matthew Josephson, The Robber Barons (Harcourt, 1934). 7. Theodore Roosevelt: Ultimate Collection (Madison & Adams Press, 2017). 8.

…

Chapter Seven What Trusts and Nazis Had in Common Just as we must convince the Germans on the political side of the unsoundness of making an irrevocable grant of power to a dictator … we must also convince them on the economic side of the unsoundness of allowing a private enterprise to acquire dictatorial power over any part of the economy.” —A Year of Potsdam: German Economy Since Surrender United States War Department Cornelius Vanderbilt was the embodiment of the nineteenth century American monopolist. He came to represent the idea of the corporation as a Goliath, yet he started out as a David. In 1808 the State of New York created a monopoly on ferry travel for a term of 20 years. Former New Jersey Governor Aaron Ogden purchased the monopoly rights and entered into partnership with Thomas Gibbons, a wealthy lawyer.

…

When their partnership collapsed, the two began competing with each other between New York and New Jersey. The partners ended up suing each other in the New York court. Gibbons decided to take his case against the monopoly all the way to the Supreme Court. As history would have it, Gibbons had hired a boatman in his mid-twenties named Cornelius Vanderbilt to pilot his ferries. Vanderbilt captained the boats, defying jail, cutting prices against the big monopolists. The case Gibbons v. Ogden in 1824 became a legal landmark in favor of free trade. The Supreme Court decided that Congress's power to regulate interstate commerce included the power to regulate transportation.

Eat People: And Other Unapologetic Rules for Game-Changing Entrepreneurs

by

Andy Kessler

Published 1 Feb 2011

And everyone who buys one has an economic rationalization—it makes them more productive. You can listen to music with earphones instead of hiring the New York Philharmonic (or AC/DC) to perform live in your kitchen. Or send an e-mail instead of tying a message to a pigeon’s leg. Or click “I’m Feeling Lucky,” instead of pestering librarians to look up the life story of Cornelius Vanderbilt. You get the point. Several trillion dollars of wealth have been created from the Scaling of bits. You can look at the market capitalization of all the tech companies, from Intel to Microsoft to Google to whoever else, and you get a trillion. The other trillion or so is the lower costs that companies like Wal-Mart and Morgan Stanley and Merck have been able to enjoy because computing power gets cheaper each and every year.

…

Good luck finding the trolley lines that used to run up and down Broadway in Manhattan. It’s political power versus competition. Over years, politics has the advantage. Over decades, competition triumphs. Cost cutting and innovation can’t be caged. Choose wisely. THIS GUY FIGURED it out—a Free Radical before it became fashionable. Cornelius Vanderbilt was born in 1794 on Staten Island, New York. As they say about Dominicans in Major League Baseball: you don’t walk off the island, you gotta hit your way off. When he was sixteen, Vanderbilt’s mom gave him $100 to clear and plant an eight-acre field. Instead, Vanderbilt bought a two-mast sailboat and started charging for ferrying passengers and goods around New York.

…

Until I read a series of articles in Tom Friedman’s very own New York Times titled “A Disability Epidemic Among a Railroad’s Retirees.” Just from reading the first few paragraphs about the Long Island Railroad, you’ll instantly understand why our public infrastructure and mass transit is Flintstonian . . . because someone is stealing the money. Cornelius Vanderbilt, who ran ships around Long Island, must be rolling over in his grave. “Virtually every career employee—as many as 97 percent in one recent year—applies for and gets disability payments soon after retirement, a computer analysis of federal records by The New York Times has found. Since 2000, those records show, about a quarter of a billion dollars in federal disability money has gone to former L.I.R.R. employees.”

The New Elite: Inside the Minds of the Truly Wealthy

by

Dr. Jim Taylor

Published 9 Sep 2008

And to get more people to read, the philosophy isn’t ‘misery loves company,’ it’s ‘misery loves voyeurism.’ ’’ In decades past, the decadence sometimes associated with wealth had something of a romance, almost an elegance to it. For example, think of F. Scott Fitzgerald’s The Great Gatsby, with Jay Gatsby at play on Long Island; or the ornate parlor cars of railroad magnates such as Cornelius Vanderbilt; or the rich collections of Andrew Carnegie; or John F. Kennedy and his family holding court in the White House. The resentment that some felt toward these 16 The New Elite wealthy lifestyles was often coupled with a paradoxical respect and admiration for the refinement this wealth engendered.

…

On an individual level, money shifted to an entirely new breed of wealthy individual, and by the end of the nineteenth century, the largest fortunes were in the range of $200–300 million—ten times what Astor had accumulated in his lifetime just a half century earlier. The names of this new elite are still familiar today: Andrew Carnegie. Henry Ford. J. P. Morgan. Thomas Edison. Indeed, in the minds of many, these names are synonymous with wealth today, particularly two of the wealthiest: John Rockefeller and Cornelius Vanderbilt. Vanderbilt was from a middle-class family, and he dropped out of school to start working when he was just eleven years old, later saying: ‘‘If I had learned education, I would not have had time to The Wealth of the Nation 27 learn anything else.’’ By sixteen, he had started his own ferry service between Staten Island and Manhattan, and over time he expanded to other routes with a fleet of more than a hundred ships.

