estate planning

description: process of planning for inheritance of property

112 results

Death Glitch: How Techno-Solutionism Fails Us in This Life and Beyond

by

Tamara Kneese

Published 14 Aug 2023

Below I provide an overview of the field of digital estate planning based on interviews with founders of digital estate–planning startup companies and estate-planning lawyers, as well as my own participation in digital estate–planning processes. Although the digital death care industry is an extension of existing death entrepreneurialism, it is also a radical departure from traditional death planning and management attached to legacy institutions. For one, digital estate planners depend on venture capitalists’ investments. Following the startup model, many digital estate–planning companies are built to fail. Web-based companies promise to keep your data alive forever, but digital estate-planning startups are erratic.

…

Starting in the 1930s, the United States government dramatically raised estate tax rates, which reached a maximum rate of 77 percent, the rate in effect from 1941 to 1977.18 Unsurprisingly, this timeline coincides with the growth of the estate-planning industry. According to its website, the Boston Estate Planning Council was founded in September 1930 and is the oldest continuously run estate-planning group in the country.19 By the early 1960s, the need for a national association spurred the creation of the National Association of Estate Planners and Councils (NAEPC). Today, the NAEPC includes various types of professionals who contribute to estate planning: attorneys, accountants, insurance financial planners and trust officers, and certified financial planners.20 Estate planning thus grew in tandem with other actuarial careers, such as those in life insurance and accounting, as a means of managing risk and assuring financial bets long into the future.21 Digital Assets Digital estate planning is tied to this twentieth-century lifeworld but also marks a major departure from it.

…

In chapter 3 I argue that digital estate planning is one attempt to solve the problem of user death, which began as both individuals and platforms realized that caring for digital remains was important. Death is a lucrative business, demonstrated by the long histories of the life insurance, estate-planning, and funeral industries, and digital death entrepreneurs sought a piece of the pie. Through their narrow and often privileged positions, death entrepreneurs attempt to solve the problem of death by founding startup companies, which are not built to last. Rather than ignoring human death, digital estate–planning startups highlight a fundamental flaw with technologists’ attempts to intervene in long-term futures.

Financial Independence

by

John J. Vento

Published 31 Mar 2013

Working closely with a trusted tax advisor is perhaps one of the best ways to ensure that you can take advantage of these tax law changes when they arise. Legal Documents to Consider for Estate Planning Regardless of the size of your estate, you should consider addressing your own individual planning issues, in order to preserve your estate and make your wishes known, preferably in writing. I recommend meeting with a qualified estate planning attorney to determine if you need a will prepared, based on your particular facts and circumstances. If you have no minor children, or if all of your assets are held jointly with your spouse, or if you have no assets to speak of, then your estate may not need to go through probate.

…

In my opinion, everyone should consider their own particular needs; then you should determine what legal documents are most appropriate for you, whether it is a will, a trust, a health care proxy, a living will, or durable power of attorney (or some combination thereof)—all of which I will explain in this chapter. Please note that the names of some of these documents vary from state to state. Before I discuss the details of estate planning techniques, it is important to understand some of the key legal documents that may be needed in this planning process. An effective estate plan may need to include one or more of these documents that may cover all three phases of your life. Phase I is while you are alive and well, Phase II is in the event that you become disabled, and Phase III is after your death.

…

Properly titling your property, naming beneficiaries, and establishing trusts may facilitate your estate to pass to your heirs without having to go through the probate or administrative processes. If you c10.indd 257 26/02/13 2:47 PM 258 Financial Independence (Getting to Point X ) do the proper estate planning while you are alive and well, you can pass your estate to your loved ones privately, without unnecessary delays and expenses; also, this process may allow you to control your estate after death. Estate Planning Strategies That Keep You in Control after Death If you would like to have continued control of your estate after your death, there are several planning strategies you may want to implement while you are alive.

Capital Without Borders

by

Brooke Harrington

Published 11 Sep 2016

See also offshore finance tax shelters: colonies as, 254; complexity of, 53; corporate, 151; offshore financial centers as, 47; trust-corporation configuration as, 188; in United Kingdom, 241–42 TEP (Trust and Estate Planning) certification, 26; in advertisement for wealth manager, 60; as industry standard, 30, 55–56; on offshore financial centers, 129, 130; on the state, 236–37; on taxes, 226 testamentary freedom, 166 Thyssen-Bornemisza, Baroness Carmen, 160 tiered entities, 189–92 Tocqueville, Alexis de, 204, 209 trade: free, 239, 254, 293; sanctions, 295; trade-restriction avoidance, 159–60; wealth from global, 5, 51 training programs, 97–98, 103 transaction costs: continuity of wealth reduces, 214; for corporations, 181, 182; for foundations, 180; increased cost of borrowing, 221; minimizing, 209, 212; for private investment opportunities, 212; succession planning reduces, 215 treaties, 133, 256, 264 Treaty of Westphalia (1684), 133, 234, 235, 290, 293–97 Trevor (Panama-based wealth manager), 83, 229, 255 Trudeau, Kevin, 157–58 trust: in client relations, 20, 81–105, 120–21, 287; culture and, 108–16; in institutions, 75; pricing related to, 107, 108; rule of law as basis of, 109; similarity as basis for, 95; social identity and, 119–20 trust and estate planning: American College of Trust and Estate Counsel, 30; bar association special-interest groups for, 29; becomes an industry, 126; Chartered Trust and Estate Planner certification, 30; disparate professions in, 55; professionalization of, 4, 5–6; transformation of capitalism and emergence of, 51; university degrees in, 56. See also STEP (Society of Trust and Estate Practitioners); wealth management Trust and Estate Planning (TEP) certification. See TEP (Trust and Estate Planning) certification trust companies, 3, 77, 190, 191–92, 250 trust-corporation configuration, 185–92; asset transfer in, 8–9; as best-of-both-worlds, 188–89; relationship among substructures in, 9; STAR (Special Trusts Alternative Regime) structure, 168, 169, 170–71, 177, 185, 276; in tiered entities, 189; VISTA (Virgin Islands Special Trusts Act) trusts, 57, 114–15, 168, 169–70, 177, 185, 222 Trustee Act (2000), 49, 284 Trustee Investment Act (1889), 48–49 trustees: class solidarity with those who request their services, 42, 51; compensation for, 45, 49–50; courts expand powers of investment of, 48–49, 74; culture and, 109; as economically celibate, 50; evolution during nineteenth century, 51–52; faithless feoffees, 41, 48; feudal aspects of, 40, 51, 214; fiduciary duty of care for, 46; full personal liability for losses to trust, 49, 83; Harvard College v.

…

See also 1 percent EMEA (Europe, Middle East, and Africa), 243 Engels, Friedrich, 16, 204 Enlightenment, 18, 203, 204, 218, 277 entail, 4, 208, 218, 276, 306n17 equal opportunity, 204 Erika (Swiss wealth manager), 61, 69, 82, 98–99, 137–38, 245–46, 248, 298 estate planning: in civil-law countries, 57–58. See also trust and estate planning ethnography, 27–30; immersion, 25, 274 European Union: cash-for-passports programs, 239–40; Cook Islands blacklisted by, 158; Savings Tax Directive, 299 euro zone banking crisis, 239 exchange funds, 206 Executive Commission (European Union), 158 express trusts, 155 family: banks, 251, 269; children kept secret from the legally recognized, 125; client relations as quasi-familial, 85–88, 92, 120–21; contemporary social scientific theories of, 278; contributions to theory and research of this study, 276–78; disputes over wealth of, 16–17; dynastic, 96, 193–94; institutions opened to the public, 250; as not high-trust environment, 84; suspicion in wealthy, 81; tear themselves apart over money, 88; transformation in, 165–67; wealth lends special dynamic to, 84–85; wealth management influences, 16–17, 272; wealth managers help families, 68.

