The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution

by

Gregory Zuckerman

Published 5 Nov 2019

Soon, it was managing several hundred million dollars, trading an array of equity-related investments, and boasting over one hundred employees. Jim Simons didn’t have a clear understanding of the kind of progress Shaw and a few others were making. He did know, if he was going to build something special to catch up with those who had a jump on him, he’d need some help. Simons called Sussman, the financier who had given David Shaw the support he needed to start his own hedge fund, hoping for a similar boost. CHAPTER EIGHT Jim Simons’s pulse quickened as he approached Sixth Avenue. It was a sultry summer afternoon, but Simons wore a jacket and tie, hoping to impress.

…

Gregory Zuckerman, Rachel Levy, Nick Timiraos, and Gunjan Banerji, “Behind the Market Swoon: The Herdlike Behavior of Computerized Trading,” Wall Street Journal, December 25, 2018, https://www.wsj.com/articles/behind-the-market-swoon-the-herdlike-behavior-of-computerized-trading-11545785641. Chapter One 1. D. T. Max, “Jim Simons, the Numbers King,” New Yorker, December 11, 2017, https://www.newyorker.com/magazine/2017/12/18/jim-simons-the-numbers-king. 2. James Simons, “Dr. James Simons, S. Donald Sussman Fellowship Award Fireside Chat Series. Chat 2,” interview by Andrew Lo, March 6, 2019, https://www.youtube.com/watch?v=srbQzrtfEvY&t=4s. Chapter Two 1. James Simons, “Mathematics, Common Sense, and Good Luck” (lecture, American Mathematical Society Einstein Public Lecture in Mathematics, San Francisco, CA, October 30, 2014), https://www.youtube.com/watch?

…

Toll Dies at 87; Led Stony Brook University,” New York Times, July 18, 2011, https://www.nytimes.com/2011/07/19/nyregion/john-s-toll-dies-at-87-led-stony-brook-university.html. 4. James Simons, “Simons Foundation Chair Jim Simons on His Career in Mathematics,” interview by Jeff Cheeger, Simons Foundation, September 28, 2012, https://www.simonsfoundation.org/2012/09/28/simons-foundation-chair-jim-simons-on-his-career-in-mathematics. 5. Simons, “On His Career in Mathematics.” Chapter Three 1. Simons, “Mathematics, Common Sense, and Good Luck.” 2. William Byers, How Mathematicians Think: Using Ambiguity, Contradiction, and Paradox to Create Mathematics (Princeton, NJ: Princeton University Press, 2007). 3.

The Quants

by

Scott Patterson

Published 2 Feb 2010

Mere days before the crash, Asness’s hedge fund was on the verge of filing the final papers for an initial public offering. Boaz Weinstein, chess “life master,” card counter, and powerful derivatives trader at Deutsche Bank, who built his internal hedge fund, Saba (Hebrew for “wise grandfather”), into one of the most powerful credit-trading funds on the planet, juggling $30 billion worth of positions. Jim Simons, the reclusive, highly secretive billionaire manager of Renaissance Technologies, the most successful hedge fund in history, whose mysterious investment techniques are driven by scientists poached from the fields of cryptoanalysis and computerized speech recognition. Ed Thorp, godfather of the quants.

…

More important to the gathering crowd, Gowen was one of the most successful female poker players in the country. Muller, tan, fit, and at forty-two looking a decade younger than his age, a wiry Pat Boone in his prime, radiated the relaxed cool of a man accustomed to victory. He waved across the room to Jim Simons, billionaire math genius and founder of the most successful hedge fund on the planet, Renaissance Technologies. Simons, a balding, white-bearded wizard of quantitative investing, winked back as he continued chatting with the circle of admirers hovering around him. The previous year, Simons had pocketed $1.5 billion in hedge fund fees, at the time the biggest one-year paycheck ever earned by a hedge fund manager.

…

Pension funds across America, burned by the dot-com collapse in 2000, rushed into hedge funds, the favored vehicle of the quants, entrusting their members’ retirement savings to this group of secretive and opaque investors. Cliff Asness’s hedge fund, AQR, had started with $1 billion in 1998. By mid-2007, its assets under management neared $40 billion. Citadel’s kitty topped $20 billion. In 2005, Jim Simons announced that Renaissance would launch a fund that could juggle a record $100 billion in assets. Boaz Weinstein, just thirty-three, was wielding roughly $30 billion worth of positions for Deutsche Bank. The growth had come rapid-fire. In 1990, hedge funds held $39 billion in assets. By 2000, the amount had leapt to $490 billion, and by 2007 it had exploded to $2 trillion.

The Physics of Wall Street: A Brief History of Predicting the Unpredictable

by

James Owen Weatherall

Published 2 Jan 2013

Acknowledgments Notes References Introduction: Of Quants and Other Demons WARREN BUFFETT ISN’T the best money manager in the world. Neither is George Soros or Bill Gross. The world’s best money manager is a man you’ve probably never heard of — unless you’re a physicist, in which case you’d know his name immediately. Jim Simons is co-inventor of a brilliant piece of mathematics called the Chern-Simons 3-form, one of the most important parts of string theory. It’s abstract, even abstruse, stuff — some say too abstract and speculative — but it has turned Simons into a living legend. He’s the kind of scientist whose name is uttered in hushed tones in the physics departments of Harvard and Princeton.

…

The quant funds limped their way to the end of the year, hit again in November and December by ghosts of the August disaster. Some, but not all, managed to recover their losses by the end of the year. On average, hedge funds returned about 10% in 2007 — less than many other, apparently less sophisticated investments. Jim Simons’s Medallion Fund, on the other hand, returned 73.7%. Still, even Medallion had felt the August heat. As 2008 dawned, the quants hoped the worst was behind them. It wasn’t. I began thinking about this book during the fall of 2008. In the year since the quant crisis, the U.S. economy had entered a death spiral, with century-old investment banks like Bear Stearns and Lehman Brothers imploding as markets collapsed.

…

In addition to Bear Stearns and Lehman Brothers, the insurance giant AIG as well as dozens of hedge funds and hundreds of banks either shut down or teetered at the precipice, including quant fund behemoths worth tens of billions of dollars like Citadel Investment Group. Even the traditionalists suffered: Berkshire Hathaway faced its largest loss ever, of about 10% book value per share — while the shares themselves halved in value. But not everyone was a loser for the year. Meanwhile, Jim Simons’s Medallion Fund earned 80%, even as the financial industry collapsed around him. The physicists must be doing something right. 1 Primordial Seeds LA FIN DE SIÈCLE, LA BELLE EPOQUE. Paris was abuzz with progress. In the west, Gustave Eiffel’s new tower — still considered a controversial eyesore by Parisians living in its shadow — shot up over the site of the 1889 World’s Fair.

More Money Than God: Hedge Funds and the Making of a New Elite

by

Sebastian Mallaby

Published 9 Jun 2010

(Clifford Asness, “The August of Our Discontent: Questions and Answers about the Crash and Subsequent Rebound of Quantitative Stock Selection Strategies,” working paper, September 21, 2007.) In an e-mail to investors, Jim Simons wrote, “While we believe we have an excellent set of predictive signals, some of these are undoubtedly shared by a number of long/short hedge funds.” (Jim Simons, e-mail to Renaissance Technologies investors, August 9, 2007.) 32. Satya Pradhuman, director of research at Cirrus Research, identified 148 companies with market capitalizations between $2 billion and $10 billion and 473 companies with market capitalizations between $250 million and $2 billion in which large quant funds had ownership stakes exceeding 5 percent.

…

Hedge funds are the vehicles for loners and contrarians, for individualists whose ambitions are too big to fit into established financial institutions. Cliff Asness is a case in point. He had been a rising star at Goldman Sachs, but he opted for the freedom and rewards of running his own shop; a man who collects plastic superheroes is not going to remain a salaried antihero for long, at least not if he can help it. Jim Simons of Renaissance Technologies, the mathematician who emerged in the 2000s as the highest earner in the industry, would not have lasted at a mainstream bank: He took orders from nobody, seldom wore socks, and got fired from the Pentagon’s code-cracking center after denouncing his bosses’ Vietnam policy.

…

By buying value stocks and shorting growth stocks, Cliff Asness was doing his part to reduce the unhealthy bias against solid, workhorse firms. By buying Ford’s stock when it dipped illogically after a large-block sale, Michael Steinhardt was ensuring that the grandma who owned a piece of Ford could always count on getting a fair price for it. By computerizing Steinhardt’s art, statistical arbitrageurs such as Jim Simons and David Shaw were taking his mission to the next level. The more markets could be rendered efficient, the more capital would flow to its most productive uses. The less prices got out of line, the less risk there would presumably be of financial bubbles—and so of sharp, destabilizing corrections.

