subprime mortgage crisis

description: 2007 mortgage crisis in the United States

133 results

Reinventing Capitalism in the Age of Big Data

by

Viktor Mayer-Schönberger

and

Thomas Ramge

Published 27 Feb 2018

See universal basic income UniCredit bank, 136 Unilever, 75 United Kingdom, 134, 147, 164 United States banking crisis in, 134, 135 capital share of, 185 corporate taxes in, 197–198 health care sector in, 213 labor market of, 184, 185, 186, 195 market concentration in, 164 stock market investment options in, 143 subprime mortgage crisis in (see subprime mortgage crisis) universal basic income proposed in, 190, 191 universal basic income (UBI), 189–193, 205–206 University of Pennsylvania’s Wharton School, 36 Upstart, 151 Upwork, 3 used car market, 40 venture capital (VC) firms, 141, 142–143, 216 Vocatus, 55 Volkswagen, 182 Volvo, 182 Wall Street Journal, 203 Walmart, 28, 52 Walt Disney Company, 69 Watson (machine learning system), 109, 111, 113–114, 115, 117, 163, 183 Watt, James, 111, 113 wealth tax, 187 Webvan, 112 WeChat, 147, 163 Wedgwood, Josiah, 94 welfare reducing transactions, 73 Wenger, Albert, 156, 189 Wenig, Devin, 1–2, 209 Wharton School, 36 Which?

…

Data-rich markets promise to greatly reduce the kind of irrational decision-making that led to Yahoo’s crazy stock price in 2014 and to diminish bubbles and other disasters of misinformation or erroneous decision-making that afflict traditional money-based markets. We have experienced the debilitating impact of such market disasters in the recent subprime mortgage crisis and in the 2001 burst of the dot-com bubble, but also in the countless calamities that have affected money-based markets over the past centuries. The promise of data-rich markets is not that we’ll eradicate these market failures completely, but that we’ll be able to greatly reduce their frequency and the resulting financial devastation.

…

In the United States, for example, people selling their cars are required to inform buyers of any major accidents the car has been involved in. Companies listed on the stock market are required to file quarterly financial reports with the stock market regulator, which are then made public. Banks and investment funds, too, must comply with stringent reporting obligations (although, as we have seen in the subprime mortgage crisis, if they bury pertinent information deeply enough, potential investors may not notice). In many jurisdictions, doing business directly with consumers obliges the seller to fully disclose any unusual contractual terms before concluding a transaction. And companies operating in certain sectors, from pharmaceuticals and health care to education and air travel, are required to provide additional information to regulators and the public.

China's Great Wall of Debt: Shadow Banks, Ghost Cities, Massive Loans, and the End of the Chinese Miracle

by

Dinny McMahon

Published 13 Mar 2018

That fact is compounded by an opaque political system steeped in a culture of secrecy; a fast-changing economy that operates in ways radically different from our own; unreliable official data and statistics; and a unique and complex set of incentives that influence the economic decisions of individuals, companies, and the myriad branches of the state. I still feel like the proverbial blind man, and I’m well aware of the imperfection of this book. But when the subprime mortgage crisis hit the United States, people scrambled to make sense of how and why things had gone so wrong when they had seemed so good. As China’s economic woes deepen, people will be looking for similar answers, but they will be harder to find. After ten years during which I tried to make sense of the absurdities of an economy that seemed to keep succeeding in spite of itself, this is my attempt to explain why it’s now unraveling—and why this fact bodes so poorly for the rest of the world. 1 The Black Box HUANG KUN’S FACE no longer has the chubbiness evident in older photos of him.

…

And the shopping strip that had sprung up around where the farmers had been housed seemed longer and busier than before. But the actual numbers told another story. Tieling was losing people. At the end of 2012, Tieling’s combined cities were home to 441,000 people. Two years later, that number was down to 438,000. The city had planned to add 60,000 by 2010, and 200,000 by 2020. Our Subprime Mortgage Crisis The legacy of Tieling’s city-building experiment isn’t simply empty buildings. Regardless of how many people move in or leave, the sheer scale of investment that went into creating New Tieling is such that local authorities will likely be crippled by this financial burden for years to come.

…

According to researchers from the University of Pennsylvania and Peking University, in the decade between 2003 and 2013, China’s biggest, most affluent cities—first-tier cities like Beijing and Shanghai—experienced annual real-price growth of 13.1%; second-tier cities—which include most provincial capitals—grew by 10.5%; and the third tier by 7.9%. In comparison, in the lead-up to the subprime mortgage crisis, U.S. housing prices grew 7.1% on average annually in the four years prior to the market’s peak, in 2006. Consequently, real estate has been a magnet for anyone with money to invest. By 2010, so many state firms had become involved in developing real estate that the central government issued an edict telling them to divest their property arms and to focus more on their core businesses.

The Irrational Economist: Making Decisions in a Dangerous World

by

Erwann Michel-Kerjan

and

Paul Slovic

Published 5 Jan 2010

Thus, as we now move into a period of unprecedented fiscal challenge, it may be a particularly good time to take up disaster policy anew. 19 Catastrophe Insurance and Regulatory Reform After the Subprime Mortgage Crisis DWIGHT M. JAFFEE INTRODUCTION The U.S. federal government and individual states now actively participate in providing catastrophe insurance for all major natural disasters (earthquakes, hurricanes, and floods) as well as terrorism. At this time, the subprime mortgage crisis is also creating catastrophic effects in U.S. loan markets and associated goods markets that clearly require governmental intervention. The experience with catastrophe insurance markets is useful for re-regulating loan markets facing severe distress because originating risky loans with highly correlated loss patterns is tantamount to writing catastrophe insurance.

…

RE-REGULATING LOAN MARKETS IN THE AFTERMATH OF THE SUBPRIME CRISIS I now apply the lessons learned from the long U.S. experience with catastrophes and governmental catastrophe insurance to the issue of regulatory reform in the aftermath of the subprime mortgage crisis. It is important to recognize in this context that making or investing in risky loans with possibly highly correlated losses is tantamount to providing catastrophe insurance. Indeed, the subprime mortgage crisis has created a set of conditions that strongly echoes this country’s experience following the occurrence of major natural disasters and the 9/11 terrorist attacks:7 • Private insurance/loan markets have systematically failed

…

In addition, the available insurance is often not purchased and cost-effective mitigation investments are often ignored.1 As an example of a specific failure, recall that the World Trade Center was the focus of a serious terrorist attack eight years before the fateful attacks of September 11, 2001, and yet few precautions were instituted to stop a new attack or to mitigate its effects. In the same fashion, few precautions were taken to avoid or mitigate the effects of the subprime mortgage crisis. A clear warning sign was the bubble in U.S. housing prices, with home prices far exceeding any normal criterion of affordability for many of the borrowing households. Anticipation of further house price increases maintained the bubble for a while, but a crash was inevitable. Nevertheless, borrowers, lenders, investors, rating agencies, and government agencies either participated actively or watched with benign neglect as the bubble expanded.

The Globalization Paradox: Democracy and the Future of the World Economy

by

Dani Rodrik

Published 23 Dec 2010

The better performing countries—such as China—were not the countries receiving capital inflows but the ones that were lending to rich nations. Those who relied on international finance tended to do poorly. Our article tried to explain why unleashing global finance had not delivered the goods for the developing nations. No sooner had we sent the article to the printer than the subprime mortgage crisis broke out and enveloped the United States. The housing bubble burst, prices of mortgage-backed assets collapsed, credit markets dried up, and within months Wall Street firms had committed collective suicide. The government had to step in, first in the United States and then in other advanced economies, with massive bailouts and takeovers of financial institutions.

…

The Asian financial crisis was followed by reams of analysis which in the end all boiled down to this: it is dangerous for a government to try to hold on to the value of its currency when financial capital is free to move in and out of a country. You could not have been an economist in good standing and not have known this, well before the Thai baht took its plunge in August 1997. The subprime mortgage crisis has also generated a large literature, and in view of its magnitude and momentous implications, surely much more will be written. But some of the key conclusions are not hard to foresee: markets are prone to bubbles, unregulated leverage creates systemic risk, lack of transparency undermines confidence, and early intervention is crucial when financial markets are going belly-up.

…

It will be quite some time before any policy maker can be persuaded that financial innovation is an overwhelming force for good, that financial markets are best policed through self-regulation, or that governments can expect to let large financial institutions pay for their own mistakes. We need a new narrative to shape the next stage of globalization. The more thoughtful that new narrative, the healthier our economies will be. Global finance is not the only area that has run out of convincing story lines. In July 2008, as the subprime mortgage crisis was brewing, global negotiations aimed at reducing barriers to international trade collapsed amid much acrimony and finger-pointing. These talks, organized under the auspices of the World Trade Organization (WTO) and dubbed the “Doha Round,” had been ongoing since 2001. For many anti-globalization groups, they had come to symbolize exploitation by multinational corporations of labor, poor farmers, and the environment.

Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions

by

Joshua Rosenbaum

,

Joshua Pearl

and

Joseph R. Perella

Published 18 May 2009

Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions is a highly accessible and authoritative book written by investment bankers that explains how to perform the valuation work at the core of the financial world. This book fills a noticeable gap in contemporary finance literature, which tends to focus on theory rather than practical application. In the aftermath of the subprime mortgage crisis and ensuing credit crunch, the world of finance is returning to the fundamentals of valuation and critical due diligence for mergers & acquisitions (M&A), capital markets, and investment opportunities. This involves the use of more realistic assumptions governing approach to risk as well as a wide range of valuation drivers, such as expected financial performance, discount rates, multiples, leverage levels, and financing terms.

