Sam Bankman-Fried

description: disgraced founder and CEO of FTX, a cryptocurrency exchange

35 results

Gilded Rage: Elon Musk and the Radicalization of Silicon Valley

by Jacob Silverman · 9 Oct 2025 · 312pp · 103,645 words

in the way of public value or even viable businesses. Think of insanely well-compensated WeWork CEO Adam Neumann or the now-fallen FTX fraudster Sam Bankman-Fried. Buoyed by the gains of cheap capital and a rising stock market, this new class of the ultra-rich could also convince themselves of their

…

of the $22 million penthouse apartment in favor of higher-stakes intrigue. The crypto industry and the media became obsessed with the subsequent arrest of Sam Bankman-Fried, the fintech wunderkind who once seemed to have it all figured out while his colleagues seethed about him behind their social-media avatars. His aggressive

…

were rebranded as blockchain collectibles and sold for millions. People bought luxury apartments with crypto while the awkward, perpetually bed-headed Wall Street dropout named Sam Bankman-Fried was feted as a visionary and quickly became the richest person in the world under 30. But how much of it was real? What could

…

to raise $22 billion in investment capital to sublet office space to other well-funded startups that lacked viable business models. It’s what allowed Sam Bankman-Fried to use a crypto token that he invented as collateral for multibillion-dollar loans. Borrowing money was cheap, especially if you asked for a lot

…

debts, the crypto industry collapsed. Token prices plummeted, numerous startups went bankrupt or collapsed amidst allegations of fraud, and the industry’s most famous persona, Sam Bankman-Fried, was arrested for crimes connected to his theft of more than $8 billion in customer funds from FTX, his crypto exchange. Yet even this colossal

…

interpreted by tech and crypto leaders as an indictment of the US government, their perpetual antagonist. Why hadn’t the SEC chair Gary Gensler stopped Sam Bankman-Fried? Why was Bankman-Fried compelled to go offshore, where his crimes were easier to conceal? (The answer to that one might be that a criminal

…

their regulatory priorities across the finish line. They had been lobbying Congress and state houses for months, showing as much zeal for influence-peddling as Sam Bankman-Fried ever did. Fairshake, the PAC funded by Coinbase, Ripple Labs, Jump, and other top players—including Andreessen Horowitz and Winklevoss Capital Management—raised more than

…

of the most expensive political-influence operations the country had ever experienced. Ironically, their actions most resembled the failed political-lobbying campaign of FTX founder Sam Bankman-Fried, who would watch the 2024 election campaign cycle play out from a prison cell. Only two years earlier, Bankman-Fried had been on top of

…

over again, this time with the goal of electing Donald Trump. 18 Didn’t the Last Guy Go to Prison? The first time I met Sam Bankman-Fried, or SBF, the founder of the FTX cryptocurrency exchange, was during a conversation over Limoncello-flavored seltzers in a conference room of a luxury Manhattan

…

taking interviews with journalists, part of the duties bestowed upon a mogul who seemingly had the world in his hands. The second time I met Sam Bankman-Fried was almost exactly a year later, alone in a long hallway in the Daniel Patrick Moynihan Courthouse in Lower Manhattan. He was a criminal defendant

…

outrageously carceral society. The US criminal justice system is designed to imprison poor people—not billionaire financiers or presidents. For that reason, every stage of Sam Bankman-Fried’s prosecution—from the raid on his Bahamas penthouse to his extradition to the revocation of his bond to his eventual prosecution and conviction—took

…

a suspicious anomaly compared to business as usual; it might also be a form of equality under the law. The ethical genius character played by Sam Bankman-Fried was a fabrication, abetted by a credulous media and paid-for celebrity supporters. He did do some things well, like taking advantage of the corruption

…

and the judge described in court as one of the largest campaign-finance violations in US history. On December 30, 2023, SDNY prosecutors announced that Sam Bankman-Fried, who had yet to be sentenced for his first trial, would not face a second trial. “Proceeding with sentencing in March 2024 without the delay

…

the most significant campaign finance crime in American history would simply be brushed aside. What was there to stop someone from doing it again? When Sam Bankman-Fried was sentenced on March 28, 2024, I was in the courthouse, this time watching via video from an overflow room. I wouldn’t stumble upon

…

least for a while, what I hoped I would do for the world, not what I ended up doing.” The world had big dreams for Sam Bankman-Fried—at least the worlds of fintech and politics in which he proved himself an expert wheeler-dealer and social climber—and he had big dreams

…

, with the full extent of their crimes uninvestigated. As attested to by the number of civil lawsuits filed against FTX, company insiders, celebrity endorsers, investors, Sam Bankman-Fried’s parents, and FTX’s lawyers at Sullivan & Cromwell, there was potentially a great deal of illegal behavior that had still gone unexamined, including allegations

…

organization could belabor its decisions and tended not to be a strong enforcer of campaign-finance law. Would anyone investigate? trump’s crypto conversion When Sam Bankman-Fried went down, it seemed that the broader public had been saved from an aggressive, amoral mogul who was just starting to put his political project

…

for failing to pay $48 million in taxes. The crypto giant Binance was a singular case, and not just for its role in taking down Sam Bankman-Fried. One of the more laughably corrupt companies around, Binance had been caught trading on its own exchange—a form of potential market manipulation—and funneling

…

Sacks wrote: “Best to be low-key during transaction.”14 Did one of the unidentified shell companies belong to Sacks? In text messages, several of Sam Bankman-Fried’s friends and allies dangled a potential multibillion-dollar investment in front of Musk. Morgan Stanley banker Michael Grimes urged Musk to meet with the

…

and political organizations raised more than $245 million—far more than any other industry during the campaign cycle.33 It seemed like someone had reactivated Sam Bankman-Fried’s 2022 influence campaign, but at a bigger scale. Crypto PACs started splashing money around everywhere, including political ads that made no mention of crypto

…

only months earlier, had circulated a draft of an industry-friendly crypto regulatory bill among his Senate colleagues. Crypto CEOs could write their own ticket. Sam Bankman-Fried would have to watch his former colleagues complete his political project while serving a 25-year sentence in federal prison. Donald Trump would get immunity

…

-bitcoin-regulators/ 8 https://www.warren.senate.gov/oversight/letters/warren-grassley-probe-cftc-chair-behnams-interactions-and-meetings-with-sam-bankman-fried 9 https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/ 10 https://twitter.com/cz_binance/status/1589283421704290306 11

…

.com/binance/status/1590449164932243456 14 https://x.com/SBF_FTX/status/1590709166515310593 15 https://x.com/SBF_FTX/status/1590709197502812160 16 https://apnews.com/article/sam-bankman-fried-ftx-second-trial-b01fae9f9dd69f2ac2e8bbda21d277ff 17 Bankman-Fried sentencing hearing transcript, March 28, 2024. 18 Bankman-Fried sentencing hearing transcript, March 28, 2024. 19 Bankman-Fried

…

-02-28/ 23 https://www.justice.gov/usao-sdny/pr/former-ftx-executive-ryan-salame-sentenced-90-months-prison 24 https://apnews.com/article/ftx-sam-bankman-fried-ryan-salame-crypto-f999baec34226d277bff373a8077d565 25 https://x.com/rsalame7926/status/1820884772127961304 26 https://x.com/rsalame7926/status/1820503049145639414 27 https://x.com/rsalame7926/status/1820503301949198502

…

Institute here and Joe Lonsdale here and Maguire here and Elon Musk here, here and Sovereign Citizen here and Twitter here, here, here conspiracy and Sam Bankman-Fried here, here, here, here and James Beeks here and the Oath Keepers here and Solano County here, here content moderation, Twitter here, here corporatism here

…

, here Moulton, Seth here Moy, Catherine here, here Mubadala here Mudge here, here Mukasey, Marc here Murphy, Chris here Musk, Elon here, here, here and Sam Bankman-Fried here, here The Boring Company here, here children here, here citizenship here compared to the Network State concept here dealings with foreign governments here and

…

Roivant here Rometty, Ginni here Roos, Nicolas here Roosevelt, Franklin D. here Roth, Yoel here Rumble (video platform) here, here Sacks, David here, here on Sam Bankman-Fried here on Biden’s Ukraine policy here on Covid-19 policies here and Ron DeSantis here, here and Florida here and national security here net

…

national-security here school board recall here, here, here Schumer, Chuck here seasteading here, here Securities and Exchange Commission (SEC) here, here, here, here and Sam Bankman-Fried here and Binance here and cryptocurrency here and Ripple Inc here and Tesla here Donald Trump on here, here and Twitter here and Vy here

