The Wisdom of Finance: Discovering Humanity in the World of Risk and Return

by

Mihir Desai

Published 22 May 2017

These schemes were called tontines. In effect, this is an annuity with an added kicker that you make out like a bandit when you live longer. It also helps the government because they can predict more easily when the last person will die rather than when an average person will die. Tontine-like arrangements remained common through the turn of the last century in the United States as well as Europe. The original site of the New York Stock Exchange was just outside the Tontine Coffee House, a building funded by the creation of a tontine. Scholars estimate that nine million tontine insurance policies were in effect in the United States in the early twentieth century, corresponding to 8 percent of national wealth.

…

The contrast between British and French public finance draws on Weir, David R. “Tontines, Public Finance, and Revolution in France and England, 1688–1789.” Journal of Economic History 49, no. 1 (1989): 95–124; Kaiser, Thomas, and Dale Van Kley, eds. From Deficit to Deluge: The Origins of the French Revolution. Palo Alto, CA: Stanford University Press, 2010; and Hardman, John. The Life of Louis XVI. New Haven, CT: Yale University Press, 2016. The evolution of tontines is covered well in McKeever, Kent. “A Short History of Tontines.” Fordham Journal of Corporate & Financial Law 15, no. 2 (2009): 490–522; Milevsky, Moshe. King William’s Tontine: Why the Retirement Annuity of the Future Should Resemble Its Past.

…

Scholars estimate that nine million tontine insurance policies were in effect in the United States in the early twentieth century, corresponding to 8 percent of national wealth. What could go wrong with these tontines? Well, how would you react if your insurance payouts depended on the mortality of other people? For this wisdom, it’s useful, as it often is, to consult The Simpsons. If you were Mr. Burns, the evil owner of a nuclear power plant, you’d try to kill all those other parties in your tontine, including Bart’s grandfather. That Simpsons plotline provides a great example of how the presence of insurance can create an incentive to alter your behavior, a manifestation of what’s known as moral hazard.

Money Changes Everything: How Finance Made Civilization Possible

by

William N. Goetzmann

Published 11 Apr 2016

From the government’s point of view, over time, as it retired one-quarter of each tontine contract when a holder passed away, the rents paid to survivors gradually declined from 8% to 6% per year. Still, the survivors of the various tontines were a burden to the government, and in 1770, despite the many promises in the document, Abbe Terray, the French controller general, restructured the tontine debts. He replaced all tontines with life annuities paying 10%—regardless of whether the holders were young or old. If Suzanne Elisabeth were alive at age 40 in 1770, this took away a lot of the value of the tontine—she would never get the chance to retire with the promised 186 livres of income.

…

The day she died, one-quarter of the revenues would go to the crown, and three-quarters would go to the survivors in her age group; Suzanne was in the second subdivision, first class of a national tontine. As these young children passed away, the survivors would receive a greater and greater share of the cash flow from the tontine. The tontine contract promises from the very start that the government guarantees the revenue to support the payments with salt and other commodity taxes—and promises that the rentes were exempt from seizure, revocation, or restructuring for any purpose whatsoever—including the needs of the king. FIGURE 19. A French tontine from 1734. This looks like a great deal from a parent’s point of view.

…

FRENCH ANNUITIES Throughout the eighteenth century, France increasingly financed itself through the issuance of life annuity contracts and tontines (i.e., annuities paid to the survivors of a group, rather than to a single individual). As already noted, these types of annuities depend crucially on understanding mortality tables and pricing the contracts accordingly. The tontines were extremely complex instruments, a bit like mortgage-backed securities of our day, except that the cash flows were based on government payments and parsed out to successive tranches of survivors. A typical tontine from this era shows how this worked. It is a four-page printed document with a parchment insert—presumably because parchment can last longer than paper.

100 Baggers: Stocks That Return 100-To-1 and How to Find Them

by

Christopher W Mayer

Published 21 May 2018

And it is what I try to do in my own portfolio: Keep the list of names relatively short. And focus on the best ideas. When you hit that 100-bagger, you want it to matter. CHAPTER 11: STOCK BUYBACKS: ACCELERATE RETURNS What is a “tontine”? If you think a tontine is a rich French pastry, you’re half right. It is indeed French. But a tontine is not a pastry. It is, instead, a tactic for amassing riches that is both legal and nonfattening. But first, I’d like to tell you about a guy named Lorenzo Tonti, from whom the word—tontine—derives. Imagine the scene. The year is 1652. The place: France, during the reign of the House of Bourbon. King Louis XIV broods on his throne. The French treasury is bare.

…

Lampert, a great investor, knows how tontines work. Ever since his involvement, AutoNation has bought back gobs of stock. All told, 65 percent of the shares have been retired. That’s 8.4 percent per year—just from stock buybacks. As Steve Bregman at Horizon-Kinetics, which owns a 5 percent stake in AN, writes, “This is most unusual in scale and duration; one is witnessing—or may participate in—a slow going-private transaction that is taking place in the open market.” The effects have been wonderful for the stock. AutoNation is up 520 percent since the tontine began. Annualized, that’s better than 15 percent per year—for 13 years!

…

Some evidence suggests it was an older Italian scheme that Tonti simply took to the effete French court.) Today, Tonti would be an activist getting in front of CEOs, not kings, speaking of the wonders of retiring shares. And more than a few 100-baggers greedily bought back their own shares when the market let them do so cheaply. Stock Buybacks: Modern Tontines Stock buybacks deserve a separate chapter in a book on 100-baggers because they can act as an accelerant when done properly. A buyback is when a company buys back its own stock. As a company buys back shares, its future earnings, dividends and assets concentrate in the hands of an ever-shrinking shareholder base.

Money for Nothing

by

Thomas Levenson

Published 18 Aug 2020

The insurance came with what would happen over time: as each bondholder died, his or her interest payments would be added to the returns paid to surviving tontine investors, increasing the payout with every death until the last investor was buried. The principal, the loan itself, would never be repaid, but those who bought in and lived long enough could do very well indeed. Best of all, each share of the tontine could be sold to someone else, allowing original investors a way to cash out at any time they chose. Tontines had been attempted in the Netherlands and France but never in England. There, the scheme had to be modified so that investors intimidated by the complexity of its evolving payout could choose a much more bond-like experience, in which they received annual payments at a fixed rate of 14 percent that would expire when they died.

…

(The higher rate was the alternative to the gambler’s chance at the larger payoffs to the longer-surviving tontine adventurers.) With that amendment, Parliament swiftly passed the measure with a target to be raised of £1 million, which received its royal assent on January 26, 1693. As it turned out, the tontine structure was not terribly attractive to the English public. Almost 90 percent of the investors opted to receive the guarantee of the annuity, with its set, high rate of return, and tontines were rarely attempted again in Britain. Even then, placing the loan was slow going; it took until February 1694 to raise the full million pounds.

