When McKinsey Comes to Town: The Hidden Influence of the World's Most Powerful Consulting Firm

by

Walt Bogdanich

and

Michael Forsythe

Published 3 Oct 2022

Enron eventually collapsed amid allegations of fraud, resulting in the loss of thousands of jobs. (McKinsey was not charged with any wrongdoing.) Thanks in part to compensation consultants, the offspring of Arch Patton’s practice, executive compensation has risen to previously unimaginable heights, prompting a committee of the U.S. House of Representatives to investigate. At a congressional hearing in December 2007, the panel reported that almost half of the nation’s 250 biggest public corporations had used compensation consultants with conflicts of interest. Those with the biggest conflicts, the committee’s research found, tended to pay their CEOs more.

…

They thought it posed a conflict of interest. How could consultants objectively evaluate the worth of executives who hire and pay them? But discomfort is one thing, profits are another, and Patton’s executive compensation practice continued for three decades before it was shut down. By then, compensation consultants had become big business, following the example set by McKinsey, conflicts of interest and all. And the compensation trend continued—more money for executives and a growing gap between them and their employees. Walker almost never got to prove his value to the firm after he questioned why he was asked to analyze country-club memberships for company executives.

…

GO TO NOTE REFERENCE IN TEXT Enron’s top five executives: “Pay Madness at Enron,” Forbes, March 22, 2002, based on an analysis by Charas Consulting. GO TO NOTE REFERENCE IN TEXT “CEOs don’t just get salaries”: Opening statement of Representative Henry A. Waxman, Democrat of California, House of Representatives, Committee on Oversight and Government Reform, Executive Pay: The Roles of Compensation Consultants, Dec. 5, 2007. GO TO NOTE REFERENCE IN TEXT Roughly 80 percent: Mishel and Kandra, “CEO Pay Has Skyrocketed 1,322% Since 1978.” GO TO NOTE REFERENCE IN TEXT “as passing insider information”: Kevin P. Coyne and Jonathan W. Witter, “Taking the Mystery out of Investor Behavior,” Harvard Business Review, Sept. 2002.

What They Do With Your Money: How the Financial System Fails Us, and How to Fix It

by

Stephen Davis

,

Jon Lukomnik

and

David Pitt-Watson

Published 30 Apr 2016

The trend toward mechanistic formulaes in the remuneration of CEOs allows directors, CEOs, shareowners, and others to pretend there is a level of precision in compensation that just doesn’t exist. Every time an anomaly arises, ever more complexity is added to the remuneration package. Directors are able to exercise ever less judgment. Supporters of this false precision—and they include shareowners, compensation consultants, directors, and intermediaries who advise institutional investors how to vote on compensation issues—claim that formulaic compensation is necessary to reduce subjectivity. But it doesn’t. A study by Income Data Services compared executive remuneration to company performance over the first thirteen years of this century.

…

In reality, small misalignments of interest along the way result in those corporations being governed through what academics call “agency capitalism,” in which the institutions are, for their own economic reasons, “rationally reticent” to be active owners.34 Once a company’s shares are bought, of course, a whole other set of intermediaries enter the scene, from the company’s directors and executives to the lawyers, compensation consultants, accountants, and others who advise them. Let us cite two examples of how the chain of agents may not always act in your best interests. One is from the money management part of the agent chain and the other from the corporate part. As we noted earlier, most fund managers compete on relative performance over short time horizons: they are looking to outperform their rivals from month to month and quarter to quarter.

…

As a European bank official admitted, compensation has become a slot machine: directors pull a lever, and three years later, out comes a trickle of coins or a fountain of folding money.56 Deciding to pay CEOs and other executives in cash would allow directors to direct, while it would remove the myopic focus on stock price. Of course, virtually every participant who benefits from the current dysfunctional system would have to accept change (an agency capitalism problem in itself). Compensation consultants would have to change their focus; boards would have to get used to making judgments, explaining them and standing behind them; proxy advisory services would have to change how they judge “alignment”; and institutional investors would have to devote resources to understanding, for each company they invested in, why directors were making the decisions they were.

The Great Divergence: America's Growing Inequality Crisis and What We Can Do About It

by

Timothy Noah

Published 23 Apr 2012

Unsurprisingly, corporate boards resisted indexing chief executives’ stock options throughout the bull market of the 1990s, with the predictable result that the value of awarded stock options reflected mainly … the bull market of the 1990s. Another cure that proved worse than the disease was the advent of compensation consultants. Under fire from stockholders for maintaining a too-cozy relationship with CEOs, corporate compensation committees turned to outside consultants to set pay levels for top executives. But a 2007 study by the Corporate Library, a corporate-governance watchdog that Minow cofounded, revealed that companies that hired such consultants actually paid their CEOs more than companies that didn’t, and that these higher pay levels were not associated with greater returns to shareholders.

