Grave New World: The End of Globalization, the Return of History

by

Stephen D. King

Published 22 May 2017

Under Bretton Woods, currencies were exchangeable for US dollars at a mostly fixed price, even if prices could occasionally fluctuate, subject (in theory) to the IMF’s approval. The US dollar, in turn, was supposedly fixed in value against gold: it wasn’t quite the gold standard, but it meant there was at least one paper currency in circulation that, until the Nixon Shock, had the attributes commonly associated with currencies in the gold standard era. For a while, the US dollar was ‘as good as gold’. Following the Nixon Shock, and thereafter the gradual abolition of exchange and capital controls, there was a danger that currency markets would become a ‘free for all’. European nations, however, had no enthusiasm for such an outcome: from the ‘currency snake’ of the European Exchange Rate Arrangement in the 1970s to the Exchange Rate Mechanism of the European Monetary System in the 1980s and 1990s and then, of course, the single currency, the majority of European nations have rejected the idea of currency chaos, preferring instead to limit their currency options to a greater or lesser extent.

…

The link between dollars and gold established by Harry Dexter White in the 1940s was ultimately an act of faith: by the mid-1960s, however, faith was in short supply. In 1968, the US decided no longer to redeem privately held dollars for gold. Three years later, President Nixon announced live on US radio and television, in what became known as the ‘Nixon Shock’, that: We must protect the position of the American dollar as a pillar of monetary stability around the world … In recent weeks, the speculators have been waging an all-out war on the American dollar. The strength of a nation’s currency is based on the strength of that nation’s economy – and the American economy is by far the strongest in the world.

…

Admittedly, the outcome of the Tokyo round was far from perfect: only a handful of major industrialized countries signed up to many of the agreements – on, for example, subsidies, import licensing and government procurement – suggesting that multilateralism was but a distant dream. Still, unlike the 1930s, protectionism was mostly held at bay. Ultimately, the post-war institutions offered an international framework for stability, backed by American dollars and military hardware. Even when stability was threatened – most obviously via the Nixon Shock – the institutions were able to adapt to new challenges. By the end of the 1970s, the IMF was stronger than ever before, even if the fixed exchange rate system conjured up in Bretton Woods had been consigned to the scrap heap. Successive GATT rounds had managed to keep protectionism at bay. And, with the European Economic Community’s enlargement in 1973, what had originally been a cross-border economic arrangement designed primarily to stop France and Germany from fighting again was fast becoming a major economic, political and social force.

Currency Wars: The Making of the Next Gobal Crisis

by

James Rickards

Published 10 Nov 2011

Nixon’s New Economic Policy was immensely popular. Press coverage was overwhelmingly favorable, and on the first trading day after the speech the Dow Jones Industrial Average had its largest one-day point gain in its history up until then. The announcement has been referred to ever since as the Nixon Shock. The policy was conceived in secret and announced unilaterally without consultation with the IMF or other major participants in Bretton Woods. The substance of the policy itself should not have been a shock to U.S. trading partners—de facto devaluation of the dollar against gold, which was what the New Economic Policy amounted to, was a long time coming, and the pressure on the dollar had accelerated in the weeks leading to the speech.

…

No provision for a return to the convertible gold standard was made, although technically gold had not yet been abandoned. As one writer observed, “Instead of refusing to sell gold for $35 an ounce, the Treasury will simply refuse to sell . . . for $38 an ounce.” The Smithsonian Agreement, like the Nixon Shock four months earlier, was extremely popular in the United States and led to a significant rally in stocks as investors contemplated higher dollar profits in steel, autos, aircraft, movies and other sectors that would benefit from either increased exports or fewer imports, or both. Presidential aide Peter G.

…

Because the market was pushing the dollar higher, it would require government intervention in the exchange markets on a massive scale if the dollar was to be devalued. This kind of massive intervention required agreement and coordination by the major governments involved. Western Europe and Japan had no appetite for dollar devaluation; however, memories of the Nixon Shock were still fresh and no one could be sure that Baker would not resort to import surtaxes just as Connally had in 1971. Moreover, Western Europe and Japan were just as dependent on the United States for their defense and national security against the communist bloc as they had been in the 1970s.

The Vanishing Middle Class: Prejudice and Power in a Dual Economy

by

Peter Temin

Published 17 Mar 2017

Hinton argued that Johnson’s creation of the Law Enforcement Assistance Administration (LEAA) “made national policy makers meaningful partners in law enforcement and criminal justice at all levels.” She concluded, “Johnson paradoxically paved the way for the anticrime policies of the Nixon and Ford administrations to be turned against his own antipoverty programs” (Hinton 2016, 8, 14). See also Thompson 2010. 3. The “Nixon Shock” was a combination of three policies, but the change in exchange-rate regime was the lasting and important one. The need for a new policy should have been obvious from Bagehot and Keynes, since the primary function of a central bank with a fixed exchange rate is to preserve the exchange rate. The Mundell-Fleming model that formalized this insight was only a decade old and probably not yet widely understood (Nixon 1971; Eichengreen 2011). 4.

…

Bradley, 116–117, 129, 142 Mincer, Jacob, 165 Minimum wage, 62, 72, 79 Minow, Martha, 111, 134 Mobility, 7, 32, 46, 133, 154, 159 Mortality, 33, 39–40, 58, 126, 154 Mortgages bubbles and, 154–155 discrimination and, 117 Fannie Mae and, 138 FIRE sector and, 80 forgiving, 156 Freddy Mac and, 138 Great Migration and, 34 HAMP and, 139–140 hedge funds and, 179n5 housing and, 34, 44–45, 69, 80, 117, 137–140, 154, 156, 179n5 Investment Theory of Politics and, 69 low-wage sector and, 34 race and, 117 reform for, 156 restricted access to, 117 security and, 138 transition and, 44–45 Mundell-Fleming model, 169n3 Murray, Charles, 132 Mutual funds, 31 NAACP, 116–117 National defense, 17–18, 93 National Federation of Independent Business, 97 National Review magazine, 51 National Rifle Association, 97 Native Americans, xi, 84 Neoliberalism, 17, 21–22 New Deal, 21, 52, 65, 80–81, 101, 141 New Federalism, 21–22, 35, 44, 83, 103, 110 New Jim Crow, 27, 49, 104, 154 New Jim Crow, The (Alexander), xvi Newman, Oscar, 131–132 New Yorker magazine, 83, 135 New York Times newspaper, 125 Nineteenth Amendment, 56, 58, 67 Nixon, Richard M. depletion allowance and, 81 floating exchange rate and, 15 Ford and, 168n2 Johnson and, 15, 27, 168n2 Kennedy and, 81 mass incarceration and, 104, 109 military draft and, 16 New Federalism and, 21–22, 35, 44, 83, 103, 110 Powell and, 17, 27, 117 Project Independence and, 16, 71, 143 public education and, 117 Rehnquist and, 95, 142 Roberts and, 142 segregation and, 27 Southern Strategy and, 15, 27, 35, 81, 117, 142 War on Drugs and, xv–xvi, 15, 37–38, 53, 55, 104, 106, 110, 132 Nixon Shock, 169n3 Nobel Prize, 7, 49, 124, 162, 164 North cities and, 132–134 concepts of government and, 88, 94 FTE (finance, technology, and electronics) sector and, 20 Great Migration and, 20, 27–28 (see also Great Migration) Investment Theory of Politics and, 62–66 low-wage sector and, 27–29, 32, 34 manufacturing jobs in, 20 mass incarceration and, 104 public education and, 119, 125 race and, 51–53, 55, 59 unions and, 20 North American Free Trade Agreement (NAFTA), 55 Northeast Corridor, 134 Norway, 149 Obama, Barack, 25, 38, 81–84, 91, 96, 127, 175n12 Occupational Safety and Health Administration (OSHA), 90 Offshoring, 28, 32 Oil, 80–81, 180n13 depletion allowance of, 81 Koch brothers and, 17–19, 83–85, 92, 97, 110–111, 158–159, 169n12, 175n17 OPEC and, 16, 143 Project Independence and, 16, 71, 143 shock of, 16 Oligarchy, 65, 72, 87–89, 93–97, 115, 159 One-percenters CEO salaries and, 24 Reagan and, 22–23 tax cuts for, 22–23 very rich and, 3, 9–12, 22–24, 77–85, 92, 96, 155, 170n28 Organization of Petroleum Exporting Countries (OPEC), 16, 143 Oxymorons, 15, 101, 110-111, 156.