…

The committee asked Paterson to resubmit his idea, telling him to come up with something that would behave like what we would now recognize as a government bond, offering a “Fund of Interest…where they [the creditor] might assign their Interest, as they please, to any who consented thereto.” In other words: create a kind of loan that people would be able to buy from or sell to others. Paterson accepted the challenge and came back with an unusual form of lending called a tontine. A tontine, named for its inventor, the Italian banker Lorenzo de Tonti, is the bastard child of a bond and a kind of insurance, its payouts triggered by the deaths of individual bondholders. Investors paid in their money in return for interest payments; Paterson proposed the rich figure of 10 percent per year, later lowered to 7 percent.

Why Wall Street Matters

by

William D. Cohan

Published 27 Feb 2017

Farther east on Wall Street, at around 70 Wall Street, stood one of the lone trees—a buttonwood tree, which we now call a sycamore—that had survived the Revolutionary War intact and thus had metaphorical importance to the young nation. Under that tree, a small group of brokers had already been in the business of buying and selling the new nation’s Treasury debt. They had also been meeting and trading at the Tontine Coffee House, farther east on Wall Street, which was named after a seventeenth-century method of raising capital devised by Lorenzo de Tonti, an Italian, and which was particularly popular in France. The traders were not pleased that the Treasury had appointed the “auctioneers” its exclusive agents.

…

So when we imagine that Wall Street is the sole cause of all financial calamities, that is not even remotely correct. It’s a crucial point to remember. Of course, that doesn’t mean Wall Street hasn’t been involved in, or exacerbated, its share of financial turmoil. In March 1817, the brokers who had been trading for years on Wall Street at the Tontine Coffee House and under the buttonwood tree decided to organize themselves more formally in what they called the New York Stock and Exchange Board. They rented a room at 40 Wall Street and started meeting regularly. The purpose of the organization, the precursor of what became the New York Stock Exchange, or the NYSE, was for the president of the board to announce on a daily basis the prices for which the stocks of the companies listed on the exchange were bought and sold.

Nerds on Wall Street: Math, Machines and Wired Markets

by

David J. Leinweber

Published 31 Dec 2008

In 1792, the New York Stock Exchange was a bunch of guys standing around a buttonwood tree at 68 Wall Street shouting at each other on days when it didn’t rain or snow: We like our markets to be liquid, efficient, resilient, and robust. But this is hard to do when all the participants have to crowd around a tree and hope for good weather. So in 1794, we see the first big technological solution: the roof. Everybody moves inside, to the Tontine Coffee House at the corner of Water and Wall streets. They’re still shouting, but they’re dry. Even when they’re warm and dry under a nice cozy roof, you can have only so many shouters participating in a market, and more participants is a good thing. Pretty soon technology solves this problem. An Illustrated History of Wir ed Markets 11 Hand signals and chalkboards worked really well.

…

MIT recently merged its Artificial Intelligence Laboratory and Computer Science Laboratory, reflecting this merger of ideas. Along the path from hand signals to Deep Blue and the World Wide Web, we’ve seen some remarkable market applications of technology. This isn’t going to stop. We’ve come a long way since the traders moved from under the buttonwood tree into the Tontine Coffee House, but we’ve really just moved indoors in our use of information technologies. There is so much written about information overload that we have an information overload information overload. But as we have seen, technological patterns repeat. An Illustrated History of Wir ed Markets 29 Living through a technology revolution isn’t easy.

…

See Troubled Asset Relief Program technological innovation on Wall Street, computer, 22–28 stock ticker, 18–20 telegraphy, 13–16 ticker tape, 19–20 See also artificial intelligence, MarketMind, QuantEx telegraphy early, 13–18 Wall Street after, 6 Wall Street before, 6 Tetlock, Paul, 208, 212 textual system, 203–226 ticker tape, 19–20 “painting the tape”, 256 Tontine Coffee House, 10, 28 trading cost, 128–130 Andre Perold on, 132 traffic analysis, 52–53, 219–20, 237, 261 Treynor ratio, 92 Treynor, Jack, 228, 250 Treynor ratio, 92 Troubled Asset Relief Program, 315–317 NABI, 315–320, 323 valuation method, 118 virtual charting, 166–167 Visible Marketplace, 50, 83, 88 visual programming – spreadsheets, 35–36 352 Index visualization dynamic market, 45–46 innovative abstract, 47–49 Map of the Market, 46–47, 246 MarketTrac, 45 Visible Marketplace, 50, 83 volume weighted average price, 41, 44, 49 VWAP.

The Blue Sweater: Bridging the Gap Between Rich and Poor in an Interconnected World

by

Jacqueline Novogratz

Published 15 Feb 2009

Most people, strapped for cash, bought and sold a great deal of their goods on credit. Overall, money was scarce in the marketplace. However, the women still managed to save. Just as I would see in Kenya and other African countries, the Rwandan market women had created a traditional system of saving and lending among themselves. Known as merry-go-rounds, or tontines, these small groups of a half dozen or so women would come together on a regular basis, weekly or monthly. Each would contribute about $1 each time the group met. At the meeting, one member would be given the total amount collected to use for whatever she required. As the women became more successful, they would sometimes contribute more than a dollar; and sometimes the group as a whole would put the extra money aside for group savings.

…

See also Blue bakery; Duterimbere; Kigali (Rwanda) Agnes’s view of, 185–86 Akagera National Park in, 51 bartering in, 65–66 bride price in, 62–63 change in, pace of, 90 churches and religion in, 68 coffee in, 58 community work in, 55 culture of, 155 description of, 41 domestic violence in, 54, 63 economy of, 42 Family Code legal system in, 62–63 food in, 114–15 genocide in (1994), 146, 151–54, 164, 167–74, 190 justice system in, 111–13, 190 juxtapositions in, 51–52 Lake Kivu, 51, 106, 121 Liberal Party in, 187 Ministry of Family and Social Affairs, 14, 42, 73, 78 moneylending system in, 58–59 Muslims in, 42, 163 Novogratz and arriving, 36–37 first hearing of, 13 first job in, 34–38 gratitude of, 211 learning curve of, 51 returning, 162–63 points of interest in, 51 postgenocide, 163–79, 195 reconstruction of, 195, 199–201 refugees, 122, 172–74 reputation in, 111 rich in, 87–88, 116 sunflower project in, 47–49 trust in, 107 vaccination of children in, 50 women in, 14–15, 40 Rwandan Patriotic Front (RPF), 167, 177–78, 185, 192, 195, 199 S Sadangi, Amitabha, 247–59, 277 Sahni, Varun, 229–30 Saiban (low-cost housing organization), 238–47 Seko, Mobutu Sese, 122 September 11, 2001, terrorist attacks, 225–27 Shah, Anuj, 259–60 Shaw, George Bernard, 126 Siddiqui, Tasneem, 238–40 Sister Mary Theophane, 4 Socialism, 147 “Social mobilization” effort, 50 Socrates, 143 Somalia, 155 South Africa, 159, 162, 184 Stanford’s Graduate School of Business, 120, 128, 135 Street kids in Brazil, 7–8 Suffering, 175, 274, 282–83 Sullivan, Lisa, 155–56, 159–62 Sumitomo Chemical Company (Japan), 258–59, 260 Sunflower project, 47–49 T Taj Mahal (India), 117 Tanzania, 1, 146–51, 158–59, 255, 259 Technology, 209 Telemedicine, 224 Tennyson, Alfred, 273 Theodore (Honorata’s husband), 168–69 Three Guineas Fund, 231 Tontines (merry-go-rounds), 59 Toole, Dan, 113–16, 146–51, 153, 201, 220 Treadle pumps project, 247–48 Trelstad, Brian, 282 Trust, 107, 112, 280, 2239 Tutsis, 13, 63, 169, 185–86, 188, 194–95, 199 Tutu, Desmond, 159 24 Next Generation Leadership (NGL), 157–62, 184 U Uganda, 17–19 Umuganda (“community work”), 55 UNICEF, 37–39, 49–50, 53, 91, 95, 97, 104, 112, 147–48, 163, 214, 258 Unilever, 250 Unions, labor, 161 United Nations Development Program, 38, 85 United Nations’ Millennium Development Goals, 261 United States Agency for International Development, 38 University of Virginia, 5 U’wa community, 158 V Valerie (Liliane’s daughter), 177, 201 Venkataswamy, Dr.