…

Even when they aren’t hired directly by the CEO—as, amazingly, has sometimes occurred in the past (only recently was this made illegal)—consultants don’t want to be the ones to screw up an important hire. Though tasked with calculating what individuals in comparable positions have been paid elsewhere, “consultants can pretty much find high comparable income data to support paying a high amount to the CEO,” Campos explained. “No compensation consultant gets fired for saying ‘you’re underpaid,’ “ Minow told me. Indeed, the consultant may cast so wide a net that he discovers perks that the board might never have heard about otherwise. “CEO perks at one company are quickly copied elsewhere,” the financier Warren Buffett, a frequent critic of CEO pay, wrote in his 2007 “chairman’s letter” to shareholders in his company, Berkshire Hathaway. “ ‘All the other kids have one’ may seem a thought too juvenile to use as a rationale in the boardroom.

…

Delves, Stock Options and the New Rules of Corporate Accountability: Measuring, Managing, and Rewarding Executive Performance (New York: McGraw-Hill, 2004), 47–49; “Congress and the Accounting Wars,” Web page for PBS Frontline documentary, Hedrick Smith interview with Arthur Levitt, March 12, 2002, at http://www.pbs.org/wgbh/pages/frontline/shows/regulation/interviews/levitt.html. 18. Alexandra Higgins, “The Effect of Compensation Consultants: A Study of Market Share and Compensation Policy Advice” (New York: Corporate Library, Oct. 2007), 4–5 and 12–13; Roel C. Campos, “Remarks Before the 2007 Summit on Executive Compensation,” Jan. 23, 2007, at http://www.sec.gov/news/speech/2007/spch012307rcc.htm; Nell Minow interview; Warren Buffett, Berkshire Hathaway Chairman’s Letter, Feb. 28, 2007, 20, at http://www.berkshirehathaway.com/letters/2006ltr.pdf. 19.

Winning Now, Winning Later

by

David M. Cote

Published 17 Apr 2020

Why wait until someone else tried to steal them away before paying them what the market said they were worth? Our corporate compensation consultant felt we were overpaying, and as proof they pointed to the low turnover we were seeing among our senior leaders. I was incredulous: stability in the leadership ranks is a bad thing? To achieve strong short- and long-term performance, you want strong performers to stay put, even if they are recruited by other companies (as many of our senior leaders were). Paying them handsomely for their contributions goes a long way. As I explained to that foolish compensation consultant, people did leave Honeywell . . . when I wanted them to!

…

The plan proved a great success, bringing about a sudden and very welcome increase in retention, and helping a One Honeywell spirit take hold. Leaders were working hard, and for a change, they were seeing both financial rewards and eventually a stock market bump in response. If a compensation plan pays out well, directors and compensation consultants sometimes assume the plan wasn’t rigorous enough. A well-constructed plan, they suggest, would pay out exactly 100 percent of projected compensation; otherwise, the original goals were obviously too easy to meet. How absurd! It’s true the original goals might have been too easy, but perhaps the higher payouts reflected exceptional performance relative to a leader’s peers.

The Clash of the Cultures

by

John C. Bogle

Published 30 Jun 2012

I know of no explanation but that these directors failed to consider the fiduciary duty that they owed to the shareholders who elected them. Even before the recent financial crisis fell upon us, Warren Buffett noted that even “intelligent and decent directors have failed miserably,” calling them “tail-wagging puppy dogs” who meekly follow recommendations by compensation consultants. Buffett is even more critical of mutual fund directors. Here, he expands his metaphor from “puppy-dogs” to “lap-dogs,” who were expected to be “Dobermans” but turned out to be “cocker spaniels.” His criticism is right on the mark. Where were the fund directors who oversaw the mutual funds that participated in the market timing scandals uncovered by New York Attorney General Eliot Spitzer in 2003?

…

Warren Buffett got it just right: “When the price of Berkshire Hathaway stock temporarily overperforms or underperforms the business, a limited number of shareholders—either sellers or buyers—receive outsized benefits at the expense of those they trade with. [But] over time, the aggregate gains made by Berkshire shareholders must of necessity match the business gains of the company.” The Ratchet Effect The rise of the executive compensation consultant is also heavily responsible for our flawed system of CEO compensation. First, consider what those in the business of recommending executive compensation must do to stay in business: lots of good analysis, yes; handsome presentations, yes; persuasiveness, of course. But above all, never recommend lower pay or tougher standards for CEO compensation.

…

And so the cycle repeats, onward and upward over the years, almost always with the encouragement of an ostensibly impartial overseer retained by the board of directors, who is at least tacitly endorsed by the CEO. So the so-called “free market” that sets CEO compensation doesn’t exist. Rather it is a controlled market that is essentially created by compensation consultants.10 Such a methodology is fundamentally flawed, and has the obvious effect: The figures in these compensation grids almost always go up for the group, and almost never go down. Again, Warren Buffett pointedly describes the typical consulting firm by naming it, tongue-in-cheek, “Ratchet, Ratchet, and Bingo.”

