The Secret Lives of Buildings: From the Ruins of the Parthenon to the Vegas Strip in Thirteen Stories

by

Edward Hollis

Published 10 Nov 2009

page_id=1112. 274 “presented as an immense accumulation of spectacles”: Guy Debord, The Society of the Spectacle, trans. Ken Knabb (Rebel Press, 1983), p. 7. 275 “If I make other people feel good”: Quoted in Bruck, “The Brass Ring.” 275 “We start with one question”: Steve Wynn, quoted in http://thinkexist.com/quotes/steve_wynn/. 275 “Las Vegas is sort of like”: Steve Wynn, quoted in http://www.woopidoo.com/business_quotes/authors/steve-wynn/index.htm. 275 “Even as this city moves forward”: Venetian Macao brochure, http://www.venetianmacao.com/uploads/media/download/brochures_english.pdf. 276 “Sire, now I have told you”: Calvino, Invisible Cities, pp. 86–87. 276 “The Venetian represents that first massive step”: Quoted in Associated Press, “Sands Calls US$2.4b Casino Opening a ‘massive step’ in Macau,” International Herald Tribune, August 16, 2007.

…

currentPage=all. 259 “Kublai Khan does not necessarily believe everything”: Italo Calvino, Invisible Cities (Harcourt Brace, 1974), pp. 5–6. 265 “tailored to one lifestyle—yours”: http://www.wynnlasvegas.com/#Shopping/. 265 “Dream with your eyes open”: http://www.wynnlasvegas.eom/#entertainment/. 266 “Our goal was to build”: Steve Wynn, quoted in Las Vegas Strip Historical Site, http://www.lvstriphistory.com/ie/sands66.htm. 266 “It’s much more difficult to give a party”: Steve Wynn, quoted in http://thinkexist.com/quotes/steve_wynn/. 266 “What was famous then”: Sands president Henri Lewin, quoted in Las Vegas Strip Historical Site, http://www.lvstriphistory.com/ie/sands66.htm. 269 “Authenticity is the basis for fantasy”: Wimberly Allison Tong and Goo, Designing the World’s Best Resorts (Images, 2001), p. 110. 274 “VENICE IS NOTA HOTEL”: “Protests Against More Venice Hotels: Residents Group Fight Proposed New Law,” Wanderlust, 17 April 2004, http://www.wanderlust.co.uk/article.php?

…

Later, those who’ve played enough golf or bought enough in the boutiques make their way to the theater and watch the Cirque du Soleil perform “Le Rêve.” “Dream with your eyes open,” the billboards say, and that’s just what happens. The dream they are all dreaming is the dream of Steve Wynn. QICHEN DOESN’T REALLY need to ask about Steve Wynn; he already knows everything he needs to know. He just did it to make Adelson feel like he was paying attention. Handsome, funny, and clever, Wynn started small, just like everyone else: he ran a bingo parlor in Maryland. After a while he made his way to Glitter Gulch to seek his fortune, working his way up from grind joints to hotels.

Frommer's Irreverent Guide to Las Vegas

by

Mary Herczog

and

Jordan S. Simon

Published 26 Mar 2004

Though he didn’t build any monuments, Hughes made Vegas “legitimate” for big business. By the 1970s, corporate interests had sufficient clout to urge the government to establish the Nevada Gaming Commission to control the goodfellas and the good times. By the mid-1980s, Las Vegas was in the doldrums. Enter Steve Wynn, who changed the face of the Strip forever by erecting the glamorous, tropically themed Mirage, with its white tiger habitat, jungle interior, and belching volcano. A string of resorts followed, culminating (so far, but stay tuned) in Wynn’s own opulent re-creation of a Lake Como villa, Bellagio (now owned by MGM Grand–Mirage Resorts).

…

The end of 2003 saw the addition of 1,000 rooms to the Venetian and the opening of the new Westin Resort, perhaps the closest thing to a boutique hotel in town, rising on the ashes of the completely unlamented (except by those who revered sleaze) Maxim. And 2005 will see a modern Vegas event: the opening of the new behemoth wonder from the mind of the man who single-handedly (well, his hands and those of thousands of construction workers) made modern Las Vegas, Steve Wynn. Shut out, corporate-takeover style, from his Mirage empire, Wynn promptly bought and demolished the old Desert Inn, and is erecting in its place the Wynn Las Vegas, complete with a 150-foot man-made mountain and all the “ours is bigger” bits of excess we so adore in Vegas hotel oneupmanship. In 2004, the Aladdin Hotel will be transformed into a Planet Hollywood–themed hotel.

…

Note, however, that genuine hoteliers, like the Four Seasons and Ritz-Carlton (as opposed to 19 The Lowdown New-style glitz... In the late ’90s, Las Vegas casino-hotels were suddenly struck with a desire for “class,” like a retired madam who madly redecorates in an effort to win over her former clients’ wives. The prime class-monger is Steve Wynn, whose swan song as CEO of Mirage Resorts was the surface-exquisite Lake Como–style palazzo Bellagio. Highly refined (at least by Las Vegas standards), it strives to offer the best of the best, or at least the best that money can buy: world-renowned chefs/restaurateurs, haute couture shops, a spa offering no less than eight facials, the ACCOMMODATIONS casino-hotels, emphasis on the casino), seem more expensive on the surface, but have much less in the way of hidden costs—at other properties, you pay extra for health club access and other goodies, which add up fast.

Words That Work: It's Not What You Say, It's What People Hear

by

Dr. Frank Luntz

Published 2 Jan 2007

If they don’t, or can’t, it is hardly the recipe for success. Such was the situation for “Le Rêve,” the original name for Steve Wynn’s newest hotel in Las Vegas. It means “the dream” in French, and in theory it would have been a perfect name for the most beautiful, innovative hotel in Las Vegas. As I discovered in my research, however, not only did people have no idea of what “Le Rêve” meant, they also had no clue how to pronounce it. Put twenty people in a room and only about half would say it correctly. This was clearly a problem. But my market research revealed that Steve Wynn already had access to a far stronger and more widely identified word—a word that had simplicity, brevity, credibility, and relevance to Vegas patrons from across the globe: his own last name.

…

I have built a career attending to matters of rhetoric, to the painstaking and deliberate choice of words. I love the soft twang of Southern belles and the gum-popping slang of Southern California valley girls, the gentle lyricism of the upper Midwest and the in-your-face bluntness of Brooklyn cabbies. I’m enthralled by the bass rumble of James Earl Jones, the velvet smoothness of Steve Wynn, the upper-crust sophistication of Orson Welles and Richard Burton, and the sexy intonations of Lauren Bacall, Sally Kellerman, and Catherine Zeta-Jones. When spoken well, the language of America is a language of hope, of everyday heroes, of faith in the goodness of people. At its best, American English is also the practical language of commerce.

…

From the political world, we will explore: • How the “estate tax” became the “death tax,” turning a relatively arcane issue into a national hot button • How Rudy Giuliani moved from a “crime agenda” to a “safety and security platform” in his successful campaign for mayor • How the Contract with America revolutionized political language in ways its authors never intended • How “drilling for oil” became “energy exploration,” frustrating the entire environmental community From the corporate world, we will explore: • How effective language can be used to prevent a strike and promote employee satisfaction • How a large Fortune 100 company stalled and then stopped the SEC from implementing popular “corporate accountability” measures by reshaping the message and redefining the debate • How “gambling” became “gaming” and how Las Vegas impresario Steve Wynn discovered the value of his own name and attached it to the most expensive hotel ever built • How the CEO of Pfizer, the largest pharmaceutical company in the world, has revolutionized the industry by applying the language of responsibility and accountability and changing the focus from “disease management” to “prevention” And from the personal world, your world, you will learn: • How to talk yourself out of a speeding ticket when you and the officer both know you’re guilty • How to talk yourself into a reservation at a crowded restaurant and onto a plane that has already closed its doors • How best to apologize when you know you’re wrong . . . and make it stick These are the challenges I face every day, and discovering the answers is the task that I set for myself when I began my professional career nearly twenty years ago.

Devil's Bargain: Steve Bannon, Donald Trump, and the Storming of the Presidency

by

Joshua Green

Published 17 Jul 2017

Dan Burton, Who Transformed House Panel into a Feared Committee, to Retire,” Washington Post, January 31, 2012, www.washingtonpost.com/politics/rep-dan-burton-who-transformed-house-panel-into-a-feared-committee-to-retire/2012/01/31/gIQACFD2fQ_story.html. George Clooney, who once stormed: Elizabeth Leonard, “George Clooney Unloads on Casino Owner Steve Wynn,” People, May 2, 2014, people.com/celebrity/george-clooney-unloads-on-casino-owner-steve-wynn/. Trump had accepted both invitations: PageSix.com staff, “Doubled Up,” New York Post, March 25, 2011, pagesix.com/2011/03/25/doubled-up/. “I’m fine with this stuff”: Roxanne Roberts, “I Sat Next to Donald Trump at the Infamous 2011 White House Correspondents’ Dinner,” Washington Post, April 28, 2016, www.washingtonpost.com/lifestyle/style/i-sat-next-to-donald-trump-at-the-infamous-2011-white-house-correspondents-dinner/2016/04/27/5cf46b74-0bea-11e6-8ab8-9ad050f76d7d_story.html.