…

Attempts to capture the full complexity of professional activity have included the fanciful (“fiscal alchemists”), the utilitarian (“transaction planners”), and the politically pointed (“income defense providers”).13 However, consensus seems to be developing around the term “wealth managers,” even among many STEP members.14 Indeed, a much-discussed article in the STEP Journal claimed that STEP practitioners—unlike lawyers, bankers, or other competing professional groups—are “the true wealth managers,” because their domain comprises “the whole spectrum of the client’s assets and other financial affairs. Wealth management is seen as the overarching role pulling together the advice of various investment, tax, and other experts into a coherent plan.”15 Thus “wealth managers” is the term I will use in this book. That the professionalization of trust and estate planning remains incomplete owes something to the changing nature of wealth itself. Historically, land ownership has been the primary source of great fortunes globally; this remains true in many parts of the world, particularly in Africa and Latin America.16 In that context, family wealth could be defended without the intervention of professionals, through practices such as intermarriage, primogeniture, and entail.17 In cases where those strategies were unavailable or impractical—as when knights of medieval Europe departed for the Crusades, leaving their lands vulnerable to seizure by the church, the state, or rival noblemen—some adopted the practice of putting their assets in trust.

Your Money: The Missing Manual

by

J.D. Roth

Published 18 Mar 2010

A Brief Overview of Estate Planning Nobody likes to think about death—especially their own. Most people don't think about creating wills until they hit middle age. But you can't always see death coming and, in addition to the emotional trauma, it can wreak financial havoc on your family. You can make things a little easier for your family and friends by planning ahead and creating a will. A will is for anyone who wants to distribute their money and possessions according to some plan. (All that you own, including physical property and investments, is known as your estate. An estate plan is a strategy for passing your money and Stuff on to your heirs.)

…

If you use software or pre-printed forms to create your will, be sure to follow the signing instructions for your state. For more on do-it-yourself estate planning, read this article from the New York Times: http://tinyurl.com/NYT-wills. A lot of people don't understand what will happen to their property when they die. For example, your retirement account—which is probably your single most valuable asset after your home—is generally not governed by a will; it's covered by a completely different set of rules. (This point is very important, but most people don't realize it.) If you make your own estate plan, you may not take this sort of thing into account. And many families have been shattered by fighting that happens when a will they thought was legally binding turns out to be invalid because it wasn't properly drafted and witnessed.

…

Though most wills share certain features, the attorney will customize it for your specific needs. Tip If you want to know how much an estate plan will cost, ask. The price depends on where you live and how complicated your estate is. In a way, preparing a will is sort of anti-climactic. There's not a lot of legal mumbo-jumbo or red tape. You simply gather info, answer a few questions, and sign on the dotted line. For some people, there's more to estate planning than just creating a simple will, but for many, it really is this easy. Once you have a will, keep it someplace safe and accessible, like a safe-deposit box, and let trusted family members know where it is.

A Thousand Brains: A New Theory of Intelligence

by

Jeff Hawkins

Published 15 Nov 2021

But I think it is a good idea to discuss what we can do now, just in case things don’t work out so well. Estate planning is something you do during your life that benefits the future, not yourself. Many people don’t bother to do estate planning because they think there is nothing in it for them. But that isn’t necessarily true. People who create estate plans often feel it provides a sense of purpose or creates a legacy. Plus, the process of establishing an estate plan forces you to think about life from a broad perspective. The time to do it is before you are on your deathbed, because by then you may no longer have the ability to plan and execute. The same holds true for estate planning for humanity.

…

In the distant future, intelligent beings—whether they evolve on Earth or travel from another star—could discover the time capsule and read its contents. We won’t know whether our repository will be discovered or not; that’s the nature of estate plans. If we do this, and it is read in the future, imagine how appreciative the recipients would be. All you have to do is think of how excited we would be to discover such a time capsule ourselves. An estate plan for humanity is similar to an estate plan for individuals. We would like our species to live forever, and maybe that will happen. But it is prudent to put in place a plan just in case the miracle doesn’t happen.

…

Classification: LCC QP376 .H2944 2021 | DDC 612.8/2—dc23 LC record available at https://lccn.loc.gov/2020038829 ISBNs: 978-1-5416-7581-0 (hardcover), 978-1-5416-7580-3 (ebook) E3-20210108-JV-NF-ORI Contents Cover Title Page Copyright Foreword by Richard Dawkins PART 1: A NEW UNDERSTANDING OF THE BRAIN 1 Old Brain—New Brain 2 Vernon Mountcastle’s Big Idea 3 A Model of the World in Your Head 4 The Brain Reveals Its Secrets 5 Maps in the Brain 6 Concepts, Language, and High-Level Thinking 7 The Thousand Brains Theory of Intelligence PART 2: MACHINE INTELLIGENCE 8 Why There Is No “I” in AI 9 When Machines Are Conscious 10 The Future of Machine Intelligence 11 The Existential Risks of Machine Intelligence PART 3: HUMAN INTELLIGENCE 12 False Beliefs 13 The Existential Risks of Human Intelligence 14 Merging Brains and Machines 15 Estate Planning for Humanity 16 Genes Versus Knowledge Final Thoughts Suggested Readings Acknowledgments Discover More About the Author Illustration Credits Explore book giveaways, sneak peeks, deals, and more. Tap here to learn more. Foreword by Richard Dawkins Don’t read this book at bedtime.

Freedom Without Borders

by

Hoyt L. Barber

Published 23 Feb 2012

Chapter 2 The Best Offshore Structures Our country is wherever we are well off. — John Milton, 1666, 17th-century English poet Author of Paradise Lost, an epic poem For privacy and asset protection, offshore is the answer. If you wish to hold assets and cash, gain maximum financial privacy protected by law, operate an offshore business, or create the best estate plan anywhere, the preferred means is to utilize one or a combination of offshore structures. Although you can certainly hold bank and investment accounts in your personal name with financial institutions in foreign countries, you will find that it is far wiser and more private and that you will be better able to insulate your wealth from domestic predators, including your own government, if you maintain these important accounts in the name of legal entities that you control or which are yours by design and part of your offshore estate.

…

The following describes the Belize APT. Nevis and the Cook Islands share many of the same advantages and similarities. Belize’s trust law is one of the strongest and most flexible asset protection trust legislations in the world, and Belize is highly favored by this author, along with Nevis and the Cook Islands, for offshore estate planning, asset protection, and investment purposes. The combination of a Belize asset protection trust and an IBC or LLC under the APT umbrella allows the principal(s) to maintain and enjoy the benefits of ownership and control while still procuring the impermeable protection and privacy of the trust.

…

In fact, the Panamanian structure was modeled after Liechtenstein legislation, but the Panama entity has more flexibility and the Liechtenstein structure is much more costly to establish and maintain. The annual Panama government fee is a modest $300. The private foundation, as it is also known, is an independent juridical entity, like a corporation, that functions similarly to a trust for estate planning but operates more like a company, although it may not operate as a business itself. It may invest in businesses and buy and sell assets in order to maximize patrimony. The Panama foundation structure offers some of the best benefits of both the trust structure and the offshore corporation in a single entity.

The Bogleheads' Guide to Investing

by

Taylor Larimore

,

Michael Leboeuf

and

Mel Lindauer

Published 1 Jan 2006

Therefore, the estate tax laws that are in effect at the time of your death will establish the level at which your estate will have to pay additional taxes on your accumulated assets for being too rich. Although it's beyond the scope of this book to offer legal advice (that's what estate planning attorneys are for), we will touch on a number of things you need to consider regarding estate planning and passing your assets on to those you want to have them. That is a better option than simply leaving those decisions up to the intestate law of your state, and perhaps leaving a major portion of your assets to the taxman. We'd all like to think that we're special, that perhaps we're somehow even immortal.

…

But since we don't know the date of our demise, we need to plan now for any number of eventualities, including the distribution of our assets after our death. It's important to know that getting our affairs in order involves so much more than just estate planning. There are a number of other legal issues that we'll have to deal with and documents that we'll want to have in place. These issues and documents are often handled by your attorney at the same time he or she is preparing your estate planning documents. Let's take a look at some of the documents you might need and some things you'll need to consider about each of them. A Will You should have a will, even if you have a trust.

