The Wisdom of Crowds

by James Surowiecki · 1 Jan 2004 · 326pp · 106,053 words

THE WISDOM OF CROWDS WHY THE MANY ARE SMARTER THAN THE FEW AND HOW COLLECTIVE WISDOM SHAPES BUSINESS, ECONOMIES, SOCIETIES, AND NATIONS JAMES SUROWIECKI DOUBLEDAY New York London Toronto Sydney Auckland CONTENTS Cover Page Title Page Dedication Introduction PART I 1. The Wisdom of Crowds 2. The Difference Difference

…

social influence, as a way of explaining herding behavior. A longer account of William Sellers’s campaign to standardize the screw can be found in James Surowiecki, “Turn of the Century,” Wired 10.01 (January 2002), http://www.wired.com/wired/archive/10.01/standards_pr.html. A definitive account of the

…

this book was talking regularly to Chris. I hope we can start doing that again. This is for my mom and dad. ABOUT THE AUTHOR JAMES SUROWIECKI is a staff writer at The New Yorker, where he writes the popular business column, “The Financial Page.” His work has appeared in a wide

…

Surowiecki, James, 1967– The wisdom of crowds : why the many are smarter than the few and how collective wisdom shapes business, economies, societies, and nations / James Surowiecki. p. cm. Includes bibliographical references. 1. Consensus (Social sciences) 2. Common good. I. Title. JC328.2.S87 2003 303.3'8—dc22 2003070095 eISBN 0

…

-307-27505-1 Copyright © 2004 by James Surowiecki All Rights Reserved www.anchorbooks.com v1.0 THE WISDOM OF CROWDS WHY THE MANY ARE SMARTER THAN THE FEW AND HOW COLLECTIVE WISDOM SHAPES

Blank Space: A Cultural History of the Twenty-First Century

by W. David Marx · 18 Nov 2025 · 642pp · 142,332 words

make us free. As political gridlock thwarted Obama’s domestic agenda, such technocratic market solutions became an attractive alternative. Books like New Yorker staff writer James Surowiecki’s The Wisdom of Crowds argued that large groups made better decisions than elites, mirroring the internet’s participatory nature. His colleague Malcolm Gladwell’s

…

, 2022, https://www.brookings.edu/articles/how-middle-eastern-conflicts-are-playing-out-on-social-media. GO TO NOTE REFERENCE IN TEXT missing Brown student: James Surowiecki, “The Wise Way to Crowdsource a Manhunt,” New Yorker, April 23, 2013, https://www.newyorker.com/news/daily-comment/the-wise-way-to-crowdsource-a

Everybody Loses: The Tumultuous Rise of American Sports Gambling

by Danny Funt · 20 Jan 2026 · 285pp · 100,897 words

,” odds are informed by betting patterns at sportsbooks around the world. If that still sounds beatable, you’ve likely not had the pleasure of reading James Surowiecki’s The Wisdom of Crowds, which explains how markets, by distilling the opinions of diverse groups of people, are extraordinarily hard for any individual to

The Seven Rules of Trust: A Blueprint for Building Things That Last

by Jimmy Wales · 28 Oct 2025 · 216pp · 60,419 words

was astonishingly close to the actual weight of 1,198 pounds. In 2006, the tale of Galton and his ox opened a new book by James Surowiecki that went on to become an enormous bestseller, and the book’s title—The Wisdom of Crowds—suddenly became shorthand for an old but critical

More Than You Know: Finding Financial Wisdom in Unconventional Places (Updated and Expanded)

by Michael J. Mauboussin · 1 Jan 2006 · 348pp · 83,490 words

are efficient at uncovering and aggregating diverse pieces of information. And it doesn’t seem to matter much what markets are being used to predict. —James Surowiecki, “Damn the Slam PAM Plan!” The Accuracy of Crowds Most investors do not associate group behavior with sparkling outcomes. An Amazon book review crows that

…

, 2002), 716-29. 6 Gawande, Complications, 44. 7 Katie Haffner, “In an Ancient Game, Computing’s Future,” The New York Times, August 1, 2002. 8 James Surowiecki, The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations (New York: Doubleday