…

Subordinated includes senior and junior subordinated debt. Equity includes HoldCo debt/seller notes, preferred stock, common stock, and rolled equity. Other is cash and any other unclassified sources. However, beginning in the second half of 2007, credit market conditions deteriorated dramatically stemming from the subprime mortgage crisis. As shown in Exhibit 4.11, the average LBO leverage level decreased from 6.1x in 2007 to 5.0x in 2008. Correspondingly, the average LBO’s percentage of contributed equity increased from 31% to 39% during the same time period (see Exhibit 4.12). EXHIBIT 4.12 Average Sources of LBO Proceeds 1999 - 2008 Source: Standard & Poor’s Leveraged Commentary & Data Group Note: Contributed equity includes HoldCo debt/seller notes, preferred stock, and common stock.

…

See financial sponsors spreading comparable companies precedent transactions springing financial covenant standalone Standard & Poor’s (S&P) Standard & Poor’s Leveraged Commentary & Data Group Standard Industrial Classification (SIC) system standstill agreement stapled financing state law steady state stock-for-stock transaction stock options stock price. See share price stock sale transaction straight-line depreciation strategic alternatives strategic buyers strategic fit strike price. See exercise price structural protections structural subordination stub period subordination provisions subprime mortgage crisis sub-sector sum of the parts super-priority suppliers syndication synergies systematic risk T tangible assets tangible value target management targeted auction advantages and disadvantages tax deductibility tax expense projection of tax regime taxable event T-bills T-bonds teaser sample tender premium tender offer tenor.

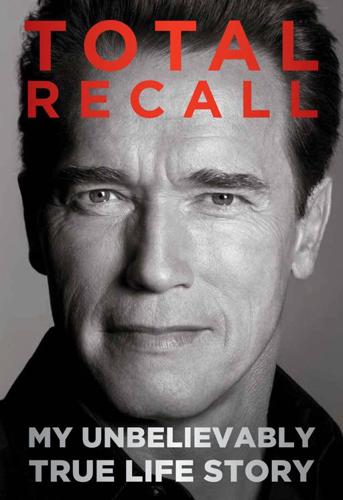

Predictably Irrational, Revised and Expanded Edition: The Hidden Forces That Shape Our Decisions

by

Dan Ariely

Published 19 Feb 2007

Why did they take my wonderful placebo away? Thoughts about the Subprime Mortgage Crisis and Its Consequences For a long time, economists have maintained that human behavior and the functioning of our institutions are best described by the rational economic model, which basically holds that man is self-interested, calculating, and able to perfectly weigh the costs and benefits in every decision in order to optimize the outcome. But in the wake of a number of financial crises, from the dot-com implosion of 2000 to the subprime mortgage crisis of 2008 and the financial meltdown that followed, we were rudely awakened to the reality that psychology and irrational behavior play a much larger role in the economy’s functioning than rational economists (and the rest of us) had been willing to admit.

…

Predictably Irrational Revised and Expanded Edition The Hidden Forces That Shape Our Decisions Dan Ariely To my mentors, colleagues, and students— who make research exciting Contents A Note to Readers Introduction How an Injury Led Me to Irrationality and to the Research Described Here Chapter 1 The Truth about Relativity Why Everything Is Relative—Even When It Shouldn’t Be Chapter 2 The Fallacy of Supply and Demand Why the Price of Pearls—and Everything Else—Is Up in the Air Chapter 3 The Cost of Zero Cost Why We Often Pay Too Much When We Pay Nothing Chapter 4 The Cost of Social Norms Why We Are Happy to Do Things, but Not When We Are Paid to Do Them Chapter 5 The Influence of Arousal Why Hot Is Much Hotter Than We Realize Chapter 6 The Problem of Procrastination and Self-Control Why We Can’t Make Ourselves Do What We Want to Do Chapter 7 The High Price of Ownership Why We Overvalue What We Have Chapter 8 Keeping Doors Open Why Options Distract Us from Our Main Objective Chapter 9 The Effect of Expectations Why the Mind Gets What It Expects Chapter 10 The Power of Price Why a 50-Cent Aspirin Can Do What a Penny Aspirin Can’t Chapter 11 The Context of Our Character, Part I Why We Are Dishonest, and What We Can Do about It Chapter 12 The Context of Our Character, Part II Why Dealing with Cash Makes Us More Honest Chapter 13 Beer and Free Lunches What Is Behavioral Economics, and Where Are the Free Lunches? Bonus Material Added for the Revised and Expanded Edition Reflections and Anecdotes about Some of the Chapters Thoughts about the Subprime Mortgage Crisis and Its Consequences Thanks List of Collaborators Notes Bibliography and Additional Readings Searchable Terms About the Author Credits Copyright About the Publisher A Note to Readers Dear readers, friends, and social science enthusiasts, Welcome to the revised and expanded edition of Predictably Irrational.

…

But if she’s like other people, Didi will use her maximum ability to pay as the starting point for figuring out what mortgage and house to get, and she’ll end up paying three thousand dollars a month for a much bigger, fancier home. She will not have any more flexibility, but she will be much more exposed to the housing market.” I don’t think Dave was very impressed with my arguments. But after the subprime mortgage crisis hit, I had the opportunity to look at some data on interest-only mortgages, and it did appear that instead of providing financial flexibility, all that they achieved was to stretch borrowing and put borrowers at higher risk in a fickle housing market. FROM MY PERSPECTIVE, one of the main failures of the mortgage market was that the bankers didn’t even consider the possibility that people cannot compute the right amount to borrow.

The Bankers' New Clothes: What's Wrong With Banking and What to Do About It

by

Anat Admati

and

Martin Hellwig

Published 15 Feb 2013

This caused many countries, including the United States, Finland, Japan, Norway, Sweden, and Switzerland, to have severe banking crises, all due to losses on real estate and business loans from the preceding boom.38 Boom-and-bust developments in real estate lending again were central to the U.S. subprime mortgage crisis in 2007, the Irish crisis of 2010, and the Spanish crisis of 2012. In the 1980s in Latin America and again since 2010 in Europe, banks have found that even governments can have problems paying their debts if they cannot print the money they owe. In Latin America in the 1980s, support for debtor countries from the IMF got most of the banks off the hook.

…

Policy Research Working Paper 5473. World Bank, Washington, DC. De Mooij, Ruud A. 2011. “Tax Biases to Debt Finance: Assessing the Problem, Finding Solutions.” IMF staff discussion note. International Monetary Fund, Washington, DC. May 3. Demyanyk, Yuliya, and Otto Van Hemert. 2009. “Understanding the Subprime Mortgage Crisis.” Review of Financial Studies 24 (6): 1848–1880. Dermine, Jean. 1990. European Banking in the 1990s. Oxford, England: Blackwell. Dewatripont, Mathias, and Jean Tirole. 1994. The Prudential Regulation of Banks. Cambridge, MA: MIT Press. ———. “Macroeconomic Shocks and Banking Regulation.”

…

See concentration Consumer Financial Protection Bureau, U.S., 249n13 contagion, 61–65; in asset price declines, 63–65, 257n16; in bank defaults, 62–63; in bank failures, 74–75, 78; in banking crises, 65; in bank runs, 52 (See also runs); capital regulation’s impact on, 95; deleveraging and, 64; in financial crisis of 2007-2009, 60–66; in home foreclosures and prices, 245n10; information contagion, 269n24; interconnectedness and, 61, 66, 161, 219; in LTCM crisis of 1998, 72, 258n20, 261n45; in money market fund runs, 62–63; simplest form of, 61–62; in solvency problems, 63; in subprime mortgage crisis, 60–61 contingent convertible bonds (co cos), 187–88; as alternative to equity, 187–88, 316n83; definition of, 187; problems with approach, 188, 316n81; types of triggers for, 316n80 contracts. See specific types convenient narratives, 209–14; liquidity in, 209–12, 330nn12–13, 330n18; reasons for success of, 213–14; solvency in, 211–12 Copeland, Adam, 238n46 core capital, 176, 315n79 Cornford, Francis, 3, 169, 171, 231n11, 303n10 corn subsidies, 198 corporate borrowing: in absence of guarantees, 140–42; alternatives to, 18, 27; in balance sheets, 27, 27f; and bankruptcy, 26, 140–41; costs of, 105, 140–42; creditor standards for, 30, 242n19; default risk in, 105; international differences in, 30, 234n26; limited liability for, 26; nonfinancial versus bank corporations, 7–8, 101, 140; problems caused by burden of, 34–35, 140–42; risk magnified in, 26–31; in taxes, 112, 139–40, 188, 226–27; variation in rates of, 30, 140 corporate equity, 27–30; cost of, 105–7; definition of, 241n12; financial markets as source of, 18, 27–29, 241nn14–16, 246n17, 249n14; increase in, and return on equity, 119; internal growth as source of, 29–30; of public corporations, 241n12; retained earnings as source of, 29, 173; risks of, 101; taxation of, 140, 188 corporate governance: culture of ROE in, 125–28, 284n29; incentives and, 277n13; in public companies, 241n10; regulation of, 127–28, 224, 227; shareholders and, 277n13, 305n24 corporate shareholders, 26–29, 105–7; ban on cash payouts to, 172–76, 182, 189, 223; compared to business owners, 105; conflicts of interest of, 126–27; dilution of, 28, 175, 306n29; dividends paid to (See dividends); governance issues and, 277n13, 305n24; impact of new shares on existing, 28, 175, 182, 241nn14–16, 246n17, 306n29; leverage of, 108; return on equity for (See return on equity); rights offering to, 175; of unlimited-liability banks, 30–31.