…

Even the esteemed biographer of the American spirit, Alexis de Tocqueville, who marveled at so many aspects of the American passion for equality and democracy, also marveled at American materialism and the resulting tolerance for inequality: ‘‘I know of no other country where love of money has such a grip on men’s hearts or where stronger scorn is expressed for the theory of permanent equality of property.’’5 Inequality in the United States has also tended to result from innovations that did have trickle-down effects, even if the financial gain from those innovations was concentrated at the top. The average American in 1920 didn’t see his income rise with that of John Rockefeller or Cornelius Vanderbilt, but he certainly saw tangible changes in his own life and that of his family as a result of railroads, electricity, telephones, radio, automobiles, and the like. In the twenty-first century, the average American has been left behind in the wealth explosion experienced by the entrepreneurial elite, but certainly has experienced personal benefits from cell phones and the Internet.

A Little History of Economics

by

Niall Kishtainy

Published 15 Jan 2017

Veblen certainly seemed to live out his criticism in his own rather modest consumption. His clothes were too big and often looked as if he’d slept in them, and he kept his watch crudely attached to his vest with a safety pin. He suggested doing away with silks and tweeds altogether and making clothes out of paper instead. Modern America’s tribal chiefs were men like Cornelius Vanderbilt, who over the nineteenth century rose from being an uneducated ferry boy to a fabulously wealthy railway owner, leaving an estate worth billions in today’s money. The Vanderbilt family built giant mansions and summer estates. One of them gave his wife for her birthday the Marble House in Rhode Island, a lavish palace made from 500,000 cubic feet of white marble.

…

One of them gave his wife for her birthday the Marble House in Rhode Island, a lavish palace made from 500,000 cubic feet of white marble. Underneath the conspicuous consumption of men like Vanderbilt was an instinct that Veblen called ‘predation’. Where barbarian kings attacked each other with spears, the modern leisure class defeated their rivals with financial trickery. Take the battle between Cornelius Vanderbilt and another businessman, Daniel Drew, for control of the railway line that ran between Chicago and New York City. Drew cooked up a scheme to outwit Vanderbilt by influencing the price of the railway company’s shares. To pull it off he needed the price to go sky high. He visited a New York bar frequented by stockbrokers, and while chatting to some of them pulled out a handkerchief to wipe his brow.

…

The contrast between old and new also runs through his theory of capitalism, which he set out in his book Capitalism, Socialism and Democracy. According to Schumpeter, the fruits of modern capitalism – the vast array of goods on offer and the new technologies used to produce them – are created by heroic figures who are modern-day versions of the swashbuckling knights of old. They’re entrepreneurs, men like the railway owner Cornelius Vanderbilt, or Andrew Carnegie, who amassed a huge fortune through expanding the American steel industry. Thorstein Veblen had seen Vanderbilt and his type as throwbacks to ancient societies of violent barbarians, ‘robber barons’ whose aggression made them rich but didn’t benefit society as a whole. But Schumpeter said that it was because they’d channelled their excess energy into industry instead of battle that they’d become society’s wealth creators.

The Survival of the City: Human Flourishing in an Age of Isolation

by

Edward Glaeser

and

David Cutler

Published 14 Sep 2021

John Stephenson: “Death of John Stephenson; the Builder of Street Cars Passes Away Suddenly,” The New York Times. George Stephenson: “George Stephenson,” Encyclopædia Britannica Online. “owner of large tracts”: Carman, The Street Surface Railway Franchises of New York City, 23. “as well as being”: Carman, 23. Cornelius Vanderbilt: “Cornelius Vanderbilt,” Encyclopædia Britannica Online. sold for $270,000: Rohde, “Why Investors Should Consider Chicago’s Real Estate Market in 2021.” Boston was $494,000: Andreevska, “Where Should You Invest in the Boston Real Estate Market?” $985,000 in San Francisco: National Association of Realtors, “Metro Home Prices Rise in 96% of Metro Areas in First Quarter of 2020.”

…

“Peter Cooper’s Vision.” https://cooper.edu/about/history/peter-coopers-vision. Cope, Zachary. “Dr. Thomas Percival And Jane Austen.” British Medical Journal 1, no. 5635 (1969): 55–56. Coppola, Francis Ford, dir. The Godfather Part II. Paramount Pictures/Coppola Company/American Zoetrope, 1974. “Cornelius Vanderbilt.” Encyclopædia Britannica Online. Accessed January 18, 2021. www.britannica.com/biography/Cornelius-Vanderbilt-1794-1877. “Coronavirus (COVID-19) Deaths—Statistics and Research.” Our World in Data. https://ourworldindata.org/covid-deaths. “Coronavirus: How New Zealand Relied on Science and Empathy.” BBC News, April 20, 2020. www.bbc.com/news/world-asia-52344299.

…

Historian Harry Carman notes how Samuel Ruggles, the “owner of large tracts of real property between Third and Fourth Avenue, in the vicinity of Irving Place and Lexington Avenue, was untiring in his efforts to obtain public support and approval” for the railroad during the 1830s. He had strong financial incentives to do so, for “as well as being a large landholder, he was also a director and one of the largest stockholders of the New York and Harlem Railroad Company.” Cornelius Vanderbilt was another director of the New York and Harlem. He pushed the construction of the Grand Central Depot that would eventually morph into Grand Central Station. As the railroad stretched north from Grand Central, the city expanded alongside the rails. All cities are both nodes on the vast transportation network that spans the globe and hubs of their own local transportation system that allows travel across their metropolitan region.