…

://www.asap.cs.nott.ac.uk/publications/pdf/gk_ai99.pdf. 5 See Iowa Electronic Markets Web site, http://www.biz.uiowa.edu/iem. 6 James Surowiecki, “Decisions, Decisions,” The New Yorker, March 28, 2003, available from http://www.newyorker.com/archive/2003/03/24/030324ta_talk_surowiecki. 7 See Hollywood Stock

…

); see http://www.hpl.hp.com/research/idl/projects/shock. 4 Francis Galton, “Vox Populi,” Nature 75 (March 7, 1907): 450-451; reprint, 1949. Also, James Surowiecki, The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations (New York: Random

Superminds: The Surprising Power of People and Computers Thinking Together

by Thomas W. Malone · 14 May 2018 · 344pp · 104,077 words

have been possible without the fast, cheap communication enabled by modern information technologies. THE WISDOM-OF-CROWDS EFFECT In his book The Wisdom of Crowds, James Surowiecki popularized another reason why large groups can be smarter than small ones.9 He tells the story of the English statistician Sir Francis Galton, who

…

Moro, Alex Pentland, and Iyad Rahwan, “Limits of Social Mobilization,” Proceedings of the National Academy of Sciences 110, no. 16 (2013): 6,281–86. 9. James Surowiecki, The Wisdom of Crowds (New York: Doubleday, 2004). 10. Andrew J. King and Guy Cowlishaw, “When to Use Social Information: The Advantage of Large Group

…

29, 2017, https://www.nytimes.com/2017/08/29/business/economy/home-health-care-work.html. 11. Autor, “Why Are There Still So Many Jobs?”; James Surowiecki, “The Great Tech Panic: Robots Won’t Take All Our Jobs,” Wired, September 2017, https://www.wired.com/2017/08/robots-will-not-take-your

Straight Talk on Trade: Ideas for a Sane World Economy

by Dani Rodrik · 8 Oct 2017 · 322pp · 87,181 words

used their influence to advance an agenda that was broadly in the national interest. By contrast, today’s super-rich are “moaning moguls,” to use James Surowiecki’s evocative term.27 Exhibit A for Surowiecki is Stephen Schwarzman, the chairman and CEO of the private equity firm the Blackstone Group, whose wealth

…

. 25. Calomiris and Haber, Fragile by Design. 26. Mark S. Mizruchi, The Fracturing of the American Corporate Elite, Harvard University Press, Cambridge, MA, 2013. 27. James Surowiecki, “Moaning Moguls,” The New Yorker, July 7, 2014, http://www.newyorker.com/magazine/2014/07/07/moaning-moguls. 28. For a good discussion of how

Reinventing Discovery: The New Era of Networked Science

by Michael Nielsen · 2 Oct 2011 · 400pp · 94,847 words

metaphor of the collective brain. Many books and magazine articles have been written about collective intelligence. Perhaps the best-known example of this work is James Surowiecki’s 2004 book The Wisdom of Crowds, which explains how large groups of people can sometimes perform surprisingly well at problem solving. Surowiecki opens his

…

of civility). Similar problems also afflict offline groups, and much has been written about the problems and how to overcome them—including books such as James Surowiecki’s The Wisdom of Crowds, Cass Sunstein’s Infotopia, and many other books about business and organizational behavior. While these practical problems are important, they

…

and Karim Lakhani’s fascinating account [87] of the Mathworks programming competition. Limits to collective intelligence: Informative summaries are Cass Sunstein’s Infotopia [212] and James Surowiecki’s The Wisdom of Crowds [214]. Classic texts include Charles Mackay’s Extraordinary Popular Delusions and the Madness of Crowds, first published in 1841, and

…

. The sheer number of ideas, the complexity, and the contribution it has made to chess make it the most important game ever played.” p 19: James Surowiecki, The Wisdom of Crowds, [214]. p 20: Nicholas Carr’s book The Shallows [35] is an expanded version of an earlier article, “Is Google Making

…

. Infotopia: How Many Minds Produce Knowledge. New York: Oxford University Press, 2006. [213] Cass R. Sunstein. Republic.com 2.0. Princeton University Press, 2007. [214] James Surowiecki. The Wisdom of Crowds. New York: Doubleday, 2004. [215] Don R. Swanson. Migraine and magnesium: Eleven neglected connections. Perspectives in Biology and Medicine, 31(4