Magic Internet Money: A Book About Bitcoin

by

Jesse Berger

Published 14 Sep 2020

Chapter 3: Money 4Established by Carl Menger, the father of the Austrian school of economics, and popularized by Ludwig Von Mises and his student, F.A. Hayek, among others. 5In 1971, former US President Richard Nixon undertook a series of economic measures to respond to increasing inflation. The most significant rendered inoperative the existing Bretton Woods system of international financial exchange. It came to be known as the Nixon Shock. 6Occurring between 2007 and 2008, it is considered by many economists to be the most serious financial crisis since the Great Depression of the 1930s. Chapter 4: Growth 7Robert Breedlove, “Bitcoin and the Tyranny of Time Scarcity” The Bitcoin Times online (December 19, 2019). 8Evelyn Cheng, “Bitcoin debuts on the world’s largest futures exchange, and prices fall slightly” CNBC: Markets online (December 17, 2017). 9Ryan Brown, “New York Stock Exchange owner launches futures contracts that pay out in bitcoin” CNBC: Cryptocurrency online (September 23, 2019).

Keeping at It: The Quest for Sound Money and Good Government

by

Paul Volcker

and

Christine Harper

Published 30 Oct 2018

I also violated strict instructions against notifying any of my international colleagues by making a single call to my Japanese counterpart, Yusuke Kashiwagi. Japan’s financial market would be opening just as Nixon spoke and I wanted him to be warned. I don’t know whether that call made it any easier for the Japanese to deal with the crisis they would call the “Nixon shokku” coming shortly after the first “Nixon shock” of the opening to China. They pleaded that they had no intention of converting their rapidly growing dollar holdings into gold in any event. I do know that my gesture was greatly appreciated by Japanese officials. Yusuke Kashiwagi, and even now his wife and sons and daughter, have remained friends for fifty years

…

See Federal Reserve Bank of New York New York Mets, 40 New York State’s Erie Canal system, 6 New York Times, 52, 149, 165, 226–227 New Zealand economic policy, 225 Nixon, Richard becoming president/inaugural parade (1969), x, 59 credit controls and, 110 government/reorganization and, 67–68, 238 inflation and, 61, 87 John Kennedy and, x, 60 rate exchange and, x, 65, 71–75, 76 Watergate scandal/resignation, xi, 86, 87, 90 See also specific events; specific individuals “Nixon shock,” 74 North American Free Trade Agreement (NAFTA), 137 North Atlantic Treaty Organization (NATO), 71, 77 Oak Ridge, Tennessee, 9 Obama, Barack Dodd-Frank legislation and, 128 economic advisory board (PERAB), xvi, 211–212, 213–214, 213n, 232, 244–245 hope for the future and, 210 Volcker and, xvi, 170, 210–211, 217, 244, 245 Office of Management and Budget, 54–55 oil, 121, 125, 126, 131 oil crises (1970s), 85–86, 102 Oil-for-Food program.

The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy

by

Stephanie Kelton

Published 8 Jun 2020

Governments could now sell gold to the United States Treasury at the price of $35 per ounce, and the US Treasury had to honor the terms of that exchange. In 1971, following growing trade deficits caused in part by the Vietnam War, other countries became concerned that the US gold holdings were no longer adequate to cover the number of dollars in circulation at the fixed exchange rate. To stem pressures on the dollar, President Richard M. Nixon shocked the world by declaring a temporary suspension of the dollar’s convertibility into gold. A second shock followed in 1973, when Nixon announced that he was making the “temporary” suspension permanent. Nixon’s move was brought about by the realization that the US needed more policy space than was available under Bretton Woods.

…

Committee on Decent Work in Global Supply Chains, “Resolution and Conclusions Submitted for Adoption by the Conference,” International Labour Conference, ILO, 105th Session, Geneva, May–June 2016, www.ilo.org/wcmsp5/groups/public/---ed_norm/---relconf/documents/meetingdocument/wcms_489115.pdf. 17. Office of the Historian, “Nixon and the End of the Bretton Woods System, 1971–1973,” Milestones: 1969–1976, history.state.gov/milestones/1969-1976/nixon-shock. 18. Kimberly Amadeo, “Why the US Dollar Is the Global Currency,” The Balance, December 13, 2019, www.thebalance.com/world-currency-3305931. 19. Brian Reinbold and Yi Wen, “Understanding the Roots of the U.S. Trade Deficit,” St. Louis Fed, August 16, 2019, medium.com/st-louis-fed/understanding-the-roots-of-the-u-s-trade-deficit-534b5cb0e0dd. 20.

An Extraordinary Time: The End of the Postwar Boom and the Return of the Ordinary Economy

by

Marc Levinson

Published 31 Jul 2016

Central bankers normally frown on the idea that government bureaucrats can determine the appropriate price for a bag of cement or a cup of coffee. But on August 15, 1971, with Burns’s blessing, Nixon went on national television to announce a ninety-day freeze on wages and prices. The president also unexpectedly declared that foreign governments could no longer exchange their dollars for gold—an announcement that would be known as the Nixon Shock.7 Price controls made great theater, and the public invariably cheered. In the United States, even the New York Times, Nixon’s arch-critic, applauded the president’s “boldness” in applying them. In the short term, controls seemed to stop inflation in its tracks. But controls did not address the problems caused by central banks pumping out money, and they blocked the sorts of adjustments that routinely occur when a poor corn harvest drives up the cost of raising cattle or when retailers run low on air conditioners during a heat wave.