Americana: A 400-Year History of American Capitalism

by

Bhu Srinivasan

Published 25 Sep 2017

Knopf, 2009), 43. refused to duel: Herbert A. Johnson, Gibbons v. Ogden: John Marshall, Steamboats, and the Commerce Clause (Lawrence: University Press of Kansas, 2010), 42–43. “strongest I ever knew”: Cornelius Vanderbilt, in Den D. Trumbull et al. v. Gibbons, April 10, 1849, quoted in Stiles, First Tycoon, 37. his young captain: Memorandum of Agreement between Thomas Gibbons and Cornelius Vanderbilt, June 26, 1818, Gibbons Family Papers, Archives and Special Collections, Drew University, Madison, New Jersey, quoted in Stiles, First Tycoon, 46. advice from Aaron Burr: Aaron Burr, “Of the Validity of the Laws Granting Livingston & Fulton the Exclusive Right of Using Fire and Steam to Propel Boats or Vessels,” Gilder Lehrman Institute of American History, New York Historical Society, quoted in Stiles, First Tycoon, 47.

…

He simply began operating his service. But he soon had a labor problem that needed solving. When the captain of the Stoudinger quit suddenly, Gibbons found himself on the wharves of New York, where he learned of the reliability and courage of a twenty-three-year-old ferry operator. Young Cornelius Vanderbilt would become a key participant in the battle to end the monopoly on the Hudson. One day the proudly uneducated Vanderbilt would become the richest man in America. For now, he was looking to make a switch from sail to steam. Born to a working-class family with Dutch roots dating back to 1650, Vanderbilt ran small sailboats between Staten Island and Manhattan.

…

To Adam Smith, these emerging industrial artists were “philosophers,” enterprising men whose role in society was “to observe everything” and by so doing become “capable of combining together the powers of the most distant and dissimilar objects.” It is unlikely that anyone who knew him would have called Cornelius Vanderbilt a philosopher. By 1840 the unschooled Vanderbilt had bought and sold steamships and routes enough times to amass a fortune, estimated at half a million dollars by some. His waters now extended well beyond the Hudson River and around Manhattan. His new battleground was the waters between Long Island and Connecticut, known as the Long Island Sound.

Americana

by

Bhu Srinivasan

Knopf, 2009), 43. refused to duel: Herbert A. Johnson, Gibbons v. Ogden: John Marshall, Steamboats, and the Commerce Clause (Lawrence: University Press of Kansas, 2010), 42–43. “strongest I ever knew”: Cornelius Vanderbilt, in Den D. Trumbull et al. v. Gibbons, April 10, 1849, quoted in Stiles, First Tycoon, 37. his young captain: Memorandum of Agreement between Thomas Gibbons and Cornelius Vanderbilt, June 26, 1818, Gibbons Family Papers, Archives and Special Collections, Drew University, Madison, New Jersey, quoted in Stiles, First Tycoon, 46. advice from Aaron Burr: Aaron Burr, “Of the Validity of the Laws Granting Livingston & Fulton the Exclusive Right of Using Fire and Steam to Propel Boats or Vessels,” Gilder Lehrman Institute of American History, New York Historical Society, quoted in Stiles, First Tycoon, 47.

…

He simply began operating his service. But he soon had a labor problem that needed solving. When the captain of the Stoudinger quit suddenly, Gibbons found himself on the wharves of New York, where he learned of the reliability and courage of a twenty-three-year-old ferry operator. Young Cornelius Vanderbilt would become a key participant in the battle to end the monopoly on the Hudson. One day the proudly uneducated Vanderbilt would become the richest man in America. For now, he was looking to make a switch from sail to steam. Born to a working-class family with Dutch roots dating back to 1650, Vanderbilt ran small sailboats between Staten Island and Manhattan.

…

To Adam Smith, these emerging industrial artists were “philosophers,” enterprising men whose role in society was “to observe everything” and by so doing become “capable of combining together the powers of the most distant and dissimilar objects.” It is unlikely that anyone who knew him would have called Cornelius Vanderbilt a philosopher. By 1840 the unschooled Vanderbilt had bought and sold steamships and routes enough times to amass a fortune, estimated at half a million dollars by some. His waters now extended well beyond the Hudson River and around Manhattan. His new battleground was the waters between Long Island and Connecticut, known as the Long Island Sound.

The System: Who Rigged It, How We Fix It

by

Robert B. Reich

Published 24 Mar 2020

Most whites were farmers, indentured servants, farmhands, traders, day laborers, and artisans. A fifth of the population was black, almost all of them slaves. A century later a new oligarchy emerged, comprised of men who amassed fortunes through their railroad, steel, oil, and financial empires—men such as J. Pierpont Morgan, John D. Rockefeller, Andrew Carnegie, Cornelius Vanderbilt, and Andrew Mellon. They ushered the nation into an industrial revolution that vastly expanded economic output. But they also corrupted government, brutally suppressed wages, generated unprecedented levels of inequality and urban poverty, shut down competitors, and made out like bandits—which is how they earned the sobriquet “robber barons.”

