Don't Be Evil: How Big Tech Betrayed Its Founding Principles--And All of US

by

Rana Foroohar

Published 5 Nov 2019

More alarming still is how some of the flow charts in the Treasury paper outlining how platform players and banks might work together to share consumers’ financial information in order to offer “personalized” products and services remind me of the complex illustrations of credit default swaps that we saw in the wake of the 2008 crisis. Both are Rube Goldberg–style studies in risk. Complexity of that sort always makes me nervous, as it leaves so much room for the party with more information to obfuscate. Call me a Luddite, but I’ve always agreed with former Fed chair Paul Volcker that the ATM has been the most useful “innovation” in finance in the past few decades. Too Big to Regulate? No matter what the Silicon Valley giants might argue, size, ultimately, is a problem, just as it was for the too-big-to-fail banks. This is not because bigger is inherently bad but because the complexity of these organizations makes them so difficult to police.

After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead

by

Alan S. Blinder

Published 24 Jan 2013

Or are they perhaps designed to enrich their designers? Economists are accustomed to thinking of innovation as unambiguously good; it raises standards of living. But is that always true in finance? Is it even usually true? I do not mean to imply that all financial innovations are harmful; as Paul Volcker pointed out, the ATM did a lot of good. So, most likely, did mutual funds, money market funds, and plain-vanilla mortgage pools. But who needed CDO-squared? What did those monstrosities contribute to the betterment of mankind? Of course, simplicity and complexity are in the eye of the beholder. They can’t be legislated, probably not even regulated.

What They Do With Your Money: How the Financial System Fails Us, and How to Fix It

by

Stephen Davis

,

Jon Lukomnik

and

David Pitt-Watson

Published 30 Apr 2016

Anat Admati, and Martin Hellwig, The Bankers’ New Clothes: What Is Wrong with Banking and What to Do about It (Princeton University Press, 2013). 33. John Sutherland, discussion at ICGN Annual Conference, Amsterdam, 2014. 8 Capitalism 1. One area where banks can claim to have made substantial productivity improvements is in transferring money. Indeed, Paul Volcker, former chairman of the US Federal Reserve, declared that in the past generation, “the ATM is the only financial innovation he [Volcker] can think of which has improved society.” Alan Murray, “Paul Volcker: Think More Boldly,” Wall Street Journal, December 14, 2009. 2. For example, a US federal court found that an electrical engineering company and the record keeper of its 401(k) plan had violated fiduciary duty.

Capitalism 4.0: The Birth of a New Economy in the Aftermath of Crisis

by

Anatole Kaletsky

Published 22 Jun 2010

Equally inconceivable would be a return to the waiting lists for mortgages and auto loans or the rationing of credit for domestic appliances that were taken for granted in most of the world until the mid-1980s. Populist enthusiasm for “driving the money changers out of the temple” has been legitimized and reinforced by the understandable, but nonetheless misguided, frustration expressed by two of the world’s most respected policymakers in the immediate aftermath of the crisis: Paul Volcker’s remark that the ATM was the only financial innovation that “had ever improved society”1 and Adair Turner’s comment that finance was a “socially useless” activity that rarely brought economic benefits to anyone except financiers.2 Deeper thinking about the causes and consequences of the crisis will surely produce different conclusions about the proper role of finance in modern societies.

The Bankers' New Clothes: What's Wrong With Banking and What to Do About It

by

Anat Admati

and

Martin Hellwig

Published 15 Feb 2013

The checking accounts in which demand deposits are kept allow people to receive and make payments through checks, bank transfers, or the use of debit cards and credit cards. Because banks provide these services, depositors are willing to accept less interest than they might earn elsewhere.6 The convenience of the payment system is captured in Paul Volcker’s 2009 quip that the ATM had been the only useful banking innovation in the previous twenty years.7 Demand deposits and the payment system that is based on them make up an important part of the infrastructure of the economy, akin to a system of roads. If the payments system is efficient, transactions are cheap and easy to make and economic exchange works smoothly.

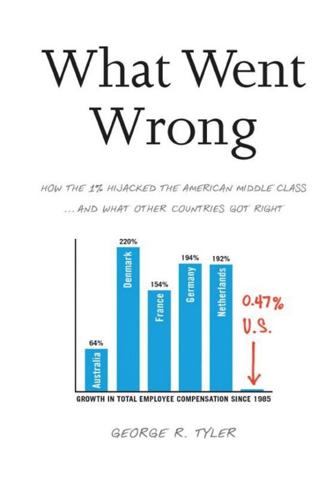

What Went Wrong: How the 1% Hijacked the American Middle Class . . . And What Other Countries Got Right

by

George R. Tyler

Published 15 Jul 2013

Sustained and robust productivity growth year after year is scarcely likely from a sector where output is highly volatile, risky behavior is routine, time horizons are measured in months, and income is highly skewed and gyrates wildly. In 2009, former Fed chairman Paul Volcker famously dismissed financial engineering, asserting that ATMs were the most useful financial innovation of the past 30 years. “I wish that somebody would give me some shred of neutral evidence about the relationship between financial innovation recently and the growth of the economy.”20 Financial Times columnist Wolfgang Münchau in December 2009 agreed with his theme: “We know that financial innovation, in combination with macroeconomic imbalances, produces bubbles.

