Troublemakers: Silicon Valley's Coming of Age

by

Leslie Berlin

Published 7 Nov 2017

One person recalls that even the women on the assembly line talked about the value of ROLM’s stock and where it might go.9 Fawn Alvarez’s mother, Vineta, who had not sold a single share of the stock for which she had paid $7,000 during her years at ROLM, discovered that her equity was worth $360,000 (nearly $830,000 in 2016 dollars).10 Fear quickly followed the elation. How would ROLM, with its 9,000 employees, retain its identity and “great place to work” culture after IBM, with 350,000 employees, absorbed it? At ROLM, many people wore jeans to work, and Friday-afternoon beer bashes were sacrosanct. On Halloween, ROLM’s vice president of marketing dressed as Supermanager, complete with red tights and a red cape.

…

Soldering iron in hand, he often appears at the local events in a T-shirt with the word MENTOR printed in capital letters across his back. Fawn Alvarez Talbott Fawn Alvarez continued to advance at ROLM after its acquisition by IBM. In 1987, she accepted a job as the assistant to the president of ROLM-IBM, Ray AbuZayyad. When ROLM was sold to Siemens a year later, she did the same job for Peter Pribilla, the CEO of ROLM Systems. These were not secretarial jobs; she functioned more as a chief of staff, calling on her long tenure at ROLM and her experience in production, engineering, finance, and marketing. She had a secretary of her own. She worked for Siemens in various capacities until 1997, after which she became a marketing consultant, finally enjoying a long tenure in a role she had wanted ever since seeing the ROLM employee who had worn lovely suits and fancy hats.

…

She had always looked a little askance at assembly jobs, even if they were dressed up in high-tech clothes. She could have asked about a different job at ROLM, but she knew that the other obvious position for a young woman without a college degree would be as a clerk in the document control group. That group tracked the thousands of pages of documentation that ROLM generated on its products as they moved through manufacturing and into the market. Alvarez did not want to work in document control at ROLM because her mother, who had left production work several years earlier, managed the group for the division that built ROLM’s ruggedized computer. Fawn, just past her 18th birthday and living on her own for the first time, loved her mother, but she also wanted to carve out an independent life for herself.

The Big Score

by

Michael S. Malone

Published 20 Jul 2021

These weren’t executives either, but workers just like him who happened to be lucky enough to work for a company out West called Rolm. The Rolm gymnasium was easily the most conspicuous part of Rolm’s employee-support program. But in many ways it was the least important. The key to Rolm lay in its daily treatment of the employees—not in the big grandstand play but in the tiny details. One need only walk around Rolm to see that philosophy was in practice. The gym, an employee cafeteria that was more of a restaurant, the carefully tended office and manufacturing areas, the friendliness of the employees matched by an equal reserve that indicated that Rolm people felt as though they were part of a team, and, most of all, an intense loyalty.

…

Secondly, the company had one hell of a time trying to raise money from venture capitalists who could see only a bunch of inexperienced businessmen, a fraternity of ex-college kids, trying to bust into an untested market populated at the time by only a few giants like IBM. In the end, Rolm was founded in June 1969 with just $75,000—and, in a nearly mythical beginning for a Santa Clara County firm, Rolm’s first building was an abandoned prune-drying shed. Oshman assumed the presidency. The founders worked feverishly, and by November the company had more than a dozen employees and its first working prototype. At $20,000 the new Rolm “mil-spec” computer was less than half the price of its nearest competitor. Still, it took several years for the company to break into the club of military contractors. By 1974, Rolm had reached $6 million in annual sales.

…

As a Merrill Lynch analyst told Business Week in 1981, “They have done as good a job managing the company as they have in designing and building their products.” Stanford business professor Steven C. Wheelwright would add, “Rolm has always been more systematic [than other companies]. Time and again, [it] has managed to anticipate the problems that come with growth.” One important reason why Rolm was so successful was that it treated its people well. As Oshman wrote: “The humanity and challenge of the Rolm work environment is predicated on a dual responsibility. Rolm Corporation acts to provide equal opportunity to grow and be promoted; fair treatment for each individual; respect for personal privacy; encouragement to succeed; opportunity for creativity; evaluation based on job performance in the context of the Rolm philosophy.”