…

Recall that this was the era of the robber barons, whose steel mills, oil rigs and refineries, and railroads laid the foundation for America’s industrial might but who also squeezed out rivals who threatened their dominance, ran their own slates for office, and brazenly bribed public officials—even sending lackeys with sacks of money to be placed on the desks of pliant legislators. “What do I care about the law?” railroad magnate Cornelius Vanderbilt famously growled. “Hain’t I got the power?” Forty-eight of the seventy-three men who held cabinet posts between 1868 and 1896 either lobbied for railroads, served railroad clients, sat on railroad boards, or had relatives connected to the railroads. The public was appropriately enraged.

The Rational Optimist: How Prosperity Evolves

by

Matt Ridley

Published 17 May 2010

The average British working man in 1957, when Harold Macmillan told him he had ‘never had it so good’, was earning less in real terms than his modern equivalent could now get in state benefit if unemployed with three children. Today, of Americans officially designated as ‘poor’, 99 per cent have electricity, running water, flush toilets, and a refrigerator; 95 per cent have a television, 88 per cent a telephone, 71 per cent a car and 70 per cent air conditioning. Cornelius Vanderbilt had none of these. Even in 1970 only 36 per cent of all Americans had air conditioning: in 2005 79 per cent of poor households did. Even in urban China 90 per cent of people now have electric light, refrigerators and running water. Many of them also have mobile phones, inter net access and satellite television, not to mention all sorts of improved and cheaper versions of everything from cars and toys to vaccines and restaurants.

…

In the 1950s it took thirty minutes work to earn the price of a McDonald’s cheeseburger; today it takes three minutes. Healthcare and education are among the few things that cost more in terms of hours worked now than they did in the 1950s. Even the most notorious of capitalists, the robber barons of the late nineteenth century, usually got rich by making things cheaper. Cornelius Vanderbilt is the man for whom the New York Times first used the word ‘robber baron’. He is the very epitome of the phrase. Yet observe what Harper’s Weekly had to say about his railways in 1859: The results in every case of the establishment of opposition lines by Vanderbilt has been the permanent reduction of fares.

…

Wherever he ‘laid on’ an opposition line, the fares were instantly reduced, and however the contest terminated, whether he bought out his opponents, as he often did, or they bought him out, the fares were never again raised to the old standard. This great boon – cheap travel – this community owes mainly to Cornelius Vanderbilt. Rail freight charges fell by 90 per cent between 1870 and 1900. There is little doubt that Vanderbilt sometime bribed and bullied his way to success, and that he sometimes paid his workers lower wages than others – I am not trying to make him into a saint – but there is also no doubt that along the way he delivered to consumers an enormous benefit that would otherwise have eluded them – affordable transport.

The Relentless Revolution: A History of Capitalism

by

Joyce Appleby

Published 22 Dec 2009

Because capitalism created unparalleled freedom of action in the economy, its history is studded with stories of personal endeavors. Major accomplishments in science and engineering gave direction to nineteenth-century entrepreneurs who scoured these advances for their commercial potential. As the scope of enterprise grew larger and larger, a few individuals carved out large economic domains of their own. Cornelius Vanderbilt, Andrew Carnegie, and John D. Rockefeller in the United States and August Thyssen, Carl Zeiss, and Siemens in Germany were the giants who carried their nations to economic preeminence in the nineteenth century. They founded the companies of Carl Zeiss, Thyssen, Krupp, and Siemens in Germany and the New York Central Railroad, U.S.

…

The German industrialist Alfred Krupp took over the management of his father’s ironworks firm. Thyssen’s was a family of successful entrepreneurs. In our own time, Bill Gates got a boost from a wealthy father. Yet other industrial giants sprang de novo into the world of trade with little in their backgrounds to suggest a future fabulous success. The perfect example, Cornelius Vanderbilt, began his ascent from a modest waterside farm on Staten Island. Carnegie came from a poor immigrant family, and Rockefeller started at the bottom of the business hierarchy. Siemens got his start through service in the German Army, and Zeiss grew up in a family of toymakers. Vanderbilt’s talents unfolded with the country’s revolution in transportation as he moved from running ferries to transatlantic steamships to railroads.

…

Matthew Gardner, The Autobiography of Elder Matthew Gardner, Dayton, 1874), 69; Christopher Clark, “The Agrarian Context of American Capitalist Development” and Jonathan Levy, “The Mortgage Worked the Hardest’: The Nineteenth-Century Mortgage Market and the Law of Usury,” in Michael Zakim and Gary Kornbluth, eds., For Purposes of Profit: Essays on Capitalism in Nineteenth-Century America (Chicago, 2009). 16. John C. Pease and John M. Niles, A Gazetteer…of Connecticut and Rhode Island (Hartford, 1819), 6. 17. T. J. Stiles, The First Tycoon: The Epic Life of Cornelius Vanderbilt (New York, 2009), 90–95. 18. Thomas P. Hughes, Human-Built World: How to Think about Technology and Culture (Chicago, 2004), 35. 19. Henry L. Ellsworth, A Digest of Patents Issued by the United States, from 1790 to January 1, 1839 (Washington, 1840); see also Kenneth Sokoloff, “Inventive Activity in Early Industrial America: Evidence from Patent Records, 1790–1846,” Journal of Economic History, 48 (1988): 818–20. 20.

