Goddess of the Market: Ayn Rand and the American Right

by

Jennifer Burns

Published 18 Oct 2009

Nathaniel Branden, Judgment Day: My Years with Ayn Rand (Boston: Houghton Mifflin, 1989), 263. 26. Ibid., 264. 27. Murray Rothbard to AR, October 3, 1957, Letters 1957, July–Dec, Rothbard Papers, Ludwig von Mises Institute. 28. Murray Rothbard to Kenneth S. Templeton, November 18, 1957, Letters 1957, July–Dec, Rothbard Papers. 29. Murray Rothbard to “Mom and Pop,” Friday afternoon 5:30, Rothbard Papers. 30. Details are taken from an interview with Robert Hessen, December 7, 2007; Murray Rothbard to “Mom and Pop,” July 23, 1958, Wed night 8:30 pm, Rothbard Papers. The paper was eventually published. Murray N.

…

Helmut Schoeck and James W. Wiggins (New York: D. Van Nostrand, 1960), 159–180. 31. Murray Rothbard to “Mom and Pop,” Friday afternoon, 5:30, Rothbard Papers; Murray Rothbard to Whittaker Chambers, August 25, 1958, Letters 1958 Jul–Dec, Rothbard Papers. This episode is also described in Justin Raimondo,An Enemy of the State: The Life of Murray N. Rothbard (Amherst, NY: Prometheus Books, 2000); Murray Rothbard, “Mozart Was a Red,” available at www.lewrockwell.com/rothbard/mozart.html [February 19, 2009]; Murray Rothbard, “The Sociology of the Ayn Rand Cult,” available at www.lewrockwell.com/rothbard/rothbard23.html [February 28, 2009]. 32.

…

During this time the libertarian-inflected law and economics movement, an outgrowth of the Chicago School, made inroads at several important law schools.65 In 1975 libertarians won another coveted prize when Harvard Professor Robert Nozick was awarded the National Book Award for Anarchy, State, and Utopia, a philosophic defense of the limited state. Nozick had been introduced to libertarianism through Murray Rothbard and cited both Rothbard and Rand in his pathbreaking book. Typically understood as a response to the egalitarianism of his Harvard colleague John Rawls, Anarchy, State, and Utopia must also be recognized as the fullest intellectual flowering of the libertarian subculture. Even while attacking the argument Rawls had propounded in A Theory of Justice, Nozick was equally concerned with responding to Murray Rothbard and the ongoing minarchist/anarchist debate. He intended to establish that a state could be compatible with “solid libertarian moral principles.”

Cryptoeconomics: Fundamental Principles of Bitcoin

by

Eric Voskuil

,

James Chiang

and

Amir Taaki

Published 28 Feb 2020

Labor is the process of consumption to produce an economic good (production). Leisure is the process of consumption that does not produce an economic good. Consumption without utility is the process of waste [652] . According to Murray Rothbard [653] , in his Man, Economy and State [654] : labor always involves the forgoing of leisure, a desirable good Murray Rothbard: Man Economy and State This subtle error implies that both labor and leisure are economic goods. Yet only actions create or consume goods [655] . Labor (production of economic goods) and leisure (production of non-economic goods) are human actions that create and consume goods over time.

…

Rothbard [237] makes this “subtle” error in What Has Government Done to Our Money [238] , one that continues to be perpetuated. The quality of work will decline in an inflation for a more subtle reason: people become enamored of “get-rich-quick” schemes, seemingly within their grasp in an era of ever-rising prices, and often scorn sober effort. Murray Rothbard: What has Government Done to Our Money It is assumed, certainly by Rothbard, that people always prefer to get rich sooner than later, as implied by the axiom of time preference. And as shown by the Fisher Hypothesis [239] , to the extent that price inflation is predictable it is offset in the real interest rate [240] .

…

As Rothbard himself elaborates in his significantly more rigorous Man Economy and State [241] , the form of the tax is economically irrelevant. For all these reasons, the goal of uniformity of taxation is an impossible one. It is not simply difficult to achieve in practice; it is conceptually impossible and self-contradictory. Murray Rothbard: Man Economy and State Therefore it cannot even be shown that seigniorage itself makes those taxed poorer than the taxes it presumably replaces. Only a net increase in tax implies a reduction in wealth. Reservation Principle The term “reserve ” [242] refers to a hoard of capital, as distinct from that portion of savings which is invested .

The Bitcoin Standard: The Decentralized Alternative to Central Banking

by

Saifedean Ammous

Published 23 Mar 2018

Reading Hayek's Monetary Theory and the Trade Cycle, from 1933, or Rothbard's America's Great Depression, from 1963, is sufficient. 9 Ludwig von Mises, Human Action, p. 560. 10 Friedrich Hayek, A Tiger by the Tail, p. 126. 11 A highly recommended historical account of the disastrous and yet grimly hilarious consequences of price controls across history is Forty Centuries of Price and Wage Controls: How Not to Fight Inflation, by Robert Schuettinger and Eamonn Butler. 12 Source: Federal Reserve Economic Data, available at https://fred.stlouisfed.org 13 See Table 10 on p. 206 of the Friedman and Schwartz book. 14 Murray Rothbard, America's Great Depression, 5th ed., p. 186. 15 An excellent detailed treatment of this depression is found in James Grant's book, The Forgotten Depression: 1921: The Crash That Cured Itself (Simon & Schuster, 2014). 16 Murray Rothbard, America's Great Depression. 17 “Fisher Sees Stocks Permanently High,” New York Times, October 16, 1929, p. 8. 18 See Murray Rothbard, Economic Depressions: Their Cause and Cure (2009). 19 Friedrich Hayek, Denationalization of Money (1976). 20 Bank of International Settlements (2016), Triennial Central Bank Survey.

…

Rothbard, Economic Depressions: Their Cause and Cure (Ludwig von Mises Institute, 2009). 12 Human Development Report 2005 (New York: United Nations Development Programme, 2005). 13 Source: United Nations Development Programme's Human Development Report (2005). 14 Jacques Barzun, From Dawn to Decadence. 15 Élie Halévy and May Wallas. “The Age of Tyrannies,” Economica, New Series, vol. 8, no. 29 (February 1941): 77–93. 16 Murray Rothbard, “The End of Socialism and the Calculation Debate Revisited,” The Review of Austrian Economics, vol. 5, no. 2 (1991). 17 J. M. Keynes, “The End of Laissez‐Faire,” in Essays in Persuasion, pp. 272–295. 18 Murray Rothbard, “A Conversation with Murray Rothbard,” Austrian Economics Newsletter, vol. 11, no. 2 (Summer 1990). 19 John Kenneth Galbraith, The Great Crash 1929 (Boston, Ma: Houghton Mifflin Harcourt, 1997), p. 133. 20 If for some reason you haven't already, you really should read Nassim Nicholas Taleb's works on this: Fooled by Randomness, The Black Swan, Antifragility, and Skin in the Game. 21 For more on this topic, see James M.

…

Had they admitted to their people the magnitude of the devaluation that took place to fight the war, and re‐pegged their currencies to gold at new rates, there would have probably been a recessionary crash, after which the economy would have recovered on a sound monetary basis. A better treatment of this episode, and its horrific aftermath, can be found in Murray Rothbard's America's Great Depression. As Britain's gold reserves were leaving its shores to places where they were better valued, the chief of the Bank of England, Sir Montagu Norman, leaned heavily on his French, German, and American counterparts to increase the money supply in their countries, devaluing their paper currencies in the hope that it would stem the flow of gold away from England.

Ayn Rand Cult

by

Jeff Walker

Published 30 Dec 1998

I interviewed the following people in person: Michael Berliner, Allan Blumenthal, Joan Blumenthal, Barbara Branden, Nathaniel Branden, Roy Childs, Albert Ellis, Antony Flew, Mary Gaitskill, Allan Gotthelf, Hank Holzer, Erika Holzer, John Hospers, David Kelley, Paul Kurtz, Ronald Merrill, William O’Neill, Leonard Peikoff, John Ridpath, Robert Sheaffer, Kay Nolte Smith, Philip Smith, and Joan Kennedy Taylor. By phone I talked with Edith Efron, Leisha Gullison, Virginia L. L. Hamel, Robert Hessen, Ralph Raico, and Murray Rothbard. I conducted most of these interviews in 1991–92, and they were used in preparing the two-hour CBC program Ideas: The Legacy of Ayn Rand (1992), which was until recently available in the U.S. in tape cassette form. I thank the Canadian Broadcasting Corporation for permitting me to draw upon those interviews in preparing the present book.