…

See North American Free Trade Agreement Nakasone, Yasuhiro, 178 National Bureau of Economic Research, 48, 134 National Energy Act, 109 national income: ratio of government debt to, 151 National Westminster Bank, 82, 84 nationalism, 267; in France, 206–208, 209, 210, 214; in Spain, 211 natural gas: deregulation of, 102, 103, 104, 108–109, 110, 113 Nazi Germany, 146, 190 Nazi Party, 27–28, 29 Nehru, Jawaharlal, 41 Netherlands, 1, 23, 30, 224; labor share in, 141; labor/trade unions in, 169; ungovernability in, 156; welfare state in, 18 new economics, 26, 261 new industries: vs. raw materials, 45–46 New International Economic Order, 43 The New York Times, 54, 231 Newsweek, 70 Nixon, Richard, 2, 3, 70–71, 119–120, 157; anti-inflation policy of, 106; Cost of Living Council and, 107; economic forecasts and, 65, 66; economic policy of, 47–49; employment and, 50; energy czar appointment by, 100, 108 (see also Simon, William); energy sector and, 102; environmentalism and, 61; inflation and, 48, 50; interest rates, unemployment, and inflation and, 55–56; monetary policy and, 51; oil crisis of 1973 in, 99–100; population growth and, 61; re-election of, 56, 180; regulation and, 108; Smithsonian agreement and, 55; Speer analogy and, 102, 108; treasury secretary appointment by, 101, 110 (see also Simon, William); unemployment and, 48, 235; Vietnam and, 48; wage and price controls and inflation and, 53–54; Watergate scandal and, 156; Watergate scandal and resignation of, 101, 110 Nixon administration, 222 Nixon Shock, 53 Nordhaus, William, 59 North America, 140; bank loans to Third World and, 241; debt crisis in, 247; economic slowdown in, 3–4; economy at close of World War II in, 17; income per person in, 6; postwar productivity in, 24; productivity bust in, 268; productivity slowdown in, 265; ungovernability in, 156–160 North American Free Trade Agreement (NAFTA), 142 Northern Europe, 81, 212 Northern Ireland, 4, 167 Norway, 1–2; anti-tax movement in, 153, 154; income distribution in, 136–137 nuts and bolts industry, 125–126 Obama, Barack, 9 oil: deregulation of, 99, 101, 102, 103, 104–106, 107–108, 109, 110, 113 oil crisis of 1973, 1–3, 68–79, 81–97, 155; Arab-Israeli conflict and, 69, 70–71; Aramco and, 69–70, 71; in Canada, 2, 71, 240; economic stagnation and stagflation and, 78; economy based on cheap oil and, 79; in Europe, 1–2, 3; Federal Reserve and, 72, 74, 77, 78, 94, 96; in France, 72–73, 77, 78; in Great Britain, 72, 74–75, 77, 167; impact on global financial system (banks and brokerage houses) and, 81–97; inflation and, 74–77, 78; in Italy, 72; in Japan, 2–3, 72, 74, 77–78, 115–119, 122–124, 240; oil price increases and production cuts and, 72, 73–74, 95; productivity bust and, 78–79; Saudi Arabia and, 1, 67, 68–71, 73, 95; Seven Sisters (US and European oil companies) and, 68–69; in Soviet Union, 162; in Sweden, 166; Third World development and, 239–240; UN Security Council Resolution 242 and, 71; in United States, 1, 2, 3, 67, 68–79, 99–100, 240; welfare state and, 148; in West Germany, 72, 74, 177; Yom Kippur War and, 73.

Samuelson Friedman: The Battle Over the Free Market

by

Nicholas Wapshott

Published 2 Aug 2021

In August 1971, he called a summit of top economic advisers—Burns, John Connally,26 his new Treasury Secretary, and Paul Volcker,27 his Undersecretary of the Treasury for Monetary Affairs, who would soon succeed Burns as chairman of the Federal Reserve—to Camp David to discuss a wide package of new economic measures—named by the press “The Nixon Shock”—ostensibly to bring inflation down. Again, Friedman was conspicuously left out. The pressing problem for Nixon was that the Vietnam War, a widening trade deficit, growing labor problems, and a 10 percent increase in the money supply had left the dollar profoundly weakened, undermining the basis of Bretton Woods, which depended upon a strong dollar.

…

actions against Allende, 159 approval ratings, 177 Bretton Woods agreement and, 142–43, 145, 148–49, 185 campaign in 1968, 141–42, 157 Camp David summit, 147–48, 149, 151 defeat in 1960, 145 economic issues in first term, 145–46 election, 116, 141, 142 Ford pardon of, 329 Friedman’s disappointment in, 117, 141, 143, 214 full employment budget, 146, 325 imperfections, 116–17, 141 inflation and, 145–50 “Nixon Shock,” 148 “Now I am a Keynesian,” 147, 267 regulations and agencies introduced by, 158 State of the Union address, 1971, 146, 147 tariffs, 141, 148, 156 wage and price controls, 149–51, 152, 154–55, 156–57 Obama, Barack, 261, 318 Oppenheimer, Julius Robert, 265, 339, 340 Parker, Richard, 7 Partee, J.

Limitless: The Federal Reserve Takes on a New Age of Crisis

by

Jeanna Smialek

Published 27 Feb 2023

As inflation took off, and in a bid to shore up domestic manufacturing, the president on August 15, 1971, announced economic reforms meant to contain rapid price increases and bolster the domestic job market. The country would suspend the practice of tying the dollar’s value to gold in any way, would institute wage and price freezes, and would slap a charge on imports. The so-called Nixon shock was the dying gasp of a gold-tied global monetary system, setting the stage for an era in which currencies fluctuated with national policies and market forces. Cutting the gold anchor, however necessary, set the stage for a drop in the dollar’s value in global currency markets. The price freeze Nixon instituted paved the way for further trouble.

…

See also bonds/Treasury securities financial/monetary system: bank runs, 45, 50, 64–6, 103, 155, 161, 335n10; central banking on Continent and in England, 53–4; clearinghouses to move cash into rural areas, 50, 52, 336n35; fractional banking system, 44–5, 335n9; global financial system with dollar at core of, 75–6, 82, 196–8; history of central banking, 6, 45–58, 67–9, 338n81; management of cash flow in, 3, 12–13; resilience of, 104; shadow banks, 168–72, 168n; stability of and development of money market in U.S., 50–1; state banks, 47–8, 336n16; weaknesses in, 6, 9, 157 financial panic of 1873, 49, 50 Financial Stability Board, 168–9, 173–4, 265–6, 268–9, 293, 347n20 Financial Stability Oversight Council, 103, 116, 169 Fink, Laurence “Larry,” 189, 209–10 First Name Club (Jekyll Island meeting), 54–6, 54n, 60–1, 200 First Security Corporation (FSC), 64–6, 64n Florida, Main Street program in, 245–9 Floyd, George, 220–3 food pantries and soup kitchens, 288–9, 352n10 fractional banking system, 44–5, 335n9 France, 63, 266, 338n85 free-market economics/capitalism, 83, 120–1, 214–16, 264–5 Friedman, Milton, 79–80, 242, 338n85 Full Employment and Balanced Growth Act, 80, 81 G Gamble, Monroe, 229–31, 233 GameStop, 52n, 291–2 Geithner, Tim, 14–15, 91–2, 342n37 George, Esther, 285 Gill, Keith, 291 Gillespie, Sean, 24n Gini index, 348n19 Glass, Carter, 55–8, 62, 68, 159–60, 180, 337n52 Glass–Steagall Act, 159–60 gold and the gold standard: Bretton Woods system and linking dollars to gold, 75–6; fractional banking system, 44–5, 335n9; gold standard and currency backed by gold, 49–50, 57, 60, 62, 63, 63n, 75–6, 159, 236, 275; gold standard policy and the Depression, 63, 63n, 75, 159–60, 338n85; greenbacks and the gold standard, 48–50; Nixon shock and end of tying dollar’s value to gold, 78; presidential power to set price of, 75; sealed and unsealed deposits, 335n9; state banks and gold-backed money, 47 Goldman Sachs, 37, 55, 156, 157, 169, 178, 193, 342n37 Gonzalez, Henry, 85–8, 86n Gorman, James, 155–6, 156n, 157 Grant, Ulysses S., 118, 287 Great Inflation, 79, 93, 115 Great Moderation, 81 greenback currency, 48–50 Greenback Party and movement, 50, 226 Greenspan, Alan: appearance of, 85; background and expertise of, 23, 83; Bernanke as successor to, 89; chairmanship of, 23, 24, 82–9, 90–2, 96–7; congressional testimony of, 85–8; economy during chairmanship of, 23, 82–3; regulation under, 90–2; secretive Fed under, 23, 23n, 83–9, 88n; on transparency of Fed, 201 H Hamilton, Alexander, 45–6, 338n85 Hamlin, Charles Sumner, 60, 160 hedge funds, 31, 35, 103, 147, 149, 169, 171–2, 171n, 193, 194, 216, 292, 345n12 Heinze, F.