For Profit: A History of Corporations

by

William Magnuson

Published 8 Nov 2022

The wealthy capitalists of the late nineteenth century understood that this was a formula for high profit. Titans of industry like Andrew Carnegie, Cornelius Vanderbilt, and J. P. Morgan all piled into the railroad business, earning themselves reputations as schemers and connivers at the same time that they earned large dividends. The robber barons were railroaders. By universal acclamation, the worst robber baron of all was a man named Jay Gould. Gould had earned notoriety in the late 1860s for his role in the so-called Erie Wars, in which he and his associate Daniel Drew duped Cornelius Vanderbilt into purchasing boatloads of essentially worthless “watered” shares in the Erie Railroad.

…

It took some time for Gould’s real strategy to become clear, though.33 Years later, when asked by a World reporter why he had become interested in the Union Pacific, Gould would explain it in the simplest of terms: “There is nothing strange or mysterious about it. I knew it [i.e., the Union Pacific] very intimately when I was a child, and I have merely returned to my first love.” This may well have been true, but there were also other, less romantic reasons for his acquisition. The first was that Horace F. Clark, son-in-law of Cornelius Vanderbilt and a railroad executive himself, had toured the railroad in May 1873 and came back deeply impressed. Clark told Gould about the trip, and Gould, seeing an opportunity, placed an order to buy any Union Pacific shares for sale at less than thirty-five dollars. Clark died shortly thereafter, and Clark’s own sizeable stake in the company was dumped on the market.

Last Train to Paradise: Henry Flagler and the Spectacular Rise and Fall of the Railroad That Crossed an Ocean

by

Les Standiford

Published 4 Aug 2003

By 1877 the company had become a behemoth that had far outgrown its Cleveland roots. Rockefeller and Flagler determined to move their operations to the burgeoning city of New York, where the company’s far-flung holdings could more easily be managed and where other titans such as railroad builder Cornelius Vanderbilt, fur mogul William B. Astor, and department store maven Alexander T. Stewart had made their homes. Despite the heady move, Flagler was not keen to join the New York City social swirl. Even in Cleveland, he had virtually no social life. His wife had been plagued by a lifetime of chronic bronchitis, and when Flagler was not at his office, he was with her.

…

surveillance blimp Sybill (tugboat) Taft, William Howard Tampa, Florida: cigar business in port facilities in railroad in Tampa Bay Hotel Tavernier, Florida Tavernier Creek bridge Theater of the Sea tidal waves Tifft, Susan tornadoes, force of Torricelli, Evangelista tourists, on US Truman, Harry S Trumbo, Howard Trumbo Island Tuttle, Julia Twain, Mark Umbrella Keys Union Pacific Railroad Upper Keys Upper Matecumbe Key US Highway accidents on built on railroad span driving along as escape route MMs (mile markers) along over open water in Uniform System, n Vanderbilt, Cornelius Vanderbilt family Van Horne, Sir William Van Vechten, Charles Venable, William Mayo Veterans’ Work Program Vines, Rev. Benito Volstead Act (1920) Walker, Will Ward, George M. water, fresh Weather Bureau, U.S. Weather Channel West Palm Beach, Florida Wilkinson, Jerry Williams, Joy Windley Key Windward Islands Wood, Franklin Works Progress Administration (WPA) wreckers yellow fever Yucatán Peninsula, Mexico About the Author Les Standiford is the author of eight critically acclaimed novels as well as several works of nonfiction.

The Rough Guide to New York City

by

Martin Dunford

Published 2 Jan 2009

All that’s left to hint that this might once have been more than a down-at-heel gathering of industrial buildings is Colonnade Row, a strip of four 1833 Greek-Revival houses with twelve Corinthian columns, just south of Astor Place. Originally over twice as long, the row was constructed as residences for the likes of Cornelius Vanderbilt; it now holds the Astor Place Theater (longtime home to The Blue Man Group; see p.361).The stocky brownstone-and-brick building across Lafayette was once the Astor Library. Built with a bequest from John Jacob Astor between 1853 and 1881 (in a belated gesture of noblesse oblige), it was the first public library in New York.

…

Madison Square Garden has moved twice since then, first to a site on Eighth Avenue and 50th Street in 1925, and finally in 1968 to its present location in a hideous drum-shaped eyesore on the corner of 32nd Street and Seventh Avenue (see p.145). 123 H MIDTOW N E AS T Midtown East | Fifth Avenue argely corporate and commercial, and anchored by Grand Central Terminal, Cornelius Vanderbilt’s Beaux-Arts transportation hub, the area known as Midtown East rolls north from the 30s through the 50s, and east from Fifth Avenue. Some of the city’s most determinedly modish boutiques, richest Art Deco facades, and most sophisticated Modernist skyscrapers are in this district, primarily scattered along Fifth, Madison, and Park avenues.