…

Leonard Peikoff is introduced to Ayn Rand by Nathaniel Branden. 1951–1952 Rand’s inner circle, ‘the Collective’, takes shape. 1953 Nathaniel Branden weds Barbara Weidman. 1954 Rand begins a platonic ‘romance’ with Nathaniel Branden. 1955 The Rand-Branden romance becomes a full-fledged sexual affair. 1957 Atlas Shrugged published. 1958 What will soon become the Nathaniel Branden Institute (NBI) begins, as Branden initiates lectures on Rand’s philosophy. Murray Rothbard and his Cercle Bastiat briefly intersect with Rand’s inner circle. 1960–1962 John Hospers has many philosophical discussions with Rand. 1962 The Objectivist Newsletter begins publication. 1962 John Hospers is excommunicated by Rand. Who Is Ayn Rand? by Nathaniel and Barbara Branden published. 1964 April, Rand pushes Nathan to resume their affair, she at age 59, he at 34.

…

The concept took off beyond Branden’s imagination. By the mid-1960s, says Joan Kennedy Taylor, “The whole Nathaniel Branden Institute network was very powerful.” Even on the west coast there were people “listening to taped lectures, writing letters to people back east, having Objectivist celebrities come by and visit their group.” Murray Rothbard recollected that any town’s NBI representative “was generally the most robotic and faithful Randian in his particular area, and so attempts were made . . . to duplicate the atmosphere of awe and obedience pervading the mother section in New York.” A magazine writer of that time, Dora Jane Hamblin, was not impressed by what she saw at NBI.

The Marginal Revolutionaries: How Austrian Economists Fought the War of Ideas

by

Janek Wasserman

Published 23 Sep 2019

To comprehend our shape-shifting subject, we have to explore the school’s evolving composition, intellectual interests, and institutional formations across time.7 A number of problems crop up when trying to reassemble the Austrian School in its multiplicity and multifariousness. First there is a membership question. Present-day US “Austrians” like Ron Paul identify Austrianism with Mises, Murray Rothbard, and, to a lesser extent, Hayek. This definition offers little in the way of explaining what made the Austrians a school, especially in Austria. The historian Tony Judt does little better, associating the tradition with four figures: Hayek, Popper, Mises, and Schumpeter. This is also a curious assemblage.

…

Ironically from the right and left, respectively, Glenn Beck and Tony Judt identify the Austrian School primarily with Hayek’s thesis in Road that central planning necessarily leads to “authoritarian repression and ultimately fascism.” Consequently free-market society is the antidote to this perilous road. Ron Paul, following Murray Rothbard, reduced the Austrian tradition down to a few principles: a subjective theory of value; marginal utility; time preference (humans value present goods more highly than future goods); anti-interventionism and antistatism; laissez-faire. In Hayek’s more sophisticated conceptualization, he identified two major strains of the school, one following Menger and Böhm and another trailing Wieser.

…

The Greaveses would be the key popularizers of Misesian economics in the 1960s and 1970s. Human Action also inspired the conservative Sun Oil magnate J. Howard Pew to establish a libertarian journal, the Freeman, in 1950. Human Action attracted a couple of important libertarian converts to Mises’s economics, Murray Rothbard and Ayn Rand. Finally, it increased Mises’s profile at NYU and the reputation of his flagging seminar. This drew the most important figure of the subsequent academic revival of Austrian economics into Mises’s orbit, Israel Kirzner.36 Whereas Mises’s fellow Austrians increasingly looked beyond the confines of economics for inspiration and developed social theories incorporating noneconomic considerations, Mises based his approach on a single, a priori principle: the action axiom.

The Politics of Bitcoin: Software as Right-Wing Extremism

by

David Golumbia

Published 25 Sep 2016

Their advocates make it sound like, and may often believe that, cyberlibertarian commitments are about limiting power, but this is only true so long as we construe “government” as equivalent with “power,” and “the internet” as being oppositional to power, rather than, at least in significant part, being strongly aligned with it. The most direct way to arrive at this perspective is to accept the definition of government developed by the far right, especially anarcho-capitalist theorists like Murray Rothbard and David Friedman, and echoed by politicians like Ronald Reagan and Margaret Thatcher. According to this view, “government” is inherently totalitarian and tyrannical; indeed, “government” and “tyranny” are essentially synonyms. Cyberlibertarian doctrine did not develop in a vacuum. It fits into, and at best does nothing to resist, the profound rightward drift evident in so much of contemporary politics.

…

Rather than a balance of powers and regular elections to curb the inherent possibility of abuse of power, the cypherpunks and crypto-anarchists accept, often without appearing even to realize it, the far-right, libertarian/anarcho-capitalist definition of government that extends from the German social theorist Max Weber (who famously and tendentiously defined the state as a “monopoly of the legitimate use of physical force within a given territory”; see Weber 1919, 33; see also Giddens 1985 for a thorough critique of Weber’s definition) to Ronald Reagan’s inaugural address of 1981, in which he famously claimed that “government is not the solution to our problem; government is the problem.” In Why Government Is the Problem (1993), Milton Friedman, a key player in the creation of neoliberal economic doctrine, makes the same case at greater length. The clearest articulation of these views is found in the work of arch right-wing thinker and Cato Foundation cofounder Murray Rothbard. In an essay titled “Anatomy of the State,” first published in the 1974 volume Egalitarianism as a Revolt against Nature, Rothbard abruptly dismisses with almost the entirety of political theory prior to Hayek, while taking Hayek even farther than he was willing to go, at least in print. Arguably the position Rothbard develops is among the farthest to the political right offered in Western discourse, with the exception of those who explicitly identify with fascism: “We must, therefore, emphasize that ‘we’ are not the government; the government is not ‘us.’

…

This same line of thought is found in nearly identical form in the conspiratorial propaganda produced today by the Patriot, militia, and Tea Party movements in the United States (Flanders 2010; Lepore 2010; Skocpol and Williamson 2013), and by prominent conspiratorialists like Alex Jones, Henry Makow, and David Icke. In addition to Mullins, this view is promulgated in the writings of Martin Larson (1975), A. Ralph Epperson (1985), G. Edward Griffin (whose 1998 Creature from Jekyll Island includes an approving blurb from Ron Paul), and Murray Rothbard (2002) himself—as well as writers like Ellen Hodgson Brown (2008), who presents analyses nearly identical to those of Mullins and others without some of their explicitly right-wing trappings; and Anthony Sutton, a wide-ranging conspiratorialist whose work mixes well-documented history with elaborate speculation, and whose writings on finance and the Federal Reserve (especially Sutton 1995) repeat many of the same “facts” and inferences found in Mullins and others.

Crack-Up Capitalism: Market Radicals and the Dream of a World Without Democracy

by

Quinn Slobodian

Published 4 Apr 2023

This right-wing alliance dreamed of Bantustans of choice—Grand Apartheid from below. Though their immediate goal failed, their vision of laissez-faire segregation lived on. For them, secession was the path to a world that was socially divided but economically integrated—separate but global. 1. The most important figure in the secessionist alliance was Murray Rothbard. Born in the Bronx in 1926, he came up through the world of neoliberal think tanks, becoming a member of the Mont Pelerin Society in the 1950s.4 Throughout his career, he developed a particularly radical version of libertarianism known as anarcho-capitalism. He had no tolerance for government of any kind, seeing states as “organized banditry” and taxation as “theft on a gigantic, and unchecked, scale.”5 In his ideal world, government would be eliminated altogether.

…

Milton was a skeptic of public education but he believed that government was necessary for a range of other functions, from law and order to property rights, printing and controlling money, and even, at times, fighting monopoly and punishing polluters.17 As he often insisted, he was no anarchist. His son, by contrast, was. Two years out from his physics doctorate, David published a manifesto titled The Machinery of Freedom: Guide to a Radical Capitalism.18 The book staked out an extreme position, joining Murray Rothbard’s call for anarcho-capitalism, defined as a system in which all state services—from roads to courts and the police—would be privatized. Public law would cease to exist altogether, along with any semblance of democracy. From the outset, anarcho-capitalism had the quality of a thought experiment.

…

They bought a second home in Sea Ranch and a primary residence in Royal Towers, the tallest building on San Francisco’s Russian Hill, rising twenty-nine stories above a thicket of bay-windowed terrace houses. At the base of the hill was the Cato Institute, founded by Charles Koch, Ed Crane, and Murray Rothbard. Steps away were the offices of Inquiry and Libertarian Review.44 The Friedmans were often joined for dinner by their neighbor Antony Fisher—former chicken magnate, failed sea turtle rancher, and think tank impresario. Fisher set up the Pacific Research Institute in 1979 and the Atlas Foundation in 1981, filling out the roster of what would become highly influential pushers of privatization policies in the Reagan years.45 It was PRI that funded Bruce Benson’s work on the Middle Ages.

