This Could Be Our Future: A Manifesto for a More Generous World

by

Yancey Strickler

Published 29 Oct 2019

SCARED SUCCESSFUL During the Internet 2.0 era—which spanned about ten years and ended with the 2016 US presidential election—fast growth and big valuations defined the mainstream idea of success. In 2014, a New York Times article profiled an HR software start-up called Zenefits, which, the lead sentence explains, is “one of the fastest-growing companies in recent Silicon Valley history.” The profile glowingly notes the company’s fast growth, A-list Silicon Valley investors, and a recent $4.5 billion “unicorn” valuation. Zenefits was the newest zeitgeist-shaking success. But in the article, Zenefits’ founder and CEO, a man named Parker Conrad, gives a series of startling quotes that clash with the breathless tone. While the Times and investors quoted in the article celebrate the company’s growth, here’s how Conrad describes it: “Even when we think things are going well, it always feels like the wheels are ready to come off the cart.”

…

This is perfectly encapsulated in the story’s headline: “Zenefits’ Leader Is Rattling an Industry, So Why Is He Stressed Out?” Why was Conrad stressed? Because Zenefits was a quickly growing service that aggressively raised nearly half a billion dollars in venture capital money based on that growth, and then had to keep delivering those growth rates—or better—for the foreseeable future. A year later Conrad was fired for violating state regulations to keep it up. The Times reported that the company’s board members had been pushing for faster growth. Though extreme, the story of Zenefits is not unusual. To fulfill the hyperexpectations that investors and others have, people run themselves ragged and take dubious shortcuts to get there.

…

Ryan, found that as people focused on extrinsic values (status, money, etc.) rather than intrinsic values (self-acceptance, belonging, community connection), the more unhappy they were (“Further Examining the American Dream: Differential Correlates of Intrinsic and Extrinsic Goals,” March 1996). “recent Silicon Valley history”: The New York Times story about Zenefits ran on September 20, 2014. pushing for faster growth: Eighteen months later, the New York Times profiled Zenefits’ downfall as well (“Zenefits Scandal Highlights Perils of Hypergrowth at Start-Ups,” February 17, 2016). “it does seem like a rational decision”: Andrew Mason’s comments about Groupon were reported by New York Magazine (“The Super-Quick Rise and Even Faster Fall of Groupon,” October 2018).

Live Work Work Work Die: A Journey Into the Savage Heart of Silicon Valley

by

Corey Pein

Published 23 Apr 2018

(He never explained why it was illegal: because brokers who received kickbacks from insurance companies would have every incentive to push worse policies on their clients, ultimately screwing over everybody who paid premiums.) However, Zenefits found a loophole. It was, in Conrad’s opinion anyway, not explicitly illegal for a broker—which Zenefits was—to provide its clients with free software and services—as Zenefits did—while at the same time receiving compensation from insurance providers that might otherwise be illegal. Because its clients weren’t paying Zenefits to act as an insurance broker, the compensation was kosher … or so Conrad hoped. In most states, insurance regulators failed to notice Zenefits’ egregious end run around consumer protection rules. But Utah regulators did notice.

…

“I was like, ‘Uh-oh, maybe we’re going to be in really big trouble here.’” It didn’t help, perhaps, that he had announced his intentions onstage at the highest-profile startup competition in the world, TechCrunch Disrupt. But where there was cash, there was hope. Coached by the investors who had poured $84 million into the startup, Zenefits “went to the mat” with the government of Utah. Zenefits staged a petition and made itself a techie cause célèbre. Then the company hired “some folks” in Utah, as Conrad put it, to “kind of help us out on the ground and make introductions so that we could sort of plead our case to the various different legislators.” Those folks included at least five lobbyists, including the former deputy mayor of Salt Lake County (“a confidant to many lawmakers”); the former head of the state’s largest political fundraising committee; and the former executive director of the Utah Republican Party.