The Ascent of Money: A Financial History of the World

by

Niall Ferguson

Published 13 Nov 2007

And there would be a sustained effort to consolidate the various debts that the Stuart dynasty had incurred over the years, a process that culminated in 1749 with the creation by Sir Henry Pelham of the Consolidated Fundl.13 This was the very opposite of the financial direction taken in France, where defaults continued to happen regularly; offices were sold to raise money rather than to staff the civil service; tax collection was privatized or farmed out; budgets were rare and scarcely intelligible; the Estates General (the nearest thing to a French parliament) had ceased to meet; and successive controllers-general struggled to raise money by issuing rentes and tontines (annuities sold on the lives of groups of people) on terms that were excessively generous to investors.14 In London by the mid eighteenth century there was a thriving bond market, in which government consols were the dominant securities traded, bonds that were highly liquid - in other words easy to sell - and attractive to foreign (especially Dutch) investors.15 In Paris, by contrast, there was no such thing.

…

tenants see landlords; rented accommodation Tennessee 59 ‘term auction facilities’ 9 terrorism/terrorist attacks 176 financial consequences 5-6 hedging against 228 New York and London 6 nuclear or biological 223 Texas 170. see also Dallas textile industry 135 Thailand 312 Thatcher, Margaret 252 ‘Third World’: loans and aid to 307 see also emerging markets ‘thrifts’ see Savings & Loan Tibet 339 tobacco 141 token coins 51 Toler, James 256-8 tontines 76 Torcy, Marquis of 138 Torrijos, Omar 310-11 tourists, currency controls on 305 trade unions: Argentina 111 growth and decline of power 116 and productivity 211 ‘tranched’ debts 4 transatlantic banking 53 treaty ports 291 ‘trilemma’ 306 triple-A rated investment grade securities 268 Trollope, Anthony 235 Trustee Savings Banks 294 trust, money and 29-30 Ts’ui Pên 111 Tugwell, Guy 231 tulip bubble 136 Tunisia 2 Turkey/Turks 37. see also Ottoman Empire Tversky, Amos 344-5 UBS (bank) 322 uncertainty 183. see also certainty; risk underwriters 187 unemployment 269 and credit 40 in Great Depression 160 and hyperinflation 105-6 Keynes on 106 United Arab Emirates 337n.

Money, Real Quick: The Story of M-PESA

by

Tonny K. Omwansa

,

Nicholas P. Sullivan

and

The Guardian

Published 28 Feb 2012

Banks have not provided a solution, as the minimum balances required are too onerous to maintain for people who constantly shift money in and out of “pockets” (school, food, farm, emergencies, etc.). The poor and unbanked have instead created their own informal vehicles, such as merry-go-rounds, ASCAs (accumulated savings and credit associations) and ROSCAs (rotating savings and credit associations), aka susus and tontines, depending on the region of the world. These mechanisms are local, based on a high degree of trust, and flexible. They work best when people stick to a regular schedule for savings and withdrawals, but account for slips in regularity without punishing the offenders. At this point there is some evidence that M-PESA is being used for savings, usually as a short-term storage mechanism rather than a long-term, lump-sum mechanism.

The Snowball: Warren Buffett and the Business of Life

by

Alice Schroeder

Published 1 Sep 2008

A type of auto insurer called “nonstandard” specializes in these customers, surcharging them, say, 80%. USAA and GEICO at the time were “ultra-preferred” companies, specializing in the best risks. 26. The main problem with tontines was that people were gambling with their life insurance policies instead of using them as protection. Originally a “survivor bet,” expulsion from a tontine pool was later based on failure to pay premiums for any reason. “It is a tempting game; but how cruel!” Papers Relating to Tontine Insurance, The Connecticut Mutual Life Insurance Company, Hartford, Conn.: 1887. 27. Office Memorandum, Government Employees Insurance Corporation, Buffett-Falk & Co., October 9, 1951.

…

Now, the door to the insurance world is one most people would rather stayed firmly nailed shut. But insurance was taught in business schools, Warren had studied it at Penn, and there was an aspect of it a little like gambling that intrigued the oddsmaker in him. He had become interested in an insurance scheme called a tontine, in which people pool their money and the last survivor gets the whole pot. But tontines were now illegal.26 Warren had even considered actuarial science—the mathematics of insurance—as a career. He could have spent decades toiling over tables of mortality statistics, handicapping people’s life expectancies. Besides the obvious ways this suited his personality—which tended toward specialization; relished memorizing, collecting, and manipulating numbers; and preferred solitude—working as a life actuary would have let him spend his time pondering one of his two favorite preoccupations: life expectancy.

Energy: A Human History

by

Richard Rhodes

Published 28 May 2018

In 1858 a new entity, the Seneca Oil Company of New Haven, Connecticut, swallowed up the Pennsylvania Rock Oil Company.44 Banker James Townsend and his fellow New Haven investors took control, brought in a new associate, a local man named Edwin L. Drake, and elected him president. It was Drake, improbably, who would find a way to release petroleum from its stone detention underground. Townsend had befriended Drake in the Tontine, the New Haven hotel where they both lived. Drake had moved there with his young son in 1855 after the death of his wife in childbirth the previous year. In 1858 he was thirty-eight years old, tall, slim, black-bearded, and engaging, a religious man who rarely swore but whose fund of stories filled hotel evenings with laughter.