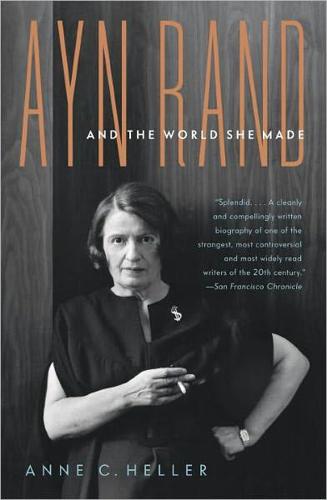

Ayn Rand and the World She Made

by

Anne C. Heller

Published 27 Oct 2009

called themselves the Circle Bastiat: The group was named after Claude Frédéric Bastiat, a nineteenth-century French political economist. The date was set for a Saturday evening: The meetings took place on July 10 and July 17, 1954, according to George Reisman (“Reisman on Murray Rothbard, Ludwig von Mises, and Ayn Rand”). arrayed on the sofa: “Reisman on Murray Rothbard, Ludwig von Mises, and Ayn Rand.” “the voice of Judgment”: “Reisman on Murray Rothbard, Ludwig von Mises, and Ayn Rand.” “While I agreed”: Letter from MR to Richard Corneulle, August 11, 1954, quoted in An Enemy of the State, p. 110. “an enhanced sense of male power”: JD, p. 140. Heretofore apprehensive in his relationships: Author interview with BB, July 1, 2008.

…

Friedman, at that time a self-declared Keynesian, would become famous as an advocate of free markets, but he and AR continued to be at odds (Murray Rothbard, “Milton Friedman Unraveled,” 1971, reprinted in Journal of Libertarian Studies, Fall 2002). At the height of Friedman’s fame in 1979, they would appear on the same Phil Donahue show in May 1980. Frank Meyer and Willie Schlamm: Interview with Bettina Bien Greaves, January 6, 2007. Mises, as he was known: Though LVM would ordinarily be referred to as von Mises, his American admirers called him Mises. didn’t see eye to eye: George Reisman, “Reisman on Murray Rothbard, Ludwig von Mises, and Ayn Rand,” speech presented to the Ludwig von Mises Institute.

…

In this small world, other friends of Hazlitt and admirers of Mises were drawn into her circle. In the Austrian economist’s weekly graduate-level seminar at NYU, academics, businessmen, and activists, including Cornuelle, came to listen and ask questions; many stayed in the seminar for years or even decades. One longtime student and friend of Mises was Murray Rothbard, a quick-witted twenty-eight-year-old intellectual prankster and self-styled “anarcho-capitalist.” The Cornuelle brothers had brought Rothbard to visit Rand in 1952, and Rothbard found the experience of paying court to her both fascinating and depressing. In 1954 he tried again. As the leader of a high-octane clique of young Mises students who called themselves the Circle Bastiat, he bowed to group pressure to provide an introduction to her.

How Capitalism Saved America: The Untold History of Our Country, From the Pilgrims to the Present

by

Thomas J. Dilorenzo

Published 9 Aug 2004

For all that anticapitalist intellectuals embrace socialism, socialist governments have always failed to effect material equality, because egalitarianism, or government-enforced material equality, is nothing less than a futile revolt against human nature. Worse, even while these intellectuals condemn the supposed evils of capitalism, they refuse to acknowledge what the twentieth century’s many experiments with socialism proved: as Murray Rothbard has put it, “An egalitarian society can only hope to achieve its goals by totalitarian methods of coercion.”4 A second reason why intellectuals tend to be enamored with socialism and government planning of economies, according to Hayek, is that they believe, falsely, that engineering techniques, which have created such great improvements in the human condition, can apply to “social engineering.”

…

They finally prevailed when, during the War Between the States, all of these policies were finally put into place.46 The election of Abraham Lincoln was, among other things, the triumph of mercantilism in America. The American economy has featured what might be called creeping mercantilism ever since. Anticapitalists of all varieties have always praised mercantilism. As Murray Rothbard wrote, government intervention–minded Keynesian economists “hail mercantilists as prefiguring their own economic insights; Marxists, constitutionally unable to distinguish between free enterprise and special privilege, hail mercantilism as a ‘progressive’ step in the historical development of capitalism; socialists and interventionists salute mercantilism as anticipating modern state-building and central planning.”47 Today, many corporations support interventionist or anticapitalist policies like trade protectionism or corporate welfare because they hope to benefit from the policies at everyone else’s expense.

…

Hoover also advocated “work sharing,” or pressuring businesses to reduce the number of hours per worker so that more workers could remain on the job. This just spread unemployment around, however. The only thing that reduces unemployment is increased production (which increases the derived demand for labor). As economist Murray Rothbard explained, Hoover was pursuing the agenda of organized labor. “The point is that unions did not have the power to enforce wage floors [i.e., above-market wages] throughout industry . . . and so the federal government was proposing to do it for them.”21 Satisfied that his strong-arm tactics had worked, Hoover announced to Congress on December 3, 1929, “I have instituted . . . systematic . . . cooperation with business . . . that wages and therefore earning power shall not be reduced.”22 Indeed, all of the leading industrialists had agreed to maintain wages, expand production, and adopt Hoover’s socialistic “work sharing” programs.

The New Depression: The Breakdown of the Paper Money Economy

by

Richard Duncan

Published 2 Apr 2012

The Credit Cycle The Austrian economists provided the best explanation for the business cycle, the alternating boom and bust pattern that has characterized the economic process in capitalist economies since the beginning of the Industrial Revolution. They identified credit expansion as the catalyst. This theory was expounded over several thousand pages by Ludwig von Mises in The Theory of Money and Credit (1912) and Human Action (Yale University, 1949). Murray Rothbard summed it up nicely in one paragraph in his America’s Great Depression (1963) as follows: Thus, bank credit expansion sets into motion the business cycle in all its phases: the inflationary boom, marked by expansion of the money supply and by malinvestment; the crisis, which arrives when credit expansion ceases and malinvestments become evident; and the depression recovery, the necessary adjustment process by which the economy returns to the most efficient ways of satisfying consumer desires.2 The two most important facts to understand about the global economic crisis that began in 2008 and the government’s policy response to it are: (1) the Austrian cycle theory is correct; and (2) the government’s policy is to prevent the credit expansion from ever ceasing.

…

The War Industries Board, under the chairmanship of Bernard Baruch, was set up to coordinate production for the war. Its powers included resource allocation, centralized purchasing, and price fixing. “More than any other single period, World War I was the critical watershed for the American business system,” Murray Rothbard wrote in 1972. “It was a ‘war collectivism,’ a totally planned economy run largely by big-business interest through the instrumentality of the central government, which served as the model, the precedent, and the inspiration for state corporate capitalism for the remainder of the twentieth century.”2 The government debt and the fiat money created during the war resulted in the tremendous economic boom of the 1920s.

…

It is necessary to understand how great the role of the government has been in the economy and how far removed our economic system is now from laissez-faire capitalism in order to understand the nature of this crisis and the options that are available to resolve it. Cutting government spending and allowing market forces to reestablish a market-determined equilibrium are not among those options. Reallocating government spending away from consumption and toward investment is. Murray Rothbard (1926 to 1995), a student and friend of Ludwig von Mises and an impressive economist in his own right, believed that the Great Depression would have ended much sooner had the government not interfered and simply allowed the economy to adjust by itself. He described what he thought would have happened in that case in his book, America’s Great Depression: The laissez-faire method would have permitted the banks of the nation to close—as they probably would have done without governmental intervention.

The Dollar Meltdown: Surviving the Coming Currency Crisis With Gold, Oil, and Other Unconventional Investments

by

Charles Goyette

Published 29 Oct 2009

But while the profits of the banks from market distortions are privatized, banking system losses, as we are wit nessing, are socialized. More alarming is the role of the central bank in funding wars not popular enough to be sustained by direct taxation. This function has been on display since the Federal Reserve Act of 1913 was first passed. Economist Murray Rothbard pointed out that the new act, which took effect in November 1914, coincided with the outbreak of World War I, so its inflationary capacity was put to the test right away:. . . it is generally agreed that it was only the new system that permitted the U.S. to enter the war and to finance both its own war effort, and massive loans to the allies; roughly, the Fed doubled the money supply of the U.S. during the war and prices doubled in consequence.

…

Hayek’s work described the way in which a central economic authority’s planning put a government at war with its own citizens, how it must become increasingly coercive in order to prevail, and how the coercive machinery of the central plan, once erected, can be employed to any coercive end. Violation of price controls was a capital offense in Diocletian’s Rome and in the French Reign of Terror. But those are not the exception; price controls have been accompanied by brutality throughout history. Dr. Murray Rothbard cites more recent episodes, cases that have been widely overlooked:Why did Chiang Kai-shek “lose” China? The main reason is never mentioned. Because he engaged in runaway inflation, and then tried to suppress the results through price controls. To enforce them, he wound up shooting merchants in the public squares of Shanghai to make an example of them.