The Hype Machine: How Social Media Disrupts Our Elections, Our Economy, and Our Health--And How We Must Adapt

by Sinan Aral · 14 Sep 2020 · 475pp · 134,707 words

real. Paradoxically, the best way for a group to be smart is for each person in it to think and act as independently as possible. —JAMES SUROWIECKI Interdependence is and ought to be as much the ideal of man as self-sufficiency. Man is a social being. —MOHANDAS GANDHI In his influential

…

book The Wisdom of Crowds, James Surowiecki described the power of collective judgment to solve many of humanity’s most challenging problems, from prediction, to innovation, to governance, to strategic decision making

…

or another, eliminating its ability to cancel out errors. Online rating bias and Google Flu Trends are potent examples of this pathology. To his credit, James Surowiecki, the author of The Wisdom of Crowds, acknowledged that humans are “social beings.” “We want to learn from each other and learning is a social

…

Social Influence and Political Mobilization,” Nature 489, no. 7415 (2012): 295. Chapter 10: The Wisdom and Madness of Crowds power of collective judgment to solve: James Surowiecki, The Wisdom of Crowds (New York: Anchor, 2005). The theory was originally proposed: Francis Galton, “Vox Populi,” Nature 75, no. 7 (1907): 450–51. Ninety

Adaptive Markets: Financial Evolution at the Speed of Thought

by Andrew W. Lo · 3 Apr 2017 · 733pp · 179,391 words

market still sticks in the craw of professional money managers, but the basic idea is more than forty years old. The long-time business journalist James Surowiecki has dubbed it the “wisdom of crowds” in his delightful book of the same name, turning Charles Mackay’s famous phrase, the “madness of crowds

…

about aerospace disasters. A catastrophic explosion might suggest a failure in the fuel tanks, made by Morton Thiokol, which turned out to be the case. James Surowiecki, the business columnist for The New Yorker, called this an example of the wisdom of crowds.8 If the Efficient Markets Hypothesis is true—and

What's Mine Is Yours: How Collaborative Consumption Is Changing the Way We Live

by Rachel Botsman and Roo Rogers · 2 Jan 2010 · 411pp · 80,925 words

Being Wrong: Adventures in the Margin of Error

by Kathryn Schulz · 7 Jun 2010 · 486pp · 148,485 words

Infotopia: How Many Minds Produce Knowledge

by Cass R. Sunstein · 23 Aug 2006

Predictive Analytics: The Power to Predict Who Will Click, Buy, Lie, or Die

by Eric Siegel · 19 Feb 2013 · 502pp · 107,657 words

Business Metadata: Capturing Enterprise Knowledge

by William H. Inmon, Bonnie K. O'Neil and Lowell Fryman · 15 Feb 2008 · 314pp · 94,600 words

The Slow Fix: Solve Problems, Work Smarter, and Live Better in a World Addicted to Speed

by Carl Honore · 29 Jan 2013 · 266pp · 87,411 words

The Logic of Life: The Rational Economics of an Irrational World

by Tim Harford · 1 Jan 2008 · 250pp · 88,762 words

Too Big to Know: Rethinking Knowledge Now That the Facts Aren't the Facts, Experts Are Everywhere, and the Smartest Person in the Room Is the Room

by David Weinberger · 14 Jul 2011 · 369pp · 80,355 words

Think Twice: Harnessing the Power of Counterintuition

by Michael J. Mauboussin · 6 Nov 2012 · 256pp · 60,620 words

Networks, Crowds, and Markets: Reasoning About a Highly Connected World

by David Easley and Jon Kleinberg · 15 Nov 2010 · 1,535pp · 337,071 words

The Internet Is Not the Answer

by Andrew Keen · 5 Jan 2015 · 361pp · 81,068 words

Buy Now, Pay Later: The Extraordinary Story of Afterpay

by Jonathan Shapiro and James Eyers · 2 Aug 2021 · 444pp · 124,631 words

Superforecasting: The Art and Science of Prediction

by Philip Tetlock and Dan Gardner · 14 Sep 2015 · 317pp · 100,414 words

Smarter Than You Think: How Technology Is Changing Our Minds for the Better

by Clive Thompson · 11 Sep 2013 · 397pp · 110,130 words

The Internet of Us: Knowing More and Understanding Less in the Age of Big Data

by Michael P. Lynch · 21 Mar 2016 · 230pp · 61,702 words

The Future Is Faster Than You Think: How Converging Technologies Are Transforming Business, Industries, and Our Lives