…

A good CPA can do the following: Assess your overall financial wellbeing. • Calculate any taxes due on the windfall. • Recommend any additional types of insurance you may need or what types of insurance you currently carry that can be dropped. • Help you decide if you need to enlist the services of an estate planning attorney. Calculate if it's better to take a lump-sum payment or monthly distributions on a windfall such as a retirement package. Give you a clearer picture of how the windfall can help you achieve your long-term financial goals. The American Institute of Certified Public Accountants has a PFS designation for CPAs specializing in personal financial services.

The King of Content: Sumner Redstone's Battle for Viacom, CBS, and Everlasting Control of His Media Empire

by

Keach Hagey

Published 25 Jun 2018

Today, as the majority owner of the family theater chain National Amusements, he controls roughly 80 percent of the voting shares of both Viacom Inc. and CBS Corp., a $36 billion media empire encompassing MTV, Comedy Central, Nickelodeon, BET, VH1, Paramount Pictures, CBS, Showtime, Simon & Schuster, and the Showcase Cinemas and Cinema de Lux movie chains. He spent decades performing meticulous estate planning so that his control would extend beyond the grave (which he loved telling reporters he would never lie in), constructing trusts designed to make it impossible for his heirs to sell his companies after he dies. “Unless they start doing terribly,” he told the Wall Street Journal in 2012, “which they will not.”

…

Smelling blood, Sumner summoned Dauman, his deal-making consigliere, from his partner’s perch at Shearman & Sterling and offered him a job in-house as Viacom’s senior vice president and general counsel. Dauman had been rewarded for his help in the Viacom takeover with a seat on the board but had remained at the law firm in the intervening years, serving as Sumner’s personal lawyer on his estate planning, executor of his will, and even trustee of his family trusts. Dauman had been part of earlier rounds of secret talks between Sumner and Davis over the years that not even Biondi knew about—Sumner felt Biondi had “loose lips” and was a poor negotiator—and Sumner trusted Dauman implicitly. By February 1993, he had his own office near Sumner’s on the fifty-second floor of Viacom’s Times Square headquarters.

…

Most challengingly for Sumner, buying Paramount forced him to publicize his succession plans. As part of Nynex’s negotiations to fund Viacom’s campaign for Paramount, Nynex wanted assurances that the company would not be sold or otherwise destabilized after Sumner’s death. Sumner agreed to show Nynex his estate plan, which named Dauman as chairman in the event of his death, assuring Nynex that his trusted consigliere knew enough about both his estate and Viacom’s operations that he could block a family attempt to sell or otherwise dismantle the company after his death. As the word began to circulate among more executives, Dooley recommended that Sumner make a wider disclosure of this plan.

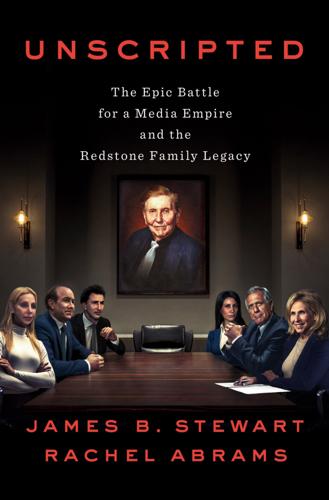

Unscripted: The Epic Battle for a Media Empire and the Redstone Family Legacy

by

James B Stewart

and

Rachel Abrams

Published 14 Feb 2023

Prior to the meeting Holland and Herzer allegedly spent “hours” with Sumner “telling him exactly what he was supposed to say.” The effort worked. Dr. Spar reported that Sumner “demonstrated impressive knowledge of his estate, knew the people named in his estate plan and how they are related to him, and revealed no hint of delusional thinking in the discussion of his estate plan.” In his opinion, “the testamentary decisions [Sumner] discussed in this evaluation struck me as reflecting his own authentic wishes, and not the influence of Manuela, Sydney, or anyone else.” Dr. Spar’s report would now help insulate Holland and Herzer from any future claims they had exerted undue influence on Sumner.

…

In return, the shares themselves would be placed in an irrevocable trust for the benefit of Sumner while he lived, and then, after he died or became incapacitated, into a trust for his and Phyllis’s children and grandchildren. There were five nonfamily trustees in addition to Sumner and Phyllis: George Abrams, a courtly, Harvard-trained Boston lawyer who advised Sumner in his divorce; David Andelman, his estate planning attorney; Philippe Dauman, his longtime corporate lawyer and a Viacom executive; and two other lawyers. Sumner and his staunch allies controlled a solid majority, and should anyone’s loyalty to Sumner falter, Sumner retained the power to replace them. As part of the settlement, Sumner also gave Phyllis half of his large stake in a pinball machine and video games maker, Midway Games, best known for its Mortal Kombat franchise, the fantasy fighting game introduced in 1992.

…

But when Holland’s matchmaker friend Patti Stanger asked her point-blank if Alexandra was Sumner’s, Holland denied it and added she’d used a surrogate. Regardless, Sumner doted on the child and seemed to enjoy having Alexandra around the house. Holland showed photos of the baby bouncing in Sumner’s lap. He added Alexandra as a beneficiary in his will and said he planned to formally adopt her. His longtime tax and estate planning lawyer in Boston, David Andelman, began looking into the tax implications of his marrying Holland and adopting Alexandra. * * * — The same day Holland picked up her baby in San Diego, Heather Naylor took advantage of Holland’s absence to have lunch with Sumner at his mansion.

The Handbook of Personal Wealth Management

by

Reuvid, Jonathan.

Published 30 Oct 2011

As business property includes AIM investments, it is possible for a well-managed AIM portfolio to be a satisfactory investment in itself, whilst also attracting IHT relief at 100 per cent. Gifts to charities It is worth noting that gifts to charity qualify for 100 per cent relief from IHT. Conclusion Inheritance tax, wills and estate planning are a very complex subject and this chapter can do no more than set out general guidelines and limits. It is no substitute for professional advice. 112 113 3.2 Estate and succession planning Tom Hewitt, Burges Salmon LLP Introduction The primary purpose of trust and estate planning is to enable family assets to be transferred from one generation to another in a manner that is tax and financially efficient and that suits the aspirations of the family.

…

To find out how the Isle of Man can enhance your personal and business wealth, please contact Isle of Man Finance on +44 (0)1624 686400. www.isleofmanfinance.gov.im You can in the Isle of Man ឣ X CONTENTS ___________________________________________________________ Part 3: Taxation issues 103 3.1 Inheritance tax, wills and estate planning for the high-net-worth individual 105 Carole Cook, Forsters LLP Inheritance tax and when it is payable 105; Rates of tax 106; How an individual can reduce the burden of IHT on death 106; Assets that should be given away 108; Lifetime gifts to trusts 108; Tax-efficient wills 109; The family home 110; Other planning points 110; Conclusion 111 3.2 Estate and succession planning 113 Tom Hewitt, Burges Salmon LLP Introduction 113; Inheritance tax (IHT) 113; Capital gains tax (CGT) 114; The use of trusts 116; Wills 117 3.3 Taxation of UK resident non-domiciliaries 121 Patrick Harney, Forsters LLP Overview 121; The difference between residence and domicile 122; The remittance basis of taxation 122; Temporary non-residence 125; Exempt property 126; Non-domiciled settlors of overseas trusts 126; Non-domiciled beneficiaries of offshore trusts 127; Non-domiciled shareholders in overseas companies 127; US citizens 127; Planning for non-domiciliaries after April 2008 127; Conclusion 129 Part 4: Pleasurable investment 131 133 4.1 Investing in wine Nick Stephens, Interest in Wine Who we are 133; Why invest in wine?