America's Bitter Pill: Money, Politics, Backroom Deals, and the Fight to Fix Our Broken Healthcare System

by

Steven Brill

Published 5 Jan 2015

Asked why salaries at Sloan Kettering are so much higher than those at equally wealthy nonprofits such as the Met and Harvard, Gunn replied, “All of us hospitals have the same compensation consultants, so I guess it’s a self-fulfilling prophecy.” Compensation consultants advise clients on what the market-based salary is for executives in a given peer group—CEOs or chief fund-raisers at hospitals of a certain size, for example. So if the same hospital compensation consultants set high salaries for a large portion of the people in each hospital peer group, then those salaries are destined to stay high while still being deemed consistent with the “market.”

…

In all, eleven New York–Presbyterian executives were paid over $1 million. The hospital had even paid Corwin’s semiretired predecessor $5.6 million in 2012 for his work as a vice chairman helping with fund-raising and lobbying on behalf of the hospital’s academic centers. I got the usual answer about how complicated the business they managed was and about how compensation consultants reviewed their salaries with the board to make sure they were on a par with industry standards. But I also got more. New York–Presbyterian has a board of financial, business, and civic luminaries, and Corwin provided a detailed explanation of how the board sets bonuses, which typically account for about half of each executive’s overall income.

The Investment Checklist: The Art of In-Depth Research

by

Michael Shearn

Published 8 Nov 2011

This gives you great insight into his character, and this is the type of CEO you should look for as a long-term partner. Beware of Companies that Use Compensation Consultants If a compensation package is determined by consultants hired by the board of directors, this should serve as a red flag. This kind of compensation benchmarking is usually not about the performance of the business, but rather a comparison to what others in the industry make. However, the peer groups used are often in completely unrelated business lines. You will find that the majority of compensation plans are determined in this way. For example, in FY 2010, jewelry retailer Zale hired a compensation consultant who put together a list of 21 companies as a peer group.

…

See cash conversion cycle CEMEX centralized management, decentralized versus Chambers, John chief executive officer salary self-promoting Child, Bill China Choice Hotels balance sheet of Christensen, Clayton Cialdini, Robert Cisco closed-ended questions Coach The Coca-Cola Company commodity resources communications, consistent Compagnie Financiére Richemont SA comparisons, limitations on Compass Minerals International compensation consultants compensation plans, long-term performance and compensation system, setup compensation, management competition amount of fierceness of intensity of competitive advantage deteriorating expanding finding business with sources of competitive landscape, understanding competitors competitors, failure of concentrated customer base conference call conscious capitalism Conseco conservative accounting standards Continental Bank continuous improvement contracts, employment copying, competing on core business model, changes to core competencies, acquisitions and core customer cost advantages cost synergies Costco Wholesale costs cutting unnecessary identifying reducing countercyclical Country Risk Reports country risks Cover Girl coverage ratios credit card firms, metrics for criteria as investment filter checklist culture, business currency risks current liabilities Custom House customer base business’ impact on manager experience with customer perspective customer research customer retention acquisitions and customer-orientation, signs of customer-retention rates customers core ease of purchase foreign market taste differences management closeness with pain cyclical Daft, Douglas Darling International database, of interviews DaVita debt-maturity schedule debt ability to pay advantages of low financing acquisitions interest rate maturity motivation for off-balance sheet recourse versus non-recourse using conservatively decentralized management, centralized versus Dell Dell, Michael dependence on new products deteriorating advantage development phase, investment gains and Dimon, Jamie Discovery Communications discretionary costs, manipulating dissenters, hiring diversified customer base dividends, increasing Dollar Financial Dorsey, Pat Dunlap, Albert E&P.

Phishing for Phools: The Economics of Manipulation and Deception

by

George A. Akerlof

,

Robert J. Shiller

and

Stanley B Resor Professor Of Economics Robert J Shiller

Published 21 Sep 2015

Crystal, In Search of Excess: The Overcompensation of American Executives (New York: W. W. Norton, 1991), especially pp. 46–47. Jenny Chu, Jonathan Faasse, and P. Raghavendra Rau have shown that management-retained consultants (in contrast to board-retained consultants) generate large increases in management pay: Chu, Faasse, and Rau, “Do Compensation Consultants Enable Higher CEO Pay? New Evidence from Recent Disclosure Rule Changes” (September 23, 2014), p. 23, accessed May 27, 2015, http://papers.ssrn.com/sol3/Papers.cfm?abstract_id=2500054. 4. W. Braddock Hickman, Corporate Bond Quality and Investor Experience (Princeton: National Bureau of Economic Research and Princeton University Press, 1958).

…

New York: Macmillan, 1927. Chen, M. Keith, Venkat Lakshminarayanan, and Laurie R. Santos. “How Basic Are Behavioral Biases? Evidence from Capuchin Monkey Trading Behavior.” Journal of Political Economy 114, no. 3 (June 2006): 517–37. Chu, Jenny, Jonathan Faasse, and P. Raghavendra Rau. “Do Compensation Consultants Enable Higher CEO Pay? New Evidence from Recent Disclosure Rule Changes.” September 23, 2014. Accessed May 27, 2015. http://papers.ssrn.com/sol3/Papers.cfm?abstract_id=2500054. Cialdini, Robert B. Influence: The Psychology of Persuasion. New York: Harper-Collins, 2007. “Cinnabon.” Wikipedia.