…

To understand Trump’s extraordinary rise, you have to go all the way back and begin with Steve Bannon, or else it doesn’t make sense. TWO “WHERE’S MY STEVE?” The Trump-Bannon partnership, like so much else in Trump’s life, has a bizarre and winding lineage that traces back to a lawsuit. In the mid-1990s, Steve Wynn, the Las Vegas casino mogul, was looking to move in on Atlantic City, New Jersey, a possibility that threatened the livelihoods of the Trump Plaza Hotel and Casino, the Trump Taj Mahal, and other gambling establishments along Atlantic City’s Boardwalk. Unable to make headway, Wynn’s Mirage Resorts, Inc., filed an antitrust suit against Trump’s company and Hilton Hotels, setting the stage for an epic showdown.

…

A week later, the reason became clear: MGM made an offer to buy Mirage Resorts that eventually netted Wynn, its largest shareholder, around $300 million. Wynn’s designs to build a casino in Atlantic City never came to fruition. In the aftermath, with both men having effectively “won” their battle, Trump and Wynn became friends. And that is how, several years later, at a fund-raiser for Children’s National Medical Center in Washington, D.C., Steve Wynn called his friend Donald Trump over and introduced him to a man who would soon set the course for his unlikely political rise: David Bossie. — By the time he met Trump in the late 2000s, Bossie, then still in his early forties, was already a hardened veteran of Washington’s political wars.

The Predators' Ball: The Inside Story of Drexel Burnham and the Rise of the JunkBond Raiders

by

Connie Bruck

Published 1 Jun 1989

He saw that Drexel could get control of the whole gaming industry. And they did.” But in the beginning Milken had raised $160 million for something that was little more than a gleam in Steve Wynn’s eye. One buyer, James Caywood, recalled that as hungry as he was for junk at that time, investing in the Golden Nugget bonds had required a leap of faith. “It was a dream. The balance sheet was nonexistent. Those of us that bought were doing nothing but betting on, number one, Drexel, and, number two, Steve Wynn,” said Caywood. Wynn concurred. “We symbolized, in terms of timing and our essential posture, the archtruth of Drexel’s philosophy. There we were, wanting more money than anyone could argue we had a right to.

…

And he had pools of capital that could be tapped to transform small-time entrepreneurs into major, and ever grateful, corporate players. There were many who would profit from Milken’s new, expanded abracadabra powers—and who would jump to do his bidding. As the first of them, Stephen Wynn, would say to Forbes magazine years later, about Drexel, “They made me.” SHORTLY AFTER Milken arrived in Century City, Steve Wynn came to see him. Five years earlier, Wynn had taken control of a foundering, third-rate casino in downtown Las Vegas, the Golden Nugget. He had added a hotel to the gambling operation. Golden Nugget’s pretax profits had been $1.1 million the year before Wynn assumed control; by the end of 1978 they were $7.7 million.

…

According to one former member of this group, Milken preferred that there be a certain amount of friction among his people, so that they would not develop alliances—and he could better maintain control. Milken kept his group cloistered. He demanded that his people shun publicity, as he did. He was convinced there was no upside—“Mike would always say, ‘You can’t make a dime off publicity,’ ” Steve Wynn recalled—and there was considerable downside. If his people started seeing themselves in print, he once commented to this reporter, they would get their heads turned, they would think they were famous. “They won’t work as well. I want them there at four or four-thirty, ready to work, until eight o’clock at night.

On the Edge: The Art of Risking Everything

by

Nate Silver

Published 12 Aug 2024

GO TO NOTE REFERENCE IN TEXT had sexually harassed: Alexandra Berzon et al., “Dozens of People Recount Pattern of Sexual Misconduct by Las Vegas Mogul Steve Wynn,” The Wall Street Journal, January 26, 2018, sec. Business, wsj.com/articles/dozens-of-people-recount-pattern-of-sexual-misconduct-by-las-vegas-mogul-steve-wynn-1516985953. GO TO NOTE REFERENCE IN TEXT damages, fines: Julia Malleck, “Casino King Steve Wynn Was Banned from Nevada’s Gambling Industry,” Quartz, July 28, 2023, qz.com/steve-wynn-casino-king-ban-nevada-gaming-sexual-miscond-1850685469. GO TO NOTE REFERENCE IN TEXT a proposed resort: Howard Stutz, “Wynn Unveils Plans and Renderings for a 1,000-Foot-Tall Hotel-Casino in UAE,” The Nevada Independent, April 28, 2023, thenevadaindependent.com/article/wynn-unveils-plans-and-renderings-for-a-1000-foot-tall-hotel-casino-in-uae.

…

What happens in Vegas stays in Vegas is an attitude that’s often taken rather literally—and the notion that anything goes in Las Vegas has some serious downsides. In 2018 and 2019, following several accusations and extensive reporting that he had sexually harassed female staff and pressured them into sex, Steve Wynn and Wynn Resorts paid more than $100 million in damages, fines, and settlements, and Steve Wynn agreed to be barred from the Nevada gaming industry. And yet, the Wynn name remains on Wynn Resorts properties in Las Vegas, Macau, and on a proposed resort in the United Arab Emirates. (Representatives for Wynn Resorts declined an interview request.)

…

Needless to say, these projects entail real risk: it’s not hard to find examples of properties that were mismanaged or never clicked with the public and became financial albatrosses. Still, today’s corporate suits are a long way removed from the Bugsy Siegels of the world—or from mavericks like Kirk Kerkorian and Howard Hughes who helped usher Vegas away from an era of mob dominance. But one man stands out singularly in making modern Las Vegas what it is today: Steve Wynn. The Casino Business Is Three Worlds in One Our tour of this part of the River is going to begin in lush environs before winding its way to a more depressing place. I wanted to warn you about that in advance, because I don’t want you to do the equivalent of judging a country based solely on visiting its luxury shopping district.

The Self-Made Billionaire Effect: How Extreme Producers Create Massive Value

by

John Sviokla

and

Mitch Cohen

Published 30 Dec 2014

Boone Pickens with Boone Pickens Capital, Richard Branson with Virgin, Yan Cheung with America Chung Nam and Nine Dragons, Steve Jobs with Pixar, Steve Wynn with Wynn Resorts—all Producers mentioned in this chapter and dozens of others made their first billion after failure or moderate success with earlier ventures. Some of their preliminary ventures are tiny. Others are substantial, like Mirage Resorts, the Vegas real estate development business that Steve Wynn formed, grew, and was kicked out of in a 2000 takeover by Kirk Kerkorian. Serial business creation seems to improve the survival prospects of a new venture.

…

She went on to cofound Oxygen Media and the Oprah Winfrey Network. Winfrey has had a vibrant acting career that includes an Academy Award nomination. She has also produced numerous films and TV series. Oprah Winfrey uses her celebrity to promote philanthropic work for educational causes. Steve Wynn b. 1942, United States Wynn Resorts, Ltd. Steve Wynn’s father died when he was a young man, leaving him a chain of bingo parlors in Maryland. Wynn took over and ran the parlors, and used his profits to invest in a hotel and casino in Las Vegas. Wynn’s profits allowed him to buy and sell more land, while renovating and expanding other investment properties.

All the Money in the World

by

Peter W. Bernstein

Published 17 Dec 2008

* * * Gambling on Vegas Gambling may be a risky business, but the house always wins in the end. During the past thirty years three men have had more of an impact on, and made more money out of, Las Vegas than just about anyone else. In addition to Sheldon Adelson (see Chapter 2), the current kings of the Strip are Steve Wynn and Kirk Kerkorian. These are the men who made Vegas what it is today, and the men that Vegas made. Steve Wynn: With a $2.6 billion fortune in 2006, Wynn is credited with leading32 the resurgence of Las Vegas’s fortunes during the 1990s, when he opened the luxury casinos Mirage and Bellagio on the once down-and-dusty Strip. The Mirage featured a “live” volcano, and its Treasure Island lured gamblers with nightly staged pirate battles, while the refined Bellagio offered an indoor lake.

…

As such, it is a new battleground for the gaming industry. Octogenarian Chinese billionaire Stanley Ho monopolized the Macau gaming industry for decades. But in 2002 Macau authorities ended his reign, opening up licenses to outside competitors. Adelson was first through the gates28, with his Vegas rival and fellow Forbes 400 member Steve Wynn, owner of the Wynn Las Vegas, not far behind. While other investors hemmed and hawed over gaming regulations, Adelson threw himself into the fray. He gambled $265 million on the Sands Macau, a casino-only venture that was built in just fourteen months. The Sands Macau raked in $400 million29 in revenues in its first year.