Capital Without Borders

by

Brooke Harrington

Published 11 Sep 2016

See also dynastic wealth; inheritance family foundations, 151 family offices, 72–73 Family Wealth: Keeping It in the Family (Hughes), 250–51 fiduciary responsibility: as absent in bankers, 63; duty of care, 45–46, 87; fiduciary capitalism, 272; gendering of fiduciary role, 64–65; ideology of moral leadership supplied by fiduciary role, 249–50; laws governing, 44–46, 315n38, 315n39; patriarchal authority of fiduciaries, 86; private fiduciaries, 252; spreads with expansion of British Empire, 253–54; structural expansion of fiduciary role, 250; in trusts, 173; of wealth managers, 23, 63, 67–68, 76, 79, 82–84 finance: complexity of international financial markets, 272; continuing crises in, 298; defined, 6; deregulation of, 126; dirty work of, 132–33; divorce financial analysis, 162, 331n101; each jurisdiction creates its own legal system for, 237; fiduciary responsibility absent in, 82; as global, 56–57, 60, 128, 253–59; lack of organization at international level, 235; little infrastructure needed for, 255; long-term relationships with clients in financial services, 320n1; payment and privilege in, 59–67; professional innovation in, 279; wealth management as at core of, 6. See also bankers; financial (subprime mortgage) crisis of 2008; offshore finance Financial Action Task Force, 158 financial (subprime mortgage) crisis of 2008: conflict over tax avoidance after, 239; Goldman Sachs in, 63; inequality of subsequent recovery, 201, 211–13; interest in 1 percent renewed by, 195; wealth management in, 19; the wealthy as able to buy when everyone else was selling, 211, 214; world financial crisis nearly destroyed by, 295 financialization, 126, 253, 283, 287, 288 flee clauses, 175, 176, 177 Forbes magazine: Forbes billionaire class, 126; Forbes 400, 195–96, 201, 213–14; on Pritzker family, 13 foundations, 177–81; beneficiaries on managing council, 179; control as characteristic of, 151–52; corporations compared with, 180, 186–87; in defining bounds of family, 277; downsides of, 180–81; in economic inequality, 275; family, 151; in financial architecture created by wealth managers, 6, 271; in Latin America, 178; legal status as persons, 179; modifying to increase their appeal, 185; in Panama, 148, 149, 185; perpetual, 176, 179, 187; privacy and, 152, 153, 180; Roman law origins of, 178; salaries of officers of, 152; for tax avoidance, 150–53; tax risks for, 178, 180, 186; transaction costs of, 180; trusts compared with, 152, 178–80, 186–87.

…

See also TEP (Trust and Estate Planning) certification Steve (Hong Kong–based wealth manager), 139, 257–58, 299–300 stewardship, 83 Stiglitz, Joseph, 230 stocks: British trustees granted power to invest in, 49; buying up after financial crisis of 2008, 211, 214; diversified portfolios, 211; full personal liability for losses to trust and investment in, 49; wealth managers had to become knowledgeable about, 288 subprime mortgage crisis. See financial (subprime mortgage) crisis of 2008 succession planning: for concentrating wealth within families, 215–17, 231; control of, 7; cultural barriers to, 117–18; elites understand, 97. See also inheritance Survey of Consumer Finances, 195 Switzerland: African and Russian wealth held in, 203; client data stolen from, 240; detachment from international treaties, 256; as global center of offshore finance, 106, 129; interviews for this study in, 32; loses its ability to protect assets, 142–43; Nigerian investment in, 259; percentage of offshore wealth held by, 130; Rybolovlev divorce case in, 163; seen as specializing in theft, 296 taboos, 98, 117–18, 120 Tasker, George, 54 tax avoidance: benefits accrue to embodied ancestral legacy, 215–16; Cayman Islands corporations for, 145; citizenship renunciations for, 248–49; colonies for, 254–55; in concentration of wealth, 194; as contentious public issue, 153; creative compliance and, 299, 301, 303; democracy threatened by, 220; economic impact of, 217–21; in economic inequality, 194, 207; exchange funds for, 206; for family businesses, 168, 171; in financial architecture, 7; as increasing, 299; lost revenues due to, 12, 18, 21, 219–20; medieval, 37, 39, 42, 43; moving assets for, 8; as multifaceted and global, 53; Muslim vaqf developed for, 112; no-tax jurisdictions, 128; offshore financial centers for, 125, 128, 133, 134, 135, 136, 174–75, 219; opinion letters for, 210; political instability and concern with, 141; seen as theft, 293; Seoul Declaration sanctions on, 12–13; special privileges of the rich in, 275; states attempt to crack down on, 239–41, 248–49; states relinquish their power to tax effectively, 238–39; STEP on, 225–30; strategies in countries with functional government and rule of law, 150–54; tax evasion distinguished from, 150; in trust-corporation configuration, 9; trusts for, 125, 128, 150–51, 153–54, 155, 173; wealth managers facilitate, 11, 12, 15, 24, 75, 76.

…

But capitalism, as Schumpeter observed, depends on change rather than stability.68 As early as the Enlightenment, recognition of the need for wealth to circulate freely in order for markets to develop created opposition to trusts, entail, and other “market-independent form[s] of allocation of capital.”69 With the growth of global commerce through the nineteenth century, philosophers such as John Stuart Mill noted that “the ‘dead hand’ of the past had hampered the growth of a free economy.”70 Such critiques continue into the present day with the movement by wealthy individuals such as Warren Buffett to ensure that inheritance taxation continues, so that at least some family wealth gets redistributed into the economy.71 Finally, while their intent may be conservative, the methods wealth managers have innovated to achieve stability in their clients’ fortunes can have a profoundly disruptive impact on markets. For example, many of the financial and legal tools they refined to protect clients’ assets also formed the organizational structure of the subprime mortgage crisis. This is particularly clear in the case of “special-purpose vehicles,” which are like the fireproof safes of offshore finance: asset-holding structures designed for the sole purpose of insulating their contents from risk. Put a corporate subsidiary into a special-purpose vehicle, and it is protected from bankruptcy, creditors, and litigants.

The Dealmaker: Lessons From a Life in Private Equity

by

Guy Hands

Published 4 Nov 2021

A continent away, however, something was happening that would have rung alarm bells had any of us realised what it presaged. In April, New Century – a US real estate investment trust specialising in securitisation – had filed for Chapter 11 bankruptcy protection. It was the first collapse in what would become the subprime mortgage crisis and would eventually lead to the great credit crash of 2008. As the deadline for the bid approached, I decided to seek advice from Michael Klein. I had some concerns about the profit warnings issued by EMI in early 2007 and wanted to know whether Citi still believed EMI to be a good investment.

…

While my preference was to reach some sort of compromise with Citi to allow the company to continue to operate under our control, I could only conclude that the IRM’s ambition was to take EMI from me as soon as it could. Meanwhile, Citi were faring badly. Chuck Prince left in November as the bank announced $18 billion in write-downs – one of the biggest casualties of the subprime mortgage crisis. There was every indication that 2008 would be worse. By now banks that had gone under included Lehman Brothers and Washington Mutual. Citi would require the biggest bailout of any American bank as it teetered on the brink. US taxpayers pumped $45 billion into the business, most of which converted into a 34 per cent stake.