Trend Commandments: Trading for Exceptional Returns

by

Michael W. Covel

Published 14 Jun 2011

As we draw out a ball it becomes part of the track record, and we put it back in the bag, but there is no guarantee that the balls will come out in the same order in the future.1 Science “Do you have a clear sense of probabilities and payoffs?” Did you answer “no?” If so, you need to figure it out, and fast. For example, trader Jim Simons (arguably a closeted trend trader—he does not identify as one), worth about $8.5 billion, has said that the advantage scientists brought to the trading table was not their computing or math skills, but their ability to think scientifically. That means the scientific method is in play: 1. Define the question/theory. 2.

…

Nassim Taleb, The Bed of Procrustes: Philosophical and Practical Aphorisms. New York: Random House, 2010, p. 80. 2. See http://www.seykota.com. 3. See http://www.seykota.com. 4. See http://www.gibbonstrading.com. Endnotes 249 Systematic Trend Following 1. Van K. Tharp, Trade Your Way to Financial Freedom. New York: McGraw-Hill, 1999. 2. Jim Simons. See http://www.hedgeworld.com. 3. Daniel P. Collins in Futures, October 2003. 4. Cullen Roche, “The Market is a Heartless Beast.” January 2011. See http://pragcap.com/the-market-is-a-heartless-beast. 5. John P. Hussman, Ph.D., “Overvalued, Overbought, Overbullish, and Rising Yields.” January 12, 2011.

…

Daniel Goleman, “What Makes a Leader?” Harvard Business Review, 1998. 7. Ibid. 8. James Montier, “Global Equity Strategy: If it makes you happy.” Dresdner Kleinwort Wasserstein Securities Limited, June 17, 2004. Commitment 1. Michael Rosenberg, “Beat, Play, Love.” Sports Illustrated, October 18, 2010. 2. Jim Simons speaking at MIT, available through MIT World video. 3. Covel, Trend Following, p. 207. 4. Jim Rogers, Investment Biker. New York: Random House, 1994. 5. Roy W. Longstreet, Viewpoints of a Commodity Trader. Greenville: Traders Press, 1968. 6. Jack D. Schwager, The New Market Wizards. New York: Harper Business, 1992. 7.

Dark Pools: The Rise of the Machine Traders and the Rigging of the U.S. Stock Market

by

Scott Patterson

Published 11 Jun 2012

ANDRESEN was in the middle of his well-rehearsed pitch, ticking off all the benefits that Island brought investors who thrived on blinding speed and nosebleed volumes. The instant execution. The gobs of streaming data. The dirt-cheap fees. And if anyone was in the market for speed, data, and low fees, it was the hedge fund he was pitching to: Renaissance Technologies. But the reclusive, white-bearded chieftain of Renaissance, Jim Simons, didn’t seem to be listening. In fact, it seemed as if Simons had dozed off in the middle of Andresen’s presentation in a conference room at Island’s 50 Broad headquarters, his Merit cigarette burning to a cinder in an ashtray before him. Was Simons actually snoring? Disconcerted, Andresen muddled on, addressing his speech to the other Renaissance executives in the room, Peter Brown and Bob Mercer, the former IBM AI experts who’d turned Renaissance into an invincible trading machine.

…

Brown, a wiry man in his early fifties with masses of dark wavy hair, had, like Peterffy, seen his share of market panics—the Asian flu of the late 1990s, the dot-com implosion, the credit crisis of 2008. Along with Bob Mercer, his colleague for decades, dating back to their time developing AI language translation systems for IBM in the 1980s, he’d taken the reins at Renaissance in early 2009 from its founder, Jim Simons. It was one of the most plum jobs in all of finance. Brown had never seen a market move so quickly. The speed of the decline was breathtaking. He wasn’t overly worried. Because of Renaissance’s AI trading systems, alert to the mere whisper of trouble in its strategies, the plunge wasn’t likely to impact the firm’s $10 billion or so worth of holdings in its flagship hedge fund, Medallion.

…

The feedback loop was broken. The machines regrouped. Instead of selling, they started buying. The market recovered—and then it surged. BACK at Renaissance, Peter Brown was stunned as he watched the market whiplash. Just as quickly as it had crashed, it began rebounding. Brown had called Renaissance founder Jim Simons to notify him that the market had plunged 9 percent. But he couldn’t explain what had happened. Then, shortly before 2:46 P.M., the rebound kicked in. “Wait,” Brown told Simons as the market ticked up suddenly. “It’s down eight percent. Now it’s down seven percent.” Exchange executives raced to contain the damage.

Trend Following: How Great Traders Make Millions in Up or Down Markets

by

Michael W. Covel

Published 19 Mar 2007

National Institute of Standards and Technology. See www.itl.nist.gov. 14. Michael J. Mauboussin and Kristen Bartholdson, A Tail of Two Worlds, Fat Tails and Investing. The Consilient Observer, Vol. 1, No. 7 (Credit Suisse First Boston, April 9, 2002). 15. Lux, Ha, The Secret World of Jim Simons. Institutional Investor, Vol. 34, No. 11 (November 1, 2000), 38. 16. Lux, Ha, The Secret World of Jim Simons. Institutional Investor, Vol. 34, No. 11 (November 1, 2000), 38. 17. Jerry Parker, The State of the Industry. Managed Account Reports, Inc. (June 2000). 18. Daniel P. Collins, Chenier: Systematizing What Works (Trader Profile). Futures, Vol. 32, No. 9 (July 1, 2003), 86. 19.

…

Short-term trading, by definition, is not less risky, as evidenced by the catastrophic blowout of Victor Niederhoffer and Long Term Capital Management (LTCM). Do some short-term traders excel? Yes. However, think about the likes of whom you might be competing with when you are trading short term. Professional short-term traders, such as Jim Simons, have hundreds of staffers working as a team 24/7. They are playing for keeps, looking to eat your lunch in the zero-sum world. You don’t stand a chance. Unfortunately, the flaws in day trading are often invisible to those who must know better. Sumner Redstone, CEO of Viacom, was interviewed recently and talked of constantly watching Viacom’s stock price, hour after hour, day after day.

…

. • Appendix A, “Trend Following for Stocks”: Cole Wilcox and Eric Crittenden of Blackstar Funds have generously provided unique research explaining the use of trend following strategies on stocks. • Appendix B, “Performance Guide”: Historical performance data from professional trend followers provides concrete results, not just theory. • Appendix C, “Short-Term Trading”: Short-term trading is hard, but not impossible. Market Wizards Jim Simons and Toby Crabel do win as short-term traders, but Ed Seykota offers good insight on the difficulty. • Appendix D, “Personality Traits of Successful Traders”: Understanding the role of personality and temperament in great trading can be critical. • Appendix E, “Trend Following Models”: Paul Mulvaney of Mulvaney Capital Management presents a useful visual model for trend following trading. • Appendix F, “Trading System Example from Mechanica”: Bob Spear of Trading Recipes Software presents a sample trend following trading system. 305 Mean reversion works almost all the time, and then it stops and you are kind of out of business.

Madoff Talks: Uncovering the Untold Story Behind the Most Notorious Ponzi Scheme in History

by

Jim Campbell

Published 26 Apr 2021

As to the professional investors who he claimed legitimized his fund through their investments, he said: “I handled the foundation account in this SSC strategy for years for Jim Simons, the highly regarded and hugely successful Head of Renaissance Technologies, and the QUANT hedge fund. Also, Simons executed a huge amount of his firm’s trading through my market-making side. Like all my clients he received daily confirmations of every trade we did for his account in the SSC strategy and he never thought it looked too good to be true. This myth was completely generated by the SIPC Trustee. Do you believe I would have been able to FOOL so many pros for 16 years?”7 I looked into whether Jim Simons, who had generated the best hedge fund returns for decades, averaging annual returns of 66 percent gross and 39 percent net of fees, was really a Madoff investor.