…

Many other Forbes 400 members have, of course, also made major philanthropic gifts to art museums and other institutions, with similarly advantageous tax write-offs. But rare is the case in which a billionaire keeps his treasures, displays them conspicuously—and still gets a tax break. Yet that’s just what casino mogul Steve Wynn has managed to do. Wynn persuaded the Nevada legislature to exempt his art collection from sales tax by arguing that because it was on view in his Bellagio Hotel, it served an educational purpose to local people—never mind that Wynn was charging admission to see the artworks. When the apparent double standard79 was brought to light, Wynn offered locals a reduced entrance fee, and the tax exemption was allowed to stand.*21 Some collectors may sail very close to the wind when it comes to tax savings on their art purchases, but all will no doubt have one eye on the fate of fellow 400 member Leona Helmsley, who served eighteen months in prison during the late 1980s for tax evasion on her art purchases

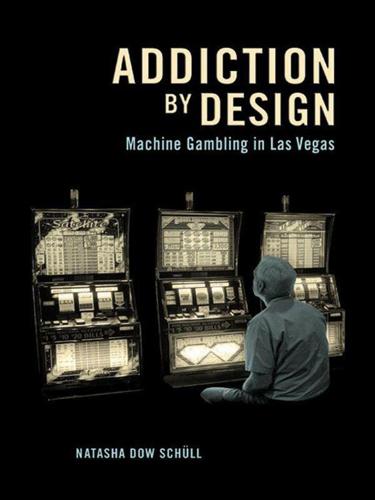

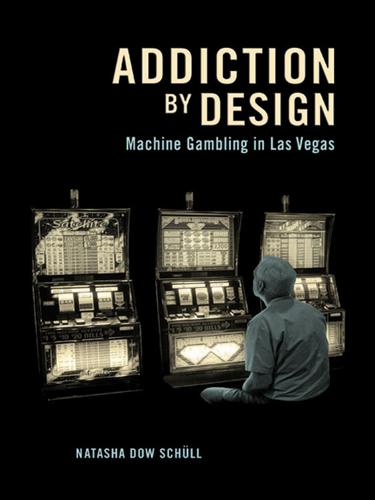

Addiction by Design: Machine Gambling in Las Vegas

by

Natasha Dow Schüll

Published 15 Jan 2012

Although such an inquiry could plausibly be set in any number of jurisdictions where the activity is le gal and readily available, Las Vegas offers a particularly illuminating backdrop. In the early 1980s, cultural critic Neil Postman said that one had only to look to Las Vegas to understand America.16 In the mid-1990s, casino tycoon Steve Wynn turned this pronouncement around, remarking that “Las Vegas exists because it is a perfect reflection of America.”17 Since then, journalists and academics alike have debated whether the rest of the country is becoming more like Las Vegas, or if, alternatively, Las Vegas is becoming more like the rest of the country.

…

One loses track of where one is and when it is.”3 Such spaces did not pretend to remedy the social ills of the “lonely crowd,” as sociologist David Riesman had despairingly designated the public at large, but instead responded to the escapist sensibilities of the American populace by satisfying them, without judgment.4 The publication of Learning from Las Vegas coincided with Nevada’s passage of the Corporate Gaming Act and the new wave of casino development that it ushered in. This wave gathered momentum in the 1990s, set off by the staggering success of the Mirage, a rainforest-themed resort financed with junk bonds in 1989 by an ambitious young casino tycoon named Steve Wynn. His winning venture inspired other companies to build competing properties on the Strip, turning the idiosyncratic structures that Venturi and his colleagues had lauded into gargantuan corporate megaresorts—“total environments” whose meticulous architectural calculations left little to chance.

…

He went on to explain what his firm meant by “experience-based” architecture: “We try to influence movement and the circulation pattern and therefore direct people’s experience.”7 Although Wynn has downplayed the role of such strategy in the design of his own casinos, stating that the winning formula behind the Mirage was the result of “confusion, not cunning,” in fact each of his properties has been a fastidiously planned affair from conception to finish, from wall treatments to ambient soundtrack.8 For instance, after he drew up floor plans for the Mirage (see fig 1.1) he delayed construction so as to entertain suggestions for alterations by the design consultant and former casino manager Bill Friedman, whose pragmatic philosophy of casino design we will examine in the following pages. Figure 1.1. Floor plan of the Mirage Casino, built by Steve Wynn in 1989. Courtesy of vegascasinoinfo.com. Friedman, the gambling industry’s maverick guru of casino design, established himself as such in 1974 when he wrote the definitive book on casino management.9 Over the next twenty-five years, he conducted research for another book, the epic 630-page tome boldly titled Designing Casinos to Dominate the Competition, published in 2000.

Addiction by Design: Machine Gambling in Las Vegas

by

Natasha Dow Schüll

Published 19 Aug 2012

Although such an inquiry could plausibly be set in any number of jurisdictions where the activity is le gal and readily available, Las Vegas offers a particularly illuminating backdrop. In the early 1980s, cultural critic Neil Postman said that one had only to look to Las Vegas to understand America.16 In the mid-1990s, casino tycoon Steve Wynn turned this pronouncement around, remarking that “Las Vegas exists because it is a perfect reflection of America.”17 Since then, journalists and academics alike have debated whether the rest of the country is becoming more like Las Vegas, or if, alternatively, Las Vegas is becoming more like the rest of the country.

…

One loses track of where one is and when it is.”3 Such spaces did not pretend to remedy the social ills of the “lonely crowd,” as sociologist David Riesman had despairingly designated the public at large, but instead responded to the escapist sensibilities of the American populace by satisfying them, without judgment.4 The publication of Learning from Las Vegas coincided with Nevada’s passage of the Corporate Gaming Act and the new wave of casino development that it ushered in. This wave gathered momentum in the 1990s, set off by the staggering success of the Mirage, a rainforest-themed resort financed with junk bonds in 1989 by an ambitious young casino tycoon named Steve Wynn. His winning venture inspired other companies to build competing properties on the Strip, turning the idiosyncratic structures that Venturi and his colleagues had lauded into gargantuan corporate megaresorts—“total environments” whose meticulous architectural calculations left little to chance.

…

He went on to explain what his firm meant by “experience-based” architecture: “We try to influence movement and the circulation pattern and therefore direct people’s experience.”7 Although Wynn has downplayed the role of such strategy in the design of his own casinos, stating that the winning formula behind the Mirage was the result of “confusion, not cunning,” in fact each of his properties has been a fastidiously planned affair from conception to finish, from wall treatments to ambient soundtrack.8 For instance, after he drew up floor plans for the Mirage (see fig 1.1) he delayed construction so as to entertain suggestions for alterations by the design consultant and former casino manager Bill Friedman, whose pragmatic philosophy of casino design we will examine in the following pages. Figure 1.1. Floor plan of the Mirage Casino, built by Steve Wynn in 1989. Courtesy of vegascasinoinfo.com. Friedman, the gambling industry’s maverick guru of casino design, established himself as such in 1974 when he wrote the definitive book on casino management.9 Over the next twenty-five years, he conducted research for another book, the epic 630-page tome boldly titled Designing Casinos to Dominate the Competition, published in 2000.

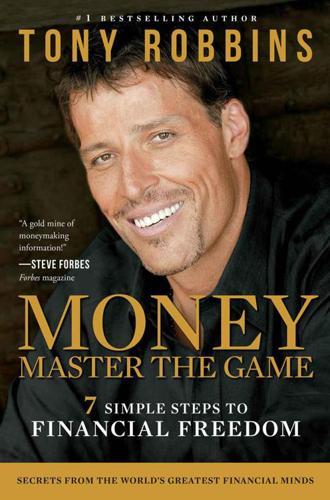

MONEY Master the Game: 7 Simple Steps to Financial Freedom

by

Tony Robbins

Published 18 Nov 2014

From that moment on, there was zero doubt in my mind about what I wanted and how I was going to achieve it. I was so clear about what I wanted that I made it happen: I became world champion.” —Derek Hough, dancer, choreographer, and five-time winner of ABC’s Dancing with the Stars “Tony Robbins is a genius . . . His ability to strategically guide people through any challenge is unparalleled.” —Steve Wynn, CEO and founder of Wynn Resorts “Before Tony, I had allowed myself to be put in a position of fear. After meeting Tony, I made a decision not to be afraid anymore. It was an absolutely game-changing, life-altering experience. I’m so excited and thankful for Tony Robbins and the incredible gift that he gave me.”

…

I’ve had the privilege to work with award-winning actors with the coolness of Leonardo DiCaprio and the warmth of Hugh Jackman. My work has touched the lives and performances of top entertainers from Aerosmith to Green Day, Usher to Pitbull to LL Cool J. And billionaire business leaders as well, such as the casino magnate Steve Wynn and the internet wizard Marc Benioff. In fact, Marc quit his job at Oracle and began building Salesforce.com after attending one of my Unleash the Power Within seminars in 1999. Today it’s a $5 billion enterprise and has been named the “World’s Most Innovative Company” by Forbes magazine for the last four consecutive years.

…

Now the goal is to get rich and work until you’re 90. Nearly half of all individuals who earn $750,000 per year or more say they will never retire, or if they do, the earliest they would consider it is age 70. How about the Rolling Stones and Mick Jagger at age 71—still rockin’ the world? Or think of business moguls like Steve Wynn at 72. Warren Buffett at 84. Rupert Murdoch at 83. Sumner Redstone at 91. At those ages they were all still running their businesses and crushing it. (Probably still are.) Maybe you will be, too. But what happens if we can’t work, or don’t want to work anymore? Social Security alone is not going to be much of a cushion for our retirement.