Broken Markets: A User's Guide to the Post-Finance Economy

by

Kevin Mellyn

Published 18 Jun 2012

However, much of the consumptiondriven prosperity of America stems from financial innovations, ranging from the widespread introduction of charge accounts by merchants a century ago to the widespread securitization of consumer credit from mortgages to car loans in the decades leading up to the crisis. Although Paul Volcker famously said that the only positive financial innovation he could think of was the ATM, and I take a swipe at financial innovation, as noted previously, there is a very important and positive type of financial innovation that we need to carefully nurture. I am talking about the application of modern technologies, especially telecommunications and computing, that vastly increase the effectiveness of sound banking practice.

The Great Escape: Health, Wealth, and the Origins of Inequality

by

Angus Deaton

Published 15 Mar 2013

They too are very highly trained, and they have also used their training and creativity to produce new products. There is no unanimity among economists on the extent to which these new financial instruments have a social value that matches the profits that they generate for their inventors. It is hard not to sympathize with Paul Volcker’s statement that the last truly useful financial innovation was the ATM machine. If bankers and financiers have private incentives that exaggerate their social incentives, we will get too much banking and financing, and there is no defense for the inequality that they cause. Financial services have played an important role in financing innovation throughout the economy, and the efficient allocation of capital is one of the most valuable tasks in a market economy.

Fixed: Why Personal Finance is Broken and How to Make it Work for Everyone

by

John Y. Campbell

and

Tarun Ramadorai

Published 25 Jul 2025

One possible approach is to employ some human financial advisers to explain (but not influence) otherwise safe and effective automated solutions to clients, especially for complex applications such as robo-advising and algorithmic portfolio management.37 To conclude, we believe there is much to be gained from the judicious use of technology in personal finance. We have moved far beyond the days when Paul Volcker, former chair of the US Federal Reserve, could skeptically assert that automated teller machines (ATMs) were the apex of modern financial innovation.38 The challenge is to realize the benefits of fintech without letting it run out of control. Technology is like a turbocharger that should only be added to a car once the chassis has been strengthened to accommodate it—meaning we should redouble our efforts to fix the fundamental economics of the personal finance system before introducing technology, rather than believing that technology alone can solve our problems.

Other People's Money: Masters of the Universe or Servants of the People?

by

John Kay

Published 2 Sep 2015

The remainder of this chapter is concerned with the functioning of the deposit channel (and the payment system that is inextricably linked to it), while Chapter 7 reviews the operation of the investment channel. The payment system Money often costs too much. Ralph Waldo Emerson, The Conduct of Life, 1860 Paul Volcker, the tall, laconic figure who preceded Alan Greenspan as chairman of the Federal Reserve Board, has been reported as saying that the only useful recent financial innovation was the ATM.4 Volcker is deeply sceptical of the developments in wholesale financial markets that excited the celebrants at Jackson Hole. What matters from the perspective of ordinary customers is innovation in retail financial services.

More: The 10,000-Year Rise of the World Economy

by

Philip Coggan

Published 6 Feb 2020

Some of them managed investment funds. They earned fees or commissions, or made trading profits along the way, and the best performers received annual bonuses in the millions of dollars. Whether all this activity was socially useful is another matter. Paul Volcker once claimed that the only useful modern financial innovation was the automated teller machine or ATM. High-frequency trading was another development with dubious benefits. This involved some firms using computer programmes to buy and sell shares within a matter of milliseconds in order to take advantage of minor price discrepancies. It is a long way from the idea that finance’s role is to provide long-term capital to the most promising businesses.

The Clash of the Cultures

by

John C. Bogle

Published 30 Jun 2012

While unit-trading costs have plummeted, trading volumes have soared, and total costs of the financial system continue to rise. Too many innovations have served Wall Street at the expense of its client/investors. Pressed to identify useful financial innovations created during the past quarter-century, Paul A. Volcker, former Federal Reserve Chairman and recent chairman of President Obama’s Economic Recovery Board, could single out only one: “The ATM.” (Mr. Volcker recently told me that if the period of evaluation had been the past 40 years, he would have also included the creation of the index mutual fund in 1975 as an important and positive innovation that has served investors well.)