Zbig: The Life of Zbigniew Brzezinski, America's Great Power Prophet

by

Edward Luce

Published 13 May 2025

Nomura gave him an office next to its chief executive officer at its headquarters in downtown Tokyo. The bank set up meetings with whomever he wanted to see from the prime minister downwards. From a foreign policy standpoint, Brzezinski’s spell in Japan was fortuitously timed. It was the year of “Nixon shocks” to America’s allies. In July 1971, Nixon stunned pretty much everyone in Washington, including his secretary of state, William Rogers, but not Kissinger (who had been working the back channels) with his bombshell declaration that he would soon be undertaking a historic trip to Mao’s China. Leaders in Europe and Japan felt bruised by Nixon’s failure to consult them or even warn them of such a dramatic shift.

…

In a second shock to both Japan and Europe in August 1971, Nixon said that the US would be exiting the gold standard and slapped a 10 percent surcharge on all imports. The US dollar would no longer be convertible into gold. At a stroke and without consulting his own Treasury Department, let alone the allies, Nixon pulled the plug on the postwar Bretton Woods system. Nixon was making America’s allies poorer and more paranoid at the same time. The Nixon shocks came a few weeks after Brzezinski and Muska had returned from Japan. During their stay in Tokyo, Brzezinski had picked up on Japan’s deep insecurity about America’s direction. Nixon made his two announcements while the Brzezinskis were in Maine. Brzezinski was writing a 150-page monograph about what he had learned from his time in Japan, which would be published the following spring as The Fragile Blossom: Crisis and Change in Japan.

…

His itinerary included a side trip with the prime minister to Newcastle, the most depressed city in England’s Northeast. Carter signaled that the United States was returning to the heart of NATO following years of neglect under Ford and Nixon. He promised major new US military commitments. His goal was to reassure his counterparts that the Nixon shocks and Kissinger’s widely derided “year of Europe” were behind them. Carter was already retreating from his campaign pledge to cut defense spending by between $5 billion and $7 billion. The Pentagon’s budget had fallen in real terms by almost 40 percent in the previous eight years.105 Carter’s U-turn on military spending was slow but cumulatively dramatic.

Chokepoints: American Power in the Age of Economic Warfare

by

Edward Fishman

Published 25 Feb 2025

Under Bretton Woods, currency values had been set by agreement among governments; after the “Nixon shock,” they were set by the market. It was the dawn of a new era for the world economy—one in which financial markets, contrary to Keynes’s wishes, would reign supreme. Many contemporary observers viewed the Nixon shock as the end of U.S. economic hegemony. From World War II through 1971, the United States had led the global economy on paper and in practice, and the dollar was as good as gold. After the Nixon shock, America became just another normal member of the world economy. The ensuing decade was disastrous for the U.S. economy, plagued by stagnant growth and high inflation, or “stagflation.”

The Quiet Coup: Neoliberalism and the Looting of America

by

Mehrsa Baradaran

Published 7 May 2024

Ending the accord temporarily halted inflation during the subsequent presidential campaign, allowing Nixon to win reelection, but it did nothing to fix the underlying problem. For that, Nixon imposed wage and price controls for ninety days to force prices down by government mandate. This type of top-down central planning should have been shut down immediately by any self-respecting capitalist, like those in the room at Camp David. The decision was called “the Nixon shock” for its effects on the world economy. The President announced the decision to the public, stating that “the effect of this action, in other words, will be to stabilize the dollar.” In November, at a meeting of the G-10, a consortium of the leading Western powers, in Rome, Connally told the finance ministers and central bank governors: “The dollar is our currency, but it’s your problem.”37 Ending Bretton Woods was one step in the transformation of monetary policy that neoliberals had long sought: taking monetary policy out of the people’s hands and delivering it to the experts.

…

Sullivan, 102 New York Times Magazine, The, 79–80 New York University (NYU), 91, 150 Nigeria, 39 “Nixinger,” 61–62 Nixon, Richard, and administration, 3, 4, 7–9, 11, 13, 14, 17–18, 24–30, 33, 48, 55, 61–62, 73–75, 84, 90, 95, 100, 101, 103–6, 109, 116, 121, 124, 126–28, 138, 153, 157, 158, 173, 187, 225, 228, 236, 270, 276, 293, 355 “Nixon shock,” 62 Nobel, Alfred, 33 Nobel Prize, 31–34, 38, 40, 46, 60, 63–67, 139, 159, 160, 166–70, 172, 227, 233–35, 295–96, 329 Nokia, 322 non-accelerating inflation rate of unemployment (NAIRU), 64 non-fungible tokens (NFTs), 330–32, 340–43 nonunionized workplaces, 212 Noonan, John, 197 North American Free Trade Agreement (NAFTA), 231 North Atlantic Treaty Organization (NATO), 42, 44 nuclear arms, 31, 38, 42, 69 Nuremberg laws, 20, 132, 134 Nuremberg trials, 42 Nutter, G.

The Cold War: A World History

by

Odd Arne Westad

Published 4 Sep 2017

And now the US president appeared, smiling and saluting, in Beijing with Mao Zedong and Zhou Enlai. The Japanese prime minister, Sato Eisaku, who had been informed just a few minutes before Nixon’s TV speech in 1971, had been in tears. “I have done everything they [the Americans] have asked,” Sato said, but “they have let me down.”22 For Japan, the “Niksonu Shokku,” or Nixon Shocks, of 1971 led to some big discussions about the country’s future, even within the ruling LDP. This was Japan’s Cold War turning point. Nixon’s departure from Bretton Woods was to a high extent directed against Japan’s commercial interests. Seen from Washington, Japan had done too well under American tutelage.

…

Record of conversation, Mao Zedong–Pham Van Dong, 23 September 1970, Westad et al., eds., 77 Conversations Between Chinese and Foreign Leaders on the Wars in Indochina, 1964–1977, 175. 21. Record of conversation, Mao Zedong–Kissinger, 21 October 1975, FRUS 1969–1976, 18:789. 22. Michael Schaller, “The Nixon ‘Shocks’ and U.S.-Japan Strategic Relations, 1969–74,” National Security Archive Working Paper No. 2 (1996), http://nsarchive.gwu.edu/japan/schaller.htm. 23. PPP Nixon 1972, 633. 24. John Kenneth Galbraith, “Reith Lectures 1966: The New Industrial State. Lecture 6: The Cultural Impact,” transmitted 18 December 1966, downloads.bbc.co.uk/rmhttp/radio4/transcripts/1966_reith6.pdf. 25. “19th Pugwash Conference on Science and World Affairs,” in Science and Public Affairs, April 1970, 21–24. 26.