by Peter H. Diamandis and Steven Kotler · 28 Jan 2020 · 501pp · 114,888 words

The Joys of Compounding: The Passionate Pursuit of Lifelong Learning, Revised and Updated

by Gautam Baid · 1 Jun 2020 · 1,239pp · 163,625 words

The Open Organization: Igniting Passion and Performance

by Jim Whitehurst · 1 Jun 2015 · 247pp · 63,208 words

Adapt: Why Success Always Starts With Failure

by Tim Harford · 1 Jun 2011 · 459pp · 103,153 words

The Information: A History, a Theory, a Flood

by James Gleick · 1 Mar 2011 · 855pp · 178,507 words

The Irrational Bundle

by Dan Ariely · 3 Apr 2013 · 898pp · 266,274 words

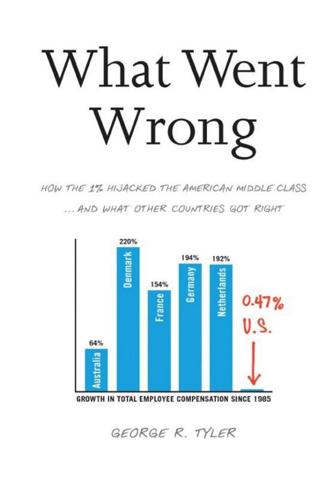

What Went Wrong: How the 1% Hijacked the American Middle Class . . . And What Other Countries Got Right

by George R. Tyler · 15 Jul 2013 · 772pp · 203,182 words

Blindside: How to Anticipate Forcing Events and Wild Cards in Global Politics

by Francis Fukuyama · 27 Aug 2007

The Rise and Fall of Nations: Forces of Change in the Post-Crisis World

by Ruchir Sharma · 5 Jun 2016 · 566pp · 163,322 words

Other People's Money: Masters of the Universe or Servants of the People?

by John Kay · 2 Sep 2015 · 478pp · 126,416 words

Success and Luck: Good Fortune and the Myth of Meritocracy

by Robert H. Frank · 31 Mar 2016 · 190pp · 53,409 words

Here Comes Everybody: The Power of Organizing Without Organizations

by Clay Shirky · 28 Feb 2008 · 313pp · 95,077 words

Thinking, Fast and Slow

by Daniel Kahneman · 24 Oct 2011 · 654pp · 191,864 words

Future Politics: Living Together in a World Transformed by Tech

by Jamie Susskind · 3 Sep 2018 · 533pp

Nomad Citizenship: Free-Market Communism and the Slow-Motion General Strike

by Eugene W. Holland · 1 Jan 2009 · 265pp · 15,515 words

House of Debt: How They (And You) Caused the Great Recession, and How We Can Prevent It From Happening Again

by Atif Mian and Amir Sufi · 11 May 2014 · 249pp · 66,383 words

Nerds on Wall Street: Math, Machines and Wired Markets

by David J. Leinweber · 31 Dec 2008 · 402pp · 110,972 words

The Myth of Artificial Intelligence: Why Computers Can't Think the Way We Do

by Erik J. Larson · 5 Apr 2021

Big Data: A Revolution That Will Transform How We Live, Work, and Think

by Viktor Mayer-Schonberger and Kenneth Cukier · 5 Mar 2013 · 304pp · 82,395 words