…

A., 17 roast potatoes, 45, 295 Rogers, Kenny, 115 Rolling Stones, 172, 175, 205 Rolls-Royce, xi, xv, 7 Roppongi, Tokyo, 136 ROSCOs, 108 Royal Bank of Scotland, 110, 268, 269, 292 Royal Television Society, 198 RTR, 276 Rubin, Robert ‘Bob’, 84 Rudd, Nigel, 166 Rudebox (Williams), 197, 211 Ruegg, Camille, 9 Ruohonen, Marina, 313 Russia, xii–xiii, 125, 158–60 Sade, 169 Sainsbury’s, 266, 284 Sakamaki, Hideo, 124 Saks Fifth Avenue, 81–3 Salisbury, Southern Rhodesia, 4, 5 Samuelson, Paul, 34 ‘Santa Claus Is Comin’ to Town’ (Coots and Gillespie), 181 Savoy Grill, London, 162 Scenario, Contingency and Planning Committee, 308 Sceti, Elio Leoni, 223 Schroders, 172 Schwarzman, Stephen, 163 ScottishPower, 144 securitisation EMI, 169–70, 176, 178–9, 244 Goldman Sachs, 80–81, 83–6, 98, 104, 113, 120, 240, 313 Nomura, 91–2, 104, 109, 110, 125, 129, 313 subprime mortgage crisis (2007–10), 181 SemGroup, 215 Seoul, South Korea, 275 September 11 attacks (2001), 126, 139 Serbia, 196 Sevenoaks, Kent, 26–33, 35, 38, 47, 87, 139, 278 Sex Pistols, xi Shaka Zulu, 17–18, 203 Sheinberg, Eric, 67, 117 Sheppard, Allen, Baron, 100–101, 121 Shibata, Takumi, 93, 96, 138 Shinjuku, Tokyo, 136 Shoreditch, London, 105 Singapore, 76, 222 Singapore Airlines, 156 Sleeper (1973 film), 48 Slough, Judith, 47 ‘Smells Like Teen Spirit’ (Nirvana), 181 Smith, Ian, 4 Soames, Rupert, 53 socialism, 67 sokaiya, 124 solar power, 276 ‘Something Better Change’ (The Stranglers), 63 ‘Somewhere Over the Rainbow’ (Garland), 181 Sony, 131, 172, 231–2 South Africa, 3–4, 5, 6, 8, 17, 25, 254 South Korea, 275 South Sea Bubble (1720), 16 Southern Cross, 268–9 Southern Rhodesia (1923–65), 4 Soviet Union (1922–91), 48 Spain, 9, 249 Spitzer, Eliot, 241 Spotify, 203 Spring Inn, 107 Springer, Gerald ‘Jerry’, 321 Stagecoach, 144 Standard Chartered Bank, 306 Starr, Ringo, 208 Stepstone, 275 Steward, Martin, 198 Stewart, Quentin, 190, 199 Stokes, Iain, 308 Stone, Joss, 207 ‘Story, the’, 3 Stranglers, The, 43, 63 stress, 296–8, 306 strikes, 50 stroke (2018), 289–92, 317 Style Council, 169 subprime mortgage crisis (2007–10), 181, 186, 188, 193–4, 215 ‘Summertime Blues’ (Cochran), 21 Super Bowl, 207 Support Capital, 283 sushi, 98, 111, 127–8 Sweden, 264–6 Sydney, New South Wales, 189–90 synaesthesia, 121 Tabuchi, Setsuya, 92 Taiwan, 275 Talika, 309, 310–11 Tank & Rast, 151–4, 264–5 tax, 69–70, 137, 138, 225, 247 technology 121 telex machines, 68, 69, 70 Tencent, 232 Terra Firma, xiii, 112, 120, 143–90, 193–228, 231–58, 262–85, 295–319 Alliance Boots bid, 164–6, 175, 176, 180, 183 Analyst Programme, 308 Annington Homes, 278, 279–81, 300 AWAS, 154–60, 276, 278 Citigroup litigation (2009–16), 232–58 Consolidated Pastoral Company (CPC), 276, 299 Covid-19 pandemic (2019–21), 305–19 EMI, 166, 169–90, 193–212, 216–28, 231–2, 267–8, 274, 284, 298 EverPower, 276, 285 Food Folk, 283, 300, 309 Four Seasons Health Care, 268–70, 276, 281, 284, 299 Fund I, 149 Fund II, 149–50, 154, 160, 172 Fund III, 161, 172, 267, 268, 274, 275, 276, 283, 284, 298 Fund VI, 273–7, 283 fundraising, 145–50 Géczy appointment (2016), 266–7 General Partners, 190, 233, 234, 269–70, 308 hiring, 150–51 InterContinental bid, 182, 186 Investment Advisory Committee (IAC), 179–80 Man Group bid, 182, 186 McDonald’s, 264–6, 278, 283, 289, 290, 309–10 Naga, 283, 310–11 no regret decisions, 307–8 Nomura and, 225 Odeon Cinemas, 278 Parmaco, 296, 300, 311–13 Project Ford, 273 psychometric/aptitude tests, 313 RTR, 276 Scenario, Contingency and Planning Committee, 308 Support Capital, 283 Talika, 309, 310–11 Tank & Rast, 151–4 tax and, 225–6, 247 Thames Water bid, 175, 176 Welcome Hotels, 283, 300, 302, 305 Wyevale Garden Centres, 270–73, 276, 281–2, 284–5, 299 Tesco, 173, 266 Thames Water, 175, 176 Thatcher, Margaret, 50–53 ‘The Fool on the Hill’ (Beatles, The), 1 Thorley, Giles, 106 Three Musketeers, 157–8 Three-Day Week (1974), 51 Till Death Us Do Part (TV series), 50 Time Out, 36 Toilers of the Sea, The (Hugo), 325 Tokyo, Japan, 72–3, 84, 127, 136, 139, 166, 189, 275 Tombstones, 81 Toronto, Ontario, 146–8 Tory Reform Group, 54, 59 Toys ‘R’ Us, 273 transient ischaemic attack, 291 travel and entertainment (T&E), 73, 97 Treasury, 186 tree planting, 225, 263 triple play, 174 Troubled Asset Relief Program, 222 ‘truck driver’ nickname, 68 Trump, Donald, 285 Tsukiji fish market, Tokyo, 166 Tuckman, Bruce, 95–6, 108, 113, 124 Tumbling Dice, 175 tuna, 166 Tunbridge Wells, Kent, 33, 38 ‘Turning Japanese’ (The Vapors), 89 Tuscany, Italy, 262 type 2 diabetes, 32, 146, 255, 257, 291–2, 294, 296, 306 Ultrastar, 169 ‘Under Toad’, 19, 36, 254, 325 Unique Pub Company, 123 United Airlines, 79 United Kingdom Beast from the East (2018), 284 Big Bang (1986), 77 Brexit (2016–20), 319 climate, 282 Financial Conduct Authority (FCA), 274 general election (1979), 50–53 music industry, 172 taxation in, 69–70, 137, 138, 225–6 United States litigation in, 235, 241 presidential election (2000), 248 Proposition 8 (2008), 248 SEC v.

Meltdown: How Greed and Corruption Shattered Our Financial System and How We Can Recover

by

Katrina Vanden Heuvel

and

William Greider

Published 9 Jan 2009

And while they consider bailing out financial institutions suffering from the subprime scandal, or homeowners fighting foreclosure, they should consider taking the preventive measure of funding civil legal aid programs to fight predatory lenders. Youth Surviving Subprime A L L I S O N K I L K E N N Y March 17, 2008 When i heard about the subprime mortgage crisis,it sounded eerily similar to the shady credit card lending practices found on most college campuses. I imagined yet another financial bubble floating down from Wall Street, filled with the gelatinous slime of adjustable interest rates; one that would inevitably pop somewhere over Poor People, U.S.A., blanketing the unsuspecting citizens below.

…

The government’s big, shiny solution comes in the form of “Project Lifeline,” a program that asks the mortgage lenders to (pretty, pretty please) wait 30 days to foreclose on houses. Really? This is the best we can do? In a great country like America, no con artist, even one who happens to be a banker, should have the right to trick citizens into a scheme like predatory lending. Thirty days’ notice isn’t fair. In the case of the subprime mortgage crisis, the government must stop protecting the banks and Wall Street and start protecting American citizens. Is This the Big One? J E F F FA U X April 14, 2008 For more than a decade,we Americans have been living on an economic San Andreas fault—a foundation of frac-turing competitiveness covered by unsustainable consumer spending with money borrowed from foreigners.

…

This page intentionally left blank Part Four The Road to Recovery ĭ ĭ ĭ This page intentionally left blank How to Fix Our Broken Economy J E F F R E Y M A D R I C K October 22, 2007 The american economyis broken.And it’s not likely that the Democrats, even if they do as well as expected in the 2008 elections, are going to fix it. Of course, there’s no chance that the Republicans will either, wedded as they are to endless tax cuts. The experience of the past decade makes clear the need for a sharply new way of thinking about the economy. The subprime mortgage crisis, although dangerous, is not the issue. It’s not even the rising prospect of recession and lost jobs. The real problem is that even when the financial times have seemed to be healthy, the economy was not. Since the 2001 recession gross domestic product is up, profits are at record levels and unemployment is low—but wages, capital investment and, now, productivity are weak.

How to Kill a City: The Real Story of Gentrification

by

Peter Moskowitz

Published 7 Mar 2017

And because Detroit charges some of the highest household water rates in the country (about $70 a month on average, compared to the national average of $40), nearly a quarter of the population is behind on their water bill. In 2014, the city began shutting off water to those residents, leaving thousands without access to fresh water. Experts from the United Nations called the move a violation of human rights. Detroit, like everywhere else in America, was also hit by the subprime mortgage crisis in the 2000s, only much, much harder. Sixty-eight percent of all mortgages to Detroiters in 2005 were subprime, compared with 24 percent nationwide. Gilbert’s Quicken Loans made some of those loans; others were made by the same banks that demanded Detroit pay them back by slashing city employee pensions during the city’s bankruptcy.

…

See also New York City author’s experience of, 3, 164 challenges to gentrification in, 186–187, 206–208 deindustrialization and, 38, 189 demographics of, 198 evictions in, 183 gentrification of, 4, 8, 31–32, 36, 68, 174, 176–180, 198 LGBT community and, 33 redevelopment of, 174, 180 rezoning and, 179 Brooklyn Anti-Gentrification Network, 206–207 Brooks, David, 26, 66–67 Brownstone Revival Committee, 31–32 Bryant, Disa, 102 Bush, Barbara, 66 Bushwick (Brooklyn), 182–184, 194, 215 business improvement districts (BID), 171–172 Bywater (New Orleans), 6, 16, 43, 45, 46–47, 210 Campanella, Richard, 16, 28 Campos, David, 130 Capitol Park (Detroit), 73–74 Carrera, Miguel, 134 Carrollton (New Orleans), 16 Castro (San Francisco), 128, 159 Central Business District (New Orleans), 16 Central City (New Orleans), 16, 20 charter schools, 27, 49–52 Chelsea (New York), 169–170, 194 Chicago, IL, 42 Chinatown (New York), 176 Chinatown (San Francisco), 131 Christopher Street (New York), 1–2, 166–167 Citizens Committee for Modern Zoning, 189–190 city-as-growth-machine philosophy, 137–141, 188, 192, 203–204 Clay, Phillip, 6, 32–35 Cleveland, OH, 33 Clinton, Hillary, 214 Cobo, Albert, 100–101, 110, 115 Cobo Center (Detroit), 100–101 Columbus, OH, 42 Combs, Sandi, 103–104 community board meetings, 198–200, 211 Concord, CA, 148–150 Conquistadors (business group), 85 Cooley, Phil, 85–87, 93 Corktown (Detroit), 7, 85, 93 Cornwell, Robert, 187 Create: Detroit conference, 78–79 “creative class,” 79–82, 93, 96 Cullen, Matt, 78 Cuomo, Andrew, 168 Dearborn, MI, 109 de-gentrification, 217–218 de-industrialization in New York, 37–38, 189–191, 195 Delany, Samuel R., 210, 215–216 Delano, Frederick, 188 Denton, Nancy, 106–107 Department of Transportation, 42 Detroit bankruptcy of, 7, 77, 83, 87, 96, 99, 192 business startups in, 73–74, 84–85 as “closed loop,” 83, 86 “creative class” and, 79–82, 93 credit ratings of, 42 decline of manufacturing in, 80, 115 demographics of, 78–79, 93, 95, 99, 102 evictions in, 76, 91–92, 102–104, 234 gentrification in, 7, 33, 40, 68, 73–74, 83, 86, 89–90, 91, 95–96, 116 map of, 70 “new Detroit,” 74–77, 83–87, 96, 98 poverty in, 99–100, 118–119 private security and, 94 publicly owned land in, 211 public subsidies to private business in, 96–98 public transportation in, 83, 86–87, 88, 94, 96, 118 racial segregation in housing, 95, 101, 107–110, 115 redevelopment of downtown areas, 7, 72–76, 78, 81, 93–94, 97, 118 rent gap theory and, 77–78 shrinking of municipal boundaries, 83 subprime mortgage crisis in, 99–102 tax revenue and, 41, 92–93, 100–102 Detroit Creative Corridor (DC3), 84 Detroit Eviction Defense, 91, 102–103 Detroit Property Exchange, 103 Detroit Riverfront Conservancy, 86, 98 Dimon, Jamie, 116 dissimilarity index, 107 Dolores Park (San Francisco), 127 East New York, NY, 179, 190, 200, 212–213 Ellis Act, 130–131 Empire Mayonnaise, 36 Engels, Friedrich, 140, 154 Essex Crossing, 176 evictions, 4, 143.