Predictably Irrational, Revised and Expanded Edition: The Hidden Forces That Shape Our Decisions

by

Dan Ariely

Published 19 Feb 2007

Once salaries became public information, the media regularly ran special stories ranking CEOs by pay. Rather than suppressing the executive perks, the publicity had CEOs in America comparing their pay with that of everyone else. In response, executives’ salaries skyrocketed. The trend was further “helped” by compensation consulting firms (scathingly dubbed “Ratchet, Ratchet, and Bingo” by the investor Warren Buffett) that advised their CEO clients to demand outrageous raises. The result? Now the average CEO makes about 369 times as much as the average worker—about three times the salary before executive compensation went public.

…

Dunkin’ Donuts, 37–39, 47 upscale ambience and, 39, 159–60 cognitive limitations, taking account of, 327 Coke, taste tests of Pepsi and, 166–68 cold remedies, price and efficacy of, 184 colds, antibiotics as placebo for, 189 collateralized debt obligations (CDOs), 279–80 comparisons, see relativity compensation: cash vs. gift rewards and, 82–83, 253–54 for bankers, calculating correct amount of, 319–24 of CEOs, 16–17, 18, 310 poetry reading experiment and, 40–42 erosion of public trust and, 306, 310, 311 Obama’s call for “commonsense” guidelines for, 323–24 recent cuts in benefits and, 82 social exchange in workplace and, 80–83 and transformation of activity into work, 39–43 see also bonuses; salaries compensation consulting firms, 17 conditioning, placebo effect and, 179 condoms: importance of widespread availability of, 100–102 and willingness to engage in unprotected sex when aroused, 89, 95, 96–97, 99, 107 conflicts: expectations and perception of, 156–57, 171–72 neutral third party and, 172 conflicts of interest, 291–96 in banking and financial industries, 291, 294–96, 311 cheating and, 292–93, 294 elimination of, 295–96, 311 in health care, 293, 295 theory of rational crime and, 291–92 conformity, ordering food and drink and, 238 Congress, U.S., 151, 152, 228 ethics reforms in, 204–6 consumerism, 109–10 context effects, 240 control, perception of: learned helplessness and, 312–16 mistaken, 243 corporate scandals, xiv, 196, 204, 214, 219, 222–23 cost-benefit analysis: dishonesty and, 202–3, 204, 292–93 relative value and, 64–65 theory of rational crime and, 291–92 credit cards, 110, 204, 304 FREE!

Start It Up: Why Running Your Own Business Is Easier Than You Think

by

Luke Johnson

Published 31 Aug 2011

If they don’t deliver, you don’t pay and you can replace them. It is a grave error to give in to the pressure for departmental fiefdoms: effective leaders care about results, not process or turf. Typically an apparatus builds up around divisions like HR to expand their role and cost more money. Compensation consultants are hired to come up with justifications for paying everyone more. Training advisors are employed to distract everyone from doing their job with pointless courses. Appraisal experts are contracted to critique staff relations. Experts are drafted in to devise an appropriate Corporate Social Responsibility Agenda – whatever that is.

Flash Boys: Not So Fast: An Insider's Perspective on High-Frequency Trading

by

Peter Kovac

Published 10 Dec 2014

Average compensation is actually well below Wall Street standards – Katsuyama’s salary of $2 million is higher than any total employee compensation package I have ever offered a high-frequency trader. Obviously his “opening bid” of $3 million a year was higher too. A brief conversation with a compensation consultant about high-frequency norms, or perhaps a chat with an employee of a high-frequency firm, would have set Lewis straight on this score.[49] Undoubtedly, employees are well compensated but they could make much more money at Goldman Sachs, or even RBC, they just choose not to work in a big bank.

Superclass: The Global Power Elite and the World They Are Making

by

David Rothkopf

Published 18 Mar 2008

Among firms in the S&P 1500, for example, a chief executive whose firm was in the top fifth of well-connected companies received a 10 percent higher salary and a 13 percent larger pay package than a CEO whose firm was in the bottom fifth. Another important aspect of CEO compensation is the increasingly influential role of compensation consultants, who advise the contract negotiation process. Since they benefit according to the size of the contracts, they have a vested interest in driving companies to raise CEO pay. Despite having profited enormously from the system in which they thrive, Barry Diller opined in 2006 that “the whole consultant group should be flushed into the East River and no loss would ever be seen by man.”