…

See Cultural Revolution Great-Russian chauvinism, 280 Greece, 75–76, 91, 215, 371, 517 Greek People’s Liberation Army (ELAS), 75–76 Green parties, 521–522 Grigorenko, Piotr, 514 Gromyko, Andrei, 305, 534, 536 Grósz, Károly, 585 Group of 77, 391–392, 436 GRU (Main Intelligence Directorate of the Red Army), 121, 359 Guam, 21 Guatemala, 224, 301, 340, 345–347, 358 Guevara, Ernesto “Che,” 298–299, 302, 326, 352–353, 361, 379 Guinea, 277 Guinea-Bissau, 338, 481–482 GULag system, 122, 192, 195 Gulf of Tonkin resolution, 321 Gulf War, 610 Guomindang (National People’s Party), 32, 130, 139–142, 148, 279 Guthrie, Woody, 48 Hanson, Ole, 30–31 Havel, Václav, 513–514, 522, 595–596 Hekmatyar, Gulbuddin, 577 Helms, Richard, 356 Helsinki Accords (1975), 514 Helsinki Final Act, 390–391 Helsinki process, 504, 522 Helsinki Watch, 574 Heym, Stefan, 109, 193 Hirohito (Emperor), 136 Hiroshima, 6, 134 Hitler, Adolf, 36–42, 44, 58, 74, 627 Hizb-i-Islami, 531 Ho Chi Minh, 26, 32, 56, 147–150, 264, 278, 313–316 Ho Chi Minh trail, 316 Holocaust, 71, 451 Honecker, Erich, 546, 590–591 Hong Kong, 403, 561 Hopkins, Harry, 62, 79 Horn of Africa crisis, 489 hostage crisis, Iranian, 493–494 Hu Yaobang, 586–587 human rights abuses in Latin America, 358, 574 Argentina, 571, 574 Carter and, 485, 487, 489 Chile, 574 crisis in post-WWII Europe, 72 decolonization and, 432–433 defense of, 514 El Salvador, 570 Most Favored Nation trading status, 476 National Union for the Total Independence of Angola (UNITA), 567 human rights nongovernmental organizations, 573–574 Soviet Union and, 476, 485, 487 Human Rights Watch, 574 Humphrey, Hubert, 440 Hungarian Communist Party, 184, 203, 585, 594 Hungarian revolution, 202–205, 229, 242 Hungarian Soviet Republic, 33–34, 86 Hungarian Writer’s Union, 202 Hungary Communists in, 79, 86–87, 203–204, 522, 585–586 conditions in 1980s, 513 elections of 1990, 594 killings under Communist rule, 185 liberalization in late-1980s, 585–586 post-WWII period in, 85–87 protests (1956), 185, 201–206, 219, 241–242 Soviet occupation, 77, 273, 435 western loans, 513 hunger, in post-WWII Europe, 71–73 Husák, Gustáv, 376, 595 Hussein, Saddam, 469, 565, 610 Hussein (King), 462 hydrogen bomb (H-bomb), 102, 303 Iakovlev, Aleksandr, 542 Ianaev, Gennadii, 608, 611 Iazov, Dmitrii, 602 ICBMs (intercontinental ballistic missiles), 225 identity politics, 7 identity talk, 575 imperialism, United States, 245, 275, 350, 377, 383 Inchon, Korea, 171 India, 423–447, 627 anti-Chinese propaganda by, 249 anticolonial movements, 24 Bandung Conference, 271, 424, 428 Bangladesh war, 441–444 border war with China, 246, 249–250, 436–438 Chinese revolution, view of, 145 Communists in, 153, 424–425 Congo crisis (1960–1961), 435 Delhi Declaration, 564–565 foreign policy, 424–429, 432–437, 563 independence, 106, 129, 151–152, 423, 425 Kashmir, 425, 430, 437–438 Korean War, reaction to, 177, 181–182 Non-Aligned Movement, 249 nuclear test, 444 partition of (1947), 425 relations with China, 430–432, 438–439 relations with United States, 439–440 Second Five Year Plan, 429 self-government, 55–56 Soviet Union and, 281–282, 429–430, 434–435, 438–439, 443–447, 487, 564–565 Tibet and, 430–431 Tito visit, 433 trade unions, 131 Yugoslavia and, 433–434 Indian National Congress, 14, 130, 151–152, 263 Indonesia at Bandung Conference, 271, 327 Communists in, 131, 148, 278, 327–329 counterrevolution, 325 coup, 328–329 independence, 56, 129, 147–148, 326–327 as indigenous, Muslim state, 130 killings after coup (1965), 329 Soviet Union and, 328 state planning, 130 industrialization, 9, 187, 219 information, global spread of, 553–554 inheritance of acquired characteristics, 207 intercontinental ballistic missiles (ICBMs), 225, 303 International Bank for Reconstruction and Development, 67 International Department of the Communist Party, 488–489 International Imperialism and Colonialism, 279 International Monetary Fund (IMF), 67, 100, 554 International Physicians for the Prevention of Nuclear War, 628 Internet, 525 internment of Japanese-Americans, 120 Iran British occupation, 56, 131, 154 Communists in, 32, 155, 269, 451, 493 Eisenhower and, 224 hostage crisis, 493–494 oil, 268–269 revolution, 493–494, 576 secular and religious political conflict, 450–451 Soviet occupation, 131, 154–155, 269 US post-WWII views on, 132 war with Iraq, 565 Iran-Contra scandal, 570, 580 Iraq, 153 Ba’ath Party, 455, 458, 469 Britain and, 452 Iran war, 565 revolution, 455–456 Soviet Union and, 469, 487, 565 United States and, 610, 618 Irgun, 468 Iron Curtain, 62, 89–90, 226, 592, 603 Islamic Brotherhood, 531 Islamists, 450 Afghan, 494–496, 498, 530–531, 539 in Egypt, 453, 471 Muslim Brotherhood, 453, 471 revolution in Iran, 576 terrorists, 471, 533 United States view on, 472 Ismay, Lord, 119 Israel, 154, 457–472 Camp David accords, 492 October War (1973), 464–466 politics in, 468 Soviet Union and, 156, 370, 451, 457 Suez crisis, 272 US support, 337, 451, 457–458, 460, 463–470 Italy Brigate Rosse, 520 Communists in, 74, 113, 219, 372–373, 502 economic growth, post-WWII, 218 European Coal and Steel Community (ECSC), 215–217 Fascists, 27, 36 Gorbachev and, 547 Soviet Union and, 503 worker migration, 371 Iudin, Pavel, 245 Jackson, Henry, 476 Jackson-Vanik amendment to the Trade Act, 529 Jakeš, Miloš, 595 James, Henry, 17 Japan attack on United States, 43, 47 Communists in, 131, 136–137 conditions after World War II, 129, 134 constitution, postwar, 135 dependence on oil, 268 economic growth, 395–396, 401–402, 560–561 expansion, 136, 159 “Give Us Rice” mass meetings, 135 Japan-China relations in 1980s, 561 Korean War, reaction to, 177 military production in WWII, 50 Japan Nixon Shocks of 1971, 412–413 post-WWII industrial production, 66 reforms, postwar, 135–139 reverse course by Americans on, 137 surrender/capitulation, 132, 140, 149, 163 trade unions, 136, 137, 400, 401, 413 United States occupation, 135–139 US-Japan alliance, 138–139, 401, 428 war against Russia, 16, 24 war with China, 47, 49–50, 139–140, 159 war with Soviet Union, 50, 59, 131, 140, 163 in World War II, 47 Japanese-Americans, internment of, 120 Japanese Red Army, 521 Jaruzelski, Wojciech, 512, 583–585 Jeju Island, 166 Jews Hitler’s atrocities against, 45, 46, 71 Israel creation, 153–154 murders in eastern Europe, 81, 184 Soviet Union and, 124, 370 Stalin’s distrust of Hungarian, 86 US Jewish lobby, 485–486 Jiang Qing, 251, 256, 557 Jiménez de Aréchaga, Justino, 347 John Paul II, 511 Johnson, Lyndon B.