…

Park Avenue Grand Central Terminal | Park Avenue Park Avenue hits 42nd Street at Pershing Square, where it lifts off the ground to make room for the massive Grand Central Terminal (W www .grandcentralterminal.com). More than just a train station, the terminal is a fullblown destination unto itself. When it was constructed in 1913 at the order of railroad magnate Cornelius Vanderbilt, the terminal was a masterly piece of urban planning. After the electrification of the railways made it possible to reroute trains underground, the rail lines behind the existing station were sold off to developers and the profits went toward the building of a new terminal – built around a basic iron frame but clothed with a Beaux-Arts skin.

Reminiscences of a Stock Operator

by

Edwin Lefèvre

and

William J. O'Neil

Published 14 May 1923

There was no more vindictiveness about the process than is felt by a hydraulic press—or no more squeamishness, either. 18.1 Known as the Old Man of the Street, Daniel Drew was born in New York in 1797 to a family of poor farmers and became one of the fiercest stock operators of the mid-1800s. He locked horns with Cornelius Vanderbilt, was alternately friends and enemies with Jim Fisk and Jay Gould, and used his directorship of the Erie Railroad to manipulate its stock. Drew’s intense and hardnosed attitude was on display early in his life. In 1814, he sold himself as a military service stand-in for $100. After a few months, he mustered out and started an illegal “bob veal” business.

…

In these early days, before standardized track widths, Erie’s first president, Eleazor Lord, chose a unique six-foot gauge. This, combined with a poorly chosen route through sparsely populated areas, resulted in the railroad’s bankruptcy in 1859. It was then that Drew, Jim Fisk, and Jay Gould took control and battled with Cornelius Vanderbilt by selling him 150,000 counterfeit shares. Before this, in 1852, Drew secured a directorship through underhanded means. First, he started giving the rival New York Central railway preferential rates on his steamboats. Then he took control of the steamers that operated on Lake Erie and served the New York & Erie Railway.

…

To make matters worse, the bears were mad with desire for revenge and started raiding Ryan’s other holdings. And bankers were closing in as well. On July 21, 1922, Ryan filed for bankruptcy, listing debts of over $32 million and assets of $643,533. Stutz Motors stock was sold at public auction for $20 a share. The company eventually failed in 1937. Ryan never recovered and died in 1940. 19.7 Cornelius Vanderbilt was born in 1794 into a Staten Island farming family that sailed its produce to market in Manhattan. After earning a small sum from his mother for fieldwork, Vanderbilt bought himself a two-masted, flat-bottomed sail-boat with which he carried passengers and freight across the bay. Two years later, during the War of 1812, Vanderbilt was awarded a U.S.

740 Park: The Story of the World's Richest Apartment Building

by

Michael Gross

Published 18 Dec 2007

Four years later, William Hale Harkness, scion of another family with ties to Standard Oil, and a friend of George Brewster’s family as well, joined the firm, and in 1929 it merged with Webb, Patterson & Hadley and became Murray, Aldrich & Webb. Harkness, his new partner Morris Hadley, and their partner Vanderbilt Webb’s brother, J. Watson Webb (both of them great-grandsons of Cornelius Vanderbilt), would all buy apartments in 740 Park. So, just a bit later, would Junior. MEANWHILE, WINTHROP ALDRICH WAS AT JUNIOR’S RIGHT HAND WHEN he orchestrated a proxy fight that forced the chairman of Standard Oil of Indiana, one of the tent poles of the Rockefeller empire, out of his job after he vexed a Senate committee investigating the oil industry.

…

Unsatisfied with the mere duplex penthouse Rosario Candela planned for the building, the Webbs added a third floor—even though there were several triplex Candela penthouses already for sale on Park Avenue. They wanted one built just for them. The Webbs weren’t rich; they were dynastic. Webb’s mother was a granddaughter of Cornelius Vanderbilt. His family had been in America for eight generations when the Commodore, as he was known, made his fortune, but despite his colonial roots, he was deemed too vulgar for society. Lila Webb was the youngest daughter of the Commodore’s eldest son, William Henry, who inherited his father’s steamship and railroad fortune—the largest cash stash in the world—and promptly doubled it.

…

Peggy was pregnant and bore Charles a son, Pierre-Frédérick Henri Charles Bernard William, that fall, but the court ordered that Muffie remain in New York. A new Cholly Knickerbocker wannabe, calling herself Suzy, reported in the New York Mirror that Peggy wanted it all hushed up, but “when you were once supposed to be the chief aspirant for the New York social throne left vacant by the late Mrs. Cornelius Vanderbilt, when you are one of the world’s best-dressed and most photographed women, when you’re young and rich and blonde and beautiful and married to a very important prince and all,” she wrote to the woman she called Madame la Princesse, that “ain’t exactly realistic.” One of Suzy’s competitors, Nancy Randolph of the Daily News, was scoring regular scoops at Peggy’s expense.

An Empire of Wealth: Rise of American Economy Power 1607-2000

by

John Steele Gordon

Published 12 Oct 2009

One man from New Jersey, Thomas Gibbons, decided to fight both in court and in the marketplace. He owned a steamboat named the Stoudinger (although, because it was very small, it was usually known as the Mouse), which he put on the New York–New Brunswick run, the first leg of the quickest route to Philadelphia. He hired as its captain a young man from Staten Island named Cornelius Vanderbilt. Vanderbilt, still in his twenties, had already owned a small fleet of sailing ships, but he realized that the future belonged to steam and went to work for Gibbons to gain experience and build up his capital. He soon convinced Gibbons to build a larger boat, designed by Vanderbilt, which Gibbons named Bellona, after the Roman goddess of war.