…

Startup entrepreneurs describe their schemes in detail to investors hoping to buy in to the next epic heist. Should these founders run into any trouble, the investors have the money, know-how, and connections to fight the law and win. It’s the perfect crime—when it works. In a 2013 Shark Tank–style live investor pitch, the founder of a startup called Zenefits, Parker Conrad, feistily promised “to mess stuff up for two very large industries”—insurance and human resources. “If you’re an insurance broker,” Conrad explained, “we’re going to drink your milkshake.” The catchphrase was borrowed from the ruthless oilman portrayed by Daniel Day-Lewis in There Will Be Blood, who uttered it shortly before murdering a business rival.

Brotopia: Breaking Up the Boys' Club of Silicon Valley

by

Emily Chang

Published 6 Feb 2018

The list of “begats” goes on. Sacks went on to become COO of the fast-growing HR software start-up Zenefits. When the founder of Zenefits, Parker Conrad, was kicked out amid accusations of cheating state compliance regulations and creating a bro-y culture that led to “sex in the stairwells,” according to an internal memo, Sacks was promoted to CEO. Sacks promptly brought in Peter Thiel as a board member. Even though the valuation of Zenefits was slashed amid the cheating scandal, it still reached $2 billion. (Sacks has since left Zenefits.) And this is just a partial list. The PayPal Mafia became so dominant that in 2017 Adam Pisoni—an entrepreneur who never worked at PayPal but was recruited by Sacks to be his Yammer co-founder—cited what he called the Mafia’s “dynastic privilege” as “one of the major contributors to the lack of diversity” in Silicon Valley.

…

“This is college journalism written over 20 years ago”: Kara Swisher, “Zenefits CEO David Sacks Apologizes for Parts of a 1996 Book He Co-wrote with Peter Thiel That Called Date Rape ‘Belated Regret,’” Recode, Oct. 24, 2016, https://www.recode.net/2016/10/24/13395798/zenefits-ceo-david-sacks-apologizes-1996-book-co-wrote-peter-thiel-date-rape-belated-regret. “I do believe in diversity”: David Sacks, “Zenefits CEO on Closing the Chapter on Compliance Issues,” interview by author, Bloomberg, Oct. 18, 2016, video, 12:23, https://www.bloomberg.com/news/videos/2016-10-18/zenefits-ceo-on-closing-the-chapter-on-compliance-issues.

…

Except for the office manager, who was female: Jodi Kantor, “A Brand New World in Which Men Ruled,” New York Times, Dec. 23, 2014, https://www.nytimes.com/interactive/2014/12/23/us/gender-gaps-stanford-94.html. “I think there is this way”: Thiel, interview by author, Bloomberg, Dec. 18, 2014. “of the six people”: Thiel, Zero to One, 173. “I ended up recruiting”: Ibid. “sex in the stairwells”: Rolfe Winkler, “Zenefits Once Told Employees: No Sex in Stairwells,” Wall Street Journal, Feb. 22, 2016, https://www.wsj.com/articles/zenefits-once-told-employees-no-sex-in-stairwells-1456183097. Mafia’s “dynastic privilege”: Adam Pisoni, “In Defense of Diverse Founding Teams,” Medium, Jan. 12, 2017, https://medium.com/@adampisoni/in-defense-of-diverse-founding-teams-e9f0b5b81f25.

The Power Law: Venture Capital and the Making of the New Future

by

Sebastian Mallaby

Published 1 Feb 2022

But by 2016 the company was careening off track, missing revenue targets by a mile and reportedly violating insurance laws in at least seven states.[5] Amid embarrassment and scandal, the firm’s valuation was slashed by more than half, from $4.5 billion to $2 billion. The Zenefits story did have one redeeming feature. Andreessen Horowitz, being a real venture firm, quickly ejected the Zenefits founder when the legal problems surfaced. A new chief executive was installed, and the corporate motto changed from “ready, fire, aim” to “operate with integrity.”[6] But it was easy to imagine a hybrid of the Zenefits and Theranos cases in which a hands-on venture shop invested alongside passive financiers. The passive financiers might be amateurish outsiders, as in the Theranos example.