…

., 134, 135, 136, 161, 163–64 New Brunswick, 141, 142–43 Newcastle upon Tyne, 10, 11–12, 16, 43, 44, 45, 77, 83, 86, 87, 89 Newcomen, Thomas, xi–xiii atmospheric steam engine of, xi–xii, 37–42, 51, 52, 57, 64, 112 New Discovery of a Very Large Country (Hennepin), 186 Newfoundland, 130, 163 New Haven, Conn., 144, 147, 151, 155, 156, 191 Tontine Hotel in, 150 New Haven Gas Light Company, 144, 149 New Jersey, 60, 264, 268, 296, 313–14 New London, Conn., 163 New Orleans, La., 136, 145 New Patriotic Imperial and National Light and Heat Company, 122, 123 Newport, R.I., 135 Newton, Isaac, 35 New York, 145, 150, 153 Long Island, 142 New York, N.Y., 59, 191, 197, 204, 303 Brooklyn, 190 Central Park, 207 Gansevoort Market, 208 Greenwich Village, 212 Manhattan, 207–8, 212, 302 population of, 215 Times Square, 308 Wall Street, 145 New York & New Haven Railroad, 150 New York Central Railroad, 294 New Yorker, 293–94 New York State Supreme Court, 199 New York Times, 245, 289 Niagara Falls, 185–87, 186, 190, 199–206 generation of power from, 203–6, 205, 206 Niagara Falls Power, 202–3 Niagara River, 186, 199, 204 Suspension Bridge over, 200 Niagara State Reservation, 199, 200, 202 Nith River, 112 nitric oxide, 171 nitrogen, xii, 19, 25, 109, 171, 213 nitrous oxide, 116, 118, 171 Nixon, Richard, 302 Nobel Prize, 321, 322–23 North, Francis, 43–44 North America, 7, 130, 140, 142 North American Free Trade Agreement (NAFTA), 302–3 North American Kerosene and Gas-Light Company, 142 North Atlantic Treaty Organization (NATO), 284, 285 North Carolina, 139, 140 North Sea, 6, 87 Northumberland, 90 Northumberland Colliery, 86 Northumbria, 92 Norwich University, 201 Nova Scotia, 140, 141, 142 Novelty, 98, 99 nuclear fission, 271, 272, 274–78, 276, 283, 284, 290–92, 315, 334 nuclear power, xii, xiv, 8, 83n, 272–92, 308, 314–25 radiation exposure from, 316–25, 319, 332–37 Oak Ridge, Tenn., 278, 281 Oak Ridge National Laboratory, 314, 315 Obama, Barack, 309 Ocean River, 163 Ocmulgee, 163 Oerlikon Machine Works, 203 Oersted, Anders, 178 Oersted, Hans Christian, 177–80, 180, 181, 182, 204n Ohio River, 143, 286, 287 Ohio State University, 237 oil, 101, 164, 339–40 burning of, 108 camphor, 139 castor, 138 coal, 140, 141, 143–44, 150, 158, 159 fish liver, 107 flax, 107, 119 fulmar, 107 jojoba, 164 medicinal, 144–45, 146 olive, 107 peanut, 138 purified, 144 rape, 107, 119, 138, 143 rock, see petroleum vegetable, 134 walnut, 107 whale, xiii–xiv, 125, 143, 144 Oil Creek, 144–48, 150, 152–53, 154, 156–59, 165, 166–67, 266 Oil Creek Railroad, 159 Olmsted, Frederick Law, 199 Olszewski, Stanislas, 258, 259 omnibuses, 207–8, 209 Ontario, Lake, 185 ore: aluminum, 204n iron, 64, 65, 66, 109, 166 uranium, 292 Ovid, 10 oxen, 7, 209, 210 Oxford University, 114 oxygen, 25, 115, 171, 241 Oystermouth Tramroad, 85 Pacific Ocean, 134, 135, 319 Paddock, Ichabod, 128 Panama Canal, 294 Papin, Denis, xi, 27–35, 37–39 1679 digester of, 28–29, 29, 39, 51–52 Paradise Lost (Milton), 9–10 parallel connection system, 194–96, 194 Paricutin volcano, 299 Paris, 26, 61, 110, 119, 120, 178, 180, 191, 202 Champs-Elysses in, 122 Paris Centennial Exhibition, 202, 203 Paris International Exposition of Electricity (1881), 258 Pasadena, Calif., xii, 300 Pastore, John O., 285 Patagonia, 134 Pavia, University of, 173 Peale, Rembrandt, 124 Peale, Rubens, 124 Peale family, 124 Peale Museum, 124 Peale’s Baltimore Museum, 124, 124 Pearl Harbor, Japanese attack on, 265 peat, 94, 113, 130 Pennsylvania, xiii, 144–47, 149–55 Venango County, 144, 145, 167 Pennsylvania militia, 59 Pennsylvania Railroad, 294 Pennsylvania Rock Oil Company, 147, 150 Pennsylvania Supreme Court, 165 Penydarren Ironworks, 74 Pepys, Samuel, 5 Perseverance, 98 Persian Gulf, 249–50, 256, 257 Peru, 79, 135, 212–15 “Petition of the Poor Chimney Sweepers of the City of London to the King,” 11 petroleum, 144–60, 157, 166–67, 187, 235, 237–39, 249–57, 301 abundance of, 146, 155–57, 159, 165 accidents with, 159 analysis and development of, 147–51 companies formed for production of, 147, 150–51 crude, 49, 148, 150, 159, 237 distillation of, 149, 167 drilling for, 151, 152–56, 152, 154, 225, 254–56 exporting of, 167 federal taxation of, 159–60 first lease signed for, 146 “fresheting” of, 157–58, 158, 159 historic August 1859 strike of, 155, 156 investment in, 167 loss and waste of, 158, 165, 167 pumping of, 166 refining of, 157, 159–60, 167 transport of, 157–58, 159, 167, 266–68 underground, 166 valuable properties of, 144–46, 147–48, 149 see also gasoline Petroleum Industry War Council Committee, 265, 267 Phebe, 137 Philadelphia, Pa., 59, 111, 124, 143, 161, 168, 215–16 Independence Hall in, 124 Philby, Harry St.

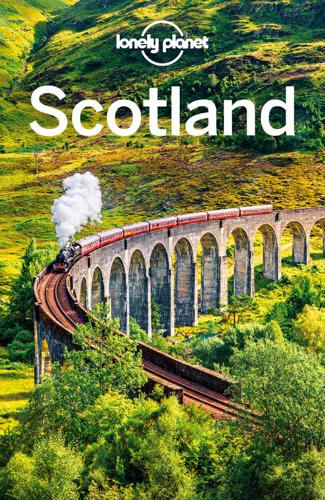

Lonely Planet Scotland

by

Lonely Planet

The art gallery has some fine pieces, and several canvases give you an idea of just how busy Greenock's harbour once was. There's also a pictorial history of Greenock through the ages, while upstairs are small displays from China, Japan and Egypt. The natural history section highlights species extinction in the modern world. There are free internet terminals here. 4Sleeping & Eating Tontine HotelHOTEL££ (%01475-723316; www.tontinehotel.co.uk; 6 Ardgowan Sq; s/d £68/78, superior s/d £88/98; pW) This noble hotel in the nicest part of Greenock has appealing recently refurbished rooms that provide comfort without taking away from the building's older features. Superior rooms in the old part of the building are more spacious.