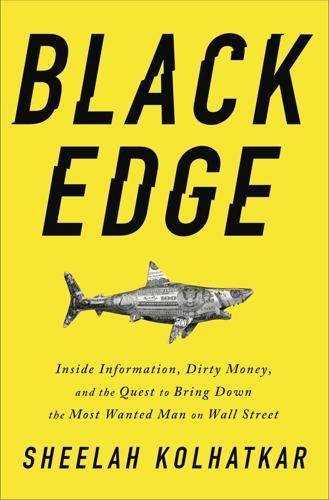

Black Edge: Inside Information, Dirty Money, and the Quest to Bring Down the Most Wanted Man on Wall Street

by

Sheelah Kolhatkar

Published 7 Feb 2017

paying $8 million for a shark: Carol Vogel, “Swimming with Famous Dead Sharks,” The New York Times, October 1, 2006. 4,360 gallons of formaldehyde: Roberta Smith, “Just When You Thought It Was Safe,” The New York Times, October 16, 2007. the casino magnate Steve Wynn had bought it: Account of Wynn cocktail party: Nick Paumgarten, “The $40-Million Elbow,” The New Yorker, October 23, 2006. “This is the most money ever paid for a painting”: “Steve Wynn to Keep Picasso He Damaged,” Associated Press, October 18, 2006. the collectors Victor and Sally Ganz: Geraldine Norman, “Life with Picasso,” The Independent, September 27, 1997. “terrible” ripping sound: Nora Ephron, “My Weekend in Vegas,” The Huffington Post, October 16, 2006.

…

When a painting by Picasso called Le Rêve (The Dream) became available in the fall of 2006, it was an opportunity to take his collecting to a whole new level. Cohen was overcome with the desire to own Le Rêve as soon as he saw it. A highly erotic portrait of Picasso’s young mistress Marie-Thérèse Walter asleep in an armchair, it was painted in 1932 when Picasso was fifty years old, a form of soft porn in jewel tones. In 2001, the casino magnate Steve Wynn had bought it from another collector who had paid $48.4 million for it in 1997. Then, five years later, he decided that he wanted to sell it. As soon as Cohen heard, he flew an art advisor out to California to look at the piece and evaluate its condition. Cohen’s advisor inspected the painting closely and wrote a report confirming that it was in fine condition.

…

He attended the World Economic Forum in Davos in January and made a rare appearance at a hedge fund conference in Palm Beach, in part to show the world that he wasn’t daunted by the enormous payment he had just agreed to hand over to the SEC. At the end of March, he received a call from the art dealer William Acquavella. Steve Wynn, the casino owner and prodigious art collector, was ready to sell Picasso’s Le Rêve; seven years had passed since Cohen’s original deal with Wynn had had to be canceled due to Wynn’s expensive bout of clumsiness. During the intervening period, Wynn had devoted significant resources to restoring the painting.

The Organized Mind: Thinking Straight in the Age of Information Overload

by

Daniel J. Levitin

Published 18 Aug 2014

Then, set up fail-safes, which include things like: Hiding a spare house key in the garden or at a neighbor’s house Keeping a spare car key in your top desk drawer Using your cell phone camera to take a close-up picture of your passport, driver’s license, and health insurance card, and both sides of your credit card(s) Carrying with you a USB key with all your medical records on it When traveling, keeping one form of ID and at least some cash or one credit card in a pocket, or somewhere separate from your wallet and other cards, so that if you lose one, you don’t lose everything Carrying an envelope for travel receipts when you’re out of town so that they’re all in one place, and not mixed in with other receipts. And what to do when things do get lost? Steve Wynn is the CEO of the Fortune 500 company that bears his name, Wynn Resorts. The designer of the award-winning luxury hotels the Bellagio, Wynn, and Encore in Las Vegas, and the Wynn and Palace in Macau, he oversees an operation with more than 20,000 employees. He details a systematic approach. Of course, like anyone else, I lose my keys or my wallet or passport.

…

The advisors pass a problem upward not because they’re not smart enough to solve it, but because it invariably involves a choice between two losses, two negative outcomes, and the president has to decide which is more palatable. At that point, President Obama says, “you wind up dealing with probabilities. Any given decision you make, you’ll wind up with a thirty to forty percent chance that it isn’t going to work.” I wrote about Steve Wynn, the CEO of Wynn Resorts, in Chapter 3. About decision-making, he says, “In any sufficiently large organization, with an effective management system in place, there is going to be a pyramid shape with decision makers at every level. The only time I am brought in is when the only known solutions have a downside, like someone losing their job, or the company losing large sums of money.

…

There is not some overlord of the theory of probability making sure that everything works out just the way you expect. If you get “heads” ten times in a row, the probability of the coin coming up “tails” on the next toss is still 50%. Tails is not more likely and it is not “due.” The notion that chance processes correct themselves is part of the gambler’s fallacy, and it has made many casino owners, including Steve Wynn, very wealthy. Millions of people have continued to put money into slot machines under the illusion that their payout is due. It’s true that probabilities tend to even out, but only in the long run. And that long run can take more time and money than anyone has. The confusing part of this is that our intuition tells us that getting eleven heads in a row is very unlikely.

Palace Coup: The Billionaire Brawl Over the Bankrupt Caesars Gaming Empire

by

Sujeet Indap

and

Max Frumes

Published 16 Mar 2021

As gaming licenses proliferated in Mississippi, Louisiana, Missouri, Iowa, and elsewhere, it was an advantage to be considered a company from down South. Harrah’s would win several riverboat and Native American licenses as they started to come up. But the company stagnated after that initial wave of regional properties was built. Satre needed a different strategy to keep up with the likes of Steve Wynn’s The Mirage, with its pyrotechnics and waterfalls. His only play was marketing; taking a commodity product, gambling, and getting players to pick Harrah’s over and over again. Satre became convinced he needed to look outside the insular casino industry. The marketing wizards of that era were in consumer products and retail, getting Americans to buy paper towels or cheeseburgers by creating brands that were able to build long-term connections with customers.

…

Harrah’s had transformed into a well-oiled machine. The organization from top to bottom was singularly focused on the user experience. Chuck Atwood, the company’s chief financial officer in the early 2000s, said, “We were talking about customers, everyone else was talking buildings,” referring to the likes of Steve Wynn, Sheldon Adelson, and Kirk Kerkorian. At the turn of the century, Harrah’s spent billions adding regional properties around the country as well as snatching up the iconic Binion’s Horseshoe in Las Vegas along with the World Series of Poker intellectual property. Even after all this wheeling and dealing, Harrah’s was still an also-ran in Sin City.

…

The cycle for building resorts lasted several years and in the early 2000s, with no sign of financial crisis and with Sin City booming, all the big players launched major projects. MGM had its City Center extravaganza, its 16 million square-foot enclave of hotels, casinos, condominiums, shopping, and commercial office space. Steve Wynn built Encore as a follow-up to Wynn. Las Vegas Sands opened Palazzo. New York developer Ian Bruce Eichner opened the hip Cosmopolitan down the street from Caesars. Between 2001 and 2011, Las Vegas expanded from 127,000 rooms to 150,000 rooms even as demand had softened considerably. Hotels were not only sensitive to occupancy rates but also to the so-called ADR, average daily rate.

Competing on Analytics: The New Science of Winning

by

Thomas H. Davenport

and

Jeanne G. Harris

Published 6 Mar 2007

Davenport and Harris have provided the guide for creating such an environment, informed by best practice from a heterogeneous group of innovative organizations. One last thing. When it comes to visionary leadership as compared to analytic management, you can lose weight without diet or exercise. Or to put it differently, vision and analytics need not be seen as mutually exclusive paradigms. In my industry, Steve Wynn and Jack Binion have both been visionary leaders of great accomplishment. Neither were students of traditional analytic methods, but both were innovators whose ideas were entirely consistent with analytic methods. The challenge for those of us who attempt to employ analytic capabilities is to ensure that they are oriented forward, where the problems are least well defined and the data is scarce, rather than backward, where the work is easy and the risk is low.

…

For example, in the gaming industry, Harrah’s uses analytics to encourage customers to play in a variety of its locations. This makes sense for Harrah’s, because it has long had its casinos scattered around the United States. But that approach clearly would not be the right one for a single casino, such as Foxwoods Resort Casino in Connecticut. It’s also less appealing for casino impresario Steve Wynn, who has translated his intuitive sense of style and luxury into the destination resorts Bellagio and the Wynn. Adaptable to many situations. An analytical organization can cross internal boundaries and apply analytical capabilities in innovative ways. Sprint, for example, easily adapted its analytical expertise in marketing to improve its human capital processes.

Billionaires' Row: Tycoons, High Rollers, and the Epic Race to Build the World's Most Exclusive Skyscrapers

by

Katherine Clarke

Published 13 Jun 2023

The program would grant the developers a significant tax break in return for incorporating some low-income housing into the project. Harry dismissed the notion out of hand. “I thought, what a heresy that would be to have subsidized housing on Park Avenue and 56th Street,” he said. They also talked to Dubai’s Emaar Properties, former New York governor Eliot Spitzer, and even the casino magnate Steve Wynn, who envisioned bringing a hotel to the site. None of the discussions were panning out. Sitting that spring in his office on the 21st floor of the GM Building, which he continued to lease following the sale of the building, Macklowe argued with his longtime friend Arthur Cohen about the future of the project.