…

See Franklin Foer, World Without Mind: The Existential Threat of Big Tech (New York: Penguin Press, 2017). BACK TO NOTE REFERENCE 2 Carreyrou, Bad Blood, 16. BACK TO NOTE REFERENCE 3 William Alden, “How Zenefits Crashed Back Down to Earth,” BuzzFeed, Feb. 18, 2016. BACK TO NOTE REFERENCE 4 William Alden, “Startup Zenefits Under Scrutiny For Flouting Insurance Laws,” BuzzFeed, Sept. 25, 2015. BACK TO NOTE REFERENCE 5 Rolfe Winkler, “Zenefits Touts New Software in Turnaround Effort,” Wall Street Journal, Oct. 18, 2016. BACK TO NOTE REFERENCE 6 Wondery, “WeCrashed: The Rise and Fall of WeWork | Episode 1: In the Beginning There Was Adam,” Jan. 30, 2020, YouTube, youtube.com/watch?

…

Seasoned venture capitalists might hope to avoid similar disasters, but they could hardly count on doing so. In 2014, Andreessen Horowitz had led two investment rounds in an online insurance startup called Zenefits. The company had become one of a16z’s largest positions, and the partnership had agitated for growth: later, the founder recalled his a16z board member barking, “You guys gotta get your heads out of your asses, start focusing on going big here.”[4] Goaded to expand by all means possible, Zenefits attained a valuation of $4.5 billion in the extraordinarily short period of just over a year. But by 2016 the company was careening off track, missing revenue targets by a mile and reportedly violating insurance laws in at least seven states.[5] Amid embarrassment and scandal, the firm’s valuation was slashed by more than half, from $4.5 billion to $2 billion.

The Optimist: Sam Altman, OpenAI, and the Race to Invent the Future

by

Keach Hagey

Published 19 May 2025

You just want to be in the zeitgeist. I think Sam did that extremely well.” Hydrazine dropped money into a grab bag of industries, from enterprise software to specialty foods, with no discernable thesis. The one thing connecting the investments was that most of them had gone through Y Combinator, including HR startup Zenefits, supply chain logistics platform Flexport, video chat language learning service Verbling, digital construction marketplace BuildZoom, meal replacement company Soylent, and online divorce service Wevorce. One outlier was Patreon, the self-streaming monetization platform, which was co-founded by Altman’s old friend from Loopt, Sam Yam.

…

The next year, they invested in Stripe, at a $1.75 billion valuation. It’s now worth around $65 billion. “The conversations I had with Sam at that time were around, ‘what’s the best?’ ” “By late 2014, this heuristic started to not work anymore, because enough people knew to do this,” Thiel said. He and Altman had identified Zenefits—a health benefits broker that gave away free HR software to small businesses in the hopes of making commissions from going on to sell them insurance—as the new YC darling. Max Altman went to work there in product, staying from 2014 to 2016. Founders Fund put an offer in when it was at a $2 billion valuation, but the aggressive co-founder, Parker Conrad, negotiated for a valuation above $4 billion.

…

Founders Fund put an offer in when it was at a $2 billion valuation, but the aggressive co-founder, Parker Conrad, negotiated for a valuation above $4 billion. That seemed high to Thiel, so Founders put in less. Within a few years, unable to meet the optimistic growth targets required to merit such a valuation and struggling with its relationships in the healthcare industry, Zenefits blew up and the investment went basically to zero. (David Sacks, a friend of Thiel’s from college and a fellow Stanford Review writer and PayPal alumnus, stepped in as interim CEO in 2016 after the company melted down.) It seemed like some kind of high-water mark had been reached. ANOTHER THIEL investment ended up having the most significant impact on Altman’s career and the future of artificial intelligence.