Our Dollar, Your Problem: An Insider’s View of Seven Turbulent Decades of Global Finance, and the Road Ahead

by Kenneth Rogoff · 27 Feb 2025 · 330pp · 127,791 words

Curse of Cash. 9. John Carreyrou, Bad Blood: Secrets and Lies in a Silicon Valley Startup (New York: Knopf, 2018). 10. “Profile: Sam Bankman-Fried,” Forbes, www.forbes.com/profile/sam-bankman-fried. 11. MacKenzie Sigalos, “Jamie Dimon Says He Is Done Talking About Bitcoin: I Don’t Care,” CNBC, January 17, 2024. 12. Ethan Wolf

Extremely Hardcore: Inside Elon Musk's Twitter

by Zoë Schiffer · 13 Feb 2024 · 343pp · 92,693 words

approach to philanthropy in an effort to maximize the benefit of every donation. “I’m not sure what’s on your mind, but my collaborator Sam Bankman-Fried has for a while been potentially interested in purchasing [Twitter] and then making it better for the world,” MacAskill said, referencing the billionaire wunderkind behind

…

!”: “Exhibit H,” Elon Musk text exhibits (Twitter v. Musk). GO TO NOTE REFERENCE IN TEXT “My bullshit meter”: Cheyenne Ligon, “Elon Musk Reveals Talks with Sam Bankman-Fried: ‘My Bulls**t Meter Was Redlining,’ ” Coindesk.com, updated May 9, 2023, coindesk.com/business/2022/11/12/elon-musk-reveals-talks-with

…

-sam-bankman-fried-my-bullshit-meter-was-redlining. GO TO NOTE REFERENCE IN TEXT Bankman-Fried thought Musk was nuts: Isaacson, Elon Musk. GO TO NOTE REFERENCE IN

Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of Fraud

by Ben McKenzie and Jacob Silverman · 17 Jul 2023 · 329pp · 99,504 words

. The financial press was practically in lockstep about the inevitable crypto-fied future of money. Politicians, their pockets brimming with donations from industry moguls like Sam Bankman-Fried of FTX, were preaching the Bitcoin gospel. They were also openly contemplating passing industry-written legislation to further legalize these rigged casinos. Celebrities were pocketing

…

mogul Justin Sun, who issued a token called TRON, along with sophisticated trading firms like Cumberland and Alameda Research, the Bahamas-based outfit owned by Sam Bankman-Fried, known in the crypto world (and now beyond) as SBF. Those players then gambled with the Tethers. The supposedly democratizing, decentralizing currency of the future

…

withdrawals. It appeared likely that few of them would ever open again. Bankruptcies proliferated, as did emergency capital infusions and loan packages from FTX and Sam Bankman-Fried, who had ended up in the business of picking survivors for the oncoming crypto winter. One of them was BlockFi, another crypto lender that offered

…

of consumer protection and looking out for the little guy, many leading Democratic politicians were taking huge donations from the crypto industry—most notably, from Sam Bankman-Fried—and spending far too much time with industry lobbyists. (We saw the photos on Twitter before you deleted them, guys.) The revolving door between crypto

…

showering politicians with donations in order to legitimize crypto and shape its regulatory future. As summer went on, it seemed like all roads went through Sam Bankman-Fried. Crypto’s boyish king—who happened to be Tether’s biggest customer—was making major interventions to determine who might weather the downturn. Notably, he

…

up what might be my only chance at a sit-down with the public face of crypto, I needed a cram session on all things Sam Bankman-Fried. If the industry was the functional equivalent of an unregulated, unlicensed casino, as I strongly suspected it to be, it was highly improbable that the

…

billion on the 2024 election cycle, “north of $100 million.” He was everywhere: on TV, in print, and seemingly online 24-7. I dug in. Sam Bankman-Fried was the child of Stanford law professors—an intellectual pedigree that later added to his nerd-king mystique. Growing up, he and his younger brother

…

-making services trading global exchange-traded funds (ETFs). The specifics of that field are not important for us here, just the obvious: At Jane Street, Sam Bankman-Fried was still playing games. These games involved real money, and Sam was very good at making money. But playing the same game over and over

…

public. According to Open Secrets, a nonprofit that tracks data on campaign finance and lobbying, in the two years leading up to the 2022 midterms, Sam Bankman-Fried had given $39.8 million to Democrats, making him their second-largest individual donor. So even if you took his pandemic preparedness numbers at face

…

fuck was that all about? ° ° ° In our journey through the wilds of crypto, Jacob and I had encountered numerous bizarre characters, but none quite like Sam Bankman-Fried. I knew from previous communiques that he would try to shape my perception of him and his businesses, and it was equally clear from his

…

empire, he was a ripe target for crypto’s conspiratorial fringe. But if there was one thing that everyone could agree on, it was that Sam Bankman-Fried had it all figured out. Even among the most die-hard crypto skeptics, it was broadly assumed that Sam was making money hand over fist

…

off to Capitol Hill, appearing on TV as often as possible. FTX/Alameda were notoriously small shops, so who was actually doing the work? If Sam Bankman-Fried really was the bean-bag-napping workaholic CEO he claimed to be, how did he have time to spend an hour and seventeen minutes with

…

excuse handy, or at least a way of deflecting blame elsewhere. But that still left the first part: the need. Why in the world would Sam Bankman-Fried need to commit fraud? He was a genius, a guaranteed moneymaker, a sure thing. No way he would have to do anything illegal. He could

…

and its capitalist antecedents, using his supposedly brilliant mind to arbitrage small discrepancies in price. But then a more disturbing thought flashed through my head. Sam Bankman-Fried loved playing games; he was addicted to them. He played them not just compulsively, but simultaneously, and not always well. Sam was literally playing a

…

from a Silicon Valley venture capital firm. While the game he was playing with me was clear, it begged the question: What other games was Sam Bankman-Fried playing? CHAPTER 10 WHO’S IN CHARGE HERE? “Most people don’t know what they’re doing, and a lot of them are really good

…

percent—and that guy was allegedly running a Ponzi scheme that soon went bankrupt. He might have been exaggerating; it was probably even less. While Sam Bankman-Fried was busy buying up companies (and their crypto assets) for pennies on the dollar, many industry executives cut bait. Michael Saylor, CEO of MicroStrategy, and

…

all this, crypto lobbying expenditures were at an all-time high, and politicians from both parties were touting pro-industry legislation. Leading the charge was Sam Bankman-Fried, the baby-faced effective altruist who had charmed institutional investors (from his offshore Bahamas compound) and was supposed to make crypto safe for Americans. As

…

even the defense industry. While many of crypto’s true believers were conservative, it was an equal opportunity industry when it came to influence-peddling. Sam Bankman-Fried largesse toward the Democrats was quickly becoming legendary, but lest you think this was a partisan issue, his colleague at FTX, Ryan Salame, as mentioned

…

and the SEC for jurisdiction over the 20,000 or so cryptocurrencies out there. The crypto industry desperately wanted the CFTC to be in charge. Sam Bankman-Fried and other crypto heavy hitters praised the agency’s light touch approach to Bitcoin as a model and met with its leaders. Commissioner Caroline Pham

…

ever, and few public officials seemed to feel any shame in passing through it. The CFTC chief at the time was Rostin Behnam, with whom Sam Bankman-Fried met over ten times. Behnam and the CFTC were supporters of Sam’s Bill, which would put crypto exchanges under the agency’s domain. Behnam

…

days as President Donald Trump’s communications chief. Scaramucci was also a major crypto investor, running the firm SkyBridge Capital, which had deep ties to Sam Bankman-Fried. It drove John nuts. “There really is no legitimate side to crypto,” said Stark. To him, crypto had simply repackaged the traditional get-rich-quick

…

James and other online critics as adversaries endangering their business. Months after his company filed for bankruptcy, Mashinsky was still playing victim, blaming everyone from Sam Bankman-Fried to crypto media that “publish[ed] false and misleading stories about Celsius and almost never covered any positive news.” The cognitive dissonance was bewildering: What

…

had developed a reputation as a huckster, Celsius was still deeply enmeshed in relationships with key companies like Tether. As the company stumbled into bankruptcy, Sam Bankman-Fried was reportedly considering picking over its corpse, gobbling up its depreciated assets. It wasn’t just the crypto vultures pursuing their self-interest. The victim

…

move on to the next thing. Somehow, Celsius had done no wrong. It was a victim of unseen forces—shadowy hedge funds, pseudonymous online investigators, Sam Bankman-Fried himself—or was, weirdly, just misunderstood. While extolling Celsius’s innocence, Krissy Mashinsky simultaneously marketed a line of T-shirts, produced by her apparel company