…

—Bethany Mclean, New York Times bestselling author of The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron Campbell sheds new light on perhaps the biggest and most improbable scandal in financial history, providing valuable and fresh insights into Madoff’s enterprise and the man himself. —Gregory Zuckerman, Special Writer at the Wall Street Journal and New York Times bestselling author of The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution Madoff Talks is a gripping, fast-paced insider’s account of the story behind the story of the biggest Ponzi scheme in American history. I never understood how or why Bernie Madoff created a culture that sucked in so many unquestioning participants for so long. But thanks to Campbell’s relentless reporting, we hear not just from Bernie Madoff himself but from his wife, Ruth, his late son Andrew, and many others who worked for him.

…

SEC bureaucratic winds, driven by a big mutual funds pricing scandal generating media exposure, caused the exam team to shift focus without resolving the Madoff investigation. The final report accepted Madoff’s verbal dodges. Failure was baked into the examination before it was belatedly launched and prematurely curtailed. 4. Internal Emails at the Hedge Fund of the Greatest Investor Ever (April 2004) Jim Simons of Renaissance Technologies was invested indirectly in Madoff via a feeder fund. His hedge fund was full of brilliant mathematicians, with an extraordinary track record averaging annual net returns of 39 percent. Madoff continually cited to me Simons’s investments in his fund as proof his returns must be real.

Radical Uncertainty: Decision-Making for an Unknowable Future

by

Mervyn King

and

John Kay

Published 5 Mar 2020

Securities traders, unlike poker players, are not operating in a small and stationary world, and there is no equivalent basis for calculating probabilities, but opportunities for making similar decisions arise often, and the outcomes are clear. So it is possible to learn from long runs of successful results; hedge fund manager Jim Simons’ trading algorithms have been – overall – very profitable. We may perhaps learn even more from long runs of unsuccessful results, although few traders are given the opportunity to establish these. But the calculation of ‘alpha’, a widely employed measure of fund manager ‘skill’, generally assumes, without justification, that investment returns are drawings from a stationary probability distribution.

…

One is that the models used by regulators and financial institutions, directly derived from academic research in finance, not only failed to prevent the 2007–08 crisis but actively contributed to it. Another is to look at the achievements of the most successful investors of the era – Warren Buffett, George Soros and Jim Simons. Each has built fortunes of tens of billions of dollars. They are representative of three very different styles of investing. Buffett’s investment company, Berkshire Hathaway, owns large, often controlling and in many cases 100% interests in a wide variety of businesses. Buffett’s philosophy is to buy into businesses with strong competitive advantages, install outstanding managers – or in many cases find them within a company – and grant them almost total discretion.

…

But we do know that diversification reduces the risk that the reference narrative – the reliable emergency fund, the security of retirement, the continued growth of the college endowment – might not be realised. The efficient market hypothesis, taken literally, implies that the investment success of George Soros, Warren Buffett and Jim Simons is impossible. Frank Knight, who recognised that radical uncertainty generates profit opportunities, has been vindicated by the extraordinary riches accumulated by these men. And the efficient market hypothesis is shown to be illuminating – an indispensable model – without being true. Buffett, history’s most successful investor, was well aware of this.

Quantitative Trading: How to Build Your Own Algorithmic Trading Business

by

Ernie Chan

Published 17 Nov 2008

My contention is that it is much more logical and sensible for someone to become a profitable $100,000 trader before xi P1: JYS fm JWBK321-Chan xii September 24, 2008 13:43 Printer: Yet to come PREFACE becoming a profitable $100 million trader. This can be shown to be true on many fronts. Many legendary quantitative hedge fund managers such as Dr. Edward Thorp of the former Princeton-Newport Partners (Poundstone, 2005) and Dr. Jim Simons of Renaissance Technologies Corp. (Lux, 2000) started their careers trading their own money. They did not begin as portfolio managers for investment banks and hedge funds before starting their own fund management business. Of course, there are also plenty of counterexamples, but clearly this is a possible route to riches as well as intellectual accomplishment, and for someone with an entrepreneurial bent, a preferred route.

…

Institute for Advanced Studies Economics Series no. 38. 169 P1: JYS bib JWBK321-Chan 170 September 24, 2008 15:5 Printer: Yet to come BIBLIOGRAPHY Klaassen, Franc. 2002. “Improving GARCH Volatility Forecasts with Regime-Switching GARCH.” Empirical Economics 27(2): 363–394. Khandani, Amir, and Lo, Andrew. 2007. “What Happened to the Quants in August 2007?” Preprint. Available at: web.mit.edu/alo/www/Papers/ august07.pdf. Lux, Hal. 2000. “The Secret World of Jim Simons.” Institutional Investor Magazine, November 1. Markoff, John. 2007. “Faster Chips Are Leaving Programmers in Their Dust.” New York Times, December 17. Available at: www.nytimes.com/ 2007/12/17/technology/17chip.html?ex=1355634000&en=a81769355deb79 53&ei=5124&partner=permalink&exprod=permalink. Nielsen, Steen, and Jan Overgaard Olesen. 2000.

Just Giving: Why Philanthropy Is Failing Democracy and How It Can Do Better

by

Rob Reich

Published 20 Nov 2018

It was revealed in 2017 that James Simons, a billionaire hedge fund manager and long-standing donor to the Institute for Advanced Study in Princeton, New Jersey, had created the Simons Foundation International with an estimated $8 billion endowment. Incorporated in Bermuda, making its assets entirely tax-free, the foundation has, according to a 2017 profile of Simons in the New Yorker, no web page or public presence at all. D. T. Max, “Jim Simons, the Numbers King,” New Yorker, December 18 and 25, 2017. 13. Protecting donor intent in perpetuity was not always given robust legal recognition. See Ray D. Madoff, Immortality and the Law: The Rising Power of the American Dead (New Haven, CT: Yale University Press, 2010), 91. 14. Posner, “Charitable Foundations.” 15.

…

In Reich, Cordelli, and Bernholz, Philanthropy in Democratic Societies, 158–177. Manuel, Frank Edward. The Prophets of Paris. Cambridge, MA: Harvard University Press, 1962. Mauss, Marcel. The Gift: Forms and Functions of Exchange in Archaic Societies. Translated by Wilfred Douglas Halls. London: Routledge, 1990. Max, D. T. “Jim Simons, the Numbers King.” New Yorker, December 18 and 25, 2017. Mayer, Jane. Dark Money: The Hidden History of the Billionaires behind the Rise of the Radical Right. New York: Anchor Books, 2017. Mettler, Suzanne. The Submerged State: How Invisible Government Policies Undermine American Democracy. Chicago: University of Chicago Press, 2011.

Other People's Money: Masters of the Universe or Servants of the People?

by

John Kay

Published 2 Sep 2015

The outcome was profitable for hedge fund promoters although not, in general, for their investors.11 Groups of traders with a successful record in investment banks established their own operations. Some hedge fund managers made extraordinary sums. George Soros has reported wealth of $26.5 billion: Jim Simons, a former mathematics professor, $15.5 billion.12 The reward for traders within banks increased, substantially if not commensurately, as these companies tried to keep hold of what they called ‘the talent’. The rise of the trader and the development of a trading culture cannot be dissociated from the political climate of the times: the power of a market fundamentalist ideology, the election of Thatcher and Reagan, the collapse of the Soviet Union and the discrediting of central planning as an economic system.

…

Some thoughtful commentators believed that the financial institutions of the future would be narrow specialists.13 And indeed most functions of banks are now also performed by specialist institutions, such as credit card companies and mortgage banks. Supermarkets diversified into simple financial services, such as deposit accounts. Private equity houses (venture capital firms) specialise in the provision of finance for business. Specialist hedge funds – tightly run speculative trading ventures such as those of George Soros and Jim Simons – attracted funds in the years after 2000. But, apparently paradoxically, the trend to specialisation was accompanied by a trend to diversification. Regulation Q, which restricted interest rates, was successively relaxed and finally scrapped in 1986. The American finance sector, which had been publicly humiliated in 1933, became a more and more powerful lobby.

…

In the end, the LTCM trades were settled profitably by the investment banks which had taken them over: a telling illustration of Keynes’s (possibly apocryphal) dictum that ‘markets can remain irrational for longer than you can stay solvent’.4 More recently, the mathematical analysis of trading patterns has enabled some algorithmic traders to make returns from minute movements in the prices of securities. The most persistently successful of these quantitative-oriented funds are the Renaissance Technologies funds of Jim Simons, which have over more than two decades earned extraordinary returns for investors while charging equally extraordinary levels of fee. Simons was a distinguished mathematician before taking to finance. The early and successful practitioners of this quantitative style could use sophisticated methods to identify recurrent patterns in data, and arbitrage anomalies in the manner of LTCM.