Shadows of Empire: The Anglosphere in British Politics

by

Michael Kenny

and

Nick Pearce

Published 5 Jun 2018

The official Foreign Office account of the negotiations, written up by its lead negotiator, Sir Con O'Neill, went so far as to describe New Zealand as ‘holding a veto over our entry to the Community’ and its prime minister as ‘more successful in the negotiations than anyone else’.28 Britain would pay a stiff price for securing breathing space for New Zealand's agricultural producers, and O'Neill put an exact figure on it – £100 million more in budget contributions over five years. This was for a country that had a higher national income per head than the UK or any of the EEC Six. Nixon's Shock Therapy While the fate of New Zealand dairy farmers was being debated, Nixon administered his ‘shock’ to the global economy, unilaterally detaching the dollar from its fixed value against gold and breaking apart the fixed currency exchange rates that had anchored the Bretton Woods system. The USA had designed the Bretton Woods framework when it was a creditor country.

Every Nation for Itself: Winners and Losers in a G-Zero World

by

Ian Bremmer

Published 30 Apr 2012

Two subsequent devaluations of the dollar—making U.S. exports more competitive and undercutting the value of foreign countries’ dollar reserves—marked the death of an accord that had produced decades of prosperity. Inside the United States, these multiple moves were largely swallowed up by the din of the war and its protesters. Outside, the move became known as the “Nixon Shock.” Why, asked OPEC officials, should we exchange our most precious resource for a currency that’s rapidly losing its value? The oil embargo, and the price spike that came with it, sent some of the world’s leading economies into a tailspin. Between 1973 and 1975, U.S. GDP fell by 6 percent while unemployment doubled.

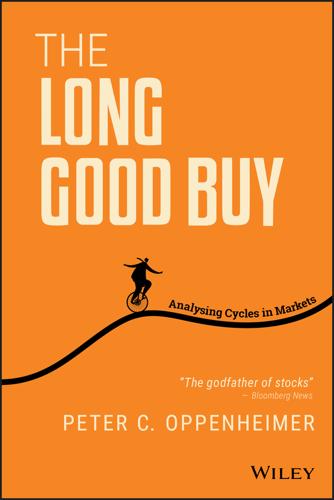

The Long Good Buy: Analysing Cycles in Markets

by

Peter Oppenheimer

Published 3 May 2020

1961–1962 ‘Kennedy Slide’: Rising rates from 1959 Cold War tension No - 1966 Inflation following Johnson Great Society programme; Fed raised rates by approximately 1.5% in 1 year No - 1968–1970 Vietnam war and inflation; Fed raised rates to 9% from 4% 2 years before; between the start of 1968 and mid-1968 rates rose by 3% Yes Dec 1969 – Nov 1970 1973–1974 The crash after the collapse of the Bretton Woods system over the previous 2 years, with the associated ‘Nixon Shock’ and USD devaluation under the Smithsonian Agreement 1973 Oil Crisis: Price of oil rose from $3 per barrel to nearly $12 Yes Nov 1973 – Mar 1975 1980–1982 ‘Volcker crash’; the 1979 second oil crisis was followed by strong inflation; the Fed raised its rates from 9% to 19% in six months Yes Jan 1980 – July 1980 Jul 1981 – Nov 1982 1987 Black Monday: Flash Crash: computerised ‘programme trading’ strategies swamped the market; tensions between the US and Germany over currency valuations No - 1990 Gulf War: Iraq invasion of Kuwait; oil prices doubled Yes July 1990 – Mar 1991 2000–2002 Dotcom bubble; technology companies bankruptcy; Enron scandal; 09/11 attacks Yes Mar 2001 – Nov 2001 2007–2009 Housing bubble; sub-prime loan & CDS collapse; US housing market collapse Yes Dec 2007 – Jun 2009 Extending this analysis shows that, on the standard definition (of declines of 20% or more), there have been 27 bear markets in the S&P 500 since 1835 and 10 in the post-war period.

The Social Life of Money

by

Nigel Dodd

Published 14 May 2014

Even here, a narrative is attached to the rating, which is unraveled whenever the rating shifts, or when various ratings agencies offer different grades for a particular financial product. 42 Bretton Woods refers to the international monetary system that was established in 1944, wherein countries agreed to adopt monetary policies aimed to ensure that their currencies maintained fixed rates of exchange against the U.S. dollar, which was in turn “pegged” to gold. After a series of difficulties during the 1960s, the system finally broke down in 1973, when a system of “floating” exchange rates was adopted. President Nixon’s decision to suspend the dollar’s convertibility into gold in 1971—known as the “Nixon shock”—was a major step toward this breakdown. 43 It was Bourdieu who accused Hans Tietmeyer, then President of the Bundesbank, of perpetuating a “monetarist religion” (see Tognato 2012: 135). 44 Issing was a key figure in the euro’s design and a founding member of the executive board of the European Central Bank. 2 CAPITAL This boundless drive for enrichment, this passionate chase after value, is common to the capitalist and the miser; but while the miser is merely a capitalist gone mad, the capitalist is a rational miser.