…

If you want to zero in on the largest of the Ridings, head to Jedburgh for the Jethart Callant's Festival. 4Sleeping Rosetta Holiday ParkCAMPGROUND£ ( GOOGLE MAP ; %01721-720770; www.rosettaholidaypark.com; Rosetta Rd; tent site for 1/2 £12/20; hApr-Oct; pW#) This campsite, about 800m north of the town centre, has an appealing green setting with lots of trees and grass. There are plenty of amusements for the kids, such as a bowling green and a games room. It also has static caravans of various grades for week-long stays. Tontine HotelHOTEL££ ( GOOGLE MAP ; %01721-720892; www.tontinehotel.com; High St; s £60, d £110-120; pW#) Right in the heart of things, this is a bastion of Borders hospitality. Refurbished rooms have high comfort levels, modish colours and top-notch bathrooms, while service couldn't be more helpful. There's a small supplement for rooms with four-poster beds and/or river views.

…

oColtman'sBISTRO, DELI££ ( GOOGLE MAP ; %01721-720405; www.coltmans.co.uk; 71 High St; mains £11-19; h10am-5pm Sun-Wed, 10am-10pm Thu-Sat; W)S This main street deli has numerous temptations, such as excellent cheeses and Italian smallgoods, as well as perhaps Scotland's tastiest sausage roll – buy two to avoid the walk back for another one. Behind the shop, the good-looking dining area serves up confident bistro fare and light snacks with a variety of culinary influences, using top-notch local ingredients. Tontine HotelSCOTTISH££ ( GOOGLE MAP ; %01721-720892; www.tontinehotel.com; High St; mains £11-19; hnoon-2.30pm & 6-8.45pm; W) Glorious is the only word to describe the Georgian dining room here, complete with musicians' gallery, fireplace and fabulous windows. It'd be worth it even for cat food on mouldy bread, but luckily the meals – ranging from pub classics like steak-and-ale pie to more ambitious fare – are tasty and backed up by very welcoming service.

In Pursuit of Privilege: A History of New York City's Upper Class and the Making of a Metropolis

by

Clifton Hood

Published 1 Nov 2016

John and Alexander Anderson patronized coffeehouses and taverns; went to the circus, museums, and the theater; and promenaded on the Battery.20 Although these venues were social spaces where people of different backgrounds mixed, most of the encounters with people from other social orders that the brothers recorded in their diaries occurred in the political realm, particularly as the outbreak of the Napoleonic Wars heightened partisan rivalries between Republicans and Federalists. John, a fervent Republican, described “a number of people, english & french” who rejoiced at France’s recapture of Toulon by dancing around French and American flags at the Tontine Coffee House and, several days later, a group of “citizens, & Frenchmen” who paraded through the streets for the same purpose.21 His brother detailed a scrap that broke out between “Aristocrat[s] & Democrat[s]” at the Tontine and a public meeting “where a multitude had assembled” to advocate that the United States remain neutral in the fighting.22 A COUSINS’ WORLD: NEW YORK’S UPPER CLASS AND THE REVOLUTIONARY WAR These political tensions and conflicts were real enough.

Revolution at Point Zero: Housework, Reproduction, and Feminist Struggle

by

Silvia Federici

Published 4 Oct 2012

Refusal to be without access to land has been so strong that, in the towns, many women have taken over plots in public lands, planted corn and cassava in vacant lots, in this process changing the urban landscape of African cities and breaking down the separation between town and country.14 In India too, women have restored degraded forests, guarded trees, joined hands to chase away the loggers, and made blockades against mining operations and the construction of dams.15 The other side of women’s struggle for direct access to means of reproduction has been the formation, across the Third World—from Cambodia to Senegal—of credit associations that function as money commons.16 Differently named, “tontines” (in parts of Africa) are autonomous, self-managed, women-made banking systems, providing cash to individuals or groups that can have no access to banks, working purely on the basis of trust. In this, they are completely different from the microcredit systems promoted by the World Bank, which functions on the basis of shame, arriving to the extreme (e.g., in Niger) of posting in public places the pictures of the women who fail to repay the loans so that some have been driven to suicide.17 Women have also led the effort to collectivize reproductive labor both as a means to economize on the cost of reproduction, and protect each other from poverty, state violence and the violence of individual men.

Green Economics: An Introduction to Theory, Policy and Practice

by

Molly Scott Cato

Published 16 Dec 2008

So far this proposal has not been implemented, but as a plan it contains many aspects of a green approach to pension provision. The Swedish JAK bank takes a mutual approach to the need to borrow money that is reminiscent of early building societies and savings schemes that people in poor communities continue to use, such as the tontines of West Africa. This sort of framework could be applied to pensions policy. In the JAK system saving and borrowing is seen as a way of balancing your needs across your own life, with support from other members. This is illustrated in Figure 11.3, which centres around a single person’s lifetime income generation, illus- GREEN WELFARE 183 Individual contribution over the life-course Period of social credit Childhood requirement for community support Requirement for community support in old age Figure 11.3 Illustration of the ability to provide for one’s individual needs over the productive life-course Source: Thanks to Chris and Tracey Bessant of New Clarion Press for permission to use this figure.

The First Tycoon

by

T.J. Stiles

Published 14 Aug 2009

—SALMAN RUSHDIE, Midnight's Children Contents List of Illustrations List of Maps Part One CAPTAIN 1794–1847 1 The Islander 2 The Duelist 3 A Tricky God 4 Nemesis 5 Sole Control 6 Man of Honor Part Two COMMODORE 1848–1860 7 Prometheus 8 Star of the West 9 North Star 10 Ariel 11 Vanderbilt 12 Champion Part Three KING 1861–1877 13 War 14 The Origins of Empire 15 The Power to Punish 16 Among Friends 17 Consolidations 18 Dynasty Epilogue Acknowledgments Bibliographical Essay Notes Primary Source Bibliography Illustrations INSERT FOLLOWING PAGE 106 Phebe Vanderbilt The Quarantine, Staten Island Sophia Johnson Vanderbilt Battery Park The Fly Market Tontine Coffee House Thomas Gibbons Bellona Hall Destruction of the Lexington A view of New York Cornelius Vanderbilt Daniel Drew George Law William H. Vanderbilt's farmhouse Cornelius Vanderbilt San Francisco, 1848 INSERT FOLLOWING PAGE 298 Abandoned ships, San Francisco, 1849 Greytown Harbor San Juan River San Carlos Virgin Bay San Juan del Sur San Francisco, 1851 The Narrows Steamship Row Cornelius K.