Rush Hour: How 500 Million Commuters Survive the Daily Journey to Work

by Iain Gately · 6 Nov 2014 · 352pp · 104,411 words

Culture & Empire: Digital Revolution

by Pieter Hintjens · 11 Mar 2013 · 349pp · 114,038 words

Present Shock: When Everything Happens Now

by Douglas Rushkoff · 21 Mar 2013 · 323pp · 95,939 words

Everything Is Obvious: *Once You Know the Answer

by Duncan J. Watts · 28 Mar 2011 · 327pp · 103,336 words

The Future of the Internet: And How to Stop It

by Jonathan Zittrain · 27 May 2009 · 629pp · 142,393 words

We-Think: Mass Innovation, Not Mass Production

by Charles Leadbeater · 9 Dec 2010 · 313pp · 84,312 words

The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management

by Alexander Elder · 28 Sep 2014 · 464pp · 117,495 words

The Great Reset: How the Post-Crash Economy Will Change the Way We Live and Work

by Richard Florida · 22 Apr 2010 · 265pp · 74,941 words

Super Thinking: The Big Book of Mental Models

by Gabriel Weinberg and Lauren McCann · 17 Jun 2019

The Road to Ruin: The Global Elites' Secret Plan for the Next Financial Crisis

by James Rickards · 15 Nov 2016 · 354pp · 105,322 words

Virtual Competition

by Ariel Ezrachi and Maurice E. Stucke · 30 Nov 2016

Grouped: How Small Groups of Friends Are the Key to Influence on the Social Web

by Paul Adams · 1 Nov 2011 · 123pp · 32,382 words

The People's Platform: Taking Back Power and Culture in the Digital Age

by Astra Taylor · 4 Mar 2014 · 283pp · 85,824 words

The Upside of Irrationality: The Unexpected Benefits of Defying Logic at Work and at Home

by Dan Ariely · 31 May 2010 · 324pp · 93,175 words

The Color of Money: Black Banks and the Racial Wealth Gap

by Mehrsa Baradaran · 14 Sep 2017 · 520pp · 153,517 words

Adam Smith: Father of Economics

by Jesse Norman · 30 Jun 2018

What Would Google Do?

by Jeff Jarvis · 15 Feb 2009 · 299pp · 91,839 words

Starstruck: The Business of Celebrity

by Currid · 9 Nov 2010 · 332pp · 91,780 words

Breaking News: The Remaking of Journalism and Why It Matters Now

by Alan Rusbridger · 14 Oct 2018 · 579pp · 160,351 words

Where Good Ideas Come from: The Natural History of Innovation

by Steven Johnson · 5 Oct 2010 · 298pp · 81,200 words

Wait: The Art and Science of Delay

by Frank Partnoy · 15 Jan 2012 · 342pp · 94,762 words

Wired for War: The Robotics Revolution and Conflict in the 21st Century

by P. W. Singer · 1 Jan 2010 · 797pp · 227,399 words

Trend Following: How Great Traders Make Millions in Up or Down Markets

by Michael W. Covel · 19 Mar 2007 · 467pp · 154,960 words

The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street

by Justin Fox · 29 May 2009 · 461pp · 128,421 words

Infonomics: How to Monetize, Manage, and Measure Information as an Asset for Competitive Advantage

by Douglas B. Laney · 4 Sep 2017 · 374pp · 94,508 words

The Future of the Professions: How Technology Will Transform the Work of Human Experts

by Richard Susskind and Daniel Susskind · 24 Aug 2015 · 742pp · 137,937 words

The Geeks Shall Inherit the Earth: Popularity, Quirk Theory, and Why Outsiders Thrive After High School

by Alexandra Robbins · 31 Mar 2009 · 509pp · 147,998 words

Stocks for the Long Run, 4th Edition: The Definitive Guide to Financial Market Returns & Long Term Investment Strategies

by Jeremy J. Siegel · 18 Dec 2007

Never Let a Serious Crisis Go to Waste: How Neoliberalism Survived the Financial Meltdown

by Philip Mirowski · 24 Jun 2013 · 662pp · 180,546 words

Everybody Lies: Big Data, New Data, and What the Internet Can Tell Us About Who We Really Are

by Seth Stephens-Davidowitz · 8 May 2017 · 337pp · 86,320 words

Consumed: How Markets Corrupt Children, Infantilize Adults, and Swallow Citizens Whole

by Benjamin R. Barber · 1 Jan 2007 · 498pp · 145,708 words

Mine!: How the Hidden Rules of Ownership Control Our Lives

by Michael A. Heller and James Salzman · 2 Mar 2021 · 332pp · 100,245 words

Makers and Takers: The Rise of Finance and the Fall of American Business

by Rana Foroohar · 16 May 2016 · 515pp · 132,295 words

The Village Effect: How Face-To-Face Contact Can Make Us Healthier, Happier, and Smarter