Madoff: The Final Word

by

Richard Behar

Published 9 Jul 2024

At other times, he was vague, simply mentioning the names of firms that his top investors supposedly worked for. “Do you think all of these professionals on Wall Street,” he said by phone in 2012, “like Jim Simons, [David] Komansky, all these other people—partners of Goldman, and Merrill, and Morgan Stanley—would invest with me if they didn’t believe in my strategy? They didn’t see anything wrong. Doesn’t mean there wasn’t something wrong [laughs].” It turns out, however, that it was only a charitable foundation of Jim Simons’s that had a small account with Bernie. Once Simons—considered one of the greatest hedge fund traders alive—conducted an analysis of Madoff, he pulled out the funds.

…

Whenever Bernie talked about his (fake) split-strike strategy, he’d always say that he never actually did the trades, but that they would have made sense if he had executed them. “And you can’t say that people should have known, because the strategy made sense,” he once said, “and a perfect example of why it made sense are people like Jim Simons and David Komansky.” This baffled Komansky. “How the hell he got my name is beyond me because I was three levels away from investing directly with him,” he said. “I never invested with Bernie.” He laughed. “Never.” Komansky said he invested in a private partnership that invested in a Madoff feeder fund.

Adaptive Markets: Financial Evolution at the Speed of Thought

by

Andrew W. Lo

Published 3 Apr 2017

At its theoretical and frictionless limit, the Adaptive Markets Hypothesis includes the Efficient Markets Hypothesis as a special case. In practice, however, this limit is rarely attained, and if it is, it usually doesn’t last very long. Today’s financial markets are still distant from a theoretical end-state of perfectly efficient markets. Investors as different as Warren Buffett and Jim Simons consistently out-earn the index funds favored by the Efficient Markets Hypothesis, despite their very different investment strategies. Unlike the Efficient Markets Hypothesis, the Adaptive Markets Hypothesis makes no claim that markets will always become more efficient over time. Instead, it predicts more complicated market dynamics.

…

THE RANDOM WALK REVISITED The adaptive implications for index funds, volatility management, and the risk/reward trade-off are all well and good, but what does the Adaptive Markets Hypothesis have to say about the financial question people seem to care about the most: “Can I beat the market?” And if the answer is yes, you can beat the market, can you do it consistently, and at large scale? I have a two-part answer to these questions. The first answer depends on who “you” are. If you’re David Shaw, Jim Simons, or George Soros, then we already know the answer from chapter 7: the answer is yes. They can beat the market and they have. By a lot. But there’s a catch (isn’t there always?). Even these extraordinarily accomplished hedge fund managers didn’t have one perfect strategy that worked all the time.

…

There are several reasons for these funding challenges, but one of the most important is the fact that the drug development process is getting more challenging, even as we become more knowledgeable about the origins of human disease. In fact, it’s because we’re getting smarter that drug development is getter harder and financially riskier. This seems really counterintuitive, especially in the investment world where getting smarter usually means less risk and greater profits—think Warren Buffett, Jim Simons, and David Shaw. Not so in biomedicine. Here’s an example. In recent years, scientists discovered that certain medicines are extremely effective when used together, even though they don’t do much individually. A prominent example of such combination therapies is the highly active antiretroviral therapy (HAART) to treat AIDS.

How to Predict the Unpredictable

by

William Poundstone

That’s the secret sauce. Madoff’s investors believed he had achieved annual returns of something like 10 percent a year with low volatility, and had done so over an otherwise volatile decade. Despite what you may have heard, this wasn’t too good to be true. Other money managers have racked up better records. Jim Simons started his Medallion Fund a couple of years before Madoff did. Since 1988, Medallion’s return has averaged 45 percent a year. Simons is a mathematician who hires only mathematicians and scientists and sequesters them in a compound on the north shore of Long Island, where they invent top secret trading algorithms.

…

Lucky, Robert W. (1989). Silicon Dreams: Information, Man, and Machine. New York: St. Martin’s. Lutz, Mary Champion, and Alphonse Chapanis (1955). “Expected Locations of Digits and Letters on Ten-Button Keysets.” Journal of Applied Psychology 39, 314–317. Lux, Hal (2000). “The Secret World of Jim Simons.” Institutional Investor, Nov. 1, 2000. faculty.fuqua.duke.edu/~charvey/Teaching/BA453_2006/II_On_Jim_.pdf. MacLean, Leonard, William T. Ziemba, and George Blazenko (1987). “Growth versus Security in Dynamic Investment Analysis.” University of British Columbia, Faculty of Commerce and Business Administration, mimeograph.

The Pattern Seekers: How Autism Drives Human Invention

by

Simon Baron-Cohen

Published 14 Aug 2020

The Parents’ Occupations Study was retrospective: it started with a child’s known autism diagnosis and then worked backwards to see if the parents were hyper-systemizers. But could we find any prospective evidence? If you start with hyper-systemizing couples, are they more likely to have an autistic child? I meet couples who have an autistic child all the time. Take couples like Jim Simons, the gifted mathematician and hedge fund entrepreneur, and his wife Marilyn Hawrys, a quantitative economist, who have an autistic daughter. Like many parents of an autistic child, Jim has used his hyper-systemizing to great advantage. He hired mathematicians and computer scientists to create computer models to predict the behavior of the financial markets.

…

Baron-Cohen and J. Hammer (1997), “Parents of children with Asperger syndrome: What is the cognitive phenotype?,” Journal of Cognitive Neuroscience, 9, 548–554; G. Windham et al. (2009), “Autism spectrum disorders in relation to parental occupation in technical fields,” Autism Research 2(4), 183–191. 4. Jim Simons became chair of Stony Brook University’s math department at age thirty. He and Shiing-Shen Chern published the landmark Chern-Simons invariants, which have applications in quantum field theory, condensed-matter physics, and even string theory. He went on to win the American Mathematical Society’s Oswald Veblen Prize, geometry’s highest honor, for his research on area-minimizing surfaces.

Automate This: How Algorithms Came to Rule Our World

by

Christopher Steiner

Published 29 Aug 2012

An employee of Renaissance, the highest concentration of elite quantitative talent in the financial world, is virtually guaranteed several million dollars, if not tens of millions, if they stay on for more than a few years. Employees—and nobody else—get access to Renaissance’s Medallion Fund, which has famously racked up 30 percent or better gains since its inception in the early 1990s. The Medallion Fund employs algorithms trading millions of shares of, as founder Jim Simons puts it, “anything that moves.” At its historical pace the Medallion Fund would turn $100,000 into more than $20 million in just twenty years. When exceedingly smart, calculating people begin turning down Renaissance riches for undetermined outcomes in Silicon Valley, the pendulum has officially swung 100 percent away from Wall Street.

…

Having said that, getting through four years of engineering school doesn’t take genius; it just takes a little more work and a good base of upper-level math and science in high school. The problem, unfortunately, is that not enough U.S. kids get that foundation of upper-level math before arriving at college. Some, including Renaissance Technology’s founder Jim Simons, say part of the solution would be to hire more of the types of minds that are responsible for our coming algorithm-centric future and put them in the classroom. People can only teach what they understand themselves. Teaching isn’t easy, however. Many of the skills a Google engineer holds do not transfer to unruly collections of sixteen-year-olds.

The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds

by

Maneet Ahuja

,

Myron Scholes

and

Mohamed El-Erian

Published 29 May 2012

Now Congress wanted to hear what he had to say about the systemic risks that hedge funds posed to financial markets, and to listen to proposals for regulatory and tax reforms. Paulson was not the only hedge fund manager who had been summoned by the Committee that day, although he was certainly the best performing over the past year. Joining him was fellow subprime winner Phil Falcone, as well as George Soros, the head of Soros Fund Management, Jim Simons of Renaissance Capital, and Ken Griffin of Citadel, all industry legends and billionaires in their own right. Each of these industry titans would have his turn to address the Committee, but right now the floor was Paulson’s. The entire room, indeed, the entire financial world, wanted to hear what this man had to say; his remarks were running live on CNBC, Bloomberg, and, of course, C-SPAN.

…

Though Paulson & Co. did see some redemption, on the whole investors were quite pleased. At the end of 2010, LCH investments conducted an independent study of hedge funds that produced the greatest net gains for investors since inception. It ranked Paulson & Co. number three, behind only George Soros’s Quantum Endowment Fund (started in 1973) and Jim Simons’s Renaissance Medallion Fund (started in 1982). In his 2010 year-end letter to investors, Paulson proudly included a graphic that listed the top 10 managers, stating, “We are proud that we are number three on the list with over $28 billion in net gains, even though we started our funds 12 and 21 years after Renaissance and Quantum, respectively.”

