Trillion Dollar Triage: How Jay Powell and the Fed Battled a President and a Pandemic---And Prevented Economic Disaster

by

Nick Timiraos

Published 1 Mar 2022

In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest

by

Andrew W. Lo

and

Stephen R. Foerster

Published 16 Aug 2021

In fact, the CBOE has created an index based on this process: the Volatility Index (VIX), usually expressed in percentage of the standard deviation of returns. Historical levels of the VIX are depicted in figure 6.1.66 The VIX has also been called the Fear Index, as a gauge of investor fear: the more uncertain investors are about future stock market values, the higher the VIX. But to describe the VIX narrowly as the Fear Index does it a disservice. The VIX provides the markets with the socially useful function of an insurance mechanism. Through the VIX, not only can you speculate on volatility, but you can also insure yourself against adverse changes in volatility. Scholes recently noted, “Market pricing of options conveys much more information than [do] the spot markets.

Principles of Corporate Finance

by

Richard A. Brealey

,

Stewart C. Myers

and

Franklin Allen

Published 15 Feb 2014

Factoring Arrangement whereby a financial institution buys a company’s accounts receivable and collects the debt. Fair price provision Appraisal rights. Fallen angel Junk bond that was formerly investment grade. FASB Financial Accounting Standards Board. FCIA Foreign Credit Insurance Association. FDIC Federal Deposit Insurance Corporation. Fear index VIX. Federal funds Non-interest-bearing deposits by banks at the Federal Reserve. Excess reserves are lent by banks to each other. Fedwire A wire transfer system for high-value payments operated by the Federal Reserve System (cf. CHIPS). Field warehouse Warehouse rented by a warehouse company on another firm’s premises (cf. public warehouse).

Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis

by

Scott Patterson

Published 5 Jun 2023

The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management

by

Alexander Elder

Published 28 Sep 2014

It is extra useful if you trade shipping industry stocks. NH-NL—I consider the New High–New Low Index the best leading indicator of the stock market and like to write down the latest weekly and daily figures every morning as a refresher. VIX—The volatility index, also called “the fear index.” There is a saying: “When VIX is high, it's safe to buy; when VIX is low, go slow.” A footnote: beware VIX ETFs, notorious for trading out of sync with the VIX index. S&P 500—I write down yesterday's closing price for the index and add the Impulse system initials for its weekly and daily charts. Daily value—I switch to the daily chart of the S&P and note whether its latest bar closed above, at, or below value and also its relation to the channel lines.

EuroTragedy: A Drama in Nine Acts

by

Ashoka Mody

Published 7 May 2018

(Indices of usage of phrases “great moderation” and “irrational exuberance” in books digitized by Google) Source: Google Books Ngram Viewer. concentrated in a few hidden pockets and that over time, financial markets would better serve the common good. As if to validate the great moderation narrative, during the course of 2004, the global “fear” index—the VIX, a measure of future volatility of the US stock market—fell steadily toward 15, well below its historical average of 20. Crucial to the benign “great moderation” view was the growing presence of “independent” central banks. Many economists and policymakers believed that central banks, now impressively insulated from self-serving and shortsighted politicians, had the right incentives and tools to dampen harmful economic booms and prevent—or at least moderate—the busts.

How to Speak Money: What the Money People Say--And What It Really Means

by

John Lanchester

Published 5 Oct 2014

Stress Test: Reflections on Financial Crises

by

Timothy F. Geithner

Published 11 May 2014

Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever

by

Robin Wigglesworth

Published 11 Oct 2021

The Devil's Derivatives: The Untold Story of the Slick Traders and Hapless Regulators Who Almost Blew Up Wall Street . . . And Are Ready to Do It Again

by

Nicholas Dunbar

Published 11 Jul 2011

The original mathematics behind the Black-Scholes formula had gone through several generations of upgrades and refinements since 1973 and was gathering acolytes daily. According to Black-Scholes, the cost of manufacturing options increased with market volatility. Traders learned to use the option price as a kind of “fear gauge,” measuring what the market expected future volatility to be. (In 2005 the CBOE would adopt this fear gauge in the form of a new index called the VIX.) What started out as a valuation recipe for obscure contracts became a crucial tool for generating information that allowed traders to make risk management or investment decisions. It is hard to overemphasize the impact of this financial revolution. The neoclassical economic paradigm of equilibrium, efficiency, and rational expectations may have reeled under the weight of unrealistic assumptions and assaults of behavioral economics.