…

Thomas neighborhood/housing projects (New Orleans), 18–20, 29–30, 52–54, 63 San Francisco, CA cost of housing in, 127, 132–133, 151, 214 demographics of, 126, 131, 151 displacement of poorer residents, 8, 126, 129, 131–133, 151 evictions in, 130–132, 134, 149 gentrification in, 8, 40, 68, 131, 137 LGBT community in, 33, 128 loss of culture in, 159 map of, 122 public housing in, 143 racial segregation in, 107 tax revenue and, 41 tech industry and, 8, 133–134, 137–138, 205 tech workers and, 127–128, 133 use vs. exchange values in, 143 Schulman, Sarah, 136, 168, 177, 209, 216–218 Section 8 housing vouchers, 28, 76, 144–145, 151 Sharkey, Patrick, 115–116 Shelnutt, Finis, 53 Sherman, Rachel, 215 “shock doctrine capitalism,” 26, 191 Sigur, Dennis, 59–60 single-room occupancy (SRO) housing, 135 Smith, Lula, 102 Smith, Neil, 9, 34, 36, 37–40, 105–106 SoHo (New York), 172–173, 190–191 Solnit, Rebecca, 130, 133, 141 South Bronx, NY, 193–194 Spitzer, Eliot, 208 Starr, Roger, 193 St. Louis, 113–114 St. Marks Place (New York), 172 Stockholm, Sweden, 142–143 subprime mortgage crisis, 99–102 suburbs, 8, 37, 147, 150–159, 205 activism and, 151 anti-communism and, 154–155 Concord, CA, 148–150 exclusion of minorities from, 95, 109, 114–115, 154–155 exodus of poor people to, 8, 102, 126, 131, 143, 145, 147, 150–153 gentrification and, 117, 147, 151 government subsidization of, 39, 113–115, 117, 157–158 highway system and, 157–158 history of, 153–157 home ownership and, 153–154 Levittown, 154 manufacturing in, 115 movement of gentrifiers from, 22, 33, 35–37, 74, 88, 158–159, 209 profit potential of, 37, 39, 105, 147 public transportation and, 150, 152, 154, 159 selling of suburban culture, 155–157 Talbot, Joe, 125–129, 163 tax incentives, 158, 207 in Detroit, 88, 94, 97, 117 gentrification and, 6, 23 in New Orleans, 60, 62 in New York, 168, 173, 205 in San Francisco, 41, 128, 133–134, 137–138 tax rates, 100, 213 television, 156–157 tenants’ activism, 53–54, 182–187, 215 Thomas, Oliver, 53 Tompkins Square Park (New York), 175–176 Tremé (New Orleans), 16, 47 Tugwell, Rexford, 153 Turner, Nat, 28 unions.

The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America—and How to Undo His Legacy

by

David Gelles

Published 30 May 2022

Under GE’s ownership, WMC became one of the biggest subprime lenders in the country over the next two years, originating about $65 billion in loans to tens of thousands of unqualified homebuyers. And by 2007, all those bad bets were catching up with the economy. Borrowers were defaulting, triggering a massive subprime mortgage crisis and leaving GE—a company most people still thought of as the reliable producer of refrigerators and light bulbs—dangerously exposed. That summer, WMC reported a $1 billion loss. GE scrambled to stanch the bleeding, winding down positions, firing most of the staff, and agreeing to sell WMC for a steep discount.

…

Thanks to a new multiyear contract and what the board called a “Leadership Performance Share Award,” he was in line to receive GE stock that could be worth as much as $233 million. As GE struggled to survive the pandemic, it was also forced to confront unsavory episodes from its past. In 2019, GE finally agreed to settle with the Justice Department for its dealings during the subprime mortgage crisis and pay a fine of $1.5 billion. “We are pleased to put this matter behind us,” the company said in a statement. A decade had passed, and the bad loans issued by WMC, which were then bundled into mortgage-backed securities that poisoned the entire financial system, were still haunting the company.

…

Boone, 57 Pierson, Ed, 156 Pigou, Arthur Cecil, 167–68 Pizzagate, 160 Plank, Kevin, 182 Polaris, 77, 84–85, 107, 116 Polman, Paul, 139–40, 203–7, 211, 217, 220 Powell, Lewis, 36–37, 39 private equity firms: dealmaking by, 2, 51, 54, 57, 70, 105, 110–11, 142, 175–82, 185, 213–14 stakeholder capitalism and, 213–14 Procter & Gamble, 102, 204 profit maximization, see shareholder capitalism Pruitt, Scott, 198–99 public benefit corporations, 212–13 QAnon, 160 Qatar Airways, 130 Rather, Dan, 131 RCA: GE acquisition, 51–54, 56, 57, 95, 152, 175, 176 GE sell-off of, 51–52, 152 RCA Records, 51 Reagan, Ronald, 7, 15–16, 24, 38–39, 47, 51, 65, 95, 196 Reaganomics, 15–16, 93 Real-Life MBA, The (Welch and Welch), 131 Regan, Donald, 39 REI, 215–16 Republican Party, 12, 156–60, 196–200 Restaurant Brands International, 179 Reuters, JW as contributor, 11, 131 Ries, Eric, 139 RJR Nabisco, 57, 70 Robertson, Pat, 134 Rocheleau, Dennis, 44, 56 Rockefeller, John D., 184 Rogers, Tom, 60, 62 Rohatyn, Felix, 51, 95 Roker, Al, 135 Rose, Charlie, 131 Rubbermaid, 77 SABMiller, 178 Sanchez, Lauren, 174 Sanders, Bernie, 162–63 Sarbanes-Oxley Act (2002), 126 Saudi Aramco, 135 Saudi Basic Industries, 137 scandals inside GE, 92–93 Hudson River PCB pollution, 93, 139, 168 Justice Department subprime mortgage investigation, 165, 225 JW divorce and remarriage, 117–20, 174 Kidder Peabody trading schemes, 54–55 pension fund shortfall, 162 SEC accounting fraud suits and settlements, 126, 147–48, 225 SEC long-term-care shortfall investigation and settlement, 164–65 Schrager, James, 107 Schulman, Dan, 207–11, 220 Schwab, Klaus, 211–12 Scott, MacKenzie, 174 Scott Paper, 71 Seamless, 170 Sears, 165 Securities Act of 1933, 65 Security Capital Group, 137 September 11 terrorist attacks (2001), 7, 82, 113–15, 117, 136–37, 138, 228 Seventh Generation, 212 Shad, John, 39 shareholder capitalism: activism for, 149–52 broad acceptance of, 93–95 Business Roundtable and, 37, 93, 214, 223–24 Covid-19 pandemic and, 221–26 critiques of, 70, 72–73, 84–85, 92–97 Friedman doctrine and, 3–4, 6–7, 35–40, 93–94, 229 GE as the most valuable company on earth, 3, 4–8, 20, 34, 50–51, 58, 68, 79, 90, 113, 137, 162, 195, 226 Golden Age of Capitalism vs., 222, 229 impact in corporate America, 8–13, 175–85, 229 JW denunciation of, 151–52 in JW vision for GE, 2–3, 4–8, 20, 33–35, 52, 68, 151–52 stakeholder capitalism vs., 36, 37, 151–52, 203–20, 231 Welchism and, 8–9, see also Welchism Sharer, Kevin, 106 Sheffer, Gary, 39–40 Siegel, Marty, 54–55 60 Minutes (CBS TV program), 42, 131 Six Sigma, 101, 112–13, 127 Skilling, Jeffrey, 124 Sloan, Alfred, 25 Smith, Greg, 190 Smith, Kyle, 89 Sonnenfeld, Jeffrey, 164 Sorscher, Stan, 89 Southwest Airlines, 190 S&P Dow Jones Indices, 165 Spencer Stuart, 78 Spitzer, Eliot, 109–10, 125–26 Sprint, 169 SPX, 77, 105 stack ranking: Amazon and, 171–74 at Ford, 171 at Microsoft, 171 by 3G Capital, 179 at 3M, 112, 171 Vitality Curve at GE, 4, 44–45, 96–97, 152, 171, 172, 174 at WeWork, 171 stagflation, 18, 25, 33 stakeholder capitalism, 203–20, 231 activism and, 149–52 B Corp movement / public benefit corporations in, 212–13 at BlackRock, 213–14 Business Roundtable and, 26, 214, 222–24 at Chrysler, 216 at Delta Air Lines, 215 employee board representation, 216–17 employee compensation, 207–11, 215–16, 220 executive compensation in, 217–18, 219–20 GE as once-model corporate citizen, 4, 16, 20, 21–26, 42–43, 74, 165 long-term view in, 217–18 minimum wage and, 93, 183, 209, 215, 218, 223 nature of, 12–13 need for, 12–13 at PayPal, 207–11, 215, 220 at REI, 215–16 shareholder capitalism vs., 36, 37, 151–52, 203–20, 231 strengthening antitrust policies, 219 sustainability and good governance in, 205–7 taxation in, 23, 218–19 at Unilever, 203–7, 211, 217, 220 upskilling workers, 216 World Economic Forum and, 211–12 see also Golden Age of Capitalism Stanley, Frederick T., 80 Stanley Works, 77, 83–84, 110 Starbucks, 170 Stephanopoulos, George, 157 Stephenson, Randall, 175 Stiglitz, Joseph, 132 stock buybacks, see financialization (generally); financialization at GE stock market performance, see shareholder capitalism Stone, Roger, 196 Stonecipher, Harry, 87–90, 127, 128–29, 187, 191, 194 Stumo, Michael, 194 Stumo, Samya, 194 subprime mortgage crisis, 8, 137–38, 141–45, 148–49, 150, 165, 225 Success magazine, 91, 132 Summers, Larry, 93–94 Sunbeam Products, 71–72 Sundstrand, 87 Swope, Gerard, 22–23, 43 Symantec, 77, 105–6 Taco Bell, 170 TaskRabbit, 170 taxation: “active financing” exception, 62–63 corporate headquarters in Bermuda, 81–82 decline in U.S. corporate taxes, 63 in GE dealmaking, 51, 61, 62–63 in stakeholder capitalism, 23, 218–19 tax breaks for corporate expansion / relocations, 88–89, 173, 219 tax reduction efforts, 10, 63, 81–82, 88–89, 162, 185, 200–201 Trump and, 200–201 terrorist attacks (September 11, 2001), 7, 82, 113–15, 117, 136–37, 138, 228 Tester, Jon, 190 30 Rock (NBC TV program), 139–40 Thomson, 52, 82–84 3G Capital, 177–82, 206–7 3M, 9, 77, 107, 111–13, 127, 171 Tichy, Noel, 77 Tiller, Tom, 84–85, 107, 116 Time Warner, 175–76 Tim Hortons, 179 TiVo, 60, 62, 77 Today (NBC TV program), 117, 135, 195 Todd, Chuck, 160 “total war,” 34 Trani, John, 83–84, 110 Trump, Donald: The Apprentice (NBC TV program), 121, 134–35, 195 business advisory councils, 199–200 Charlottesville, Virginia white nationalist violence (2017), 199–200 conspiracy theories, 158, 160 JW and, 12, 59, 90–91, 121, 134–35, 158, 194–201, 221 presidency, 12, 166, 169, 188, 197–200, 214 Trump International Hotel and Tower, 7, 59, 119, 121, 195 Tungsram, 83 Tyco International, 124–25 Uber, 170, 226 Under Armour, 182 Unilever, 139–40, 203–7, 211, 217, 220 unions: at Boeing, 88, 89, 128–30 at Chrysler, 216 decline of, 46–47, 49–50 employee compensation and, 46–47, 49 JW opposition to, 11, 46–47, 132 United Auto Workers, 216 United Financial Corporation of California, 66–67 U.S.