The Code: Silicon Valley and the Remaking of America

by

Margaret O'Mara

Published 8 Jul 2019

He was as willing to pitch in for the industry as the next guy, but he thought his business partner was wasting his time. The market was bleak, but there were signs that it would rebound. One of the brightest signs was ROLM, a company that his old partner Jack Melchor had seeded and nurtured since its founding in 1969. McMurtry was closer to ROLM than to any other company in his portfolio. The connection was personal—the firm’s four young founders were members of the Rice Mafia, three of whom had worked under McMurtry in his final months before becoming a VC. The fourth was someone he’d tried to recruit. ROLM stood out among its peers for the diversity of its product line: its early marquee products included a “rugged” field-ready minicomputer for the military and the first fully computer-controlled telephone exchange.

…

Needing to raise more cash, it went public in 1976—and proceeded to sell under its offering price for fifteen months. But right as Reid Dennis was gathering folks around his dining room table, ROLM’s stock price started to bob up from under the water. “The market was beginning to arise,” McMurtry remembered. “The early birds were coming out.” In the case of Burt McMurtry, patience paid off. Ultimately, he and his partners reaped a fortyfold return on their ROLM investment, making him a fortune, and a reputation as one of the sagest VCs in town.24 Even though these promising signs meant that some Valley insiders weren’t convinced that politicking was necessary, the true believers dove into the task with single-minded focus.

…

Reinhold, “Life in High-Stress Silicon Valley Takes a Toll”; Smith, “Silicon Valley Spirit.” 27. Thomas & Company, “Competitive Dynamics”; Paul Freiberger, “IBM Counts its Chips, Invests $250 Million in Intel,” InfoWorld 5, no. 5 (January 31, 1983): 30; Jean S. Bozman, “The IBM-Rolm Connection,” Information Week 37 (October 21, 1985): 16; Katherine Maxfield, Starting Up Silicon Valley: How ROLM became a Cultural Icon and Fortune 500 Company (Austin, Tex.: Emerald Book Co., 2014). 28. Mitch Kapor, interview with the author, October 19, 2017, Oakland, Calif.; Udayan Gupta, Done Deals: Venture Capitalists Tell Their Stories (Cambridge, Mass.: Harvard Business School Press, 2000), 83–88; John W.

Masters of Deception: The Gang That Ruled Cyberspace

by

Michelle Slatalla

and

Joshua Quittner

Published 15 Jan 1995

It was a technical treatise on how to crack a Rolm-made PBX phone system. Rolm PBXs, as any hacker in 1990 could have told you, are valuable properties. They are favored by large corporations and government agencies, which need to route thousands of calls a day to their employees. The phile on Fifth Amendment said that this particular type of PBX had a back-door entrance to enable repairs by remote maintenance support staff. The phile went on to explain how to break into the system using the back door, and how, once inside, to monitor phone lines. Armed with such knowledge, virtually anyone anywhere could crack a Rolm PBX. The patrons of the Fifth Amendment board didn't want such information widely disseminated for one simple reason.

…

If lamers got hold of it, they'd go into a PBX and screw something up. Rolm would get complaints from customers, and the whole system would be overhauled to close up the holes. So, while the phile was available for perusal, you weren't supposed to copy it. Don't share it with anybody who didn't have access to Fifth Amendment. What better way to tweak the Texans than to spread their precious secrets? John, acting as Broken Leg, snatched the phile, surreptitiously copying it right off its super-secure resting place on the BBS. It was a fine deception. Less than a week later, the Rolm Revelation was posted on bulletin boards all over the country.

Alpha Girls: The Women Upstarts Who Took on Silicon Valley's Male Culture and Made the Deals of a Lifetime

by

Julian Guthrie

Published 15 Nov 2019

But she knew intuitively that this was the right place for her: Silicon Valley was the embodiment of breathtakingly bold ideas and inventions, a region awash in unparalleled ingenuity, originality, tenacity, optimism, and opportunity. It had given rise to more new companies and industries than anywhere else in the world, including such technology giants as Hewlett-Packard, Fairchild Semiconductor, Intel, Teledyne, ROLM, Amgen, Genentech, Advanced Micro Devices, Tandem, Atari, Oracle, Apple, Dell, Electronic Arts, Compaq, FedEx, Netscape, LSI, Yahoo!, Amazon, Cisco, PayPal, eBay, Google, Salesforce, LinkedIn, Tesla, Facebook, YouTube, Uber, Skype, Twitter, and Airbnb. But Mary Jane and the other Alpha Girls would need steel in their spines to stay the course, and they would pay a steep emotional price along the way.

