Parker Conrad

description: co-founder of Zenefits, a software-as-a-service company for human resources

6 results

Live Work Work Work Die: A Journey Into the Savage Heart of Silicon Valley

by Corey Pein · 23 Apr 2018 · 282pp · 81,873 words

win. It’s the perfect crime—when it works. In a 2013 Shark Tank–style live investor pitch, the founder of a startup called Zenefits, Parker Conrad, feistily promised “to mess stuff up for two very large industries”—insurance and human resources. “If you’re an insurance broker,” Conrad explained, “we’re

This Could Be Our Future: A Manifesto for a More Generous World

by Yancey Strickler · 29 Oct 2019 · 254pp · 61,387 words

a recent $4.5 billion “unicorn” valuation. Zenefits was the newest zeitgeist-shaking success. But in the article, Zenefits’ founder and CEO, a man named Parker Conrad, gives a series of startling quotes that clash with the breathless tone. While the Times and investors quoted in the article celebrate the company’s

Super Founders: What Data Reveals About Billion-Dollar Startups

by Ali Tamaseb · 14 Sep 2021 · 251pp · 80,831 words

,” Codingvc (blog), March 3, 2016, www.codingvc.com/startups-are-risk-bundles/. 7. Sam Altman, “Lecture 9: How to Raise Money (Marc Andreessen, Ron Conway, Parker Conrad),” How to Start a Startup, October 21, 2014, https://startupclass.samaltman.com/courses/lec09/. 8. National Venture Capital Association, 2020 Yearbook, https://nvca.org/research

Lab Rats: How Silicon Valley Made Work Miserable for the Rest of Us

by Dan Lyons · 22 Oct 2018 · 252pp · 78,780 words

companies had sent them on a two-week safari. When I met them, Zenefits, one of the hottest unicorns, had just booted out its CEO, Parker Conrad, in a scandal that involved allegations of cheating on licensing tests and letting unlicensed brokers sell insurance policies, as well as having an out-of

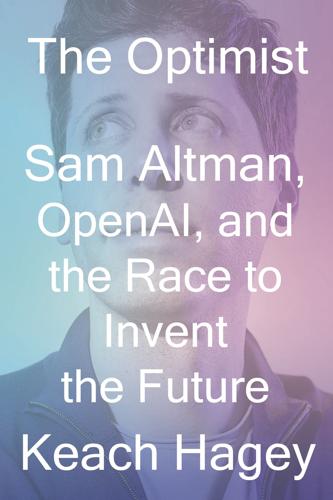

The Optimist: Sam Altman, OpenAI, and the Race to Invent the Future

by Keach Hagey · 19 May 2025 · 439pp · 125,379 words

product, staying from 2014 to 2016. Founders Fund put an offer in when it was at a $2 billion valuation, but the aggressive co-founder, Parker Conrad, negotiated for a valuation above $4 billion. That seemed high to Thiel, so Founders put in less. Within a few years, unable to meet the

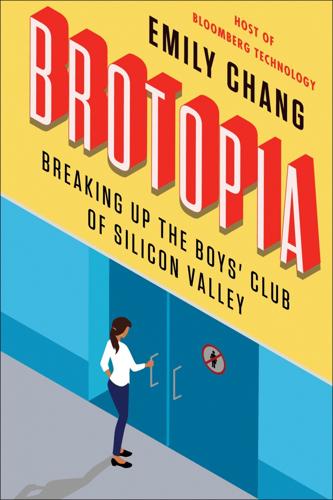

Brotopia: Breaking Up the Boys' Club of Silicon Valley

by Emily Chang · 6 Feb 2018 · 334pp · 104,382 words

list of “begats” goes on. Sacks went on to become COO of the fast-growing HR software start-up Zenefits. When the founder of Zenefits, Parker Conrad, was kicked out amid accusations of cheating state compliance regulations and creating a bro-y culture that led to “sex in the stairwells,” according to