…

While in the years since I have been a stockbroker and president of a precious metals and commodity futures brokerage house, most memorable for me have been the people from whom I have learned. I have been especially fortunate to have known and discussed over dinner and into the night the issues in this book with many men of great economic wisdom such as the late Dr. Murray Rothbard and Nobel Prize winner Dr. Milton Friedman. Twenty-five years ago, hosting monetary conferences in California and Arizona, I arranged for a little-known Texas congressman who understood sound money and Austrian economics to be the keynote speaker. Even then, Ron Paul was able to speak with foresight and wisdom about what the prevailing economic policies would mean for the future.

The Classical School

by

Callum Williams

Published 19 May 2020

Henry Higgs, a founding member of the British Economic Association, argued that while “[t]here were earlier English works of great merit, such as those of Vaughan, Locke, Child, Mun, etc… Cantillon’s essay is, more emphatically than any other single work, ‘the Cradle of Political Economy’.” That “cradle” quotation is, in turn, taken from William Stanley Jevons (see Chapter 17), who was obsessed with Cantillon. Murray Rothbard, from a libertarian perspective, calls Cantillon “the founding father of modern economics”. Does Cantillon deserve such adulation? To be sure, he seems to be thinking about the economy as a system: “If I spend money,” he appears to be asking himself, “where does it go, and then when it is spent again, where does it go next?”

…

As Friedrich Hayek puts it, Cantillon uses “the method of isolating abstraction… with true virtuosity… He repeatedly excludes the effects of accidental circumstances in order to avoid overcomplicating an already complex problem.” As we will see in Chapter 9 on David Ricardo, this methodology became hugely influential. Thinking in ceteris paribus terms makes it easier to discern cause and effect. Under the influence of Cantillon, economics became a more neutral, scientific discipline. Murray Rothbard argues that Cantillon’s immediate predecessors “were special pleaders whose titbits of analysis were pressed into the service of political ends, either in subsidising particular interests or in building up the power of the state”. Cantillon played a different role. He saw himself as an impartial observer of the economy.

…

Only work that is “socially necessary”–that is, has some social value–truly “counts” towards value. But this undermines the labour theory of value, rather than strengthening it. It turns out that Marx believes that there is a subjective component to value–it is in part determined by what people demand. Murray Rothbard generally takes an extremist approach to economic history but this time he is on the money: “This is a cop out, and evades the issue by begging the entire question… what is ‘socially necessary’? Whatever the market decides.” Philip Wicksteed, writing in the 1880s, argues that the “socially necessary” qualification “in reality surrenders the whole of the previous analysis”.

Bit by Bit: How P2P Is Freeing the World

by

Jeffrey Tucker

Published 7 Jan 2015

The world is unfolding before our eyes at a breathtaking pace of advancement. So fast is this all happening that this book will be obsolete in 24 months. It is a snapshot in time and nothing more. This delights me mostly because no one really seemed to expect it, though many hoped for it. I often think of my friend Murray Rothbard (1926–1995) who dreamed of a world in which individuals and their preferred associations were the primary social and political unit. Now that this world is dawning and shows promise, few seem to understand its significance or trajectory. It’s confirmation of two mighty truths: the world cannot finally be controlled and human beings will not forever live in cages.

…

Money has gotten worse rather than better—and this evolution is different from that of private commodities, like phones, cars, and computers. Money can indeed be a product of private enterprise. The right reform plan is to just forget about the government’s system and move onward to something more wonderful. In the competition for money and payment systems, the market system will win. Murray Rothbard (1926–1995). The first I ever heard of private coinage was from Rothbard’s 1963 book, What Has Government Done to Our Money? The idea astonished me, though, 29 again, the notion seems not entirely outlandish now. New research has emerged that has shown that private currency is a huge part of modern history, from England in the Industrial Revolution to the American 19th century.

…

Think about the latest apps from among the millions available that you might have downloaded for your smartphone or your tablet computer. What is the nationality of the maker? You don’t know and there is no reason to care. 88 In a P2P world, we are all citizens — consumers and producers — of the world. Economic relationships delineated by arbitrary lines on a map, as drawn by politicians, just don’t matter as much. Murray Rothbard wrote that after industrialization, humankind would never tolerate going back to a world of feudalism, poverty, and dependency. He was right, despite fits and starts on the way toward the gradually emerging anarchist world order. What he said is even more true of the P2P world. We wouldn’t tolerate going back 15 years ago before file sharing was invented.

End the Fed

by

Ron Paul

Published 5 Feb 2011

The appearance of wealth by borrowing and inflation always leads to heartache and suffering. An opportunity has arrived for our “sound social and economic theories” to be made available and acceptable to the majority. Of all the Austrian economic greats of the twentieth century, I got to know Murray Rothbard the best. During my first tour of duty in Congress (1976–1984), while Lew Rock-well, founder of the Mises Institute, was serving as my chief of staff, we contacted Murray and invited him to Washington in 1979 for a visit. On his first trip, as he watched our office in action, I recall him saying he was amazed that a member of Congress actually made a determined effort to understand the details of each piece of legislation in the context of the Constitution.

…

Surviving the 1970s gave the dollar a reprieve and set the stage for one giant financial bubble to be formed over the next twenty-seven years to get us to today. If, as a result of the Gold Commission, we had returned to our senses in 1981, the problems and grave dangers we now face could have been averted. Murray Rothbard argued in his testimony before the commission that it was not the gold standard that caused the Depression of the 1930s; rather, it was the misuse of the gold standard that led up to it. In the closing part of his statement, he urged that if gold were ever to return as a standard, it must be a gold coin standard where citizens have the right to have their paper currency redeemed in gold coins.

…

As for his claim that central bankers were behaving as if on a gold standard, the record of the 1990s indicates otherwise, and the result is the catastrophe that began in 2008. The message Greenspan was delivering in 1966 was quite different from his message and policy as Federal Reserve Board chairman. In one private conversation, he did acknowledge his association with Murray Rothbard but volunteered no value judgment. Maybe Rothbard had been a favorable influence on Greenspan, since it was during that time that the excellent article on gold and freedom was written. In a way, it’s pretty astounding. After inflating the currency endlessly for every correction and every political crisis during his tenure, he claimed that he recognized the danger of how excessive credit of liquidity creates inflation.

Inflated: How Money and Debt Built the American Dream

by

R. Christopher Whalen

Published 7 Dec 2010

My political mentor John Carbaugh was one of the most effective Washington political operatives of his generation and supported some of the research reflected in this book. Robert Novak called John Carbaugh his best source ever. He was my good friend. Martin Mayer, Alex Pollock, Alan Meltzer, Bill Greider, Anna Schwartz, Bill Janeway, Paul Volcker, Ed Kane, George Kaufman, Murray Rothbard, Robert Higgs, F.A. Hayek, Roger Kubarych, and Nouriel Roubini are a few of my personal influences when it comes to matters of economics and money. Some of these people I’ve known for decades, others more recently or through their writings, but all have shaped my understanding of money and debt.

…

By embracing legal tender laws, Lincoln was adopting one of the most economically oppressive aspects of European society and one millions of his fellow citizens had sought to escape through immigration to the New World. For Lincoln and many future American presidents, the end justified such means.7 Historian Murray Rothbard wrote in A History of Money and Banking in the United States before the Twentieth Century: The Civil War, in short, ended the separation of the federal government from banking, and brought the two institutions together in an increasingly close and permanent symbiosis. In that way, the Republican Party, which inherited the Whig admiration for paper money and governmental control and sponsorship of inflationary banking, was able to implant the soft-money tradition permanently in the American System.8 The Civil War led to a vast increase in federal spending, from just $66 million in total federal outlays in 1861 to $1.3 billion four years later, at a time when federal tax revenues were falling.

…

Later, however, sitting as Chief Justice of the Supreme Court, he would declare the notes unconstitutional.25 During and after the Civil War, the political and legal battle raged regarding the legality of the federal government issuing greenbacks and whether such emergency currency could be used, for example, for the payment of state taxes. Murray Rothbard notes that in a large number of state court decisions on the issue of whether paper money was legal tender and thus sufficient to pay all debts, the Republican justices upheld the constitutionality of the greenbacks, but Democrats generally held that fiat money was unconstitutional. The question eventually reached the Supreme Court in Hepburn v.