…

Now she was being asked—more accurately, ordered—to participate in a timed downhill event with the hard-charging boys of banking, including some notable Olympic skiers. Yet Sonja couldn’t say no. She needed to be a good sport. After all, this was Thom Weisel, who had sold his company, Montgomery Securities, to NationsBank for $1.3 billion, the same investor who had helped take public several seminal companies, including Amgen, Micron Technology, ROLM, Integrated Device Technology, Yahoo!, and Siebel Systems. It was no surprise to anyone that he wanted his firm’s name on the left side of a company’s initial public offering prospectus. The lead banker always got the coveted left side. Like any venture capitalist, Sonja wanted to fit in with Weisel’s alpha male bankers.

…

, were still using humans to help build the ontologies. Before the Google guys began making the rounds looking for financing, they had followed a well-trodden path to the offices of attorney Larry Sonsini, who had helped incorporate, build, and take public just about every major tech company, from ROLM and Apple to Netscape, Pixar, and hundreds more. Brin and Page had visited Sonsini on a Saturday in 1998 to talk about incorporating Google and raising money. They told him their goal was to “make information ubiquitous,” and they discussed how much money Google would need to grow. The three concluded that Google would need about $20 million.

Atomic Accidents: A History of Nuclear Meltdowns and Disasters: From the Ozark Mountains to Fukushima

by

James Mahaffey

Published 15 Feb 2015

By the time we discovered him, he had chewed up the insulating sheath on our very expensive cable no. 5769, connecting the ROLM I/O box to the Directrol. Why he so enjoyed the taste of plastic insulation on that particular cable, I could not comprehend. It had zero food value, but he made a meal of it.283 Damage to the cable was strictly cosmetic, and we wrapped some electrical tape over the wound. It still worked perfectly, but we were too embarrassed to deliver it to the plant in that condition, so we called ROLM Military Computers in Cupertino, California, and ordered a new unit. They sent it promptly, and this was an improved example of the cable.

…

Hatch Nuclear Power Plant near Baxley, Georgia, on a mission to install my life’s work in the former operator’s break room, which had been converted into an equipment bay. There was a list of new equipment mandated by the Nuclear Regulatory Commission after the Three Mile Island disaster, and my contribution was four ROLM MSE/14 minicomputers and associated hardware, taking up four racks for each of the two reactors. These machines would work hard, 24 hours a day, constantly updating a long list of data considered crucial to the safe operation of the two reactors at the plant and making it available to the operators on demand.

…

The digital data were collected using a wired loop running all over the plant and passed on to the computer systems by a Cutler Hammer Directrol Multiplexer Communications Station, bolted to the back wall of the electronics bay. A fat, multi-conductor cable (no. 5769) ran between the Directrol and the ROLM 2150 I/O expansion box. Both the Directrol and the expansion box had been exercised continuously back at our shop in Atlanta for years without a single error. Had something broken at the plant? We decided to let it keep running to see if the system self-regulated, and also so we could collect more data and try and figure out what the problem was.

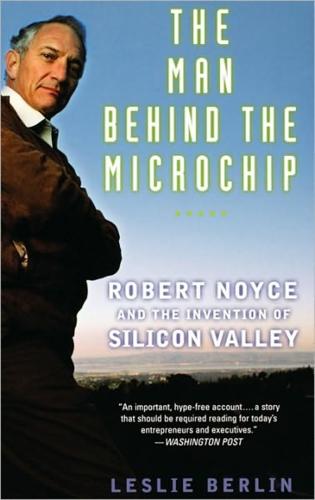

The Man Behind the Microchip: Robert Noyce and the Invention of Silicon Valley

by

Leslie Berlin

Published 9 Jun 2005

Noyce did not think this was the best way to go, but he never explicitly said as much to Teresi. Instead, he told Teresi that he would introduce him to Mike Markkula, now chairman of Apple Computer, who might have some other ideas for OmniPage. This redirection is vintage Noyce. “Even if he was blasting you,” recalls Kenneth Oshman, CEO and founder of ROLM, the business communications and military computer systems firm on whose board Noyce served for two years, “you just felt good about it.” The people on the receiving end of this “blasting” rarely believed that Noyce thought their work was inadequate or their ideas poorly considered. Instead, he seemed to be telling them that their already-excellent work could be taken even farther.

…

Between 1982 and 1985, Austin added 10,000 manufacturing jobs to its economy—two-thirds of them in high-tech businesses. In this sun-drenched city, reported a somewhat concerned San Jose Mercury News in 1985, high-tech talk was becoming “as common as a tall Lone Star beer on a hot day.” Within a few years, several prominent Silicon Valley companies—Intel, ROLM, Tandem Computers, Advanced Micro Devices, National Semiconductor—had sites in or near Austin. Motorola and Data General had facilities in the area, too, as did both IBM (which owned a 3.8-million-square-foot plant in Austin) and Microelectronics and Computer Technology Corp. (MCC), one of the earliest electronics research consortiums.