Why Startups Fail: A New Roadmap for Entrepreneurial Success

by

Tom Eisenmann

Published 29 Mar 2021

Hem was subsequently sold: Ingrid Lunden, “Hem.com Is on the Block; Swiss Furniture Maker Vitra Likely Buyer,” TechCrunch, Dec. 30, 2015. “I allowed silos”: Shontell, “Tech Titanic.” Uber, for example: Kate Taylor and Benjamin Goggin, “49 of the Biggest Scandals in Uber’s History,” Business Insider website, May 10, 2019. Zenefits, a licensed health insurance broker: Claire Suddath and Eric Newcomer, “Zenefits Was the Perfect Startup. Then It Self-Disrupted,” Bloomberg Businessweek, May 9, 2016. It helps to have a radar detector: The origins of the RAWI test are shrouded in mystery, but I believe my HBS colleague Shikhar Ghosh should be credited with the invention, with some assistance from me, Felda Hardymon, Toby Stuart, and other members of our teaching group for the required HBS MBA course on entrepreneurship.

…

Middle managers start to wonder if senior management really knows what’s going on and what needs to be done—especially since the CEO is spending so much time out of the office, trying to raise more capital. Step 9: Ethical Lapses. Sometimes, the relentless pressure to sustain growth leads entrepreneurs to cut legal, regulatory, or ethical corners. Uber, for example, was accused of encouraging its employees to book and then cancel rides with its rival, Lyft. Zenefits, a licensed health insurance broker, created software that allegedly allowed its new salespeople to cheat on state licensing exams to sustain the startup’s rapid growth. At Fab, however, Goldberg avoided this ethical slippery slope. Step 10: Investor Alarm. As the venture burns through cash, its stock price declines.

…

We’ll explore these questions in Chapter 10, which lays out the moves entrepreneurs can make if they think they are on a path toward failure. Variations on these themes play out over and over among startups that scale too quickly. Some survive by trimming head count, cutting marketing, and refocusing on more loyal and profitable customer segments. Birchbox, Blue Apron, Groupon, Zenefits, and Zynga are examples. However, for Fab and many other startups, such as Beepi, Homejoy, Munchery, and Nasty Gal, the Speed Trap is fatal. The RAWI Test How to avoid or safely pass through a Speed Trap? It helps to have a radar detector, and for entrepreneurs, that is the RAWI test.

Lab Rats: How Silicon Valley Made Work Miserable for the Rest of Us

by

Dan Lyons

Published 22 Oct 2018

Local tour guides now sell “innovation tours,” shuttling visitors around on buses to visit start-ups. In 2017 on one trip to San Francisco I met a group of German businessmen whose companies had sent them on a two-week safari. When I met them, Zenefits, one of the hottest unicorns, had just booted out its CEO, Parker Conrad, in a scandal that involved allegations of cheating on licensing tests and letting unlicensed brokers sell insurance policies, as well as having an out-of-control frat-boy party culture. (Conrad and Zenefits would later settle charges brought by the Securities and Exchange Commission that they misled investors; they paid a fine but did not admit or deny wrongdoing.)

Traffic: Genius, Rivalry, and Delusion in the Billion-Dollar Race to Go Viral

by

Ben Smith

Published 2 May 2023

The downtown New York scene by now was a distant memory. The 2010s were, for many, a regret. Marc Andreessen, in particular, later told others he was remorseful about ever investing in BuzzFeed. He’d come to believe that BuzzFeed News and I had taken a hard line on one of his companies, a failed insurance startup called Zenefits, specifically in order to prove our independence from him. The thought hadn’t crossed our minds; we hadn’t thought, or realized, he was that important, though by 2022 his and Chris Dixon’s massive investments in cryptocurrency had made them both even larger players in American life. Others who had gotten on the bandwagon a little late had regrets too.