…

confirmed through patient investigation. I shouldn’t have been surprised when James played a key role in an even more dramatic crypto crash: that of Sam Bankman-Fried and his company FTX. Even so, I still was shocked at what unfolded. Like so much in crypto, the situation was weirdly dramatic, incredibly volatile

…

12 CHAPTER 11 “Capitalism without bankruptcy is like Christianity without hell.” —Frank Borman Over the course of the summer of 2022, things got squirrely with Sam Bankman-Fried’s empire. On July 20, the day of my interview with Sam, Brett Harrison, president of FTX US, claimed in a Twitter thread that “direct

…

, directly or by implication, concerning FTX US’s deposit insurance status.” The FDIC order forced FTX to back down and delete the tweets. But then Sam Bankman-Fried took to Twitter to play damage control, and in a since-deleted Tweet, claimed to “apologize if anyone misinterpreted” FTX’s previous statements. I was

…

some actor moonlighting as a reporter thought? Regardless, I didn’t forsake my principles before and I sure as hell wasn’t going to for Sam Bankman-Fried. Also, I didn’t need to. He was already DMing me. In my position—just trying to understand what is going on here—it was

…

dumb to realize that crypto’s figurehead might not be a brilliant visionary but rather an epic fraudster. Of course, Toomey still spoke as if Sam Bankman-Fried was the lone bad actor in crypto, and he wanted to push forward with legislation favorable to the industry before he retired in January. Tick

…

should—be trusted to provide honest statements about the health of their business. The previous few months had shown that many, from Alex Mashinsky to Sam Bankman-Fried, would say that things were great right up until the bankruptcy filing—and maybe even afterward. Trading volume plunged to lows not seen since the

…

new class of intermediaries—fell apart under its own contradictions, including rampant opportunities for fraud. Crypto had indeed produced something no one could trust, and Sam Bankman-Fried, their knockoff J. P. Morgan, would be remembered as one of its architects. Bankman-Fried was no Morgan; he had more in common with Bernie

…

fraud, as his clients rushed to withdraw their money only to find it wasn’t there. Almost exactly fourteen years later, on December 12, 2022, Sam Bankman-Fried was charged with similar crimes after the crypto markets experienced a similarly precipitous drop, and FTX customers experienced a similar result. The similarities didn’t

…

end there: Madoff ran a legitimate market making business in addition to his fraudulent one. Did Sam Bankman-Fried’s Alameda Research serve the equivalent role, or had it been a con from the beginning? While Madoff could be depicted as an isolated villain

…

say we had it all wrong. They did their best. The recent revelation by Mr. O’Leary that he had been paid $15 million by Sam Bankman-Fried’s now bankrupt crypto exchange to hawk its services to the general public was slightly awkward. Mr. O’Leary’s views on crypto had evolved

…

CNBC, the story changed. Now he was “at zero” when it came to his payday from the company owned by the soon-to-be-indicted Sam Bankman-Fried. He claimed he hadn’t won, but he also hadn’t lost. By the time he was testifying before Congress six days later, and SBF

…

cryptoland, so it was fairly understandable that the narratives surrounding it couldn’t quite keep up. On December 12, two days before the Senate hearing, Sam Bankman-Fried was arrested in the Bahamas. The next day, December 13, he was charged in the Southern District of New York (SDNY) with eight counts of

…

Lot Richer, Thanks To New FTX Funding Round,” Forbes, October, 21, 2021. 150 “THE NEXT WARREN BUFFET?”: Jeff John Roberts, “Excusive: 30-year-old billionaire Sam Bankman-Fried has been called the next Warren Buffett. His counterintuitive investment strategy will either build him an empire—or end in disaster,” Fortune, August 1, 2022

…

, “A 30-Year-Old Crypto Billionaire Wants to Give His Fortune Away,” Bloomberg, April 3, 2022. 150 “north of $100 million”: MacKenzie Sigalos, “FTX’s Sam Bankman-Fried backs down from ‘dumb quote’ about giving $1 billion to political races,” CNBC, October 14, 2022, www.cnbc.com/2022/10/14

…

/sam-bankman-fried-backtracks-from-1-billion-political-donation.html. 150 He was everywhere . . . I dug in: Various articles from Reuters, Bloomberg, the New York Times, Forbes, and

…

others. 152 Sequoia was blown away . . . during a Zoom call: Sequoia Capital, profile on Sam Bankman-Fried from Sequoiacap.com (since removed), September 22, 2022. 156 We began: Ben McKenzie interview with Sam Bankman-Fried, 1 Hotel Central Park (New York, NY), July 2022. CHAPTER 10: WHO’S IN CHARGE HERE? 180 Elon

…

-receives-cease-and-desist-from-fdic-about-insurance.html. 218 He slid into my DMs: Direct Messages between Ben McKenzie and Sam Bankman-Fried. 220 Alameda’s balance sheet: Ian Allison, “Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet,” Coin-Desk, November 2, 2022, https://www.coindesk

…

.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/. 220 an ominously titled post: James Block, “Is Alameda Research Insolvent?,” Dirty Bubble Media, November

…

4, 2022, https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent. 223 Sam signed over control: MacKenzie Sigalos, “Sam Bankman-Fried steps down as FTX CEO as his crypto exchange files for bankruptcy,” CNBC, November 11, 2022, https://www.cnbc.com/2022/11/11

…

/sam-bankman-frieds-cryptocurrency-exchange-ftx-files-for-bankruptcy.html. 228 “ ‘God Mode’ to short coins . . .”: Alex Mashinsky (@Mashinsky), Twitter, December 3, 2022, https://twitter.com/mashinsky/with_

…

.youtube.com/watch?v=UgoZGn6Y74g. 258 his written testimony leaked: https://s.wsj.net/public/resources/documents/SBFwrittentestimonynotes12122022.pdf. 259 Back door code: Pete Syme, “Sam Bankman-Fried’s secret ‘backdoor’ discovered, FTX lawyer says,” Insider, January 13, 2023. 260 The Block: Sara Fischer, “Exclusive: SBF secretly funded crypto news site,” Axios December

Number Go Up: Inside Crypto's Wild Rise and Staggering Fall

by Zeke Faux · 11 Sep 2023 · 385pp · 106,848 words

_144880586_ PROLOGUE Nassau, Bahamas February 17, 2022 Total Value of All Cryptocurrencies: $2 Trillion (Yes, Trillion with a “T”) “I’m not going to lie,” Sam Bankman-Fried told me. This was a lie. We were in his office in the Bahamas, and I had just pulled up my chair to his desk

…

know something about it, and arranged interviews with several of them. First, a colleague had invited me to tag along for a brief meeting with Sam Bankman-Fried, whose exchange FTX was reportedly a big user of Tether. I wanted to talk with him about something called “commercial paper.” Commercial paper is a

…

lot more trading—at least until the boom died down in 2018. The frenzy seeded many of what would become the biggest companies in crypto: Sam Bankman-Fried made his first big score as a trader exploiting Bitcoin price discrepancies around this time. For Giancarlo Devasini, the ICO craze was good for both

…

it would use future trading revenue to buy them back. Among the buyers were EOS, the ICO promoted by Tether co-founder Brock Pierce; and Sam Bankman-Fried’s hedge fund Alameda Research. Devasini had essentially printed his own money to replace what was lost by Crypto Capital and sold it to the

…

all the people I met researching Tether, one stood out as both a source of information about Tether and a potential story subject for Bloomberg: Sam Bankman-Fried. In the months since we’d met briefly in Miami, he’d become the most prominent crypto booster of all. And on November 10,

…

York. One of his public relations representatives readily agreed to an interview at FTX’s new office in Nassau. CHAPTER NINE Crypto Pirates Long before Sam Bankman-Fried relocated his crypto exchange to the Bahamas, the island territory had been a haven for schemers, smugglers, and pirates. In 1696, the buccaneer Henry Avery

…

put it on equal footing with traditional finance. The Bahamas was ready for a new generation of “financial wizards.” Among the first to come was Sam Bankman-Fried, who relocated his crypto exchange from Hong Kong to the Bahamas in the fall of 2021. FTX made plans to build a $60 million headquarters

…

of crypto pirates followed him to the Caribbean. CHAPTER TEN Imagine a Robin Hood Thing By the time I arrived in Nassau, in February 2022, Sam Bankman-Fried was swimming in money. He was just four years removed from his days of trading in his Berkeley crash pad. But the previous month, FTX

…

kind of coin for another, or make a loan to another user. DeFi used these smart contracts to create decentralized, anonymous versions of exchanges like Sam Bankman-Fried’s FTX. It was a genuinely powerful innovation. But naturally, crypto bros quickly turned DeFi into a series of get-rich-quick schemes, just like