…

Calderón, Felipe Calmy-Rey, Micheline campaign finance capitalism and communism, struggle between Carlucci, Frank Carlyle Group Carnegie, Andrew Carnegie Endowment for International Peace Carter, Jimmy Carville, James Case, Steve Castro, Fidel celebrities and entertainers Center for American Progress central bankers Cerf, Vint Chao, Elaine Chávez, Hugo Cheney, Dick Chernow, Ron Chicago school of economics China National Offshore Oil Corporation (CNOOC) China’s seventeenth-century elites Chirac, Jacques Chongzhen, Chinese Emperor Chubais, Anatoly Churchill, Winston Clark, Helen Clark, Wesley Claro, Ricardo Clean Sky project Cleisthenes Clement XII, Pope Clinton, Bill Clinton, Hillary Rodham Clinton Global Initiative (CGI) Coelho, Paulo Cohen, William S. Coll, Steve Communist Manifesto, The (Marx and Engels) compensation consultants compensation of superstars conflicts of asymmetry Conservation International conspiracy theories about plotting elites Conway, William, Jr. corporate elites agenda-setting and concentrated power among corporation-to-country power comparisons energy elites executive pay and exercise of influence in global way global institutions/governance and globalization and governments, power over linkages and collaboration among Mills’s views on philanthropy by revolving door between government and corporate communities revolving door between military and corporate communities Russian oligarchs wealth of Correa, Rafael Corrigan, Gerald corruption by corporations Corzine, Jon Council on Foreign Relations Cox, Harvey Cramer, Jim Cronkite, Walter Crutzen, Paul Culture of Conspiracy, The (Barkun) Cypselus of Corinth Dabdoub, Ibrahim Dalai Lama D’Alema, Massimo Dalton, John H.

A Failure of Capitalism: The Crisis of '08 and the Descent Into Depression

by

Richard A. Posner

Published 30 Apr 2009

For then every day that you stay in you make a lot of money, and you know that when the bubble bursts you'll be okay because you have negotiated a generous severance package with your board of directors. Limited liability is a factor too; neither an executive heavily invested in his company's stock nor any other shareholder will be personally liable for the company's losses should it go broke. And how do executives get such a sweet deal? Well, the board will have hired a compensation consultant who will have advised generosity in fixing the compensation of senior management and as part of that largesse will have recommended that senior executives receive a fat severance package (a "golden parachute") if they are terminated. The consultant will have told the board this because if the board is generous to senior management, senior management may out of gratitude hire the consultant to do other consulting for the firm.

Broken Markets: A User's Guide to the Post-Finance Economy

by

Kevin Mellyn

Published 18 Jun 2012

If it is massively overpriced, this represents institutional governance flaws, especially the so-called agency problem. Boards too often do not effectively represent shareholder interest, but are creatures of the professional management of the firm. Pay practices, legitimized by a specialized executive compensation consulting industry, reflect this and can charitably be called a market failure. Large public companies are more like feudal kingdoms than embodiments of market capitalism. Oddly, although market capitalism is under siege in the political world—see the Financial Times series “Capitalism in Crisis” for a range of views—large financial institutions and public companies have never fully embraced its rigors.

The Essays of Warren Buffett: Lessons for Corporate America

by

Warren E. Buffett

and

Lawrence A. Cunningham

Published 2 Jan 1997

I have yet to see this vital point spelled out in a proxy statement asking shareholders to approve an option plan. I can't resist mentioning that our compensation arrangement with Ralph Schey was worked out in about five minutes, immediately upon our purchase of Scott Fetzer and without the "help" of lawyers or compensation consultants. This arrangement embodies a few very simple ideas-not the kind of terms favored by consultants who cannot easily send a large bill unless they have established that you have a large problem (and one, of course, that requires an annual review). Our agreement with Ralph has never been changed.

Big Business: A Love Letter to an American Anti-Hero

by

Tyler Cowen

Published 8 Apr 2019

For some recalculations of the Jensen and Murphy results, see Conyon 2006, Frydman and Saks 2007, and Frydman and Jenter 2010, who discuss the prewar era as well. It is a little-known fact that the current use of high-powered financial incentives for American CEOs still has not reattained the level it held in the pre–Second World War period. 26. See Giertz and Mortenson 2013. Sometimes you hear the claim that the hiring of compensation consultants favors the interests of an entrenched CEO and boosts pay. You can find serious studies on both sides of this issue, but for the time being it is probably best to judge it as a toss-up. It does seem in statistical studies that the composition of the compensation committee does not matter for the level of compensation, although it still could be argued that some directors are cronyist picks in a manner that is not detected by standard measures of who is a crony or close associate.

Economists and the Powerful

by

Norbert Haring

,

Norbert H. Ring

and

Niall Douglas

Published 30 Sep 2012

“The Formation of ‘Modern’ Economics: Engineering and Ideology.” London School of Economics Department of Economic History Working Paper 62/01. Muller, Karl A. III, Monica Neamtiu and Edward J. Riedl. 2009. “Insider Trading Preceding Goodwill Impairments.” Working paper. Murphy, Kevin J. and Tatiana Sandino. 2010. “Executive Pay and ‘Independent’ Compensation Consultants.” Journal of Accounting and Economics 49: 247–62. Narayanan, M. P. and H. Nejat Seyhun. 2008. “The Dating Game: Do Managers Designate Option Grant Dates to Increase Their Compensation?” Review of Financial Studies 21: 1907–45. Nettels, Curtis P. 1962. The Emergence of a National Economy 1715–1815.