Walk Away

by

Douglas E. French

Published 1 Mar 2011

But how could it possibly be that corporate entities have a duty of financial prudence while individuals have a moral duty to destroy their dignity and finances in the process of honoring a contract that lenders themselves would not honor if put in the same position? Aristotle explained that man is a rational being. Man learns what works in the world, natural laws, to achieve his desired ends—survival and prosperity. As Murray Rothbard explained in The Ethics of Liberty, “the very fact that the knowledge needed for man’s survival and progress is not innately given to him or determined by external events,” shows that man has the free will to either employ reason or not and that an act set against his life and health would objectively be called immoral.

…

That was up from 35% in 2003, and a mere 13% in 1996, according to CNNMoney.com Even Transportation Security Administration (TSA) applicants for airport screener jobs are rejected if they have more than $5,000 in overdue debt! If fewer people were able to over-lever themselves buying homes, that capital would be freed up for more productive uses—loans to businesses. A point that Murray Rothbard made frequently and that investor Doug Casey often makes today is that one of the benefits to American society if the U.S. government repudiated or defaulted on its debt would be that people would think twice about lending it more money. Politicians will waste money with impunity if the government can continually borrow.

Big Three in Economics: Adam Smith, Karl Marx, and John Maynard Keynes

by

Mark Skousen

Published 22 Dec 2006

However, The Wealth of Nations denied the basic physiocratic premise that agriculture, not manufacturing and commerce, was the source of all wealth (1965 [1776], 637-52). Richard Cantillon The other prominent influences on the Scottish economist were Richard Cantillon, Jacques Turgot, and Etienne Bonnot de Condillac. Richard Cantillon (1680-1734) is regarded by Murray Rothbard and other economic historians as the true "father of modern economics." An Irish merchant banker and adventurer who emigrated to Paris, Cantillon became involved in John Law's infamous Mississippi bubble in 1717-20, but shrewdly sold all of his shares before the financial storm hit. His independent status allowed him to write a short book on economics, Essay on the Nature of Commerce in General (published posthumously in 1755).

…

The classical economists had no answer to Marx, at least initially. And thus Marx won the day by "proving" through impeccable logic that capitalism inherently created a monstrous "class struggle" between workers, capitalists, and landlords—and the capitalists and landlords had an unfair advantage. Murray Rothbard observes, "As the nineteenth century passed its mid-mark, the deficiencies of Ricardian economics became ever more glaring. Economics itself had come to a dead end" (Rothbard 1980, 237). It was not until the work of Philip Wicksteed, the British clergyman, and Eugen von Bohm-Bawerk, the influential Austrian economist, that Marx was answered effectively, with a focus on the risk-taking and the entrepreneurial benefits the capitalists provide.

…

Friedrich Hayek, the leading anti-Keynesian in the 1930s, made the strategic error of ignoring The General Theory when it came out in 1936, a decision he later regretted. During World War II, Hayek lost interest in economics and went on to write about political philosophy in works such as The Road to Serfdom (1944) and The Constitution of Liberty (1960). Other free-market economists, such as Henry Hazlitt and Murray Rothbard, wrote largely from outside the profession and had marginal influence. How did Friedman almost single-handedly change the intellectual climate back from the Keynesian model to the neoclassical model of Adam Smith? After acquiring academic credentials, he focused on scholarly technical work, particularly empirical evidence to test the Keynesian model.

The Voice of Reason: Essays in Objectivist Thought

by

Ayn Rand

,

Leonard Peikoff

and

Peter Schwartz

Published 1 Jan 1989

If it were ever successful, it would destroy the remnants of freedom that still exist in this country far faster than any of the more explicit enemies of liberty. Libertarianism has no philosophy. To put this more accurately: it renounces the need for any intellectual basis for its beliefs. The volumes of scholarly material defending Libertarianism are self-admittedly pointless, since the true Libertarian position is that no defense is necessary. Murray Rothbard, widely viewed as the father of the movement, expresses this clearly in presenting his central argument for liberty. “Should virtuous action (however we define it) be compelled, or should it be left up to the free and voluntary choice of the individual?” he asks. And he answers: “To be virtuous in any meaningful sense, a man’s actions must be free....

…

If Libertarianism were consistent in its avowed rejection of the realm of morality, if it stopped smuggling in implicit value judgments to give its statements a deceptive veneer of coherence, it could say nothing in favor of liberty. This contempt for ideas extends far beyond the field of ethics. It is not only moral principles that Libertarianism repudiates, but all philosophic ideas. Murray Rothbard claims to hold a philosophy but predictably regards it, too, as inconsequential. He writes: As a political theory, Libertarianism is a coalition of adherents from all manner of philosophic (or nonphilosophic) positions, including emotivism, hedonism, Kantian a priorism, and many others. My own position grounds Libertarianism on a natural rights theory embedded in a wider system of Aristotelian-Lockean natural law and a realist ontology and metaphysics.

…

Libertarians do not believe that by crippling the state they are helping the cause of freedom. The dissolution of the state is an end of itself. To Libertarians, whatever harms the state is categorically good; whatever helps the state is categorically bad—regardless of the effect on human liberty. For example, when South Vietnam was conquered by North Vietnam in 1975, Murray Rothbard found it an occasion for celebration: “What is inspiring to Libertarians is to actually see the final and swift disintegration of a State.... None of [America‘s] superior might and firepower could in the end prevail against the will and determination of the mass of Vietnamese (and Cambodians) bent against seemingly impossible odds to dislodge dictatorial governments.”

Demanding the Impossible: A History of Anarchism

by

Peter Marshall

Published 2 Jan 1992

All however would oppose any centralization of power, which, as Alex Comfort has argued, leads to psychopathic leadership: ‘The greater the degree of power, and the wider the gap between governors and the governed, the stronger the appeal of office to those who are likely to abuse it, and the less the response which can be expected from the individual’.54 Even ‘anarcho-capitalists’ like Murray Rothbard assume individuals would have equal bargaining power in a market-based society. At the same time, while opposing power over others, anarchists are not necessarily averse to power over oneself in the form of self-discipline, self-management, or self-determination. Given the unequal distribution of power between the rulers and the ruled, Bookchin has borrowed the language of liberation movements and made out a case for ‘empowering’ the weaker members of society.55 And they are not merely concerned with political power in the form of the State and government, but with economic power in society and patriarchal power in the family.

…

If every person received the fruits of his own labour, the just and equal distribution of wealth would result. Although he did not call himself an anarchist, Spooner invariably traced the ills of American society to its government and argued that civil society should be organized as a voluntary association. Contemporary right-wing libertarians in the United States like Murray Rothbard and Robert Nozick have been impressed by Spooner’s arguments, but his concern with equality as well as liberty makes him a left-wing individualist anarchist. Indeed, while his starting-point is the individual, Spooner goes beyond classical liberalism in his search for a form of rough equality and a community of interests.

…

A massive non-conformist youth culture developed across the land, especially in California, New York and New England, although its libertarian rhetoric was often a disguise for a self-indulgence which never really threatened the Establishment. It petered out into street-fighting amongst the Yippies inspired by Abbie Hoffman and Jerry Rubin, and the spluttering pyrotechnics of the Weathermen. The seventies and eighties in the United States saw a resurgence of right-libertarianism, with ‘anarcho-capitalists’ like Murray Rothbard drawing inspiration from Spooner and Tucker. The Libertarian Party became in the eighties the third largest party in the country. Philosophers like Robert Paul Wolff have argued in Defence of Anarchism (1970), rejecting all political authority on grounds of the individual’s moral autonomy. Paul Feyerabend attempted an anarchist theory of knowledge in his work Against Method (1975), maintaining that historical explanations are the only feasible accounts of scientific success and that ‘anything goes’ in science.

The Government of No One: The Theory and Practice of Anarchism

by

Ruth Kinna

Published 31 Jul 2019

While it may still be possible to talk about the ‘primary colors of our moral sense’, disjuncture assumes that these are significantly diluted by social pressures to conform. Étienne de la Boétie’s The Politics of Obedience: The Discourse of Voluntary Servitude is an exemplar for this model. His 1549 treatise has been revived by Murray Rothbard and Saul Newman. Rothbard sums up its fundamental insight: ‘every tyranny must necessarily be grounded upon general popular acceptance … the bulk of the people themselves … acquiesce in their own subjection’.27 Illusion, habit, mystery, the hierarchy of privilege and propaganda combine to ensure compliance and to forestall the mass withdrawal of consent which is fatal to tyranny.

…

He left New Orleans for San Francisco, served a five-year sentence for armed robbery, converted to Islam in 1989 and returned to New Orleans before Hurricane Katrina struck. He has spent forty years participating in anti-poverty projects. On 23 November 2008 he published an essay, ‘This is Criminal’, in the San Francisco Bay View. This set out his analysis of racism and explained that ‘people are dying for no other reason than lack of organization’.11 MURRAY ROTHBARD (1926–1995) Attracted as a student at Columbia University to Austrian economics, Rothbard was an advocate of laissez-faire and individualist anarchy. Having studied with Ludwig von Mises, he became Academic Vice-President of the Mises Institute, worked at the Brooklyn Polytechnic Institute and was appointed S.