…

my head,” he said. I laughed. “It’s not funny,” he said. * * * — STONE TOLD ME that one of the other big players in DeFi was Sam Bankman-Fried. Stone could tell from watching Bankman-Fried’s crypto wallet addresses that his hedge fund, Alameda Research, was farming giant sums on tokens like SushiSwap

…

Philippines, Vietnam, Brazil, and beyond are applying for Axie Scholarships like they would apply for college or a job, hoping to bend their trajectories upwards.” Sam Bankman-Fried’s exchange, FTX, paid for in-game naming rights to one group of scholars. Among the game’s other backers was Mark Cuban, the Shark

…

to a dictator’s weapons program. In April 2022, two months after my visit to FTX’s offices in the Bahamas and Razzlekhan’s arrest, Sam Bankman-Fried was hosting a conference in Nassau. Dubbed simply “Crypto Bahamas,” it was billed as “an exclusive gathering of the leading investors and builders in the

…

morning in Nassau, a shuttle bus waited outside my hotel to bring me to the Baha Mar, the 2,300-room resort and casino where Sam Bankman-Fried was hosting his Crypto Bahamas conference. Baha Mar had sold out. Katy Perry and her husband, Orlando Bloom, were rumored to be flying in,

…

former Jane Street colleague who was by then the head of Alameda. But I didn’t see them anywhere either. * * * — A DAY BEFORE Crypto Bahamas, Sam Bankman-Fried had all but admitted that much of his industry was built on bullshit. Not on stage, of course—it was in an interview on a

…

for 2022, with an unheard-of 84 percent profit margin. Of course the venture capitalists bought in, led by Axie Infinity–backers Andreessen Horowitz and Sam Bankman-Fried’s FTX, which seemed to have so much money it was backing almost every crypto start-up. The investment round, announced in March 2022, valued

…

, instead of bailing Celsius out, Tether liquidated its loan to Celsius, further depleting Mashinsky’s reserves. Then Celsius tried a Hail Mary. It turned to Sam Bankman-Fried. Since his Bahamas conference, he’d become the most famous man in crypto. His supply of money was seemingly limitless. Celsius executives approached him about

…

would go up, calling it “the most pure digital asset that you can buy that’s going to inevitably increase in value.” * * * — FOR HIS PART, Sam Bankman-Fried came out of crypto’s summer of crisis looking like a hero. In June 2022, he bailed out BlockFi and Voyager with emergency loans after

…

million in Tethers. From there, many of the Tethers were sent to addresses associated with the crypto exchange Binance, and to others that belonged to Sam Bankman-Fried’s FTX. Sanders said that was typical. Scammers would send their Tethers to exchanges, trade the crypto for local currency, and withdraw the cash to

…

Assets Are Not Fine “Excited to see him repping the industry in DC going forward! uh, he is still allowed to go to DC, right?” Sam Bankman-Fried wrote on Twitter on October 29, 2022. He was responding to an obsequious message posted by one of his deputies praising Changpeng Zhou, better known

…

finally revealed—and it was Janet Yellen, the central banker hated by Bitcoiners. FTX’s bankruptcy made the front page of The New York Times. “Sam Bankman-Fried Went From Crypto Golden Boy to Villain,” wrote The Wall Street Journal. On Twitter, crypto followers were debating whether it was a bank run set

…

few weeks,” Bankman-Fried told me. Together we rode the elevator up to his penthouse. Then the doors opened. CHAPTER TWENTY-THREE Inside the Orchid Sam Bankman-Fried’s $30 million Bahamas penthouse looked like a dorm after the students have left for winter break. The dishwasher was full. Towels were piled in

…

to add lines to crypto spreadsheets, to record that they owned a stash of Dogecoins, or a rare Bored Ape. By manipulating sheets like these, Sam Bankman-Fried had made himself into one of the world’s richest men. On the screen in the courtroom, the spreadsheet lost its power. It looked like

…

in 2021. That year, by some estimates, Bitcoin mining consumed as much energy as the entire country of Argentina, population 46 million. (Andrey Rudakov/Bloomberg) Sam Bankman-Fried, founder of the crypto exchange FTX, in the Bahamas in the spring of 2022, a few months after he relocated there. FTX had recently raised

…

of cryptocurrency to invest. “I’m just like click, click, click, make money, make money, make money,” Stone explained of his trading strategy. (Dave Krugman) Sam Bankman-Fried poses with supermodel Gisele Bündchen at FTX’s Crypto Bahamas conference in April 2022. The unlikely pair also starred in a glossy magazine advertising campaign

…

2022 after suffering severe beatings and torture. He proved a valuable source of information about the scam compound where he was held captive. (Zeke Faux) Sam Bankman-Fried lived in a $30 million penthouse at this condo building, called the Orchid, in Albany, a resort in the Bahamas. Bankman-Fried’s supposed thriftiness

…

was part of his public persona, so this wasn’t part of the typical tour he gave to visiting journalists. (Zeke Faux) Sam Bankman-Fried being walked in handcuffs to a plane in Nassau in December 2022 after FTX’s collapse. He was flown to New York after agreeing to

…

NOTE REFERENCE IN TEXT Forbes estimated his personal net worth: Steven Ehrlich and Chase Peterson-Withorn, “Meet the World’s Richest 29-Year-Old: How Sam Bankman-Fried Made a Record Fortune in the Crypto Frenzy,” Forbes, October 6, 2021. GO TO NOTE REFERENCE IN TEXT Chapter Nine: Crypto Pirates a stolen warship

…

, December 13, 2022. GO TO NOTE REFERENCE IN TEXT “the nerdiest stuff you can imagine”: Roger Parloff, “Portrait of a 29-Year-Old Billionaire: Can Sam Bankman-Fried Make His Risky Crypto Business Work?,” Yahoo! Finance, August 12, 2021. GO TO NOTE REFERENCE IN TEXT Over lunch at Au Bon Pain: Adam Fisher

…

-Known Crypto Trader. Then FTX Collapsed,” New York Times, November 23, 2022. GO TO NOTE REFERENCE IN TEXT “We Do Cryptocurrency Bitcoin Arbitrage”: Sylvie Douglas, “Sam Bankman-Fried and the Spectacular Fall of His Crypto Empire, FTX,” Planet Money, NPR, November 16, 2022. GO TO NOTE REFERENCE IN TEXT about $500,000 in

…

Harrison, former president of FTX US. GO TO NOTE REFERENCE IN TEXT He gave $5 million: Sander Lutz, “White House Refuses to Answer Questions About Sam Bankman-Fried Donations,” Decrypt, December 14, 2022. GO TO NOTE REFERENCE IN TEXT spread around at least $90 million: Matthew Goldstein and Benjamin Weiser, “New Details Shed

…

FTX’s Founder,” CoinDesk, November 15, 2022. GO TO NOTE REFERENCE IN TEXT “weird brand-building exercises”: Sam Harris, “Earning to Give: A Conversation with Sam Bankman-Fried,” Making Sense, December 24, 2021. GO TO NOTE REFERENCE IN TEXT ultramarathon running record: Mercury News, “Saratogan Nishad Singh Sets the World Record for Fastest

…

REFERENCE IN TEXT “One of the main criticisms”: Packy McCormick, “Infinity Revenue, Infinity Possibilities,” Not Boring, July 19, 2021. GO TO NOTE REFERENCE IN TEXT Sam Bankman-Fried’s exchange: Andrew Hayward, “FTX Sponsors Play-to-Earn ‘Scholars’ in Ethereum Game Axie Infinity,” Decrypt, August 5, 2021. GO TO NOTE REFERENCE IN TEXT

…

, Funding Nuclear Program,” Wall Street Journal, June 11, 2023. GO TO NOTE REFERENCE IN TEXT Chapter Fourteen: Ponzinomics Clinton was reportedly paid: Lydia Moynihan, “How Sam Bankman-Fried’s Ties with the Clintons Helped Him Dupe Investors,” New York Post, January 19, 2023. GO TO NOTE REFERENCE IN TEXT Brady and Bündchen were

…

. “Our philosophy, since inception, is to develop iteratively and release modularly,” Wagner told me. GO TO NOTE REFERENCE IN TEXT A writer who visited: Fisher, “Sam Bankman-Fried Has a Savior Complex—And Maybe You Should Too.” GO TO NOTE REFERENCE IN TEXT was earning: Shaurya Malwa, “Solana-Based STEPN Reports $122.5M

…

Q2 Profits,” CoinDesk, July 12, 2022. GO TO NOTE REFERENCE IN TEXT an interview on a podcast: SBF. Interview. Joe Weisenthal and Tracy Alloway, hosts. “Sam Bankman-Fried and Matt Levine on How to Make Money in Crypto,” Odd Lots podcast, April 25, 2022. GO TO NOTE REFERENCE IN TEXT Kyle Samani, a