…

Investors in New York began to meet six times a week for formal stock auctions at the Merchants' Coffee House on Wall Street; between sessions, they clustered outside under a buttonwood tree to trade informally. In 1792, they formalized the stock market with the Buttonwood Agreement, setting fixed commissions for brokers (or “stockjobbers”) and establishing the Tontine Coffee House at the corner of Wall and Water streets as a physical exchange (though the informal “curb market” continued to thrive).27 These new institutions laid a foundation that was absolutely essential for the future. But their immediate scope and impact should not be exaggerated. The stock market remained small for many years, because there was little stock to trade.

…

As seen here, women both sold and purchased goods amid the densely built-up city, where packs of pigs and dogs roamed freely Collection of the New-York Historical Society Young Vanderbilt inhabited the lower social and economic tiers of a world captured in Francis Guy's 1820 painting of the corner of Wall and Water streets. To the right, the ships can be seen moored along South Street. On the left, with flag, is the Tontine Coffee House, the city's first financial market. Collection of the New-York Historical Society An aristocratic Southern planter who settled in Elizabethtown, New Jersey, Thomas Gibbons was Vanderbilt's mentor and only employer. He turned a personal dispute into an attack on the Livingston family's monopoly on steamboats in New York waters.

Empire of Pain: The Secret History of the Sackler Dynasty

by

Patrick Radden Keefe

Published 12 Apr 2021

But IMS was still a going concern, and a year after Frohlich’s death executives at IMS made an astonishing discovery. Frohlich, they learned, had entered into a secret agreement with the Sackler family whereby Raymond and Mortimer Sackler would inherit a majority ownership stake in the company following his death. The agreement was known as a tontine, an antique investment instrument, with origins in seventeenth-century Europe, in which a number of participants band together in what is effectively a mortality lottery, pooling their funds with an understanding that the last investor to die will win everything. But what the IMS executives had actually stumbled upon was the residue of the four-way musketeers agreement that the brothers had made with Bill Frohlich on a snowy night in New York City back in the 1940s.

…

“most beautiful villa”: Mortimer Sackler to Martí-Ibáñez, Aug. 29, 1969, FMI Papers. then pass out: Tanner, Our Bodies, Our Data, 28. immediately took charge: Interview with Richard Leather. diagnosed with a brain tumor: Tanner, Our Bodies, Our Data, 28. secret agreement: Ibid., 29. known as a tontine: Interview with Richard Leather; Tanner, Our Bodies, Our Data, 29. four-way musketeers agreement: Interview with Richard Leather. two written agreements: Ibid. obscuring their brother’s involvement: Tanner, Our Bodies, Our Data, 29. $37 million: Ibid. “Four people founded IMS”: RDS 2019 Deposition.

MONEY Master the Game: 7 Simple Steps to Financial Freedom

by

Tony Robbins

Published 18 Nov 2014

The Latin word annua is where we get our word annual, because the original Romans got their income payment annually. And, of course, that’s where the word annuity comes from! How’s that for “exciting” water cooler trivia? In the 1600s, European governments used the same annuity concept (called a tontine), to finance wars and public projects (again keeping a cut of the total deposits). In the modern world, the math and underpinnings of these products are still the same, except governments have been replaced by some of the highest-rated insurance companies, including many that have been in business for well over 100 years; insurance companies that stood the test of time through depressions, recessions, world wars, and the latest credit crisis.

…

., 160 tax-advantage accounts, 235, 472 tax efficiency, 287–89, 402 taxes, 35–37 capital gains, 277 and compounding, 235, 277–78, 279, 445–46 deferring, 235, 236, 278, 279, 408 and depreciation, 285–86 and exclusion ratio, 421n and 401(k)s, 149–50, 152, 235, 472 future, 149–50, 153, 236 and home ownership, 308 income, 277, 290 and moving to another place, 288–90 and mutual funds, 111, 114, 119, 279, 472 and planning, 235–36 and PPLI, 444 and rebalancing, 362 reducing, 273–80 tax loss harvesting, 362–63 T-bills, 316 T-bonds, 316 teachers, 266–67 technology, 87 and agriculture, 264 artificial intelligence (AI), 569, 570 cloud computing, xxvii computers “R” us, 569–71 disruption caused by, 264–65 email, 553 and energy, 556–57 exponential growth of, 564–65 food, 566 genome project, 565 as hidden asset, 549–53 and internet expansion, 560–61 jobs in, 264 and living standards, 554–55 Maker Revolution, 559–61 medical, 410, 551–52, 557–59, 562, 566–68 nanotechnology, 562, 567 robotics, 562 SwipeOut, 596–600, 602 3-D printing, 410, 561–62, 567, 568 technology wave, 562–63 TED Talks, 18, 39, 67 Templeton, Sir John, 61–62, 350, 351, 456, 524, 540 author’s interviews with, 61, 79, 455, 540–45 on gratitude, 79, 347, 544–45, 577 and philanthropy, 62, 541, 542, 602 and savings, 62, 63, 542–43 on trust, 542 1035 exchange, 171 Tepper, David, 263, 517 Teresa, Mother, 541 Tergesen, Anne, 426–27 testosterone, 197, 334 Thaler, Richard, 66–67, 249 Thatcher, Margaret, 69 Think and Grow Rich (Hill), 19 $13 trillion lie, 93, 97 Thompson, Derek, 431 Thoreau, Henry David, 341, 576 3-D printing, 410, 561–62, 567, 568 Three to Thrive, 211–12, 225–26, 292, 585 TIAA-CREF, 169, 402, 447–48, 470 Tier 1 capital, 442 time: and compounding, 311, 312 diversifying against, 355 value of, 287, 570 time-weighted returns, 118–19, 121 timing, 62, 256, 348–66 and dollar-cost averaging, 355–59, 363, 365–66, 613 getting in front of a trend, 270 and long-term investing, 351 market, 97, 296, 300, 354, 380, 471–72 mistake in, 177, 348 and mob mentality, 348–49 and patterns of investing, 359 and probabilities, 361 and rebalancing, 359–62 and tax loss harvesting, 362–63 and volatility, 363 tipping point, 90, 193 TIPS (Treasury inflation-protected securities), 305, 316–17, 328, 329, 374, 473, 474 tithing, 602 T-notes, 316 Today, 349–50, 485 tontines, 167 training, retooling our skill sets, 264, 265 transformation, 185, 195 Trebek, Alex, 301 Trichet, Jean-Claude, 518, 520 Truckmaster truck driving school, 259 Trump, Donald, 210 trust, absence of, 119–20, 125, 542 trust deeds, 313 Tubman, Harriet, 345 Tullis, Eli, 491 Turner, Ted, 595 TWA, 318 Twain, Mark, 11, 481, 566 Tyson, Mike, 6, 53, 60 uncertainty/variety, 75 Unconventional Success (Swensen), 469 unemployment, 264, 265 unicorns, 14n, 99, 180, 331, 350 United Parcel Service (UPS), 60 United States: income ladder in, 263 national debt of, 149, 236 states with no income tax, 290 Unleash the Power Within (UPW), 15, 194, 559 Unlimited Power (Robbins), 18 255–56 Uram, Matt, 551–52 Usher, 15, 18 Ustinov, Peter, 549 US Treasury bonds, 305, 316–18, 328–29, 400, 473, 474 US Treasury money market fund with checking privileges, 303 V2MOMs, xxvi value, added, 193, 261, 262–63, 265, 268, 269, 272, 343, 595, 611 value investing, 486 Vanguard Group: annuities, 169, 402 founding of, 470, 476–78 index funds, 95, 97, 113, 143, 144, 157, 472 mutual funds, 10, 477 return after taxes, 235 target-date fund, 163, 181 variety/uncertainty, 75 Venter, Craig, 566–67 Vichy-Chamrond, Marie de, 238 Virgin Airways, 173 volatility, 104, 301, 321, 356, 358, 363, 382, 390 wage, minimum, 263 Walton, Sam, 76 Ward, William A., 54 Warren, Doug, 138 water, potable, 565–66, 599–600 wealth: creation of, 64 final secret of, 588–606 growing, 176 keeping, 295 kinds of, 576 and living trust, 448–49 secrets of ultrawealthy, 442–49, 614 tithing, 602 without risk, 181 wealth calculator, 234, 236, 611 Wealth Mastery seminars, 332–33 Weissbluth, Elliot, 128–31 whale blubber, 556 Where Are the Customers’ Yachts?