The Fear Index

by

Robert Harris

Published 14 Aug 2011

He was bored with it. It was time to sell up and move on. He decided they should call themselves Hoffmann Investment Technologies in a nod to Jim Simons’s legendary quant shop, Renaissance Technologies, over in Long Island: the daddy of all algorithmic hedge funds. Hoffmann had objected strongly – the first time Quarry had encountered his mania for anonymity – but Quarry was insistent: he saw from the start that Hoffmann’s mystique as a mathematics genius, like that of Jim Simons, would be an important part of selling the product. AmCor agreed to act as prime brokers and to let Quarry take some of his old clients with him in return for a reduced management fee and ten per cent of the action.

Life After Google: The Fall of Big Data and the Rise of the Blockchain Economy

by

George Gilder

Published 16 Jul 2018

George Gilder, Microcosm: The Quantum Revolution in Economics and Technology (New York: Simon & Schuster, 1989), 262–89. 8. Jaron Lanier, Who Owns the Future (New York: Simon & Schuster, 2013), xxv. 9. Ibid. 10. Ibid., xxiii. 11. Hal Lux, “The Secret World of Jim Simons,” Institutional Investor, November 2000, https://www.institutionalinvestor.com/article/b151340bp779jn/the-secret-world-of-jim-simons 12. Robert P. Crease, The Prism and the Pendulum: The Ten Most Beautiful Experiments in Science (New York: Random House, 2004), 59–76, Chapter Four: “Newton’s Decomposition of Light with Prisms.” 13. Lanier, Who Owns the Future, xxvi. 14.

The Revolution That Wasn't: GameStop, Reddit, and the Fleecing of Small Investors

by

Spencer Jakab

Published 1 Feb 2022

Its employees are mostly mathematicians or physicists who program computers to look for anomalies in the market. They certainly appear to have found one in GameStop. The fund’s founder, Jim Simons, a renowned mathematician himself with no previous finance background, is the most successful fund manager of all time. Between 1988 and 2018, his Medallion Fund made an incredible gross annual return of 66 percent a year. That isn’t a typo. Whose money is it—or, rather, was it? In Gregory Zuckerman’s fascinating The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, the mathematician Henry Laufer, now a billionaire thanks to his stint at Renaissance, was asked that question.

The Deep Learning Revolution (The MIT Press)

by

Terrence J. Sejnowski

Published 27 Sep 2018

Sarfaz Manzoor, “Quants: The Maths Geniuses Running Wall Street,” Telegraph, July 23, 2013. http://www.telegraph.co.uk/finance/10188335/Quants-the-maths -geniuses-running-Wall-Street.html. 23. D. E. Shaw, J. C. Chao, M. P. Eastwood, J. Gagliardo, J. P. Grossman, C. Ho, et al., “Anton: A Special-Purpose Machine for Molecular Dynamics Simulation,” Communications of the ACM 51, no. 7 (2008): 91–97. 24. D. T. Max, Jim Simons, “The Numbers King,” New Yorker, December 18 & 25, 2017. https://www.newyorker.com/magazine/2017/12/18/jim-simons-the-numbers -king/. 25. Soon to be a major motion picture. 26. John von Neumann, as quoted in Jacob Bronowski, The Ascent of Man, documentary TV series, episode 13 (1973). 27. See M. Moravčík, M. Schmid, N. Burch, V. Lisý, D. Morrill, N. Bard, et al., “DeepStack: Expert-Level Artificial Intelligence in Heads-Up No-Limit Poker,” Science 356, no. 6337 (2017): 508–513.

Profit Over People: Neoliberalism and Global Order

by

Noam Chomsky

Published 6 Sep 2011

White House letter, January 20, 1998. I am indebted to congressional staffers, particularly the office of Representative Bernie Sanders. 15. Jane Bussey, “New Rules Could Guide International Investment,” Miami Herald, July 20, 1997; R.C. Longworth, “New Rules for Global Economy,” Chicago Tribune, December 4, 1997. See also Jim Simon, Seattle Times, “Environmentalists Suspicious of Foreign-Investor-Rights Plan,” Seattle Times, November 22, 1997; Lorraine Woellert, “Trade Storm Brews over Corporate Rights,” Washington Times, December 15, 1997. Business Week, February 9, 1998; New York Times, February 13, 1998, paid advertisement; NPR, Morning Edition, February 16, 1998; Peter Ford, Christian Science Monitor, February 28, 1998; Peter Beinart, New Republic, December 15, 1997; Fred Hiatt, Washington Post, April 1, 1998. 16.

Crypto: How the Code Rebels Beat the Government Saving Privacy in the Digital Age

by

Steven Levy

Published 15 Jan 2002

So on February 5, 1973, a high-level meeting was held to review “the status and plans of cryptography within the entire IBM corporation.” As Tritter later summarized the meeting, “It appeared to be broadly agreed . . . that IBM was apparently in the crypto business for keeps, and would have to acquire a corporate expertise in the area. In the meanwhile, attacks on Lucifer were to be intensified.” An outside expert, Jim Simons of the math department at the State University of New York at Stony Brook—who had also practiced cryptography at the Institute for Defense Analysis, the NSA satellite in Princeton—was recruited to organize a concentrated attack on Lucifer. He worked with three researchers from Yorktown Heights for about seven weeks in the late spring of 1973.

…

This was in 1984, about the same time that RSA was going through its roughest period. Omura and Morris didn’t find the going any easier. “The venture community then couldn’t have cared less about information security,” says Omura. It was only through a private referral that the business plan fell into the hands of Jim Simons, who was not only a mathematician and cryptographer (he’d been one of the early reviewers of Lucifer) but dabbled in venture capital as well. He agreed to help put the newly dubbed Cylink company on its feet. Unlike RSA, which had a mission of getting crypto into the hands of the general public, Cylink focused on securing the communications of big companies, typically those that were government contractors.

Big Mistakes: The Best Investors and Their Worst Investments

by

Michael Batnick

Published 21 May 2018

But there a plethora of problems come with swinging for the fences. First of all and most obviously, they are incredibly difficult to come by. The 50 largest hedge funds do 50% of all NYSE listed stock trading, and the smallest one spends $100 million annually buying information.19 Imagine that you were physically exchanging stock certificates with Jim Simons of Renaissance Technologies every time you went to buy or sell a stock. This is who you're playing against. The idea that you will stumble upon riches by dumb luck alone is possible, but a little naive. The second problem, and this is a problem we all wish for, is that once you've experienced outsized success in the stock market, you crave a similar rush.

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

by

Morgan Housel

Published 7 Sep 2020

Effectively all of Warren Buffett’s financial success can be tied to the financial base he built in his pubescent years and the longevity he maintained in his geriatric years. His skill is investing, but his secret is time. That’s how compounding works. Think of this another way. Buffett is the richest investor of all time. But he’s not actually the greatest—at least not when measured by average annual returns. Jim Simons, head of the hedge fund Renaissance Technologies, has compounded money at 66% annually since 1988. No one comes close to this record. As we just saw, Buffett has compounded at roughly 22% annually, a third as much. Simons’ net worth, as I write, is $21 billion. He is—and I know how ridiculous this sounds given the numbers we’re dealing with—75% less rich than Buffett.

The Aristocracy of Talent: How Meritocracy Made the Modern World

by

Adrian Wooldridge

Published 2 Jun 2021

The meritocratic idea is shaping society from top to bottom. A growing proportion of great fortunes are in the hands of people with outstanding brain power: computer geeks such as Bill Gates (Microsoft) and Mark Zuckerberg (Facebook) or financial wizards such as George Soros (who pioneered hedge funds) and Jim Simons (who helped to found computer-driven ‘quant investing’).9 The world’s richest man, Jeff Bezos, graduated summa cum laude and Phi Beta Kappa from Princeton and makes a point of surrounding himself with academic super-achievers. High-IQ types are even thriving in the more rough-and-ready corners of capitalism: six of the seven biggest Russian oligarchs of the 1990s earned degrees in maths, physics or finance before becoming natural-resource tycoons.