…

McKay (ed.), Direct Struggle Against Capital: A Peter Kropotkin Anthology (Edinburgh, Oakland, and Baltimore: AK Press, 2014), p. 360. [359–61]. 23 Holly Devon, ‘Defending the Collective: an Interview with Malik Rahim’, Iron Lattice, 11 April 2017, online at http://theironlattice.com/index.php/2017/04/11/defending-the-collective-an-interview-with-malik-rahim/ [last access 4 June 2018]. 24 Holly Devon, ‘Defending the Collective: an Interview with Malik Rahim’. 25 Tim Shorrock, ‘The Street Samaritans’, Mother Jones, March/April 2006, online at https://www.motherjones.com/politics/2006/03/street-samaritans-2/ [last access 4 June 2018]. 26 Neille Ilel, ‘A Healthy Dose of Anarchy’, Reason, December 2006, online at https://reason.com/archives/2006/12/11/a-healthy-dose-of-anarchy [last access 4 June 2018]. 27 Murray Rothbard, ‘The Political Thought of Étienne de la Boétie’, introduction to The Politics of Obedience: The Discourse of Voluntary Servitude by Etienne de la Boétie, trans. Harry Kurz (New York: Free Life, 1975), p. 13. 28 Rothbard, ‘The Political Thought of Étienne de la Boétie’, pp. 28–29. 29 Saul Newman, Postanarchism (Oxford: Polity, 2016), p. 128. 30 Rothbard, ‘The Political Thought of Étienne de la Boétie’, p. 29. 31 Emma Goldman, ‘The Tragedy of Woman’s Emancipation’, in Alix Kates Shulman (ed.), Red Emma Speaks (London: Wildwood House, 1979 [1914]), p. 141. 32 Angry Brigade communiqués, online at http://www.spunk.org/texts/groups/agb/sp000539.txt [last access 5 June 2018]. 33 The Invisible Committee, ‘Let’s Destitute the World’, Now, trans.

Libertarian Idea

by

Jan Narveson

Published 15 Dec 1988

At a minimum, y is some part of that person‟s body or mind; the agent in question must employ his body and/or mind to do anything, and the liberty to do it will follow automatically from the liberty to use those pieces of human equipment as that person will. Thus it is plausible to suggest that Liberty is Property, and in particular that the libertarian thesis is really the thesis that a right to our persons as our property is the sole fundamental right there is. One can do no better than to quote Murray Rothbard‟s forthright statement of this view: “in the profoundest sense there are no rights but property rights. . . . There are several senses in which this is true. In the first place, each individual, as a natural fact, is the owner of himself, the ruler of his own person. Then „human‟ rights of the person that are defended in the purely free-market society are, in effect, each man‟s property right in his own being, and from this property right stems his right to the material goods that he has produced.

…

One of its main originators is A. M. Honorssee, for example, “Property, Title, and Redistribution” from Equality and Freedom: Past, Present and Future, ed. by Carl Wellman, ARSP Archives for Philosophy of Law and Social Philosophy: Beiheft Neue Folge nr. 10 (Wiesbaden: Steiner-Verlag, 1977), pp. 107-115. 7. Murray Rothbard, Power and Market (Menlo Park, Calif.: Institute for Humane Studies, 1970), p. 76. 8. In connection with freedom of speech, see Narveson, “Rights and Utilitarianism,” in W. E. Cooper, K. Nielsen, and S. C. Patten, eds.. New Essays on John Stuart Mill and Utilitarianism, Canadian Journal of Philosophy Supplementary Vol. 5 (1979): 148; for the general thesis, see “Human Rights: Which, If Any, Are There?”

…

David Braybrooke, “Justice and Injustice in Business” in Tom Regan, ed., Just Business (New York: Random House, 1984), pp. 167-201. See esp. p. 174, where he argues that persons having extraordinary wealth are “in a position to restrict other people‟s freedom and exercise power over them, in any of a number of ways, from hiring henchmen to beat them up to influencing politicians to disregard their claims.” 3. Murray Rothbard, Power & Market (Menlo Park, Calif.: Institute for Humane Studies, 1970), p. 99. 4. Kai Nielsen, Equality and Liberty (Totowa, N.J.: Rowman & Allenheld, 1983), discusses this idea at some length, giving no apparent credit to its utter disconnection from the libertarian theory even though he takes it to be the archetypal defense of property. 1. 103 PART TWO: Foundations: Is Libertarianism Rational?

The Glass Half-Empty: Debunking the Myth of Progress in the Twenty-First Century

by

Rodrigo Aguilera

Published 10 Mar 2020

More often than not, it descends into a cherry-picked conception of these thinkers’ complex and nuanced ideas, such as ignoring their views on the role of the state in society or on the less-than-rational essence of human behavior. Through its single-minded pursuit of individual freedom and free markets, defended via unfalsifiable axiomatic argumentation (such as praxeology7), the libertarian ideology shows its true colors as a political project whose purpose is the erosion of the state. To quote Murray Rothbard, one of the most influential twentieth-century libertarians: Libertarianism does not offer a way of life; it offers liberty, so that each person is free to adopt and act upon his own values and moral principles. Libertarians agree with Lord Acton that “liberty is the highest political end” — not necessarily the highest end on everyone’s personal scale of values.8 It should not come as a surprise that the New Optimist progress narrative has been wholly embraced and is vigorously being promoted by some of the most influential libertarian outlets.

…

Forty years from an outbreak of a pandemic to treatment and, hopefully, eradication is but the blink of an eye.9 The website is the brainchild of the Cato Institute, one of the world’s leading libertarian think tanks which was originally founded in the 1970s by a libertarian politician (Ed Crane), a libertarian economist (Murray Rothbard), and a libertarian entrepreneur (Charles Koch). Its current shareholders are Charles Koch and his (now deceased) brother David, the second richest siblings in the world behind Walmart’s Walton Family (worth $100 billion together10). The Koch brothers are well known for their libertarian activism and lobbying, which includes financing a plethora of right-wing think tanks and political organizations as well as the Tea Party movement when it sprung up in 2009.

…

, Adam Smith Institute, 15 Nov. 2011, https://www.adamsmith.org/blog/economics/milton-friedman-libertarian-or-statist 6 Ledger, R., Neoliberal Thought and Thatcherism: ‘A Transition from Here to There?’ (Routledge, 1998) 7 Praxeology calls itself “the science of human action” but in reality it is simply a series of axioms that attempt to justify basic free market principles and avoid relying on empirical evidence. Among its main advocates were Ludwig von Mises and Murray Rothbard. An overview can be found in Rothbard, M.N., “Praxeology: The Methodology of Austrian Economics.”, 11 Jul. 2019, https://mises.org/library/praxeology-methodology-austrian-economics 8 Rothbard, M.N., “Myth and Truth About Libertarianism”, Mises Institute, 20 Jul. 2019, https://mises.org/library/myth-and-truth-about-libertarianism (taken from a 1979 paper) 9 Tupy, L.M., “Humanity is Winning the War on AIDS”, HumanProgress, 6 Aug. 2018, https://humanprogress.org/article.php?

The Evolution of Everything: How New Ideas Emerge

by

Matt Ridley

In their manifesto of 1649, ‘An Agreement of the Free People of England’, the four leaders of the movement, John Lilburne, Thomas Walwyn, Thomas Prince and Richard Overton demanded, from prison in the Tower of London, that politicians be restrained from raising too much tax or restricting too much trade, sentiments rarely heard on the left today: That it shall not be in their power to continue to make any Laws to abridge or hinder any person or persons, from trading or merchandising into any place beyond the Seas, where any of this Nation are free to trade. Little wonder that the Levellers have received the approbation of modern free marketeers, from Friedrich Hayek and Murray Rothbard to Hannan and Carswell. Commerce as the midwife of freedom By the end of the seventeenth century, European states had invented centralised, bureaucratic government whose chief job was to maintain order – Thomas Hobbes’s Leviathan. Then came the Glorious (English), American and French revolutions, and the idea that government should be tamed, liberated, limited and held accountable to ‘the people’.

…

The Evolution of Darwinian Liberalism. Paper to the Mont Pelerin Society June 2013. On the decline of violence, Pinker, Steven 2011. The Better Angels of Our Nature. Penguin. On medieval violence, Tuchman, Barbara 1978. A Distant Mirror. Knopf. On Lao Tzu, Blacksburg, A. 2013. Taoism and Libertarianism – From Lao Tzu to Murray Rothbard. Thehumanecondition.com. On bourgeois values, McCloskey, Deirdre N. 2006. The Bourgeois Virtues. University of Chicago Press. On Pope Francis, Tupy, Marion 2013. Is the Pope Right About the World?. Atlantic Monthly 11 December 2013. On the common law, Hutchinson, Allan C. 2005. Evolution and the Common Law.