…

Four NFT Novices Created a Billion-Dollar Ecosystem of Cartoon Apes,” Rolling Stone, November 1, 2021. GO TO NOTE REFERENCE IN TEXT suspected to be Sam Bankman-Fried: Nate Freeman, “SBF, Bored Ape Yacht Club, and the Spectacular Hangover After the Art World’s NFT Gold Rush,” Vanity Fair, January 18, 2023. GO

…

Crypto Lender,” Los Angeles Times, August 12, 2022. GO TO NOTE REFERENCE IN TEXT “a trading wunderkind”: Jeff John Roberts, “Exclusive: 30-Year-Old Billionaire Sam Bankman-Fried Has Been Called the Next Warren Buffett. His Counterintuitive Investment Strategy Will Either Build Him an Empire—Or End in Disaster,” Fortune, August 1, 2022

…

$8 Billion Shortfall,” Bloomberg, November 9, 2022. GO TO NOTE REFERENCE IN TEXT U.S. regulators opened investigations: Lydia Beyoud, Yueqi Yang, and Olga Kharif, “Sam Bankman-Fried’s FTX Empire Faces US Probe into Client Funds, Lending,” Bloomberg, November 9, 2022. GO TO NOTE REFERENCE IN TEXT many of FTX’s top

…

NOTE REFERENCE IN TEXT Chapter Twenty-Three: Inside the Orchid U.S. Department of Justice scrutinized: Katanga Johnson, Lydia Beyoud, Allyson Versprille, and Annie Massa, “Sam Bankman-Fried Facing Possible Trip to US for Questioning,” Bloomberg, November 15, 2022. GO TO NOTE REFERENCE IN TEXT “So the ethics stuff, mostly a front?”: Kelsey

…

and Doing Good,” 80,000 Hours podcast, April 14, 2022. GO TO NOTE REFERENCE IN TEXT “Fifty-one percent you double the earth”: Tyler Cowen, “Sam Bankman-Fried on Arbitrage and Altruism,” Conversations with Tyler podcast, January 6, 2022. GO TO NOTE REFERENCE IN TEXT “The way to really make money”: Caroline Ellison

…

Against $9bn in Liabilities,” Financial Times, November 12, 2022. GO TO NOTE REFERENCE IN TEXT Epilogue he got a call from his lawyer: Steven Ehrlich, “Sam Bankman-Fried Recalls His Hellish Week in a Caribbean Prison,” Forbes, January 26, 2023. GO TO NOTE REFERENCE IN TEXT His opening line: Gillian Tan and Max

…

Chafkin, “Sam Bankman-Fried’s Written Testimony Is Called ‘Absolutely Insulting’ at House Hearing,” Bloomberg, December 13, 2022. GO TO NOTE REFERENCE IN TEXT Around 6:00 p.m

…

“The Only Living Boy in Palo Alto,” Puck, January 10, 2023. GO TO NOTE REFERENCE IN TEXT “It’s not fit for humanity”: Lee Brown, “Sam Bankman-Fried’s Bahamas Jail Infested by Rats and Maggots: ‘Not Fit for Humanity,’ ” New York Post, December 14, 2022. GO TO NOTE REFERENCE IN TEXT He

…

was assigned: Ehrlich, “Sam Bankman-Fried Recalls His Hellish Week in a Caribbean Prison.” GO TO NOTE REFERENCE IN TEXT “I was trying to pretend”: Ibid. GO TO NOTE REFERENCE IN

…

an Arc of Brotherhood and Betrayal,” Bloomberg, February 15, 2023. GO TO NOTE REFERENCE IN TEXT His ankle restraints clanking: Jacob Shamsian and Sindhu Sundar, “Sam Bankman-Fried to Be Released on $250 Million Bail and Will Be Required to Stay with Parents Ahead of FTX Trial,” Business Insider, December 22, 2022. GO

On the Edge: The Art of Risking Everything

by Nate Silver · 12 Aug 2024 · 848pp · 227,015 words

I was writing this book—poker cheating scandals; Elon Musk’s transformation from rocket-launching renegade into X edgelord; the spectacular self-induced implosion of Sam Bankman-Fried—you’d think the River had a rough few years. But guess what: the River is winning. Silicon Valley and Wall Street are still

…

appetite for involving themselves in all sorts of controversies. Effective altruism came under substantial scrutiny in 2022 following the implosion of the cryptocurrency exchange FTX. Sam Bankman-Fried, FTX’s founder—who I spoke with several times for this book both before and after FTX’s bankruptcy, and who I cover extensively in

…

civilization and pose an existential risk to humanity. So it has been an interesting time to write about these movements. Between their catastrophic association with Sam Bankman-Fried (SBF) on the one hand, and the astonishing progress of AI tools like ChatGPT on the other hand—progress that was well predicted by

…

generally skeptical of movements such as EA and rationalism. But the grudge cuts in both directions: people within the River are seeking more political influence. Sam Bankman-Fried had become a major political player, donating millions of dollars openly to Democrats, but also covertly to Republicans. Meanwhile, Elon Musk’s purchase of Twitter

…

that can be thought of as a book within a book, structured as a play in five acts. Nominally, the subject of the play is Sam Bankman-Fried. I met with SBF many times, as well as with many people close to him. As a Riverian myself, I see SBF on his

…

can probably guess what happened next. Before long, they were the equivalent of steroid-infused meatheads, barreling right on past optimal to dangerous, potentially catastrophic, Sam Bankman-Fried levels of risk-taking. Coates believes that much of what accounts for the “irrational exuberance” that makes for financial bubbles are these biological factors. Traders

…

word we scrutinize often depends on our preconceived notions of the person. The River has these biases as much as any other place. Why did Sam Bankman-Fried get away for so long with a $10 billion fraud when Robbi Jade Lew was villainized for a $269,000 poker hand? I also

…

year’s hiatus in December 2023. The personality types you’ll encounter in the River are varied. Yes, you’ll find some cheaters, some Sam Bankman-Frieds, people willing to do anything to increase their EV. But people in the River are also good at abstraction, skilled at taking data points and

…

been more questionable. Social media may well have had net-negative effects on society. Crypto gave rise to a lot of scams and cons, like Sam Bankman-Fried’s FTX—heavily invested in by Sequoia and other VC firms—which cost cryptocurrency holders out of at least $10 billion. And with AI,

…

founders because they’re disagreeable, you may get the wrong ones. Especially if founders deliberately play into stereotypes that they think VCs will like, as Sam Bankman-Fried did (we’ll cover him in the next chapter). And yet, if all you care about is the right tail, the selection process gets

…

concluding chapters. 6 Illusion Act 1: New Providence Island, the Bahamas, December 2022 The room was getting darker, the power was going out on Sam Bankman-Fried’s laptop, and he was telling me increasingly unhinged things. I was sitting alone with Bankman-Fried—SBF—on the ground floor of a luxury

…

, but he said that was a matter of luck since he mostly trades NFTs rather than crypto itself. At the center of it all was Sam Bankman-Fried. He was the biggest focal point of all, Betancourt said. “It’s almost like a self-fulfilling story where you want to believe that

…

a year and donates the rest of his income. However, the location hadn’t been MacAskill’s idea—instead, the party was hosted by Sam Bankman-Fried, who had become one of the world’s largest benefactors of effective altruism through the FTX Foundation, which at one point had claimed that it

…

(for medium-scale problems), I am much more suspicious that it functions well as a framework for personal ethics—it can quite directly lead to Sam Bankman-Fried’s conclusion, as revealed at his criminal trial, that the ends justify the means. I am also suspicious that it works well for very

…

Extropianism, Singularitarianism, Cosmism, Rationalism, Effective Altruism, and Longtermism. No, there won’t be a pop quiz. 8 Miscalculation Act 5: Lower Manhattan, October–November 2023 Sam Bankman-Fried, at least by his own account,[*1] wasn’t much of a fan of poker or other forms of capital-G Gambling. And yet, the

…

years. “I think instead it’s going to be north of twenty,” he had correctly predicted. In Which SBF Spectacularly Fails a Fact Check Sam Bankman-Fried had told me a story that, but for one revealing admission he made later on, he mostly stuck to: what happened at FTX was just

…

prepare the memo. Far from being a tenth percentile scenario, 50 percent declines in crypto prices had been a biennial occurrence. Four Theories of Sam Bankman-Fried Even after having spent so much time with SBF and having the good fortune that his criminal trial happened before this book was due to

…

your lifestyle or take you months or years to recover from. It’s just too risk-on, even for most people in the River. But Sam Bankman-Fried, of course, thought the Kelly criterion had you wagering far too little. He thought it was for wimps. In a 2020 Twitter thread, @SBF

…

are. In other words, 5x Kelly is higher EV—if you don’t care about ruin. There’s every indication that is exactly how Sam Bankman-Fried was thinking about FTX and maybe everything else in his life. That’s why it was no big deal for him to admit to me

…

with Alameda’s finances was extremely crude. *5 A network of polyamorous relationships, as ostensibly happened at FTX; https://nypost.com/2022/11/30/ftxs-sam-bankman-fried-fumed-over-media-spotlight-on-polyamorous-sex-life/. *6 It was indeed vegan—including leftover lentil soup that had apparently been prepared by SBF’s

…

plausible-sounding bullshit when it didn’t know how to answer the question—were uncannily humanlike. So at the very moment in late 2022 that Sam Bankman-Fried’s empire was collapsing, Sam Altman’s was soaring to new heights. Inside OpenAI, the recognition of the miracle had come sooner[*8]—with

…

going that quickly. Now it’s your turn to decide whether to push the button. Except, it’s not the “go” button that I imagined Sam Bankman-Fried pressing. Instead, it’s a big red octagonal button labeled STOP. If you press it, further progress on AI will stop permanently and irrevocably.