The Winner-Take-All Society: Why the Few at the Top Get So Much More Than the Rest of Us

by

Robert H. Frank, Philip J. Cook

Published 2 May 2011

There ensued a period of spectacular financial success for Disney. The company's earnings rose from 15 cents per share in the fiscal year just before Eisner's appointment to $6 per share in the fiscal year end ing in September 1990.9 Eisner's perfonnance has been handsomely rewarded. As fonner compensation consultant Graef Crystal describes the Disney chief's pay package: In 1990, he received · a bonus of $10.5 million in addition to his $750,000 per year base salary. But the real payoff has come from his stock option grants . . . . Calculated off a late March 199 1 market price of $1 19.25 per share, his unexercised option gains were likely on the order of $240 million.

The Myth of Capitalism: Monopolies and the Death of Competition

by

Jonathan Tepper

Published 20 Nov 2018

Managers should certainly be compensated for the difficult work they do, but it is hard to believe CEOs, as a group, are now ten times more valuable relative to workers than they were in the 1970s. Part of the issue is that, originally management pay was determined according to “internal equity.” A manager's value to the firm was determined by his or her performance relative to other employees. In the 1970s, with the rise of executive compensation consulting, the focus shifted to “external equity” – or comparing CEOs to what others were being paid across the industry. Boards and compensation committees agree to compensation packages based on benchmarking against other comparable companies, but they are all benchmarking against each other in a never-ending infinite loop of salary increases.

Secrets of Sand Hill Road: Venture Capital and How to Get It

by

Scott Kupor

Published 3 Jun 2019

This shows that you were not trying to hoard the opportunity for yourself but rather reacting to a true lack of market interest. If you can hire a banker to run this process, even better. Be careful not to entangle new option grants to employees too closely with the inside financing. It’s customary to want to reincent the team, but doing so after the financing closes (versus before) and employing a compensation consultant to gauge the size of an appropriate grant would help eliminate any suspicion that an executive board member’s vote was contingent upon her receiving a new option grant. Give other investors (and particularly major common shareholders) the opportunity to participate in the deal.

The Great Escape: Health, Wealth, and the Origins of Inequality

by

Angus Deaton

Published 15 Mar 2013

Compensation committees typically set top salaries, and their members are nominally independent directors. But, as has been noted by Warren Buffett among others, the members of these boards often receive a large share of their own total income from board membership and are effectively under the control of the CEO. Buffett has also drawn attention to the role of firms of compensation consultants (“Ratchet, Ratchet, and Bingo!”), who help spread giant packages from one company to another. The use of these firms, together with the common practice of CEOs sitting on each other’s boards, might explain how jumbo compensation packages spread from financial firms to the broader corporate world.

Smarter Than You Think: How Technology Is Changing Our Minds for the Better

by

Clive Thompson

Published 11 Sep 2013

To fix it, you need to analyze what’s going on each city and suburb block, for hundreds of miles across an entire state, parsing an absolutely Olympian mountain of information (maps, databases, dense charts of voting data, and so on.) As a result, a professional class of map riggers has emerged, lushly compensated consultants hired by politicians to guarantee victory. The evils of this system are protected by the byzantine nature of the problem. Voters have little chance of figuring out why things are going so wrong, let alone of fixing it. “The average citizen throws up their arms and tunes out,” Panagopoulos says.

Luxury Fever: Why Money Fails to Satisfy in an Era of Excess

by

Robert H. Frank

Published 15 Jan 1999

In the market for executive talent, for example, these barriers have largely disappeared in the United States but remain strong in many other industrial nations. This explains why chief executives in Germany and Japan, who are arguably just as productive as those in this country, currently earn considerably less. According to the estimates of compensation consultant Graef Crystal, German and Japanese CEOs earn not hundreds of times as much as the average worker, but less than 25 times as much.24 There is simply no reason to expect that the promotion-from-within norms still prevailing in those countries will withstand competitive pressure indefinitely.

Collision Course: Carlos Ghosn and the Culture Wars That Upended an Auto Empire

by

Hans Gremeil

and

William Sposato

Published 15 Dec 2021

“When you compare Nissan compensation to Toyota compensation or to Honda compensation, well, we have differences. It’s coming from the fact that some of our competitors pay only as a function of the Japanese standard. We don’t. That’s the big difference.” Before the shareholder meetings, Kelly would prepare data compiled for Nissan from Towers Watson, the global compensation consultancy that later became Willis Towers Watson. It showed Nissan’s executive pay was modest by comparison with global benchmarks. In 2011, for example, Ghosn was paid $12.5 million. But the industry average for automotive CEOs was just under $18 million. And the highest-paid CEO was pulling down nearly $29 million at the time, nearly two and a half times Ghosn’s haul.