…

Buyers would watch the promotional movie in the sales office and become visibly emotional, Sertic said. The long view of the park, the “money shot” as they called it, was the true selling point. Big names came through the sales office almost every day, each with their own set of unique requirements. For Steve Wynn, the casino magnate, who suffers from a rare eye condition, the team had to recalibrate the dim lighting in the sales office. A senior United Nations representative got halfway up in the construction hoist elevator before beginning to shake uncontrollably from a newly discovered fear of heights and had to be shuttled back to the ground.

…

A string of big ticket closings reflected a tidal wave of demand for ultra-luxury homes on 57th Street and far beyond. The following year, 2012, had been one for the record books. In May, the billionaire investor Howard Marks paid $52.5 million for a thirty-room spread at 740 Park Avenue. In June, the casino mogul Steve Wynn dropped $70 million for a duplex at the Ritz-Carlton on Central Park South. In November, the entertainment executive David Geffen paid $54 million for a duplex at 785 Fifth Avenue. The average price per square foot for a Manhattan luxury apartment ballooned by close to 40 percent, and there was a widening chasm between the prices for new development units and the prices of resales.

Overbooked: The Exploding Business of Travel and Tourism

by

Elizabeth Becker

Published 16 Apr 2013

The response was so extraordinary that he then built a “strip” of landfill connecting two small islands in the territory, where he built the Venetian Macao, an enormous replica of the Las Vegas resort. Adelson became one of the world’s wealthiest men on the strength of the high-stakes gambling in his VIP lounges in Macao. Steve Wynn, the better-known Las Vegas casino billionaire, soon followed and opened the Wynn Macau, a far more elegant resort but with the same accent on the high rollers. By 2006, gambling in Macao had outpaced that in Las Vegas. Now, with $33.5 billion in wagers in 2011, it is at least five times larger than the money gambled in Las Vegas.

…

The most surprising facet of the appeal of Las Vegas is its insistence that good labor relations is part of its hospitality—what the mayor and nearly every other official told me during my stay in the city. Emanuel had blamed the unions for Chicago’s decline in the convention business, but Las Vegas has stronger union labor than Chicago. Meyer of the Convention Authority said that by signing a five-year union contract, Steve Wynn set the standard for solid management-labor relations. “Labor knows what’s going on in the hotels. All of our major brands are based here—Caesar’s, MGM, Wynn—it is still the case that labor unions work well in Las Vegas and that management values the training and engagement of union workers.” The labor movement agrees.

…

the opening up of China: Evan Osnos, “The God of Gamblers: Why Las Vegas Is Moving to Macau,” New Yorker, April 9, 2012. Kung Fu Mahjong: Desmond Lam, “Chinese Gambling Superstitions and Taboos,” http://www.urbino.net/articles.cfm?specificArticle=Chinese%20Gambling%20Superstitions%20and%20Taboos. soon followed and opened the Wynn Macau: Donald Frazier, “Gambling Titan Steve Wynn Fights for Top Prize: China,” Forbes, March 28, 2012. When I attended: Las Vegas Convention and Visitors Authority meeting, May 8, 2012. Rahm Emanuel: Jonathan Alter, “Meet the New Boss,” The Atlantic, April 2012. “Who is he kidding?”: Author interview with Mayor Carolyn Goodman, May 7, 2012.

Running Money

by

Andy Kessler

Published 4 Jun 2007

The CEO, Bobby Kotick, looked about 12 years old but was a pretty savvy dude. He had just taken over by lending the company a pot of dough, some of it from Steve Wynn, the Vegas casino king. In a conference room at the Treasure Island casino, we gathered a bunch of big institutional investors who were in Vegas for the Consumer Electronics Show. Bobby insisted the meeting start at 3:15 and be done by 4:00. I protested, but Bobby just said, “Trust me.” The meeting went well. Steve Wynn popped in for the last 15 minutes and said Bobby was the smartest kid he’d ever met. This was going to be an easy deal. At 4:00, Bobby asked everyone to step out onto a terrace just off the conference room.

Triumph of the Yuppies: America, the Eighties, and the Creation of an Unequal Nation

by

Tom McGrath

Published 3 Jun 2024

Milken never talked to the press, but to the people who worked with him every day, his drive to create a new way of doing things was palpable. “Mike was on a mission,” Gary Winnick, a member of Drexel’s high-yield bond team, would later say. “I’ve never seen anybody in my career who has unbridled brilliance and unbridled ambition and total conviction.” There was no better illustration of how impactful Milken’s approach could be than Steve Wynn. Wynn, then thirty-six years old and the owner of a single casino in Las Vegas, the Golden Nugget, had been introduced to Milken in 1978, not long after the Drexel trader had moved back to California. Wynn had been spending time in Atlantic City, where gaming was legalized a couple of years earlier, and he was dazzled by the possibility of opening a second Golden Nugget there.

…

The deal, not surprisingly, drew enormous attention, and at a moment when mergers and takeovers were getting larger than ever, people wondered: If a relative nobody like Nelson Peltz could walk in and simply take over a major corporation, was any company truly safe from corporate raiders? As if to emphasize that the answer was no, Milken clients, all just a fraction of the size of their targets, mounted no fewer than five hostile takeover attempts in the next month. Lorimar went after Multimedia. Financier Sir James Goldsmith went after Crown Zellerbach Corporation. Steve Wynn’s Golden Nugget went after Hilton. Farley Industries went after Northwest Industries. It was a frenzy, and it only grew with another Milken-backed raid that summer: an attempt by investor Ron Perelman to take over international cosmetics company Revlon. The fight for the company took several months—there were lawsuits, and various charges hurled back and forth between the parties—but by the fall Perelman had won out, acquiring Revlon for $900 million, $750 million of which Milken had arranged for him to borrow through junk bonds.

Nomad Capitalist: How to Reclaim Your Freedom With Offshore Bank Accounts, Dual Citizenship, Foreign Companies, and Overseas Investments

by

Andrew Henderson

Published 8 Apr 2018

Payroll taxes are practically non-existent. Hong Kong does not need your tax dollars because guys like Ka-shing are footing the bill. This is similar to how Nevada can apply extremely light taxation to businesses and completely cut out personal income tax thanks to the hundreds of casinos run in the state. Steve Wynn pays the bills so no-one else has to. The same is true in the Gulf states where taxation is zero nearly across the board due to heavy taxation of oil revenues. People were shocked when Dubai went so far as to impose a VAT. The point is that if you understand why a country offers the incentives (or disincentives) that it does, you will have a better idea of where your company can be treated best.

…

The best part is that average entrepreneurs and small-time investors can take advantage of this vestige of wealth by storing their own gold there. Le Freeport, at its core, is merely another commercial building available for lease. It just so happens that it is among the world’s most secure commercial buildings with tenants like Christie’s storing what will no doubt be Steve Wynn’s thirteenth Renoir and Jay Leno’s 117th classic car. However, it also has lesser known tenants that rent their own private vault within the facility and allow clients to store gold there. In fact, it is possible to store as little as one silver coin worth about $20 in Le Freeport. It is also possible to start with $20 and gradually build up each month.

Magical Urbanism: Latinos Reinvent the US City

by

Mike Davis

Published 27 Aug 2001

Distressingly - to the gringo eye at least - she looks like the Statue teased for a Playboy centerfold. In Munoz Garcia and his family where on a delirious reality, Munoz she is of Liberty stripped and is the home of Armando an urban imaginer some- spectrum between Marcel Vegas casino entrepreneur Steve Wynn. "Give Duchamp and Las me enough rebar and an oxyacetlylene torch," he boasts, "and Til line the border with giant nude Amazons." In the meantime, he curls up built a to sleep inside her enormous eats in breasts. La Monas belly and When asked house with pubic hair and nipples, he growls back, ^Porque no?

It's Not TV: The Spectacular Rise, Revolution, and Future of HBO

by

Felix Gillette

and

John Koblin

Published 1 Nov 2022

CHAPTER 12 Novel Reckonings In the early 2000s, HBO began developing an original movie about Donald Trump. The project came to HBO via Jeffrey Auerbach, a media executive who had done stints working for the Philadelphia Eagles, Hearst Entertainment, and Sony Entertainment Pictures. The idea was to focus on the epic battle that Trump had waged in the 1990s against rival casino owner Steve Wynn over control of an undeveloped property in Atlantic City. Wynn wanted to turn the site, formerly occupied by the city’s dump, into a resort. Trump wanted it for a golf course. Much litigation, backstabbing, and name-calling ensued. At HBO, Kary Antholis, a programming executive on the West Coast, began actively shepherding the project, to be entitled Trump vs.

…

GO TO NOTE REFERENCE IN TEXT disappeared with no warning: Brett Martin, “The Night Tony Soprano Disappeared,” GQ, June 19, 2013. GO TO NOTE REFERENCE IN TEXT Gandolfini backed down: Bill Carter, “Sopranos Star Drops Suit and Will Return to Series,” New York Times, March 19, 2003. GO TO NOTE REFERENCE IN TEXT CHAPTER 12: NOVEL RECKONINGS Much litigation, backstabbing: Mark Davis, “Steve Wynn Bid for A.C. Site: His Hotel-Gaming-Shopping Plan Topped Donald Trump’s Bid for a Golf Course. Next the City Will Vote,” Philadelphia Inquirer, August 19, 1995. GO TO NOTE REFERENCE IN TEXT Danny DeVito signed on: Stephen Lynch, “Fight Night! Trump vs. Wynn Brawl Coming to HBO,” New York Post, December 6, 2003.