…

The entirety of Arthur Rock’s comment to Noyce—“I think taking the Sematech chairmanship was a class act”—was not an unqualified endorsement of it. Nor was Andy Grove’s note calling him a “mensch” for accepting the position. “The U.S. government, the U.S. semiconductor industry, and Sematech are damned lucky that you are a glutton for punishment,” wrote Ken Oshman, founder of ROLM. “With you at the helm, a possibility I never contemplated, all my objections [to SEMATECH] evaporate.” Gordon Moore summarized the feelings of many of Noyce’s friends when he said the SEMATECH job was “a huge sacrifice” for Noyce. “I didn’t think Bob wanted to take on a terribly difficult job, a job with a strong political content as well as a major managerial task at the time,” Moore says.

Big Blues: The Unmaking of IBM

by

Paul Carroll

Published 19 Sep 1994

He thought that might tie the two companies together more closely, because Microsoft would feel more beholden to IBM, and IBM would benefit if Microsoft prospered. Maybe that would stop the endless bickering. Gates and Lowe never got very specific, but the general idea was that IBM buy 10 percent of Microsoft. Lowe initially seem ed inter ested. T here was even a precedent, because IBM had bought similar stakes in Intel and Rolm. But following the initial Gates-Lowe conversa tion, Lowe came back and said h e’d pass. The sting of the U.S. antitrust suit was still great enough that Lowe didn’t want to be seen as throwing IBM ’s weight around too much by gaining some control over Microsoft. Completely misunderstanding how the PC market would develop, Lowe said IBM didn’t want to be seen as dominating the PC market too thoroughly.

…

Ross, 14 Persian Gulf War, 263 Pfeiffer, Eckhard, 318 Phvpers, Dean, 60 PictureTel, 331 Policy Management Systems, 224, 225 Prime Computer, 6 Proctor & Gamble, 15 Proffit, Brian, 118, 188 Puckett, Bernard, 225, 264, 370 Silicon Valley Group, 207 Smith, Sally, 366 Software Publishing, 76, 189 Sony Company, 71 Spectrum, 371 Spindler, Michael, 293-94, 297 State Farm Insurance, 319 Strobel, John, 365 Sun Microsystems, 5, 62, 79, 203-4, 205, 206, 211, 212-13,313,316,369 Swavelv, Mike, 143-44 Svdnes, Bill, 21-22 Tandy Company, 4, 22, 33, 35, 36, 37, 75, 143, 148, 149, 303, 335 Texaco Company, 64 Texas Instruments, 144, 208 Thomas, Clarence, 290 Time magazine, 67 TOPS software, 313 Toshiba Company, 345 Trisler, John, 306—8 Turner, Mary Lee, 266-67, 269, 346 Qureshev, Safi, 149 Reagan, Ronald, 158 Reiswig, Lee, 238, 239, 277-81, 283, 285, 286 Remington Rand, 4, 52 Rizzo, Paul, 66, 339 RJR Nabisco, 349, 350, 352, 354 Roach, John, 149 Robinson, Jim, 354 Rogers, Jack, 2 Rolm Company, 119 Rosen, Ben, 145, 147—48 Rusnack, Greg, 328 Russell, Bill, 328 Sabol, John, 112, 113, 165, 183 Sams, Jack, 8-9 , 17-18, 24-25, 32 Santelli, Tony, 245 Sargent, Murray, 182, 184 Sarrat, Fernand, 228-30 Schwartz, Steve, 243-44, 245 Scott, O.M., 174-75 Scullev, John, 148, 295, 297, 310, 314, 315, 350, 371 Seagate Company, 131, 349 Sears, Roebuck & Co., 5, 246, 247, 248, 249, 251, 252 Sevin, L.J., 145, 147 Sevin Rosen, 77, 145 Shabazian, Michael, 38—39, 247 Shapiro, Irving, 55, 153, 156 Shellenberg, Frank, 344 Unisys Company, 264 United Airlines, 151-52 United Way, 290 Univac computer, 4, 52 Unix operating system, 183, 184 Vieth, Kathy, 133, 320, 323-24 VisiCorp, 87 Wall Street Journal, 14, 141, 163, 239, 366 Wang Company, 4, 6, 75, 303 Warner, Bill, 359 Washington Post, 296 W n tc n n D ip lc Watson' Tom, Jr., 19, 48-54, 55, 57, 108, 163, 270, 366, 371 Watson, Tom, Sr., 19, 45-48, 49, 50, 53, 164, 165, 270, 291, 302, 359 Welch, Jack, 349-50 West, Jerry, 158 Western Digital, 254 Wheeler, Earl, 107-11, 113, 226, 229, 370 Wilkie, Dan, 29-30, 80 Windows software.