Inner Entrepreneur: A Proven Path to Profit and Peace

by

Grant Sabatier

Published 10 Mar 2025

Do they have good leadership in a growing industry? Do they have a unique competitive advantage? How well has their stock done in the past? Would you invest in this business otherwise? If you believe in the future potential of the business, then it’s worth considering equity as part of your seller’s compensation. Consulting, Employment, and Noncompete Agreements As part of the sale, the seller might enter into a consulting agreement in which the seller agrees to provide advisory services or guidance to the buyer for a specified period after the acquisition. The terms could include compensation for the seller’s expertise, knowledge transfer, or assistance in the transition phase to ensure a smooth handover of operations.

Women Leaders at Work: Untold Tales of Women Achieving Their Ambitions

by

Elizabeth Ghaffari

Published 5 Dec 2011

I am certain that I will have many years to give back to the world the many gifts I have received. Robin Ferracone Founder and Executive Chair, Farient Advisors LLC Born 1953 in Englewood, New Jersey. Robin Ferracone is founder and executive chair of Farient Advisors LLC, an independent executive compensation consulting firm that she founded in October 2007. The firm is based in Los Angeles, California, and New York. Ms. Ferracone is also CEO of RAF Capital LLC, a private, portfolio-management firm that she founded in April 2007 to make strategic investments in companies within the human resources software, information, and consulting fields.

The End of Work

by

Jeremy Rifkin

Published 28 Dec 1994

In 1993 temporary agencies leased more than 348,000 temporary workers a day to the nation's manufacturing companies, up from 224,000 in 1992 .40 Professional employment is also becoming temporary. The Executive Recruiter News reports that more than 125,000 professionals work as temps every day. "Professionals are the fastest growing group of temporary workers," says David Hofrichter, managing director of the Chicago office of the Hay Group compensation consultants. Many companies, according to Dr. Adela Oliver, president of Oliver Human Resources Consultants, are eliminating entire departments because they know they can quickly pick up experts in different areas on a contract basis."41 Dick Ferrington, an employee-training expert, is typical of the new professional temps.

The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street

by

Justin Fox

Published 29 May 2009

“Is it any wonder then,” they wrote in the Harvard Business Review in 1990, “that so many CEOs act like bureaucrats rather than the value-maximizing entrepreneurs companies need to enhance their standing in world markets?”20 These may have been the most influential of the many influential words Jensen wrote. Of course CEOs shouldn’t be paid like bureaucrats, everyone from shareholder activists to compensation consultants to journalists to corporate board members to CEOs themselves agreed. They should be paid for performance. Measuring executive performance has its complications, of course. What’s the relevant time period—a quarter, a year, five years, ten? What’s the right metric—profits, cash flow, free cash flow minus the cost of capital?

Unscripted: The Epic Battle for a Media Empire and the Redstone Family Legacy

by

James B Stewart

and

Rachel Abrams

Published 14 Feb 2023

But the new contract further limited “malfeasance” by adding the words “during the employment defined term.” In practical terms, that meant if Moonves committed any malfeasance before the start of the new contract, no matter what it was, he couldn’t be terminated for cause. That included any instance of sexual assault—misconduct serious enough to qualify as malfeasance. Ross Zimmerman, a compensation consultant hired to advise the board, spotted the change. He warned Bruce Gordon in a “heads-up” email in April that Moonves couldn’t be fired for cause for anything he’d done before the beginning of the new contract, which was to take effect when the merger was consummated. “It struck me in these days of #MeToo this limitation could be an issue.

We Are the Nerds: The Birth and Tumultuous Life of Reddit, the Internet's Culture Laboratory

by

Christine Lagorio-Chafkin

Published 1 Oct 2018

Wong obsessed over the concept known as “runway,” a term popular among startups, which use it to describe the amount of time a company has before it runs out of money. As general manager, Martin had made a meaningful attempt to get Reddit to break even. Wong, though, had changed the curve by adding funding—but with it he had also grown head count, which meant his math was more complex. With every hire, every well-compensated consultant—and there were several—the roughly $20 million financial runway the company had to taxi down would grow shorter and shorter. Wong figured, at best, the company had a year and a half of funding. Reddit by this time was making money in three ways: advertising, Reddit Gold, and Reddit Gifts.

Crash of the Titans: Greed, Hubris, the Fall of Merrill Lynch, and the Near-Collapse of Bank of America

by

Greg Farrell

Published 2 Nov 2010

Like McCann, Fleming had received no bonus in 2007 and it wasn’t fair for him to have to miss out on a bonus for the second straight year, the CEO argued. His argument over, the board prepared to go into executive session without Thain to discuss the matter further. But Thain wouldn’t budge. He refused to let the directors bring their lawyers and compensation consultants into the room, and he was adamant about not leaving. Instead, he wanted to hear from the directors themselves what they felt about bonuses, not receive a message that had been filtered through paid advocates. Finnegan implored Thain to step outside, so that the board could deliberate on its own, but the CEO stubbornly resisted.