…

The board of the Erie, however, was largely unconcerned with such mundane, long-term matters as profitability or even viability. They were far more interested in short-term trading profits on the Street. This made the Erie the wild card of New York railroading (and caused Charles Francis Adams to dub the line the “Scarlet Woman of Wall Street”). An increasingly powerful figure in that market, Cornelius Vanderbilt, wanted to do something about it. Vanderbilt had left the employ of Thomas Gibbons in 1829 and struck out on his own in the steamboat business. He was soon the greatest shipowner in the country, and in 1837 the Journal of Commerce first used the honorary title by which he has been known to history ever since: Commodore.

…

Wherever he ‘laid on’ an opposition line, the fares were instantly reduced, and however the contest terminated, whether he bought out his opponents, as he often did, or they bought him out, the fares were never again raised to the old standard. This great boon—cheap travel—this community owes mainly to Cornelius Vanderbilt.” Even the Times would soon come around to this view of the Commodore. The term robber baron, of course, came to stand for the men, of whom Vanderbilt was one of the first, who built great industrial and transportation empires in the late nineteenth-century American economy. While many of these men were capable of ruthlessness, gross dishonesty, and self-aggrandizement (and others were honest men who scrupulously stayed within what were often inadequate laws), none of them merely transferred wealth to themselves from others by their activities.

All the Money in the World

by

Peter W. Bernstein

Published 17 Dec 2008

The best is probably to contrast relative scale, treating earlier fortunes as a percentage of inflation-adjusted GDP and then translating that percentage into contemporary dollars. By this standard34 John D. Rockefeller would today be worth $305.3 billion, Andrew Carnegie $281.2 billion, and Cornelius Vanderbilt $168.4 billion. Today’s big rich are rather modest by comparison: Bill Gates, at $53 billion, would be the thirteenth richest American of all time. * * * All-time richest Americans To compile this list, each individual’s wealth was calculated (in billions) at its peak. The figure was compared to the U.S. gross domestic product at the time and converted to 2006 dollars.

…

Josiah Hornblower, heir to the Vanderbilt and Whitney fortunes, tells Johnson he became so depressed at college that he had to take a couple of years off, traveling to Texas where he did manual labor for an oil field services company. S. I. Newhouse IV said fellow pupils at a Quaker school beat him up when they found out how rich he was. * * * Wayward Heirs Huntington Hartford was not the first heir to squander his inheritance. A century after Cornelius Vanderbilt’s death in 1877, not a single one of his more than seven hundred descendants was wealthy enough to be counted among the Forbes 400. Many were the victims of an ever-growing family tree. But others found much more enjoyable ways of lightening their pockets. Commodore Vanderbilt’s son Corneel27 was the first in a line of profligate Vanderbilt heirs.

…

The centerpiece is the 175,000-square-foot Biltmore mansion, the largest private home ever built in America. His widow had to sell Biltmore in order to repay his debts. The Commodore’s great-grandson Reginald Claypoole Vanderbilt squandered his fortune on women, gambling, and booze. And the Commodore’s great-great-grandson Cornelius Vanderbilt IV went broke during the 1920s launching a newspaper empire that failed. Other heirs have taken a more circuitous route to ignominy. During the 1980s28 E. Newbold Smith and his wife, Margaret Du Pont Smith, were so worried that their son Lewis Du Pont Smith had fallen under the sway of fanatic Lyndon LaRouche that they placed him under the control of a financial guardian to stop him from squandering a $10 million inheritance on the extremist group.

Capitalism in America: A History

by

Adrian Wooldridge

and

Alan Greenspan

Published 15 Oct 2018

Carnegie started life as a bobbin boy, endeared himself to the leading businesspeople in Pittsburgh, and by his early thirties had become a millionaire even before investing a dollar in steel. Rockefeller borrowed a thousand dollars from his father at the start of the Civil War, invested it in a food distribution business, emerged from the war with seventy thousand dollars, and purchased a light-fuel factory. Cornelius Vanderbilt started his business career ferrying people in a flat-bottomed boat from New Jersey to New York, traded up to a steamer, and then traded up again to locomotives. “Law, rank, the traditional social bonds—these things meant nothing to him,” T. J. Stiles noted. “Only power earned his respect, and he felt his own strength gathering with every modest investment, every scrap of legal knowledge, every business lesson.”2 Collis Huntington came to California as part of the gold rush but quickly decided that there was more money to be made selling axes and shovels to the miners.

…

The railroads produced a breed of speculators, brilliantly satirized in Anthony Trollope’s The Way We Live Now (1875), who were more interested in gaming railroad stocks to make a quick buck than in actually building railroads. In the so-called Erie War of 1868, Daniel Drew and his allies James Fisk and Jay Gould secretly printed millions of dollars of bonds in the Erie Railway Company in order to stop Cornelius Vanderbilt from taking it over. Speculation was particularly common in the transcontinental railroads, which, as Richard White has demonstrated, were rife with overbuilding, insider dealing, and other sharp corporate practices. This combination of “building well ahead of demand” and endemic speculation meant that the industry was far from the model of rational planning that Alfred Chandler praised.