…

Guy was instrumental in the company’s formation and funding and was Managing Director until 2008. He has now become Managing Director of Oxigen Plantations (Priv) Ltd, Sri Lanka. Carole Cook is a partner at Mayfair-based solicitors Forsters LLP. Forsters is widely recognized as a leading law firm specializing in tax and trusts. Carole’s expertise includes tax and estate planning for both UK and international clients, in particular entrepreneurs, offshore and onshore trust advice and creation, will drafting and advice to charity trustees. She is a member of the Technical Committee of the Society of Trust and Estate Practitioners (STEP). John Davey studied chemical engineering at the University of Bath before commencing his career in finance.

How to Write Your Will: The Complete Guide to Structuring Your Will, Inheritance Tax Planning, Probate and Administering an Estate

by

Marlene Garsia

Published 1 Jan 2008

What this book does is point out areas of potential problems, but as readers can appreciate, it cannot cover all detail and cases as they are potentially so numerous. Legal advice in these instances is recommended. In researching this book it has become clear that, under English law, provided an estate is relatively straightforward, xxviii ■ Preface complicated trusts are not involved, and extensive estate planning is not needed, then there is nothing to stop the individual from handling his or her relation’s or friend’s affairs – whatever the size of the estate. Despite this, only a minority of people do so. Scotland is another matter. I have explained briefly the position in Scotland, dealing with small estates, the differences when writing a will and gaining Confirmation.

…

What it can do is to provide information about what will be needed and what matters have to be dealt with in as straightforward and uncomplicated a manner as the subject allows. It tells you what to do and why, and how to go about it. It takes a step-by-step view of the necessary procedures from writing a will to estate planning and proving a will. The first part of the book will be concerned with how to write a will. Basically you ‘make’ a will because you want to direct who receives your assets following your death. Occasionally, you may even want to ensure that certain people do not receive a share in your estate.

…

Approximately one in every five persons writes their own will. In London the number is higher, one in every three, while in Scotland the figure is approximately one in every four. However, most people still go to a solicitor, not because their affairs are complex but because they do not know where to start or find the task daunting. Estate planning and inheritance tax are examined in Chapter 6. For the inexperienced and unsure this subject can be not only bewildering but frightening too. You may feel more confident arranging for a consultation with a solicitor or tax consultant before planning your will. House prices in 2008 and so far in 2009 have shown a decrease of circa 17.9 per cent.

How to Retire the Cheapskate Way

by

Jeff Yeager

Published 1 Jan 2013

—isn’t likely to be one of the most enjoyable exercises of your lifetime, but it is a necessary one. It’s also one that’s best done sooner rather than later. And once it’s done, it’ll put your mind at ease and let you get on with enjoying the rest of your life and retirement. Here are some thoughts on estate planning, the cheapskate way: Wills Obviously a last will and testament is the cornerstone of any estate plan, even though roughly 60 percent of adult Americans don’t have a will of any kind, according the legal news website www.Findlaw.com. The key points addressed in most wills are who will manage your estate once you’re gone; who gets your assets and other belongings; and who will be the guardian of any minor children or disabled dependents after you die.

…

Even for a cheapskate, it’s usually worth the few hundred dollars an attorney should charge you to draw up a will, particularly if you have a good-size estate, complicated arrangements in terms of beneficiaries, or reason to believe that someone may try to contest your will after your death. A qualified attorney (see the National Association of Estate Planners & Councils, www.naepc.org) can also provide you with other estate planning advice, which could prove extremely valuable and save you serious money in the long run. Often at least some basic estate planning advice is provided without additional charge when you hire an attorney to prepare your will. But if you have few assets and straightforward plans for your estate, then you shouldn’t rule out a simple, inexpensive do-it-yourself will.

…

However, being a cheapskate, I’m pretty sure that if I see a blinding white light at the end of a tunnel, the first thing I’ll say when I get there is, “Do we really need to have so many lights on?” In a way, we’ve come full circle from where this book began. We’re back to the same question Bob Johnson asked me in the park that day: What do you really, really want? If anything, that question may be even more important when considering your final wishes and estate plans, because once you’re gone, there ain’t no changing your mind. Speaking of Bob Johnson, I’ll make no further drama of it. Nor will I leave you wondering: my friend and mentor Bob (formally Robert B. Johnson) died of colon cancer one sunny April morning in 1988, at the way too early age of forty-one.

Retirementology: Rethinking the American Dream in a New Economy

by

Gregory Brandon Salsbury

Published 15 Mar 2010

Do you know how to pass assets on to your heirs without having them incur huge tax burdens? Do you have any charities to which you’d also like to leave money? Speak to an adviser regarding tax ramifications and the taxes that will be due and payable by the recipients. Estate planning for your surviving spouse and children can be vital to their ongoing financial health, so establish a basic estate plan and standard trusts like a living trust, a credit shelter trust, and a bypass trust. Taking care of these things can make the difference between seeing millions go to your family—or to the IRS. Procrastinating—staying where you’ve been and not adjusting your portfolio—can be very expensive given the changing landscape.

…

Vice President, Publisher: Tim Moore Associate Publisher and Director of Marketing: Amy Neidlinger Executive Editor: Jim Boyd Editorial Assistant: Pamela Boland Development Editor: Russ Hall Operations Manager: Gina Kanouse Senior Marketing Manager: Julie Phifer Publicity Manager: Laura Czaja Assistant Marketing Manager: Megan Colvin Cover Designer: Anne Jones Managing Editor: Kristy Hart Senior Project Editor: Lori Lyons Copy Editor: Apostrophe Editing Services Proofreader: Kay Hoskin Indexer: Erika Millen Compositor: Nonie Ratcliff Manufacturing Buyer: Dan Uhrig © 2010 by Pearson Education, Inc. Publishing as FT Press Upper Saddle River, New Jersey 07458 This book is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, estate planning, tax, or other professional services or advice by publishing this book. Each individual situation is unique. Thus, if legal or financial advice or other expert assistance is required in a specific situation, the services of a competent professional should be sought to ensure that the situation has been evaluated carefully and appropriately.

…

“Looking back on my experiences, I definitely had some unexpected curveballs thrown my way,” Liz concluded. “But when it comes to being there and helping take care of my family, there is nothing I would have done differently. Except I do think we could have saved ourselves some big headaches if we had just done more to make sure my parents and siblings were all on the same page when it came to estate planning and the family’s finances...and I wish I had forced myself to set aside a little more money for my own retirement.” Dependence on family for financial support in difficult times is nothing new, though it’s rarely discussed. That’s probably because it’s never been a great source of pride for any of the parties involved, no matter what their financial situation is.

5 Day Weekend: Freedom to Make Your Life and Work Rich With Purpose

by

Nik Halik

and

Garrett B. Gunderson

Published 5 Mar 2018

You’ll never find a widower or widow who felt like he or she had too much coverage. Do you understand the different types of insurance and is your policy right for you? Do you have the proper beneficiary assignment with your policy? Estate Planning Estate planning determines what happens to your assets when you pass away. But equally important is the perpetuation of your values, philosophy, vision, and contribution. A proper estate plan maximizes your legacy — both financial and personal. Do you have a properly documented will? Do you have a properly executed trust? Do you have a Power of Attorney set up in case you are incapacitated and cannot make decisions?

…

Protective expenses include your liquid savings, which should be enough to cover a minimum of six months’ expenses. These savings won’t be overly productive in terms of earning interest, but they will be there to protect you and prevent you from worrying about money every second. Other protective expenses include estate planning, corporate structure planning, life insurance, disability insurance, medical insurance, auto insurance, and emergency preparedness. 3. Productive Expenses Productive expenses allow you to build assets, expand your cash flow, and grow your business. This could include purchasing a tax lien or rental property.