Southwest USA Travel Guide

by

Lonely Planet

The va-va-va-voom casino lives up to the hotel’s name, and the hotel bars – from a James Bond-esque lounge to a live music joint where soul singers belt it out on a stage that’s practically on top of the bar – are some of the best in town. Encore CASINO (www.encorelasvegas.com; 3121 Las Vegas Blvd S) A slice of the French Riviera in Las Vegas – and classy enough to entice any of the Riviera’s regulars – Steve Wynn has upped the wow factor, and the skyline, yet again with the Encore. Filled with indoor flower gardens, a butterfly motif and a dramatically luxe casino with scarlet chandeliers, it’s an oasis of bright beauty. Botero, the restaurant headed by Mark LoRusso, is centered on a large sculpture by Fernando Botero himself.

…

Come summertime, the Encore Beach Club (www.encorebeachclub.com) throws one of the hottest pool parties in town. Bellagio CASINO (www.bellagio.com; 3600 Las Vegas Blvd S) Fans of eye-popping luxury, along with movie buffs who liked Ocean’s Eleven (several key scenes were shot here) won’t want to miss Steve Wynn’s Vegas’ original opulent pleasure palazzo. Inspired by a lakeside Italian village, the Bellagio is now a classic fixture of the strip, perhaps best known for its dazzling choreographed dancing fountain show that takes place every 15 to 30 minutes during the afternoon and evening. Other highlights include the dreamy pool area, a swish shopping concourse, a European-style casino and the Bellagio Gallery of Fine Art (adult/student $17/12; 10am-6pm Sun-Tue & Thu, to 7pm Wed, Fri & Sat).

…

High-stakes gamblers will appreciate the classy casino and cutthroat poker room, while those who prefer observing the survival of the fittest in nature will appreciate Bay’s Shark Reef (702-632-4555; adult/child $18/12; 10am-8pm Sun-Thu, 10am-10pm Fri & Sat), a walk-through aquarium that’s home to thousands of submarine beasties. M-Bay is connected to Luxor by the eclectic Mandalay Place shopping mall. Wynn Las Vegas CASINO (www.wynnlasvegas.com; 3131 Las Vegas Blvd S) Steve Wynn’s signature (literally, his name is written in script across the top, punctuated by a period) casino hotel stands on the site of the imploded 1950s-era Desert Inn. The curvaceous, copper-toned 50-story tower exudes secrecy – the entrance is obscured from the Strip by an artificial mountain of greenery.

Age of Ambition: Chasing Fortune, Truth, and Faith in the New China

by

Evan Osnos

Published 12 May 2014

The casinos had reordered the rhythms of life and work, in ways that were not universally celebrated. Au Kam San, a member of Macau’s Legislative Assembly, who worked as a high school teacher, had students who told him, “I can go get a job in a casino right now and earn more than my teacher.” A short drive from the ferry, the Las Vegas tycoon Steve Wynn had a complex with two hotels, where the Louis Vuitton store was said to generate more sales per square foot than any other Louis Vuitton store worldwide. Walking past a tank of luminescent jellyfish, which required a specially designed curtain to sleep at night, the casino PR person who was showing me around told me that Chinese clientele demanded a heightened level of luxury because “everyone is a president or a chairman.”

…

Give the strikers “a rifle diet for a few days,” suggested Thomas Scott of the Pennsylvania Railroad, “and see how they like that kind of bread.” Europeans liked to say that America had gone from barbarism to decadence without the usual interval of civilization. Macau afforded China’s new moneyed class the chance to indulge. In designing his casino, Steve Wynn celebrated Chinese superstitions about the path to fortune: when the hotel designers realized that the number of private rooms in the spa was four—an unfortunate number, because it sounds, in Chinese, like “death”—they installed a line of fake doors across the hall to suggest a total of eight, a word in Chinese that sounds like “get rich.”

The Ripple Effect: The Fate of Fresh Water in the Twenty-First Century

by

Alex Prud'Homme

Published 6 Jun 2011

“If you were to shut off the canals at the Venetian and the fountains at the Bellagio, you would affect the mainstay of our economy. The casinos are the largest economic driver in the state, by far. Why would you not invest three percent of your water in making them attractive to tourists?” When Steve Wynn, the legendary casino and hotel developer, was building Treasure Island, a hotel-casino with a nautical water feature that included a “sea” in which a life-size replica of a pirate ship does battle with a naval frigate, he wanted to know how to maintain the illusion of an ocean in the desert. “Double-plumb Treasure Island,” Mulroy replied.

…

See also “Lake Mead Could Be Dry by 2021,” Scripps press release, February 12, 2008. 163 Using the same data, the federal Bureau of Reclamation: “Reclamation and Scripps Institution of Oceanography Look to Collaborate,” US Bureau of Reclamation press release, June 9, 2010. 163 population of Clark County: Mulroy interview. 163 a $13,000-a-year administrative assistant: Ibid. 163 65 percent of the water flowing: “Conserve Water,” Las Vegas Wash Coordination Committee: www.lvwash.org/html/help_waterconservation.html. 164 76 percent of the water used: “Turf Wars,” Peter Gleick Circle of Blue blog, February 21, 2010: www.circleofblue.org/waternews/2010/world/peter-gleick-turf-wars/. 164 Steve Wynn: Mulroy interview. 165 Each year, the SNWA spends: George Knapp, “Why Doesn’t the SNWA Focus on Water Conservation?” 8NewsNow.com, August 20, 2009: http://www.8newsnow.com/story/10966745 /why-doesnt-the-snwa-focus-on-water -conservation?redirected=true. 165 Vegas grew by four hundred thousand people: Stephanie Tavares, “Q&A: Pat Mulroy,” Las Vegas Sun, May 1, 2009. 165 Las Vegas continues to use more water: Heather Cooley, et al., “Hidden Oasis: Water Conservation and Efficiency in Las Vegas,” Pacific Institute, November 2007, p. 18. 165 A survey shows the top one hundred: Henry Brean, “Not a Drop in the Bucket,” Las Vegas Review-Journal, March 22, 2009. 165 Mulroy herself uses: Confirmed by J.

Boom: Mad Money, Mega Dealers, and the Rise of Contemporary Art

by

Michael Shnayerson

Published 20 May 2019

They had barely just bought their first Warhols at the Art Basel in 1987 when they scooped up 20 Marilyns.4 “Larry [Gagosian] bought all the Warhols he could get at auction too,” d’Offay recalled. “When an important Warhol came to auction, there would be ten or fifteen collectors who wanted it very much. Larry would want it for inventory, and Mugrabi would want it as an investment. Or [hedge-fund manager] Steven Cohen or [casino king] Steve Wynn. It brought the whole game up to a higher level.” Essentially, Warhol’s market became a market unto itself—like the market in soy beans—and, to the extent that any one artist’s could, it dominated the contemporary art market. Mugrabi was that market’s most visible advocate. “He walked around with a notebook full of Warhols and Basquiats,” recalled art lawyer Aaron Richard Golub.

…

He cultivated the very rich who thrilled to be told which artists to invest in, by the dealer who seemed never to harbor a doubt. These included Ron Perelman, the dealmaker of MacAndrews & Forbes; LA real-estate developer Eli Broad; hedge funder Steve Cohen; private equity king Leon Black of Apollo Global Management; casino magnate Steve Wynn; entertainment mogul David Geffen; British über collector Charles Saatchi; media maven Peter Brant; the Nahmads and the Mugrabis; and Condé Nast publisher S. I. Newhouse. These were Gagosian’s inner circle, not unlike Gagosian in personality. “Larry is inherently impatient,” noted one of his staffers, “so he gravitates to other impatient people.”

The Wisdom of Finance: Discovering Humanity in the World of Risk and Return

by

Mihir Desai

Published 22 May 2017

Koons commented as he viewed the piece, “You have a sense of transcendence taking place here . . . he eats that spinach and he transcends into the strength. I think that’s the art. The spinach is the art. Art can change your life. It can expand your parameters. It can give this vastness to life.” A better description of leverage is hard to find. Who knew spinach, art, and leverage were all connected? As a coda, casino magnate Steve Wynn purchased Popeye for $28 million in 2014. Wynn’s father had built a small empire of bingo parlors in Connecticut on leverage. When Wynn was nineteen, his father died more than $300,000 in debt, which led to Wynn dropping out of college. Wynn, undeterred by this trauma, went west to Las Vegas and built an empire of his own, starting with the Golden Nugget, through the savvy use of leverage.

Bringing Down the House: The Inside Story of Six M.I.T. Students Who Took Vegas for Millions

by

Ben Mezrich

Published 2 Dec 2002

Luring millions of conventioneers with a state-sanctioned, lax attitude toward the sex industry, and a new focus on the consumption-oriented middle class, the city built by gangsters became America’s premier vacation and corporate conference destination. At the end of the eighties and the beginning of the nineties, fueled by America’s economic boom and a lust for high living, a massive influx of corporate money spawned the Vegas we know today: an over-the-top world of excess and imagination. Beginning with Steve Wynn’s Mirage, built in 1989, Vegas picked up where the MGM Grand of 1973 left off. Inaugurating a multibillion-dollar construction boom, the Mirage was a six-hundred-fifty-million-dollar trip into fantasy. From the fifty-four-foot erupting volcano out front to illusionists Siegfried and Roy’s “Secret Garden” attached to the pool, the Mirage reinvented the concept of the megaresort.