…

, topsy-turvy world, it’s hard to know when an ideological movement might suddenly accumulate a lot of power very quickly, as utilitarianism did under Sam Bankman-Fried, and exercise its worst impulses. Even if you think a philosophy is mostly right,[*8] the undistilled version of it is often dangerous. Finally,

…

INVESTMENT ADVICE: Investment advice. A Riverian trope for a legalistic disclaimer that means the opposite of what it says. The phrase was frequently employed by Sam Bankman-Fried in all caps before offering analysis that in fact provided actionable intelligence to investors. NPC: See: non-player character. Nuts (poker): A hand that

…

to Satoshi Nakamoto, the pseudonymous creator of Bitcoin, or a satoshi, the smallest denomination of Bitcoin, equal to 0.00000001 BTC. SBF: Felonious FTX founder Sam Bankman-Fried. Scaling (AI): The tendency in machine learning for capabilities to scale upward with the amount of compute. The scaling is typically not linear; instead, capabilities

…

of ruin will inevitably result in ruin, even though the sequence of bets ostensibly has an expected value of positive infinity. Understood by everybody but Sam Bankman-Fried as a shortcoming of strict utilitarianism. Straight (poker): Five consecutive cards of the same rank, e.g., 8♣7♦6♥5♥4♣. Drawing to

…

IN TEXT major political player: Bankman-Fried confirmed this in my interviews with him. Also see Nik Popli, “Sam Bankman-Fried’s Political Donations: What We Know,” Time, December 14, 2022, time.com/6241262/sam-bankman-fried-political-donations. GO TO NOTE REFERENCE IN TEXT the Village’s claims: Nate Silver, “Twitter, Elon and the

…

-welch-doesnt-live-in-a-prius-anymore. GO TO NOTE REFERENCE IN TEXT Why did Sam Bankman-Fried: Kate Gibson, “Sam Bankman-Fried Stole at Least $10 Billion, Prosecutors Say in Fraud Trial,” CBS News, October 5, 2023, cbsnews.com/news/sam-bankman-fried-fraud-trial-crypto. GO TO NOTE REFERENCE IN TEXT also strongly disliked: GTOx, gtox.

…

Counts in FTX Fraud Trial,” November 2, 2023, coindesk.com/policy/2023/11/02/sam-bankman-fried-guilty-on-all-7-counts-in-ftx-fraud-trial. GO TO NOTE REFERENCE IN TEXT worth $26.5 billion: “Sam Bankman-Fried,” Forbes, forbes.com/profile/sam-bankman-fried. GO TO NOTE REFERENCE IN TEXT the Met Gala: Michael Lewis, Going Infinite

…

’s lawyers asked for a shorter prison sentence due to what they said was his autism spectrum disorder. Wall Street Journal, wsj.com/finance/currencies/sam-bankman-fried-suggests-shorter-sentence-for-fraud-conviction-citing-autism-e8481876. GO TO NOTE REFERENCE IN TEXT Bitcoin had achieved: “Bitcoin Price Today, BTC to USD

…

crisis-is-not-just-in-enrollment-but-completion. GO TO NOTE REFERENCE IN TEXT another $10 million: Joseph Gibson, “We Now Know (Allegedly) How Much Sam Bankman-Fried Paid Tom Brady, Steph Curry and Larry David for Their FTX Endorsements,” Celebrity Net Worth, October 4, 2023, celebritynetworth.com/articles/celebrity/we-now-know

…

-allegedly-how-much-sam-bankman-fried-paid-tom-brady-steph-curry-and-larry-david-for-their-ftx-endorsements. GO TO NOTE REFERENCE IN TEXT who scoffed at: “FTX Super Bowl Don

…

2017, pgt.com/news/vanessa-selbst-eliminated-on-day-1b-of-main-event. GO TO NOTE REFERENCE IN TEXT Bloomberg Odd Lots: Matt Levine, “Transcript: Sam Bankman-Fried and Matt Levine on How to Make Money in Crypto,” taizihuang.github.io, April 25, 2022, taizihuang.github.io/OddLots/html/odd-lots-full-transcript

…

Cryptocurrency That Brought in Millions. Then It Brought Down the Company,” NPR, November 15, 2022, sec. Business, npr.org/2022/11/15/1136641651/ftx-bankruptcy-sam-bankman-fried-ftt-crypto-cryptocurrency-binance. GO TO NOTE REFERENCE IN TEXT of nearly $2 billion: Erin Griffith and David Yaffe-Bellany, “Investors Who Put $2 Billion

…

the Most Good Possible,” Time, August 10, 2022, time.com/6204627/effective-altruism-longtermism-william-macaskill-interview. GO TO NOTE REFERENCE IN TEXT hosted by Sam Bankman-Fried: SBF was described as the host in the invitation that MacAskill emailed to me. When I later asked SBF about the choice of venue, he

…

had worked: Benjamin Wallace, “The Mysterious Cryptocurrency Magnate Who Became One of Biden’s Biggest Donors,” Intelligencer, February 2, 2021, nymag.com/intelligencer/2021/02/sam-bankman-fried-biden-donor.html. GO TO NOTE REFERENCE IN TEXT 6th Congressional District: Per interview with Carrick Flynn. GO TO NOTE REFERENCE IN TEXT backing Carrick

…

Flynn: Daniel Strauss, “The Crypto Kings Are Making Big Political Donations. What Could Go Wrong?,” The New Republic, May 24, 2022, newrepublic.com/article/166584/sam-bankman-fried-crypto-kings-political-donations. GO TO NOTE REFERENCE IN TEXT EA-friendly political neophyte: Miranda Dixon-Luinenburg, “Carrick Flynn May Be 2022’s Unlikeliest Congressional

…

Candidate. Here’s Why He’s Running,” Vox, May 14, 2022, vox.com/23066877/carrick-flynn-effective-altruism-sam-bankman-fried-congress-house-election-2022. GO TO NOTE REFERENCE IN TEXT Flynn had never: Coordinating with a super PAC would have been illegal anyway under campaign

…

e217943, doi.org/10.1001/jamanetworkopen.2021.7943. GO TO NOTE REFERENCE IN TEXT Sam Bankman-Fried’s conclusion: James Fanelli, “Sam Bankman-Fried’s Moral Thinking,” The Wall Street Journal, October 11, 2023, wsj.com/livecoverage/sam-bankman-fried-ftx-trial-caroline-ellison/card/sam-bankman-fried-s-moral-thinking-FbKBJQkdl83SlNEUWwiT. GO TO NOTE REFERENCE IN TEXT as “infinite ethics.”: Joe

…

Will Preside over SBF Cryptocurrency Case,” The Guardian, December 27, 2022, sec. Business, theguardian.com/business/2022/dec/27/judge-trump-prince-andrew-trials-sbf-sam-bankman-fried-ftx-cryptocurrency. GO TO NOTE REFERENCE IN TEXT $4 million gray: Sophie Mann, “SBF Arrives at $4m Family Home for Christmas Under House Arrest,” Daily

…

Mail, December 23, 2022, dailymail.co.uk/news/article-11569591/Sam-Bankman-Fried-arrives-4m-family-home-California-Christmas-house-arrest.html. GO TO NOTE REFERENCE IN TEXT lived in Stanford: The Bankman-Fried home is sometimes described