…

Harv Elder, Larry email, and productivity rituals emergency preparedness, as protective expense Emerson, Ralph Waldo emotional attachment, and Momentum investments and real estate investments emotional energy energy, amplifying entertainment, as tax deduction entrepreneurship, and academic systems and active income analyzing income opportunities and cash flow and continuous improvement direct sales/network marketing opportunities domain trading opportunities e-commerce opportunities and embracing failure and experimentation fix and flip opportunities and freedom and Growth investments and hiring employees and income growth lack of resources for and letting go and leverage online opportunities and opportunities presented by technology and passion and perfectionism personal service opportunities and quick adjustments to feedback and quitting your job and risk and scalability of businesses and self-employment sharing economy opportunities starting small and strong mindset three levels of and value creation equity growth, and real estate investments estate planning, as protective expense Ethereum Evans, Richard Paul excellence, replacing perfectionism with exercise, and energy amplification exit strategies, for Growth investments for real estate investments expense ratios expenses, and Active Income Ratio cutting and Passive Income Ratio experimentation F Facebook failure, and productivity fear, and building your inner circle and economic cycles and entrepreneurship and opportunity and procrastination and purpose and real estate investments and the Rockefeller Formula and security and strengthening your mindset of taxes federal government assistance, and loans for real estate investments Federal Housing Administration (FHA) feelings of entrapment, and weekend/workweek structure financial capital, and entrepreneurship financial independence, and Passive Income Ratio financial wealth, and Passive Income Ratio 5 Day Weekend, changing your mindset toward work contract for creating a vision for free-time activities five steps of importance of following correct sequence and “mailbox money” myth manifesto and passive vs. active income streams and security vs. freedom and thinking outside the box universal availability of weekend/workweek paradigm 5DayWeekend.com, and Passport codes 5-Second Rule, for impulse buying Fiverr.com fix and flip opportunities fix-up costs, for real estate investments Fon Ford, Henry foreclosure, and tax lien certificates Forleo, Marie foundation step (keep more money) Francis of Assisi (saint) Frank, Ben Frank, Joyce Franklin, Benjamin fraud, and cryptocurrencies freedom, and active vs. passive income creation and boredom and entrepreneurship and generosity and learning when to say no and lifestyle and peace and perfectionism and purpose sacrificing for security and simplicity Freedom Lifestyle freelancing, as entrepreneurial opportunity frequency of work requirements, business ownership (not managing) business ownership (working and managing) royalties and overrides sales subscriptions wage or salary employment Frost, Robert fulfillment, and purpose Fuller, Buckminster G Gardner, Chris generosity Gerber, Michael Gibbs, Marshall goal setting, and Passive Income Ratio and purpose Godin, Seth gold, as Momentum investment opportunity Golightly, Craig Google government social welfare programs, and retirement Grameen Bank gratitude Graybiel, Ann Gretzky, Wayne Groupon Growth investments, and active vs. passive income streams aggressive and conservative strategies for Bank Strategy and cash flow description of and economic cycles for funding Momentum investments minimum criteria for opportunities for Sharelord Strategy storage units tax lien certificates Guitar Institute of Technology (GIT) Gunderson, Garrett H habits, fortifying Halik, Nik happiness, and generosity and materialism hard money lenders, and loans for real estate investments health, and habits health savings accounts (HSA) “HELL YEAH” philosophy Hendrix, Jimi Herodotus Hicks, Bill hidden fees Hill, Napoleon hiring employees hiring your children, as tax deduction hobbies Holland, Danny home expenses, as tax deduction home office deductions homeowner’s insurance Hopper, Grace Hori, Jim hugedomains.com Hulu HyreCar.com I Idea Optimizer impulse buying income, and Active Income Ratio increasing with entrepreneurship and Passive Income Ratio See also cash flow income growth step (make more money) Income Opportunity Score Sheet incorporation Industrial Revolution, vs.

How to Form Your Own California Corporation

by

Anthony Mancuso

Published 2 Jan 1977

. $29.99 EVL Nolo’s Guide to California Law................................................................................... $24.99 CLAW ORDER 24 HOURS A DAY @ www.nolo.com call 800-728-3555 • Mail or fax the order form in this book ESTATE PLANNING & PROBATE Price Code 8 Ways to Avoid Probate ........................................................................................... $19.99 PRAV Estate Planning Basics . ............................................................................................. $21.99 ESPN The Executor’s Guide: Settling a Loved One’s Estate or Trust..................................... $34.99 EXEC How to Probate an Estate in California....................................................................... $49.99 PAE Make Your Own Living Trust (Book w/CD-ROM)..................................................... $39.99 LITR Nolo’s Simple Will Book (Book w/CD-ROM)............................................................ $36.99 SWIL Plan Your Estate......................................................................................................... $44.99 NEST Quick & Legal Will Book (Book w/CD-ROM) .......................................................... $19.99 QUIC Special Needs Trust: Protect Your Child’s Financial Future (Book w/CD-ROM)......... $34.99 SPNT FAMILY MATTERS Always Dad................................................................................................................ $16.99 DIFA Building a Parenting Agreement That Works............................................................ $24.99 CUST The Complete IEP Guide........................................................................................... $34.99 IEP Divorce & Money: How to Make the Best Financial Decisions During Divorce........... $34.99 DIMO Divorce Without Court.............................................................................................. $29.99 DWCT Do Your Own California Adoption: Nolo’s Guide for Stepparents and Domestic Partners (Book w/CD-ROM).................................................................................... $34.99 ADOP Every Dog’s Legal Guide: A Must-Have for Your Owner............................................ $19.99 DOG Get a Life: You Don’t Need a Million to Retire Well.................................................. $24.99 LIFE The Guardianship Book for California........................................................................ $34.99 GB A Legal Guide for Lesbian and Gay Couples............................................................... $34.99 LG Living Together: A Legal Guide (Book w/CD-ROM).................................................. $34.99 LTK Nolo’s IEP Guide: Learning Disabilities..................................................................... $29.99 IELD Parent Savvy............................................................................................................... $19.99 PRNT Prenuptial Agreements: How to Write a Fair & Lasting Contract (Book w/CD-ROM)................................................................................................. $34.99 PNUP Work Less, Live More................................................................................................. $17.99 RECL ORDER 24 HOURS A DAY @ www.nolo.com call 800-728-3555 • Mail or fax the order form in this book GOING TO COURT Price Code Beat Your Ticket: Go To Court & Win!

…

And this remains true even if a portion of this money is invested back in the business—that is, even if the owner doesn’t pocket business profits for personal use. Legal Life Same as Owner’s. On the death of its owner, a sole proprietorship simply ends. The assets of the business normally pass under the terms of the deceased owner’s will or trust, or by intestate succession (under the state’s inheri tance statutes) if there is no formal estate plan. warning Don’t let business assets get stuck in probate. The court process necessary to probate a will can take more than a year. In the meantime, it may be difficult for the inheritors to operate or sell the business or its assets. Often, the best way to avoid having a probate court involved in business operations is for the owner to transfer the assets of the business into a living trust during his or her lifetime; this permits business assets to be transferred to inheritors promptly on the death of the business owner, free of probate.

…

Often, the best way to avoid having a probate court involved in business operations is for the owner to transfer the assets of the business into a living trust during his or her lifetime; this permits business assets to be transferred to inheritors promptly on the death of the business owner, free of probate. For detailed information on estate planning, including whether or not it makes sense to create a living trust, see Plan Your Estate, by Denis Clifford and Cora Jordan (Nolo). Sole Proprietorships in Action. Many one-owner or spouse-owned businesses start small with very little advance planning or procedural red tape. Celia Wong is a good example—Celia is a graphic artist with a full-time salaried job for a local book publishing company.

The Millionaire Next Door: The Surprising Secrets of America's Wealthy

by

Thomas Stanley

and

William Danko

Published 15 Nov 2010

Our numbers are growing much faster than the general population. Our kids should consider providing affluent people with some valuable service. Overall, our most trusted financial advisors are our accountants. Our attorneys are also very important. So we recommend accounting and law to our children. Tax advisors and estate-planning experts will be in big demand over the next fifteen years. ♦ I am a tightwad. That’s one of the main reasons I completed a long questionnaire for a crispy $1 bill. Why else would I spend two or three hours being personally interviewed by these authors? They paid me $100, $200, or $250. Oh, they made me another offer—to donate in my name the money I earned for my interview to my favorite charity.