The Trains Now Departed: Sixteen Excursions Into the Lost Delights of Britain's Railways

by

Michael Williams

Published 6 May 2015

‘I particularly enjoyed this work when the “Rattlers” [the Ford railcars] broke down away from Kinnerley. A platelayer’s trolley was acquired and Sid and myself pumped our way to the scene of the disaster. This seemed often to take place when they were doing a run to Criggion, and failure usually took place in the vicinity of the Tontine Hotel! Among other things he taught me was that classic “It Was Christmas Day in the Workhouse”.’ With his ragbag collection of prehistoric locomotives and carriages, Colonel Stephens fought hard but eventually lost his battle against the motor bus. His appeal to prospective passengers to ‘travel across country away from the dusty and crowded roads on home-made steel instead of imported rubber’ fell on deaf ears.

Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty

by

Abhijit Banerjee

and

Esther Duflo

Published 25 Apr 2011

Self-help groups (SHGs), popular in parts of India and found in many other countries as well, are savings clubs that also give loans to their members out of the accumulated savings of the group. In Africa, the most popular instruments are rotating savings and credit associations (ROSCAs)—more commonly known as “merry-go-rounds” in English-speaking Africa and as tontines in Francophone countries. ROSCA members meet at regular intervals, and all deposit the same amount of money into a common pot at every meeting. Each time, on a rotating basis, one member gets the whole pot. Other savings arrangements include paying deposit collectors to take their deposits and put them in a bank, depositing savings with local moneylenders, leaving them with “money guards” (acquaintances who take care of small sums of money for a little fee, or for free), and, as we saw, slowly building a house.

Scotland Travel Guide

by

Lonely Planet

Many yards went into liquidation in the 1960s, and in 1972 Upper Clyde Shipbuilders was liquidated, causing complete chaos, a sit-in and a bad headache for Ted Heath’s government. Now the great shipyards of the Clyde are mostly derelict and empty. The remains of a once-mighty industry include just a handful of companies still operating along the Clyde. Sleeping & Eating Tontine Hotel HOTEL ££ ( 01475-723316; www.tontinehotel.co.uk; 6 Ardgowan Sq, Greenock; s/d £65/75, superior s/d £85/95; ) Spend the extra for the superior rooms at this noble hotel in the nicest part of Greenock. These spacious chambers are in the old part of the building, and have been recently refurbished, with good bathrooms.

…

Sunflower Restaurant RESTAURANT ££ ( 01721-722420; www.thesunflower.net; 4 Bridgegate; mains £10-15; lunch Mon-Sat, dinner Thu-Sat) The Sunflower, with its warm yellow dining room, is in a quiet spot off the main drag and has a reputation that brings lunchers from all over southern Scotland. It serves good salads for lunch and has an admirable menu in the evenings, with creative and elegant dishes that always include some standout vegetarian fare. Tontine Hotel RESTAURANT WITH ROOMS ££ ( 01721-720892; www.tontinehotel.com; High St; mains £7-14; lunch & dinner; ) Glorious is the only word to describe the Georgian dining room here, complete with musicians’ gallery, fireplace, and windows the like of which we’ll never see again. It’d be worth it even if they served catfood on mouldy bread, but luckily the meals – ranging from pub classics like steak-and-ale pie to more ambitious fare – are tasty and backed up by very welcoming service.

The Village Effect: How Face-To-Face Contact Can Make Us Healthier, Happier, and Smarter

by

Susan Pinker

Published 30 Sep 2013

During a field trial lasting ten years, women visiting new mothers in rural India reduced infant deaths by 70 percent (in comparison with matched control villages). Abhay T. Bang et al., “Neonatal and Infant Mortality in the Ten Years (1993 to 2003) of the Gadchiroli Field Trial: Effect of Home-Based Neonatal Care,” Journal of Perinatology 25, no. S1 (2005): S92–S107. In Youndé, Cameroon, women belonging to voluntary associations called tontines—which are social networks of a sort—are more likely to use condoms and encourage their use among their close friends. T. W. Valente et al., “Social Network Associations with Contraceptive Use among Cameroonian Women in Voluntary Associations,” Social Science and Medicine 45, no. 5 (1997); Ann Swidler, “Responding to AIDS in Sub-Saharan Africa,” in Successful Societies: How Institutions and Culture Affect Health, ed.

Investment: A History

by

Norton Reamer

and

Jesse Downing

Published 19 Feb 2016

With the French Revolution beginning in 1789 and the Napoleonic Wars lasting until 1815, disruption and destruction in France and the Low Countries cleared the way for a rising England.67 88 Investment: A History The American Experience In the United States, the federal government floated $77.1 million in debt in 1790 to pay back costs incurred by the American Revolution, giving birth to the first US public debt markets.68 On May 17, 1792, the Buttonwood Agreement (so named because it was signed under a buttonwood tree by twenty-four stockbrokers) was executed. Soon, in 1793, the Tontine Coffee House in New York City became a forum for trading government debt and equities, while many of the stockbrokers’ colleagues traded securities in the street nearby.69 The Buttonwood Agreement created what is today the New York Stock Exchange. It is of interest that the agreement specified that the brokers were to deal directly with one another and that commissions for trades would be twenty-five basis points (or one-fourth of 1 percent).