…

Also Robert Higgs, Some basics of state domination and public submission. Blog.independent.org 27 April 2104. On Ferguson, Missouri, Paul, Rand. We must demilitarize the police. Time 14 August 2014. Balko, Radley 2013. Rise of the Warrior Cop. PublicAffairs. On Lao Tzu, Blacksburg, A. 2013. Taoism and Libertarianism – From Lao Tzu to Murray Rothbard. Thehumanecondition.com. Lord Acton’s letter to Mary Gladstone (24 April 1881), published in Letters of Lord Acton to Mary Gladstone (1913) p. 73. Michael Cloud quoted in Frisby, Dominic 2013. Life After the State. Unbound. On the Levellers, see ‘An arrow against all tyrants’ by Richard Overton, 12 October 1646, available at constitution.org.

Endless Money: The Moral Hazards of Socialism

by

William Baker

and

Addison Wiggin

Published 2 Nov 2009

But he would reverse this sentiment by the time of the Stamp Act in 1765.10 By the 1770s enough tension had built between England and the American colonies to ignite rebellion. The ensuing war required massive financing, and once again the new world turned to the borrowing and printing of new dollars. Murray Rothbard estimates that the Continental Congress issued over $225 million of paper money in the five years through 1779, dwarfing the money supply of just $12 million prior to independence. States issued another $210 million of currency. Additionally, loan certificates of some $600 million were issued to pay for army supplies.

…

Moreover, other governments might want to soak up some of the roughly 100,000 tonnes not held by central banks.8 Table 18.1 calculates an equilibrium price of gold of some $11,000 per ounce, which would arise from a base case of our not buying any metal openly. If the Treasury were able to double its stock of gold through open market purchases, it would ameliorate some of the devaluation. In his short but trenchant analysis in 1994 of fractional reserve banking, The Case Against the Fed, Murray Rothbard laid out another methodology for establishing an benchmark price of gold based upon liquidation value of the Federal Reserve. For perspective, in 1994 gold closed the year at $384/ounce, while the broadest measure of money having been printed in the United States (M3) stood at $4.4 trillion, or only 31 percent of its 2008 quantity.9 When he performed this exercise using the balance sheet of April 6, 1994, he calculated that shutting down the Federal Reserve and distributing gold bullion to its creditors would reset the dollar’s value to $1,555 per ounce.

…

Treasury Deposit 615 365 Cancel Reverse Repos 96 88 Net against repos Other 12 58 Pay in gold Capital 40 42 Write Off 1,804 2,266 Net Liquidation Liability 660 2,630 Necessary Gold Value $2,500 $10,100 Total Note: Totals may not add due to rounding. Methodology developed by Murray Rothbard. or miscellaneous accounts. Today there are a host of credits provided by the Fed to weak banks, which are collateralized by troubled assets. There has also been a large swap program with foreign central banks. For the purpose of this update, the loans to weak banks are assumed to have zero value, for calling these loans and reinjecting the collateral back into the system now might initiate rapid monetary contraction.

Stealth of Nations

by

Robert Neuwirth

Published 18 Oct 2011

“A colorful illustration is provided by the extensive business in used containers,” Bauer wrote. “Petty traders purchase, collect, store, clean, repair and resell containers such as tins, boxes, bottles, and sacks. They thereby extend the effective life and use of these products. Labor is used and capital is conserved.” The libertarian Austrian-school economist Murray Rothbard would have concurred with Bauer, though with his own conspiratorial twist: “Numerous ordinances outlawing pushcart peddlers [emphasis in original] destroy an efficient market form and efficient entrepreneurs for the benefit of less efficient but more politically influential competitors,” Rothbard wrote in his magnum opus, Man, Economy, and State, published in 1962.

…

In shockingly vehement language—it may be that the philosopher of communism had his own unconscious class biases—Marx termed them “scum, offal, refuse of all classes,” and labeled them as evil reactionaries who served as “the light infantry of capital.” Yet, a century on, one of Marx’s prominent twentieth-century disciples, the visionary psychiatrist Frantz Fanon, turned the teachings of the master on their head, asserting that the lumpenproletariat was “spontaneously and radically revolutionary.” The conservative/libertarian economist Murray Rothbard was as enthusiastic about System D as Fanon, but articulated his vision from a contrary pole of the political spectrum. He believed that System D merchants should have no restrictions on their actions whatsoever. He was against business licenses and driver’s licenses. “Licenses deliberately restrict the supply of labor and of firms in the licensed occupations,” he wrote.

Life After Google: The Fall of Big Data and the Rise of the Blockchain Economy

by

George Gilder

Published 16 Jul 2018

Markov models are idiot savants that can predict either a random pattern or a planned process without the slightest understanding of either. For its future, the industry must move beyond them. At one point during my interview, Mercer challenged the prevailing regime of fractional-reserve banking. Citing the libertarian economist Murray Rothbard, he suggested that in an ideal system, the maturities of assets and liabilities would match. This is the view of an outside trader, governed by the Markovian present. The maturities do not match in almost any banking system because of the divergence between the motivations of savers and the sources of the value of savings.

…

But as he probed, he found a fundamental flaw: the belief that the money supply can and should be determined by the supply of bitcoin or gold—in other words, that gold (or bitcoin mimicking gold) should serve not only as a measuring stick or unit of account but as the actual medium for all exchanges. Such monolithic money was also the error of Murray Rothbard, an idiosyncratic exponent of Austrian theory who believed that any authentic gold standard must have 100 percent gold backing. He did not even believe in fractional reserve banking, intrinsic to the role of banks, which necessarily mediates between savers seeking safety and liquidity and entrepreneurs destroying it through long-term investments.

Dark Money: The Hidden History of the Billionaires Behind the Rise of the Radical Right

by

Jane Mayer

Published 19 Jan 2016

Ironically, although Charles had criticized Robert Welch for turning the John Birch Society into a cult of personality by flaunting his ownership of the organization’s stock, Charles had set Cato up in the same way, as a nonprofit with stockholders, who picked the board of directors. The arrangement was rare in the nonprofit world. But as Charles had observed of the John Birch Society, it guaranteed the directors an unusual measure of continuing control. The director whom Charles fired at Cato was a major figure in libertarian circles, Murray Rothbard, a radical Upper West Side Jewish intellectual whose work Charles had subsidized in happier days. Rothbard called the putsch “iniquitous,” “high-handed,” and “illegal.” He went on to claim that Charles had “confiscated the shares which I had naively left in Koch’s Wichita office for ‘safekeeping,’ an act clearly in violation of our agreement as well as contrary to every tenet of libertarian principle.”

…

But after the referendum succeeded, the Los Angeles Times discovered that the true organizers and much of its funding traced back to a secretive group run by Howie Rich and Eric O’Keefe, U.S. Term Limits. There were ties to the Kochs, too. Fink admitted when confronted by the paper that they had in fact provided “seed money.” Similarly, in Washington State a congressional term-limits ballot initiative nearly passed in 1991 until The New York Times exposed what Murray Rothbard, the irreverent libertarian theorist who had split with the Kochs, called “the Kochian deep pockets behind the ‘grassroots’ movement.” The paper discovered that what supporters billed as “a prairie fire of populism” was in fact the product of a Washington-based group calling itself Citizens for Congressional Reform, which was started with hundreds of thousands of dollars from David Koch.

…

Only the Kochs know: Private foundations are legally required to publicly disclose their grants, but the recipients have no obligation to disclose the identities of their donors. Thus if the recipients pass the donations to secondary groups, the money trail becomes obscured. “a shell game”: Koch associate, interview with author. Rothbard called the putsch: David Gordon, “Murray Rothbard on the Kochtopus,” LewRockwell.com, March 10, 2011. “cannot tolerate dissent”: The Rothbard memo is described in Schulman, Sons of Wichita, 156–57. “staunchly anti-regulatory center”: Al Kamen, “I Am OMB and I Write the Rules,” Washington Post, July 12, 2006, A13. “a lobbying group disguised”: Coppin, “Stealth,” pt. 2.

American Kingpin: The Epic Hunt for the Criminal Mastermind Behind the Silk Road

by

Nick Bilton

Published 15 Mar 2017

He had explained to her on their first date that in addition to joining the NOMMO drumming club, he was also an avid member of a club at Penn State called the College Libertarians, a political group that met once a week to discuss libertarian philosophies and to read books on economics and theory. The books—penned by Murray Rothbard, Ludwig von Mises, and other visionaries—were what he read for fun when he wasn’t devouring applied physics papers. When Julia asked what libertarianism was, Ross, without judgment, explained: everything—from what you do with your life, to what you put in your body—should be up to each individual, not the government.