…

Type B housewives tend to live in close proximity to their parents. They often accompany their mothers on shopping trips. It’s not unusual for middle-aged Type B housewives to receive clothing allowances from their affluent mothers and fathers. Parents also care for their Type B daughters via provisions in wills/estate plans. They are provided with cash gifts and inheritance because their parents believe they “really need the money.” In essence, Type Bs are cared for by their parents instead of the other way around. The parents of Type B housewives tend to hold back from distributing substantial cash gifts to their daughters out of fear that their daughters and their husbands may be poor money managers.

…

In fact, all things being equal, estates in which the heirs, typically the sons and daughters, are professional estate attorneys tend to be taxed less. Sons and daughters who are attorneys act as formal and informal legal advisors and opinion leaders for their affluent parents. They have a significant influence over all aspects of estate plans, including the choice of the estate attorney, provisions in wills, the ultimate disposition of family assets, the choice of executor(s), the use of trust services, and the incidence and size of the financial gifts to be given to children and grandchildren. “Attorney relatives” typically advise their affluent parents on how to minimize estate taxes via annual gift giving to the children and grandchildren.

The Power of Passive Investing: More Wealth With Less Work

by

Richard A. Ferri

Published 4 Nov 2010

These include individual investors and their families, trustees of charities and private accounts, pension trustees and those who select investment options for employer sponsored pension plans, and professional investment advisors. Each of these four groups has special reasons why implementing a passive investment strategy is better for them. Individual investors should select a strategy that has the highest probability of reaching their retirement and estate planning goals. There is no reason to believe that an individual investor will find a top money manager who will outperform the markets. That’s why it’s undoubtedly in the best interest of an individual to create and maintain a portfolio of index funds and ETFs for the long run. Substantial time is spent explaining why passive investing is a prudent choice for trustees who have a legal responsibility to act in the best interest of the accounts they oversee.

…

Policy Changes Changing an investment policy is a major decision. Any change requires deep thinking and an evenhanded judgment and should not be made in a time of duress. There are several good reasons to change an investment policy. The following are four prominent reasons. 1. The account owner’s financial needs change. 2. Estate planning considerations change. 3. A bull market puts a portfolio close to its financial goal. 4. A bear market exposes more risk than an investor can handle. Financial needs change for all of us during life’s journey. There are periods when cash flow needs are high and periods when cash flow needs are low.

…

The next step is generally the purchase of a home, which often coincides with starting a family and all the costs associated with raising children. Sometime during middle age, focus shifts to securing adequate retirement income. During retirement, focus can shift again to a policy of giving. This is the distribution of wealth to family members and loved ones as well as favored charities. Estate planning takes care of the rest upon our demise. Accordingly, an investment policy review during different stages of life ensures that it is up to date with these changing priorities. Estimating Future Obligations We all have a limited time on Earth, and the government is kind enough to tell us about how much time that is.

Humans Need Not Apply: A Guide to Wealth and Work in the Age of Artificial Intelligence

by

Jerry Kaplan

Published 3 Aug 2015

Common commercial contracts, from leases to loans to licenses to incorporation papers to purchase agreements, are well structured enough to allow a first draft, if not a final one, to be written by a computer program. Consider the legal-tech startup FairDocument.33 By focusing on estate planning, a well-defined and fairly routine area of law, the company is able to “interview” clients on its website and prepare initial draft documents. Potential clients answer some initial questions, then attorneys bid to get their business. Most of the time, if the case is relatively straightforward, attorneys opt for the standard recommended bid of $995 for an estate plan prepared through Fair-Document, for a service that might otherwise typically cost $3,500 to $5,000. You might think this simply reduces the lawyer’s pay, but attorneys still come out ahead because of what happens next.

…

Instead of conducting the usual phone or in-person interview to educate the new client and collect the needed information, then spending several hours drafting documents, the attorneys let FairDocument walk the client through a lengthy, structured online consultation, explaining the required concepts and collecting the client’s particulars. The software then delivers an initial draft to the lawyer, calling out areas that are likely to require his or her additional judgment or attention. Jason Brewster, the company’s CEO, estimates that FairDocument reduces the time required to complete a straightforward estate plan from several hours to as little as fifteen to thirty minutes, not to mention that his company is doing the prospecting for new clients and delivering them to the attorneys. A more sophisticated example of synthetic intellects encroaching on legal expertise is the startup Judicata.34 The company uses machine learning and natural language processing techniques to convert ordinary text—such as legal principles or specific cases— into structured information that can be used for finding relevant case law.

…

See also computers Ellison, Larry, 115 emissions trading (cap and trade), 168 empathy, 81, 82 employees. See labor market; workplace Energy Star program, 178 entrepreneurship, 44, 95–96, 200, 223–24n15 environmental protection, 168, 195 Environmental Protection Agency, 168, 178 equal opportunity, 170 estate planning, 146–47, 175 ethics, 9–10, 74–75, 79, 81–82, 87. See also moral agency European Union, 143 Experience Music Project Museum (Seattle), 114 expertise, 22–23, 29 expert systems (computer programs), 23 Facebook, 48 face-recognition capability, 40 Fairchild Semiconductor, 223–24n15 FairDocument, 146–47 Fair Labor Standards Act (1917), 171 fairness, 74–75, 102, 162–63 families.

All About Asset Allocation, Second Edition

by

Richard Ferri

Published 11 Jul 2010

These fully retired investors are not as active as they used to be usually because of their own health concerns or those of a spouse. The needs for mature Building Your Portfolio 245 retirees are different from the needs of any other group. Their needs range from health planning, to long-term care, to estate planning. At this stage, financial matters are often discussed with children, other family members, or a professional trustee. Investors in all stages have some similar financial goals and similar concerns. Similar goals include a desire for financial security and the desire to pay less income tax. Similar concerns include the fear of running out of money and the fear of not having adequate health-care coverage when it is needed.

…

At some point, we all need to get our financial house in order and prepare for the afterlife. This means that someone else will be handling your financial affairs eventually. That may occur while you are still alive, and it will definitely occur after you’re gone. It is a common for mature retirees to do detailed estate planning. One of the decisions to make is who will manage their affairs when they are no longer able too. This chore is normally taken over by the healthy spouse while both husband and wife are still living. When there is only one person, the job is typically taken on by a son or daughter, a relative, or a professional representative.

…

When there is only one person, the job is typically taken on by a son or daughter, a relative, or a professional representative. I highly recommend that if you choose a son or daughter to handle your finances, you give them fair warning far in advance. Once a helper has been chosen, that person will need to become informed of your financial situation. This includes an understanding of your estate plan, your investment accounts, and your insurance documents, including knowing where all these things are located in your home. Any financial planner will tell you that the transition of financial responsibility from parents to children can work out either very well or very poorly. There are steps you can take to avoid cost and confusion and to ensure that the transition occurs smoothly.

J.K. Lasser's New Tax Law Simplified: Tax Relief From the HIRE Act, Health Care Reform, and More

by

Barbara Weltman

Published 30 Nov 2010

In 2010, there were dramatic changes affecting each of these taxes, which are levied on transferring wealth. This chapter explains the changes in these transfer taxes for 2010 and what may lie ahead. This area of tax law is about to experience additional changes that certainly will affect your estate planning for years to come. There also may be state estate or inheritance taxes to deal with; state-level taxes are not covered in this chapter but should be discussed with your financial advisor. W Estate Tax Changes If your property (called your “estate”) at the time of your death is worth a certain amount, your estate usually has to file a federal estate tax return and your estate may owe federal estate taxes on the value of your assets.

…

Or if the value of your assets rises (e.g., the stock market recovers and the value of your stocks and stock mutual funds held both personally and in retirement accounts increases), again you may find that the size of your estate is large enough to fall victim to estate tax—or at least the need to plan to minimize or avoid it. Until now, a common estate-planning strategy for married couples with sufficient assets to be subject to the federal estate tax was to set up a credit shelter or by-pass trust so that the exemption amount could be fully used in the estate of the first spouse to die. It worked like this: A will provided that a credit shelter trust (also called a by-pass trust) would be created with an amount equal to the maximum exemption amount.