…

deprivation: Kari McMahon and Vicky Ge Huang, “4 Hours of Sleep a Night in a Bean Bag Chair: Inside the Hectic Life of Crypto Titan Sam Bankman-Fried, the World’s Youngest Mega-Billionaire,” Business Insider, December 17, 2021, businessinsider.in/cryptocurrency/news/4-hours-of-sleep-a-night-in-a-bean-

…

, 2023, nypost.com/2023/03/17/ftxs-margaritaville-tab-swells-to-600k. GO TO NOTE REFERENCE IN TEXT for his anhedonia: Spencer Greenberg, “Who Is Sam Bankman-Fried (SBF) Really, and How Could He Have Done What He Did?—Three Theories and a Lot of Evidence,” Optimize Everything (blog), November 10, 2023,

…

spencergreenberg.com/2023/11/who-is-sam-bankman-fried-sbf-really-and-how-could-he-have-done-what-he-did-three-theories-and-a-lot-of-evidence. GO TO NOTE REFERENCE IN TEXT “was

…

NOTE REFERENCE IN TEXT actually a misconception: Brad DeLong, “There Are Complex-Number One-Norm Square-Root of Probability Amplitudes of 0.006 in Which Sam Bankman-Fried Is Happy,” Brad DeLong’s Grasping Reality (blog), October 5, 2023, braddelong.substack.com/p/there-are-complex-number-one-norm. GO TO NOTE

…

is a simplification, since usually there are several NFL games simultaneously. GO TO NOTE REFERENCE IN TEXT Sam’s potential emotional deficits: Greenberg, “Who Is Sam Bankman-Fried (SBF) Really, and How Could He Have Done What He Did?” GO TO NOTE REFERENCE IN TEXT government’s incisive prosecutor: Caroline Ellison testimony, October

Going Infinite: The Rise and Fall of a New Tycoon

by Michael Lewis · 2 Oct 2023 · 263pp · 92,618 words

The Org Chart ACT III 8 THE DRAGON’S HOARD 9 THE VANISHING 10 MANFRED 11 TRUTH SERUM Coda Acknowledgments Preface I first heard about Sam Bankman-Fried at the end of 2021 from a friend who, oddly enough, wanted me to help him figure out who he was. My friend was about

More Everything Forever: AI Overlords, Space Empires, and Silicon Valley's Crusade to Control the Fate of Humanity

by Adam Becker · 14 Jun 2025 · 381pp · 119,533 words

in August 2022, the same month What We Owe the Future was published, with a headline asking if Sam Bankman-Fried was “the next Warren Buffett.” You probably already know the rest of the story. Sam Bankman-Fried’s cryptocurrency exchange, FTX, imploded in November 2022. He and his lieutenants at FTX used customers’ private account

…

SBF, the EA community had finally gotten its wish. Effective altruism had broken into mainstream awareness—in the worst possible way. “How Effective Altruism Let Sam Bankman-Fried Happen,” read one Vox headline in the immediate aftermath of SBF’s fall.66 The New York Times, the Atlantic, the New Yorker, the Washington

…

over $5.4 million from Vitalik Buterin, the billionaire cryptocurrency mogul. Jaan Tallinn, the Skype billionaire, has donated more than $2.6 million.71 And Sam Bankman-Fried’s charitable foundation, FTX Future Fund, donated over $4 million to CFAR before FTX’s implosion in 2022.72 (As of this writing, there are

…

Institute where [it] will be used by other people.”184 This echoes Will MacAskill’s “earn to give” philosophy, the logic he successfully pitched to Sam Bankman-Fried. The effective altruists and longtermists grew out of the same transhumanist milieu at roughly the same time; the journalist Tom Chivers calls the two movements

…

. (MacAskill got Musk’s number through his friend Igor Kurganov, an effective altruist and associate of Musk’s.)26 MacAskill offered to introduce Musk to Sam Bankman-Fried in order to help with purchasing Twitter—something that, according to MacAskill, SBF had been contemplating himself. “Does he have huge amounts of money?” Musk

…

to his standing in the race—not with over $10 million in support for his campaign from a political action committee funded almost entirely by Sam Bankman-Fried. That included nearly a million dollars of attack ads against Flynn’s main opponent in the primary, Andrea Salinas, a state legislator.44 Polls showed

…

Utopia Through Artificial General Intelligence,” https://dx.doi.org/10.5210/fm.v29i4.13636. ACKNOWLEDGMENTS I think, if you wrote a book, you fucked up. —Sam Bankman-Fried Many people made this book possible. But I am ultimately responsible for its contents. All errors, misrepresentations, and other inaccuracies are my own. And I

…

that could be done in the world if most of one’s salary from such a job were donated to worthy causes. 2 Adam Fisher, “Sam Bankman-Fried Has a Savior Complex—and Maybe You Should Too,” Sequoia Capital, September 22, 2022, archived October 27, 2022, at the Wayback Machine, https://web.archive

…

.org/web/20221027181005/https://www.sequoiacap.com/article/sam-bankman-fried-spotlight/; Nicholas Kulish, “How a Scottish Moral Philosopher Got Elon Musk’s Number,” New York Times, October 8, 2022, www.nytimes.com/2022/10/08

…

.org/10.1007/s10677-013-9433-4. 56 William MacAskill, personal communication. 57 “Sam Bankman-Fried,” 80,000 Hours, archived June 13, 2021, at the Wayback Machine, https://web.archive.org/web/20210613111013/https://80000hours.org/stories/sam-bankman-fried/. 58 Fisher, “Sam Bankman-Fried Has a Savior Complex.” 59 Reed Albergotti and Liz Hoffman, “Charity-Linked Money Launched

…

Sam Bankman-Fried’s Empire,” Semafor, December 8, 2022, www.semafor.com/article/12/07/2022/charity-money-launched

…

-sam-bankman-frieds-empire. 60 White House, “FACT SHEET: Climate and Energy Implications of Crypto-Assets in the United States,” news release, September 8

…

-fried-ceo-ftx-crypto-exchange-arrested-bahamas-charges-sdny; David Gura, “Sam Bankman-Fried Is Found Guilty of All Charges in FTX’s Spectacular Collapse,” NPR, November 2, 2023, www.npr.org/2023/11/02/1210100678/sam-bankman-fried-trial-verdict-ftx-crypto; Rafael Nam, “Sam Bankman-Fried Sentenced to 25 Years in Prison for His FTX Crimes,” NPR

…

, March 28, 2024, www.npr.org/2024/03/28/1241210300/sam-bankman-fried-ftx-sentencing-crimes-crypto-mogul-greed. 63 Zachary Robinson, “EV Updates: FTX

…

Clinebell, “By Returning $10M, Semafor Becomes the Latest Media Outlet Distancing Itself from SBF,” Investopedia, January 18, 2023, www.investopedia.com/media-outlets-are-returning-sam-bankman-fried-s-funds-7096408; “ProPublica Returns Grant Funded by Bankman-Fried Family,” ProPublica, February 28, 2022, updated December 20, 2022, www.propublica.org/atpropublica/bankman-fried

…

-family-donates-5-million-to-propublica. 66 Dylan Matthews, “How Effective Altruism Let Sam Bankman-Fried Happen,” Vox, December 12, 2022, www.vox.com/future-perfect/23500014/effective-altruism-sam-bankman-fried-ftx-crypto. 67 Jennifer Szalai, “How Sam Bankman-Fried Put Effective Altruism on the Defensive,” New York Times, December 9, 2022, www.nytimes.com

…

/2022/12/09/books/review/effective-altruism-sam-bankman-fried-crypto.html; Annie Lowrey, “Effective Altruism Committed the Sin It Was

…

, November 17, 2022, www.theatlantic.com/ideas/archive/2022/11/cryptocurrency-effective-altruism-ftx-sam-bankman-fried/672149/; Gideon Lewis-Kraus, “Sam Bankman-Fried, Effective Altruism, and the Question of Complicity,” New Yorker, December 1, 2022, www.newyorker.com/news/annals-of-inquiry/sam-bankman-fried-effective-altruism-and-the-question-of-complicity; Nitasha Tiku, “The Do-Gooder Movement

…

, 2022, www.washingtonpost.com/technology/2022/11/17/effective-altruism-sam-bankman-fried-ftx-crypto/; Eric Levitz, “Is Effective Altruism to Blame for Sam Bankman-Fried?,” New York, November 16, 2022, https://nymag.com/intelligencer/2022/11/effective-altruism-sam-bankman-fried-sbf-ftx-crypto.html; Zeeshan Aleem, “How Sam Bankman-Fried’s Fall Exposes the Perils of Effective Altruism,” MSNBC, December