A Curious Mind: The Secret to a Bigger Life

by

Brian Grazer

and

Charles Fishman

Published 6 Apr 2014

Wolfe: playwright, theater director, two-time winner of the Tony Award Steve Wozniak: cofounder of Apple Inc., designer of Apple I and Apple II computers, inventor John D. Wren: president and CEO of marketing and communications company Omnicom Will Wright: game designer, creator of Sim City and The Sims Steve Wynn: businessman, Las Vegas casino magnate Gideon Yago: writer, former correspondent for MTV News Eitan Yardeni: teacher and spiritual counselor at the Kabbalah Centre Daniel Yergin: economist, author of The Prize: The Epic Quest for Oil, Money and Power, winner of the Pulitzer Prize Dan York: chief content officer at DirecTV, former president of content and advertising sales, AT&T Michael W.

Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the World

by

Molly Bloom

Published 23 Jun 2014

“I can’t extend any credit the first night. So anything you want to play with you have to bring, in cash.” “What about casino chips?” “I’ll take chips from Bellagio or Wynn,” I said. Those were the only chips the other guys would accept as payment. I supposed this had to do with the fact that Steve Wynn was conservative and his casinos were solid. His stock was steady and he was a hands-on operator. My big guns knew the chips from his shops were good. “No problem,” he said. “Oh, and Derek,” I said. “May I suggest wearing civilian clothes?” He laughed. “You got it.” WITH THE ADDITION OF BEN, Derek, and Rick, I had more than enough players for the big game, and I started planning for the following Tuesday at the Beverly Hills Hotel.

Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader

by

Colin Lancaster

Published 3 May 2021

Global money flows tell an interesting story. We are in the limo to our hotels. Lifecoach is staying at the Aria, which will be our first stop, and the rest of us are staying at the Wynn. Lifecoach still refuses to stay there. She thinks too many people were complicit in the bad stuff Steve did, and this is her form of boycott. Steve Wynn was the first major CEO to fall from grace in the MeToo era. Many of the allegations were made by salon and spa employees at the hotel. CNBC is on the limo’s TV and Ray Dalio is talking about wealth inequality. The world is experiencing the biggest wealth gap since the 1930s. “In the United States the top one-tenth of 1% of the population has a net worth that’s approximately equal to the bottom 90%,” he says.

Den of Thieves

by

James B. Stewart

Published 14 Oct 1991

Client service was taken to new lengths: when an institutional junk-bond buyer asked for a mirrored ceiling and walls in his hotel room, Drexel had them installed. The Friday-night dinner for 1,500 had to be moved to the Century Plaza Hotel. This time no one fell asleep. Instead of the dreary economist or pollster, a giant screen was unfurled, the lights were dimmed, and a video "commercial" appeared, starring Steve Wynn and Frank Sinatra. Then Milken and Wynn came onstage and into the spotlight. "You guys don't know how to do commercials," Milken kidded Wynn. "Oh yeah?" Wynn replied. "Let's have an expert decide." With that, Sinatra himself came striding onstage, brandishing a fistful of cash. "Here you are kid," Sinatra said, handing the money to Wynn.

…

That year's guest list was practically a who's-who of self-made multimillionaires of the 80s: Merv Adelson, Norman Alexander, Henry Kravis, George Roberts, Boone Pickens, John Kluge, Fred Carr, Marvin Davis, Barry Diller, William Farley, Harold Geneen, Rupert Murdoch, Steve Ross, Ron Perelman, Peter Grace, Sam Heyman, Carl Icahn, Ralph Ingersoll, Irwin Jacobs, William McGowan, David Mahoney, Martin Davis, John Malone, Peter Ueberroth, David Murdock, Jay and Robert Pritzker, Samuel and Mark Belzberg, Carl Lindner, Nelson Peltz, Saul Steinberg, Craig McCaw, Frank Lorenzo, Peter May, Steve Wynn, James Wolfensohn, Oscar Wyatt, Gerald Tsai, Roger Stone, Harold Simmons, Sir James Goldsmith, Mel Simon, Henry Gluck, Ray Irani, Peter Magowan, Alan Bond, Ted Turner, Robert Maxwell, Kirk Kerkorian. Mingling with them were key Drexel corporate finance and bond salesmen, such as Siegel, Ackerman, and Dahl.

Stephen Fry in America

by

Stephen Fry

Published 1 Jan 2008

Sometimes clichés are unavoidable so I forgive myself for yelling…‘California, here I come…’ * * * NEVADA KEY FACTS Abbreviation: NE Nicknames: The Silver State, The Sagebrush State, The Battle Born State Capital: Carson City Flower: Sagebrush Trees: Single-leafed piñon pine, bristlecone pine Bird: Mountain bluebird Fossil: Ichthyosaur Motto: All For Our Country Well-known residents and natives: Pat Nixon, Edna Purviance, Steve Wynn, Michael Chang, Andre Agassi. * * * CALIFORNIA ‘The pioneers who had struggled through the sparse deserts of the west screamed with delight when they fell upon this lush, fertile land.’ As you can see from the Key Facts box, I gave up on the list of well-known natives once I had reached the end of the Gs.

Reskilling America: Learning to Labor in the Twenty-First Century

by

Katherine S. Newman

and

Hella Winston

Published 18 Apr 2016

Although the Southeast seems to be farthest ahead in adapting German approaches to training, in conjunction with German firms, signs of revival in vocational education are also evident in the Northeast. We learned much of what there was to know, especially on the educational side of this equation, from Steve Wynn, assistant principal at the High School for Construction Trades, Engineering and Architecture in Ozone Park, Queens; Jean Mallon, principal of Tri-County Regional Vocational High School in Franklin, Massachusetts; Mary-Ellen MacLeod, director of cooperative education at Tri-County Regional Vocational High School in Franklin, Massachusetts; Mike Adams, principal of Cape May County Technical High School, Cape May Court House, New Jersey; Caterina Lafergola, principal of Automotive High School, Greenpoint, Brooklyn, New York; and Deno Charalambous, principal of Aviation High School in Long Island City, New York.

Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism

by

Jeff Gramm

Published 23 Feb 2016

During that period, Michael Milken’s domination of the rapidly growing market for junk bonds drove a twenty-five-fold increase in the bank’s revenues.34 In 1985, the year Carl Icahn took on Phillips, Milken focused on a promising new niche in the market—hostile raids financed by junk bonds. At the company’s annual high-yield conference—the so-called Predators’ Ball—Drexel CEO Fred Joseph said, “For the first time in history, we’ve leveled the playing field. The small can go after the big.”35 Within a few weeks of the conference, Pickens went after Unocal, Steve Wynn bid for Hilton Hotels, Sir James Goldsmith targeted Crown Zellerbach, and Lorimar bid for Multimedia.36 All of these deals saw smaller players funded by Milken’s bonds trying to gobble up billion-dollar companies. But none of them seemed as topsy-turvy as Carl Icahn’s bid for Phillips Petroleum.

Powerhouse: The Untold Story of Hollywood's Creative Artists Agency

by

James Andrew Miller

Published 8 Aug 2016

Watt Naomi Watts Elliot Webb Bob Weinstein Harvey Weinstein Jerry Weintraub Sam Weisbord Lou Weiss Audrey Wells John Wells Phil Weltman Tom Werner William Wesley Howard West Fred Westheimer Jim Wiatt Robin Williams Gary Wilson Oprah Winfrey Debra Winger Irwin Winkler Kate Winslett David Wolper Stevie Wonder Bob Wright Steve Wynn Walter Yetnikoff Jed York Rick Yorn Robert Zemeckis Howard Zieff Anthony Ziker Jeremy Zimmer Sergei Zubov Jeff Zucker Alan Zweibel Ed Zwick PREFACE In the spring of 2015, roughly seven hundred agents from the Creative Artists Agency invaded La Costa Resort & Spa outside San Diego, California, for the company’s annual retreat.

…

I represented every client in the agency in my coverage area, so if somebody was doing something at HBO, I would be brought in. I would then keep the primary agent involved. A perfect example, which was one of my worst days, was when Cher had a concert special set up with HBO. We found out that Steve Wynn would give her an extra million dollars if we would move the show from HBO to CBS, and to me it was an easy decision: Okay, an extra million dollars just so we can run “Live at the Mirage” in the bumpers? I only made one mistake, I never talked to the client. I didn’t think that she would care.