How the Other Half Banks: Exclusion, Exploitation, and the Threat to Democracy

by

Mehrsa Baradaran

Published 5 Oct 2015

Timothy Geithner, “The Paradox of Financial Crises,” Wall Street Journal, May 13, 2014, accessed March 13, 2015, www.wsj.com/articles/SB10001424052702304885404579552430842061834?mobile=y. 31. The assumption, of course, was that these Wall Street banks engaged in activities that are useful to the society at large. Here again are various opinions ranging from cynical (Paul Volcker famously derided Wall Street by saying that the only useful financial innovation of the last twenty-five years was the ATM) to those claiming that despite the misfeasance and malfeasance of Wall Street, Wall Street banks remain at the center of many of our secondary markets: they create more money and more credit in the economy, just as banks do. 32. Bush, “Speech to Nation,” September 4, 2008. 33.

Winner-Take-All Politics: How Washington Made the Rich Richer-And Turned Its Back on the Middle Class

by

Paul Pierson

and

Jacob S. Hacker

Published 14 Sep 2010

Moreover, most of these “innovations” could occur only because of the failure to update financial rules to protect against the resulting risks—much to the chagrin of the rest of Americans who ended up bailing the innovators out. Former Fed chairman Paul Volcker was no doubt channeling a widespread sentiment when he said in 2009 that the last truly helpful financial innovation was the ATM.7 What is more, government policy not only failed to push back against the rising tide at the top in finance, corporate pay, and other winner-take-all domains, but also repeatedly promoted it. Government put its thumb on the scale, hard.

The Democracy Project: A History, a Crisis, a Movement

by

David Graeber

Published 13 Aug 2012

The conventional story is that we have moved from a manufacturing-based economy to one whose center of gravity is the provision of financial services. As I’ve already observed, most of these are hardly “services.” Former Fed chairman (under Carter and Reagan) Paul Volcker put the reality of the matter succinctly when he noted that the only “financial innovation” that actually benefited the public in the last twenty-five years was the ATM machine. We are talking little more than an elaborate system of extraction, ultimately backed up by the power of courts, prisons, and police and the government’s willingness to grant to corporations the power to create money.

Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever

by

Robin Wigglesworth

Published 11 Oct 2021

No wonder that Bloomberg’s podcast on a form of index funds known as exchange-traded funds (ETFs) is called Trillions, a tongue-in-cheek reference to Billions, Showtime’s series on the fictional hedge fund manager Bobby Axelrod. The boons are being reaped by nearly everyone, directly or indirectly. Paul Volcker, the former chair of the Federal Reserve, famously said in 2009 that the only valuable innovation the finance industry has conjured up in the past twenty years was the ATM. Broaden that to the past fifty years, and I would argue that the index fund—first born in the early 1970s—is up there. The average cost of mutual funds in the United States has halved over the past two decades, largely thanks to the growth of index funds and the pressures they bring to all investment fees.

Adaptive Markets: Financial Evolution at the Speed of Thought

by

Andrew W. Lo

Published 3 Apr 2017

And just as the original index fund caused a major evolutionary change in the investment ecosystem, dynamic index funds have the potential to create a similar change as more people with more opinions add their knowledge to the market, reducing the potential for groupthink. Former Federal Reserve chairman Paul Volcker said in 2009 that the only useful innovation made by banks in the last twenty years has been the automated teller machine (ATM). I would strongly disagree, but that shouldn’t blind us to how useful the ATM has been to the financial consumer. Imagine portfolio management as uncomplicated and as reliable as an automated teller. This wouldn’t displace the role of active management, just as the proliferation of ATMs hasn’t displaced the need for human tellers in banks.

Money: The Unauthorized Biography

by

Felix Martin

Published 5 Jun 2013

Adair Turner, Chairman of the U.K. Financial Services Authority, put it diplomatically in August 2009 when he said that at least some of the previous decade of financial innovation had been “socially useless.”5 Paul Volcker, the grand old man of global financial regulation, was more direct. The only financial innovation of the previous two decades that had added any genuine value to the broader economy, he said with withering contempt, was the ATM.6 The result of this powerful and widespread reaction to the crisis is that today, for the first time in decades, there are serious campaigns in progress in virtually all of the world’s most developed economies to reform banking, finance, and the entire framework of monetary policy and financial regulation.

The Price of Inequality: How Today's Divided Society Endangers Our Future

by

Joseph E. Stiglitz

Published 10 Jun 2012

The negative-sum nature is reflected in the immense losses in the real estate sector. The financial sector likes to claim that it has been highly innovative, and that these innovations are at the root of the economy’s overall success. But as Paul Volcker, former chairman of the Federal Reserve, pointed out, there is little evidence of any significant effect of these innovations on economic growth or societal well-being (with the exception of the ATM machine). But even if the financial sector had contributed slightly to the country’s growth in the years before the crisis, the losses associated with the crisis more than offset any of these gains. 13.