…

, 69, 74, 106, 196, 202, 286 Yelp, 66 Yiannopoulos, Milo, 293–94 YouTube and BuzzFeed’s news and social content, 167 and BuzzFeed’s video content, 264–65 and Contagious Media Showdown, 49 and devaluation of traffic, 267 and Gionet, 292, 295 and Jezebel’s style and content, 96 and Maker Studios sale, 201 and Ozy’s traffic manipulation, 285–86 and Peretti’s speeches, 200 and shifting media environment, 128 and social engagement on Facebook, 272–73 and Upworthy, 181 Z Zaleski, Katharine, 107 Zenefits, 299 Zuckerberg, Mark and backlash against progressive activism, 132 and BuzzFeed’s news and social content, 160–64 and BuzzFeed’s traffic growth, 205–8 and Daulerio’s background, 138–39 and Facebook’s dominance of social media, 270 and Hughes’s background, 109 and origin of social media politics, 114–15 and privacy issues at Facebook, 141–42 and social engagement on Facebook, 271–73, 275–76 SPAC deal, 303 and Thiel’s investment, 85 and Upworthy, 182, 184 and Valleywag’s launch, 65 and Yahoo!’

The Contrarian: Peter Thiel and Silicon Valley's Pursuit of Power

by

Max Chafkin

Published 14 Sep 2021

“what they want to hear”: Julia Carrie Wong, “Peter Thiel, Who Gave $1.25 Million to Trump, Has Called Date Rape ‘Belated Regret,’ ” The Guardian, October 21, 2016, https://www.theguardian.com/technology/2016/oct/21/peter-thiel-support-donald-trump-date-rape-book; Ryan Mac and Matt Drange, “Donald Trump Supporter Peter Thiel Apologizes for Past Book Comments on Rape,” Forbes, October 25, 2016; Kara Swisher, “Zenefits CEO David Sacks Apologizes for Parts of a 1996 Book He Co-wrote with Peter Thiel That Called Date Rape “Belated Regret,’ ” Recode, October 24, 2016, https://www.vox.com/2016/10/24/13395798/zenefits-ceo-david-sacks-apologizes-1996-book-co-wrote-peter-thiel-date-rape-belated-regret; Andrew Granato, “How Peter Thiel and the Stanford Review Built a Silicon Valley Empire,” Stanford Politics, November 27, 2017, https://stanfordpolitics.org/2017/11/27/peter-thiel-cover-story/.

Pattern Breakers: Why Some Start-Ups Change the Future

by

Mike Maples

and

Peter Ziebelman

Published 8 Jul 2024

—Paul Graham, cofounder, Y Combinator Maddie Hall is the CEO and cofounder of Living Carbon, a biotech start-up that uses genetic engineering to create “supertrees” that grow faster and capture and store more carbon from the atmosphere than normal trees. She took another path to live in the future. Maddie was employed as a product manager at a Silicon Valley company called Zenefits, a cloud-based human resources platform. She decided she wanted to start a new company and initially went about it by trying to think of start-up ideas. But then she made a very wise decision: she decided to work on special projects with Sam Altman instead. Sam was one of the first entrepreneurs to go through Y Combinator, and he later served as YC’s president for several years.

Empire of AI: Dreams and Nightmares in Sam Altman's OpenAI

by

Karen Hao

Published 19 May 2025

In 2012, he started a personal investment fund called Hydrazine Capital with his brother Jack, who had studied economics at Princeton and was trying his hand at investment banking. Jack subsequently switched to tech and founded a startup, Lattice, that would get funded by YC after Sam became the incubator’s president. Max, who had studied computer science at Duke and worked briefly at Microsoft before becoming a trader, switched to working at another YC company, Zenefits, in 2014. Two years later, he would join Sam and Jack at Hydrazine Capital. During that time, both younger brothers moved in with Sam for what was meant to be a temporary arrangement. The three ended up living together—a tight knot of brotherly love and business relationships—for many years to come