Lonely Planet's Best of USA

by

Lonely Planet

Venetian / DUANE WALKER / GETTY IMAGES © Great For… y Don’t Miss The Bellagio’s dancing fountains (free shows take place at least twice hourly) and its blockbuster Gallery of Fine Art. 8 Need to Know See www.lasvegas.com for the lowdown on restaurants, bars and events. 5 Take a Break The Cosmopolitan’s Chandelier Bar rolls out three levels of otherworldly drinks. o Top Tip Distances are deceiving; a walk to what looks like a nearby casino usually takes longer than expected. This famous boulevard is always changing. The themed casinos built on Las Vegas Blvd in the last half of the 20th century drove home the idea that bigger is better. In 1989 Steve Wynn opened the Mirage, with its erupting volcano and 20,000-gallon tropical aquarium. Other spectacular resorts soon followed, and many classic casinos were abandoned and imploded. In 2005 Wynn reset the Strip’s standard with his namesake casino hotel, embodying a new, sophisticated resort style, free of campy themes.

Blood and Oil: Mohammed Bin Salman's Ruthless Quest for Global Power

by

Bradley Hope

and

Justin Scheck

Published 14 Sep 2020

Anoud and her husband left Florida abruptly in 2001, and FBI reports unearthed years later by a local investigative reporting operation, the Florida Bulldog, revealed that two 9/11 attackers spent time at the Ghazzawi home. In the ensuing years, Anoud and DiBello both made their way to Dubai. Anoud became a designer of custom-made abayas. DiBello moved west, working for a producer in LA and casino magnate Steve Wynn in Las Vegas before getting a production job with a Kardashian reality show. Soon she was referring to herself as one of Kim Kardashian’s best friends. In a sign that DiBello was fully ensconced in Hollywood, in 2011 she publicly denied having an affair with Kobe Bryant. A couple years later, DiBello moved to Dubai and started a business connecting American entertainers with opportunities in the Gulf, marketing herself with the Kardashian connection.

Casino

by

Nicholas Pileggi

Published 13 Aug 2015

Nineteen eighty-three was a turning point in the history of Las Vegas. The Tropicana and Argent cases were wending their way through pretrial hearings and on to trials and eventually to convictions. The last Teamster pension fund loan was paid off. The mortgage on the Golden Nugget was bought by Steve Wynn and paid off with junk bonds. The mob’s main muscle—as far as controlling the financing of casinos—was over. In 1983, slot machines became the largest casino revenue producer, surpassing all other forms of gaming. Las Vegas, which had begun as a town for high rollers, became a mecca for Americans looking for low stakes and ALL YOU CAN EAT FOR $2.95 buffets.

Fire and Fury: Inside the Trump White House

by

Michael Wolff

Published 5 Jan 2018

In the final weeks of the campaign, Trump contemptuously measured Christie’s increasing distance from his losing enterprise, and then, with victory, his eagerness to get back in. Trump and Christie went back to Trump’s days trying—and failing—to become an Atlantic City gaming mogul. The Atlantic City gaming mogul. (Trump had long been competitive with and in awe of the Las Vegas gaming mogul Steve Wynn, whom Trump would name finance chairman of the RNC.) Trump had backed Christie as he rose through New Jersey politics. He admired Christie’s straight-talk style, and for a while, as Christie anticipated his own presidential run in 2012 and 2013—and as Trump was looking for a next chapter for himself with the fading of The Apprentice, his reality TV franchise—Trump even wondered whether he might be a vice presidential possibility for Christie.

Billionaire, Nerd, Savior, King: Bill Gates and His Quest to Shape Our World

by

Anupreeta Das

Published 12 Aug 2024

The former couple held about 16 percent of Amazon, worth about $140 billion at the time of the divorce, and Bezos was its largest shareholder. He now owns under 10 percent, while Scott left with a 4-percent stake. Since the divorce, Scott has emerged as one of the world’s most prolific philanthropists, taking a low profile and unfussy approach to grant-making. When the casino mogul Steve Wynn divorced from his wife Elaine Wynn in 2010, they each retained an equal stake in Wynn Resorts, but the split—which started out amicably—turned acrimonious when Elaine was pushed off the board. Bill Gross, the bond fund manager, fought his ex-wife Sue for ownership of their Picasso and their three cats.

The Biggest Bluff: How I Learned to Pay Attention, Master Myself, and Win

by

Maria Konnikova

Published 22 Jun 2020

It wasn’t until Bugsy Siegel brought in the mob and built the Flamingo that Vegas started acquiring something of a more permanent sheen, as a place that wasn’t just on the way to Hollywood but somewhere Hollywood fantasies could come to life. And then Hollywood itself came to Vegas. In 1966, Howard Hughes, the reclusive millionaire mogul, moved into the Desert Inn—and bought the whole hotel rather than leave. He soon owned much of the town. And by the time Steve Wynn decided to build the Mirage, the first of the truly modern Vegas resorts, in 1989, the mob was all but replaced by Hollywood glitter. Vegas should have disappeared into desert. Instead, it became a living, walking fantasy. The moment you’re off the airplane, the lines between fiction and reality blur.

What Happened to Goldman Sachs: An Insider's Story of Organizational Drift and Its Unintended Consequences

by

Steven G. Mandis

Published 9 Sep 2013

But on the other hand, Goldman is receiving valuable recurring revenue fees from the outside investors in the funds so the risks and rewards are not exactly the same as those for outside clients. Advising Companies in the Gambling Industry Goldman had also traditionally declined to do business with companies involved in the gambling industry, for reputational reasons. The firm changed this policy in 2000. Its first foray was to represent Mirage Resorts and Steve Wynn. Mirage was sold to MGM Grand Inc. for $6.6 billion ($21 a share) in June 2000. Although the gambling industry was starting to be regarded as increasingly professional and mainstream, one could argue that Goldman made this change simply because it saw a huge financial opportunity. To raise its profile in the industry and in junk bonds, Goldman hosted a lavish conference in Las Vegas, with entertainment by Cirque du Soleil and Jay Leno, which was attended by eight hundred people.

Madoff: The Final Word

by

Richard Behar

Published 9 Jul 2024

He’d made the investment with his father, David, then a vice president for retail stockbroker EF Hutton, which gave his dad some understanding of how markets were supposed to work and how trades cleared. David once co-owned a 1950s-style motel in town called the Desert Rose with an aunt and uncle. David did the accounting for the motel, until casino tycoon Steve Wynn bought it from them for $10 million, which they all plunked into a Madoff feeder. Kenn said neither he nor his father knew at first that it was Madoff at the end of the feeder. Eventually he found that out, and phoned Bernie directly to ask if an aunt and uncle could also get in on the action.

The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real Money

by

Steven Drobny

Published 18 Mar 2010

This manager builds a diverse portfolio of small bets, all reasonably independent of each other, where on average he feels he has a slight edge. This process led him to once present his fund to his investors as a casino, although he was quick to note he was the house, not the gambler. After all, as Steve Wynn once said: “The only way to win in a casino is to own one.” Overlooking the marina, we ate roe and fresh fish, as my mind raced to keep abreast of “The House’s” thought process, a rare combination of rapid-fire connections, pragmatic wisdom, and deep analysis. Where trading often conjures images of taking outsized bets and winning, over time his game is won through superior portfolio construction.

Inventors at Work: The Minds and Motivation Behind Modern Inventions

by

Brett Stern

Published 14 Oct 2012

Now, it’s kind of funny in the North American market because we make a big deal in North America that fried food is not good for you. In the foreign marketplace—in South America, in Central America, and Asia—they all fry food. And that’s all they do—fry food. And they use a variety of oils to fry the food. I had the occasion to be with one of my closest friends in the world, Steve Wynn, and we were on his on his yacht in the Mediterranean. We were having lunch and he looked at me and said, “What’s your invention?” I said, “It’s a deep fryer.” He looked at me and he said, “Couldn’t you find an easier product to develop? The marketing on that is going to kill you.” Here’s basically how I explained it to Steve: “Before I think about inventing a product, I ask myself, ‘What do I believe is really needed in the marketplace in the way of a small consumer product?’

A Man for All Markets

by

Edward O. Thorp

Published 15 Nov 2016

On the way there and also coming back, we passed through Las Vegas. My friend Peter Griffin (no relation to the Griffin agency or its founders) of The Theory of Blackjack fame arranged with Joe Wilcox, who was then the casino manager at Treasure Island, to pay for (“comp”) our stay there. Joe agreed, if in return I would not play blackjack in any of Steve Wynn’s casinos. Joe was a gracious host and the room, food, and shows were excellent. He mentioned that the casinos were losing significant amounts to the shuffle-trackers and indicated that no one seemed to have found a shuffle that gave effective protection. After watching the dealers at Treasure Island and at two other casinos, and seeing what was wrong, with a little math I found a new shuffle that prevented tracking.

People, Power, and Profits: Progressive Capitalism for an Age of Discontent

by

Joseph E. Stiglitz

Published 22 Apr 2019

From Stuart Silverstein, “This Is Why Your Drug Prescriptions Cost So Damn Much: It’s Exhibit A in How Crony Capitalism Works,” Mother Jones, Oct. 21, 2016. 26.These include Sheldon Adelson, who, with his wife and the companies they control, spent more than $82 million in support of Republicans and conservative outside groups in the 2016 election cycle alone; and Steve Wynn, who served as the Finance Chairman of the Republican National Committee until he was brought down by allegations of extreme sexual misconduct. See “Top Individual Contributors: All Federal Contributions,” OpenSecrets.org, https://www.opensecrets.org/overview/topindivs.php. These are just one group of the many “rent-seekers” who feature so prominently in the Republican Party.

Diet for a New America

by

John Robbins