…

See also chartalism neoliberalism, 68, 130, 192, 193, 197–98, 270, 291, 331, 383; and utopia, 304–5, 315n, 383 neurosis, 12 neutral money, 9, 271, 273, 283, 285, 297, 318–19, 329n New Deal, 70, 72 new economic sociology, 279 New Economics Foundation (NEF), 374 new economy, 76, 77 New World, 13, 222, 223 New York fiscal crisis, 75, 77; parallels with Eurozone crisis, 79 Newton, Isaac, 109 Nicolayon, Sismondito, 65 Nietzsche, Friedrich, 12, 13, 36n, 136–42, 178, 181, 247, 271, 275, 291, 295, 318, 340; on bankers, 137; Beyond Good and Evil, 136, 141; The Birth of Tragedy, 154; on calculation and thought, 147, 295; on culture, 138; Daybreak, 135, 137, 148–49; on debt, 89, 135, 231; on desire, 229; Ecce Homo, 142; on ethics, 228; The Gay Science, 160; On the Genealogy of Morals, 135–36, 147, 152; on guilt, 136; Human, All Too Human, 139–40; on inheritance, 153; on modernity, 137; on money, 135–36, 137, 138–39, 273, 274, 389; on nobility, 138, 139, 323; on nobility of mind, 138; Philosophy in the Tragic Age of the Greeks, 145; on prices, 139–40, 147; on promising and memory, 152, 157; ressentiment, 160; on the sea, 222; and socialism, 139; on society, 138; on superman, 148; Thus Spoke Zarathustra, 135, 141, 142, 351; on the transvaluation of all values (Umwertung aller Werte), 141, 205, 274; Untimely Meditations, 135, 161; Writings from the Late Notebooks, 137. See also death of God; eternal return; Übermensch Nigeria, 301 ninety-nine percent, 3, 129–30, 370–71 nihilism, 141, 142 Nishibe, Makoto, 345 Nixon, Richard, 45, 98–99, 244 Nixon shock, 45n Nobel Prize, 330 nomos, 262, of the Earth, 222, 223 nongovernmental organizations (NGOs), 239 nonpecuniary values, 287, 294 North, Peter, 373 North Atlantic Treaty Organization (NATO), 239 Nostradamus, 49 Nuer, 284 numismatics, 165; sociological, 34 nummus, 223, 262 occultism, 7, 11; and capital, 56, 154 Occupy movement, 1, 3, 50, 130n55, 201, 267, 370 Oedipus complex, 149, 150, 230 Oesterreichische Nationalbank, 20n Old Glory Mint, 361 one trillion dollar platinum coin, 385, 386, 387, 392 optimal currency area (OCA), 20, 253 order of worth, 200 Organisation for Economic Co-operation and Development (OECD) Orléan, André, 19, 43–46, 250; on Mauss, 32 Ortega y Gasset, José, 247 overaccumulation, in Bataille, 176; in Baudrillard, 192; and financialization, 61n22; in Harvey, 68, 166, 243; Marxian concept of, 65, 88, 205 overbanking, 122, 124 overproduction, 57, 73 Owen, Robert, 342 Pan, 77, 246 panic, etymology, 77n; financial, 77 paradox of thrift, 208, 347, 348 parallax view, 80–81, 205 Park, Robert, 319 Parsons, Talcott, 8, 34, 230, 276n patriarchy, 336 Patton, Paul, 227 Paulhan, Jean, 172n payday loans, 325 PayPal, 378, 380n Peace of Westphalia, 216 Pecunix, 42, 316 Peebles, Gustav, 304–5 peer-to-peer (P2P) currencies, 105, 365, 370 peer-to-peer (P2P) lending, 247, 316 peer-to-peer (P2P) payment networks, 365 pension fund socialism, 77 pension funds, 59, 68, 75, 110, 129n52, 132, 221, 243 pensioners, 2, 22, 72, 77, 88, 126 perfect money, 14, 30, 197, 315, 316, 317–22, 326, 328–30, 339, 341, 356–57, 375, 382 perfect society, 30, 315, 316, 320–21, 322, 326, 329–30, 351 Perroux, François, 207 philanthropy, 166 Pixley, Jocelyn, 315n Plato, 200, 313 Platonism, 322, 326 Plender, John, 50 Poe, Edgar Allen, 185 poetry, 313, 314, 331 Polanyi, Karl, 13, 36, 57n16, 271, 279–86, 291, 292, 294, 299, 306; on the double movement, 128, 280, 311; on embeddedness, 279, 280–81, 285; on fictitious commodities, 279–80; on formal versus substantive approaches to the economy, 285; The Great Transformation, 279, 282, 284, 286; on limited and general purpose money, 279, 282–83, 285, 286, 325, 373; on the market, 372, 279–81; on money and language, 297; on planned laissez-faire capitalism, 280 Polillo, Simone, 218–19 Polybius, Histories, 239 Ponzi, Charles, 117n Ponzi finance, 58, 117n, 118, 199; and Bitcoin, 368 Ponzi stage, 120.

How to Speak Money: What the Money People Say--And What It Really Means

by

John Lanchester

Published 5 Oct 2014

The specific aim of the conference was to avoid the “beggar thy neighbor” policies between states that had played such a role in the turmoil of the twentieth century. The Bretton Woods system lasted from 1945 until President Nixon unilaterally took the USA off it on 15 August 1971, an event known as the “Nixon shock,” which reintroduced free-floating currencies. Nixon’s reasons for doing that were linked to the pressures on the US economy created by the Vietnam War and the growing trade deficit; his actions allowed the US dollar to drop in value, which was a help to industry and exports. BRIC A term coined by the former Goldman Sachs economist Jim O’Neill, meaning Brazil, Russia, India, China.

The Sushi Economy: Globalization and the Making of a Modern Delicacy

by

Sasha Issenberg

Published 1 Jan 2007

Nixon responded by devaluing the dollar; under an agreement signed in December 1971, it would trade at 308 yen. In Washington, this move was part of a package of moves to dismantle the postwar global-finance system—the abolition of the gold standard, which led to the end of the Bretton Woods system—that came to be known as “the Nixon Shock.” At Tsukiji, it meant one thing: Overnight, the cost of importing bluefin tuna into Japan fell by 15 percent. Allowed to float freely, Japan’s currency set off on a generation-long upward trajectory against the United States, eventually trading for fewer than 100 yen to the dollar. The two-decade period whose blistering growth came to bear an aura of perpetual inevitability later became known to the Japanese as “the Bubble.”

A History of the World in Seven Cheap Things: A Guide to Capitalism, Nature, and the Future of the Planet

by

Raj Patel

and

Jason W. Moore

Published 16 Oct 2017

By 1945, two of every three barrels of oil were produced in the United States.77 Only in the 1970s did the Soviet Union and then Saudi Arabia displace America as the world’s leading oil producer.78 Global oil production grew prodigiously after World War II, outstripping the era’s extraordinary economic growth by almost 60 percent.79 When the United States abandoned the gold standard in August 1971,80 international capital sought refuge from this “Nixon shock” in commodity purchases. At the same time, the Soviet Union—following poor harvests—traded its oil for wheat, driving up the price of bread. Fourteen months later, the Organization of the Petroleum Exporting Countries (OPEC), nominally responding to the Yom Kippur War between Israel and Egypt, announced a 70 percent rise in the oil production tax.81 World oil prices leaped from three to twelve dollars per barrel.

Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk

by

Philipp Carlsson-Szlezak

and

Paul Swartz

Published 8 Jul 2024

While changes to the trade architecture will represent challenges for economies and firms, they can also represent opportunities. Trade is not as bad as it often sounds. CHAPTER 20 The False Alarms of Dollar Death Over the past 50 years or so, the false alarm of the dollar’s death has sounded over and over. Starting with the Nixon shock of 1971 that finished off the remaining facade of the gold standard, obituaries for the greenback have been written many times. In recent years, the surge in US government borrowing needed to finance the pandemic stimulus brought a new wave of obituaries.1 Yet over the decades, the dollar’s share of world reserves has been dominant, with no other currency even coming close to dethroning it (see figure 20.1B).