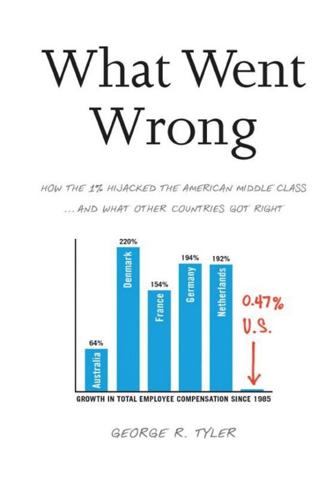

What Went Wrong: How the 1% Hijacked the American Middle Class . . . And What Other Countries Got Right

by

George R. Tyler

Published 15 Jul 2013

In fact, no consistent connection has yet been made between CEO pay and corporate performance levels as measured by financial indicators such as stock price, profits, and sales.”46 Professors Alex Edmans from the Wharton School of Business at the University of Pennsylvania and Xavier Gabaix from the Stern School of Business at New York University concluded similar research in 2010 by noting, “Many CEOs are richly paid, even if their performance has been poor.”47 The iconic compensation expert Graef Crystal in 2009 examined the pay of 271 CEOs, using formulas he devised during his 30 years as compensation consultant to Fortune 500 firms like CBS and Coca-Cola. “Simply put, companies don’t pay for performance.”48 University of Southern California economist Murphy reached the same conclusion. While at the University of Rochester in 1990, Murphy and Jensen of Harvard parsed a database of 2,505 CEOs at 1,400 large firms over the period 1974 to 1988; they found that “in most publicly held companies, the compensation of top executives is virtually independent of performance….

The Enlightened Capitalists

by

James O'Toole

Published 29 Dec 2018

However, several informants told me that, not long after the executive had assumed office, company morale ebbed to an all-time low, and several key employees decided to leave in search of greener pastures. The turmoil that followed led to declining productivity, sales, and profitability. The CEO—unsure how to respond to the looming crisis—hired a compensation consultant, who in effect assumed the role of co–chief executive. After a quick study of the situation, she gave the CEO what turned out to be poor advice, concluding that the most effective way to quickly cut costs was to fire a large number of long-term executives and managers who, she felt, had grown stale in their jobs.

The Age of Turbulence: Adventures in a New World (Hardback) - Common

by

Alan Greenspan

Published 14 Jun 2007

Taxpayer funds are not involved. I was aware of the tendency toward "excess" compensation a generation ago. I recall a discussion of the salaries of the senior officers of Mobil Corporation at a compensation-committee meeting in the early 1980s. Management had hired Graef "Bud" Crystal, a well-known executive compensation consultant, to "assist" the committee in determining appropriate salary levels.* He put up a series of charts showing that the salaries of Mobil's top officers were only average relative to their corporate peers'. Obviously, Crystal asserted, Mobil would want its executive salaries to be above average.

The Meritocracy Trap: How America's Foundational Myth Feeds Inequality, Dismantles the Middle Class, and Devours the Elite

by

Daniel Markovits

Published 14 Sep 2019

Meritocracy’s champions develop these intuitions. They insist that grades and test scores measure students’ academic achievements, that wages track workers’ output, and that both processes align private advantage and the public interest. Meritocratic practices reinforce these associations. Entire professions—educational testing, compensation consulting—work to improve and to ratify the connections. In these ways, meritocracy makes industry—effort and skill, converted into economic and social product—into the measure of advantage. These connections enabled the meritocratic revolution to push aside dull, sluggish, and inert aristocrats, to open the elite to anyone who is ambitious and talented, and to arouse the superordinate workers whose vigor and dynamism now light up the culture and drive the economy forward.

The Golden Passport: Harvard Business School, the Limits of Capitalism, and the Moral Failure of the MBA Elite

by

Duff McDonald

Published 24 Apr 2017

They eat what they kill, whereas the majority of corporate executives eat what they want. More to the point, they eat what they think they deserve, which is more than they do. While the majority of corporate boards have compensation committees that determine executive pay, those boards all tend to use compensation consultants, and those consultants base their estimates on prevailing compensation, which is set by boards with a heavy presence of current or former CEOs of other firms. In other words, it’s one of the most intricately designed circle jerks in business history. CEOs are paid what other CEOs think they should be paid, which is based on what other CEOs have been paid.

The Irrational Bundle

by

Dan Ariely

Published 3 Apr 2013

Once salaries became public information, the media regularly ran special stories ranking CEOs by pay. Rather than suppressing the executive perks, the publicity had CEOs in America comparing their pay with that of everyone else. In response, executives’ salaries skyrocketed. The trend was further “helped” by compensation consulting firms (scathingly dubbed “Ratchet, Ratchet, and Bingo” by the investor Warren Buffett) that advised their CEO clients to demand outrageous raises. The result? Now the average CEO makes about 369 times as much as the average worker—about three times the salary before executive compensation went public.