Navinder Sarao

description: a British trader convicted of market manipulation through 'spoofing,' contributing to the 2010 Flash Crash.

5 results

Flash Crash: A Trading Savant, a Global Manhunt, and the Most Mysterious Market Crash in History

by

Liam Vaughan

Published 11 May 2020

persuaded the U.S. government to insert an amendment: “Order Granting Joint Motion for Entry of an Addendum to the Consent Order of Preliminary Injunction,” CFTC v. Navinder Singh Sarao, December 12, 2015. But it was a desperate plea: Navinder Sarao v. USA, Approved Judgment, November 3, 2016. whether he really wanted to be remembered: The 1988 film Rain Man stars Dustin Hoffman as an autistic savant with a photographic memory who is put to work by his brother, played by Tom Cruise, counting cards in a casino. they agreed on a CMP of two times the gains: “Federal Court in Chicago Orders U.K. Resident Navinder Sarao to Pay More than $38 million in Monetary Sanctions for Prince Manipulation and Spoofing,” November 17, 2016 www.cftc.gov.

…

When Nav pressed him about “back of the book” again, Hadj told him it was beyond Autotrader’s functionality and he would need to find an external programmer. Sarao’s insistence struck Hadj as odd, but before long TT hired a new engineer in London and it was no longer his problem. He wouldn’t give Navinder Sarao another thought until six years later when he saw him on the evening news. CHAPTER 10 ◼ THE CRASH On Thursday, May 6, 2010, Nav awoke in his upstairs bedroom, got up, and switched on the computer that sat at the end of his single bed. He still kept a desk at CFT, but he preferred to trade from his parents’ home in Hounslow where there were no distractions or prying eyes.

…

Around the same time, MacKinnon, Dupont, and Davie incorporated Wind Energy Scotland LLP, the management company, in the UK. Nav handed MacKinnon and Dupont an $800,000 finder’s fee for lining up the deal and agreed to give them a share of his profits once the seed money had been paid back. To celebrate, they went to a bar in London and drank expensive scotch, Nav’s watered down with a coke. Navinder Sarao, business tycoon, was born. CHAPTER 13 ◼ THE DUST SETTLES While Nav mulled what to do with his growing riches, the debate in the United States over high-frequency trading grew louder. CBS’s 60 Minutes aired a segment on the “math wizards” who secretly controlled the market, and scarcely a day passed without reports of another “mini flash crash” involving unexplained blips in stocks like Cisco Systems and the Washington Post Company.

Fluke: Chance, Chaos, and Why Everything We Do Matters

by

Brian Klaas

Published 23 Jan 2024

“mutual accessibility of ideas”: Felipe Fernández-Armesto, A Foot in the River: Why Our Lives Change—and the Limits of Evolution (Oxford: Oxford University Press, 2015). measured in milliseconds: See, for example, Michael Lewis, Flashboys (New York: Penguin, 2015). wiped out in a few minutes: Andy Verity and Eleanor Lawrie, “Hound of Hounslow: Who Is Navinder Sarao, the ‘Flash Crash Trader’?,” BBC News, 28 January 2020. CHAPTER 6: HERACLITUS RULES a divination machine: See, for example, R. Wilhelm and C. F. Baynes, The I Ching (Princeton, NJ: Princeton University Press, 1950). knucklebones of hooved animals: For a discussion of the history of probability, see Peter Bernstein, Against the Gods: The Remarkable Story of Risk (Hoboken, NJ: Wiley, 1998); and James Franklin, The Science of Conjecture: Evidence and Probability before Pascal (Baltimore, MD: John Hopkins University Press, 2015).

Fed Up: An Insider's Take on Why the Federal Reserve Is Bad for America

by

Danielle Dimartino Booth

Published 14 Feb 2017

Norton, 2014), 44. Now a household word: The CBOE VIX measures stock market volatility, www.cboe.com/micro/VIX/vixintro.aspx. Demonstrators stormed the Parliament: Dan Bilefsky, “Three Reported Killed in Greek Protests,” New York Times, May 5, 2010. The crash’s trigger: Bernard Goyder, “Navinder Sarao Faces U.S. Extradition,” Wall Street Journal, March 23, 2016. “This guy, for want”: Suzi Ring, John Detrixhe, and Liam Vaughan, “The Alleged Flash-Trading Mastermind Lived with His Parents and Couldn’t Drive,” Bloomberg.com, June 9, 2015, www.bloomberg.com/news/articles/2015-06-09/the-alleged-flash-trading-mastermind-lived-with-his-parents-and-couldn-t-drive.

Moneyland: Why Thieves and Crooks Now Rule the World and How to Take It Back

by

Oliver Bullough

Published 5 Sep 2018

This might not be such a problem if the only takers for Nevis’ services were rich Americans keen to hide their wealth from their fellow citizens. However, just as with Warburg’s eurobonds, the island’s peculiar trade draws in crooks and tyrants from all over the world. The evil money always mixes with the naughty money. Name a scam, any scam, as long as it’s complex and international, and it will involve somewhere like Nevis. Navinder Sarao, the British day trader convicted in 2016 for ‘spoofing’ the US markets in the ‘Flash Crash’ of 2010 (when the Dow Jones Industrial Average lost more than 600 points in minutes, at least partly because Sarao sent fake orders to drive down prices, temporarily wiping trillions of dollars off the value of US shares), diverted his profits into two Nevis-registered trusts, one of which he called the NAV Sarao Milking Markets Fund.

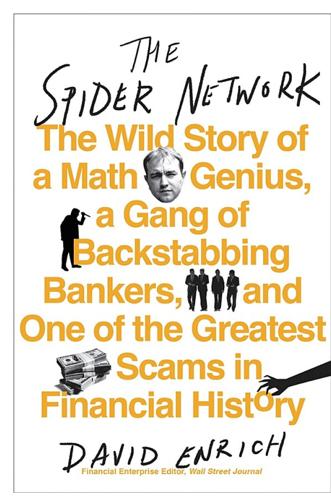

The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History

by

David Enrich

Published 21 Mar 2017

* Hayes would later claim that he simply thought it would be more effective if Hoshino casually approached the London colleagues in person, and that’s why he told him not to put it in writing. * Years later, regulators would still be searching for a convincing explanation for what caused the plunge. American authorities would criminally charge a socially awkward math whiz named Navinder Sarao as a primary culprit. Trading out of his family’s modest London home, Sarao had been using algorithms to simulate bids and offers—a strategy that prosecutors would allege had helped trigger the crash. * No Barclays traders had been arrested. It’s unclear what Celtik was referring to. * The FSA would later tell Wilkinson that his bosses had been lying—the agency had nothing to do with his suspension