…

See also DALL-E Thiel, Peter Altman and, 26–27, 36, 38–39, 39–42 Founders Fund, 38 founding of OpenAI, 12–13, 50 “monopoly” strategy of, 39–40, 142 Palantir, 38, 69 PayPal, 38, 40, 142 Trump and, 38, 42 Threads, 260 Three-Body Problem, The (Liu), 83 Three Mile Island, reopening, 275 TikTok, 304 Tiku, Nitasha, 253–54 Time (magazine), 137, 192, 210, 416–17 Tironi Rodó, Martín, 273–74, 297–98, 300 Toner, Helen, 58 Altman and board, 7, 11, 253, 321–22, 375, 376 leadership behavior, 324, 348–51, 353–55, 356–59, 361–62, 364 “costly signals” paper, 357–59, 364 Murati and, 348–51, 356–57 Sutskever and, 325, 343, 351–52, 353–55, 359–60 Tools for Humanity, 185–86 TPUs (tensor processing units), 171 transcription, 220–21 Transformers, 120–22, 158–59, 160, 165–66, 169, 235 transparency, 5, 9, 14, 19–20, 81, 82, 86, 119, 134, 143, 166, 167, 172, 173–74, 230, 301, 384, 403, 406, 419–20 Trump, Donald, 38, 42, 51, 195, 321, 406 Tuna, Cari, 230 Turing, Alan, 81–82, 89, 91, 93, 373 Turing Award, 105, 162 Turing machine, 81–82, 91 Twitch, 9, 34, 367 U Uber, 106, 107, 110, 136, 194, 228 Ukraine war, 52, 191 “United Slate, The” (Altman), 42 universal basic income (UBI), 85, 185–86 University of Applied Sciences Dresden, 196 University of California, Berkeley, 49, 56, 108, 118, 217, 235, 419 University of California, Los Angeles, 162 University of California, San Diego, 97 University of Chicago, 272–73, 296 University of Massachusetts Amherst, 79–80, 159–60 University of Toronto, 47, 105, 117 “unknown unknowns,” 249 Upwork Research Institute, 18 Uruguay, 272, 417 data centers, 291–96 water crisis, 292–95 Utawala, Kenya, 190, 209, 211 V Vallejos, Rodrigo, 296–99 veil of ignorance, 3 Venezuela crisis, 195–97, 203 Venezuela, data annotation, 195–96, 198–202, 203–4, 218 Victoria, Lake, 207 Villagra, Julia, 389–90 Vincent, James, 119 Virginia, data centers, 278 Volpi, Mike, 203 Volta, Alessandro, 133 W WALL-E (movie), 234 Wall Street Journal, The, 33, 35, 41, 69, 102, 188, 193, 212, 280, 367, 384, 390–91, 416 Wang, Alexandr, 202–3, 213, 218 Warzel, Charlie, 370 Washington Post, The, 69, 114, 253, 371, 400, 403 water pollution, 293 water resources, 15, 17, 271, 273, 275, 277–78, 280–84, 287–96, 297, 299 Watson Health, 99 Waymo, 100 Weil, Elizabeth, 326–27, 328–29, 332–33, 336–40, 343 Weil, Kevin, 404 Weinstein, Emily, 307, 309 Weizenbaum, Joseph, 95–97, 420–21 Welinder, Peter, 150, 155, 250–51 Weng, Lilian, 267, 406 West, Kanye, 221 West, Sarah Myers, 308 Whale, 279–80 Whisper, 244, 247, 267, 413 whistleblower protections, 403 white hats, 107–8 Wikipedia, 57, 125, 135, 221 Willner, Dave, 238, 249–52, 267, 406 WilmerHale, 375 Wong, Hannah, 256, 326–28, 338–40 workplace impacts, 78–81, 114–15, 222, 265–66 World Bank, 207 Worldcoin, 185–86 World War II, 29, 91 X X (formerly Twitter), 3, 257, 260, 312, 328, 368–69 xAI, 321, 322, 397, 403, 404–5 Xerox PARC, 54–55 Y Yale University, 196, 291 Y Combinator, 23, 27–28, 32, 34, 36–38, 39, 43 Yom Kippur, 326–27 YouTube, 34, 51–52, 102–3, 136, 244–45, 334 Yudkowsky, Eliezer, 319–20 Z Zaremba, Wojciech, 59, 152, 181–82 Zenefits, 36 Zilis, Shivon, 63, 320–21, 324, 384 Zoloft, 329, 330 Zoph, Barret, 247, 381–82, 387, 404, 406 Zuboff, Shoshana, 101 Zuckerberg, Mark, 38, 42, 159, 311, 406–7 A B C D E F G H I J K L M N O P Q R S T U V W X Y Z About the Author Karen Hao is an award-winning journalist covering the impacts of artificial intelligence on society.