…

/s/5782108/1/Harry_Potter_and_the_Methods_of_Rationality. 72 Kelsey Piper, “Sam Bankman-Fried Tries to Explain Himself,” Vox, November 16, 2022, www.vox.com/future-perfect/23462333/sam-bankman-fried-ftx-cryptocurrency-effective-altruism-crypto-bahamas-philanthropy. 73 “Transcript of Sam Bankman-Fried’s Interview at the DealBook Summit,” New York Times, December 1, 2022, www

…

.nytimes.com/2022/12/01/business/dealbook/sam-bankman-fried-dealbook-interview-transcript.html. 74 Lucianne Walkowicz, interview with the

…

Consequences of Silicon Valley’s AI Obsession,” Bloomberg, March 7, 2023, www.bloomberg.com/news/features/2023-03-07/effective-altruism-s-problems-go-beyond-sam-bankman-fried; Charlotte Alter, “Effective Altruism Promises to Do Good Better. These Women Say It Has a Toxic Culture of Sexual Harassment and Abuse,” Time, February 3

…

/wytham-abbey-sale-effective-altruism-group-evf. 26 Kulish, “How a Scottish Moral Philosopher.” 27 Liz Hoffman, “Sam Bankman-Fried, Elon Musk, and a Secret Text,” Semafor, November 23, 2022, www.semafor.com/article/11/22/2022/sam-bankman-fried-elon-and-a-secret-text. Link there to the texts themselves: “Exhibit H,” Twitter, Inc. v

…

Went from a Niche Movement to a Billion-Dollar Force,” Vox, August 8, 2022, www.vox.com/future-perfect/2022/8/8/23150496/effective-altruism-sam-bankman-fried-dustin-moskovitz-billionaire-philanthropy-crytocurrency. 36 Jason Matheny, “Effective Altruism in Government,” Effective Altruism, June 3, 2017, www.effectivealtruism.org/articles/effective-altruism-in-government

…

Flynn May Be 2022’s Unlikeliest Candidate. Here’s Why He’s Running,” Vox, May 14, 2022, www.vox.com/23066877/carrick-flynn-effective-altruism-sam-bankman-fried-congress-house-election-2022. 43 Cullen O’Keefe et al., The Windfall Clause: Distributing the Benefits of AI (Oxford: FHI, 2020), www.fhi.ox.ac

The Age of Extraction: How Tech Platforms Conquered the Economy and Threaten Our Future Prosperity

by Tim Wu · 4 Nov 2025 · 246pp · 65,143 words

billion from over 300,000 people, and the judge sentenced him to 11,196 years in prison.[7] The story repeated itself in 2022, when Sam Bankman-Fried (also known as SBF), the young operator of the FTX exchange, was found with his hands deep in the piggy bank. Among other things, Bankman

Supremacy: AI, ChatGPT, and the Race That Will Change the World

by Parmy Olson · 284pp · 96,087 words

dozens of OpenAI’s staff members also counted themselves as effective altruists. Effective altruism hit the spotlight in late 2022 when one-time crypto billionaire Sam Bankman-Fried became the movement’s most well-known supporter. But it had been around since the 2010s. The idea, which was spawned by a handful of

…

name in 2012, when MacAskill reached out to someone whom he hoped to recruit to the cause, an MIT student with dark curly hair named Sam Bankman-Fried. The two had coffee, and it turned out that Bankman-Fried was already a fan of Peter Singer and interested in causes related to animal

…

didn’t anticipate was how much people would actually believe in it. The effective altruist movement was so powerful that it had driven people like Sam Bankman-Fried and Dustin Moskovitz to donate billions of dollars. It had compelled hundreds of college students to change their career choices. And it could compel four

…

bypassed with simple tricks, and superficially masked.” Twitter, December 4, 2022, 10:55 a.m. https://twitter.com/spiantado/status/1599462375887114240?lang=en. Piper, Kelsey. “Sam Bankman-Fried Tries to Explain Himself.” Vox, November 16, 2022. “Rishi Sunak & Elon Musk: Talk AI, Tech & the Future.” Rish Sunak’s YouTube channel, November 3, 2023

Elon Musk

by Walter Isaacson · 11 Sep 2023 · 562pp · 201,502 words

The Quiet Coup: Neoliberalism and the Looting of America

by Mehrsa Baradaran · 7 May 2024 · 470pp · 158,007 words

Character Limit: How Elon Musk Destroyed Twitter

by Kate Conger and Ryan Mac · 17 Sep 2024

Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis

by Scott Patterson · 5 Jun 2023 · 289pp · 95,046 words

The Price of Life: In Search of What We're Worth and Who Decides

by Jenny Kleeman · 13 Mar 2024 · 334pp · 96,342 words

The Bill Gates Problem: Reckoning With the Myth of the Good Billionaire

by Tim Schwab · 13 Nov 2023 · 618pp · 179,407 words

Moral Ambition: Stop Wasting Your Talent and Start Making a Difference

by Bregman, Rutger · 9 Mar 2025 · 181pp · 72,663 words

Empire of AI: Dreams and Nightmares in Sam Altman's OpenAI

by Karen Hao · 19 May 2025 · 660pp · 179,531 words

Battle for the Bird: Jack Dorsey, Elon Musk, and the $44 Billion Fight for Twitter's Soul

by Kurt Wagner · 20 Feb 2024 · 332pp · 127,754 words

Blank Space: A Cultural History of the Twenty-First Century

by W. David Marx · 18 Nov 2025 · 642pp · 142,332 words

The Optimist: Sam Altman, OpenAI, and the Race to Invent the Future

by Keach Hagey · 19 May 2025 · 439pp · 125,379 words

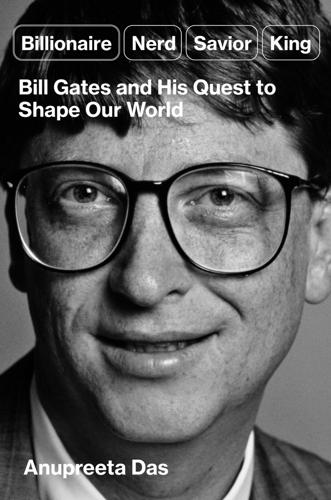

Billionaire, Nerd, Savior, King: Bill Gates and His Quest to Shape Our World

by Anupreeta Das · 12 Aug 2024 · 315pp · 115,894 words

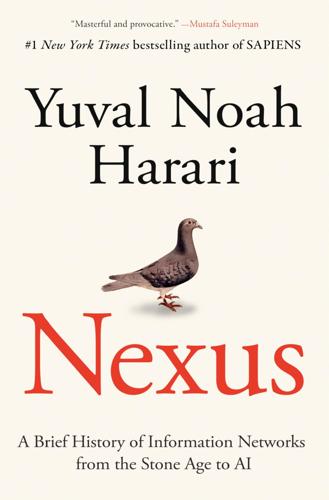

Nexus: A Brief History of Information Networks From the Stone Age to AI

by Yuval Noah Harari · 9 Sep 2024 · 566pp · 169,013 words

The Capitalist Manifesto

by Johan Norberg · 14 Jun 2023 · 295pp · 87,204 words

The Missing Billionaires: A Guide to Better Financial Decisions

by Victor Haghani and James White · 27 Aug 2023 · 314pp · 122,534 words

Left Behind

by Paul Collier · 6 Aug 2024 · 299pp · 92,766 words

Growth: A Reckoning

by Daniel Susskind · 16 Apr 2024 · 358pp · 109,930 words

Billionaires' Row: Tycoons, High Rollers, and the Epic Race to Build the World's Most Exclusive Skyscrapers

by Katherine Clarke · 13 Jun 2023 · 454pp · 127,319 words

Nobody's Fool: Why We Get Taken in and What We Can Do About It

by Daniel Simons and Christopher Chabris · 10 Jul 2023 · 338pp · 104,815 words

The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life

by Sahil Bloom · 4 Feb 2025 · 363pp · 94,341 words

Empty Vessel: The Story of the Global Economy in One Barge

by Ian Kumekawa · 6 May 2025 · 422pp · 112,638 words

Money in the Metaverse: Digital Assets, Online Identities, Spatial Computing and Why Virtual Worlds Mean Real Business

by David G. W. Birch and Victoria Richardson · 28 Apr 2024 · 249pp · 74,201 words

Breaking Twitter: Elon Musk and the Most Controversial Corporate Takeover in History

by Ben Mezrich · 6 Nov 2023 · 279pp · 85,453 words

Blood in the Machine: The Origins of the Rebellion Against Big Tech

by Brian Merchant · 25 Sep 2023 · 524pp · 154,652 words

Boom: Bubbles and the End of Stagnation

by Byrne Hobart and Tobias Huber · 29 Oct 2024 · 292pp · 106,826 words