Big Data and the Welfare State: How the Information Revolution Threatens Social Solidarity

by

Torben Iversen

and

Philipp Rehm

Published 18 May 2022

Moreover, the GSEs tightened the underwriting guidelines for conforming mortgages that lenders had to adhere to8 and increased their quality controls in various ways. These changes were rolled out starting in early 2008, and the beginning of that year therefore serves as a break after which lenders had strong incentives to use more information to accurately assess mortgage applications. From the perspective of our theoretical framework, the subprime mortgage crisis is a discontinuity, at which the effort lenders expend and the amount of information they use to assess mortgage quality sharply increased. Again, the trigger for lenders to acquire more information was regulatory reforms, put-backs in particular, that raised the costs of not accurately identifying default risks.

…

Moreover, the GSEs tightened the underwriting guidelines for conforming mortgages that lenders had to adhere to8 and increased their quality controls in various ways. These changes were rolled out starting in early 2008, and the beginning of that year therefore serves as a break after which lenders had strong incentives to use more information to accurately assess mortgage applications. From the perspective of our theoretical framework, the subprime mortgage crisis is a discontinuity, at which the effort lenders expend and the amount of information they use to assess mortgage quality sharply increased. Again, the trigger for lenders to acquire more information was regulatory reforms, put-backs in particular, that raised the costs of not accurately identifying default risks.

…

Moreover, the GSEs tightened the underwriting guidelines for conforming mortgages that lenders had to adhere to8 and increased their quality controls in various ways. These changes were rolled out starting in early 2008, and the beginning of that year therefore serves as a break after which lenders had strong incentives to use more information to accurately assess mortgage applications. From the perspective of our theoretical framework, the subprime mortgage crisis is a discontinuity, at which the effort lenders expend and the amount of information they use to assess mortgage quality sharply increased. Again, the trigger for lenders to acquire more information was regulatory reforms, put-backs in particular, that raised the costs of not accurately identifying default risks.

Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever

by

Robin Wigglesworth

Published 11 Oct 2021

“So you have a huge group of people making—I put the estimate as $140 billion a year—that, in aggregate, are and can only accomplish what somebody can do in ten minutes a year by themselves.” Seides was somewhat sympathetic to Buffett’s point that many professional money managers in practice do a poor job, but the proposed bet just looked dumb to him. As CNBC was trumpeting in his office that summer morning, the subprime mortgage crisis had just begun to rumble, and Seides thought that things would get worse before they got better. The hedge fund industry’s freewheeling buccaneers looked like they would be far more adept at navigating the coming storm. After all, hedge funds can profit from markets moving both up and down, and invest in far more than just the S&P 500 index of US stocks that Buffett had offered up to fight in his corner.

…

It was a startling success story that attracted envy across Wall Street—nowhere more so than at an ambitious, gung-ho New York investment group called BlackRock. Chapter 13 LARRY’S GAMBIT ON APRIL 16, 2009, ROB KAPITO went to the newly built Yankee Stadium, where the pride of New York was taking on the Cleveland Indians. The economy was in shambles, after the US subprime mortgage crisis triggered a near-fatal heart attack for the global financial system, and many Wall Streeters were desperate for any fleeting distractions. But the balding former bond trader was not there to watch a game of baseball. Kapito was on a secret mission that would not only transform the fortunes of his employer, BlackRock, but change the face of the financial industry.

…

See SampP 500 Stanford University, 68, 185, 187, 188 Starbucks, 238 State Farm Insurance, 145 State Street, 122, 190, 234, 283 ETFs, 175–76, 200–201, 246, 256, 263–64 “Giant Three” scenario, 297–99 SPDRs, 240, 267 WFNIA and, 191 State Street Research (SSR), 216 Stiglitz, Joseph, 28, 280 stochastic movements, 25 stock market crash of 1974, 75, 82, 84 Stocks, Bonds, Bills, and Inflation (Ibbotson), 64, 144 stock splits, 30, 146 Stoneman Douglas High School shooting, 285–87 Stonk meme of 2021, 51 Stulz, René, 254 subprime mortgage crisis, 3, 203, 220–21 Sushko, Vladyslav, 260 sustainability-focused ETFs, 291–92 Swensen, David, 2 Tanger Factory Outlet Centers, 263–64 Taraporevala, Cyrus, 283 Tax Cuts and Jobs Act of 2017, 246 Taylor, Martin, 192 Tecu, Isabel, 295 Tesla, 251–52, 254 thematic ETFs, 241–42, 246 Theory of Investment Value, The (Williams), 40 Theory of Speculation (Bachelier), 21–25, 48 Thiel, Peter, 266 Thiel Macro, 266 Thompson, Hunter S., 56 Thorndike, Doran, Paine & Lewis (TDP&L), 94–102 Thorndike, Nicholas, 94–96, 102, 116–17, 118, 131, 133 three-factor model, 155–56, 159–60 Timken Company, 150n Tint, Lawrence, 189 Titman, Sheridan, 154 Tobin, James, 28 Top Glove, 238 Toronto Stock Exchange (TSE), 179 Treynor, Jack, 45, 70 Trillions (podcast), 17 T.

How I Built This: The Unexpected Paths to Success From the World's Most Inspiring Entrepreneurs

by

Guy Raz

Published 14 Sep 2020

In many ways, you could argue that they helped finance the building of America into the strongest, wealthiest nation the world has ever known, that there was a real purpose behind the services they offered. During the real estate bubble of the early 2000s, however, both firms struggled in vain to resist the pull of mortgage-backed securities on the secondary market—a market so choked with greed that commentators in the aftermath of the subprime mortgage crisis took to calling it a casino because they could find no other purpose for it. The participants acted more like gamblers than investors or money managers—taking bigger risks in search of bigger paydays, regardless of what it took to place those bets, which in this case meant getting lenders to increase the number of mortgages they granted to increasingly uncreditworthy borrowers, just so they had more chips to play with.

…

They had helped hundreds of companies and made thousands of millionaires. Yet neither of these venerable firms, in the end, could survive their own greed. The Beatles told us that money can’t buy you love. Rousseau taught us that money doesn’t buy you happiness. The Bible warns us that the love of money is the root of all evil. And these casualties of the subprime mortgage crisis showed us that money can’t be the primary motivating force behind our businesses. A company that is successful and resilient and that acts as a force for good in the world long after you’re gone has a larger purpose—a mission—at its center. One that you, as founder, are responsible for identifying and articulating from the very beginning, then guarding during times of plenty and leaning on during times of difficulty.