Money: 5,000 Years of Debt and Power

by

Michel Aglietta

Published 23 Oct 2018

Such costs could not be sustained by the goldsmiths; their short-term financing was totally inadequate to these demands. Thanks to the establishment of the new sovereign, it had become possible to levy a loan by mobilising the nation’s savings on a large scale. This took place in three stages from 1693 to 1694, through the tontine, the lottery and, most importantly, the creation of a banking establishment of a new type, the Bank of England, whose characteristics we defined in Chapter 3. The transformation of capitalism in England was truly a textbook case for the theory of money that considers it as a fundamental social relation underpinned by sovereignty.

How the Scots Invented the Modern World: The True Story of How Western Europe's Poorest Nation Created Our World and Everything in It

by

Arthur Herman

Published 27 Nov 2001

Alexander Bogle alleged that “all the merchants in Glasgow . . . are quite idle for one half or two-thirds of the year” when their ships were at sea and so had to find other ways to keep themselves occupied. They joined the Literary Society of Glasgow, and the Sacred Music Institution, and founded the Hodge Podge Club, which invited luminaries such as Adam Smith and Thomas Reid to speak. They gathered in the coffee room of the Tontine Hotel for polite conversation or a glass of rum punch, the drink of choice among the Tobacco Lords and Glasgow’s West Indian merchants. It was tobacco merchant George Bogle who cast the deciding vote on the university board of regents enabling Francis Hutcheson’s friend William Leechman to become professor of theology, over the objections of Presbyterian hard-liners.

Never Let a Serious Crisis Go to Waste: How Neoliberalism Survived the Financial Meltdown

by

Philip Mirowski

Published 24 Jun 2013

Technologies for both facilitating and taking advantage of personal “failures of plasticity” have proliferated in the neoliberal era; here we simply opt to describe two colorful examples that tend to impinge upon much everyday life: the market for viatical settlements, and the uses and enforcement of FICO credit scores. Life insurance is of course very old, and was often tied to state-sponsored lotteries and tontines from the seventeenth century until the nineteenth century. However, from the eighteenth century onward, various schemes were devised to pool mutual payments into burial societies, and from the nineteenth century onward, dedicated life insurance policies were often sold as methods to make provisions for descendants and other assignees in case of early death.

Money and Government: The Past and Future of Economics

by

Robert Skidelsky

Published 13 Nov 2018

P. (1923), The Decay of Capitalist Civilisation. 3rd edn. Westminster: The Fabian Society. Weeks, J. (2011), Mean, median and mode of impoverishment: why to Occupy Wall Street. Social Europe. Available at: https://www.socialeurope.eu/ mean-median-and-mode-of-impoverishment-why-to-occupy-wall-street [Accessed 28 July 2017]. Weir, D. R. (1989), Tontines, public finance, and revolution in France and England, 1688–1789. Journal of Economic History, 49, pp. 95–124. 458 Bi bl io g r a p h y Went, R. (2002), The Enigma of Globalization: A Journey to a New Stage of Capitalism. London: Routledge. Whittaker, E. (1940), A History of Economic Ideas. London: Longman, Green & Co.

Reminiscences of a Stock Operator

by

Edwin Lefèvre

and

William J. O'Neil

Published 14 May 1923

No man can always have adequate reasons for buying or selling stocks daily—or sufficient knowledge to make his play an intelligent play. 2.1 By the late 1890s, the New York Stock Exchange was already a 100-year-old institution that had survived wars, depressions, fires, and panics. Begun in 1792 by 24 securities brokers who agreed on a minimum commission of 0.25% when trading between each other, it moved progressively from beneath a buttonwood tree on Wall Street, to the Tontine Coffeehouse near Water Street, to the back room of the defunct Courier & Enquirer newspaper, and finally to the grand structure at 12 Broad Street, where Livermore and colleagues would view it with a mixture of respect, awe, distrust, and hopefulness. Although Livermore was not a member of the NYSE and therefore could not trade from the floor, he would have been familiar with the sights, sounds, and smells of the exchange building, which was torn down and rebuilt in its current form in 1903.

God Created the Integers: The Mathematical Breakthroughs That Changed History

by

Stephen Hawking

Published 28 Mar 2007

The stability of institutions which are based upon probabilities depends upon the truth of the preceding theorem. But in order that it may be applied to them it is necessary that those institutions should multiply these advantageous events for the sake of numerous things. There have been based upon the probabilities of human life divers institutions, such as life annuities and tontines. The most general and the most simple method of calculating the benefits and the expenses of these institutions consists in reducing these to actual amounts. The annual interest of unity is that which is called the rate of interest. At the end of each year an amount acquires for a factor unity plus the rate of interest; it increases then according to a geometrical progression of which this factor is the ratio.

…

Many scholars, among whom one ought to name Deparcieux, Kersseboom, Wargentin, Dupré de Saint-Maure, Simpson, Sussmilch, Messène, Moheau, Price, Bailey, and Duvillard, have collected a great amount of precise data in regard to population, births, marriages, and mortality. They have given formulæ and tables relative to life annuities, tontines, assurances, etc. But in this short notice I can only indicate these useful works in order to adhere to original ideas. Of this number special mention is due to the mathematical and moral hopes and to the ingenious principle which Daniel Bernoulli has given for submitting the latter to analysis.

Frommer's England 2011: With Wales

by

Darwin Porter

and

Danforth Prince

Published 2 Jan 2010

David’s Grand Centre Theatre Shopping Centre St. Way Cardiff S t. Bond d. ll R Fleet St. ha ild u G Rodney St. Beach WALES 1 St. tern Wes . c St o d Ma . rd St Oxfo Ln. pton y ham t r swa No King The Terr. Bryn Syfi Terr. d. Technical College W if t on 3 ra Rd. nd H ill lexa 2 A e la eP ov Be Gr W lle Sw a n S t. Tontin e St. . Ebenez St er S t. ay W Swansea n 0 40 km Br y St. Helens A v. r R d. Rd. ’s len t. He dS St. for x O St. rn ste e W nt St. Vince St. Fleet S t. R St a Heat h field R . Mansel St Carlton St. ge Pa t. ll S ho Nic St. rge G eo St. tta nrie He . l St sel us Mo St. Brun swi ck Rd.

The Prize: The Epic Quest for Oil, Money & Power

by

Daniel Yergin

Published 23 Dec 2008

[6] The "Colonel" Their candidate was one Edwin L. Drake, who was chosen mainly by coincidence. He certainly brought no outstanding or obvious qualifications to the task. He was a jack-of-all-trades and a sometime railroad conductor, who had been laid up by bad health and was living with his daughter in the old Tontine Hotel in New Haven. By chance, James Townsend, the New Haven banker, lived in the same hotel. It was the sort of hotel where men gathered to exchange news and shoot the breeze, a perfect setting for the thirty-eight-year-old Drake, who was friendly, jovial, and loquacious, and had nothing else to do.