…

Discuss with your tax or legal advisor new ways to limit the amount of assets passing into a credit shelter or by-pass trust. For example, you may wish to limit the funding of a credit shelter trust to a set dollar amount or a percentage of the estate, or some combination of these two limits. Most important, you’ll want to review any current estate plans in light of estate tax changes that may be enacted for 2011 and future years. Miscellaneous Estate Tax Changes There are a number of changes that can affect the computation of the federal estate tax. Some of these changes are minor or merely technical in nature, but others can have a significant impact on the amount of taxes that will be paid by an estate.

The New Elite: Inside the Minds of the Truly Wealthy

by

Dr. Jim Taylor

Published 9 Sep 2008

But in many respects, wealth brings with it new challenges, new complexities, and new risks, and the do-it-yourself approach that has served them well often becomes a disservice. Four in ten acknowledge that they are not as on top of their finances as they should be. In fact, about half get no professional wealth management advice, relying only on themselves, friends, spouses, and other relatives. This causes problems in areas as basic as estate planning. Over a quarter don’t have an updated will, and they question whether there will be a smooth transition after their death. Nearly one in five expects serious conflict among their relatives after their passing. And consider risk management. Threefourths know that there are property insurance companies that specialize in the challenges faced by wealthy households.

…

On a personal level, three-quarters feel they are not as in control of their finances as they would like to be—by far the highest of any segment. Many struggle with the fear that they could lose all their money and have to start rebuilding their lives all over again, despite their average of nearly $20 million in assets. Less than one in four feels he or she has an organized estate plan and many believe that the distribution of their assets will be a major source of family turmoil and conflict after their death. Virtually none of their kids have a good understanding of the value of their Flavors of Wealth 135 estate. Heck, forget the kids—over half of wrestlers haven’t told their spouses of the degree or nature of their financial empire!

…

In a retail context, they don’t look for an exclusive or luxurious sales environment, nor do they want to be made to feel like they are the most important customer in the store. Instead, they want sales staff who are knowledgeable, are down to earth, and treat them like ‘‘any other person off the street.’’ Mavericks are living in the moment, and are inherently selffocused; as a result, they tend to be less worried about the legacy of their money. In a sense, their estate plans are more often in their minds than on paper. While they are relatively likely to say they envision passing their companies to their children, they are among the least likely to have actually communicated any kind of plan for what would happen in the event of their injury or death. They are so psychologically entwined with their businesses and their ambitions they often find it difficult to think in concrete terms about any kind of exit or succession plan.

Work Optional: Retire Early the Non-Penny-Pinching Way

by

Tanja Hester

Published 12 Feb 2019

It might sound deeply unromantic to think that way, but I think it’s the exact opposite. Knowing that we’re together 100% by choice and that money plays no part in keeping us together—not even a little bit—is extra romantic and relationship affirming. Create Your Estate Plan If you have a partner, children, or anyone else you want to be sure has clear access to your assets after you’re gone, then you’ll want to be sure to have a strong estate plan in place as soon as possible. Depending on the laws in your state, it may not always be clear that your spouse gets automatic access to your accounts, especially if you have children from a prior marriage or other circumstances that create legal confusion.

…

If you wish to engage an estate attorney, keep an eye out for unnecessary add-ons that they may try to push. Financial experts say you do not need a revocable living trust in most circumstances, and an estate attorney who insists that you do is just trying to pad your bill. Find another attorney to work with. Estate planning is also important if leaving behind a charitable legacy is important to you, even if you do not have heirs. Write your will to specify how you’d like your assets divided when you pass on, and update the beneficiaries on all of your financial and insurance accounts to reflect whom you’d like to receive the funds.

…

BULLETPROOF PLANNING CHECKLIST Determine your asset allocation for both long-term growth and risk management. Decide which withdrawal strategy you’ll use. Create your bare-bones budget and determine how you’ll cut expenses if you need to. Determine what your sources of backup capital will be. Make sure you have adequate insurance for your circumstances. Create your estate plan. If you have a partner, discuss how you’ll handle divorce or splitting up. Determine how you could optimize your income to reduce health care costs, if needed. Stay current on financial analysis impacting retirement account, withdrawal strategy, etc. PART III THRIVING IN YOUR WORK-OPTIONAL LIFE Fast-forward to the moment when you can say you’ve done it.

DIY Investor: How to Take Control of Your Investments & Plan for a Financially Secure Future

by

Andy Bell

Published 12 Sep 2013

This is why, in recent years, considerably more small companies have moved from a listing on the main LSE index to an AIM listing. Many stocks listed on AIM are overseas companies. Tax breaks for AIM shares A large number of shares held on AIM become exempt from inheritance tax once they have been held for two years, making them a potential estate-planning tool, although the downside is that the volatility associated with them makes them generally less suitable for investors approaching the end of their life. From 6 April 2014, AIM shares are exempt from stamp duty when they are purchased. Investing in AIM companies AIM companies are all about growth – not dividends – and liquidity is even more of an issue in AIM than it is in the FTSE SmallCap.

…

Onshore bonds are less attractive than they used to be years ago because returns are subject to a minimum tax of between 16 and 20 per cent, irrespective of your tax status. They can be of use to higher rate taxpayers wanting to defer paying tax until a time in the future when they pay tax at a lower rate – for example, in retirement. Offshore investment bonds can be useful estate planning tools in the event you have large sums of money to give away without attracting an inheritance tax liability, but these too need specialist advice. chapter 17 * * * When it all goes wrong – death, divorce, bankruptcy, complaints and the Financial Services Compensation Scheme Nobody likes to dwell on life’s negatives, but it is worth knowing what will happen to your money when significant personal events such as death, divorce or bankruptcy come along, or when an investment or investment provider goes bust.

…

chapter 17 * * * When it all goes wrong – death, divorce, bankruptcy, complaints and the Financial Services Compensation Scheme Nobody likes to dwell on life’s negatives, but it is worth knowing what will happen to your money when significant personal events such as death, divorce or bankruptcy come along, or when an investment or investment provider goes bust. Death and taxes Benjamin Franklin’s famous quote about death and taxes being the only things certain in life serves to underline just how important inheritance tax planning can be for your loved ones. This is a book about DIY investing, not about estate planning, so I am going to go no further than explain what happens to the various assets a DIY investor may have built up in the event of their death. In a nutshell, I would urge you to seek some professional advice and write a will. Intestacy laws do not always lead to the outcomes that you might expect, and society is full of people who have not benefited from their deceased loved one’s estate in the way they had hoped they would, often causing years of resentment and hardship for those affected.

Be Your Own Financial Adviser: The Comprehensive Guide to Wealth and Financial Planning