by Susan Pinker · 30 Sep 2013 · 404pp · 124,705 words

Death of the Liberal Class

by Chris Hedges · 14 May 2010 · 422pp · 89,770 words

Reimagining Capitalism in a World on Fire

by Rebecca Henderson · 27 Apr 2020 · 330pp · 99,044 words

You Are Not a Gadget

by Jaron Lanier · 12 Jan 2010 · 224pp · 64,156 words

Evil Genes: Why Rome Fell, Hitler Rose, Enron Failed, and My Sister Stole My Mother's Boyfriend

by Barbara Oakley Phd · 20 Oct 2008

Do Nothing: How to Break Away From Overworking, Overdoing, and Underliving

by Celeste Headlee · 10 Mar 2020 · 246pp · 74,404 words

Future Files: A Brief History of the Next 50 Years

by Richard Watson · 1 Jan 2008

Essentialism: The Disciplined Pursuit of Less

by Greg McKeown · 14 Apr 2014 · 202pp · 62,199 words

Rebel Ideas: The Power of Diverse Thinking

by Matthew Syed · 9 Sep 2019 · 280pp · 76,638 words

Too big to fail: the inside story of how Wall Street and Washington fought to save the financial system from crisis--and themselves

by Andrew Ross Sorkin · 15 Oct 2009 · 351pp · 102,379 words

The Art of Execution: How the World's Best Investors Get It Wrong and Still Make Millions

by Lee Freeman-Shor · 8 Sep 2015 · 121pp · 31,813 words

The Enlightened Capitalists

by James O'Toole · 29 Dec 2018 · 716pp · 192,143 words

The Ascent of Money: A Financial History of the World

by Niall Ferguson · 13 Nov 2007 · 471pp · 124,585 words

Liars and Outliers: How Security Holds Society Together

by Bruce Schneier · 14 Feb 2012 · 503pp · 131,064 words

Originals: How Non-Conformists Move the World

by Adam Grant · 2 Feb 2016 · 410pp · 101,260 words

Nixonland: The Rise of a President and the Fracturing of America

by Rick Perlstein · 1 Jan 2008 · 1,351pp · 404,177 words

Can Democracy Work?: A Short History of a Radical Idea, From Ancient Athens to Our World

by James Miller · 17 Sep 2018 · 370pp · 99,312 words

13 Bankers: The Wall Street Takeover and the Next Financial Meltdown

by Simon Johnson and James Kwak · 29 Mar 2010 · 430pp · 109,064 words

The Signal and the Noise: Why So Many Predictions Fail-But Some Don't

by Nate Silver · 31 Aug 2012 · 829pp · 186,976 words

Take the Money and Run: Sovereign Wealth Funds and the Demise of American Prosperity

by Eric C. Anderson · 15 Jan 2009 · 264pp · 115,489 words

Stocks for the Long Run 5/E: the Definitive Guide to Financial Market Returns & Long-Term Investment Strategies

by Jeremy Siegel · 7 Jan 2014 · 517pp · 139,477 words

A World Without Work: Technology, Automation, and How We Should Respond

by Daniel Susskind · 14 Jan 2020 · 419pp · 109,241 words

A Short History of Nearly Everything

by Bill Bryson · 5 May 2003 · 654pp · 204,260 words

Tools of Titans: The Tactics, Routines, and Habits of Billionaires, Icons, and World-Class Performers

by Timothy Ferriss · 6 Dec 2016 · 669pp · 210,153 words

The End of Wall Street

by Roger Lowenstein · 15 Jan 2010 · 460pp · 122,556 words

The People vs. Democracy: Why Our Freedom Is in Danger and How to Save It

by Yascha Mounk · 15 Feb 2018 · 497pp · 123,778 words

Traffic: Why We Drive the Way We Do (And What It Says About Us)

by Tom Vanderbilt · 28 Jul 2008 · 512pp · 165,704 words

Empty Vessel: The Story of the Global Economy in One Barge

by Ian Kumekawa · 6 May 2025 · 422pp · 112,638 words

Risk: A User's Guide

by Stanley McChrystal and Anna Butrico · 4 Oct 2021 · 489pp · 106,008 words

Incognito: The Secret Lives of the Brain

by David Eagleman · 29 May 2011 · 383pp · 92,837 words

A Curious Mind: The Secret to a Bigger Life

by Brian Grazer and Charles Fishman · 6 Apr 2014 · 302pp · 74,878 words

Quiet: The Power of Introverts in a World That Can't Stop Talking

by Susan Cain · 24 Jan 2012 · 377pp · 115,122 words

Everything for Everyone: The Radical Tradition That Is Shaping the Next Economy

by Nathan Schneider · 10 Sep 2018 · 326pp · 91,559 words

Overbooked: The Exploding Business of Travel and Tourism

by Elizabeth Becker · 16 Apr 2013 · 570pp · 158,139 words

Messing With the Enemy: Surviving in a Social Media World of Hackers, Terrorists, Russians, and Fake News