Systematic Trading: A Unique New Method for Designing Trading and Investing Systems

by

Robert Carver

Published 13 Sep 2015

Rigged Money: Beating Wall Street at Its Own Game

by

Lee Munson

Published 6 Dec 2011

Handbook of Modeling High-Frequency Data in Finance

by

Frederi G. Viens

,

Maria C. Mariani

and

Ionut Florescu

Published 20 Dec 2011

Heads I Win, Tails I Win

by

Spencer Jakab

Published 21 Jun 2016

Clearly, then, sentiment can tell you a lot. As they say, though, talk is cheap. Wouldn’t it be nice if there were a single number based on people who put their money where their mouths are? There is—sort of. The most famous of these is what journalists call the stock market’s “fear gauge.” It’s a misnomer, but the CBOE Volatility Index, or VIX, is an interesting and useful indicator of how much traders are willing to pay to sleep better at night. The VIX as we know it today was developed by a Vanderbilt University professor in 1992 and is based on a Nobel Prize–winning 1973 option pricing formula by Fischer Black and Myron Scholes that, through some complicated math, tells us how much stock volatility is expected over the next thirty days.

Fed Up!: Success, Excess and Crisis Through the Eyes of a Hedge Fund Macro Trader

by

Colin Lancaster

Published 3 May 2021

The Fear Index

by

Robert Harris

Published 14 Aug 2011

If you want the math, it’s calculated as the square root of the par variance swap rate for a thirty-day term, quoted as an annualised variance. If you don’t want the math, let’s just say that what it does is show the implied volatility of the market for the coming month. It goes up and down minute by minute. The higher the index, the greater the uncertainty in the market, so traders call it “the fear index”. And it’s liquid itself, of course – there are VIX options and futures available to trade, and we trade them. ‘So the VIX was our starting point. It’s given us a whole bunch of useful data going back to 1993, which we can pair with the new behavioural indices we’ve compiled, as well as bringing in our existing methodology.

The Investopedia Guide to Wall Speak: The Terms You Need to Know to Talk Like Cramer, Think Like Soros, and Buy Like Buffett

by

Jack (edited By) Guinan

Published 27 Jul 2009

VIX is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which numerically expresses the market’s expectation of 30-day volatility; it is constructed by using the implied volatilities of a wide range of S&P 500 Index options. The results are meant to be forward-looking and are calculated by using both call and put options The VIX is a widely used measure of market risk and often is referred to as the investor fear gauge. There are three variations of the volatility indexes: (1) the VIX, which tracks the S&P 500, (2) the VXN, which tracks the Nasdaq 100, and (3) the VXD, which tracks the Dow Jones Industrial Average. Investopedia explains VIX (CBOE Volatility Index) The first VIX Index was introduced by the CBOE in 1993 and was a weighted measure of the implied volatility of eight S&P 100 at-themoney put and call options.

The Joys of Compounding: The Passionate Pursuit of Lifelong Learning, Revised and Updated

by

Gautam Baid

Published 1 Jun 2020

The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse

by

Mohamed A. El-Erian

Published 26 Jan 2016

Red-Blooded Risk: The Secret History of Wall Street

by

Aaron Brown

and

Eric Kim

Published 10 Oct 2011

Shutdown: How COVID Shook the World's Economy

by

Adam Tooze

Published 15 Nov 2021

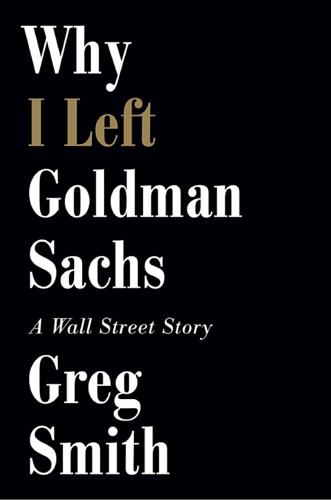

Why I Left Goldman Sachs: A Wall Street Story

by

Greg Smith

Published 21 Oct 2012