…

Sandel, The Tyranny of Merit: What’s become of the Common Good (London, Allen Lane, 2020), pp. 65–7, 79 2 See, for example, Tony Blair, New Britain: My Vision of a Young Country (London, Fourth Estate, 1996), p. 19 3 David Cameron, Conservative Party Conference Speech, 2012 4 David Lipsey, ‘The Meritocracy Myth’, New Statesman, 26 February 2016 5 Nikki Graf, ‘Most Americans Say Colleges Should Not Consider Race or Ethnicity in Admissions’, Pew Research Center, Fact Tank, 25 February 2019 6 https://www.chinadaily.com.cn/china/19thcpcnationalcongress/2017-11/04/content_34115212.htm 7 Sandel, The Tyranny of Merit, p. 107 8 Ibid., p. 84 9 Gregory Zuckerman, The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution (New York, Portfolio, 2019) 10 ‘America’s New Aristocracy’, Economist, 22 January 2015 11 Peter Saunders, Social Mobility Myths (London, Civitas, 2010), p. 69 12 Alice Sullivan et al., ‘The Path from Social Origins to Top Jobs: Social Reproduction via Education’, British Journal of Sociology 69 (3) (2018), pp. 782–4 13 Abdel Abdellaoui et al., ‘Genetic Correlates of Social Stratification in Great Britain’, Nature Human Behaviour, 21 October 2019; ‘Will Ye Nae Come Back Again: Migrants from Coalfields Take More than Just Their Talent with Them’, Economist, 24 October 2019 14 Emma Duncan, ‘Special Report: Private Education’, Economist, 13 April 2019, p. 6 15 Jody-Lan Castle, ‘Top 10 Exam Rituals from Stressed Students across Asia’, BBC News, 3 March 2016 16 Tomas Chamorro-Premuzik, ‘Ace the Assessment’, Harvard Business Review, July–August 2015 17 See, for example, Robin DiAngelo, White Fragility: Why It’s So Hard for White People to Talk about Racism (London, Allen Lane, 2018), p. 9 18 Ibid., pp. 40–43 19 Ibram X Kendi, How to be an Antiracist (London, The Bodley Head, 2019), p. 101 20 Ibid., p. 102; Wayne Au, ‘Hiding behind High-Stakes Testing: Meritocracy, Objectivity and Inequality in US Education’, International Education Journal: Comparative Perspectives 12 (2) (2013), pp. 7–19.

Quantitative Value: A Practitioner's Guide to Automating Intelligent Investment and Eliminating Behavioral Errors

by

Wesley R. Gray

and

Tobias E. Carlisle

Published 29 Nov 2012

A PEEK INSIDE THE BLACK BOX Many investors legitimately fear that quantitative analysis is an inscrutable “black box,” from which emanate incomprehensible investment ideas, many of which don't look like winners. While we know the past results for Quantitative Value have been outstanding, it often feels like one or more of the current crop of stocks selected by the model are particularly weak and should be avoided. Surely we can pick and choose from the model's output? Jim Simons disagrees. The billionaire mathematician turned quantitative hedge fund titan, believes that much of his success is attributable to his strict adherence to the output of his models6: Did you like what the model said or did you not like what the model said? That is a hard thing to backtest. If you are going to trade using models, you just slavishly use the models; you do whatever the hell it says no matter how smart or dumb you think it might be at that moment.”

Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader

by

Colin Lancaster

Published 3 May 2021

Two months ago, the best and worst performing factors of 2019—growth and value—were hit by a quant quake even worse than the first one back in August 2007. This sent value stocks soaring as momentum and growth stocks dumped. The Rabbi is wondering if we are about to see another one. My mind starts to wander, mulling over the influence of the quant strategies on the markets. They’re a new force. Go ask Jim Simons. He’s the most successful money maker in the history of modern finance and an amazing European-style chain smoker. There is an old tale—who knows if it’s true or not—that Simons was visiting Goldman. Everyone was sitting in a conference room talking business when Simons pulls out a cigarette and lights up.

Devil's Bargain: Steve Bannon, Donald Trump, and the Storming of the Presidency

by

Joshua Green

Published 17 Jul 2017

And the particular way in which Mercer had taken this worldview and applied it at Renaissance Technologies—by stringing together a series of models that functioned in tandem—was the same way that Bannon thought about politics and hoped to attack the system. The model that Mercer believed in so fiercely was devised by a mathematician and former code breaker for the Pentagon’s secretive Institute for Defense Analyses named Jim Simons. In the late 1970s, Simons was chairman of the math department at Stony Brook University on Long Island and an avid amateur speculator in commodities (he spent his wedding money trading soybean futures). Believing that he could bring mathematical rigor to the gut-driven practice of commodities trading, Simons began recruiting some fellow mathematicians and code breakers to help him automate the process of finding the best trades.

Market Sense and Nonsense

by

Jack D. Schwager

Published 5 Oct 2012

There are too many examples of extraordinary performance in the markets to be consistent with a theoretical framework that asserts that the only way to beat the market is by chance. We need consider only one such track record to make the point: the Renaissance Medallion fund, which was headed by the mathematician Jim Simons and supported by a brilliant team of mathematicians and scientists. Over a 19-year period (1990 to early 2009) for which we have results, the fund realized an average monthly gross return of 4.77 percent with 90 percent of the months being positive. (We used gross returns in our analysis instead of net returns because we are interested in calculating the probability of attaining the track record, not the implied return to investors after fees.)

The greatest trade ever: the behind-the-scenes story of how John Paulson defied Wall Street and made financial history

by

Gregory Zuckerman

Published 3 Nov 2009

“"Why do they want to hear from me, I didn’'t do anything wrong?”" he asked Waldorf with some annoyance. Paulson was especially concerned that details of his pay would be released publicly. When the committee met on November 13, Paulson sat in a row of luminaries of the hedge-fund world: George Soros, Jim Simons, Kenneth Griffin, and Philip Falcone. For years, Paulson aspired to be viewed as one of the top investors. Now he would have to deal with the consequences. As the hearings got under way, Soros expounded on global markets, while Griffin showed a feisty side, pushing back against a congressman who challenged some of his initiatives.

SUPERHUBS: How the Financial Elite and Their Networks Rule Our World

by

Sandra Navidi

Published 24 Jan 2017

Steve Cohen (net worth $12.7 billion), founder of SAC Capital, now renamed Point72 Asset Management, in 2013 took home $2.4 billion, in 2014 $2 billion, and in 2015 $1.55 billion. John Paulson (net worth $9.8 billion), founder of Paulson & Co., in 2013 pocketed $2.3 billion, which was good for him, because in 2014 and 2015 he failed to make the list. Jim Simons (net worth $15.5 billion), founder of Renaissance Capital, in 2013 earned $2.3 billion, in 2014 $1.2 billion, and in 2015 $1.7 billion. In comparison, the titans of private equity made significantly less, though they will likely still be able to get by: Steve Schwarzman (net worth $9.5 billion), cofounder of Blackstone, in 2013 made $374.5 million, in 2014 $690 million, and in 2015 $810.6 million.

High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems

by

Irene Aldridge

Published 1 Dec 2009

I am also immensely grateful to all reviewers for their comments, and to my immediate family for their encouragement, edits, and good cheer. xi CHAPTER 1 Introduction igh-frequency trading has been taking Wall Street by storm, and for a good reason: its immense profitability. According to Alpha magazine, the highest earning investment manager of 2008 was Jim Simons of Renaissance Technologies Corp., a long-standing proponent of high-frequency strategies. Dr. Simons reportedly earned $2.5 billion in 2008 alone. While no institution was thoroughly tracking performance of highfrequency funds when this book was written, colloquial evidence suggests that the majority of high-frequency managers delivered positive returns in 2008, whereas 70 percent of low-frequency practitioners lost money, according to the New York Times.

Dark, Salt, Clear: Life in a Cornish Fishing Town

by

Lamorna Ash

Published 1 Apr 2020

Back in 1937, the beginnings of an idea for a bold stunt that might save their town spread around Newlyn, inspired by the history of the Cornish revolts, this time in the form of a protest to London – not across land, but over the seas. A crew of nine upstanding Newlyn men came forward ready to set sail for Westminster: Cecil Richards, W. (Swell) Richards, skipper, J. S. (Jimmy Strick) Matthews, Ben Batten, J. P. (Sailor Joe) Harvey; W. (Billy Bosun) Roberts (a preacher), J. (Jim) Simons, J. H. (Jan Enny) Tonkin and W.H. (Skinny) Williams. The Rosebud, owned by the Richards’ brothers, was to be the chosen vessel. Three days later the Rosebud was steaming down the Thames carrying a vial of water from the sacred Madron Well in West Cornwall and a petition declaring: ‘We the undersigned inhabitants of Newlyn and district wish to protest respectfully and strongly against the wholesale destruction of our village.