by Clint Watts · 28 May 2018 · 324pp · 96,491 words

On the Edge: The Art of Risking Everything

by Nate Silver · 12 Aug 2024 · 848pp · 227,015 words

Blockchain Revolution: How the Technology Behind Bitcoin Is Changing Money, Business, and the World

by Don Tapscott and Alex Tapscott · 9 May 2016 · 515pp · 126,820 words

The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism

by Arun Sundararajan · 12 May 2016 · 375pp · 88,306 words

Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

by James Clear · 15 Oct 2018 · 301pp · 78,638 words

How to Stand Up to a Dictator

by Maria Ressa · 19 Oct 2022

Disaster Capitalism: Making a Killing Out of Catastrophe

by Antony Loewenstein · 1 Sep 2015 · 464pp · 121,983 words

Tailspin: The People and Forces Behind America's Fifty-Year Fall--And Those Fighting to Reverse It

by Steven Brill · 28 May 2018 · 519pp · 155,332 words

Power, for All: How It Really Works and Why It's Everyone's Business

by Julie Battilana and Tiziana Casciaro · 30 Aug 2021 · 345pp · 92,063 words

The Drunkard's Walk: How Randomness Rules Our Lives

by Leonard Mlodinow · 12 May 2008 · 266pp · 86,324 words

The Spirit Level: Why Greater Equality Makes Societies Stronger

by Richard Wilkinson and Kate Pickett · 1 Jan 2009 · 309pp · 86,909 words

The Most Human Human: What Talking With Computers Teaches Us About What It Means to Be Alive

by Brian Christian · 1 Mar 2011 · 370pp · 94,968 words

Mastering the VC Game: A Venture Capital Insider Reveals How to Get From Start-Up to IPO on Your Terms

by Jeffrey Bussgang · 31 Mar 2010 · 253pp · 65,834 words

Competition Overdose: How Free Market Mythology Transformed Us From Citizen Kings to Market Servants

by Maurice E. Stucke and Ariel Ezrachi · 14 May 2020 · 511pp · 132,682 words

The Wikipedia Revolution: How a Bunch of Nobodies Created the World's Greatest Encyclopedia

by Andrew Lih · 5 Jul 2010 · 398pp · 86,023 words

Bad Company

by Megan Greenwell · 18 Apr 2025 · 385pp · 103,818 words

eBoys

by Randall E. Stross · 30 Oct 2008 · 381pp · 112,674 words

How to Speak Money: What the Money People Say--And What It Really Means

by John Lanchester · 5 Oct 2014 · 261pp · 86,905 words

The Crux

by Richard Rumelt · 27 Apr 2022 · 363pp · 109,834 words

Start With Why: How Great Leaders Inspire Everyone to Take Action

by Simon Sinek · 29 Oct 2009 · 261pp · 79,883 words

Hello World: Being Human in the Age of Algorithms

by Hannah Fry · 17 Sep 2018 · 296pp · 78,631 words

What Money Can't Buy: The Moral Limits of Markets

by Michael Sandel · 26 Apr 2012 · 231pp · 70,274 words

The Economic Consequences of Mr Trump: What the Trade War Means for the World

by Philip Coggan · 1 Jul 2025 · 96pp · 36,083 words

Dual Transformation: How to Reposition Today's Business While Creating the Future

by Scott D. Anthony and Mark W. Johnson · 27 Mar 2017 · 293pp · 78,439 words

Traders at Work: How the World's Most Successful Traders Make Their Living in the Markets

by Tim Bourquin and Nicholas Mango · 26 Dec 2012 · 327pp · 91,351 words

Brick by Brick: How LEGO Rewrote the Rules of Innovation and Conquered the Global Toy Industry

by David Robertson and Bill Breen · 24 Jun 2013 · 282pp · 88,320 words

The Unusual Billionaires

by Saurabh Mukherjea · 16 Aug 2016