…

See crisis management Chaparral Energy, 167 Charney, Dov, 206–8, 263 chauvinism, 150, 194 Chesky, Brian, 53–61, 71, 142 Chesney, Kenny, xi Chez Panisse, 209–11 Chicken Salad Chick, ix–xii Chicken Salad Chick Foundation, xi Chipotle, 78 Chouinard, Yvon, 260–64 Christensen, Clayton, 14 Clif Bar company culture, 263 competition, 99–100 iterations, 88–92 marketing, 122 offer to sell and growth, 245–47 Cobain, Kurt, xii co-founders, 42–50 of Bumble, 67–68 customer service and, 52 divorce and, 228–31, 257 examples of, 43–44, 48–49 history of, 49 importance of, 42–43 Method development, 44–47 Shopify, 108–9 skill sets, 44 storytelling, 65 tension between, 222–31 Cohen, Ben, 33, 40, 106, 112 Commodore, 217 communication money and, 75–76 signal-to-noise ratio, 126 storytelling, 63–73 tension and, 222–31 See also building buzz Compaq Computer, 267 Computer Dealer (magazine), 218 Conagra, 247, 252 Condé Nast, 226 Conway, Ron, 61 copyright and intellectual property, 159–68 Cosby Show, The, 4, 6 Crate & Barrel, 77 Crawford, Kit, 263 credit card use Airbnb and, 58, 59 Angie’s BOOMCHICKAPOP, 248, 250–51 FUBU and, 29 general, among founders, 23, 53, 61 Method and, 52 online shopping, 107 See also bootstrapping Crest Whitestrips, 63 crisis management, 169–79 divorce, 228–31 of financial nature, 193–94 identity crisis, 239–42 James Burke on, 170–72 Jeni Britton Bauer on, 172–76 lack of, 176–79 partnership tension, 222–28 crowdfunding, 81 crowdsourcing, 123 crucible phase, 137–46 Airbnb example, 143–44 author on, 144–45 defined, 137–38 Drinkworks, 196–97 Jeni’s Splendid Ice Creams, 173 Stonyfield Farm, 139–43 Cuban, Mark, 29 culture, of a business, 203–13 employees and, 208–10 identity crisis, 235–38, 240–41 kindness, 253–64 leaders’ role in, 222–23, 236–37 under a monarch CEO, 205–8 Reed Hastings on, 203–5 values and, 210–13 culture deck, the, 203 customer loyalty customer service and, 52 Glitch, 187 Hangover, The (film), 128 Jeni’s Splendid Ice Creams, 172–76 The Knot, 131 storytelling, 65 Warby Parker, 256 Wells Fargo, 215–16 See also word of mouth D Darwin, Charles, 180 delegation, 204–5 Dell, Michael, 18–21 Dell Computer Corporation, 21 Democratic National Convention (DNC), 2008, 56–57, 122, 142 Dermalogica, 186 Dippin’ Dots, 162–68 Disney, Walt, 136 divorce, 228–31, 257 DNC (Democratic National Convention), 2008, 56–57, 122, 142 DocuSign, 215 Doerr, John, 208 Dots of Fun, 164 Drinkworks, 196–97 Dropbox, 111 Drybar, 131–32, 134 Dual Cyclone (vacuum), 161 Dunn, Andy on company identity, 239–42 education, 270 on partnership tension, 226–27, 228, 230 on self-knowledge, 233–38 Dyson, James, 159–62 E economy AOL and Time Warner merger, 239 Bonobos, 237 Dippin’ Dots, 165–66 Five Guys, 128–29 panic of 1855, 215–16 Stonyfield Farm, 140 subprime mortgage crisis, 193–94 2008 financial crisis, 269 Ecover, 224 Edmonds, Kenny “Babyface”, 112 Eileen Fisher (brand), 257–58 Eldredge, Niles, 180 Ells, Steve, 78 employees company culture, 208–9 empowering, 260–64 kindness, 256–57 partnership tensions, 230 rewarding, 251–52, 258–59 storytelling, 65 talent, attracting, 208–9, 253–64 tensions among, 235–38 values and, 210, 212–13 entrepreneurship co-founders, 42–50 definition and call of, 1–2 demands of, xii–xiii kindness and, 253–55 learning the ropes of, 21 luck vs. hard work, 265–72 managing risk in, 23–24 money challenges and, 82–83 money vs. control, 243–52 origin of word, 22 product iterations, 84–93 research and, 32–33 self-doubt in, 156–57 success, fear of, 191–92 transition into, 27–31 See also funding the business; leadership EO Products, 228–29 Erickson, Gary brand building, 122 employee kindness and, 263 iterative process, 88–92 niche market of, 99–100 on selling vs. staying, 245–47 mentioned, xiv evolution, 180 Exploding Kittens (card game), 81 F Fab, 193 failure AOL and Time Warner merger, 239 Bloq, 224 in dating, 68 fear of, xvi, 95 Firestone ATX tires, 176–77 Gary Erickson on, 92 of identity, 234 mitigating, 30 pivoting from, 186 purpose and value, 192 fallback plans, 29–30 Fallon, Jimmy, 196, 254 Fallows, James, 13, 17 familiarity vs. fear, 13–14, 18–19 Fargo, William, 215–16 Fault in Our Stars, The (Green), 181 FBI, 171 FDA, 171 fear culture, of a business, 236 vs. danger, 13–14 of failure, xiii, xvi, 95 feedback and customer reviews, 90 risk taking and, 1–2, 16, 20 of success, 191–92 feedback and customer reviews, 88–93 Financial Times, 207 Finkelstein, Sydney, 207 Firestone ATX tires, 176–79 Fischer, Mark and Scott, 167 Fisher, Eileen, 257–58, 262 Five Guys, 128–30, 134–36 5-hour Energy, 100–103 five Ps, 224 Fleiss, Jennifer, 149, 195 Flickr, 187 Flynn, Erin Morrison, 223, 228 Foley, John, 270 Forbes, 65 Ford Explorers, 176–79 Fortune, 171, 185 founders.

Global Financial Crisis

by

Noah Berlatsky

Published 19 Feb 2010

In the United States, the Financial Crisis Creates Tent Cities and Homelessness Kathy Sanborn There is a major increase in homelessness and in tent cities across the United States. This is directly related to the joblessness and economic distress caused by the financial crisis. 74 2. Canada Will Not Suffer a Subprime Mortgage Crisis Jonathan Kay 80 Canada had fewer bad mortgages and better lending standards than the United States. As a result, it did not have a housing bubble, and it should avoid the mortgage meltdown that happened in the United States. 3. Australia’s Economy Remains Bound Up with That of the United States Sean Carmody 85 Before the crisis, some commentators had argued that Australia’s economy had decoupled, or separated from that of the United States and the developed world.

…

At least 10–15% of homeless individuals are the “new poor,” or those who have recently lost their jobs and homes. We can be certain that if the economy doesn’t improve soon, there will be more of the new poor pitching their tents in shantytowns across America—maybe in your neighborhood. 79 2 Viewpoint Canada Will Not Suffer a Subprime Mortgage Crisis Jonathan Kay Jonathan Kay is a writer for Canada’s National Post and has also written for Harper’s, the New York Times, and other publications. In the following viewpoint, Kay argues that Canada will not suffer a financial meltdown such as the one in the United States. Kay notes that, unlike America, Canadians did not build up high levels of debt and did not experience a housing bubble.

Boomerang: Travels in the New Third World

by

Michael Lewis

Published 2 Oct 2011

You’re the world’s foremost expert on sovereign balance sheets. You are the go-to guy for sovereign trouble. You taught at Princeton with Ben Bernanke. You introduced Larry Summers to his second wife. If you don’t know this, who does?’ I thought, Holy shit, who is paying attention?” Thus his new investment thesis: the subprime mortgage crisis was more symptom than cause. The deeper social and economic problems that gave rise to it remained. The moment that investors woke up to this reality, they would cease to think of big Western governments as essentially risk-free and demand higher rates of interest to lend to them. When the interest rates on their borrowing rose, these governments would plunge further into debt, leading to further rises in the interest rates they were charged to borrow.

…

Then the financial world began to change again—and very much as Kyle Bass had imagined it might. Entire countries started to go bust. What appeared at first to be a story chiefly about Wall Street became a story that involved every country that came into meaningful contact with Wall Street. I wrote the book about the U.S. subprime mortgage crisis and the people who had made a fortune from it, but began to travel to these other places, just to see what was up. But I traveled with a nagging question: how did a hedge fund manager in Dallas even think to imagine these strange events? Two and a half years later, in the summer of 2011, I returned to Dallas to ask Kyle Bass that question.

The Price of Inequality: How Today's Divided Society Endangers Our Future

by

Joseph E. Stiglitz

Published 10 Jun 2012

But we noted, too, that the crisis had cast doubt on this theory.76 Those who perfected the new skills of predatory lending, who helped create derivatives, described by the billionaire Warren Buffett as “financial weapons of mass destruction,” or who devised the reckless new mortgages that brought about the subprime mortgage crisis walked away with millions, sometimes hundreds of millions, of dollars.77 But even before that, it was clear that the link between pay and societal contribution was, at best, weak. As we noted earlier, the great scientists who have made discoveries that provided the basis of our modern society have typically reaped for themselves no more than a small fraction of what they have contributed, and received a mere pittance compared with the rewards reaped by the financial wizards who brought the world to the brink of ruin.

…

And yet the interest rate charged to students was incommensurate with these risks: the banks have used the student loan programs (especially those with government guarantees) as an easy source of money—so much so that when the government finally scaled down the program in 2010, the government and the students could, between them, pocket tens of billions of dollars that previously had gone to the banks.25 America sets the pattern Usury (charging exorbitant interest rates),26 of course, is not limited to the United States. In fact, around the world the poor are sinking in debt as a result of the spread of the same rogue capitalism. India had its own version of a subprime mortgage crisis: the hugely successful microcredit schemes that have provided credit to poor farmers and transformed their lives turned ugly once the profit motive was introduced. Initially developed by Muhammad Yunus of the Grameen Bank and Sir Fazle Hasan Abed of BRAC in Bangladesh, microcredit schemes transformed millions of lives by giving the poorest, who had never banked, access to small loans.

…

In India the banks seized upon the new opportunities, realizing that poor Indian families would pay high interest rates for loans not just to improve livelihoods but to pay for medicines for sick parents or to finance a wedding for a daughter.28 They could cloak these loans in a mantle of civic virtue, describing them as “microcredit,” as if they were the same thing that Grameen and BRAC were doing in neighboring Bangladesh—until a wave of suicides from farmers overburdened with debt called attention to the fact that they were not the same. THE MORTGAGE CRISIS AND THE ADMINISTRATION OF THE RULE OF LAW When the subprime mortgage crisis finally broke wide open, precipitating the Great Recession of 2008, the country’s response to the ensuing flood of foreclosures provided a test of America”s “rule of law.” At the core of property rights and consumer protection are strong procedural safeguards (such as record keeping) to protect those who enter into contracts.