Nobody's Fool: Why We Get Taken in and What We Can Do About It

by

Daniel Simons

and

Christopher Chabris

Published 10 Jul 2023

Half of those would be right the third time, and after the tenth pick, only one person would have been right every time—purely by luck. If we knew only about that person and had no information about the 1,023 others, we might unjustifiably conclude that we had discovered a brilliant investor. To be clear, we aren’t saying that investors like Peter Lynch, Ray Dalio, and Jim Simons owe their success to luck alone—only that when thinking about success stories, we should keep in mind that most of what we hear is about people like them.12 Documenting the true causes of success requires more than a clever narrative. We have to think about the planes that never came back, the cards that weren’t picked, and the other outcomes that a psychic performer could have accommodated.

Nerds on Wall Street: Math, Machines and Wired Markets

by

David J. Leinweber

Published 31 Dec 2008

The firm’s 20-year record of consistent positive performance (alpha) led in 2007 to the sale of a 20 percent stake to Lehman Brothers for a sum reported to be in the billions. Perhaps the most secretive, and most successful, of these high-technology firms is Renaissance Technologies, founded by Jim Simons, former head of the mathematics department at Stony Brook University. How these firms have achieved their success is not something you read in the library or on the Web. Company web sites are short and cryptic. Renaissance Technologies, for example, has removed almost everything except the address from its site, www.rentec.com.

A Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial Innovation

by

Richard Bookstaber

Published 5 Apr 2007

Others in their ranks included Paul Tudor Jones, the founder of Tudor Investments, who, like Bacon and Robertson, has Southern roots, and George Soros, a Hungarian Jewish émigré. The list of highpowered, multibillion-dollar hedge funds expanded in the 1990s with a new generation that relied on computer power and analytical models, such as Long-Term Capital Management, D.E. Shaw, and Jim Simon’s Renaissance Technologies, and has continued to balloon to this day. 165 ccc_demon_165-206_ch09.qxd 7/13/07 2:44 PM Page 166 A DEMON OF OUR OWN DESIGN It would seem that any discussion of hedge funds should include a taxonomy describing all the types of strategies and instruments, putting everything into a neat set of boxes.

System Error: Where Big Tech Went Wrong and How We Can Reboot

by

Rob Reich

,

Mehran Sahami

and

Jeremy M. Weinstein

Published 6 Sep 2021

Increasingly, AI is used to power ever-more-sophisticated models for trading equities, commodities, and derivatives. Called “quantitative hedge funds,” these systems use algorithmic techniques, frequently powered by machine learning models, to make split-second transactions on everything from Apple stock to zinc futures. One of the pioneers in this area, Renaissance Technologies, was founded by Jim Simons, a mathematics PhD who had spent time working at the National Security Agency on code breaking—a somewhat different but equally quantitative form of pattern recognition. Renaissance’s Medallion fund has generated more than $100 billion in profits since the company’s founding in 1982. Indeed, the world of finance has shifted in the wake of technological developments, as financial services firms increasingly focus on customer relationship management and access to private funds utilizing quantitative technologies.

Machine, Platform, Crowd: Harnessing Our Digital Future

by

Andrew McAfee

and

Erik Brynjolfsson

Published 26 Jun 2017

Massive amounts of technology have been deployed to automate the work of actually buying the assets once the decisions have been made (and then keeping track of them over time), but these decisions were almost always made by minds, not machines. This started to change in the 1980s when pioneers like Jim Simons (one of the most accomplished mathematicians of his generation) and David Shaw (a computer scientist) founded, respectively, Renaissance Technologies and D. E. Shaw to use machines to make investment decisions. These companies sifted through large amounts of data, built and tested quantitative models of how assets’ prices behaved under different conditions, and worked to substitute code and math for individual judgment about what and when to buy.

Trading at the Speed of Light: How Ultrafast Algorithms Are Transforming Financial Markets

by

Donald MacKenzie

Published 24 May 2021

“The Categorical Imperative: Securities Analysts and the Illegitimacy Discount.” American Journal of Sociology 104/5: 1398–1438. ________. 2000. “Focusing the Corporate Product: Securities Analysts and De-Diversification.” Administrative Science Quarterly 45/3: 591–619. Zuckerman, Gregory. 2019. The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution. London: Penguin. INDEX 50 Broad Street, 1, 2f Abbott, Andrew, 16 Abolafia, Mitchel, 19 actor-network theory, 14 advertising, online, 236–37 Aldrich, Eric, 229 Aldrich, Eric, and Seung Lee, 248nn23 and 27 algorithms, 4, 172–205, 213–17; defined, 12–13; volume-participation, 230–31 Amazon, 236 Angel, James, 225 Anova, 155, 156, 159–60, 253n12 AOptics, 159–60 application-specific integrated circuits (ASICs), 254n23 Aquilina, Matteo, 183–84, 223, 256n13 Aquis, 225 arb, 43 arbitrage, 175; statistical, 243n5 Archipelago, 91, 96, 255n7 asterisk, battle of, 219–20, 222 Aurora, 50, 52 Automated Trading Desk (ATD), 28, 29, 66–69, 77–80, 82–84, 90, 101–4, 176, 210–11; staff roles, 84f banks, 5, 103 Barclays Bank, 197 BATS (Better Alternative Trading System), 96, 97 Biais, Bruno, and Richard Green, 110 bigs and littles, 54–55 bilateral relationships, 227–28 Birch, Kean, 246n32 bird droppings, 160 bitcoin, 234–35 Bloomberg FIT (Fixed-Income Trading), 106–7, 110 Borch, Christian, 10–11, 231, 241 Brogaard, Jonathan, 240 broker groups, 46–47 BrokerTec, 105–6, 110, 113, 114, 115t, 165 Budish, Eric, 23, 223–24, 225–26, 240 C++, 167 cabling, 139–47, 165–66 Callon, Michel, 243n17 Cantor Fitzgerald, 111–13 Carlson, Ryan, 60, 247nn5 and 6 Cermak, 135–37, 136f Chicago Board of Trade, 33, 35f, 36f, 37, 59–60 Chicago Board Options Exchange (CBOE), 203–4 Chicago Mercantile Exchange (CME), 29, 32, 33, 37, 63–64, 232–33 Chi-X, 99–101, 240, 256n21 Christie, William, and Paul Schultz, 94 circuit breakers, 261n26 Citadel, 4, 104, 233, 260n16 Citigroup, 103–4 Citron, Jeffrey, 85, 250n17 Clackatron, 3f, 128 clearing and settlement, 209 CLOBs (consolidated limit order books), 71–72, 97, 178, 218, 219 clock synchronization, 11, 187 coils, 258n34 Commodity Exchange Authority, 39 Commodity Futures Trading Commission (CFTC), 41–42, 133 cookies, 261n36 Coombs, Nathan, 242 Copenhagen Business School, 231, 241 coronavirus, 10 Cowan, Ruth Schwartz, 14 cryptocurrencies, 234–35 Cummings, Dave, 3–4, 29, 92 dark pools, 19–20, 116, 251n24 datacenters, 6–8, 135–39, 138f, 162–71 Datek, 85 dealers, 105–8, 110f, 119 decimalization, 101, 198, 199, 252n12 Deutsche Terminbörse, 57, 58 digital economy, 235–37 Direct Match, 114–16, 209 Dodd-Frank Act 2010, 221, 259n16 Dourish, Paul, 243n18 Einstein, Albert, 11 Electronic Broking Services (EBS), 126–28, 198, 199, 200–201 E-Mini, 51f, 54, 55, 56 equities triangle, 7f, 8 ES, 55, 56, 61, 183, 247n27 eSpeed, 112, 113, 114 ethereum, 234, 235 Eurex, 59, 62, 164, 165, 168–69, 244n13, 254n22 EuroMTS, 120 exchange-traded funds (ETFs), 61 Exegy, 9 Facebook, 235, 237 fees, 20–21, 223 fiber-optic cable, 253n9 fiber tail, 152–53, 158, 208 field theory, 14–15, 16, 222 fill messages, 163–65, 209 FINRA (Financial Industry Regulatory Authority), 259nn8 and 15 Fixed Income Clearing Corporation (FICC), 116 Flash Boys, 142, 239 flash crashes, 228–30 foreign exchange trading, 123–31, 134, 196–201, 213, 214 Foucault, Michel, 217 FPGAs (field programmable gate arrays), 30, 169–71, 170f, 233 fragmentation, 97t, 132–34, 154, 211 futures, 37–38, 40–43, 69, 131, 209, 210; defined, 8, 32–33 futures lead, 43, 61–65, 92, 97t, 132–33, 211, 249n30 Galison, Peter, 11 geodesics, 9 Getco (Global Electronic Trading Co.), 55, 232 Ginsey, 247n8 Globex, 49–53, 55, 56, 61 Godechot, Oliver, 17 gold line, 140–41, 209, 252n6 Google, 235–36, 237 governmentality, 217–18 Guardian, 236 Gutterman, Burt, 50, 52 Hackers, 87–88 Harris, Lawrence, and Venkatesh Panchapagesan, 19 Hawkes, James, 67–68 Hendershott, Terrence, 262n2 high-frequency trading, 23–29; defined, 4 hinges, 16, 20–21, 93–98, 210, 224–25; in Europe, 99–101 Hobson, John, and Leonard Seabrooke, 245n23 Hotspot, 129, 130 IEX, 202–3, 202f, 204, 258n36 information, politics of, 210–13 Instinet, 67, 76–77, 78–79, 96 Intercontinental Exchange (ICE), 62, 257n30 Intermarket Sweep Orders (ISOs), 179–81, 215–16, 217, 255n10 Intermarket Trading System (ITS), 72–73, 91 interviewees, 24–28, 25t, 246n34 inverted exchanges, 257n32 Island, 1–3, 4, 29, 56, 85–93, 96, 201, 243n10, 257n31 Itch, 89 jitter, 232–33, 248n25 Johnson, Neil, 230 journalism, 236 Jump Trading, 55, 153 Knight Capital, 232 Lange, Ann-Christina, 6 lasers, 159–60 last look, 196–97 Latour, Bruno, 202, 243n17 Latour Trading LLC, 255n11 Laughlin, Gregory, 20, 244nn12 and 14 Laumonier, Alexandre, 147, 242 Law, John, and Annemarie Mol, 14 Lehmann Brothers, 3f, 128 Lenglet, Marc, 242 leverage, 63 Levine, Josh, 85, 87, 89, 250nn16, 17, and 18 Levy, Stephen, 87–88 Lewis, Michael, 142, 239 LIFFE (London International Financial Futures Exchange), 48–49, 57, 58, 59, 62, 248n14 light, speed of, 4, 11–12 liquidity, stickiness of, 27, 63, 249n28 Liquidity Edge, 117–18 liquidity-taking, 30.