The Power Law: Venture Capital and the Making of the New Future

by

Sebastian Mallaby

Published 1 Feb 2022

By now they had routinized the Qume formula: they would have fixed 3Com’s management anyway, so the fact that Metcalfe had preempted them was not a game changer. Dick Kramlich of New Enterprise Associates was sticking with his offer of $13 per share. Jack Melchor, known for backing a successful 1970s computer maker called ROLM, was also offering $13. Mayfield had upped its number from $7, but refused to go higher than that apparently magical $13 level. Metcalfe suspected collusion. The Valley network was bountiful, but it could also feel like a cartel. It was ganging up against him. Metcalfe resolved to cast his net wider.

…

., 24 “prudent-man rule,” 61, 91, 92, 129 Q Qiming, 223–25, 234–35, 400, 446n Qualtrics, 451n quantitative analysis, 14, 47 quantitative easing, 336, 337, 338 QuantumScape, 263 Quartermaster Corps, 28 Quist, George, 51 Qume, 101, 190, 208, 426n Sutter Hill deal, 66–67, 98, 102, 103, 115, 184, 187–88, 290 R Rachleff, Andrew, 161–62, 167, 171–72, 416n, 439–40n racial diversity, 14–15, 384–85, 412 Radar Partners, 265 Rambler, 287 Ramsey Beirne, 168 Rand, Ayn, 61 randomness thesis, 376–77 “ratchet-down” clauses, 105 Raytheon Technologies, 18, 395 Reagan, Ronald, 92 recombinant DNA, 72–78 Reddit, 218 Red Hat, 170 Research in Motion, 331 Reynolds, Ryan, 368 Rickey’s Hyatt House, 67–68 Rieschel, Gary, 222–25, 234–35, 248, 445n, 446n RingCentral, 333 risk management, 12, 40, 46–47 Roberts, Sheldon, 34, 54 Robertson, Julian, 8, 278, 281, 282, 283, 337 Robertson, Michael, 458n Robertson, Sandy, 426n Rock, Arthur, 43–57, 79–80, 209, 220, 378–79, 382, 390, 422–23n Apple, 86–91, 229, 377 background of, 31–32 at Davis & Rock, 44–51, 382 Fairchild Semiconductor, 31–39, 52–55, 225 financial model of, 40, 46–48, 51, 225, 382 at Hayden, Stone, 31–33, 35–37, 44, 46, 225 Intel, 55–57, 237, 378 “intellectual book value,” 47, 78, 390 Kapor and, 135 SDS investment, 48–50 Tandem Computers, 71 Rockefeller, Laurance, 26 Rockefeller family, 26, 32, 35, 51, 56, 71 Rockefeller University, 68 Rodgers, T. J., 434n, 437n Rodriguez, Sixto, 375–76, 379 ROLM Corporation, 103 Romer, Paul, 447n Roosevelt, Franklin, 18 Ross, Steve, 66 RPX Corporation, 269–70 S Sacks, David, 444n Salesforce, 191, 302 Salganik, Matthew, 376, 377 Salomon Brothers, 61–62 Sand Hill Road, 68, 1502 San Francisco Ballet, 86 SARS outbreak, 282–83, 285, 286 Saudi Arabia, Public Investment Fund, 363, 364, 371, 372 Saxenian, AnnaLee, 94–96, 97, 220, 389–90 SBICs (Small Business Investment Companies), 41–43, 52, 61, 80, 395, 421–22n Schillage, Tanya, 308 Schmidt, Eric, 186–88, 208 Schoendorf, Joe, 437n Schroeder, Bob, 426n Schultz, Howard, 170 Schwartz, Mark, 229–30 Scientific Data Systems (SDS), 48–50, 423–24n Scott, Mike, 85–86, 89–90 screen addiction, 14 Searching for Sugar Man (documentary), 375–76 Sears, 64–65, 80, 426n Sears Tower, 64 “seasteading,” 212 Securities and Exchange Commission (SEC), 30 Seedcamp, 220–21 seed investing, 65, 70, 217–21.