The End of Growth: Adapting to Our New Economic Reality

by

Richard Heinberg

Published 1 Jun 2011

Warren Karlenzig, “China’s New National Plan: Green By Necessity,” Common Current. com, posted November 29, 2010. 18. The history of currencies is recounted in Niall Ferguson, The Ascent of Money: A Financial History of the World (New York: Penguin Press, 2008). 19. See Wikipedia.org, “Genoa Conference (1922).” 20. See Wikipedia.org, “History of the United States Dollar” and “Nixon Shock.” 21. David E. Spiro, The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets (Ithaca, NY: Cornell University Press, 1999). 22. See Marvin Friend, “A Short History of US Monetary Policy,” The Powell Center, powellcenter.org/econEssay/history.html. 23. Bill Black, “The EU’s New Bailout Plan Will Exacerbate Political Crises,” Business Insider, posted December 13, 2010. 24.

The Great Race: The Global Quest for the Car of the Future

by

Levi Tillemann

Published 20 Jan 2015

Krebs, Michelle. 2004. “Behind the Wheel/2004 Mitsubishi Galant; another Baby Born in Hard Times.” New York Times, August 1, http://www.nytimes.com/2004/08/01/automobiles/behind-the-wheel-2004-mitsubishi-galant-another-baby-born-in-hard-times.html. Kumita, Kunihiko. 2013. Interview. Kuroda, Haruhiko. “The ‘Nixon Shock’ and the ‘Plaza Agreement’: Lessons from Two Seemingly Failed Cases of Japan’s Exchange Rate Policy.” China & World Economy 12, 3. Kyodo News. 2011. “Iwate Saw Wave Test 38 Meters.” Lai, Xiaokang. 2011. Interview. Lampe-Onnerud, Christina. 2011. Interview. Lampton, David M. 2001. Same Bed, Different Dreams: Managing U.S.

Transcending the Cold War: Summits, Statecraft, and the Dissolution of Bipolarity in Europe, 1970–1990

by

Kristina Spohr

and

David Reynolds

Published 24 Aug 2016

He promised that this new policy would ‘not be at the expense of our old friends’; nor, he said, was it ‘directed at any other nation’—a disingenuous reference to the Soviet Union. ‘We seek friendly relations with all nations. Any nation,’ he continued, ‘can be our friend without being any other nation’s enemy.’ He closed by saying that ‘all nations’ would benefit from Sino-US rapprochement.49 What became known as the ‘Nixon shock’ stunned America’s Asian and European allies, who had been given as little as half an hour’s notice of the announcement. While a minority of Americans complained, especially conservative Republicans, most of the country praised Nixon’s initiative and looked forward to an improvement in Sino-US relations.

Selfie: How We Became So Self-Obsessed and What It's Doing to Us

by

Will Storr

Published 14 Jun 2017

The US economy was one of mass production, and, partly because of the protections afforded them by unions and the state, the wages of the middle classes had been high enough to buy what the nation itself had been making. But then in the 1970s, in the US and the UK, everything started to go wrong. The economy stagnated, inflation surged, stock markets crashed, there was the oil crisis, steel crisis, banking crisis, the ‘Nixon Shock’, the three-day week. The GDP tanked, the unions fought, millions lost their jobs. It was during these tumultuous times that Greenspan began manoeuvring himself into a position of enormous power. He’d entered politics in 1968, after insistent urging by Rand, as an adviser to Richard Nixon. By 1974 he’d been made Chairman of the Council of Economic Advisers, with Rand proudly watching over his inauguration.

The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order

by

Paul Vigna

and

Michael J. Casey

Published 27 Jan 2015

America, hobbled by the cost of the Vietnam War and unable to compete with cheaper foreign producers, couldn’t bring in enough foreign currency with which to restock its gold reserves and so started to run out of them as countries such as France demanded that their dollars be redeemed for the precious metal. Feeling trapped, President Richard Nixon took the stunning step on August 15, 1971, of taking the dollar off the gold peg. He did so with an executive order that was designed in consultation with just a handful of staffers from the Treasury, the Fed, and the White House. The “Nixon Shock” rendered the Bretton Woods agreement pointless. By 1973, once every country had taken its currency off the dollar peg, the pact was dead, a radical change. Governments could now decide how big or small their country’s money supply should be. Finally, it seemed, the chartalists’ moment had come.

Seven Crashes: The Economic Crises That Shaped Globalization

by

Harold James

Published 15 Jan 2023

Energy share of net energy use, 1960 –2015 (percent) (Source: World Bank Data) The most obvious explanation of the crisis or malaise then came in terms of the supply shock generated by (mostly Middle Eastern) oil-producing countries, organized in the Organization of Petroleum Exporting Countries (OPEC). OPEC’s move to increase oil prices, and then to use petroleum as a political weapon, occurred against a background of currency disorder engendered by the Nixon shock: the par value system built around the dollar collapsed in August 1971, and the attempt to restore it in December 1971 at the Smithsonian monetary conference was unconvincing and short-lived. Since petroleum prices were conventionally quoted in dollars, oil producers at first wanted to protect the real value of their exports, and then in March 1973, when the restored par value system finally disintegrated, realized that increasing oil prices could be employed as an economic and also a political weapon.

Extreme Money: Masters of the Universe and the Cult of Risk

by

Satyajit Das

Published 14 Oct 2011

By the early 1970s, the ratio of gold available to dollars deteriorated from 55 percent to 22 percent. Holders of the dollar lost faith in the ability of the United States to back currency with gold. On August 15, 1971, President Richard Nixon unilaterally closed the gold window, making the dollar inconvertible to gold directly. The Nixon Shock was announced in an address on national television on a Sunday evening. The President risked antagonizing fans of the popular TV program Bonanza to make the announcement before markets opened. Frantic efforts to develop a new system of international monetary management followed. The Smithsonian Agreement devalued the dollar to $38/ounce, with 2.25 percent trading bands.

This Changes Everything: Capitalism vs. The Climate

by

Naomi Klein

Published 15 Sep 2014

Bureau of Labor Statistics, http://data.bls.gov. 7. Michael Grunwald, The New New Deal: The Hidden Story of Change in the Obama Era (New York: Simon & Schuster, 2012), 10–11, 163–168; “Expert Reaction to Two New Nature Papers on Climate,” Science Media Centre, December 4, 2011. 8. Roger Lowenstein, “The Nixon Shock,” Bloomberg Businessweek Magazine, August 4, 2011; Bruce Bartlett, “Keynes and Keynesianism,” New York Times, May 14, 2013. 9. The 3.7 million jobs estimate comes from the Apollo Alliance Project, which merged with the BlueGreen Alliance in 2011. “Make It in America: The Apollo Clean Transportation Manufacturing Action Plan,” Apollo Alliance, October 2010; Smart Growth America, “Recent Lessons from the Stimulus: Transportation Funding and Job Creation,” February 2011, p. 2. 10.

The Man Who Knew: The Life and Times of Alan Greenspan

by

Sebastian Mallaby

Published 10 Oct 2016

He would still be willing to humor Reagan by paying occasional lip service to the virtues of the gold standard. But he no longer believed this message. In one sense, Greenspan’s new stance was only logical. It would clearly be futile to go back onto the gold standard so long as inflation raged, because inflation would undermine the credibility of the gold peg and the Nixon shock would be repeated. Equally clearly, if raging inflation could in fact be contained, then going back to gold would have been proved unnecessary. Yet in another, deeper way, Greenspan’s new stance reflected a changed understanding of democracy. Modern pluralistic systems, Greenspan was saying, were messy and willful; after witnessing government up close, he knew this conclusively.