…

In 1867, Crédit Mobilier, a construction company founded by the principals of the Union Pacific Railroad, skimmed off millions from railroad construction, bribing politicians to turn a blind eye in the process. The politicians embroiled in the scandal would eventually include a vice president, Schuyler Colfax, and a vice-presidential nominee, Henry Wilson; the Speaker of the House, James Blaine; and a future president, James Garfield. The 1869 “war” between Cornelius Vanderbilt and Jay Gould for control of New York’s Erie Railroad involved hired judges, corrupted legislatures, and under-the-counter payments. The railroads changed the nature of lobbying as well as its scale. They used their lobbies to fight their competitors and to beg favors from the government, blurring the line between economic and political competition.

The Story of the Pony Express

by

Glenn D. Bradley

Published 1 Jan 1913

The steamship company, it appears, thought its remuneration too low and it further protested that the diversion of mail traffic, due to the daily Overland Stage Line and the Pony Express would reduce its revenues still further. Congress finally adjourned without effecting a settlement, and the mail, which was far too heavy for the overland facilities to handle at that time, was piling up by the ton awaiting shipment. Matters were getting serious when Cornelius Vanderbilt came to the Government's relief and agreed to furnish steamer service until Congress assembled in March, 1861, provided the Federal authorities would assure him "a fair and adequate compensation." This agreement was effected and the affair settled as agreed. At the expiration of the period, the war and the growing importance of the overland route made steamship service by way of the Isthmus quite obsolete

The Great Bridge: The Epic Story of the Building of the Brooklyn Bridge

by

David McCullough

Published 1 Jun 2001

The Union Pacific was laying track at a rate of eight miles a day by this time. In Massachusetts a hole was being bored nearly five miles through the solid rock of Hoosac Mountain, just to slice a little time off the railroad run from Boston to Albany. Boston itself was being doubled in size by filling in Back Bay swamp. In New York Cornelius Vanderbilt was erecting a very grand new Grand Central Depot, the train-shed roof of which, an immense vault of glass and iron, would contain the largest interior space in the country. There was a new tunnel under the Chicago River, a first bridge over the Missouri at Kansas City, and at St. Louis a river captain named Eads had begun building a railroad bridge over the Mississippi.

…

But nowhere else was quite so much happening every day or was there so much opportunity for the young, the talented, the ambitious, not to mention the lucky or the unscrupulous. Yesterday’s ragpicker or coal heaver was today’s millionaire (a new word). It not only happened in stories, it happened. A. T. Stewart had once been an ordinary shopkeeper, living over a store with his wife in a single room. Cornelius Vanderbilt began penniless, everyone knew. The city was the undisputed center of the new America that had been emerging since the war. It was a place of a thousand and one overnight schemes, some brilliant, some preposterous, some plain evil, and all, it seemed, calling for enormous outlays of capital and pure nerve.

…

But there was no easy way to delay the direct question and so the usually amiable Stranahan, who reminded people of an English statesman and who was looking more dignified than ever now that he was in his seventies, had been filled with great righteous indignation, basing his case, as it were, on the excellence of his personal character and past services. The tactic worked. Mayor Grace said he meant no harm and asked no further questions. Stranahan said there was really no reason for the gentlemen from New York to be apprehensive. He told them how ten years earlier he had talked with Cornelius Vanderbilt about linking up with the New York Central and how Colonel Roebling had met with Vanderbilt’s engineer to figure a way to handle the problem. It was thought that a sunken line could be run from Grand Central Depot south to the bridge, then the trains could be raised by hydraulic lifts to cross over the bridge.

Engineers of Dreams: Great Bridge Builders and the Spanning of America

by

Henry Petroski

Published 2 Jan 1995

One chronicler of bridges has written that “the success of an engineering project may often be measured by the absence of any dramatic history,” but what may appear to be undramatic from one perspective can be very traumatic from another. To build a bridge from Brooklyn to Staten Island across the Narrows that ferryboat services, including one begun by Cornelius Vanderbilt in 1810, had plied for centuries required an enormous amount of land for approaches. Robert Moses called the bridge “the most important link in the great highway system stretching from Boston to Washington, or, if you please, Maine to Florida.” However, to close this link, especially on the Brooklyn side, meant disrupting long-established neighborhoods, and this was at least as difficult to accomplish as any engineering aspect of the problem.

…

One project that had been shelved during the 1940s was the crossing of the Straits of Mackinac, which had so separated the Upper from the Lower Peninsula of Michigan that the Upper Peninsula was for all practical and economic purposes more a part of Wisconsin than of Michigan. Thousands of cars would wait sometimes almost a full day to get ferry service across the straits during summer-vacation time. At least as far back as 1888, when Cornelius Vanderbilt was attending a directors’ meeting at the Grand Hotel on Mackinac Island and said, “What this area needs is a bridge across the Straits,” an obvious advantage had been seen in such a structure. In one of his later poems, “The Bridge at Mackinac,” Steinman would not only set the scene but also use rhyme to clarify the pronunciation of the place name.

…