Crude Volatility: The History and the Future of Boom-Bust Oil Prices

by

Robert McNally

Published 17 Jan 2017

The collapse of the U.S. securities firm Bear Stearns in March 2008 intensified concerns about a financial crisis, and September brought more foreboding signs as Washington was forced to seize the government-sponsored housing lenders Fannie Mae and Freddie Mac.92 On September 14, 2008, the U.S. subprime mortgage crisis erupted into a global financial emergency when Lehman Brothers—the fourth-largest investment bank in the country—declared bankruptcy. Like many other financial institutions, Lehman held enormous amounts of low quality household debt securities. Its failure prompted contagion risk and a widespread collapse in market confidence.

…

Abbot, “Saudis Willing,” 1, 5. 88. Dinnick, “Saudis Will Increase Oil Output.” 89. Abbot, “Saudis Willing,” 1, 5. 90. Editorial, “The Saudi Spigot,” Washington Post. 91. Front Month WTI Crude Futures Prices, Bloomberg. 92. “U.S. Seizes Control of Mortgage Giants,” Washington Post. 93. Duca, “Subprime Mortgage Crisis.” 94. Custom Table Builder, Short-Term Energy Outlook, EIA 95. “Crude Oil Prices See Year of Boom and Bust,” Middle East Economic Survey. 96. Krauss, “Where is Oil Going Next?” New York Times, January 14, 2009. 97. IEA, Impact of High Oil Prices, 60. 10. OIL’S THIRD BOOM–BUST ERA: 2009–?

…

Bank for International Settlements. March 18, 2015. http://www.bis.org/publ/qtrpdf/r_qt1503f.htm. Dombey, Daniel, and Javier Blas. “Naimi Tightlipped on Bush Oil Appeal.” Financial Times, January 16, 2008. Downey, Morgan. Oil 101. New York: Wooden Table Press LLC, 2009. Duca, John V. “Subprime Mortgage Crisis.” Federal Reserve History, http://www.federalreservehistory.org/Events/DetailView/55. Eaton, Jonathan, and Zvi Eckstein. “The U.S. Strategic Petroleum Reserve: An Analytic Framework.” In The Structure and Evolution of Recent U.S. Trade Policy, edited by Robert E. Baldwin and Anne O. Krueger, 237–76.

Naked City: The Death and Life of Authentic Urban Places

by

Sharon Zukin

Published 1 Dec 2009

In one of the most important contemporary projects in New York, the rebuilding of the World Trade Center site, a state agency, the Lower Manhattan Development Corporation, controls the process without a public vote or even a deciding voice for the local community board. The largest contemporary redevelopment project in Brooklyn, Atlantic Yards, on a site Robert Moses picked for urban renewal many years earlier, stirred a lot of public protest but was derailed only by the collapse of financial markets in the subprime mortgage crisis.32 The major difference between Moses’s time and ours lies in a shift from the ideal of the modern city to that of the authentic city. To the extent that the city planning commissioners honor Jane Jacobs’s vision, they say, “If you allow the character of a neighborhood to be eroded, the people who live in that neighborhood will leave the city.”33 Whose character, though, is most authentic?

…

Like landlords, potential homebuyers, white or black, could not get loans to finance the extensive renovations old houses in Harlem required. When they did get loans, often by putting up their homes as collateral, they faced high interest rates and the risk of foreclosure, very much like in the later subprime mortgage crisis. Neither was it possible, even if developers had wanted, to build the same kinds of apartment houses above retail stores that filled the Upper East and Upper West Sides, for much of Harlem was zoned for the “towers in the park” design of high-rise public housing projects. Most important, there was not yet an affluent black middle class, a potentially significant agent of change that would be attracted to Harlem’s stately townhouses and cultural authenticity and could anchor gentrification.

…

If developers can make more money and have less political interference by building ranch homes in the suburbs, they’ll do so, but when that becomes too difficult or costly, they’ll switch to building loft apartments downtown. Concerted, for-profit development strategies were intensified by the overexpansion of global financial markets that began in the 1980s. The Asian economic crisis of 1997 and the subprime mortgage crisis of 2008 showed that this kind of financial homogenization can bring disaster, and the movement of private investment capital into New York City housing markets at that time inflicted unexpected pain. During the 1990s and the following decade private equity funds did not just target penthouse apartments and “trophy” buildings in Manhattan, pressing prices of less costly apartments to rise, but also purchased low-rent apartment houses in Brooklyn, the Bronx, and Queens.

Freedom Without Borders

by

Hoyt L. Barber

Published 23 Feb 2012

If interested, ask your coin or precious metals dealer about the 1/10-ounce $5 American Gold Eagle. In late 2010, these coins were available for $143 each, but you know that price won’t hold for long. Some experts and rich investors have speculated on where gold prices may be headed. John Paulson, a hedge fund tycoon, foresaw the subprime mortgage crisis coming long before anyone knew there was a problem with them. Betting against them, he made a fortune. Right now, he and other sharp-eyed investors are wagering that gold will rise a lot, if not skyrocket. Former Treasury Secretary Henry Paulson feels that the metal—based on current fundamentals and quoting at a moment recently when gold was $1,300 an ounce—could easily reach $2,400 an ounce and possibly go as high as $4,000 an ounce by 2013.

…

See also International real estate Real Estate Equity Investment Strategy (REEIS), 101–2 Recessions, 36, 45 Reciprocal enforcement, 26 Reference letters, 52 Refinancing real estate, 100 Registered agents, 21, 24 Register of Trusts, 27 Repatriation, 3, 83 Residency status, 6, 12, 13, 18 Retirement accounts, 89 Revocable beneficiary, 85 Secondary mining companies, 66–67 Segregated metal, 74 174 Index Silver: bonds, 59; bullion, 46, 72–73; gold-silver ratio, 71; stocks, 71 Singapore, 80 Small Business Investor Visa, 116 Social Security, 39–40, 104 Soft-money cycle, 54, 56 Soros, George, 38 Sovereign investing: global financial crisis, 37–40; overview, 35; personal monetary policy, 43– 48; and recessions, 36; and stimulus plan, 36–37; trends, 40–43 Spain, 123 Stable currencies, 43–44 Stimulus plan, 36–37 St. Kitts, 14–16, 123–24 Stocks: blue chip, 59–60; commodity, 61; crisis-investing, 60–61; defense stocks, 47; energy stocks, 47; global opportunity, 60; gold, 65–66; income, 47, 60; market trends, 41–42; mining, 73–74; silver, 71; in Switzerland, 61–62 St. Vincent, 8, 10, 130 Subprime mortgage crisis, 65 Sugar Industry Diversification Foundation (SIDF), 15–16 Suspicious Activity Report (SAR), 137 Switzerland: annuities, 84–89; bank secrecy in, 64, 80–82, 132; brokerage firms, 51; citizenship, 17; financial-related insurance products, 2, 3; investment management in, 82; life insurance, 89–90; portfolio bond, 82–84; real estate investments in, 62; stocks from, 61–62; tax havens in, 8, 10, 23; weather in, 95 Tax audits, 137–38 Taxes/taxation: in Argentina, 109; of assets, 5; avoiding, 4–5, 7–8, 94–95; beneficiary, 5; doubletaxation treaty, 109; legislation, 135–36; loopholes, 12–14; and recessions, 36, 44; reporting requirements, 133–34; special exemptions, 7; worldwide income tax, 4, 6 Tax havens: in Argentina, 109–10; and bank secrecy laws, 130; in Belize, 110; in Brazil, 110; in Costa Rica, 111; in Ecuador, 110; “flags-of-convenience,” 32; in France, 112; fraudulent transfers, 139–40; general information on, 118–24; “Green List,” 8; in Ireland, 112–13; in Italy, 113–14; in Mexico, 114–15; in Nicaragua, 115–16; and OECD, 8, 23, 50, 81, 117, 127–28; offshore, 2; overview, 108–9; in Panama, 116–17; and “pentapus,” 134–35; and Qualified Intermediaries, 130–33.

House of Debt: How They (And You) Caused the Great Recession, and How We Can Prevent It From Happening Again

by

Atif Mian

and

Amir Sufi

Published 11 May 2014

Adam Ashcraft, Paul Goldsmith-Pinkham, and James Vickery, “MBS Ratings and the Mortgage Credit Boom,” Federal Reserve Bank of New York Staff Report #449, May 2010. 16. Piskorski, Seru, and Witkin, “Asset Quality Misrepresentation.” 17. Yuliya Demyanyk and Otto Van Hemert, “Understanding the Subprime Mortgage Crisis,” Review of Financial Studies 24 (2011): 1848–80. 18. This estimate is based on the ABX index that tracks the value of mortgage-backed securities with mortgage originated in 2007. Chapter Eight 1. Daniel Altman, “Charles P. Kindleberger, 92, Global Economist, Is Dead,” New York Times, July 9, 2003. 2.

…

Sumit Agarwal, Gene Amromin, Itzhak Ben-David, Souphala Chomsisengphet, Tomasz Piskorski, and Amit Seru, “Policy Intervention in Debt Renegotiation: Evidence from the Home Affordable Modification Program” (working paper, University of Chicago Booth School of Business, 2012). 13. Tomasz Piskorski, Amit Seru, and Vikrant Vig, “Securitization and Distressed Loan Renegotiation: Evidence from the Subprime Mortgage Crisis,” Journal of Financial Economics 97 (2010): 369–97. 14. Sumit Agarwal, Gene Amromin, Itzhak Ben-David, Souphala Chomsisengphet, and Douglas Evanoff, “Market-Based Loss Mitigation Practices for Troubled Mortgages Following the Financial Crisis,” (working paper, SSRN, October 2010). 15.

Belt and Road: A Chinese World Order

by

Bruno Maçães

Published 1 Feb 2019