Unknown Market Wizards: The Best Traders You've Never Heard Of

by

Jack D. Schwager

Published 2 Nov 2020

In those days, most software testing was done manually, which was a very time-consuming and error-prone process. We created software that automated the testing using a methodology that we were able to patent. Ultimately, Segue agreed to buy our technology in exchange for stock, and our group was merged into Segue. An interesting side note is that Jim Simons of Renaissance was the principal investor in Segue and was involved in the merger negotiations, which resulted in our getting stock in Segue in exchange for our technology. At the time, did you know who Simons was? Someone told me he was a rich guy who was a commodity trader. I didn’t even know what a commodity trader was.

The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a Wall Street Legend

by

Rob Copeland

Published 7 Nov 2023

“What Is a Jeweler?”: Cassidy, “Mastering the Machine.” the best thing: Lawrence Delevingne and Michelle Celarier, “Ray Dalio’s Radical Truth,” Absolute Return, March 2, 2011. a matrix: Hilda Ochoa-Brillembourg, author interview. Sharpe ratio: Gregory Zuckerman, The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution (Portfolio, 2019). “What the hell”: A representative for Jones said this was “not his style or voice.” protect the retirement savings: Hilda Ochoa-Brillembourg, author interview. railroad bond prices: Robert McGough, “Fair Wind or Foul?,” Financial World, May 2, 1989.

Investing Amid Low Expected Returns: Making the Most When Markets Offer the Least

by

Antti Ilmanen

Published 24 Feb 2022

Related work by Taleb (2001), Kahneman (2011), and Mauboussin (2012) highlights the difficulty of disentangling luck versus skill, as well as the common tendency to underestimate the role of luck in outcomes. 3 For example, Warren Buffett's track record is about long-run success, not about implausible short-run consistency. Exceptions to this rule typically involve return smoothing (which conceal true economic fluctuations in private asset funds) or effective market-making gains (high-frequency liquidity provision strategies are partly behind the success of Jim Simons' most famous fund, Medallion, which is anyway closed to outside investors). 4 This is why I could not publish a manuscript “Patience,” now in Chapter 9. It would have sounded too self-serving and outright irritating to some suffering investors. So please don't think I consider patience easy. It is fair to ask underperforming managers if a systematic strategy is broken or a discretionary manager has lost her touch.

In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest

by

Andrew W. Lo

and

Stephen R. Foerster

Published 16 Aug 2021

But where would that have left other investors, ones who weren’t so fortunate to have Buffett as their money manager? Now imagine if Buffett were to approach Markowitz, asking “What could you do to help me?” Markowitz’s response would be “Here is a framework and an approach for portfolio management.” We readily acknowledge the investment success of Buffett, John Templeton, Peter Lynch, David Shaw, Jim Simons, George Soros, and many other great investors whose styles and approaches to investment aren’t easily replicated. However, the academic financial research by Markowitz as well as his fellow Nobel laureates such as James Tobin, Paul Samuelson, Bill Sharpe, Myron Scholes, Bob Merton, Gene Fama, and Bob Shiller and by other exceptional researchers has created a framework and repeatable process for investors that has led to the democratization of investment management.

Antifragile: Things That Gain From Disorder

by

Nassim Nicholas Taleb

Published 27 Nov 2012

Now, the more asymmetries there are between the something and the function of something, then the more difference there is between the two. They may end up having nothing to do with each other. This seems trivial, but there are big-time implications. As usual science—not “social” science, but smart science—gets it. Someone who escaped the conflation problem is Jim Simons, the great mathematician who made a fortune building a huge machine to transact across markets. It replicates the buying and selling methods of these sub–blue collar people and has more statistical significance than anyone on planet Earth. He claims to never hire economists and finance people, just physicists and mathematicians, those involved in pattern recognition accessing the internal logic of things, without theorizing.

Area 51: An Uncensored History of America's Top Secret Military Base

by

Annie Jacobsen

Published 16 May 2011

Munir Redfa’s MiG had been nicknamed the doughnut because the jet fighter’s nose had a round opening in it, like a doughnut’s. It was the first advanced Soviet fighter jet ever to set its wheels down on U.S. soil. Colonel Slater, overseeing Black Shield in Kadena at the time, remembers getting a call in the middle of the night from one of his staff, Jim Simon. “Simon called me up all excited and said, ‘Slater, you are not going to believe this!’ He told me about the MiG. How it landed at [Area] 51 in the middle of the night, hidden inside a cargo plane. How it was accompanied by someone from a foreign government. Simon couldn’t get over it and I couldn’t wait to see it,” Slater remembers.

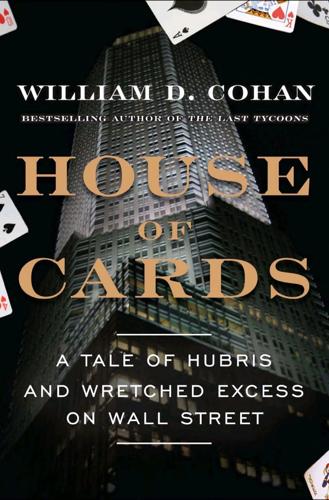

House of Cards: A Tale of Hubris and Wretched Excess on Wall Street

by

William D. Cohan

Published 15 Nov 2009

We were putting out fires every day, all day every day, for firms that wouldn't take assignments, or wouldn't take our name in the foreign exchange markets, or wherever, either localized within departments or at the corporate level. I'd have done the same thing.” At least two major hedge funds began pulling their cash from the firm. “The prime brokerage withdrawals began in earnest that Tuesday night,” Boyd explained. “I think the two big funds that kicked it all off were Renaissance Technologies—Jim Simons's $30 billion fund. I had two or three people tell me that he pulled, and I think he had $20 billion [at Bear]—and I think Highbridge did, too.” (Since September 2004, JPMorgan Chase has controlled Highbridge Capital Management, a hedge fund with around $35 billion in capital.) To be sure, the cash was theirs and they were entitled to it at any moment, and this cash was not to be confused with Bear's own corporate cash, which was in a separate, segregated account.