…

Back at Penn State, a short lifetime ago, while sitting in the Willard Building off Pollock Road, Ross had defended this very topic with Alex and his friends in the College Libertarians Club. “Yes, but the use of force is completely justified if you have to defend your own rights or personal property,” young Ross had argued while discussing one of the latest Murray Rothbard books he had devoured. Back then it had just been idealistic, hypothetical banter by a group of college students. The conversation had even followed some of the club members to the Corner Room bar on College Avenue, where, amid the sound of sports talk and the clink of pints of Samuel Adams, they had discussed Rothbard’s War, Peace, and the State, which explained why you could use violence against any “individual criminal” trying to harm you or steal your personal property.

Never Let a Serious Crisis Go to Waste: How Neoliberalism Survived the Financial Meltdown

by

Philip Mirowski

Published 24 Jun 2013

Consequently, the views I shall present might equally be entitled, under current conditions, the “new liberalism,” a more attractive designation than “nineteenth century liberalism.” In another historical phenomenon that I feel has not received sufficient attention, soon after many of the neoliberals renounced the label, opponents to their right began to resort to it in order to be provocative. Murray Rothbard, from a more libertarian perspective, began to excoriate Friedman for his position. Later classical liberals, dissatisfied specifically with the evolution of the Mont Pèlerin Society, would resort to the term to contrast the position of Ludwig von Mises with what they considered the debased version found in Friedrich Hayek and elsewhere.29 The question of why the target group in and around Mont Pèlerin invoked a self-denying ordinance in using the label is interesting in its own right, and we will return to it in the next section.

…

“As the World Burns,” Rolling Stone, January 21, 2010. Goodhart, Charles. “The Squam Lake Report: Commentary,” Journal of Economic Literature 49 (2011): 114–19. Goodman, Peter. “Taking a Hard Look at the Greenspan Legacy,” New York Times, October 8, 2008. Gordon, David. “The Kochtopus vs. Murray Rothbard” (2008), at www.lewrockwell.com/gordon/gordon37.htm. Gorton, Gary. “The Big Short Shrift,” Journal of Economic Literature 49 (2) (2011): 450–53. Gorton, Gary. Interview, Minneapolis Federal Reserve Report, December 2010, at www.minneapolisfed.org. Gorton, Gary. Slapped by the Invisible Hand (New York: Oxford University Press, 2010).

…

The NPR interview identifying Cochrane as ringleader can be accessed at www.npr.org/blogs/money/2008/09/economist_leads_push_against_t.html. 156 Glenn, “In Dismal Times.” 157 In John Cochrane, “Comments on the Milton Friedman Institute Protest” at http://faculty.chicagobooth.edu/john.cochrane/research/Papers/friedman_letter_comments.htm. 158 The close connections between George Mason and numerous appendages of the neoliberal Russian doll are explored in Tkacik, www.daskrap.com/. 159 Mayer, “Covert Operations”; Gordon, “The Kochtopus vs. Murray Rothbard.” 160 Flitter et al., “For Some Professors, Disclosure Is Academic.” 161 Some major sources here are Hundley, “Billionaire’s Role in Hiring Decisions at Florida State University Raises Questions”; Berrett, “Not Just Florida State”; and Jaschik, “Who Controls a Grant?” 162 Hundley, “Billionaire’s Role in Hiring Decisions.” 163 Sherman quoted in David Corn, “Thank You, Wall Street.

Why Wall Street Matters

by

William D. Cohan

Published 27 Feb 2017

The reasons for the panic were complex, of course—they always are—but the gist of the problem will seem familiar to those of us who lived through 2008. In the years after the War of 1812, the federal government and the banks it controlled were encouraging easy access to credit. One historian, Murray Rothbard, has called the era after the war and before the crash a “boom,” with the Bank of the United States, aided and abetted by the U.S. Treasury, “acting as an expansionary, rather than as a limiting, force.” The federal government was encouraging people to borrow and to invest. Land buyers were required to pay only a quarter of the purchase price within forty days, and Congress repeatedly postponed the penalty—forfeiture—for failure to pay what was owed within five years.

The Mysterious Mr. Nakamoto: A Fifteen-Year Quest to Unmask the Secret Genius Behind Crypto

by

Benjamin Wallace

Published 18 Mar 2025

Anonymity transposed to meatspace. Ledger’s Gauthier was saying that 70 percent of the world doesn’t live in a democracy. “Wow!,” the guy next to me exclaimed. “Woo!” Afterward, on the street, I passed a man hoisting a placard bearing the names of libertarian economist icons: Ludwig von Mises, Murray Rothbard, Friedrich Hayek. Nearby, a parallel gathering timed to coincide with this one was hosting gun enthusiasts. I saw rare dissenting graffiti: “Fuck Crypto, it’s an MLM, and not the fun kind.” After lunch, Peter Thiel, PayPal founder turned venture capitalist, was scheduled to speak. For all the talk of Bitcoin being leaderless, Satoshi Nakamoto was, in absentia, everywhere.

…

“Max More,” he said, extending a fist for a bump. As Max O’Connor, growing up in Bristol, England, he had been an insatiable reader of science fiction. His earliest doodles were of rockets and flying boots. When he was five, he watched the Apollo landings on TV. By his teen years, he was reading libertarians like Murray Rothbard and David Friedman and the books of Robert Anton Wilson, who wrote about things like AI and brain-augmenting drugs. It was through Wilson, who’d had his daughter Luna’s brain cryopreserved after she was murdered at age fifteen, that Max learned that cryonics was a real thing. When he was seventeen, he started taking the train to London once a month for meetings of a life extension group, and as an undergraduate at Oxford he founded England’s first cryonics organization and a magazine called Biostasis.

On Anarchism

by

Noam Chomsky

Published 4 Nov 2013

Like, when somebody comes out in favor of a tax, you can say: “No, I’m a libertarian, I’m against that tax”—but of course, I’m still in favor of the government building roads, and having schools, and killing Libyans, and all that sort of stuff. Now, there are consistent libertarians, people like Murray Rothbard [American academic]—and if you just read the world that they describe, it’s a world so full of hate that no human being would want to live in it. This is a world where you don’t have roads because you don’t see any reason why you should cooperate in building a road that you’re not going to use: if you want a road, you get together with a bunch of other people who are going to use that road and you build it, then you charge people to ride on it.

Attack of the 50 Foot Blockchain: Bitcoin, Blockchain, Ethereum & Smart Contracts

by

David Gerard

Published 23 Jul 2017

They are not subject to verification or falsification on the ground of experience and facts. Despite this, proponents keep making predictions and claims, and insisting they are, somehow, still worth listening to and applying to the world. Austrian economics was heavily promoted by heterodox23 economist Murray Rothbard, founder of the Ludwig von Mises Institute. Rothbard invented the term anarcho-capitalism for his ideology that a complete absence of government is essential, and that property rights, which are paramount, will somehow still function without it. An offence against one’s property is equivalent to an offence against the self; so the “Non-Aggression Principle” holds that trespassing is aggression, but the owner shooting you for trespassing somehow isn’t.

Private Government: How Employers Rule Our Lives (And Why We Don't Talk About It)

by

Elizabeth S. Anderson

Published 22 May 2017

See Robert Nozick, Anarchy, State, and Utopia (New York: Basic Books, 1974), 331; Walter Block, “Toward a Libertarian Theory of Inalienability: A Critique of Rothbard, Barnett, Smith, Kinsella, Gordon, and Epstein,” Journal of Libertarian Studies 17, no. 2 (2003): 39–85; Stephen Kershnar, “A Liberal Argument for Slavery,” Journal of Social Philosophy 34, no. 4 (2003): 510–36. For libertarians opposed to the validity of slave contracts, see Murray Rothbard, The Ethics of Liberty, rev. ed. (New York: New York University Press, 1998), 40–41; Randy Barnett, “Contract Remedies and Inalienable Rights,” Social Philosophy and Policy 4, no. 1 (1986): 179–202. 41. Matt Marx, “The Firm Strikes Back: Non-Compete Agreements and the Mobility of Technical Professionals,” American Sociological Review 76, no. 5 (2011): 695–712; Steven Greenhouse, “Noncompete Clauses Increasingly Pop Up in Array of Jobs,” New York Times, June 8, 2014, http://www.nytimes.com/2014/06/09/business/noncompete-clauses-increasingly-pop-up-in-array-of-jobs.html; Clare O’Connor, “Does Jimmy John’s Non-Compete Clause for Sandwich Makers Have Legal Legs?”