by

Jonquil Lowe

Published 14 Jul 2010

You have already seen how debt advisers can help (in Chapter 1). This chapter considers overall financial planning and generic advice, insurance M02_LOWE7798_01_SE_C02.indd 38 05/03/2010 09:50 2 n Do you need an adviser? 39 and mortgage advice, equity release, various types of investment advice, and estate planning and tax advice. A quick overview of who to consult is given in Table 2.1. Table 2.1 Types of advice For advice/to find an adviser (see Appendix B for contact details) Debt (Chapter 1) Debt adviser/ money adviser Citizens Advice Consumer Credit Counselling Service National Debtline Payplan Community Legal Advice Money Advice Scotland Advice NI Overall financial planning (all chapters) Independent financial adviser IFA Promotion Institute of Financial Planning Personal Finance Society Generic financial advice (all chapters) Money guidance service Moneymadeclear Insurance (Chapters 3 to 5) Insurance broker Independent financial adviser Insurance providers British Insurance Brokers Association IFA Promotion Institute of Financial Planning Personal Finance Society Mortgage (Chapter 6) Mortgage broker Mortgage providers IFA Promotion Equity release Independent financial adviser Equity release providers IFA Promotion Institute of Financial Planning Personal Finance Society Safe Home Income Plans (SHIP) M02_LOWE7798_01_SE_C02.indd 39 Area of financial Type of adviser planning (where to find information in this book) 05/03/2010 14:27 40 Part 1 n Planning and advice Table 2.1 Types of advice continued Type of adviser Area of financial planning (where to find information in this book) For advice/to find an adviser (see Appendix B for contact details) Government The Pension Service State pensions (Chapters 7 and 8) Independent advice The Pensions Advisory organisation Service Occupational pensions Pension scheme (Chapters 7 and 8) trustees/pensions administrator Independent advice organisation Independent financial adviser Pension scheme trustees Your HR department at work The Pensions Advisory Service IFA Promotion Institute of Financial Planning Personal Finance Society Personal pensions Independent financial adviser IFA Promotion (Chapters 7 and 8) Independent advice Institute of Financial Planning organisation Personal Finance Society Personal pension providers The Pensions Advisory Service Pension transfers Independent IFA Promotion financial adviser Institute of Financial Planning Consulting actuary Personal Finance Society Association of Consulting Actuaries Society of Pension Consultants Stock-market investments Stockbroker London Stock Exchange (e.g. shares and bonds) Association of Private Client (Chapters 9 and 10) Investment Managers and Stockbrokers (APCIMS) Independent Other investments (Chapters 9 and 10) financial adviser Investment providers M02_LOWE7798_01_SE_C02.indd 40 IFA Promotion Institute of Financial Planning Personal Finance Society 05/03/2010 09:50 2 n Do you need an adviser?

…

Table 2.1 Types of advice For advice/to find an adviser (see Appendix B for contact details) Debt (Chapter 1) Debt adviser/ money adviser Citizens Advice Consumer Credit Counselling Service National Debtline Payplan Community Legal Advice Money Advice Scotland Advice NI Overall financial planning (all chapters) Independent financial adviser IFA Promotion Institute of Financial Planning Personal Finance Society Generic financial advice (all chapters) Money guidance service Moneymadeclear Insurance (Chapters 3 to 5) Insurance broker Independent financial adviser Insurance providers British Insurance Brokers Association IFA Promotion Institute of Financial Planning Personal Finance Society Mortgage (Chapter 6) Mortgage broker Mortgage providers IFA Promotion Equity release Independent financial adviser Equity release providers IFA Promotion Institute of Financial Planning Personal Finance Society Safe Home Income Plans (SHIP) M02_LOWE7798_01_SE_C02.indd 39 Area of financial Type of adviser planning (where to find information in this book) 05/03/2010 14:27 40 Part 1 n Planning and advice Table 2.1 Types of advice continued Type of adviser Area of financial planning (where to find information in this book) For advice/to find an adviser (see Appendix B for contact details) Government The Pension Service State pensions (Chapters 7 and 8) Independent advice The Pensions Advisory organisation Service Occupational pensions Pension scheme (Chapters 7 and 8) trustees/pensions administrator Independent advice organisation Independent financial adviser Pension scheme trustees Your HR department at work The Pensions Advisory Service IFA Promotion Institute of Financial Planning Personal Finance Society Personal pensions Independent financial adviser IFA Promotion (Chapters 7 and 8) Independent advice Institute of Financial Planning organisation Personal Finance Society Personal pension providers The Pensions Advisory Service Pension transfers Independent IFA Promotion financial adviser Institute of Financial Planning Consulting actuary Personal Finance Society Association of Consulting Actuaries Society of Pension Consultants Stock-market investments Stockbroker London Stock Exchange (e.g. shares and bonds) Association of Private Client (Chapters 9 and 10) Investment Managers and Stockbrokers (APCIMS) Independent Other investments (Chapters 9 and 10) financial adviser Investment providers M02_LOWE7798_01_SE_C02.indd 40 IFA Promotion Institute of Financial Planning Personal Finance Society 05/03/2010 09:50 2 n Do you need an adviser? 41 Table 2.1 Types of advice continued Type of adviser Area of financial planning (where to find information in this book) For advice/to find an adviser (see Appendix B for contact details) Tax adviser Chartered Institute of Estate planning (Chapter 11) Independent financial adviser Taxation Society of Trust and Estate Practitioners IFA Promotion Institute of Financial Planning Personal Finance Society Tax Tax advisers Chartered Institute of (all chapters Independent Taxation and Appendix A) advice organisation Accountants Tax Aid Tax Help for Older People State benefits Government (all chapters Money advisers and Appendix A) Jobcentre Plus The Pension Service Citizens Advice Community Legal Advice Money Advice Scotland Overall financial planning Independent financial advisers (IFAs) can either help you with specific aspects of financial planning (as described below) or take a holistic approach that aims to sort out all aspects of your finances in an integrated way, often developing a life-long relationship with you in much the same way as you might choose one firm to act as your family solicitor.

…

In some cases, advisers did not draw this adequately to their customers’ attention. When the stock market fell over the period 2000 to 2003, many of these bonds matured with a loss. Around £159 million was paid out in compensation to customers, three large providers were fined and an IFA banned from trading.11 Estate planning and tax advice Tax advice is not regulated by the FSA or by any other statutory regulator. In fact, anyone can set themselves up and call themselves a tax adviser. But many advisers belong to professional bodies that require their members to have qualifications, keep their knowledge up to date through continuous professional development and to behave ethically and professionally in their dealings with clients.

Work Less, Live More: The Way to Semi-Retirement

by

Robert Clyatt

Published 28 Sep 2007

. $29.99 PICL Nolo’s Encyclopedia of Everyday Law............................................................................................... $29.99 EVL Nolo’s Guide to California Law......................................................................................................... $24.99 CLAW ESTATE PLANNING & PROBATE 8 Ways to Avoid Probate ................................................................................................................. $19.99 PRAV Estate Planning Basics . ................................................................................................................... $21.99 ESPN The Executor’s Guide: Settling a Loved One’s Estate or Trust........................................................... $34.99 EXEC How to Probate an Estate in California............................................................................................. $49.99 PAE Make Your Own Living Trust (Book w/CD-ROM)........................................................................... $39.99 LITR Nolo’s Simple Will Book (Book w/CD-ROM).................................................................................. $36.99 SWIL Plan Your Estate............................................................................................................................... $44.99 NEST Quick & Legal Will Book (Book w/CD-ROM) ................................................................................ $19.99 QUIC Special Needs Trust: Protect Your Child’s Financial Future (Book w/CD-ROM)............................... $34.99 SPNT ORDER 24 HOURS A DAY @ www.nolo.com call 800-728-3555 • Mail or fax the order form in this book Price Code FAMILY MATTERS Always Dad...................................................................................................................................... $16.99 DIFA Building a Parenting Agreement That Works.................................................................................. $24.99 CUST The Complete IEP Guide................................................................................................................. $34.99 IEP Divorce & Money: How to Make the Best Financial Decisions During Divorce................................. $34.99 DIMO Divorce Without Court.................................................................................................................... $29.99 DWCT Do Your Own California Adoption: Nolo’s Guide for Stepparents & Domestic Partners (Book w/CD-ROM)....................................................................................................................... $34.99 ADOP Every Dog’s Legal Guide: A Must-Have for Your Owner.................................................................. $19.99 DOG Get a Life: You Don’t Need a Million to Retire Well........................................................................ $24.99 LIFE The Guardianship Book for California.............................................................................................. $34.99 GB A Legal Guide for Lesbian and Gay Couples..................................................................................... $34.99 LG Living Together: A Legal Guide (Book w/CD-ROM)........................................................................ $34.99 LTK Nolo’s IEP Guide: Learning Disabilities........................................................................................... $29.99 IELD Parent Savvy..................................................................................................................................... $19.99 PRNT Prenuptial Agreements: How to Write a Fair & Lasting Contract (Book w/CD-ROM)...................... $34.99 PNUP Work Less, Live More....................................................................................................................... $17.99 RECL GOING TO COURT Beat Your Ticket: Go To Court & Win!

…