Insane Mode: How Elon Musk's Tesla Sparked an Electric Revolution to End the Age of Oil

by

Hamish McKenzie

Published 30 Sep 2017

The so-called PayPal Mafia includes Reid Hoffman, who founded LinkedIn; Max Levchin, whose most recent of several start-ups is the financial services company Affirm; Peter Thiel, a Facebook board member and President Trump–supporting venture capitalist who cofounded “big data” company Palantir; Jeremy Stoppelman, who started reviews site Yelp; Keith Rabois, who was chief operating officer at Square and then joined Khosla Ventures; David Sacks, who sold Yammer to Microsoft for $1.2 billion and later became CEO at Zenefits; Jawed Karim, who cofounded YouTube; and one Elon Musk. In a similar way, Tesla alumni are involved with many of the ventures that make up Silicon Valley’s new-auto ecosystem. Ian Wright, the founder of Wrightspeed, was one of Tesla’s five founders and left the company in 2005. Proterra’s CEO is Ryan Popple, a former senior finance director at Tesla (he left in 2010).

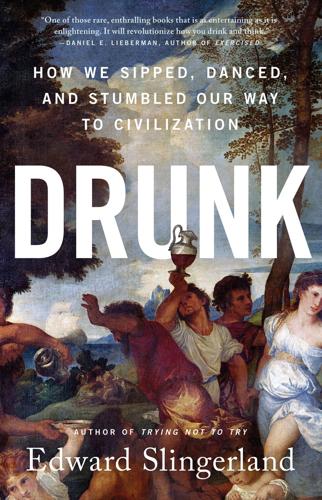

Drunk: How We Sipped, Danced, and Stumbled Our Way to Civilization

by

Edward Slingerland

Published 31 May 2021

(2014). “Modernity, Tradition, and Intoxication: Comparative Lessons from South Africa and West Africa.” In Phil Withington and Angela McShane (Eds.), Cultures of Intoxication, Past and Present (Vol. 222, pp. 126–145). Oxford: Oxford University Press. O’Brien, Sara Ashley. (2016, February 26). “Zenefits Lays Off 250 Employees.” CNN. O’Brien, Sara Ashley. (2018, October 31). “WeWork to Limit Free Beer All-Day Perk to Four Glasses.” CNN. O’Connor, Anahad. (2020, July 10). “Should We Be Drinking Less? Scientists Helping to Update the Latest Edition of the Dietary Guidelines for Americans Are Taking a Harder Stance on Alcohol.”

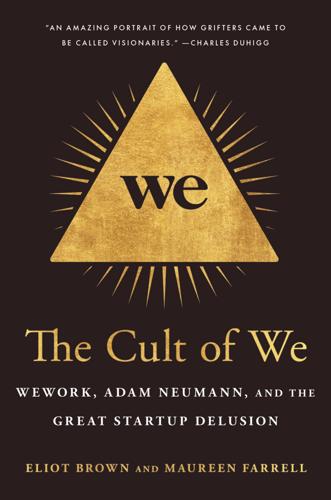

The Cult of We: WeWork, Adam Neumann, and the Great Startup Delusion

by

Eliot Brown

and

Maureen Farrell

Published 19 Jul 2021

That monsoon of money trickled through everyday life in San Francisco, the new capital of Silicon Valley startups. The city quickly became a terrarium of money-losing startups that turned former jewelry and rug storage spots into buzzy offices with Ping-Pong tables and macchiato stations. Employees at VC-funded HR software companies (Zenefits) would line up for lunch at VC-backed salad purveyors (Sweetgreen) and stop for coffee at VC-backed coffee shops (Philz), wearing VC-backed wool sneakers (Allbirds). They’d get rides for well below their cost from unprofitable ride-hail companies (Uber) or park their cars below cost with unprofitable on-demand valets (Luxe).